The transition from practicing law to sitting on the bench, and watching and listening while others practice it, is a big leap, according to those who have experienced it. There is a lengthy learning curve, and a number of trade-offs involving everything from compensation to socialization. Overall, those who don the black robe every day say they’re making a different, and in many ways more rewarding, contribution to society.

Kenneth Neiman remembers walking by himself after lunch one day, several months after being appointed United States magistrate judge, and feeling … well, “physically different.”

That’s one of the many ways the former general practitioner who, among other things, handled some of the copyright work for the creators of the Teenage Mutant Ninja Turtles, described the transition from practicing law to sitting behind the bench and watching and listening, intently, while others practiced it.

“Let’s just say I felt more relaxed,” said Neiman, who was appointed to the District of Massachusetts and its Springfield facility in 1995. That was 14 years after he co-founded a law firm in Northampton and 24 years after he graduated from law school and soon joined the Center on Social Welfare Policy & Law in New York, the first of several career stops that made him familiar with Federal Court and aspire to it.

Elaborating, Neiman told BusinessWest that lawyers and judges take much different roles within the courtroom, and that for him, anyway, the new role was appealing, challenging, but also less stress-inducing — at least after he became acclimated to it.

“The biggest difference for me was switching from being an advocate and one of the adversaries in that system to being a decision maker and resolving disputes,” he explained. “That was almost a startling change; I realized that I was no longer in the midst of an argument — it was their argument, the lawyers’ argument, and my responsibility was to try to resolve it.

“As a lawyer, I had no problem with being an advocate,” he continued, “but in the long run, this role, the one of making decisions, suits me much better.”

Using language that was mostly similar, others who have made the same career transition talked with BusinessWest about why they sought work on the bench (sometimes it seeks them) and what they’ve experienced since donning the black robe.

“For me, it was enormously liberating to be impartial,” said Dina Fein, associate justice in the state Housing Court’s Western Division since 1999, when she left a practice dominated by civil work. “The opportunity to see a dispute impartially was really wonderful. The job description is to come to work every day and use your best judgment to do what you think is right. For me, it’s an enormous privilege to have that define my work.”

William Hadley, a former litigator with the Springfield firm Doherty, Wallace, Pillsbury and Murphy who was appointed a District Court judge two years ago, compared his transition to that of an athlete who moves on to become a referee in the same sport.

“For trial lawyers, it’s a somewhat combative profession — you want to win, and you have to be highly motivated to win,” he explained. “As a judge, you have to back away from really caring about who wins and loses and ensure that the trial is fair and the law is applied properly.”

There might be less stress or tension for most judges, but their work is difficult, often requires long hours and considerable travel, and comes complete with enormous responsibilities.

Which explains why, for the first several months she was on the bench, Fein would come home exhausted, despite working fewer hours than she did while handling mostly civil work for the law firm started by her grandfather and then managed by her father.

“I couldn’t figure out why I was finding the job so exhausting, and then other judges told me they had the same experience,” she recalled. “What I realized was that judges are expected to do so much simultaneously. One has to hear the facts as they’re coming in, understand them as they’re coming in, assess credibility, keep an eye on the courtroom, remember the law, apply it, articulate rulings from the bench, and do all of those things in the public eye. That’s a lot of multi-tasking.

“We spend our days doing active listening,” she continued. “We may not be asking the questions, but there is nothing passive about being a judge. That active listing — listening to what’s said, what isn’t said, and how it’s said … is just challenging, but also very exhilarating.”

In this issue, BusinessWest talked with several individuals who have transitioned to the bench about why they took that route. While explaining their motivations and aspirations, they also shed some light on what happens in their courts and also on the many challenges facing the legal system today.

Honorable Mention

“Moriarty and Wilson.”

That’s how Hampden County Superior Court Judge C.J. Moriarty answered a phone call from BusinessWest recently, invoking the name of the Holyoke-based law firm he founded and worked at for 30 years before being appointed to the bench just over a year ago.

“Old habits die hard,” he said with a chuckle, adding that it had been a while since he’d made that gaffe, but it happened frequently at his new office — and his home — in the months after he left private practice.

There were other old habits that lived on, as well.

Indeed, during one of his first cases as a judge, Moriarty, upon hearing a question from one of the attorneys, blurted out “objection.” There was some laughter, he remembers, adding quickly that most in the courtroom that day had probably seen it happen before. “When I mention that episode to other judges here, they say, ‘I did that, too.’”

Hadley told BusinessWest that, while he doesn’t believe he’s ever actually said ‘objection,’ he’s thought about doing so — or that the opposing lawyer should do so — on myriad occasions. Being able to keep such thoughts to himself was just part of the transition, he said.

As was acknowledging and then understanding that he, like all judges, was now under a microscope.

“People are always watching and wondering why you scratched your chin or moved to your left the way you did,” he explained. “They’re looking for clues to see which way you’re leaning, so you have to be cognizant of almost everything you do or say.”

All this is part of a “serious learning curve,” as Hadley called it, for those who ascend to the bench. There are those aforementioned changes in roles, some emotional swings, those early feelings of exhaustion, and, as in Neiman’s case, even some improvement to one’s overall health and well-being.

Meanwhile, however, the paycheck usually has a smaller number on it, and there are often long stretches during which judges in the federal and state trial systems (most of the latter are getting paid just under $130,000 at present, less than many new associates in New York and Boston) will not see raises or even cost-of-living increases.

Then again, the number is stable, and one doesn’t have to chase work, or pray that it comes through the front door, to earn it.

“Any accomplished lawyer would be taking a pay cut when they become a judge,” said Neiman, adding quickly that no one seeks and accepts such a career change for the money.

Their reasons for doing so vary, but usually revolve around practical considerations as well as a desire to serve society in a different and, in many ways, more fulfilling manner than practicing law.

“I think it’s in my blood,” said Moriarty, whose father was a long-time Superior Court judge. “I thought a lot about following in his footsteps. I’d been trying cases here for a long time, and decided I wanted to try the other side.”

When asked why she pursued the bench, Fein first prefaced her remarks. “This is going to sound corny,” she told BusinessWest, “but this was a way to implement a fundamental belief I have that those of us who are privileged by wealth and great education and wonderful opportunities in life do have an obligation to put those advantages toward the public good. I’d like to think that I brought those values to the practice of law, but it’s clearly easier to live those values in this position.

“As a lawyer in private practice, I always thought I had three responsibilities,” she continued. “I had to win the case; I expected myself to do the right thing; and I had to make money. In my experience, those responsibilities are not always compatible with one another. And if you took those responsibilities as seriously as I did, it would just wear you down, and my friends who are still practicing law tell me it certainly hasn’t gotten any easier.”

Court of Opinion

Hadley told BusinessWest that he thoroughly enjoyed being in court arguing cases while at Doherty Wallace, and that when his practice started to change, with the bulk of his work taking place in his office or that of a mediator, he sought a way to return to the environment he loved, specifically an opening in District Court.

“I took an assessment of what I wanted to do with my life — either stay at a place where I was happy or do something different,” he explained. “At that time in my life, my mid-’40s, I decided it was time to make a change and do something I think is very important, and hopefully make a greater contribution to the community.”

Like others we spoke with, Hadley said there are trade-offs when one goes from practicing law to presiding over a court. On the positive side, the pay is secure, there is no concern about billable hours, and when a judge goes on vacation, someone fills in for him or her; lawyers don’t have that luxury.

On the flip side, however, this is a much lonelier profession — which explains why Neiman was walking alone that day. Judges cannot socialize with lawyers, at least to the extent that they did before they took the bench, to avoid any indication of favoritism, said Hadley. Meanwhile, although judges do socialize amongst each other and share general thoughts on matters, they cannot actually discuss specific cases. “With individual cases, you’re pretty much on your own.”

Those we spoke with all said that there were times, even very early in their careers, when they would think about perhaps becoming a judge. Moving from there to the point of sending in an application for a vacant or soon-to-be-vacant position is a big leap, and a function of timing, feeling comfortable about making the transition — from both career and economic perspectives — and then finding a proper fit.

“Judges tend to find the court they’re best suited for,” said Fein, adding that while she was encouraged by some to apply for District Court positions, she felt that court, with its preponderance of criminal matters, did not match her background in civil work.

For Fein, who also applied for the position eventually given to Neiman, a much better match was Housing Court, which, until late 1998, had been a one-judge court. For many years, that individual was John Greaney, who now sits on the State Supreme Judicial Court, and later William Abrashkin, who still sits in that court.

Fein said she wound up in Housing Court while handling several civil matters during her work with the firm Fein, Pearson, and Edmund, and liked what she saw and heard. “I got to know it, and thought it was a fabulous court.”

When the state Legislature approved a measure to add a second judge to the Housing Court Division’s Western Division in 1998, she jumped at the opportunity.

Neiman told BusinessWest that he didn’t give himself much a chance to win the judge magistrate’s post when he applied, but knew at the time he would regret not seeking a post on a court he first came to know early in his career through work with first the Center on Social Welfare Policy & Law and then Western Massachusetts Legal Services.

“I was a poverty lawyer working for poverty wages,” he quipped, adding that things got better, compensation-wise at least, when he partnered with Fred Fierst to form Fierst & Neiman, which is now Fierst, Pucci, and Kane, with Fierst still handling a wide range of work in the entertainment industry, both locally and nationally.

Neiman handled criminal and civil matters in a number of courts, and enjoyed the work, but became intrigued when then-Magistrate Judge Michael Ponsor was appointed as a district judge. “I had tried a number of cases in federal court, so I was familiar with it,” he said. “I was thinking about applying, and some people thought I could do it, so I went ahead and applied.”

For Moriarty, the decision to seek the bench came down to several factors, including a desire to preside over a court he knew well and that his father served as a judge. But there were also some practical, or economic, issues that played into things.

“Being a lawyer is a very expensive way to make a living,” he said. “And when you’re in this community, most lawyers are depending on what walks in the door.”

Weighing the Evidence

Before sitting down with BusinessWest in her office, Fein first had to climb a short set of steps, go into Courtroom One, and deliver a quick, 10-minute talk she’s now given several hundred times.

It is Thursday, and in Springfield’s Housing Court, Thursday is ‘eviction day.’ (It’s Monday in Hampshire County, Tuesday in Franklin County, and Wednesday in Berkshire County, and Fein travels to all those courts weekly. “Have gavel, will travel,” she said, borrowing a line she attributed to Abrashkin.

Many of those facing eviction, as well as most looking to do some evicting, appear in Housing Court without legal representation, said Fein, noting that there are several volunteer, or pro-bono work, programs designed to help those who must appear in her court. The lack of lawyers in the room explains the need for the talk — which goes over everything from options to ground rules (if the opposing party fails to show up, the other prevails in the dispute) to the need to do one’s math before they sit before the judge or mediator — and it is also one of things Fein likes most about her work.

Indeed, while there are civil matters and some complex litigation that comes before the court — everything from class action cases involving lead paint to slip-and-falls — there are also the landlord-tenant disputes and other summary judgment matters that Fein equates to ‘people’s court.’

“If we do our jobs well, we’re really a problem-solving court,” she explained, noting that most of those facing eviction have issues that contribute to their dilemma, including substance abuse, mental illness, or some combination of both.

“We have the opportunity, if we choose to take it, to deconstruct the presenting dispute, identify the underlying social problem, and try to do something about it,” he said. “And that’s what makes the work of this court so exciting to me. I think we have an opportunity here to get people on the right track in their lives, and that’s enormously gratifying.”

As he talked with BusinessWest, Hadley was heading east on the Turnpike, returning from District Court in Pittsfield. Recently, he’s been spending less time on the road — he was assigned to handle the civil docket in the Springfield court — but still travels regularly, as many judges in that court do.

Hadley is associate justice of the Greenfield District Court, which means that, while he handles matters in that court when the presiding judge is out, he moves from court to court across Western Mass. While the travel can wear one down, it does have certain benefits.

“Every community has different issues,” he said. “Meanwhile, there’s different personnel in each of the courthouses, and you get to meet a lot of lawyers. Overall, I don’t mind the travel.

‘Variety’ was a word Hadley used often to describe his court, which handles a wide array of criminal cases (mostly misdemeanors) and civil matters involving dollar amounts that are usually, but not always, under $25,000. Between the diversity of the cases and she

r volume of them (100 new criminal cases each day, on top of thousands of civil cases moving through the system), judges work full, long days.

And each one represents a learning experience in many respects. “If you really enjoy the law intellectually, you are allowed to become an expert,” Hadley explained. “There’s an academic expansion to this that I really enjoy. I can spend as much time as I need to become an expert in a specific area of the law, and without having to worry about billing someone for my time.”

Coming to Terms

Moriarty took a quick break from his talk with BusinessWest to handle what’s known as a bail review, one of the many types of matters that come before Superior Court judges. The party in question believed bail has been set too high and was requesting that it be lowered.

During the 15-minute hearing on the matter, the attorney for the defense argued that his client, arrested on drug charges, was not a risk to flee. The prosecutor, citing several previous defaults and the serious nature of the charges (possession within close proximity to a school) argued that bail should remain where it was.

Noting that past history is very often a good predictor of future conduct, Moriarty denied the defendant’s request. Later, he acknowledged that, as decisions go, this one was comparatively simple.

Most, however, are not, and all of them, especially those dealing with sentencing and bail (meaning one’s freedom) come with huge doses of responsibility, and consequences for all those involved. But this is the world that judges must operate in — and often with what would be considered very little training or education, at least compared to other fields or professions.

“I was sent to Boston for three days,” said Moriarty. “We were shown how to work a computer, we sat in on one jury impanelment with another judge, and that was essentially it — they said, ‘OK, you’re ready, see you later.’

“I’ve had a lot of on-the-job training, what with 30 years in the business,” he continued, adding that, in the process of making the transition, he has learned that presiding over a court is a world apart from practicing law in one, and the adjustment has been challenging in many ways.

“I remember that on my first day, I had to take a guilty plea,” he recalled for BusinessWest. “Therefore, I had to make sure that the one making the guilty plea knows what he’s doing, knows what rights he’s waiving, and knows what he’s giving up. They handed me the file, and it’s dawning on me for the first time that I’m being asked to sentence this person, and yet I know less about him than anybody involved with this case.

“It was then that I fully grasped the magnitude of the responsibility I had,” he continued. “As a lawyer, I knew everything about my client, and the prosecutor, while he didn’t know as much as me, still knew an awful lot. Here I was, set to sentence someone, and when I walked into the court, I didn’t even know the gentleman’s name.”

For Neiman, while he has enjoyed the transition from advocate to decision maker, he said it hasn’t been without challenges. Overall, he said he enjoys the intellectual aspects of his work, which he described as problem-solving.

“In probably 60% of cases in which you’re faced with a dispute, whatever that dispute is, if you got 10 judges together, or individually, it would probably come out the same way — it’s relatively self-evident as to what the resolution of that particular dispute should be with regard to how the law applies,” he explained. “And then, they get progressively more difficult.

“I enjoy the challenge of figuring out what the law is and applying the facts,” he continued. “Almost always when I go through that process, at some point something will click, and I’ll understand what I believe to be the proper resolution of that dispute given the law and given the facts. I like that exercise, and I hope that I do it with an understanding of the effort that the lawyers have put into it and the plight that the litigants find themselves in.”

Final Arguments

When asked if he ever worried about being wrong with his decisions, Neiman, known for his dry wit, said, “that’s what appeals are for.”

Continuing, he said his rulings have rarely been overturned on appeal, something he takes a good measure of pride in. But how does he feel when judges with the First Circuit Court of Appeals do reverse one of his decisions?

For that he summoned a quote he attributed to the late Frank Freedman, a long-time federal judge in Springfield: “they’re entitled to be wrong.”

Such confidence in his decision-making abilities is just one more product of the transition from lawyer to judge for Neiman. It’s a change that’s made him feel better about himself — and just feel better in general.

George O’Brien can be reached at[email protected]

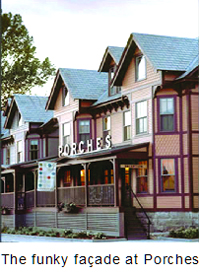

The Porches Inn at MassMoCA in North Adams was recently named one of the world’s “coolest hotels” by Condé Nast Traveller, among other honors. It earned the distinction for its wide range of amenities and whimsical style, which includes complimentary breakfast delivered in a vintage lunch pail.

The Porches Inn at MassMoCA in North Adams was recently named one of the world’s “coolest hotels” by Condé Nast Traveller, among other honors. It earned the distinction for its wide range of amenities and whimsical style, which includes complimentary breakfast delivered in a vintage lunch pail. “We had certain people in mind,” she said. “Those who may not consider themselves preservationists, but appreciate history, and the experience of staying in a hotel that has a past, a tradition, and a sense of place in its community.”

“We had certain people in mind,” she said. “Those who may not consider themselves preservationists, but appreciate history, and the experience of staying in a hotel that has a past, a tradition, and a sense of place in its community.” “There is a wide range of properties that have been converted into hotels, from cotton warehouses to bottling plants,” she said, adding that HHA is not a luxury organization; while each property has its own unique draws, HHA hotels fall within a number of price points and welcome all types of travelers. “We’re defined by history, and that’s something we let consumers know,” she said.

“There is a wide range of properties that have been converted into hotels, from cotton warehouses to bottling plants,” she said, adding that HHA is not a luxury organization; while each property has its own unique draws, HHA hotels fall within a number of price points and welcome all types of travelers. “We’re defined by history, and that’s something we let consumers know,” she said. Still, Billingsley explained that while the strengths HHA hotels possess — a strong sense of history, a rich collection of stories, and often a unique set of amenities that blend the intrigue of the past with the creature comforts of today — can also be a weakness for such destinations. While these features set them apart from modern-day hotels, she said, they can also isolate them. Most historic hotels are privately owned, and as such don’t have the same marketing strength as larger, corporate-owned outfits.

Still, Billingsley explained that while the strengths HHA hotels possess — a strong sense of history, a rich collection of stories, and often a unique set of amenities that blend the intrigue of the past with the creature comforts of today — can also be a weakness for such destinations. While these features set them apart from modern-day hotels, she said, they can also isolate them. Most historic hotels are privately owned, and as such don’t have the same marketing strength as larger, corporate-owned outfits.