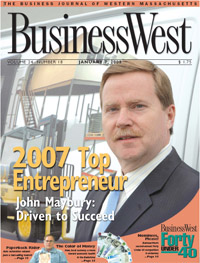

John Maybury was only a few months out of high school when he embarked on what started out as another in a series of odd jobs, but would eventually become a career and very successful entrepreneurial venture. He began selling workbenches, shelving, and industrial stools, but soon partnered with his father to start a diversified business in the competitive field of material handling. Today, the company reflects Maybury’s passion for technology, commitment to excellence, and drive to continuously improve. His success — and methods for achieving it — have earned him BusinessWest’s Top Entrepreneur Award for 2007.

John Maybury says that for him to get involved with something, there usually has to be some element of danger.

He’s an avid snowmobiler and skier, and he’s scuba dived, skydived, and flown planes (he doesn’t so much anymore). “If it has a motor, then I’m interested in it,” he said, noting that he probably had 20 cars before his 18th birthday. The only time you’ll find him on a golf course is for a charity tournament, and he’s taken part in many. He has to drive the cart, and he’ll invariably tinker with it to get it to go faster than the club pro might like.

He approaches all these danger-spiced activities with a philosophy, or thought process: to know and understand the risks, push the envelope — but not too far, and have fun. And this is the approach he takes to business and Maybury Material Handling, a venture he started while attending Western New England College 32 years ago, and trying to figure out just what to do with his life.

He took a cue, of sorts, from his father, who worked for many years as a salesperson then sales manager, specializing in, among other things, items in a field known as material handling — meaning equipment used to move, store, retrieve, and catalog inventory, records, parts, and other items.

The Younger Maybury started off as a free agent, selling various product lines to companies like American Bosch, Moore Drop Forge (later known as Danaher Tool), and other large manufacturers, using mostly contacts from his father to get his foot in those doors. He enjoyed enough early success to inspire his father to take a leave of absence from the company join him a venture that would put the Maybury name on letterhead, if not over the door — they started out as a home-based operation, but quickly outgrew those facilities.

Over the past three decades, Maybury has grown his venture into a highly diversified operation now specializing in sales, service, rentals, and training for equipment ranging from forklifts to work stations; from mezzanines to modular offices. The company has expanded and moved several times, the latest step being construction of a 42,000-square-foot building on Denslow Road in East Longmeadow, not far from where he and his father built the company’s first home on the site of an old tobacco barn.

But it is not merely what Maybury has accomplished that has earned him BusinessWest’s Top Entrepreneur for 2007 award. Rather, it’s also the how that has made him this year’s honoree.

To say that this is a company that reflects the character and drive of its owner would be a real understatement. It is, like Maybury, technology-focused, employing the latest hardware and software to enable employees to do work better, faster, and cheaper. It’s also excellence-driven; it was among the early winners of the Pioneer Valley Excellence Award, and Maybury has his sights set on a Mass Excellence Award, and has the ambitious goal of earning the coveted Malcolm Baldridge award within the next decade.

And this company is people-oriented, with an emphasis on fun. At the 2007 All Associates Year End Gathering, for example, staffers were broken into teams for a spirited contest of ‘Are You Smarter Than a Fifth Grader?’ featuring several special guests from nearby Mapleshade Elementary School.

The teams were formed with the goal of breaking down departmental barriers and inspiring people in different capacities to work together toward a common goal — in this case, triumphing over the other teams and winning some cash ($4,000 was put on the table).

This philosophy of working together is at the heart of the company’s success, said Maybury, noting that he stresses teamwork in every facet of the operation, and it has yielded steady sales growth, cutting-edge continuous-improvement practices, and a workplace that attracts and retains top talent.

In this issue, BusinessWest examines what drives Maybury — literally and figuratively — in his quest for excellence, and why his story of entrepreneurial daring is an uplifting, and ongoing, saga.

A Real Spark Plug

As he gave BusinessWest a tour of the new plant and posed for a few pictures, Maybury displayed some of that passion he has for all things motorized.

He jumped onto one of the newest and most versatile fork truck models, showed all that it can do, and then maneuvered it in out of some tight spaces. “I can handle these better than most people who drive them for a living,” he said, noting that he’s fluent with every piece of equipment on his showroom floor, and needs to be if he is to properly serve his clients.

Maybury got his first practice on a forklift back in the fall of 1975. He was a freshman at WNEC and also working several part-time jobs to help pay his tuition. One of them was at Milton Bradley — now known as Hasbro Games — and its East Longmeadow plant. He worked in what was known then as Department 26, moving around pallets of games like Monopoly, Life, and Chutes and Ladders, for loading onto boxes that would be packed into freight cars for transport on a rail line that no longer exits.

When Maybury returns to Department 26 these days — he’s made several visits over the years and still runs into people he worked with three decades ago — it is to help Hasbro stay on the cutting edge of material-handling equipment and processes. The toy maker is just one name on a long and distinguished client list. Others include regional and national manufacturers, distributors, and retailers including Friendly’s, Big Y, Lenox, J Polep, JCPenney, Macy’s Target, Wal-Mart, and even Foxwoods and Mohegan Sun.

Maybury supplies racks and shelving, conveyors, forklifts, and other equipment to the casinos to move and store money and chips. It also played a lead role in helping Mohegan Sun set a record a few years ago — with an 18-foot-tall, seven-tiered wedding cake weighing 15,032 pounds, or 7.5 tons. Maybury engineers created the huge platforms, or cake separators that the cake rested on (they were supported with steel pipes made by the company and painted to match a frosting sample) and also positioned massive, 30,000-pound-capacity scales in order to give the casino the exact weight.

The current, ever-growing client list and show of diversity and imagination put on display at Mohegan Sun provide evidence of just how far this company has come from its humble beginnings. How Maybury has orchestrated this evolution and progression is a story of entrepreneurial drive, vision, and ample doses of both luck and determination — mostly the latter.

Recalling how things got started, Maybury said that in addition to his forklift adventures at Milton Bradley, he also worked at Big Y, SIS (now TD Banknorth), and other area companies while trying to choose a career path. Instead, one chose him.

Growing up, he recalled, the conversations around the dinner table often revolved around his father’s work in material-handling equipment, and he eventually gravitated toward it himself.

“I grew up with it, and was kind of fascinated by it,” he said, re-emphasizing his childhood interest in all things mechanical, which manifested itself in early exploits in snowmobiling, mini-bike and motorcycle riding, and an endless parade of cars. “I would go into where my father was employed, go out back, and see all that equipment; it was something that really interested me.”

That company was Stanley Handling Equipment Co., later to be called StanLift, in Agawam. It was sold while Maybury’s father was executive vice president, and he then left and did consulting work for a similar venture based in Boston.

“It was at the supper table one night … I asked my father if he thought I could sell the things he used to sell,” Maybury recalled. “He said, ‘let’s give it a try,’ and we did.”

He started as an independent agent of sorts representing dealers trying to penetrate the Western Mass., market, selling workbenches, industrial stools, shelving, pushcarts, and other items needed by manufacturers that didn’t require help with installation, and was helped considerably by some of his father’s contacts.

“I’m 18, 19 years old … these people basically adopted me like a son or a grandson, because I was so young,” he explained. “I would go in, show them the book, show them the prices, tell them how much I needed to make, and they were cutting me orders.

“If I had any questions, I would go and ask my father,” he continued, adding that as the orders started rolling in, the father-and-son team saw a business opportunity unfolding before him. With a $25,000 loan from what was known then as First Bank — “they enjoyed the signature of the 40-year-old father much more than the 19-year-old son,” said Maybury — they were off and running.

Hitting on All Cylinders

Beyond the changes in street address over the years, the company was also in a constant state of change and diversification, said Maybury, patterns that have made it unique in the material-handling sector.

After starting with benching, shelving, and stools, the company moved into larger shelving installations, and two-story installations, including some work for Subaru of America. These installations would require lift trucks, he noted, adding that in the beginning the company would rent such equipment for jobs, but later purchased a fleet of the vehicles to ensure it could get a job done — and on time.

These ‘installs,’ as they were called, were usually done over a weekend, when a plant was shut down, he continued, adding that the mechanics hired to do these jobs often had little to do during the week, so the company started subbing them out to other businesses.

This was the beginning of Maybury’s power equipment division, which sells, leases, and maintains forklifts, scrubbers, sweepers, and other pieces of equipment and accounts for roughly 50% of total revenues.

Maybury remembers when the fleet consisted of one van (he still keeps a picture of it his files) and five hand trucks. Today, it’s 30 vans and more than 300 left trucks serving an area that stretches east to Worcester and south into Northern Conn., but Maybury says the company goes wherever its customers want.

It’s done work in Pennsylvania for Friendly’s, for example, and also in Nebraska, Texas, the Dominican Republic, and elsewhere for other clients.

This constant evolution has yielded a company that Maybury describes as a “solution provider,” and one that has no across-the-board competition.

“Our competitors are silo businesses,” he explained. “We have lift truck competitors, shelving and rack competitors, conveyor competitors, and mezzanine competitors, for example, but there aren’t any real solution providers that can address the full scope of material handling like we do.”

Summing up what his company does, and simplifying matters as he does so, Maybury says his team of 100 employees helps clients become more efficient, thus making them more profitable and competitive in the face of increasingly global competition. And throughout its existence, the company has essentially practiced what it has preached — using technology, processes, and teamwork to simplify and streamline operations and provide new opportunities for growth.

“We’re about as paperless as a company like this can get,” said Maybury, citing just one example of how the company works to take time and waste from its processes, while also serving customers more efficiently. The company has used self-directed work teams, the Kaizen process, and other strategies to reduce process times and reduce errors.

These efforts were rewarded with a Pioneer Valley Excellence Award in 2005, what Maybury calls the first step in an aggressive drive to winning a Baldridge within the next decade. Established in 1988, and named after former Commerce Secretary Malcolm Baldridge, a strong proponent of quality management, the award is given to companies to large and small judged to be outstanding in seven areas: leadership; strategic planning; customer and market focus; measurement, analysis, and knowledge management; human resource focus; process management; and results.

Maybury said that while his goal is on winning the award, his focus is on doing the things necessary to achieve that end, which means not achieving results, but sustaining them, which is the key to not merely filling a lobby with plaques and trophies, but also taking a company to desired heights in terms of efficiency and profits.

And for this, Maybury returns to the subject of teamwork, specifically a team of ‘Level 5 leaders’ as defined by business writer Jim Collins, author Good to Great.

“I have a human resources manager, a controller, a power equipment division manager, a material handling division manager, and a sales and marketing manager, and those positions support our strategy and our goals,” he explained, “and our initiatives and action steps are carried out by that group of people.

“Into everything we do over the course of a year we come up with some critical impact factors that will impact our business either in a positive or negative way, and then we develop strategies and action steps and come up with goals and plans so we deploy a common theme,” he continued. “If it’s self-managed teams, then it’s self-managed teams until we get it; if it’s paperless, it’s paperless until we get it; if it’s proper deployment of technology, it’s that until we get it; we don’t just say ‘let’s do this,’ and then it never happens.”

Gasket Case

There has been considerable deployment of communications technology over the years, said Maybury, adding that the progression of steps, such as the outfitting of service technicians with tablet PCs to eliminate all use of paper, is consumer- and service-driven.

“We don’t have technology just to have technology — we have technology to be the accelerator for our processes,” he said, noting that the use of the tablet PCs and aircards that provide Internet access eliminate the need for everything from paper receipts to repair manuals.

Which is significant, because each technician needs vast amounts of information at his or her disposal to maintain or repair the wide range of equipment sold and serviced by the company.

“With the technology and advancements, our technicians now have the ability to go online,” he said, “and go to the manufacturers’ sites, get their technical service bulletins, get schematics, get parts resources, and communicate by E-mail with the supplier so we can get all the information we need without having any books on the trucks.”

There are countless other examples of putting technology to work to streamline processes, allow people to do more work in less time, and even save a few trees, he continued, noting that technology is just half the equation; the other is the people who use it, and the company is careful to invest heavily in them, as well.

This strong focus on people was on display at the All Associates Year End Gathering, a tradition at Maybury for nearly 20 years now.

As the name implies, everyone who works for the company (and they’re called associates, not employees) is required to attend. In recent years, the date was moved from just before Christmas to the middle of the month to make it easier to fit into the holiday schedule.

As in prior years, this day-long program had a packed agenda, starting with a welcome from Maybury, a quick review of the safety record (169 days without a lost-time accident by Dec. 14), and then a comprehens

ve review of the company’s 401(k) program delivered by Charles Epstein, president of Epstein Financial Services.

“This is a good time to be a having a review,” said Maybury, noting the stock market’s rocky third and fourth quarters and the questions it would generate. “This is a time when people need information about their money and what to do with it to make it grow.”

The agenda continued with reviews of the health and dental plans, a look back at the accomplishments of 2007 and a glance ahead to the goals for ’08, a celebration of anniversaries (there was a 25th and two 20ths, among others) and new associates, a question-and-answer period, and that spirited round of ‘Are You Smarter Than a Fifth Grader.’

The associates’ day, and the specific parts of the program, are reflective of Maybury’s desire to make his a people-oriented company, one focused on helping employees balance work and life.

Finding that balance is something Maybury has had to work at himself, noting that, over the years, he’s managed to make time for his family, community activities, chamber of commerce duties (he was president of the East Longmeadow chamber for two years), work on boards such as the one at Baystate Health he’s a member of, and even some snowmobiling.

“When I balance my family with my business and the community, that makes me feel better,” he said. “I could probably lock myself in here for several more hours a day, but I wouldn’t have the same self-satisfaction. And I like to learn — I’m a constant learner … I don’t think I’ve every stopped.”

Growth Engine

The Maybury company may be essentially paperless, by its president proudly hangs on to an item that could have been recycled years ago.

It’s a placemat from the Fort restaurant in Springfield, on which Maybury scribbled the preliminary business plan for a subsidiary, or sister business, he started with a partner in 2005 called Atlantic Handling Systems. Based in the New Jersey community of Ho-Ho-Kus, it offers entry into a new, large market, and provides new opportunities for growth.

There was and is that requisite amount of danger with the Atlantic venture, he explained, adding quickly that this latest endeavor, called ‘Baby Maybury’ by some, amounts to a calculated risk, one that has worked out very well and holds considerable promise for the future.

And getting it off the ground has been fun, which, like that element of danger, must be part and parcel to everything that intrigues our Top Entrepreneur for 2007.

George O’Brien can be reached at[email protected]