Month: August 2008

Young Professionals and the Future of Massachusetts

Greg Torres, president of MassINC, said that, when it comes to the latest study completed by the nonprofit research entity he leads, the proof is in the statistics, and the devil is in the details.

“We make it a practice to look at specific demographic groups and their attitudes, and in turn to look at how the economics of the state stack up, given those attitudes,” he said. “But we don’t make any specific recommendations. We frame the problem and get the research out.”

The latest group studied by MassINC is one that has not been examined closely in the past — young adults in the Commonwealth, ages 25 to 39. The study, titled Great Expectations: A Survey of Young Adults in Massachusetts, delves into this demographic’s views and priorities, with the goal of evaluating what impact these perceptions have on the Massa-chusetts economy.

“There is plenty of research on Boomers, but very little looking at young adults,” said Torres, adding that what the study found was in parts surprising — including a high level of positive thinking regarding the state and its future — and intriguing, such as the discovery of an equally high level of cynicism when it comes to state and federal government.

It also touched upon a disparity in opinions and concerns between different types of residents — those who moved here versus those who were born and raised in the Bay State, for instance, or those living in Greater Boston versus those in southeastern, central, and western communities.

In this issue, BusinessWest takes a closer look at Great Expectations, as well as how it relates — and does not relate — to the pressing issues of Western Mass.

A Case for Education

Torres noted that studies like Great Expectations are research-heavy and light on specific recommendations. However, the statistics presented become important tools for regional employment boards and other economic-development entities across the state as they implement new programs to better the Commonwealth’s economic outlook and retain its young population.

The need to get a finger on the pulse of this age group has become doubly important, Torres added, due to the growing emphasis on the Commonwealth’s knowledge-based economy. It’s a big piece of discussions surrounding the potential for Massachusetts to lead the country in areas such as life sciences and biotechnology, but on a broader scale, education has a marked impact on economic stability, and today’s young-adult population is a more educated group on the whole than the any other, both regionally and nationally. According to Great Expectations, about 46% of this group has earned a college degree or higher, 49% earn $50,000 or more annually, and 54% own a home.

“When you look at education levels and the extent to which young people are doing well economically, there’s a direct tie-in,” said Torres. “A high-school diploma used to be the standard, but all of our research suggests that a college degree is now the key.”

There are other trends, Torres continued, that are perhaps more intangible than the education piece, but no less intriguing. The largest common denominator among the young adult set, he said, was an undercurrent of optimism regarding the future.

“We were struck by that,” Torres said. “The optimism that was reflected regarding their economic standing and that of their children surprised us a little bit, especially with the economic storm clouds on the horizon and no real wage growth over the last decade.

“It struck us that, as a group, young adults are pretty confident that they’ll be able to do better moving forward,” Torres continued. “They believe they’ll be able to increase their economic standing.”

The Cynical Side of the Street

There is a downside to this optimism, however — not only are young adults upwardly mobile, they’re not averse to taking their talents elsewhere if they feel they’re not reaching the heights they’re capable of in the Bay State, an already historically expensive place to live.

“Twenty percent are saying if they can’t get a handle on costs in Massachusetts, they would consider leaving in the next five years,” said Torres. “We’re a high-cost state, and there’s no getting around that. It’s not going to change in any immediate sense.”

Even more specifically, Torres said, Great Expectations reveals that this demographic has a greater respect for and confidence in the private sector, and a lack of confidence in public sector.

“This offers us some interesting insight that we intend to focus on,” he said. “What this means is that the majority of young adults in Massachusetts believe that solutions to problems like environmental issues are going to be driven by creative work in the private sector, and further, that confidence is low in public sectors.”

He said that while some political candidates, including Gov. Deval Patrick and presidential candidate Barack Obama, have successfully tapped into the overriding optimism of young adults on the campaign trail, MassINC’s research offers an opportunity to delve further into the potential pitfalls of low confidence in state and federal government.

“The less confident the population, the higher the rates of non-participation,” he said. “People who don’t believe the public sector can do what needs to be done are less likely to vote, and support for taxes goes down. We hope to explore politics more so candidates can reflect on it — and, in general terms, we need more of a balance between public and private sectors.”

Curb Your Enthusiasm

Anita Dancs, an economics professor at Western New England College, agreed that the attitudes of this demographic have an impact on the state’s economic outlook, as well as some of its existing realities, including in the political arena.

“It caught my attention that this group is so cynical about government; I wonder what future impact that could have,” she said. “They’ve heard all through their lives that government fails, but I do find that a concern, because there is a role for government to play, especially in terms of the race with the rest of the world.”

However, Dancs added that she takes certain aspects of the MassINC report with a grain of salt, particularly when applied to Western Mass., which is working to clear its own hurdles that differ from those in other parts of the state.

For one, she said, the high percentage of optimism could be colored by certain variables.

“I think the first thing we need to realize is that this is an age group that is in the prime of their lives,” she said. “Buying a home, starting a family, advancing in a career … these are all things that are happening to these people because of their life stage, and they’re hopeful.”

More specifically, the optimism reflected in the report is driven in part by people who have moved to Massachusetts because of the better, knowledge-driven jobs in Greater Boston,” Dancs said, referencing one of three groups, ‘the Imports,’ into which the surveyed demographic is broken in Great Expectations.

According to the report, 37% of the 25-to-39 demographic represent this sub-group — those who grew up outside of Massachusetts and relocated. The remainder consists of ‘the Boomerangs,’ 23% of the total, who grew up in Massachusetts but have lived outside of the state for a year or more before returning, and ‘the Homegrowns,’ the largest percentage of young adults at 40%, who have not lived outside of the Commonwealth for a significant period of time.

“If you take apart the report a little more and look at the homegrowns, this is the group that is more representative of Western Mass.,” said Dancs. “There’s more concern over finances in this group and more concern over availability of jobs. In Western Mass., wages tend to be lower, and we have fewer high-paying technical jobs.”

Indeed, the MassINC study states that “imports are the most satisfied with the way things are going for them.” The majority are college graduates (60%), while only 32% of Homegrowns have an advanced degree. Further, three-quarters of Imports work in professional or managerial jobs, compared to 41% of Homegrowns. Finally, 71% of the Imports live in Greater Boston.

Dancs went on to note that some pervasive economic issues also run contrary to the positive view many young adults have of their own futures and that of the state; it just may take longer for these effects to be felt within the surveyed population.

“It’s likely that a recession will be coming on, and economic indicators aren’t looking very promising,” she said. “There are also a few general, national trends that Massachusetts follows that need to be taken into account; optimism may exist, but income inequality is also growing tremendously. Massachusetts had the third-largest income-inequality growth in nation in last two decades.

“There’s also income instability,” Dancs continued. “People’s wages go up and down more than those of their grandparents or parents, and we also know that weekly earnings are lower than in the 1970s in real terms. There’s something about this report that flies in the face of economic reality.”

Great Expectations does state that outside of Greater Boston, the survey population focuses on a different set of concerns than their Hub-based counterparts. For one, those in the Boston area cite high costs of living as a primary worry, while others — particularly Homegrowns — speak to the need for job creation.

Offering this research to be applied to new or existing programs to augment the Commonwealth’s young workforce is one of MassINC’s primary goals, according to Torres; however, in areas where problems such as high unemployment and high-school dropout rates already exist, including in many locales of Western Mass., the approach employment organizations and departments must take is not so straight-forward as reading the statistics and trying to reflect them.

Rather, in many ways, these findings represent an ideal that may exist within much of the 25- to 39-year-old age group now, but could easily wane if the economy continues its downward trend, or if younger populations are not educated on their options and offered opportunities by assistance agencies, schools, and employers alike.

Tomorrow’s Adults,

Today’s Concern

Melissa Scibelli, manager of Youth Projects with the Hampden County Regional Employment Board (REB), said she works primarily with youths ages 13 to 21 to provide educational, career-ladder, and work-training opportunities. She agreed with Torres that education and career experience are intertwined and proven to have a marked effect on employment rates.

However, in Hampden County, the road to that ‘new standard’ of a bachelor’s degree to prepare for career stability and advancement is a long one.

“Education and work experience are aligned,” she said, “and with a 50% non-graduation rate over four years in this area, many of today’s students need support that previous generations did not. We have to start early to educate students on their options and cultivate their goals.”

This is an objective that doesn’t start and stop in high school, either. Scibelli said her department’s work begins with children as early as pre-kindergarten, and carries on to young-adult populations.

“This is how we are preparing the next generation — by finding every way possible to get kids connected and contributing to the community.”

Further, this work cannot include only young, developing populations. Instead, Scibelli explained that the latest push in youth development and career training in Hampden County is engaging businesses in the process of developing tomorrow’s workforce.

“Many businesses are stepping up to the plate,” she said, citing MassMutual, Big Y, Baystate Health, and Western Mass. Electric Co. among the REB’s largest partners. “They’re providing career-ladder training, internships, and educational opportunities that help students develop 21st-century skills. But more importantly, these businesses are signaling to the students what positions exist for them following education and training. This, ultimately, is what’s going to keep those young people in the area.”

As more area businesses sign on to work more proactively with young populations, Scibelli noted that new opportunities are surfacing, which could lead to further development of the connection between education and economic security cited in Great Expectations among the 25-to-39-year-old set.

“More partners are realizing they need to be a bigger part of the picture,” she said, “and they’re starting to introduce programs that link to internships and scholarships at the higher-education level. They’re essentially building a new infrastructure that’s aimed at knowledge transfer, and helping younger people to do better overall.”

Common Ground

In its closing assessment, Great Expectations reports that, overall, “there is a lot of goodwill toward the state, which leaders can build upon as they try to attract and retain young adults.”

In response, Dancs said this is the greatest strength of the study and its findings.

“There are a lot of questions that come up when we read this; it will also be interesting to see five years from now if that level of optimism still exists,” she said. “But in the end, any optimism is going to have a positive effect on the economic outlook.”

For now, the economic outlook is hazy. But the belief that things will get better, and that the young workforce of Massachusetts will be a driving force thereof, is a documented fact.

Another Max’s Classic

On July, more than 290 golfers competed over two area courses, Crestview Country Club and the Ranch, at the fifth annual Max Classic Golf Tournament, with proceeds going to benefit Baystate Health and its Children’s Hospital. The 2007 event brought in $162,000 to Baystate’s Neonatal Intensive Care Unit, with 2008 donations expected to exceed that amount. The major sponsor of this year’s event was New Country Motor Cars of Hartford. Pictured (clockwise, from left), are Donny Frost, left, general manager of New Country Motors, and Adam Quenneville, owner of Adam Quenneville Roofing; left to right, Ron and Brenna Sadowsky, Founders of the Max Classic tournament, Susan Toner, vice president of Development for the Baystate Health Foundation, and Jennifer Baril, major gifts officer for the Baystate Health Foundation; the winning foursome at Crestview Country Club: from left, John Joyce of Northwestern Mutual; Todd Hemenway, representative of Hitachi Data; Brice Craven, president of Johnson Packings; and C.J. Denmark, a student at Echert College.

Groundbreaking Developments

Groundbreaking ceremonies were staged July 29 at Westover Airpark West in Chicopee for a new 72,000-square-foot multi-tenant industrial complex, with an anchor tenant, a flooring-products distribution center, occupying 25,000 square feet. The remaining space will offer industrial rental units from 4,000 square feet and up and will be finished to suit for a variety of users. Development Associates of Agawam purchased the 7.6-acre site as a joint venture with an investor from Long Island, N.Y. This project is the 10th building to be developed at Westover by Development Associates and its 15th building in Chicopee. Doing the honors are, from left, Charles D’Amour, chairman of WMDC; Edward O’Leary, founding partner of Development Associates; Ken Vincunas, general manager and partner of Development Associates; Chicopee Mayor Michael Bissonnette; and Kenneth Delude, senior vice president of Westover Metropolitan Development Corp. (WMDC)

Up, Up, and Away

Paul Sena, owner of Worthington Balloons in Worthington, Mass., takes the helm of his balloon, the Thunderbuster, during this year’s Green River Music and Balloon Festival in Greenfield. The festival is held on the Greenfield Community College grounds during one weekend each summer, and is organized by the Franklin County Chamber of Commerce. Local and national companies serve as sponsors of the event, now in its 22nd year; this year’s local sponsors were Turn It Up records, Signature Sounds, 93.9 the River, Masslive.com, the VNA & Hospice of Cooley Dickinson Hospital, Freedom Credit Union, AAA, and Greenfield Community College.

Making a Hit

Boston Red Sox Batting Coach Dave Magadan works in the indoor batting cage with Chicopee resident Christopher Axner, a player on the Sunshine Challenger Eagles Little League Team, as part of the recent CVS Caremark All Kids Can Baseball Camp. The camp is the result of a team endeavor between CVS and the Red Sox to provide New England children with disabilities a dream-fulfilling opportunity to play ball at Fenway Park.

Elevator Pitch

Visitors to the Mont Marie Health Care Center, an 84-bed skilled nursing facility sponsored by the Sisters of St. Joseph of Springfield, enjoy a more accessible entrance and a new elevator thanks, in part, to a contribution from PeoplesBank of Holyoke. The bank’s gift of $40,000 is part of its ongoing commitment to support charitable and civic organizations within the region. The recently completed construction project also includes a 36-space parking lot and an updated phone system. Additional donations, loans, and grants helped fund the project. Here, Mont Marie Health Care Center Administrator Sr. Elizabeth Sullivan (right) and Sisters of St. Joseph of Springfield President Sr. Mary Quinn (center) thank PeoplesBank officials for their recent donation to the center. Representing PeoplesBank are, from left, Douglas Bowen, president and CEO; Susan Wilson, vice president; and Mary Meehan, vice president, Commercial Loans.

The following business incorporations were recorded in Hamden, Hampshire and Franklin counties and are the latest available. They are listed by community.

| AGAWAM BRIMFIELD Maunsn Inc., Main St., Brimfield 01010. Shakeel Ahmed, 8 Osceola Lane, Longmeadow 01016. To operate a convenience store and gas station. CHICOPEE ABN Enterprises Inc., 1177 Granby Road, Chicopee 01020. Joe T. Alam, 16 East Main St., Westborough 01581. To operate one or more motor vehicle service stations selling gasoline, convenience items, etc. Hope Everlasting Inc., 159 Casey Dr., Chicopee 01020. Robert Zygarowski, same. (Nonprofit) To provide services for underprivileged adults, children, and battered women, animal assistance, find shelters for the homeless, etc. New England Pellet of Western Mass. Inc., 50 George St., Chicopee 01013. Richard R. Carbonneau, same. Purchase and sale of wood pellets for residential heating. EASTHAMPTON EAST LONGMEADOW Peruvian Education Initiative Inc., 203 Canterbury Circle, East Longmeadow 01028. Romulo Cabeza, same. (Nonprofit) To provide for the specific educational needs of economically disadvantaged students in Peru. Speedway Cars and Hobbies Inc., 89 Maple St., East Longmeadow 01028. Judith Dventhe, 111 Chestnut St., East Longmeadow 01028. Selling toy cars and boats, hobby toys. GREENFIELD Hamilton Home Health Inc., 489 Bernardston Road, Greenfield 01301. Ebony Hamilton Sterbinsky, same, president, treasurer, and secretary. Home health care. HAMPDEN HOLYOKE INDIAN ORCHARD McLymont 2 Inc., 1236 Worcester St., Apartment 2l, Indian Orchard 01151. Alicia Elizabeth McLymont, same. Sales. NORTHAMPTON SYED Inc., 137 Damon Road, Unit #G, Northampton 02060. Atif Tasneem, same. Gasoline and convenience retail trading. | The Andanje Foundation Inc., 351 Pleasant St., Suite 180, Northampton 01060. Elly Dickson Tuti, same. (Nonprofit) To make distributions to need-based community establishments, public schools, places of worship in remote regions of developing countries in Africa, etc. ORANGE SPRINGFIELD 413 Production Inc., 141 Massachusetts Ave., Springfield 01109. Cleveland Wilson, same. (Nonprofit) Education in music production for youths engaged in the music industry. Black Leadership Alliance Inc., 727 State St., second floor, Springfield 01109. Ronald A. Copes, 54 Blueberry Ridge, Westfield 01085. (Nonprofit) To build and strengthen the black community by addressing and positively impacting all quality of life issues, etc. Charles in Charge Inc., 127 Lebanon St., Springfield 01109. Charles McNair, same. (Nonprofit) Interior decoration consultation for veterans and families. Kiddo’s Transportation Inc., 3 Norfolk St., Springfield 01109. Rony Pena, same. School bus compamy. RMO Real Estate Company Inc., 41 Tyler St., Springfield 01109. Rosita Otero, same. Real estate. Tristate Mobile Inc., 364 Belmont Ave., Apartment 4, Springfield 01108. Jeremy Branco, same. (Nonprofit) To provide alternate consumer solutions for mobile solutions and free consultation and help choosing the right carrier and rate plans. WESTFIELD MJS Solutions Inc., 399 Falley Dr., Westfield 01085. Michael Simard, same. Marketing consultant to education providers. Rory Farrell.com Inc., 37 Broad St., Westfield 01085. Rory M. Farrell, same. Internet Web design and related programing. The Westfield Kiwanis Foundation Inc., 82 Broad St., Suite 2, Westfield 01085. Paul J. Hutchinson, 92 Glenwood Dr., Westfield 01085. (Nonprofit) To assist needy persons, particularly young people, in attaining vocational excellence, to aid handicapped persons, etc. WESTHAMPTON WEST SPRINGFIELD Kevin B. Terrell DDS, P.C., 367 Memorial Ave., West Springfield 01089. Kevin B. Terrell, DDS, same. To engage in the practice of dentistry. |

The following Business Certificates and Trade Names were issued or renewed during the month of June 2008.

| AMHERST Amherst Style, LLC Cat’s Eye Production Wireless Hook-ups Zx Inc. CHICOPEE Action Cleanout And Removal Services Gutter Shutter Company Kat Prints EASTHAMPTON CC Ventures Mike’s Autobody EAST LONGMEADOW Berselli’s Truck Service Elements Therapeutic Massage Gibson Machine Company Joe & Suzi’s Farmstand GREENFIELD Blue Lagoon Pools & Spas Inc. JLC Claims Meadows Golf Course RR + S Livery Service HADLEY Cinemark Esselon Coffee Roasting Co. Little Bird Daycare Midas Muffler Mitch’s Marina LUDLOW Lavoie Development Corporation Oscar’s Pizza Restaurant, LLC NORTHAMPTON Club K Hampshire County Jail LV Style Inc. Mr. Handi’s Tailor & Tuxedo Rental Underground Salon Yankee Mattress Factory Inc. PALMER Buddy’s Services Cities Chudy Industrial Countryside Landscaping | Coyer Construction Milltown Ink Tattoo S&H Builders Sabos Landscaping Soliciters Underground Operations SOUTHWICK Karen Stone SPRINGFIELD Investment Property Group Jupiter Consulting Group Leonard Viscito Ludlow Floor Sanding New England Curb Appeal Omega Provision Puerto Rico Bakery II Scopes Spot Steve’s Cleaning Removal Tas Logistics TD Banknorth Thanh Thuy Fashion Torres Painting Unique Solutions Urban Outfitters Valley Automotive Inc. WESTFIELD C.P. Net Solutions IHB Services Northside Creamery Richard & Martha Ochs Whip City Gallery Speed Queen Laundromat WEST SPRINGFIELD Able Caning Annalisa Liquori Hairstylist Contained Within Rooms Direct St. Jean Plumbing & Heating TD Banknorth |

The following is a compilation of recent lawsuits involving area businesses and organizations. These are strictly allegations that have yet to be proven in a court of law. Readers are advised to contact the parties listed, or the court, for more information concerning the individual claims.

CHICOPEE DISTRICT COURT

Titan Roofing Inc. v. Monaco Restorations Inc. & Paul Monaco

Allegation: Non-payment of goods and services rendered: $5,000

Filed: 7/03/08

FRANKLIN SUPERIOR COURT

Denis Menard v. Town of Greenfield

Allegation: Breach of contract and failure to pay police officer benefits: $125,000

Jeffrey Hoyt v. First Light Power Resources Inc.

Allegation: Improper wiring of equipment causing electrocution: $273,000+

Filed: $6/26/08

GREENFIELD DISTRICT COURT

James J. Sawicki v. Commonwealth Construction

Allegation: Breach of contract for home repairs: $4,365

Filed: 6/20/08

HAMPDEN SUPERIOR COURT

Bobby-Jo Murray v. American International College

Allegation: Breach of contract, negligent misrepresentation, fraud, and deceit occurring when defendant expelled Murray: $45,000

Filed: 6/11/08

Celly Jonocha v. Transportation Advisor Inc.

Allegation: Employment discrimination: $25,000+

Filed: 6/13/08

Christopher and Elizabeth Comey v. Landmark Inc.

Allegation: Breach of contract and warranties in sale and installation of swimming pool: $35,000

Filed: 6/30/08

Mary Lou Sanborn v. D & S Construction, LTD

Allegation: Non-payment of merchandise sold and delivered: $26,216.06

Filed: 6/12/08

Quality Machine Solutions Inc. v. Hyundai-Kia Machine America Corporation

Allegation: Breach of contract: $1,000,000

Filed: 6/09/08

United Steel Inc. v. Celestial Praise Church of God Inc.

Allegation: Breach of contract, unjust enrichment, and failure to pay for design services and custom steel fabrications: $205,000

Filed: 6/06/08

HAMPSHIRE SUPERIOR COURT

M.A. Alexander Inc. v. Medical Specialties Group LLC

Allegation: Breach of business purchase-and-sale agreement: $46,000

Filed: 6/24/08

NORTHAMPTON DISTRICT COURT

Larry Giambrone v. The Donut Man

Allegation: Negligent maintenance causing slip and fall: $14,199.92

Filed: 6/12/08

PALMER DISTRICT COURT

Verizon New England Inc. v. Caracas Construction Corp.

Allegation: Negligent performance of excavation causing damage: $15,408.54

Filed: 6/15/08

SPRINGFIELD DISTRICT COURT

Bobcat of CT Inc. v. Northeast Timber Company

Allegation: Non-payment of rental agreement: $12,127.50

Filed: 3/28/05

Bradco Supply Company v. Atlas Roofing & Skylight Company

Allegation: Non-payment of goods sold and delivered: $5,034.09

Filed: 3/18/08

Eastern Lumber & Millwork Inc. v. Siller Home Improvement

Allegation: Non-payment of goods sold and delivered: $8,146.96

Filed: 4/30/08

Michael Sarkis v. John Mastronardi & Sons

Allegation: Breach of contract to remove and replace driveway: $20,000

Filed: 7/03/08

North Pacific Group Inc. v. Home Lumber Company Inc.

Allegation: Non-payment of merchandise sold and delivered: $20,524.68

Filed: 3/28/08

Ivey Industries Inc. v. Jay’s Welding & Steel Fabrication

Allegation: Non-payment of goods sold and delivered: $8,460.34

Filed: 6/19/08

United Refrigeration Inc. v. E.P. Letendre Inc.

Allegation: Non-payment of merchandise sold and delivered: $4,089.14

Filed: 3/31/08

United Rentals Inc. v. American Pile Driving & Construction Corp.

Allegation: Non-payment of materials, equipment, and services for various construction projects: $49,616.31

Filed: 3/25/08

U.S.A. Hauling & Recycling Inc. v. Affordable Waste Management

Allegation: Breach of contract for waste removal services: $28,176.81

Filed: 3/17/08

W.B. Mason Inc. v. Advanced Back & Neck Center of Massachusetts, P.C.

Allegation: Non-payment of goods sold and delivered: $4,646.64

Filed: 5/28/08

WESTFIELD DISTRICT COURT

Barbara A. Fontaine v. Friendly Ice Cream Corp.

Allegation: Slip and fall: $20,000

Filed: 6/18/08

Easthampton Savings Sees Steady Growth

EASTHAMPTON — William Hogan Jr., president and CEO of Easthampton Savings Bank, recently reported that the bank has continued to experience steady growth during the second quarter. Hogan noted that total assets increased $44 million from a year ago, which is an increase of almost $17 million over the last quarter. Additionally, total assets now stand at $781 million, with the bank experiencing a deposit gain of $52 million from a year ago. The bank’s loan portfolio — $586 million — also saw an increase of almost $11 million or 8% for the quarter and more than $35 million for the year.

Berkshire Hills Reports 25% Earnings Growth

PITTSFIELD — Berkshire Hills Bancorp Inc. recently reported a 25% increase in 2008 earnings to a second-quarter record of $5.7 million. Earnings per share increased by 6% to a second-quarter record of $0.55 compared to $0.52 in 2007. Additionally, Berkshire reported record six-month earnings of $11.8 million in 2008, which was an increase of 24% over the first half of 2007. First-half earnings per share were a record $1.13 in 2008, an increase of 6% over $1.07 in 2007. Berkshire is the parent of Berkshire Bank.

BSE Now Offers Hybrid Home-comfort System

WEST SPRINGFIELD — Berkshire Service Experts (BSE), a local heating and cooling service company, recently began offering a new hybrid home-comfort system that not only provides energy-efficient cooling in the summer months, but can also reduce heating bills in the winter. The new hybrid home-comfort system makes use of an electric heat pump, which is an all-in-one heating and cooling system. During the warmer months, the heat pump provides high-efficiency air conditioning, while in the winter, the pump is paired with a traditional natural gas, oil, or propane furnace to heat a home, automatically selecting the most energy-efficient fuel source — much like hybrid vehicles that use both gas and electricity. “Hybrid home-comfort systems using an electric heat pump are an effective solution for cooling and heating a home because they allow you to take advantage of the least expensive energy source available during peak usage times — whether it’s electricity, natural gas, or oil,” said Schley Warren, general manager of BSE. “In fact, New England homeowners living in an average, 1,500-square-foot home can save as much as $1,200 during the cold winter months, when the heat pump is matched with an existing forced-air oil furnace.”

Hampden Bancorp Reports Income Drop

SPRINGFIELD — Hampden Bancorp Inc. (NASDAQ — HBNK), which is the holding company for Hampden Bank, announced the results of operations for the three and 12 months ended June 30, 2008. Net income for the three months ended June 30, 2008 was $191,000, or $0.03 per fully diluted share, compared to $658,000 for the same period in 2007. This decrease in net income was primarily the result of an increase in the provision for loan losses of $347,000 for the three months ended June 30, 2008. The increase in the provision for loan losses is due to increases in loan delinquencies, increases in non-accrual loans, growth in the loan portfolio, and general economic conditions. For the three-month period ended June 30, 2008, net interest income increased by $245,000 compared to the three-month period ended June 30, 2007. Non-interest income, including gains on sales of securities and loans, decreased by $124,000 compared to the three-month period ended June 30, 2007. For the three months ended June 30, 2008, non-interest expense increased $304,000 compared to the three months ended June 30, 2007, which was primarily due to an increase in salary and employee benefit expenses, including expenses for the equity incentive plan of $252,000. Net income was $1.2 million, or $0.16 per fully diluted share, for the 12-month period ended June 30, 2008, compared to a net loss of $1.5 million for the 12-month period ended June 30, 2007. The reason for the net loss for the 12-month period in 2007 was the funding of the Hampden Bank Charitable Foundation.

Silverscape Designs Named One of ‘Coolest’ Jewelry Stores

NORTHAMPTON — INSTORE magazine, a trade magazine for the U.S. jewelry industry, recently named Silverscape Designs to its list of coolest jewelry stores in the U.S. A panel of expert judges from the jewelry industry evaluated more than 117 entries and placed Silverscape Designs as number five on their list of ‘Big Cool’ stores (‘Big Cool’ is a store with more than 11 full-time employees.) In their published comments, the judges singled out the qualities of Silverscape’s Northampton, Mass. location at 1 King Street in a 1928 Art Deco bank building, calling it a “dramatic site and building” and the “set for a vintage movie.” Silverscape is the only store on the list located in New England.

STCC Offers New Water Remediation Program

SPRINGFIELD — Applications are now available for a new one-year certificate program titled ‘Water Remediation Technician’ at Springfield Technical Community College. Classes in the new program start in September and include English, water remediation, math, chemistry, occupational safety, drinking and industrial water processes, biology, and computers. Graduates of the certificate program may pursue state certification in an area such as wastewater treatment. United Water is currently offering a $500 scholarship for Springfield residents enrolled in the program. For more information, call the Admissions Department at (413) 755-3333 or visit www.stcc.edu.

Wind-farm Financing Tops $14M

HOLYOKE — A new $8 million loan agreement with the Berkshire Wind Power Cooperative Corp. brings PeoplesBank’s support of renewable energy to $14.5 million since last December, according to Douglas Bowen, president and CEO of PeoplesBank. The financing has allowed the cooperative to acquire the assets of a proposed 15-megawatt wind project in the Berkshires and will be used for deposits on the 10 1.5-megawatt wind turbines to be constructed on the site. Also, PeoplesBank recently announced $6.5 million in financing for a wind farm in Princeton. When completed, the Princeton wind farm will consist of two 1500-kilowatt wind turbines capable of generating the equivalent energy consumption of 800 homes. Other Peoples-Bank sustainable-energy projects include $6 million in financing to improve Holyoke Gas & Electric’s hydroelectric equipment and capacity. Bowen also noted that PeoplesBank is focusing internally on environmentally friendly initiatives. To date, the bank has dramatically improved the energy efficiency of some older buildings and plans to improve others.

Premier Realty Group Merges With Keller Williams Realty

LONGMEADOW — Premier Realty Group recently merged its East Longmeadow office into the Keller Williams Realty office in Longmeadow. Michael Robie, principal broker and owner of Premier Realty Group for 17 years, said he merged with Keller Williams Realty because of its “agent-centric business model.” Robie added that Keller Williams’ focus on cutting-edge training, profit sharing, and wealth-building opportunities piqued his interest.

Tri-State CDL Training Center Moves to Springfield

SPRINGFIELD — An eight-acre training facility at 255 Liberty St. is the new home for Tri-State CDL Training Center Inc., formerly of Holyoke. Tri-State offers classroom and field training as well as on-site testing and job-placement assistance to individuals pursuing a career in the trucking industry. The company, owned by Anne and Morgan Finn, is a member of the National Safety Council and the American Trucking Assoc. The Finns note that their state-of-the-art training center is the largest tractor-trailer training facility in New England.

STCC Awards 30,000th Degree

SPRINGFIELD — More than 30,000 degrees and certificates have been awarded by Springfield Technical Community College (STCC) in its 41-year history. At its recent commencement, STCC honored the men and women who earned those degrees, and recognized the 30,000th degree recipient, Jessie Fisher of West Springfield, graduating from the Nursing program. STCC President Ira Rubenzahl noted that, while STCC’s career-focused academic offerings attract students from across the region and surrounding states, the majority of the students hail from Greater Springfield. “Because our students live here, after graduation they stay here,” he said, adding those students contribute to the local economy, staffing hospitals and industry, starting new businesses, and the like. STCC has awarded 8,551 degrees or certificates in nursing and allied health fields; 7,619 in engineering technologies; 6,968 in business and information technologies; 932 in math, science, and engineering, and 6,197 in liberal arts and social sciences.

Country Bank Increases Income

WARE — Country Bank recently reported net income of $3.8 million in the first six months of the year compared with $2 million in income during the same period in 2007, an 82% increase. Bank officials noted that the increase was due to the Federal Reserve lowering the interest rate it charges for money. Deposits were also up $50 million, and the bank originated $130 million in new loans.

PaperRocks! Launched

AGAWAM — The Southworth Co. has begun offering a new brand of notebooks and paper products for students called PaperRocks!, and will donate thousands of dollars worth of the products to the Kids in Need Foundation. The foundation is based in Dayton, Ohio, and provides school supplies to underprivileged children. Paper-Rocks! notebooks and filler paper are color-coded and have places for students to write in the date and subject matter.

The following building permits were issued during the month of July 2008.

| AGAWAM Rick & Joanne Locke Tony Cirillo AMHERST Amherst Housing Authority CHICOPEE Pioneer Valley Church Polish National Credit Union GREENFIELD Alliance Church Fiske Family Trust William F. Martin SPRINGFIELD American International College Balise Automotive Realty Casale Inc. | City of Springfield Frank Forastiere Springfield Label Solutia TW Realty Urstadt Biddle Properties WESTFIELD Berkshire Industries L&B Trucking Our Lady of the Blessed Sacrament WEST SPRINGFIELD Lattitudes Restaurant Walter Rickus Wendy’s Restaurant |

The following bankruptcy petitions were recently filed in U.S. Bankruptcy Court. Readers should confirm all information with the court.

| Abert, Aleah J. Akalis Electric Arena, Barbara August Blue Moon Barber, Becky M. Batutis, Paul A. Becker, Helaine M. Bell, Darrick L. Bernardo, Martha J. Buchanan, Mark David Cady, David P. Cardone, John Joseph Carosello, Richard Chege, Peter Ndungu Chmiel, Richard Collins-Rancourt, Joanne L. Cruz, Daniel daCunha, Brian W. Del Properties, LLC, Depault, Lisa J. Desantis, Paul R. Diefenderfer, Mark Frederick Dufour, Michael R. Early, Scott Edward Ely, Cindy L. Finnegan, Robin V. Gaudet, Dennis E. Giampolo, Arthur Gilpatrick, Susan J. Goodrich, Corey W.A. Govor, Nikolay Green, Paris Y. Greene, James Hall, Lisa R. Hamel, Dominic Robert Hamel, Jane Leigh Hathaway, Roosevelt Hill, Paul R. | Hodges, Thomas Allen Houle, Barrie L. Houle, Christopher J. Hunter, Shorrie R. Hussey, Thomas F. Imler, Shane P. Jay’s Welding and Steel Leclair, Jennifer M. LeClair, Susan M. Ljungberg, Mark D. Matos, Isaias Mayfield, Rodney Tyrone McLean, Richard H. Nehmer, Michele A. Oldenburg, Roger W. Oliver, Zhu/Twoli Ylang-Ylang Ortiz, Carmen D. Parker, David E. Pero, Stephen A. Pet-O-Rama, Provost, Patricia Ann Pulcher, Dale A. Randall, Richard A. Rodriguez, Nereida L. Rouvellat, Robert E. Shanley, Damion P. Shanley, Michelle L. Sheehan, James F. Snyder, Dennis Spelko, Erica Elizabeth St. John, Mark R. Trepp, Stephen D. Troiano, John M. Trumble, William C. Vazquez, Marisol Walker, Mary Ellen Walter, Catherine C. Wheeler, Ethel M. Williams, Ryan F. |

Those Are the Themes Behind an Expanding Northampton Enterprise

Ten years ago, Liz Cole had two ideas: one for a health club, and one for a daycare. The two businesses launched independently of one another, but as both continue to prosper along with two more of Coles ventures, theyre blending together as they focus on a dominant theme: healthy families.

Liz Cole calls it organized chaos the delicate balance of managing four independent businesses under one roof, three of which call children their primary clients.

At 33 Hawley St. in Northampton, the former home of the Rugg Lumber Company, Cole has created a unique mix of family- and fitness-oriented endeavors, including a health club, a daycare, a kids fun and fitness center, and an entertainment venue that provides everything from pizza parties for kids to club dances for the older set.

In fact, the notion of fitness and family is one that Cole returns to often; she noted that each service shes devised was designed to provide a comfortable space for both adults and children, and to teach a little something to all parties along the way. It can be a complicated business model to explain, but as the level of activity on Hawley Street continues to rise, its proving to be a successful one.

Is every day utopia? No, said Cole with a laugh. But our bills are paid, theres a little left over, and we have fun.

Training Days

Cole has a background in social work and early-childhood education, including an eight-year stint in Seattle, Wash. with Head Start, the longest-running national school-readiness program in the U.S. This professional background, paired with the belief that physical fitness is a cornerstone for any healthy individual, was the driving force behind Coles idea to open fitness- and child-related businesses concurrently under one roof. She bought the 25,000-square-foot building that now houses her four individual businesses and a fifth, a pilates studio, in 1997. A year of renovations followed, and in January 1998 Coles inaugural venture, Universal Health and Fitness, opened its doors.

The gym has an emphasis on overall fitness, and has an atmosphere where we hope everyone feels welcome young, old, the very physically fit, and beginners, Cole explained, noting that everything from the layout of the gym to the equipment reflects that mission. The lines of equipment we use are sized for both men and women, and therefore are a little more gender-neutral than some other lines, for example, and the free weights arent hidden in the back so someone who wants to use them has to walk past everyone else in the gym to get there. Thats a big deterrent for some people, so ours are the first thing you see when you walk in. We tried to look at the gym from a new perspective, aimed at making the trip not-so-scary for people.

A month after Universal Health and Fitness opened, Dolphin Daycare was launched on the bottom floor of the building, offering care and early education for infants to pre-kindergarten-aged children. Cole said her mantra about the two anchor businesses is, my head is in the gym, but my heart is in the daycare, and this helps explain the two divergent ventures.

My background is in social work, so even though Im not spending all day putting out fires for families in crisis, I can still help with parenting issues, behavioral issues, and other things, she said. We are a resource for families, and that adds something nice to the work I do every day.

Plus, the gym doesnt create as many referrals for the daycare as some people might think, she added. Theyre definitely two different businesses. But that is good for word-of-mouth, and often, children who are part of the daycare move on to our before- and after-school programs that are used by parents who are also gym members. So gradually, all of the businesses are starting to mesh.

The hardest evidence of this meshing quality came last spring, when Cole built another service into her existing families and fitness objective.

Fitting It All In

With Universal Health and Fitness occupying the top floor and Dolphin Daycare using only half of the ground floor, a variety of tenants occupied the remainder of the building until last year, when Cole launched a third business, Universal Kids. This addition is a blend of activities, education, and entertainment, inviting children and their parents to visit for a dive into the ball pit, a kids yoga class, a birthday party, or just some play time in the free-play and snack-bar area.

Its all about fitness, families, and kids having fun, Cole said. The gym and the daycare have always coexisted, but this felt like the missing link it made sense to combine the two ideas.

As it turned out, Cole thought Universal Kids was a good idea on which to build, as well. Just last month, she added a fourth business to her repertoire, Club K, which operates in the same space as Universal Kids during evening and weekend hours.

Club K is an entertainment venue for children, teens, and adults, and events are scheduled on alternating nights to accommodate each age set. Thursdays, for example, are family fun night, at which parents and their children can learn a craft as they socialize over pizza and apple juice. Fridays are either teen nights, providing dancing and karaoke for 13- to 17-year-olds, or 18-plus open mic nights; and Saturdays are adult nights, welcoming anyone 21 or over to attend themed, DJ-led dance parties that begin earlier than most clubs (8 p.m.) and close at midnight. Club K has also secured a limited beer-and-wine liquor license for adult nights, which Cole is hoping to expand on further in the coming months.

We launched Club K deliberately in the early summer because its a slower time for the other businesses, and we could get a feel for what people wanted and tweak the model from there, she said. Its been a little hard to explain that we have events with beer and wine and also a daycare, but while the idea to provide all sorts of activities for families is part of everything we do, Club K has been designed to keep things very separate.

As Universal Kids and Club K continue to grow in terms of programming parenting classes and speed dating nights complete with child care for parents are among the ideas being mulled the building itself is also undergoing some changes. Cole said work is now underway to expand the upstairs pilates studio, which is rented to Nadya Kostek for her business, Personal Touch Pilates. Downstairs, the daycare is also getting a facelift, expanding to include six classrooms.

Working It Out

On the longer-range side of things, Cole said shes also completed plans for a possible water park on the property, and is now in the process of securing a final location and financing. It is, indeed, the latest addition to a diverse model that requires a little bit of explanation, but everything is tied together, Cole repeated, with that pervasive theme of family.

Every member of a family has needs, and were working to meet them, she said. When someone leaves after a great workout, they feel good. When a child comes home and can sing a whole song through for the first time, the child feels good, and the parents feel great. And when a parent leaves their six-week-old here with us, and leaves feeling good about it, we feel good.

This is important work, Cole concluded. Its fun and also exhausting, but above all else, its important.

Jaclyn Stevenson can be reached at[email protected]

Westmass Unveils Ambitious Plans for a Ludlow Mill Complex

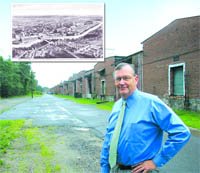

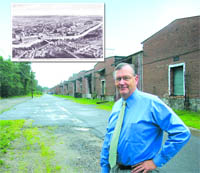

Left, an undated lithograph shows the Ludlow Manufacturing Associates complex nearly a century ago. Below, Kenneth Delude stands near some of the dozens of small stockhouses at the mill complex, which comprise one of many challenges to re-use of the site.

Westmass Area Development Corp. is finalizing acquisition of the sprawling Ludlow Manufacturing Associates complex, which was once the largest jute-making facility in the world. Westmass administrators say the ambitious initiative, which blends elements of greenfield and brownfield development, could, over the next 15 to 20 years, attract perhaps $300 million in private-sector investments and create more than 2,000 jobs.

Its a powerful image a lithograph (date unknown) th.at depicts the sprawling Ludlow Manufacturing Associates complex that gave the community its identity both literally and figuratively.

Indeed, Ludlow has been known throughout most of its 234-year existence as a mill town, and it was known as Jute City thats the product (twine) that was made at the complex. Meanwhile, the clock tower on the northwest corner of what was known years ago as Mill No. 8 has become perhaps the towns most identifiable landmark. It appears on the town seal, the masthead of the local weekly newspaper, the Register, Ludlow High School class rings, and many other places.

The mill complex along the banks of the Chicopee River, including several buildings that are no longer standing, certainly dominates the lithograph, first published in a 1928 book on the making of jute, but thats not the only thing that catches Kenneth Deludes eye.

Look at all the housing, on both sides of the river, that was built by the mill and because of the mill, said Delude, president of Westmass Area Development Corp., who also referenced streets, parks, and the town library as current fixtures that came about as a direct result of the mill complex and its ownership.

At one time, there were about 8,000 people living in Ludlow and 4,000 people working at the mill complex, he said as he moved his hands in a circular motion across the image. When I look at this picture, I think of the enormous regional impact that this complex had the jobs it created were part of the economic fabric of the community. And thats what we hope to do again.

Indeed, Delude sees history repeating itself, albeit on a certainly smaller scale, if an ambitious Westmass project currently in the formative stage unfolds as he expects that it will. The agency, part of the Economic Development Council of Western Mass., is in the process of acquiring what remains of the mill complex some 1.6 million square feet of floor space on a 170-acre parcel, nearly half of it undeveloped and create a mixed-use complex on the site. Preliminary estimates (and they are very preliminary) indicate that such reuse and new development could create perhaps 2,000 or more new jobs, generate millions of dollars in tax revenue, and spur additional economic development much of it in the form of businesses that would support those 2,000 workers.

The business plan for the project, known for the moment as at Rivers Edge (more on that later), is still very much a work in progress, said Delude, who used an enlarged version of the lithograph and some aerial photographs of the site to show what could happen there.

Gesturing toward what is now known as the clock tower building, he said its ground floor could house a bank, a restaurant or two, and other enterprises that would support workers in the redeveloped complex, while its upper floors could house fledgling businesses. Tapping a large, five-story mill building now largely vacant, he said it could be retrofitted into elderly or market-rate housing.

Meanwhile, a currently undeveloped section of the complex could be put toward development of smaller buildings (10,000 square feet to 50,000 square feet) for growing businesses, he continued, while the 79 acres of undeveloped, wooded land could become an industrial park. Several dozen small stockhouses, used to store raw materials for jute making, could be put to imaginative uses, perhaps as incubator spaces, said Delude, adding that many will likely be razed.

All these coulds will be more thoroughly explored over the next 18 months or so, said Delude, adding that the hope is to retain as many of the current buildings as possible to preserve a sense of character and history, while also creating a business park that will help retain existing companies and attract new ones.

The Ludlow project, as envisioned, would be the most ambitious project to date for Westmass, which has developed industrial parks in Agawam, Westfield, Hadley, and East Longmeadow (in that order) and its first true brownfield project meaning development of former industrial space that has environmental issues to be addressed.

Such brownfield development was deemed a priority by the Westmass board of directors, said Stephen Roberts, thats bodys president, both out of necessity and a sense of civic responsibility.

Elaborating, he said the region has many potential brownfield development sites most of them former mills that produced everything from paper to tires and Westmass has committed itself to blending that type of development with the more-traditional greenfield variety that has defined the agencys past and present. Meanwhile, there are simply fewer of those greenfields to be developed, making projects like the one in Ludlow more of a necessity than an option.

In this issue, BusinessWest takes an indepth look at the Ludlow project, as currently conceived, and how this elaborate plan might come together.

Name of the Game Project India.

That was the first, and quite unofficial, name given to the Ludlow project, said Delude, noting that, like most large-scale commercial real estate initiatives these days, this one involved a high level of discretion and thus needed a code name.

This one was chosen because the raw materials that went into making jute came from India, he explained, adding quickly that, now that word is out, Project India is more or less obsolete, and those within Westmass have moved on, sort of. The organization wants to use at Rivers Edge somehow in the name, but hasnt determined yet what to put before those words hence the three dots that currently precede them in large part because the vision of the final product is still being shaped.

That Project India code name was in use for more than a year, or since the start of talks between Westmass and the current owner of the mill complex, Ludlow Industrial Realties Inc. negotiations that were brokered by Doug Macmillan, second-generation owner and president of Springfield-based Macmillan & Son Inc., which has been handling some leasing and other real estate-related matters at the mill complex since it was purchased by Arthur Fastenberg in the late 60s.

Fastenberg eventually acquired several other commercial properties in the region, including the former Westinghouse plant on Page Boulevard in Springfield, which is slated for conversion into a retail complex, said Macmillan. In Ludlow, Fastenberg arranged a sale-leaseback of the property with Ludlow Manufacturing Associates, thus ensuring a prominent, long-term anchor, and many other tenants, large and small, were added over the years.

When I first saw that site back in the 80s, it was really humming, said Macmillan, adding that, until perhaps a decade or so ago, the mill complex was 80% occupied, or more. Over the past several years, that percentage has fallen, reflecting a decline in manufacturing across the region, and the continual downsizing of Ludlow Manufacturing, later to be known as Ludlow Textiles, which moved out completely about 18 months ago.

At or around that time, at the behest of several of Fastenbergs descendents, who now control Ludlow Industrial Industrial Realties Inc., Macmillan approached Westmass about potential interest in the complex.

Initial discussions centered around the undeveloped, wooded portion of the property, said Macmillan, but ownership wanted to sell the entire complex, and quickly convinced Westmass to take that course. More formal discussions took place in New York earlier this year, and, over the course of the past several months, a purchase-and-sale agreement was reached, with the price still undisclosed.

Thus, the Ludlow project becomes what Delude believes is the largest mill-reuse development initiative in New England, and one that will be somewhat unique in that it will focus more on commercial and industrial development than residential, although there will likely be housing components.

This uniqueness makes it hard to find models to follow, said Delude, but there are some.

One is the former Digital complex in Maynard, Mass., which is similar to the Ludlow site, right down to the clock tower, which gives it its name Clock Tower Place. Located along the Assabet River, the 1.1 million-square-foot complex was originally home to the Assabet Manufacturing Co., which made carpets and yarn, and later to DEC, which started as one of many smaller tenants to inhabit the mill in the 1950s, and later occupied the entire complex as Ken Olsens enterprise became one of the leading makers of minicomputers.

But Olsens failure to grasp the concept of the personal computer led to DECs demise, and by the late 90s, the mill complex was almost entirely vacant. It has been rejuvenated with new ownership, and is now home to Monster, the Yacobian Group, and many other tenants.

Another potential model is the Bates Mill Complex in Lewiston, Maine, a 1.2 million-square-foot series of mills that once produced uniforms for the Union army during the Civil War, and is now home to a number of diverse businesses. The list includes the loan-processing operations center for Peoples Heritage Corp., but also dozens of start-up businesses and support services.

Knots Landing

Delude, who plans to visit still another potential model in Rhode Island later this month, said Westmass hopes to take lessons and inspiration from these projects as it goes about writing the next chapter in the history of the Ludlow mills.

If we dont have to reinvent the wheel, then we wont, he said. Theres a lot that we can take away from whats happened before.

As he gave BusinessWest a tour of the Ludlow complex, Delude stopped the car at several locations to point out both opportunities and challenges, and there are several of both.

In the latter category, he referenced a warehouse, circa 1914, that housed finished product and was, in its day, the largest jute warehouse in the world. It is eight stories high, but shorter than the neighboring five-story mill because each level outfitted with some of the first concrete floors used in this country due to the excessive weight of the twine is only eight feet high.

This will limit re-use possibilities, but there are several options, said Delude, who said the building is one of many he would like to preserve if possible.

The stockhouses present another challenge for reuse, he continued, noting that their size (roughly 6,000 square feet each) and shape do not lend themselves to easy re-use. Meanwhile, they stand between the mill complex and the riverfront, and one of Deludes goals with this project is to make more and better use of the river.

For more than a century now, access to the river has been blocked, he said as he pulled the car to a spot along the bank. People can see it, but they cant get to it; we want to change that.

Development opportunities abound at the site, said Delude as he drove down State Street to the large, undeveloped stretch of the mill property, which winds along the river and eventually abuts Ludlow Country Club. The 70-acre site sits across from an attractive residential neighborhood, but Westmass industrial parks have shown they can live in harmony with such areas, he explained.

This is the case in Agawam, where a business park built on what was once Bowles Municipal Airport abuts several residential streets. Weve shown that we can successfully co-exist with neighborhoods like this one.

There are more than 60 buildings on the Ludlow site, said Roberts, who told BusinessWest that Westmass will attempt to reuse all those where preservation makes sense. In those cases where it doesnt, the agency will pursue what he called deconstruction a word he preferred to demolition and reuse the bricks and other building materials in a broad effort to maintain the look and feel of the historic jute-making complex.

The next steps in the process of making the vision for the site reality are to finalize purchase of the property which is expected to take place over roughly the next year and complete what Delude called a business plan for the project.

This involves gauging what is feasible with regard to what he considers to be perhaps five distinct phases, and coordinating a plan for how and when to proceed with each one. Were going to spend the next 18 months testing theories and principles, he explained. Were going to determine what we can do, and what we should do to create jobs and opportunities for this region.

Overall, Delude said the sites location only a few minutes from Turnpike exit 7 in Ludlow and various amenities add up to an attractive, and sustainable, economic-development initiative that will make the clock tower building as much a part of the towns present and future as its past.

Its such a significant feature of the town, he said of the landmark. But what it meant for the region, not just Ludlow, was vitality and energy, and it can be that again.

Not a Run-of-the-mill Project

As he talked about the Ludlow initiative and how he envisions it progressing, Delude compared it in many ways to the Agawam Industrial Park.

Although much different in nature, the sites are similar in size, at least with regard to how many square feet of industrial and commercial space each can accommodate. Meanwhile, the Agawam project has taken roughly 20 years to develop and reach near-full occupancy and roughly the same is expected for the Ludlow site and both locations necessitate industrial park development in a mostly residential setting.

The Agawam park now boasts more than 2,000 jobs and contributes millions in tax revenue to the community, said Delude, adding that, if this rate of performance can be matched in Ludlow, Westmass will go a long way toward making an impact that will be on a smaller scale than that made by Ludlow Manufacturing Associates, but perhaps just as significant.

An image to rival that lithograph will probably be two decades in the making and thats if all goes as planned but if things develop as Delude believes they will, it might be just as powerful.

George OBrien can be reached at[email protected]

How Professional Service Firms Can Tip the Scales

Many professional service firms find that getting clients through the door is tough these days, and the competition for available business is fierce. So what is the silver bullet that gets prospective clients to hire you regardless of the economy and instead of your competitors?

Add more and more value to your service.

One of the most significant marketing lessons to be learned is that people want value. It may seem oversimplified, but all human beings are motivated the same way. All decisions are made by balancing investment against perceived returned value.

Perceived returned value is the only reason people part with their money. When you create the perception that there is abundant value in your professional service, choosing you becomes obvious to prospective clients.

As soon as your competitor adds more perceived value to their service than your firm has, the scales start tipping in its favor. However, the better you know and understand your particular clients wants, needs, motivators, and pain, the more value you can provide and claim in your marketing.

Take a few minutes right now to look at your own materials and Web site through fresh eyes. Put yourself in the shoes of a prospective client and ask, What do I get? Now ask, How can this firm or company solve my problems? And finally ask, Why this firm instead of another? If there are no obvious and compelling answers to those questions, it is time to create everything afresh from your clients perspective. Yes, you will have to spend money, but what is the cost of letting all that business go elsewhere? It goes back to your own pain

Is the cost of not doing this greater than the investment in materials that work? Only you can make that judgment.

So how can you add value to your professional service?

Quality

What quality do clients expect from your work? Explain this by defining exactly what quality means to your clients. Is it precision? Sustainability? Excellence? Superiority? Reputation? Worth? Simply listing the word quality in an ad wont do it. You must define the quality you provide in as many qualitative terms as you can, even if they seem obvious to you. Oftentimes, when you state something that your competition doesnt, it appears that they dont provide it.

Time

Is the timeliness and responsiveness of your service to your clients comparable to or better than what they would receive elsewhere? This refers to the various aspects of delivering your work and how long it takes to initiate a project and submit work or changes back to your clients for review. What exactly does time mean to your clients? How quickly do they expect to see preliminary drafts and final results? How does your work delivery compare with the competition? How can you one-up them? Can you promise delivery of your work by offering a bonus of some sort if you dont deliver on time? Remember the power of Dominos old offer, 30 minutes or its free.

Expertise Provided

How does your level of expertise compare to what your competition offers? How does that benefit your clients? For example, if youre a lawyer who earned an LL.M in Taxation, and you simply list that as part of your signature, it just boosts your ego. But if you explain to your clients how that extra schooling and knowledge will save them save money and protect their interests, you effectively turn that distinction into a client benefit. Determine what special talents, personalities, employees, or technology your firm possesses that add value to your professional service. Is that being communicated as value-added to your potential clients?

Services Offered

Does your firm offer an impressive range of services that can help your clients in some way? How so? Explain this in terms that benefit them. Do you have unique processes or equipment? Do you possess any copyrighted materials or contracts that streamline your work and benefit your clients by saving time and effort? How else can you embellish your offering to create more perceived value that is meaningful to your clients? If they dont know theyre getting something special, they cant possibly perceive it as a benefit that tips the scales in your favor. Spell it out. Remember, though, that you must explain these in terms of how they benefit your clients, because prospects will not necessarily make that leap if you simply list your services.

Guarantee

Do you offer your clients a guarantee or assurance of your work? Do your competitors offer anything? Guarantees are all about reducing your prospects perceived risk and making them more inclined to engage you. Can you formulate a promise that eliminates or reduces the risk a client has to take when they hire you? If you are confident in the quality of your work product, and how much would it actually cost your firm to reverse the risk from your clients onto yourself? Even if the guarantee is challenged from time to time, the goodwill earned in making the client happy will more than pay off in referrals and repeat business.

Price

How does your price compare to the competitions in terms of the same levels of service, quality, response time, expertise, etc? To define exactly what price means to your clients, you must understand if there is a specific cost for your service that they expect to pay. Why is that? Can you offer packages of services under a larger fee that offer the perception that clients are getting a lot of value for their money? Can you add or subtract services to adjust the package price? Can your services be quoted on a pre-determined fee basis that eliminates the perceived risk factor of the client paying too much in add-ons and extra work?

Perceived Level of Service

You should strive to control how potential clients perceive your firm. This is about how your clients compare you to other professionals in the market who do similar work. Although it is subjective, how can you tip the scales of this perception? To add value to your perceived level of service, you must thoroughly understand your market and your competition. How can you change or reframe the emphasis of your clients screening process or their encounter with your professional service to create a special experience that is uniquely yours?

A word of caution, though, when using any of the above value-added techniques: do not fall into the trap of using just single-word descriptions. Firms typically use single words to describe themselves when they dont understand their own innate value. Relative terms like quality, price, and service are meaningless because people expect these things in all interactions with professionals. These terms dont state anything uniquely yours.

So, the only way to compete head-to-head with a firm that offers the same professional services at a similar price is to offer more perceived value. These can be subtle or explicit value differences. It can be as simple as an info-packed, regularly updated blog or a Web site that is really easy to navigate. It can be the extraordinary way clients feel they are treated, or it can be more-attractive payment terms or a guarantee that your competition doesnt offer.

Think of this in terms of a scale. The more you add to one side, the more the scale is weighted in your favor and the less resistance there will be to purchase. There comes a point when youve added so much value to your own service that it simply doesnt make sense for a client to look elsewhere. Thats the position you want to be in.

It is important to keep in mind, however, that sometimes people do business with a particular firm because they just plain like it. But once you define all the reasons your clients secure their professional services from you, keep giving them more of the same. Truly, the more you give, the more you get. Adding more value is about going that extra step to be perceived as a cut above your competitors.

If you want more prospects to say yes, make your firm or practice outstanding by tipping the scales in your favor with exceptional value.

Christine Pilch and Dennis Kunkler are partners with Your Brand Partnership. They collaborate with clients and agencies to get results through innovative positioning strategies: (413) 537-2474;yourbrandpartnership.com, Expect Results.

A Gift to Northampton 80 Years Ago Continues to Hone Its Presence

The Pines Theater, one of Look Park’s many attractions, has become a popular site for outdoor concerts.

Theres a portrait of Fannie Burr Look hanging in the Look Park Garden House that seems to cast a watchful eye on the sprawling property.

Are the flower gardens pruned? Are there people enjoying the pedal boats in the pond? Did the steam train go by already, sounding its whistle? If portraits could talk, its likely that Fannie Burr Looks would have plenty to say.

In 1928, she became the impetus behind creating what is now one of the regions largest and most diverse parks in the name of her late husband, Frank Newhall Look, a prominent businessman in the late 1800s and early 1900s, by gifting a 157-acre parcel of land to the city of Northampton (the park is in Florence).

Even today, signs of her influence remain, and help to move plans at Look Park forward.

Though city-owned, taxes are not used to finance any aspect of Look Parks operation; it functions as a self-sustaining attraction governed by a six-person volunteer board of trustees. Ray Ellerbrook, Look Parks executive director, said this was a stipulation that Fannie Burr Look set out for the park before its inception.

Mrs. Look wanted no connection with the city, he explained. Making the mayor of Northampton a member ex-officio on the board of trustees was as far as she would go, and thats the way it still is today.

While that separation may have stemmed from a distrust of government on Looks part, Ellerbrook said it has made for a self-contained business model at the park that has long allowed its staff to tap varied funding sources and make incremental improvements. Look provided the land, development funds, and a trust fund for ongoing maintenance, and today these funds are augmented by visitor fees, grants, and gifts.

Mrs. Look was a woman ahead of her time, he said. Before her involvement, this was only farmland that the city thought was too far away to be of any use publicly.

A New Destination

Over the years, as both Northampton and Florence have grown, however, the public has found several uses for Look Park, including as a concert venue (the open-air Pines Theater is on the grounds), a banquet facility, and a place for celebrations, in addition to serving as a family-oriented park offering childrens programs, a small zoo, paddleboats, day-camp sites, walking trails, a splash park, and a well-known train that chugs its way through the park on a regular basis.

Jillian Larkin, facilities manager at Look Park, said improvements are currently planned throughout the facility, in terms of both infrastructure and programming.

Were in a nice spot right now because we already offer so much, but we have room to grow as well, she said, listing a few of the parks popular features: the Sanctuary at Willow Lake, which can accommodate 150 people for weddings or other functions; a Victorian gazebo, suitable for smaller weddings; and the Dow Pavilion, the largest gathering space at the park, able to hold 200 people. In addition to these facilities, Look Park also has a ballfield, multiple playgrounds, and a Picnic Store that offers light lunches and novelties.

Adding to this landscape of late is one of the most important developments already completed at the park, Larkin noted the renovated Look Park Garden House, where Fannie Burr Look peers out over the grounds.

Completed in 2002, the renovation project converted the parks former pool house into banquet and event space. The building can accommodate functions for up to 170 people, including weddings, receptions, and business meetings, with that last category being one that Larkin is looking to expand in the coming months.

We have wi-fi, a built-in P.A. system, and I think this is a great place for corporate retreats, she said. Instead of having a coffee break, people can come here for a little bit of a nature break.

Pooling Resources

Ellerbrook agreed that the Garden House has become a particular focus at the park of late.

Its not the first time that corner of the park has been the center of the action; the former pool house once sat adjacent to a large pool that earned some local fame during its heyday; in fact, many Northampton and Florence residents were sad to see it go.

The pool was a tremendous feature, said Ellerbrook. It was huge, and had multiple waterslides before safety concerns changed. When the trustees decided to close it, it was actually a controversial decision people did not want to see that happen.

But it was old, he added. It was cracked and in need of repairs that would have cost $500,000. It was time for it to go.

The area the pool once occupied is now a small bumper-boat park and a playground, and the Garden House is gaining more recognition as a unique event space each year. Larkin said every weekend is generally booked, and she hopes to increase that pace to include mid-week functions.

Were getting there, she said. As we host more events, were able to show our different strengths as both a park and a venue. That helps us call attention to the role we can play in events for the whole family.

Ellerbrook said that same goal is prompting renovations throughout the park, which are largely aimed at beautifying the space and making it more accessible to various groups of visitors.

The large fountain at the entrance of the park, for one, is being refurbished as part of a focus on curb appeal, and the Look Park train station, a popular fixture for several years, is also being renovated and updated.

Outside of the parks parameters, state and local projects now underway are also having an impact. A bike path is being extended to run through the park, and on Bridge Road where Look Park sits, a roundabout is being constructed that Ellerbrook hopes will ease traffic concerns.

The Eyes Have It

All the while, he said that family-oriented flavor Look Park has cultivated over the last 80 years is always in the forefront of his mind as improvements continue.

If for no other reason, he pays close attention to that mission to honor the wishes of Fannie Burr Look, whose picture keeps a discerning watch over the parcel of land that has become a fixture in Hampshire County.

Jaclyn Stevenson can be reached at[email protected]

The Effect of E-mail Communication on Attorney-client Privilege

There is no doubt that we are all more technologically advanced than ever. What used to be just a cell phone is now our phone, a camera, and it plays music. We are able to communicate with each other electronically 24 hours a day, and some of us have created relationships with others whom we have never met, having only communicated through E-mail, chat rooms, or social-networking sites such as MySpace, Facebook, or LinkedIn.

What we dont consider is how these advanced means of communication may be creating a trail that we do not want to be followed.

Attorneys are always mindful of the attorney-client privilege. A prudent practitioner will take tremendous steps to see that communications between their client and themselves do not fall outside of that privilege. We instruct our clients as to the importance of the privilege and to take steps to insure that no one is privy to the communications so that the privilege may be lost.

What some may not realize, though, is that they may be losing this privilege via the use of E-mail or other forms of electronic communication. A question arises: when a client communicates with his attorney via E-mail, is this communication still protected by attorney-client privilege?

This issue that has yet to be addressed by the Appeals Court or the Supreme Judicial Court in the Commonwealth of Massachusetts, but it has begun to be addressed by courts in other jurisdictions. Notably, courts in the state of Tennessee in the case of Hazard v. Hazard stated that when one of the parties sent a letter to their attorney through the family computer, this communication was not protected by the attorney-client privilege. The court in the Hazard case reasoned that, because others had access to the computer, it was as if the husband was talking to his attorney with his wife in the room.

In addition to the ruling in the Hazard case, other jurisdictions have held that there is no expectation of privacy on the family computer even if you are able to password protect your communications. The consensus of other jurisdictions on this issue is that if others have access to the computer, anything that you do on this computer is fair game.

This is not the first time that courts have determined that communications one might think are privileged are actually not safe from disclosure in the future. The issue arose previously when dealing with E-mail communications between a husband and wife.