| Ackley, Keith Edward

Ackley, Marie Christine

7 Birch Hill Road

Blandford, MA 01008

Chapter: 7

Filing Date: 04/09/09 Acosta, Israel

53 Elmwood Ave.

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/08/09 Adams, Mechelle L.

a/k/a Gardner-Adams, Mechelle L.

240 Prospect St.

Athol, MA 01331

Chapter: 7

Filing Date: 04/13/09 Aldrich, Michael D.

Aldrich, Kimberly A.

3 Park Dr.

Wilbraham, MA 01095

Chapter: 7

Filing Date: 04/06/09 Alicea, Domingo

81 Woodside Ter.

Springfield, MA 01108

Chapter: 7

Filing Date: 04/15/09 Andrade, Carrie-Ann

a/k/a Gaynor, Carrie-Ann

3 Jeanne Dr.

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/15/09 Anello, Patrick J.

22 May Ter.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 04/09/09 Ansaldo, Marie L.

3 Golden Court

Hadley, MA 01035

Chapter: 7

Filing Date: 04/15/09 Ashe, Steven T.

194 East Longmeadow Road

Hampden, MA 01036

Chapter: 7

Filing Date: 04/06/09 Austin, Calandra B.

260 Pittsfield Road #3A

Lenox, MA 01240

Chapter: 7

Filing Date: 04/13/09 Barnes, Cynthia I.

110a Hillside Road

South Deerfield, MA 01373

Chapter: 7

Filing Date: 04/14/09 Barton, Christopher C.

Barton, Sarah E.

a/k/a Smith, Sarah E.

51 Pineywood Road

Southwick, MA 01077

Chapter: 7

Filing Date: 04/15/09 Batchelder, Amanda

a/k/a Bessette, Amanda

a/k/a Batchelder, Amanda W.

38 Stanley Place

Agawam, MA 01001

Chapter: 7

Filing Date: 04/13/09 Beyer, Gloria J.

132 Ambrose St.

Springfield, MA 01109

Chapter: 7

Filing Date: 04/04/09 Beyer, William D.

Beyer, Suzanne C.

53 Pitroff Ave.

South Hadley, MA 01075

Chapter: 7

Filing Date: 04/02/09 Biancucci, Peter

140 Vincent St.

Springfield, MA 01129

Chapter: 7

Filing Date: 04/07/09 Blais, Claudette E.

12 Temple St.

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/07/09 Boulanger, Ronald H.

Boulanger, Jennifer L.

96 Sunflower Ave.

Chicopee, MA 01013

Chapter: 7

Filing Date: 04/02/09 Bray, Vernon L.

Bray, Patricia A.

268 Palmer Road

Monson, MA 01057

Chapter: 7

Filing Date: 04/15/09 Brown, Angela

120 Methuen St.

Springfield, MA 01119

Chapter: 7

Filing Date: 04/02/09 Bryant, John W.

62 Millbrook Dr.

East Longmeadow, MA 01028

Chapter: 7

Filing Date: 04/03/09 Buoniconti, Lucy V.

79 Almon Ave.

West Springfield, MA 01089

Chapter: 7

Filing Date: 04/15/09 Byron, Daniel P.

354 Vine St.

Athol, MA 01331

Chapter: 7

Filing Date: 04/15/09 Canedy, Bruce Emery

278 Deerfield St.

Greenfield, MA 01301

Chapter: 7

Filing Date: 04/02/09 Carlson, Stephanie A.

a/k/a Sermini, Stephanie A.

45 Pearl St.

Great Barrington, MA 01230

Chapter: 7

Filing Date: 04/09/09 Carpenter, Randy A.

213 Grattan St.

Chicopee, MA 01020

Chapter: 7

Filing Date: 04/09/09 Chapman, Bruce W.

Chapman, Anna M.

62 Foss Ave.

Chicopee, MA 01013

Chapter: 7

Filing Date: 04/03/09 Chittenden, Sharon Ann

93-C Grove St.

Adams, MA 01220

Chapter: 13

Filing Date: 04/14/09 Christianson, John E.

Christianson, Leona F.

28 Little Alum Road

Brimfield, MA 01010

Chapter: 7

Filing Date: 04/09/09 Christie, Shannon L.

a/k/a Forgues, Shannon

38 South St.

South Hadley, MA 01075

Chapter: 7

Filing Date: 04/14/09 Christina’s Country Store

Just Doggin’ It

Czerwiec, Keith

25 Belvidere Ave.

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/14/09 Clawson, Wendell L.

41 Piquette Ave.

Chicopee, MA 01020

Chapter: 7

Filing Date: 04/14/09 Clemens, Kelli R.

26 Irvington St.

Springfield, MA 01108

Chapter: 7

Filing Date: 04/10/09 Cloutier, Daniel M.

Cloutier, Tara J.

a/k/a Phelps, Tara J.

86 Meridian St.

Greenfield, MA 01301

Chapter: 7

Filing Date: 04/01/09 Coe, Adrianne M.

PO Box 1026

Pittsfield, MA 01202

Chapter: 7

Filing Date: 04/06/09 Conrad, Georgina R.

760 Williamsville Road

Barre, MA 01005

Chapter: 7

Filing Date: 04/02/09 Convery, Cheryl A.

919 Southampton Road

Westfield, MA 01085

Chapter: 7

Filing Date: 03/31/09 Cote, Merle G.

81 South Maple St.

Westfield, MA 01085

Chapter: 7

Filing Date: 04/14/09 Cruz, Ronald

Cruz, Tammy W.

127 Holyoke St.

Easthampton, MA 01027

Chapter: 7

Filing Date: 04/14/09 Dalinsky, Debra M.

47 Victoria St.

Springfield, MA 01104

Chapter: 7

Filing Date: 04/07/09 Del Padre, Emily E.

199 Rogers Ave.

West Springfield, MA 01089

Chapter: 7

Filing Date: 04/14/09 Dionne, Carol A.

39 Payson Ave.

Easthampton, MA 01027

Chapter: 7

Filing Date: 04/06/09 Dionne, Michael F.

39 Payson Ave.

Easthampton, MA 01027

Chapter: 7

Filing Date: 04/06/09 Dixon Titles, Inc.

Sinkora, Denise S.

a/k/a Dixon, Denise S.

54 Pine St.

Belchertown, MA 01007

Chapter: 7

Filing Date: 03/31/09 Donnelly, Maureen L.

a/k/a Labossiere, Maureen L.

150 Freedom St.

Athol, MA 01331

Chapter: 7

Filing Date: 04/03/09 Drew, Jason

25 Pleasant Green

Easthampton, MA 01027

Chapter: 7

Filing Date: 04/02/09 Drummond, Randolph T.

367 Island Pond Road

Springfield, MA 01118

Chapter: 7

Filing Date: 04/03/09 Egan, Richard C

Egan, Diane M.

90 Harris St.

Granby, MA 01033

Chapter: 7

Filing Date: 04/06/09 Ellsworth, Peter R.

717 Crane Ave., Apt. A

Pittsfield, MA 01201

Chapter: 7

Filing Date: 04/09/09 Etown Videos

Brunswick Consulting

MyWAN

Kielhorn, Sven

54 Pine St.

Belchertown, MA 01007

Chapter: 7

Filing Date: 04/14/09 Fernandes, Jose

a/k/a Fernandes, Joe

Fernandes, Rosemary A.

88 Phoenix Ter.

Springfield, MA 01104

Chapter: 7

Filing Date: 04/15/09 Fitzgerald, John K.

379 East St., #402

Pittsfield, MA 01201

Chapter: 7

Filing Date: 04/09/09 Fleming, Thomas K.

76 Nonotuck St.

Holyoke, MA 01040

Chapter: 13

Filing Date: 04/14/09 Fleurent, Theresa

a/k/a Jackson, Theresa Marie

a/k/a Woodard, Theresa Marie

16 Rita Lane

Belchertown, MA 01007

Chapter: 7

Filing Date: 03/31/09 Flores, Susan

28 Grosvenor St.

Springfield, MA 01107

Chapter: 13

Filing Date: 04/15/09 Foley, Mary C.

10 B Crandall St.

Adams, MA 01220

Chapter: 7

Filing Date: 04/02/09 Gilmartin, Nicholas A.

55 White Birch Dr.

Springfield, MA 01119

Chapter: 7

Filing Date: 04/15/09 Girhiny, Bart Allen

44 Chestnut St.

East Longmeadow, MA 01028

Chapter: 7

Filing Date: 03/31/09 Gleitsmann, Eleanor A.

354 Vine St.

Athol, MA 01331

Chapter: 7

Filing Date: 04/15/09 Gonzalez, Viana I.

a/k/a Velez, Viana I.

35 Cliftwood St.

Springfield, MA 01108

Chapter: 7

Filing Date: 04/02/09 Grechka, Ivan

Grechka, Tatyana

68 Merrick St.

West Springfield, MA 01089

Chapter: 7

Filing Date: 04/07/09 Gress, Kenneth J.

8A Arbor Way

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/09/09 Grover, Robert E.

740 Riverglade Dr.

Amherst, MA 01002

Chapter: 7

Filing Date: 04/15/09 Guyette, Christopher P.

Guyette, Jill E.

Henrich, Jill E.

Beane, Jill E.

202 High Meadow Dr.

West Springfield, MA 01089

Chapter: 7

Filing Date: 04/05/09 Haines, Shaun P.

a/k/a Haines, Megan E.

Parent, Megan Elizabeth

280 Garnet St.

Springfield, MA 01129

Chapter: 7

Filing Date: 03/31/09 Hamilton, Andrew S.

Hamilton, Bethany A.

a/k/a Desrosiers, Bethany A.

34 Pond St.

Ludlow, MA 01056

Chapter: 7

Filing Date: 04/09/09 Handerhan, Amanda

a/k/a Thacker, Amanda

2113 Stewart St.

Hatfleld, PA 19440

Chapter: 7

Filing Date: 03/31/09 Harris, Kelsie F.

49 Clem Ct.

Barre, MA 01005

Chapter: 7

Filing Date: 04/06/09 | | Holness, Favian L.

Holness, Venice A.

199 Stapleton Road

Springfield, MA 01109

Chapter: 13

Filing Date: 04/13/09 Ianello, Anthony J.

414 Chestnut St.

Springfield, MA 01104

Chapter: 7

Filing Date: 04/03/09 Johns, Elizabeth

775 Armory St.

P.O. Box 1011

Springfield, MA 01101

Chapter: 7

Filing Date: 04/15/09 Johnson, Ronnie D.

Johnson, Katherine W.

42 Amherst Ave.

Feeding Hills, MA 01030

Chapter: 7

Filing Date: 04/01/09 Kelley, William D.

Kelley, Vivian A.

153 Woodside Ter.

Springfield, MA 01108

Chapter: 13

Filing Date: 04/01/09 Killeen, Katherine A.

79 Birchwood Ave.

Longmeadow, MA 01106

Chapter: 7

Filing Date: 04/07/09 Kimball, Aric S.

Kimball, Meghann E.

Gradowski, Meghann E.

35 Knollwood Road

Brimfield, MA 01010

Chapter: 7

Filing Date: 04/05/09 Liebel, Kevin

Liebel, Mary A.

a/k/a Liebel, Mary

114 Westwood Ave.

East Longmeadow, MA 01028

Chapter: 7

Filing Date: 04/14/09 Loper, Michael

Loper, Miranda

33 Foch Ave.

Westfield, MA 01085

Chapter: 7

Filing Date: 04/07/09 Lowell, Irving R.

Lowell, Barbara A.

86 Independence Road

Feeding Hills, MA 01030

Chapter: 7

Filing Date: 03/31/09 Lynch, David J.

Lynch, Karolyn N.

77 Danek Dr.

Westfield, MA 01085

Chapter: 7

Filing Date: 03/31/09 Lynn, Joseph Francis

35 McClellan St.

Amherst, MA 01002

Chapter: 7

Filing Date: 04/15/09 Maccarone, Peter J.

P.O. Box 5510

Springfield, MA 01101

Chapter: 7

Filing Date: 04/14/09 Maher, Michael P.

P O Box 312

Greenfield, MA 01302

Chapter: 7

Filing Date: 04/09/09 Malcovsky, Linda L.

P. O. Box 192

Granville, MA 01034

Chapter: 7

Filing Date: 03/31/09 Mallette, Ronald P.

283 Bearsden Road

Athol, MA 01331

Chapter: 7

Filing Date: 04/02/09 Martin, Scott G.

2 Silver St.

Monson, MA 01057-9429

Chapter: 7

Filing Date: 04/06/09 Mascolo, John J.

144 Paige Hill Road

Brimfield, MA 01010

Chapter: 13

Filing Date: 04/09/09 Masse, David A.

18 Melinda Lane

Easthampton, MA 01027

Chapter: 7

Filing Date: 04/14/09 McClendon, Cheryl

a/k/a Smith, Cheryl L.

1470 Page Blvd.

Springfield, MA 01104

Chapter: 7

Filing Date: 04/06/09 McIntyre, Michael A.

P. O. Box 808

Belchertown, MA 01007

Chapter: 7

Filing Date: 04/15/09 McKinley, Larry

McKinley, Joan L.

17 Westminster St.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 04/10/09 Meisner, Victoria A.

a/k/a Merry, Victoria A.

37 Moriarty Road

Ware, MA 01082

Chapter: 7

Filing Date: 04/14/09 Mercado, Sr. Pedro A.

PO Box 5430

Springfield, MA 01101

Chapter: 7

Filing Date: 04/14/09 Millenium Women Destine Fund

Betts, Jacqueline

Simmons, Jacqueline

2473 Roosevelt Ave.

Springfield, MA 01104

Chapter: 13

Filing Date: 04/08/09 Murray, Michael S.

24 Holly Court

Florence, MA 01062

Chapter: 7

Filing Date: 04/09/09 Nelson, George E.

Nelson, Jessica L.

a/k/a Tucker, Jessica L.

80 Orange St.

Athol, MA 01331

Chapter: 7

Filing Date: 04/09/09 Ochenowski, Walter E.

886 Main St. #28

Agawam, MA 01001

Chapter: 7

Filing Date: 04/03/09 O’Connell, Brian G.

O’Connell, Lyn A.

51 Liberty St.

Feeding Hills, MA 01030

Chapter: 7

Filing Date: 04/10/09 Ogorzalek, Jeffrey M.

Ogorzalek, Toni

a/k/a Loguidice, Toni

P. O. Box 261

Agawam, MA 01001

Chapter: 7

Filing Date: 04/08/09 Ortiz, Esther

88 Marble St.

Springfield, MA 01105

Chapter: 7

Filing Date: 04/09/09 Ovitt, Travis B.

Ovitt, Christine M.

74 Adelaide Ave.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 04/02/09 Padua, Lisa Y.

Padua, Lisandro

15 Alden St.

Palmer, MA 01069

Chapter: 7

Filing Date: 03/31/09 Provost, Kim M.

22 Fair Oak Road

Springfield, MA 01128

Chapter: 7

Filing Date: 04/08/09 Reilly, Thomas M.

336 Front St.

Chicopee, MA 01013

Chapter: 7

Filing Date: 04/14/09 Reyes, Maria D.

183 Garvey Dr.

Springfield, MA 01109

Chapter: 7

Filing Date: 03/31/09 Riel, Monica A.

67 Bissell Road

Williamsburg, MA 01096

Chapter: 7

Filing Date: 04/02/09 Righi, Catherine A.

29 Commonwealth Ave.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 04/01/09 Roberts, Steven Dennis

Roberts, Shannon Marie

441 East Main St.

North Adams, MA 01247

Chapter: 13

Filing Date: 04/15/09 Rodriguez, Juan B.

Rodriguez, Yelitza

62 Pearl St.

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/09/09 Roger E. McGinnis Trucking

McGinnis, Roger E.

McGinnis, Grete M.

a/k/a Graves, Grete M.

a/k/a Raffa, Grete M.

Uncommon Cuts

7 Brandywine Dr.

Belchertown, MA 01007

Chapter: 7

Filing Date: 04/15/09 Roy, Gerard P.

20 Maybrook Road

Springfield, MA 01129

Chapter: 7

Filing Date: 04/08/09 Roy, Susan M.

20 Maybrook Road

Springfield, MA 01129

Chapter: 7

Filing Date: 04/08/09 Sanders, Carol M.

281 East St.

Springfield, MA 01104

Chapter: 7

Filing Date: 04/08/09 Sarrette, Cheryl

10 Fairview Road

Wilbraham, MA 01095

Chapter: 7

Filing Date: 04/01/09 Shah, Lack

Shah, Kaziban B.

43 Fisher St.

Springfield, MA 01109

Chapter: 7

Filing Date: 04/09/09 Sharif, Tammy

1809 Roosevelt Ave.

Springfield, MA 01109

Chapter: 7

Filing Date: 04/08/09 Shelton, Carl W.

570 Alden St.

Springfield, MA 01109

Chapter: 7

Filing Date: 04/09/09 Silva, Melissa

29 Decatur St.

Indian Orchard, MA 01151

Chapter: 7

Filing Date: 04/07/09 Slater, Warren Robert

Slater, Delma Quimque

100 Forest Hill Road

Feeding Hills, MA 01030

Chapter: 7

Filing Date: 04/01/09 Smith, Patrick J.

96 Hazelwood Ave.

Longmeadow, MA 01106

Chapter: 7

Filing Date: 04/09/09 Stevens, Sandra Gates

56 Prospect St., #4

Greenfield, MA 01301

Chapter: 7

Filing Date: 04/08/09 Sullivan, Jr. James M.

Sullivan, Jamie L.

44 North St.

Ware, MA 01082

Chapter: 7

Filing Date: 04/14/09 Taylor, Deborah A.

148 Main St.

Northfield, MA 01360

Chapter: 7

Filing Date: 04/13/09 Torres, Eugenio

1421 Dwight St.

Holyoke, MA 01040

Chapter: 7

Filing Date: 04/01/09 Uva, Kenneth Richard

20 Indian Hill Road

Ware, MA 01082

Chapter: 7

Filing Date: 04/09/09 Vasco, Maria C.

188 Center St.

Indian Orchard, MA 01151

Chapter: 7

Filing Date: 04/15/09 Vergara, Blanquita

24 Joanne Road

Springfield, MA 01119

Chapter: 7

Filing Date: 04/08/09 Wackerbarth, Mark J.

383 Granby Road

Granville, MA 01034

Chapter: 7

Filing Date: 04/03/09 Walker, Samantha J.

142 Vining Hill Road

Southwick, MA 01077

Chapter: 7

Filing Date: 03/31/09 Walz, Christopher J.

Walz, Beverly A.

420 Meadow St.

Chicopee, MA 01013

Chapter: 7

Filing Date: 04/09/09 Weagle, Barbara Ann

217 Rocky Hill Road

Hadley, MA 01035

Chapter: 7

Filing Date: 04/14/09 Wiggins Gamble, Julia Pamela

Wiggins-Gamble, Pamela

Gamble, Julia W.

a/k/a Wiggins, Julia

192 Marsden St.

Springfield, MA 01109

Chapter: 13

Fi

ing Date: 04/07/09 Willers, George

91 Mulberry St.

Springfield, MA 01105

Chapter: 7

Filing Date: 04/06/09 Winco, Jeffery L.

Winco, Kerry A.

a/k/a France, Kerry A.

144 Cedar St.

Sturbridge, MA 01566

Chapter: 13

Filing Date: 03/31/09 Winslow, Brian P.

219 Greenwich Road

Ware, MA 01082

Chapter: 7

Filing Date: 04/10/09 Winter, Hollie L.

163 Leyden Road

P.O. Box 174

Greenfield, MA 01302

Chapter: 7

Filing Date: 04/02/09 Worrell, Susan M.

120D Lamplighter Lane

Springfield, MA 01119

Chapter: 7

Filing Date: 04/07/09 |

Christine Pilch is a partner with Grow My Company and a social-media marketing strategist. She trains clients to utilize LinkedIn, Twitter, Facebook, and other social-media tools to grow their businesses, and she collaborates with professional service firms to get results through innovative positioning strategies; (413) 537-2474; linkedin.com/in/christinepilch; twitter.com/christinepilch; growmyco.com; “Miracle Growth for Your Company.”

Christine Pilch is a partner with Grow My Company and a social-media marketing strategist. She trains clients to utilize LinkedIn, Twitter, Facebook, and other social-media tools to grow their businesses, and she collaborates with professional service firms to get results through innovative positioning strategies; (413) 537-2474; linkedin.com/in/christinepilch; twitter.com/christinepilch; growmyco.com; “Miracle Growth for Your Company.” Dawn Creighton has been named Regional Director of Member Relations for Western Mass. by Associated Industries of Mass. (AIM), based in Boston. In her new position, Creighton will work with AIM-member firms and organizations to ensure they are fully aware of the range of resources and services that are available to them, and to serve as a liaison with a number of civic and business groups operating throughout the Pioneer Valley that are concerned about the state’s economic prospects for the future.

Dawn Creighton has been named Regional Director of Member Relations for Western Mass. by Associated Industries of Mass. (AIM), based in Boston. In her new position, Creighton will work with AIM-member firms and organizations to ensure they are fully aware of the range of resources and services that are available to them, and to serve as a liaison with a number of civic and business groups operating throughout the Pioneer Valley that are concerned about the state’s economic prospects for the future.

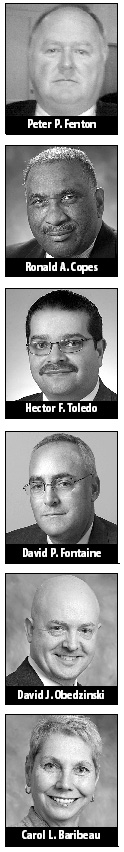

Peter P. Fenton has joined Royal & Munnings to practice in the area of labor relations. He brings more than 26 years of experience in management-side labor relations to the firm.

Peter P. Fenton has joined Royal & Munnings to practice in the area of labor relations. He brings more than 26 years of experience in management-side labor relations to the firm.

Amy B. Royal, Esq. is a partner in the law firm Royal & Munnings, LLC. She focuses her practice in management-side labor and employment law; (413) 586-2288;

Amy B. Royal, Esq. is a partner in the law firm Royal & Munnings, LLC. She focuses her practice in management-side labor and employment law; (413) 586-2288;