Month: January 2014

The following real estate transactions (latest available) were compiled by Banker & Tradesman and are published as they were received. Only transactions exceeding $115,000 are listed. Buyer and seller fields contain only the first name listed on the deed.

FRANKLIN COUNTY

BERNARDSTON

439 Huckle Hill Road

Bernardston, MA 01337

Amount: $120,474

Buyer: Paul L. Volungis

Seller: Wells Fargo Bank

Date: 12/17/13

34 School Road

Bernardston, MA 01337

Amount: $160,000

Buyer: Christopher D. Rooney

Seller: John Sciandra RET

Date: 12/26/13

BUCKLAND

74 Upper St.

Buckland, MA 01338

Amount: $129,000

Buyer: Paul Bernier

Seller: Helene A. Smith

Date: 12/26/13

38 West Brown Road

Buckland, MA 01338

Amount: $370,000

Buyer: Christopher Seward

Seller: Erik Abend

Date: 12/26/13

CONWAY

136 South Shirkshire Road

Conway, MA 01341

Amount: $203,500

Buyer: Ana Rueda-Hernandez

Seller: Richard B. Chandler

Date: 12/23/13

GREENFIELD

10 Carol Lane

Greenfield, MA 01301

Amount: $218,500

Buyer: Peter F.McLver

Seller: Kurkoski IRT

Date: 12/16/13

65 Cleveland St.

Greenfield, MA 01301

Amount: $185,900

Buyer: Daniel Christenson

Seller: Philip R. Allard

Date: 12/20/13

234 Conway St.

Greenfield, MA 01301

Amount: $169,000

Buyer: Dawn A. Roske

Seller: Peter F. McIver

Date: 12/16/13

86 High St.

Greenfield, MA 01301

Amount: $185,500

Buyer: Kevin J. O’Neil

Seller: Horan, James, (Estate)

Date: 12/24/13

104 Silver St.

Greenfield, MA 01301

Amount: $130,000

Buyer: 104 Silver Street LLC

Seller: Maxine M. Gunn

Date: 12/16/13

256 Wisdom Way

Greenfield, MA 01301

Amount: $143,000

Buyer: Terry J. Kimball

Seller: USA HUD

Date: 12/19/13

LEVERETT

49 Long Hill Road

Leverett, MA 01054

Amount: $211,000

Buyer: Benjamin D. Feeley

Date: 12/27/13

336 Long Plain Road

Leverett, MA 01054

Amount: $159,900

Buyer: Robart A. Weller

Seller: Pioneer Valley Red LLC

Date: 12/27/13

NEW SALEM

547 Daniel Shays Hwy.

New Salem, MA 01355

Amount: $148,000

Buyer: Shawn Chouinard

Seller: Marie Hess

Date: 12/16/13

ORANGE

95 Fairman Road

Orange, MA 01364

Amount: $170,000

Buyer: Eric R. Amato

Seller: Jacos S. Balk

Date: 12/17/13

330 Sentinel Elm Road

Orange, MA 01364

Amount: $190,000

Buyer: Joshuah C. Buell

Seller: Farm School Inc.

Date: 12/24/13

SHUTESBURY

14 Beechwood Lane

Shutesbury, MA 01072

Amount: $214,000

Buyer: Henry J. Allan

Seller: Mitchell D. Freund

Date: 12/20/13

SUNDERLAND

31 Garage Road

Sunderland, MA 01375

Amount: $123,375

Buyer: Valley Building Co. Inc.

Seller: Robert W. Humphreys

Date: 12/23/13

19 Old Amherst Road

Sunderland, MA 01375

Amount: $166,000

Buyer: Danica L. Messerli

Seller: William F. Snyder

Date: 12/16/13

WHATELY

14 Laurel Mountain Road

Whately, MA 01093

Amount: $275,000

Buyer: Erik Abend

Seller: Victor S. Lisewski

Date: 12/26/13

223 State Road

Whately, MA 01093

Amount: $203,500

Buyer: Ronald Lavallee

Seller: Norman E. Young

Date: 12/19/13

HAMPDEN COUNTY

AGAWAM

70 Bailey St.

Agawam, MA 01001

Amount: $120,000

Buyer: Yelana Ivanov

Seller: Lorie L. Baker

Date: 12/23/13

52 Briarcliff Dr.

Agawam, MA 01030

Buyer: Michael J. Tufariello

Seller: Alexa C. McCabe

Date: 12/20/13

105 Butternut Dr.

Agawam, MA 01001

Amount: $207,750

Buyer: Kathryn M. Carmody

Seller: Michael F. McKenna

Date: 12/18/13

95 Christopher Lane

Agawam, MA 01030

Amount: $320,000

Buyer: David A. Wilkinson

Seller: Kathryn M. Carmody

Date: 12/18/13

46 Cottonwood Lane

Agawam, MA 01001

Amount: $287,500

Buyer: Chester S. Wojcik

Seller: Gary E. Nardi

Date: 12/27/13

48 Liquori Dr.

Agawam, MA 01030

Amount: $220,000

Buyer: Joshua J. Devine

Seller: Christopher J. Corriveau

Date: 12/20/13

1811 Main St.

Agawam, MA 01001

Amount: $550,000

Buyer: Riverside Properties LLC

Seller: John Eisenbeiser LLC

Date: 12/20/13

152 Mallard Circle

Agawam, MA 01001

Amount: $245,000

Buyer: Leslie A. Murphy

Seller: Laurie J. Vandergrift

Date: 12/20/13

386 Poplar St.

Agawam, MA 01030

Amount: $168,000

Buyer: Joshua D. Laporte

Seller: David W. Laporte

Date: 12/23/13

687 Silver St.

Agawam, MA 01001

Amount: $460,000

Buyer: Sandy Dollar LLC

Seller: Dorinne A. Rodriguez

Date: 12/18/13

134 Wagon Wheel Dr.

Agawam, MA 01030

Amount: $360,000

Buyer: Patrick J. Moriarty

Seller: William D. Corbin

Date: 12/18/13

CHESTER

93 Blandford Road

Chester, MA 01011

Amount: $390,000

Buyer: Henry R. Frey

Seller: Kathryn Albanese

Date: 12/18/13

CHICOPEE

112 Academy St.

Chicopee, MA 01013

Amount: $142,000

Buyer: Christopher S. Baker

Seller: Catherine A. Deska

Date: 12/20/13

54 Armanella St.

Chicopee, MA 01020

Amount: $116,025

Buyer: Kevin J. Czaplicki

Seller: JP Morgan Chase Bank

Date: 12/27/13

206 Champagne Ave.

Chicopee, MA 01013

Amount: $144,906

Buyer: John A. Ruyffelaert

Seller: Donald R. Benoit

Date: 12/20/13

262 Fairview Ave.

Chicopee, MA 01013

Amount: $160,000

Buyer: Kara A. Supczak

Seller: Tony Monteiro

Date: 12/20/13

72 Jamrog Dr.

Chicopee, MA 01020

Amount: $172,000

Buyer: Daniel M. Boutin

Seller: Mary A. Freeman

Date: 12/16/13

88 Leo Dr.

Chicopee, MA 01020

Amount: $205,000

Buyer: Mark W. Sims

Seller: Daniel M. Boutin

Date: 12/16/13

59 Pajak St.

Chicopee, MA 01013

Amount: $155,000

Buyer: Ralph H. Avery

Seller: Andrew J. Craven

Date: 12/27/13

14 Parker St.

Chicopee, MA 01013

Amount: $140,000

Buyer: Wilmary Labonte

Seller: Ellen J. Labonte

Date: 12/20/13

29 Sullivan St.

Chicopee, MA 01020

Amount: $160,000

Buyer: Kathleen M. Gay

Seller: Joseph W. Gay

Date: 12/17/13

47 Veterans Dr.

Chicopee, MA 01022

Amount: $1,123,500

Buyer: Chicopee Partners LLP

Seller: Willow LLC

Date: 12/19/13

18 West St.

Chicopee, MA 01013

Amount: $215,000

Buyer: Daniel Branco

Seller: Brian P. Despard

Date: 12/24/13

1675 Westover Road

Chicopee, MA 01020

Amount: $148,736

Buyer: Nationstar Mortgage LLC

Seller: Bobbie L. Teehan

153 Woodcrest Dr.

Chicopee, MA 01020

Amount: $195,000

Buyer: Heather E. Locklin

Seller: Theodore L. Klekotka

Date: 12/19/13

EAST LONGMEADOW

43 Alpine Ave.

East Longmeadow, MA 01028

Amount: $198,000

Buyer: Melissa Knott

Seller: Jeffrey A. Hastings

Date: 12/18/13

46 Highlandview Ave.

East Longmeadow, MA 01028

Amount: $142,500

Buyer: Brian Palazzi

Seller: Teresa R. Frazier

Date: 12/27/13

30 Linden Ave.

East Longmeadow, MA 01028

Amount: $175,000

Buyer: Dion Woods

Seller: Joseph J. Giannini

Date: 12/18/13

8 Melwood Ave.

East Longmeadow, MA 01028

Amount: $175,000

Buyer: Amanda M. Kelly

Seller: Carl R. Swanson

Date: 12/19/13

18 Merriam St.

East Longmeadow, MA 01028

Amount: $207,000

Buyer: Veronica P. Mickelson

Seller: Thomas F. Caldbeck

Date: 12/17/13

75 North Main St.

East Longmeadow, MA 01028

Amount: $420,000

Buyer: CTB Realty LLC

Seller: Barry M. Stephens

Date: 12/27/13

32 Parker St.

East Longmeadow, MA 01028

Amount: $205,000

Buyer: Ryan J. Callan

Seller: Reanne A. Burke

Date: 12/23/13

HAMPDEN

32 Ames Road

Hampden, MA 01036

Amount: $213,000

Buyer: Thomas E. Sutherland

Seller: Evelyn M. Parent

Date: 12/23/13

205 Chapin Road

Hampden, MA 01036

Amount: $198,229

Buyer: Wells Fargo Bank

Seller: Michael K. Campbell

Date: 12/17/13

53 Meadow Brook Lane

Hampden, MA 01036

Amount: $238,900

Buyer: Lauren E. Cusson

Seller: Timber Development LLC

Date: 12/20/13

211 South Road

Hampden, MA 01036

Amount: $116,000

Buyer: Paula A. Savoie

Seller: Sherry Himmelstein

Date: 12/23/13

HOLLAND

77 East Brimfield Road

Holland, MA 01521

Amount: $175,000

Buyer: Peter M. Drake

Seller: Normand J. Corriveau

Date: 12/19/13

HOLYOKE

58 Brookline Ave.

Holyoke, MA 01040

Amount: $159,900

Buyer: Michelle Monett

Seller: Majkowski, Christine, (Estate)

Date: 12/18/13

1245 Dwight St.

Holyoke, MA 01040

Amount: $130,000

Buyer: Scott Family Props. LLC

Seller: Peluyera, Maximino, (Estate)

Date: 12/19/13

15 Ladd St.

Holyoke, MA 01040

Amount: $165,000

Buyer: Rigoberto Serrano

Seller: Edward L. Senecal

Date: 12/24/13

37 Mountain Road

Holyoke, MA 01040

Amount: $168,000

Buyer: Timblin Judy

Seller: Angela Perrotta

Date: 12/19/13

22 Orchard St.

Holyoke, MA 01040

Amount: $140,000

Buyer: Daniel W. Sullivan

Seller: Cathleen M. Bradlee

Date: 12/23/13

15 Prew Ave.

Holyoke, MA 01040

Amount: $153,820

Buyer: Beneficial Mass. Inc.

Seller: Jose C. Alvarez

Date: 12/24/13

466 South St.

Holyoke, MA 01040

Amount: $172,500

Buyer: Peter D. Hotz

Seller: Mark O. Bergeron

Date: 12/20/13

92 Sycamore St.

Holyoke, MA 01040

Amount: $140,000

Buyer: Nancy K. Sachs

Seller: Tammy J. Daysh

Date: 12/20/13

35 Steiger Road

Holyoke, MA 01040

Amount: $375,000

Buyer: John S. Weathers

Seller: T. P. Kennedy

Date: 12/16/13

LONGMEADOW

36 Chatham Road

Longmeadow, MA 01106

Amount: $335,000

Buyer: Peter M. Payson

Seller: Frank J. Anzalotti

Date: 12/18/13

348 Emerson Road

Longmeadow, MA 01106

Amount: $400,000

Buyer: Gregory L. Burt

Seller: Douglas E. Burt

Date: 12/16/13

378 Emerson Road

Longmeadow, MA 01106

Amount: $200,000

Buyer: Douglas E. Burt

Seller: Gregory L. Burt

Date: 12/16/13

131 Maple Road

Longmeadow, MA 01106

Amount: $249,000

Buyer: Jason N. Tsitso

Seller: Stephen Foster

Date: 12/27/13

77 Massachusetts Ave.

Longmeadow, MA 01106

Amount: $167,066

Buyer: Deutsche Bank

Seller: Robert C. Homon

Date: 12/23/13

62 Pinewood Dr.

Longmeadow, MA 01106

Amount: $394,000

Buyer: Anil Inamdar

Seller: Janet A. Weiss

Date: 12/16/13

97 Roseland Terrace

Longmeadow, MA 01106

Amount: $287,500

Buyer: Christopher V. Maglio

Seller: Mica LLC

Date: 12/16/13

148 Warren Terrace

Longmeadow, MA 01106

Amount: $210,000

Buyer: Rebecca G. Feinberg

Seller: Russell H. Webster

Date: 12/20/13

LUDLOW

35 Eden St.

Ludlow, MA 01056

Amount: $189,100

Buyer: Wendy M. Pereira

Seller: Benjamin M. Paquette

Date: 12/16/13

300 Winsor St.

Ludlow, MA 01056

Amount: $138,000

Buyer: Deidra M. Thompson

Seller: Andrea Silva

Date: 12/19/13

333 Winsor St.

Ludlow, MA 01056

Amount: $150,000

Buyer: Corrinne A. Mercier

Date: 12/19/13

MONSON

134 Wales Road

Monson, MA 01057

Amount: $186,000

Buyer: Steven D. Pelletier

Seller: Glenn R. Davey

Date: 12/16/13

164 Wales Road

Monson, MA 01057

Amount: $251,000

Buyer: Kevin M. Brown

Seller: Donald C. Demers

Date: 12/20/13

PALMER

1084 Central St.

Palmer, MA 01069

Amount: $137,000

Buyer: Amanda L. Ellithorpe

Seller: Bonny B. Rathbone

Date: 12/18/13

56 Edgewood St.

Palmer, MA 01080

Amount: $174,900

Buyer: Brian K. Sutherland

Seller: Donna L. Martin

Date: 12/23/13

1330 Ware St.

Palmer, MA 01069

Amount: $150,000

Buyer: William M. Kinney

Seller: Robert A. Roy

Date: 12/17/13

SPRINGFIELD

70 Barrington Dr.

Springfield, MA 01129

Amount: $300,000

Buyer: Shoukat Hussain

Seller: Michael D. Akers

Date: 12/20/13

1274 Berkshire Ave.

Springfield, MA 01151

Amount: $120,000

Buyer: Amanda A. Staubin

Seller: Janina Czupryna

Date: 12/23/13

1780 Boston Road

Springfield, MA 01129

Amount: $375,000

Buyer: Marks Realty LLP

Seller: Colonial Pacific Leasing

Date: 12/20/13

48 Burdette St.

Springfield, MA 01108

Amount: $148,000

Buyer: Kristen M. Culver

Seller: Matthew A. Charpentier

Date: 12/20/13

Cadwell Dr. (WS)

Springfield, MA 01101

Amount: $975,000

Buyer: Palmer Paving Corp.

Seller: 8712 LLC

Date: 12/23/13

16 Calley St.

Springfield, MA 01129

Amount: $182,500

Buyer: Alan D. Cook

Seller: Suzie G. Ice

Date: 12/17/13

36 Calley St.

Springfield, MA 01129

Amount: $185,000

Buyer: Ashlee Hyland

Seller: Tara Manzi

Date: 12/18/13

37 Chilson St.

Springfield, MA 01118

Amount: $125,000

Buyer: Lisa S. Kane

Seller: Lynn Makara

Date: 12/24/13

100 Colorado St.

Springfield, MA 01118

Amount: $158,900

Buyer: Nicholas Melikian

Seller: Howard C. Eldridge

Date: 12/20/13

649 Cottage St.

Springfield, MA 01104

Amount: $1,000,000

Buyer: Pioneer Valley Transit Authority

Seller: H&S Truck Leasing Inc.

Date: 12/26/13

Cottage St (SS)

Springfield, MA 01101

Amount: $600,000

Buyer: Pioneer Valley Transit Authority

Seller: R. M. Sullivan Transportation Inc.

Date: 12/26/13

47 Denwall Dr.

Springfield, MA 01119

Amount: $120,000

Buyer: William M. O’Malley

Seller: Omalley, Lillian M., (Estate)

Date: 12/27/13

116 Donbray Road

Springfield, MA 01119

Amount: $134,000

Buyer: Antonieta Ferreira

Seller: Tarpey, Philip J. Jr., (Estate)

Date: 12/20/13

59 Edendale St.

Springfield, MA 01104

Amount: $119,900

Buyer: Sergey Kuropatkin

Seller: Wayne R. Bettinger

Date: 12/20/13

16 Eton St.

Springfield, MA 01108

Amount: $183,000

Buyer: David Ha

Seller: Lee Lepouttre

Date: 12/23/13

39 Fenway Dr.

Springfield, MA 01119

Amount: $134,000

Buyer: Jorge H. Bordonhos

Seller: Yen K. Lee

Date: 12/18/13

103 Fern St.

Springfield, MA 01108

Amount: $200,000

Buyer: James G. Ndungu

Seller: James Mugwanja

Date: 12/17/13

137 Homestead Ave.

Springfield, MA 01151

Amount: $122,500

Buyer: Jacqueline E. Farrow

Seller: Eugene H. Marceau

Date: 12/24/13

41 Hyde Ave.

Springfield, MA 01107

Amount: $136,000

Buyer: Omar Almodovar

Seller: Ana L. Mattey

Date: 12/19/13

91 Jeffrey Road

Springfield, MA 01119

Amount: $138,000

Buyer: Abram Aviles

Seller: Brenda B. Forbes

Date: 12/17/13

28 Jennings St.

Springfield, MA 01119

Amount: $129,900

Buyer: D. Callands-Robinson

Seller: JV Properties Inc.

Date: 12/20/13

87 Lloyd Ave.

Springfield, MA 01119

Amount: $150,000

Buyer: David Nieto

Seller: Jason Balut

Date: 12/23/13

142 Merrimac Ave.

Springfield, MA 01104

Amount: $125,000

Buyer: Jessica Berrios

Seller: Lois F. Zdroykowski

Date: 12/20/13

134 Monrovia St.

Springfield, MA 01104

Amount: $131,000

Buyer: Bret W. Biram

Seller: Olga Pineiro

Date: 12/24/13

133 Oklahoma St.

Springfield, MA 01104

Amount: $123,900

Buyer: Carly O. Eaton

Seller: David M. Kane

Date: 12/20/13

106 Packard Ave.

Springfield, MA 01118

Amount: $242,000

Buyer: Anthony T. Kelliher

Seller: Patrick J. Moriarty

Date: 12/18/13

740 Parker St.

Springfield, MA 01129

Amount: $144,500

Buyer: Sharroya Charles

Seller: AMP Real Estate Group LLC

Date: 12/20/13

524 Plainfield St.

Springfield, MA 01107

Amount: $122,000

Buyer: Nolava LLC

Seller: Kenneth L. Fitzgibbon

Date: 12/20/13

170 Powell Ave.

Springfield, MA 01118

Amount: $125,000

Buyer: Vicki Soditis-Blanchard

Seller: Diane M. Soditis

Date: 12/17/13

2001 Roosevelt Ave.

Springfield, MA 01104

Amount: $550,000

Buyer: Polman Realty LLC

Seller: Envelope Product Group LLC

Date: 12/23/13

58 San Miguel St.

Springfield, MA 01104

Amount: $129,700

Buyer: Maria L. Adorno

Seller: Ara Degray

Date: 12/19/13

16 Sedgewick St.

Springfield, MA 01108

Amount: $130,000

Buyer: Jessica W. Maury

Seller: Gerald Hamburg

Date: 12/27/13

68 Virginia St.

Springfield, MA 01108

Amount: $125,000

Buyer: Thyda Huynh

Seller: Richard C. Olson

Date: 12/19/13

68 Washington Road

Springfield, MA 01108

Amount: $245,000

Buyer: Harry D. Seymour

Seller: Paul J. Riendeau

Date: 12/18/13

2132 Wilbraham Road

Springfield, MA 01129

Amount: $120,000

Buyer: Kenneth C. Wood

Seller: US Bank

Date: 12/24/13

66 Willowbrook Dr.

Springfield, MA 01129

Amount: $150,000

Buyer: Latania Johnson

Seller: Keefe, Rosemary A., (Estate)

Date: 12/23/13

1138 Worthington St.

Springfield, MA 01109

Amount: $200,000

Buyer: Janell S. Haulsey

Seller: Carlo J. Dilizia

Date: 12/19/13

SOUTHWICK

26 Pineywood Road

Southwick, MA 01077

Amount: $142,000

Buyer: Roy A. Crockwell

Seller: Gary R. Allen

Date: 12/18/13

84 Point Grove Road

Southwick, MA 01077

Amount: $229,900

Buyer: Michael T. Panella

Seller: Teresa R. Caronna

Date: 12/17/13

12 Renny Ave.

Southwick, MA 01077

Amount: $187,124

Buyer: FNMA

Seller: Stuart R. Rowley

Date: 12/27/13

WEST Springfield

472 Brush Hill Ave.

West Springfield, MA 01089

Amount: $185,000

Buyer: Daniel J. Garrity

Seller: Trisha Guiel

Date: 12/19/13

195 Falmouth Road

West Springfield, MA 01089

Amount: $320,000

Buyer: Jeffrey R. Krok

Seller: Jason D. Favreau

Date: 12/16/13

36 George St.

West Springfield, MA 01089

Amount: $155,000

Buyer: Budhiman Subedi

Seller: Dzemal Jusufbegovic

Date: 12/20/13

16 Jensen Circle

West Springfield, MA 01089

Amount: $239,900

Buyer: John Bielanski

Seller: Vincent J. Brozini

Date: 12/18/13

1304 Morgan Road

West Springfield, MA 01089

Amount: $295,000

Buyer: David Sutherland

Seller: Peter K. Fritz

Date: 12/17/13

84 Myron St.

West Springfield, MA 01089

Amount: $615,000

Buyer: Salamon Realty LLC

Seller: Bruce D. Aldo

Date: 12/23/13

61 Pheasants Xing

West Springfield, MA 01089

Amount: $469,900

Buyer: Jason D. Favreau

Seller: Donald R. Felix

Date: 12/16/13

102 Westwood Dr.

West Springfield, MA 01089

Amount: $200,000

Buyer: Glenn Grabowski

Seller: Barbara A. Grabowski

Date: 12/27/13

WESTFIELD

100 Acres Road

Westfield, MA 01085

Amount: $135,133

Buyer: Stuart Arnold Real Estate

Seller: DA Farms LLC

Date: 12/17/13

26 Clinton Ave.

Westfield, MA 01085

Amount: $155,000

Buyer: Amber R. Sayer

Seller: Wallis, Marguerite P., (Estate)

Date: 12/19/13

28 Crown St.

Westfield, MA 01085

Amount: $170,000

Buyer: Matthew J. Romano

Seller: Mark A. Pires

Date: 12/20/13

316 Falley Dr.

Westfield, MA 01085

Amount: $237,000

Buyer: Christopher Mitchell

Seller: Ian C. Plakias

Date: 12/16/13

80 Knollwood Dr.

Westfield, MA 01085

Amount: $170,000

Seller: Deborah A. Ashton

Date: 12/23/13

170 Lockhouse Road

Westfield, MA 01085

Amount: $2,700,000

Buyer: Rail Realty Development

Seller: Ronald E. Schortmann

Date: 12/19/13

416 North Road

Westfield, MA 01085

Amount: $187,500

Buyer: Jeffrey S. Slater

Seller: Jean M. Parker

Date: 12/18/13

13 Spring St.

Westfield, MA 01085

Amount: $150,000

Buyer: Alexsander Bloom

Seller: Ralph C. Royland

Date: 12/16/13

95 Westwood Dr.

Westfield, MA 01085

Amount: $186,500

Buyer: Torry R. Gajda

Seller: Madeline T. Marshall

Date: 12/20/13

WILBRAHAM

4 Brainard Road

Wilbraham, MA 01095

Amount: $235,000

Buyer: Paul M. Pereira

Seller: Nermin Hodzic

Date: 12/17/13

971 Main St.

Wilbraham, MA 01095

Amount: $315,000

Buyer: Joseph A. Moran

Seller: Jean-Guy Girard

Date: 12/19/13

28 Old Boston Road

Wilbraham, MA 01095

Amount: $159,000

Buyer: Jose M. Martins

Seller: Kathryn P. Kogut

Date: 12/18/13

3 Pleasant View Road

Wilbraham, MA 01095

Amount: $206,500

Buyer: Gail Harris

Seller: Laura K. Syron

Date: 12/23/13

HAMPSHIRE COUNTY

AMHERST

Gray St.

Amherst, MA 01002

Amount: $340,000

Buyer: Amherst Community Television

Seller: Barbara L. Guidera

Date: 12/19/13

29 Harris St.

Amherst, MA 01002

Amount: $329,000

Buyer: Diana C. Scriver

Seller: Debra L. Beturney

Date: 12/27/13

209 Rolling Ridge Road

Amherst, MA 01002

Amount: $365,000

Buyer: Lie Wang

Seller: Lawrence Orloff

Date: 12/23/13

652 South East St.

Amherst, MA 01002

Amount: $265,000

Buyer: RGC LLC

Seller: Greenfield Savings Bank

Date: 12/23/13

BELCHERTOWN

47 Cottage St.

Belchertown, MA 01007

Amount: $500,000

Buyer: Charles W. True

Seller: Peter S. Landry

Date: 12/20/13

28 Emily Lane

Belchertown, MA 01002

Amount: $363,300

Buyer: David R. Boisjolie

Seller: JP Builders Inc.

Date: 12/20/13

56 N. Main St.

Belchertown, MA 01007

Amount: $135,000

Buyer: Shannon M. Kurzeski

Seller: UMass Five College Credit Union

Date: 12/20/13

68 North St.

Belchertown, MA 01007

Amount: $250,000

Buyer: Miloslava Waldman

Seller: Kevin P. Gustafson

Date: 12/23/13

43 Pondview Circle

Belchertown, MA 01007

Amount: $395,000

Seller: Brian K. Douglas

Date: 12/23/13

11 Rita Lane

Belchertown, MA 01007

Amount: $209,000

Buyer: Shoshana Y. Wirth

Seller: Gail M. Harris

Date: 12/20/13

CHESTERFIELD

72 Bray Road

Chesterfield, MA 01012

Amount: $228,500

Buyer: Cynthia J. Davis

Seller: Lisa C. Rollins

Date: 12/16/13

EASTHAMPTON

15 Cottage St.

Easthampton, MA 01027

Amount: $328,000

Buyer: Cottage Square Apts. LP

Seller: Jefferson Development Partners LLC

Date: 12/17/13

62 Florence Road

Easthampton, MA 01027

Amount: $335,000

Buyer: Joseph W. Simanis

Seller: Raymond & C. Lyman RT

Date: 12/20/13

33 Hendrick St.

Easthampton, MA 01027

Amount: $185,000

Buyer: Thomas A. Briotta

Seller: Jonathan A. Letourneau

Date: 12/27/13

92 Line St.

Easthampton, MA 01027

Amount: $120,750

Buyer: Ashtons Acquisition LLC

Seller: Kevin P. Dostaler

Date: 12/23/13

253 Main St.

Easthampton, MA 01027

Amount: $213,000

Buyer: Maria S. Held

Seller: Julie M. Flahive

Date: 12/20/13

27 Paul St.

Easthampton, MA 01027

Amount: $357,400

Buyer: Brad R. Bullough

Seller: David Garstka Builders LLC

Date: 12/19/13

51 Pomeroy St.

Easthampton, MA 01027

Amount: $179,900

Buyer: Robert L. Kwiatkowski

Seller: Debra A. Collins

Date: 12/17/13

35 Treehouse Circle

Easthampton, MA 01027

Amount: $338,095

Buyer: Jonathan Y. Loh

Seller: EH Homeownership LLC

Date: 12/20/13

GOSHEN

2 Washington Road South

Goshen, MA 01032

Amount: $290,000

Buyer: Michael A. Woolf

Seller: Peter J. Contuzzi

Date: 12/17/13

GRANBY

151 Carver St.

Granby, MA 01033

Amount: $310,000

Buyer: Kevin D. Rolfe

Seller: Joseph V. Zwirko

Date: 12/18/13

144 Porter St.

Granby, MA 01033

Amount: $385,000

Buyer: Michael T. Simpson

Seller: Eva M. Sartori

Date: 12/19/13

HADLEY

42 East St.

Hadley, MA 01035

Amount: $324,000

Seller: Marrion A. Waskiewicz

Date: 12/16/13

12 Farm Lane

Hadley, MA 01035

Amount: $177,500

Buyer: Katie A. Szelewicki

Seller: Kelly Anne Tedford

Date: 12/24/13

203 River Dr.

Hadley, MA 01035

Amount: $160,000

Buyer: Erin F. Doherty

Seller: Carol Ryan

Date: 12/18/13

HATFIELD

42 West St.

Hatfield, MA 01088

Amount: $270,000

Buyer: Michael P. Laude

Seller: Chandler FT

Date: 12/20/13

HUNTINGTON

124 Goss Hill Road

Huntington, MA 01050

Amount: $285,000

Buyer: James Stoudenmire

Seller: Wayne C. Englosh

Date: 12/18/13

NORTHAMPTON

93 Bridge Road

Northampton, MA 01062

Amount: $247,000

Buyer: Jeffrey Robertson

Seller: N. P. Nangle

Date: 12/16/13

35 Chestnut Ave.

Northampton, MA 01053

Amount: $190,000

Buyer: Jesse C. Montgomery

Seller: Isabelle B. Himmelman

Date: 12/20/13

31 Elizabeth St.

Northampton, MA 01060

Amount: $295,500

Buyer: D. Murphy Properties LLC

Seller: Bizzy Street LLC

Date: 12/20/13

399 Elm St.

Northampton, MA 01060

Amount: $315,000

Buyer: Susan F. Rice

Seller: Kristen A. Cole

Date: 12/17/13

4 Ford Xing

Northampton, MA 01060

Amount: $601,659

Buyer: Sally H. Kahn

Seller: Wright Builders Inc.

Date: 12/20/13

9 Massasoit St.

Northampton, MA 01060

Amount: $460,000

Buyer: Harry Keith Johnson RET

Seller: Johnson Childrens GSTE TR

Date: 12/23/13

100 Moser St.

Northampton, MA 01060

Amount: $530,977

Buyer: Ranjan A. Mehta

Seller: Kent Pecoy & Sons Construction

Date: 12/20/13

120 Moser St.

Northampton, MA 01060

Amount: $494,769

Buyer: Susan C. Breines

Seller: Kent Pecoy & Sons Construction

Date: 12/27/13

202 North Main St.

Northampton, MA 01062

Amount: $125,000

Buyer: Robert G. Cromley

Seller: Bill & Marie G. Emerson RET

Date: 12/20/13

906 Ryan Road

Northampton, MA 01062

Amount: $115,000

Buyer: Thomas E. Dawson-Greene

Seller: Cheryl A. Major

Date: 12/18/13

54 Sherman Ave.

Northampton, MA 01060

Amount: $254,900

Buyer: Ann J. Thomas

Seller: Samuel W. Craig

Date: 12/24/13

275 State St.

Northampton, MA 01060

Amount: $250,000

Buyer: Christopher L. Leclerc

Seller: Jan Janusz

Date: 12/23/13

17 Stilson Ave.

Northampton, MA 01062

Amount: $371,000

Buyer: Robyn B. Coady

Seller: Barbara F. Storper

Date: 12/18/13

83 Sylvester Road

Northampton, MA 01062

Amount: $340,000

Buyer: Rebel A. McKinley

Seller: Michelle L. Sauve

Date: 12/20/13

105 Turkey Hill Road

Northampton, MA 01062

Amount: $390,000

Buyer: John Fortier

Seller: David G. Cohen

Date: 12/20/13

134 Williams St.

Northampton, MA 01060

Amount: $275,000

Buyer: Matthew B. McConkey

Seller: Susan M. Nicastro

Date: 12/20/13

48 Willow St.

Northampton, MA 01062

Amount: $238,000

Buyer: Kate Lepore

Seller: Cathleen Lepore

Date: 12/23/13

SOUTH HADLEY

127 Granby Road

South Hadley, MA 01075

Amount: $200,000

Buyer: Francis A. Diratanto

Seller: Victor J. Solano

Date: 12/20/13

68 Hadley St.

South Hadley, MA 01075

Amount: $165,000

Buyer: Sam S. Lemanski

Seller: Hilly A. Delphia

Date: 12/27/13

46 High St.

South Hadley, MA 01075

Amount: $182,000

Buyer: Jeffrey C. Meon

Seller: David R. Masse

Date: 12/20/13

28 Mountain View St.

South Hadley, MA 01075

Amount: $195,000

Buyer: Kathleen A. Reardon

Seller: Belliveau, Robert N., (Estate)

Date: 12/27/13

16 Pheasant Run

South Hadley, MA 01075

Amount: $399,900

Buyer: Benjamin B. Morgan

Seller: Mary A. Kedzior

Date: 12/27/13

SOUTHAMPTON

139 College Hwy.

Southampton, MA 01073

Amount: $274,000

Buyer: Maya L. Leiva

Seller: Richard Debonis

Date: 12/16/13

26 Fomer Road

Southampton, MA 01073

Amount: $193,000

Buyer: Wendy Fournier

Seller: Jeffrey M. Golas

Date: 12/27/13

60 Gunn Road

Southampton, MA 01073

Amount: $750,000

Buyer: James R. Labrie

Seller: Adelia Derwiecki

Date: 12/20/13

84 Gunn Road

Southampton, MA 01073

Amount: $245,000

Buyer: Walter J. Hudzikewicz

Seller: Mary A. Chicone

Date: 12/20/13

WARE

13 Cummings Road

Ware, MA 01082

Amount: $142,000

Buyer: Jill E. Berthiaume

Seller: Country Bank For Savings

Date: 12/23/13

139 North St.

Ware, MA 01082

Amount: $140,000

Buyer: Brendan T. O’Niel

Seller: Paul P. Benoit

Date: 12/20/13

61 Old Poor Farm Road

Ware, MA 01082

Amount: $185,154

Buyer: Bank Of America

Seller: Keith J. Bordeau

Date: 12/17/13

41 Pine St.

Ware, MA 01082

Amount: $119,500

Seller: Luszcz, Ronald J., (Estate)

Date: 12/20/13

WESTHAMPTON

121 Kings Hwy.

Westhampton, MA 01027

Amount: $225,000

Buyer: Barbara L. Brillon

Seller: Glenn A. Williams

Date: 12/27/13

348 Southampton Road

Westhampton, MA 01027

Amount: $500,000

Buyer: Kimberly A. Pedigo

Seller: Laurie E. Wilga

Date: 12/18/13

WILLIAMSBURG

61 South St.

Williamsburg, MA 01096

Amount: $350,000

Buyer: Julie A. Sylvester

Seller: C. C Neely

Date: 12/16/13

WORTHINGTON

140 Cudworth Road

Worthington, MA 01098

Amount: $215,000

Buyer: Val Production Ltd

Seller: Gerald L. Bartlett

Date: 12/18/13

496 Old Post Road

Worthington, MA 01098

Amount: $255,000

Buyer: Patricia A. Lapointe

Seller: Susan T. Romanowski

Date: 12/27/13

210 Williamsburg Road

Worthington, MA 01098

Amount: $157,000

Buyer: James R. Bowles

Seller: Carol A. Wrobleski

Date: 12/16/13

The following bankruptcy petitions were recently filed in U.S. Bankruptcy Court. Readers should confirm all information with the court.

Baez, Juan

48 Day St.

West Springfield, MA 01089

Chapter: 7

Filing Date: 12/18/2013

Bandoski, David M.

Bandoski, Benita P.

6 Tanglewood Lane

Feeding Hills, MA 01030

Chapter: 13

Filing Date: 12/30/2013

Beamon, Juanita A.

57-59 McKnight St.

Springfield, MA 01109

Chapter: 13

Filing Date: 12/20/2013

Castro, Marangely

65 Lynch Dr.

Holyoke, MA 01040

Chapter: 7

Filing Date: 12/17/2013

Dietz, Eric A.

174 Barton Road

Greenfield, MA 01301

Chapter: 7

Filing Date: 12/22/2013

Farrington, Robert W.

63 Ludlow St.

Belchertown, MA 01007

Chapter: 7

Filing Date: 12/20/2013

Felix, Darryl L.

Miller-Felix, Mara

48 Jefferson St., Apt #3

Westfield, MA 01085

Chapter: 7

Filing Date: 12/20/2013

Flaherty, Paul

PO Box 2177

Plainville, MA 02762

Chapter: 7

Filing Date: 12/18/2013

Gardner, Darcey Andrew

39 Piedmont St.

Springfield, MA 01104

Chapter: 7

Filing Date: 12/31/2013

Gore, Debra Ann

Kratovil, Debra A.

a/k/a Provencher, Debra A.

95 Breckwood Blvd.

Springfield, MA 01109

Chapter: 7

Filing Date: 12/18/2013

Gouvan Susan M.

23 Margerie St.

Springfield, MA 01109

Chapter: 7

Filing Date: 12/30/2013

Green, Tina L.

a/k/a Dietz, Tina L.

174 Barton Road

Greenfield, MA 01301

Chapter: 7

Filing Date: 12/22/2013

Grigas, Ann Heather

41 Everett Ave., Apt 27A

Belchertown, MA 01007

Chapter: 7

Filing Date: 12/20/2013

Hebert, Eugene T.

1023 Montgomery St.

Chicopee, MA 01013

Chapter: 7

Filing Date: 12/20/2013

Hernandez, Betzaida

Hernandez-Wilson, Betzaida

7 Laramee Green West

Indian Orchard, MA 01151

Chapter: 7

Filing Date: 12/18/2013

Johnson, Lamar

27 Mary Louise St.

Springfield, MA 01119

Chapter: 7

Filing Date: 12/23/2013

Jones, John Michael

Jones, Sondra Marie

16 Helen St.

Chicopee, MA 01020

Chapter: 7

Filing Date: 12/30/2013

Kelly, Christine Diane

54 North St.

North Adams, MA 01247

Chapter: 7

Filing Date: 12/23/2013

Kesler, Kim Jon

Kesler, Donna M.

a/k/a Land, Donna M.

138 Hartford Terrace

Springfield, MA 01118

Chapter: 7

Filing Date: 12/26/2013

Kowalczyk, Steven J.

Kowalczyk, Denise A.

24 Victoria Terrace

Ludlow, MA 01056

Chapter: 7

Filing Date: 12/24/2013

Lacoste, Kelly A.

324 Burlingame Road

Palmer, MA 01069

Chapter: 7

Filing Date: 12/20/2013

Letourneau, Walter F.

113 River Road

South Deerfield, MA 01373

Chapter: 7

Filing Date: 12/27/2013

Loischild, Judith

10 Belleview Circle

Amherst, MA 01002

Chapter: 7

Filing Date: 12/17/2013

McMahon, Debra Marie

21 Higland Ave.

Pittsfield, MA 01201

Chapter: 7

Filing Date: 12/17/2013

Miles, Stephen J.

57 Factory Hollow Road

Greenfield, MA 01301

Chapter: 7

Filing Date: 12/23/2013

Murdock, Sally J.

343 Chicopee St. #21

Chicopee, MA 01013

Chapter: 13

Filing Date: 12/30/2013

Ortiz, Jessica P.

220 Chapin Terrace

Springfield, MA 01104

Chapter: 7

Filing Date: 12/20/2013

Petroff, George A.

14D Standish Ct.

Greenfield, MA 01301

Chapter: 7

Filing Date: 12/31/2013

Pierog, Robert David

Pierog, Kathleen Marie

5 Barbara St.

Chicopee, MA 01020

Chapter: 7

Filing Date: 12/24/2013

Pilot, Jr. Edward W.

611 State Road, Apt. 308

North Adams, MA 01220

Chapter: 7

Filing Date: 12/24/2013

Rodrigues, Zarre K.

Rodrigues, Lisa

47 Stephens St.

Chicopee, MA 01022

Chapter: 7

Filing Date: 12/17/2013

Sammataro, David M.

4 Gwen Circle

Ware, MA 01082

Chapter: 7

Filing Date: 12/20/2013

Soule, Joshua L.

a/k/a Leclair, Joshua L.

249 New Boston Road

Sturbridge, MA 01566

Chapter: 7

Filing Date: 12/30/2013

Suarez, Mario D.

116 Townhouse Dr., Apt. C

Easthampton, MA 01027

Chapter: 7

Filing Date: 12/17/2013

Tak Trucking

Lloyd, Norman J.

Lloyd, Linda M.

1029 Wilson Ave.

Palmer, MA 01069

Chapter: 7

Filing Date: 12/30/2013

Tingley, Sean R.

Tingley, Lari Ann

71 Foster Road

Southwick, MA 01077

Chapter: 7

Filing Date: 12/31/2013

Turcotte, Jason A.

Turcotte, Lisa M.

a/k/a Morrissette, Lisa M.

6 Clifford Ave.

Ware, MA 01082

Chapter: 7

Filing Date: 12/27/2013

Waugh, Steven T.

538 North Brookfield Road

Barre, MA 01005

Chapter: 7

Filing Date: 12/24/2013

White, Joseph L.

White, Lisa M.

394 East St.

Chicopee, MA 01020

Chapter: 7

Filing Date: 12/20/2103

Riverfront Club’s Mission Blends Fitness, Teamwork, Access to a ‘Jewel’

Jonathon Moss (left) and Jim Sotiropoulos, founder and director, respectively, of the Pioneer Valley Riverfront Club.

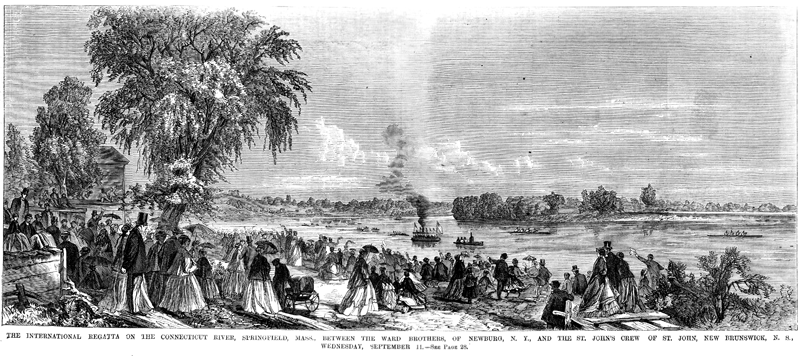

It’s a framed copy of an engraving and short story in Frank Leslie’s Illustrated Newspaper that chronicles the International Regatta, which took place on a stretch of the Connecticut River in Springfield on Sept. 11, 1867 — and, more specifically, the marquee event that day, a race between a crew from Newburg, N.Y. and another from St. John, New Brunswick, Canada.

Moss, the president and co-founder of the Pioneer Valley Riverfront Club (PVRC), says he can’t tell from this artwork where, exactly, on the river the action is taking place — although he suspects it was at or near the site of the current Riverfront Park near the Memorial Bridge. But he can easily discern that this was, in fact, an event.

“There were 10,000 people on hand for this,” he said, citing the account of the regatta as his source for that number. “At the time, the population of Springfield was 15,000 to 20,000 — so the equivalent of half the city showed up on the riverbanks to watch the event. You can see the sundresses and the pomp and the circumstance surrounding this gathering; this was immediately after the Civil War, and folks were looking for a competitive outlet. This was something to celebrate as the country healed.”

Instead, it’s about recapturing some of the river’s great history in rowing — and there is, as that engraving shows, much more of it than most would think — while also reconnecting area residents with a waterway that most know only from driving over it. And it’s also about introducing people of all ages to the sport of rowing and promoting fitness and well-being.

That’s a rather broad mission, he acknowledged, adding quickly that the club is growing into it, and fairly quickly. And it is doing so by focusing on five words that sum up what this organization is all about: activity, diversity, access, health, and team.

These have been the focal points since the PVRC was created in 2007 and operated programs and competitions at the Pioneer Valley Yacht Club (often taking participants from Springfield by taxi to competitions there). And things have only gained speed since 2012, when the club took up residence in what’s known as North Riverfront Park in Springfield, in the shadow of the North End Bridge, and, more specifically, in the 113-year-old facility (long owned by the city of Springfield) known originally as the Rockrimmon Boathouse that was most recently home to Bassett Boat’s showroom.

That framed engraving now hangs in the PVRC’s conference room in the boathouse, one of many rooms in an ongoing state of transformation that will give a nod to the past, but with some 21st-century amenities (more on that later).

And while the restoration and reconstruction work continues, so too does the club’s efforts to introduce people to the river while also stressing the importance of everything from fitness to teamwork.

It does so through a variety of programs and competitions staged throughout the year, including rowing classes for people of all ages, indoor community fitness, youth fall and spring racing teams, the annual Rockrimmon Regatta staged each fall, dragon-boat racing (20-person teams), running and bicycling programs that make use of the bike trail along the river, kayak rentals, and, perhaps most notably, group team building.

Elaborating on that last bullet point, both Moss and Jim Sotiropoulos, PRVC’s executive director, said that perhaps the club’s greatest success comes in putting young people from different communities — and different backgrounds — together in the same boat, where they can row, compete, and grow together.

A big part of the PVRC’s broad mission is to introduce — or reintroduce — area residents to the Connecticut River.

(Photo by Jonathan Moss)

For this issue, BusinessWest takes an indepth look at the PVRC and what could be called current events. This is an ongoing story with no finish line — at least in a figurative sense — because the hope is that this work will continue with the next several generations of area residents.

Past Is Prologue

It’s called the ‘great room.’

When asked why, Sotiropoulos, with tongue firmly planted in cheek, said “because everyone who goes in it says, ‘this is great.’”

Actually, no one really knows why it’s called that, said Moss, adding quickly that this large room with a vaulted ceiling on the second floor of the boathouse was once very likely the focal point of fellowship at the facility.

At the moment, it is in the midst of the slow-moving process of deconstruction and then restoration, led in large part by students at Springfield’s Putnam High School. It is currently a museum of sorts for rowing machines. Indeed, there’s a collection of them, representing perhaps each of the past five or six decades of products, as well as a few (donated by Smith College) that are more than a century old.

What will become of the room for the long term is not yet known, said Moss, adding that a more pressing matter is renovating the first-floor space to accommodate showers and lockers, a repeated request (if not demand) from the growing numbers of people enjoying frequent workouts at the facility. And then, there’s that ongoing mission and those five words that define it.

But before telling that story, Moss wanted to first go back in time — to when Springfield could truly be called a mecca for rowing — because relating that history goes a long way toward explaining the PVRC’s reason for being.

“Springfield, at the crossroads of New England and with a beautiful riverfront, featured prominently in rowing from very early on,” he said, noting that there are accounts of regattas going back to the 1850s. Crews from Ivy League powerhouses Harvard and Yale raced on the Connecticut River in Springfield because they considered it an attractive neutral site, he went on, even though the work to transport boats and people here from Cambridge and New Haven was rather involved back then.

Rowing was, by most accounts, the first intercollegiate sport, said Moss, and a number of colleges and universities competed on the Connecticut River and in Springfield. By the end of the 1800s, many area public high schools were involved as well.

“And that was extraordinarily unusual,” he told BusinessWest, “because it was only 50 years earlier that it was introduced at all, and it was completely an Ivy League, gentleman’s sport. For there to be public high-school rowing was very unusual, and it was during those Industrial Revolution years that it became very prominent.”

The 20th century would be marked by a number of highs and lows when it came to rowing on the river, said Moss. One of the highs was a huge regatta that accompanied the opening of what was known then as the Hampden County Memorial Bridge in 1922, he noted, adding that the lows were precipitated by world wars, economic downturns (rowing programs are capital-intensive propositions), and, most recently, the dramatic decline in the river’s cleanliness in the ’60s and ’70s.

“People referred to it as America’s most beautifully landscaped sewage system, or something like that,” said Sotiropoulos, who relayed an anecdote about a traveling team beating a unit from Technical High School in the early ’70s, but foregoing the long-standing tradition of throwing the coxswain into the river after a race amid fears for his health.

“They waited until they got back home and then threw him in a nearby lake; they didn’t dare throw him in the Connecticut River,” he went on, adding that, by the mid-’70s, competitive rowing was all but dead on the river, even as work funded by the Clean Water Act began the process of reversing the river’s fortunes.

Fast-forwarding a few decades, Moss said the Greater Springfield YMCA, at the urging of some area businesspeople, introduced a rowing program, which he eventually joined as a volunteer at the start of this century.

“They were teaching middle-aged adults how to paddle and recreate on the river,” he recalled. “I said, ‘this is great, but there’s more to this.’”

The so-called ‘great room’ at the boathouse at North Riverfront Park is currently a museum of sorts for rowing machines, but PVRC officials envision a grander future.

It was then that Moss and several supporters launched the PVPC, a nonprofit agency that eventually bought some larger boats and incorporated a youth program, as well as an initiative for teen mothers working to get their GEDs, and staged programs and competitions in Longmeadow.

The Current Is Strong

Soon, it was decided that, instead of bringing program participants to the yacht club, the more prudent course would be to bring the program to Springfield, said Moss, adding that the PVRC’s fortunes changed considerably when Springfield officials issued a request for proposals for the old boathouse property.

“Their thinking at the time was, ‘we don’t have great access to the river, and we don’t have great recreational activities on the river in Springfield — let’s do something more than allow someone to have a retail establishment here,’” he went on. “The program that we were running — and planned to run — met their needs.”

The club moved into its new home in 2012, said Moss, and soon became one of many organizations, with the Pioneer Valley Planning Commission taking the lead, to collaborate on an application for a two-year, $2 million Community Transformation Grant (CTG) from the Centers for Disease Control and Prevention.

With its share of that award — roughly $350,000 — as well as donations from several area businesses and foundations and revenue in the form of membership fees, the PVRC has been able to take large strides to renovate and repurpose the boathouse and move aggressively to meet its core mission.

“We want to help people make positive lifestyle choices,” said Moss. “This includes exercise, the bike path, experiencing and exploring the river, training indoors in the winter, things like that.”

Going back to those five mission-defining words — activity, diversity, access, health, and team — Moss and Sotiropoulos said a number of programs have been created to address one or, as is usually the case, several of them.

For example, the Healthy Prescription Program is described as a community outreach undertaken in conjunction with the nearby Brightwood Health Clinic, part of Baystate Health System. When a physician prescribes exercise for a patient, that prescription can be filled at the club, and without co-pays, said Sotiropoulos.

“It’s a very unique endeavor that we fund ourselves, and it’s one of the programs I’m most hopeful for, he said, adding that this is an effort born from the CTG grant.

Another initiative with great promise is the Ready, Set, Row program, which takes some of the club’s many rowing machines and deploys them to area middle schools for use in curricula that promote team building and mindfulness.

“What we’ve seen from some of the surveys that we do before and after the program is that it has a positive impact on kids, and teachers can see it,” he noted. “The kids are getting along better amongst themselves, and the teacher-student dynamic is also improved. But we would like to see this expanded to where it’s not done in a vacuum, and we’re able to do this throughout the year and not in a school for a short period of time.”

Moss agreed, and noted that rowing is a sport with benefits not readily apparent to many people. It is a non-contact activity, he said, and one that people can start when they’re young and continue with for a lifetime. Meanwhile, it’s an activity where people are responsible for their own success.

And in the larger boats, as Moss and Sotiropoulos mentioned, rowing has great potential to build responsibility, camaraderie, and teamwork, while also bridging cultural divides.

“They all started out not knowing anything about rowing,” said Moss, “so it’s a very level playing field in there.”

Wave of the Future

Moving forward, there are a number of challenges facing the PVRC, said Sotiropoulos, starting with the still-lingering perception of the Connecticut as a polluted river not fit for water sports such as rowing. That’s if people have opinions on the river at all.

“That’s one of our barriers to reaching people — there’s the belief that the river still is dirty. Because of the Clean Water Act and people changing their lifestyles, the river has become significantly cleaner, and I don’t believe people fully realize that yet,” he said. “And people don’t have the same association with the river they did years ago; if you look at the way Springfield is built, it’s all turned from the river, and I-91 cut off everyone from the river. So part of our mission is to not only promote healthy lifestyles, but also to reintroduce people to the river and let them know it’s a viable resource and that they should be enjoying it — it’s a jewel.

“We’re in the North End in Springfield; we’re in the middle of a city,” he went on. “And I will guarantee you a bald eagle sighting if you spend more than a couple of days on the river in the spring, summer, or fall. If you run north of here [the boathouse], you won’t know you’re in the North End of Springfield, and people are taken aback by that; it gives you a different perspective on the city. But you need to get people out there.”

The boathouse is another challenge, said Sotiropoulos, adding that the facility is old and has undergone a significant amount of work over the years. The deconstruction process has revealed a lot about the structure’s past — including the last vestiges of a wrap-around porch on the second floor — but also some tests that lie ahead. The first-floor renovations top on the priority list, with the great-room renovations to follow.

And funding will certainly be an issue moving forward, he went on, adding that the grant funding will run out next year, and the club will become more reliant on revenues from memberships and gifts from area businesses and foundations.

Thus, one of the club’s ongoing priorities is to tell its story, said Moss, adding that awareness of the club’s multi-faceted mission will help generate support from both public and private sources.

Meanwhile, the organization must be focused on smart, controlled growth, said Sotiropoulos, adding that the Community Transformation Grant certainly accelerated the club’s pace of growth, and the challenge is to manage this opportunity effectively.

“We want to make sure our business is growing at a reasonable rate,” he explained. “Sure, we want the river flooded with canoers, kayakers, rowers, and stand-up paddleboaders, but if 1,000 people show up at the door, we want to be prepared for that. We don’t want to be that organization that grew too fast, with people saying, ‘that could have been a great idea.”

Paddle to the Metal

Moss told BusinessWest that he can’t recall exactly what he paid for the engraving that captured the International Regatta, but believes it wasn’t more than $50.

The item needs a little work and maybe a better frame, and it will likely get both, he went on, adding quickly that, while he and all those associated with the PVRC want to recognize — and honor — this city’s glorious past when it comes to rowing, it is far more focused on the present and future.

In time, he said, the historic boathouse will feature photos from three centuries, and probably more from the 21st, because, while this organization has a number of missions, at the top of that list is a commitment to see that there is a lot more history written at — and on — the Connecticut River.

George O’Brien can be reached at [email protected]

Amherst’s ‘Biddy’ Martin Puts the Focus on Inclusion

It’s called the ‘Committee of Six.’

It’s called the ‘Committee of Six.’

That’s the name attached to an elected — and quite powerful — group of professors at Amherst College, who continue a tradition that is said to be as old (193 years) as the institution itself.

Tasked primarily with making recommendations on tenure and promotions, this group, an executive committee of the faculty whose influence is said to extend to all manner of administrative matters, meets with the president of the college and other administrators every Monday morning, often for three hours or more.

For Carolyn “Biddy” Martin, who took the helm at Amherst in late 2011, these sessions, which take place at a round table in the front of her spacious office in Converse Memorial Library, have constituted a learning experience on a number of levels, and comprise just one of many reasons why she summoned the word intense to describe both the college and the task of leading it.

“Those meetings are always interesting,” she said, noting that, while this panel is not entirely unique, it is unusual. “There are other places where there are tenure and promotion committees, but I don’t know of another place that has a committee of this sort that meets as regularly and at such length with the president, the provost, and the dean of the faculty of the institution. It was a godsend when I first came, because the extent of the contact, and the intensity of it, allows a new administrator to learn a lot about the college in a very short period of time.”

When asked what she’s learned, Martin — who came to Amherst after stints as provost at Cornell and then chancellor at the University of Wisconsin at Madison — paused for a moment as if to indicate this would be a lengthy answer. And it was, one that focused primarily on the faculty and its commitment to teaching, research, service to the community, and, in general, meeting or exceeding very high standards.

“The students are extraordinary, and the faculty is stronger than I could have even imagined it to be,” she told BusinessWest, “because of the way they combine high expectations for research with the incredible amount of intellectual capital they invest in teaching.

“And after working at research universities for most of my career, that investment in the art of teaching is a boon,” she went on. “I love seeing it, I love supporting it; I believe it’s essential.”

Among her many current initiatives, Martin told BusinessWest, is the drafting of a new strategic plan for the institution. While she generally used broad terms to discuss what will likely go in that plan, she said the school will continue to accelerate current work to create greater diversity on campus by aggressively recruiting and then supporting lower-income individuals and those with what would be considered non-traditional backgrounds.

This strategic initiative, launched more than 15 years ago, saw Amherst become the first college in the nation to eliminate loans for low-income students and one of the first to replace all loans with scholarships in financial-aid packages and extend need-blind admission to international students.

“This is a place that has put its money where its values are,” said Martin, adding quickly that the next challenge, and it’s a sizable one, is achieving progress in what she called “the really hard work, and maybe the hardest work.”

By this, she meant efforts to not merely bring such individuals onto the campus, but create cultural changes to ensure what Martin called “genuine inclusion.”

“We want an environment where no students feel as though they’ve been added on to a culture that has its core, its center, somewhere else,” she explained. “I can’t think of a more worthy project, but it’s not an easy project to change culture. But I love doing it.

“I admired what was accomplished here, and wanted to work at a place where, on a daily basis, or even an hourly basis, it’s possible to see the enlivening difference it makes to have people from so many different backgrounds learning together,” she continued. “I thought it would be an extraordinary challenge to see how that can be made into the educational advantage that it ought to be.”

For this issue and its focus on education, BusinessWest talked with Martin, the school’s first woman president and first openly gay president, about everything from these efforts to promote inclusion to the sometimes-difficult career transition from teaching to administration, and the different kinds of rewards in each realm.

Teaching Moments

Among the many items occupying space in a large bookshelf in one corner of Martin’s office is a white football helmet with a large red ‘W’ that instantly identifies it as being from the University of Wisconsin.

It was a gift from colleagues at the school where she served as chancellor for three years and became well-known for, among other things, her support of the sports teams (a pattern that has continued at Amherst) and her controversial and ultimately unsuccessful efforts to essentially separate the Madison campus from the rest of the University of Wisconsin system (more on that later).

It was in Madison where she earned a Ph.D. in German literature, with a dissertation titled The Death of God, the Crisis of Liberal Man, and the Meanings of Woman: A Study of the Works of Lou Andreas-Salome, and then an embark on a career that would take her from teaching into administration.

This was a path that would have seemed highly unlikely a decade earlier.

Indeed, Martin, who grew up in Northern Virginia, told BusinessWest that she can easily relate to many of those students at Amherst who fall into that non-traditional category, or who didn’t expect to ever be part of that school’s culture.

“My parents didn’t believe that girls should — or needed to — attend college,” she explained, adding that it was only because of the intervention of some teachers and advisors that she wound up attending the public school William & Mary in the early ’70s.

There, she earned a degree in English Literature and, during her junior year, studied abroad at Exeter University in England, where she met a number of German students and became fascinated by the divide between East and West Germany and how it had affected literature and culture.

When she returned to William & Mary for her senior year, she studied German extensively, and went to Germany to earn her master’s degree. One intriguing career stop while there came at a nursing home, where she served as a nurse’s aide.

“It was one of the most interesting — and hardest — jobs I ever had,” she explained, adding that she needed the work to support her studies, but also desired to learn German from people who were not academics. “It was a fascinating experience. This was a nursing home for women; most of them were in their 80s and 90s, so they had lived through both world wars. I learned a lot.”

Fast-forwarding a little, Martin said she began a career in teaching (both German and Women’s Studies) at Cornell, and eventually shifted into administration, a path she says she probably couldn’t have imagined even a few years earlier.

“But I’ve enjoyed it, and I find it conceptually and intellectually challenging,” she said, adding that she finds administration as rewarding as teaching, but obviously in different ways. “There’s almost nothing as rewarding as teaching, but administration also involves teaching — it’s just of a different sort and with different people. I think the biggest reward, obviously, comes from facilitating the success of students and faculty.”

At Madison, that process became more difficult due to budget cutbacks that forced reductions in faculty that brought about larger class sizes and other consequences, she told BusinessWest, adding that, eventually, she led an effort, which came to be known as the New Badger Partnership, to put in place a new business model for the school. Specifically, the plan would gain for the university status as a public authority reporting to its own board of trustees, a distinction already held by the University of Wisconsin Hospital and Clinics.

Martin eventually struck a deal with Gov. Scott Walker to separate UW-Madison from the rest of the system in this fashion, but the proposal met with staunch opposition from the University of Wisconsin regents and, later, from state legislators, many of whom feared the measure was the next step in making the school private. The Legislature would later pass a series of administrative and fiscal reforms that would apply to the entire system.

Course of Action

Choosing her words carefully, Martin said she didn’t necessarily feel compelled to leave the Madison campus, but understood it would be rather difficult to be impactful in that environment.

“I was worried, given the controversy about the initiative we’d tried, that I might be not be able to push as hard at Wisconsin as I needed,” she explained. “And I feel the reward from these jobs comes when you feel you can make a difference. And while I feel I made a difference while I was there, there would have been a limit to how much more I could have done, given the boldness of our initiative.”

She said she wasn’t necessarily looking for a job when she was approached about succeeding Anthony Marx as president of Amherst, but soon became intrigued by the prospect of leading one of the nation’s premier private schools — and again being in a position to make a difference.

In essence, she traded the financial woes and political turmoil at Madison for the scrutiny, internal politics, and, yes, the Committee of Six at Amherst. And she’s found it to be a good swap.

In a February 2012 piece about her transition to Amherst that appeared in the Chronicle of Higher Education, Martin referenced an unnamed former president of Dartmouth who had some thoughts on her new post. “Being president of Williams is fun,” he’s alleged to have said. “Being president of Dartmouth is a hard job. Being president of Amherst is an impossible job.”

Martin said it’s far from impossible, but it is challenging and — here’s that word again — intense.

And with that, she returned to her discussion about the faculty, and those high standards she mentioned.

“In ordered to get tenured here, you have to be doing cutting-edge work in your field, and you have to have been productive at the level of publication,” she explained. “But if your teaching isn’t also outstanding, it’s highly unlikely that you’ll get tenure.

“Unfortunately, that’s not true at all research universities, where research has priority,” she went on, adding that she and others consider Amherst a ‘research college,’ a phrase that the faculty, and students, have readily adopted. “And this signals that the expectations for scholarship and scientific research at Amherst exceed those you might expect at a liberal-arts college both in terms of productivity and the visibility and impact of the work.

“It’s an intense place,” she continued. “It’s intellectually very intense, because people don’t let themselves off the hook in teaching or in their participation in the governance of place just because they’re expected to do research.”

And while Amherst is, indeed, intense, the word that is being used increasingly to define it is diverse, a development that brings, as Martin said, both great promise and extreme challenge as she endeavors to build on the progress achieved by her predecessors and others at the school.

“The past few presidents and the faculty have done an incredible job of assembling a very diverse student body,” she told BusinessWest. “Given my own background, the fact that Amherst has done what it’s done to attract low-income students and support them is remarkable and quite inspiring.

“Tony Marx made it his highest priority that Amherst was aggressively recruiting and supporting low-income students and students from what would be considered non-traditional backgrounds,” she went on, adding that initiatives have included everything from community-college transfers to the recruitment of students from high schools. “And while the amount of financial aid is a key, so too are the very innovative and aggressive strategies that our admissions office has used to attract students who might otherwise think that Amherst is unaffordable, inaccessible, or not a place where they could succeed.”

At a recent White House summit devoted to improving access and success for low-income students nationally, Martin today announced four new initiatives aimed at providing low-income students access to college and fostering their success in higher education at Amherst and beyond. She said they will:

• Boost the number of Native Americans who go to college;

• Help low-income and disadvantaged students in Western Mass. get into college;

• Increase the proportion of low-income Amherst students who major in science and math fields; and

• Close the college experience gap between low-income students and the student body as a whole.

The retention and graduation rates for low-income students are as high as they are for students overall, she continued, adding that the challenge moving forward is to be even more aggressive with this tack and, as she said, to move boldly on the bigger challenge — true inclusion.

“We have created a critical mass of diversity,” she went on. “But we have a lot of work to do before we get to a place where every student on this campus would say, ‘I feel as much at the center of the culture of the place as anyone else.’ We’re not there yet, at least in my opinion, but we’re going to work hard to get there.”

George O’Brien can be reached at [email protected]

Planned United, Rockville Merger Has the Industry’s Attention

Jeff Sullivan, left, and William Crawford will be the president and CEO, respectively, of the ‘new United Bank.’

They’re called MOEs, or mergers of equals.

And while neither the phrase nor the acronym is new to the banking industry, they have become far more prevalent in this sector’s lexicon in recent months as institutions of like size and character have come together to take advantage of many benefits of scale in the currently challenging economic and regulatory climate.

And one of the most watched of these mergers — or mergers in progress, as the case may be — is the one involving West Springfield-based United Bank and Glastonbury, Conn.-based Rockville Financial, which was announced late last fall, and will, if everything goes as planned, be finalized by the end of the first quarter.

The deal, which would create a $4.8 million community institution with more than 50 branches in Massachusetts and Connecticut, is similar to others consummated in recent months in that the banks are of similar size (United has $2.5 billion is assets, Rockville has $2.2 billion), there has been considerable give and take in the negotiations, and the ‘selling’ bank — United, in this case — is actually the one keeping its name, because those involved believe it will ultimately travel better.

But in some respects, this transaction is resetting the bar when it comes to the MOE.

Indeed, expectations are quite high, and industry experts are predicting that this ‘new United,’ as it’s being called, could become a powerful force in the Springfield-Hartford corridor — and beyond.

“This creates a scalable franchise with a competitive advantage among the small to mid-sized banks,” Damon Delmonte, an analyst with Keefe, Bruyette & Woods, recently told American Banker. “There is a real lack of $5 billion-asset banks in Southern New England.”

Meanwhile, David Englander, a columnist with Barron’s, wrote recently that “the merger looks like a good one. When it closes in 2014, the combined bank will have $4.8 billion in assets and more than 50 Massachusetts and Connecticut branches, positioning it well to compete with larger banks. It will also have lots of excess capital to fund growth.”

Bill Crawford, president and CEO of Rockville, and Jeff Sullivan, COO of United, would agree with all that.

They will become CEO and president, respectively, of the new United, if the merger clears the remaining hurdles, and both believe this merger represents a huge step forward for both institutions and an opportunity to do something together that they certainly couldn’t do apart — at least not for a long time.

“We’ll have great strategic options,” said Crawford, noting that the entity created by the merger will have $150 million in excess capital that can be deployed in a number of ways. “We’ll have the ability to grow organically and later look at partnering with other banks through acquisition. Each bank, independently, could have grown, and would have done reasonably well, but how long would it have taken Rockville, with $2.2 billion in assets, to get to $5 billion? This deal puts us ahead six or seven years, and it’s the same for United.”

“We’ll have great strategic options,” said Crawford, noting that the entity created by the merger will have $150 million in excess capital that can be deployed in a number of ways. “We’ll have the ability to grow organically and later look at partnering with other banks through acquisition. Each bank, independently, could have grown, and would have done reasonably well, but how long would it have taken Rockville, with $2.2 billion in assets, to get to $5 billion? This deal puts us ahead six or seven years, and it’s the same for United.”

But while MOEs bring many potential benefits to the parties involved, they are in many ways more complicated than traditional acquisitions, where the acquiring firm sets the tone, takes the name, and dictates most of the terms.

“What’s challenging for us — and really interesting for us — is that this is a merger, not an acquisition,” Sullivan explained. “We have to reinvent almost every business process we have at the bank. In an acquisition, the acquiring bank says, ‘welcome to the family, this is how we do things, get on board.’ We’re building a new company in a lot of ways by taking the best practices of both banks, or, in some cases, saying, ‘neither one of us is an all-star at this — and we need to think about a different way of doing business.’

“So we’re spending a lot of time in the weeds looking at all business processes and all of our technology,” he went on, “and looking at how to do things better. If this were an acquisition, it would be a lot easier.”

While hammering out these details, officials with both banks, but especially those at Rockville — who use the marketing slogan ‘Rockville Bank … That’s My Bank’ and whose customers will experience a name change — are explaining that little, if anything, else will be different when this new institution makes its debut.

“The United name stands for the same things the Rockville name stands for,” Crawford noted. “That’s what I’ve told the Rockville customers — we’re merging with someone who’s very similar to us; the main differences are they’re in a different state, and their logo is green. That’s where the differences end.”

By All Accounts

Crawford and Sullivan both acknowledged that, until fairly recently, it would be hard to imagine putting the number $5 billion and the phrase ‘community bank’ together in the same sentence.

But the times — and the numbers — are changing.

Indeed, when Bank of America and Wells Fargo have more than $2 trillion in assets and many institutions have several hundred billion, $5 billion represents a “rounding error” for such banks, said Crawford. Meanwhile, he added, given current trends and challenges, community banks need to be far more concerned about being too small than what some might perceive as too big to be worthy of that designation.

“It’s very difficult to do what you need to do from a risk-management-compliance perspective, and in terms of technology investments to serve your customers,” he explained. “That’s why you’re seeing these mergers of equals across the country.”

Richard Collins, president and CEO of United, who will retire when the merger deal closes, agreed. “Increased scale is important in a number of ways,” he said. “It’s getting harder to go a good job these days; the regulatory thrusts are omnipresent, and having the funds available to get the technology you want to keep up with what’s happening today is critical, and that means getting bigger is important.”

And United has been getting bigger in recent years, expanding its footprint through two significant mergers. The first came in 2009, when the bank acquired Worcester-based Commonwealth National Bank, taking the United name east, almost to Route 495. And in 2012, United acquired Enfield-based New England Bancshares, bringing the brand as far south as New Haven County.

As it eyed further expansion, United focused its attention on Rockville, as well as the trend toward MOEs, which, analysts say, have enormous potential for the stakeholders, but also come with a high degree of difficulty when it comes to putting the deal together.

There have been several MOEs in recent months, including the pairing of SCBT Financial and First Financial Holdings in South Carolina, Home BancShares and Liberty Bancshares in Arkansas, Heritage Financial and Washington Banking in Washington State, and Provident New York Bancorp and Sterling Bancorp in New York.

It was the proximity of that last merger, not to mention the positive response from investors, that caught and held the attention of those at United and Rockville, who by that time were in serious discussions about a deal of their own.

“This was a strategic merger of equals, and when we saw how investors responded and how that deal was put together, it was very instructive of what we could do that would make a lot of sense for both banks and their customers,” Crawford noted. “What was interesting about that deal is that they announced it, and both stocks went up, which almost never happens in any kind of acquisition or merger; usually one goes up and one goes down.”

Richard Collins, president and CEO of United Bank, who will retire when the merger is finalized, says there are many advantages to being bigger in today’s banking climate.

Collins told BusinessWest that the banks, similar in size and other characteristics, have had mostly informal talks about a merger for several years, but moving forward wasn’t possible until Crawford, who took the helm at Rockville in early 2011, completed the process of converting the institution from a mutual bank to a stock institution.

“United was growing very nicely and had just done an acquisition, and we were growing organically, and we just sort of hit this intersection point,” said Crawford, adding that, when the merger deal involving the banks was announced in November, both stocks went up.

United in Their Vision

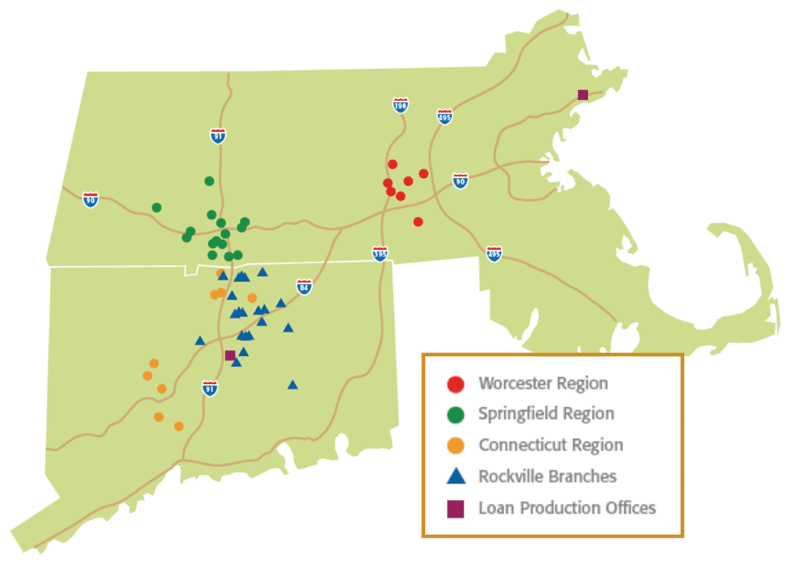

The ‘new United’ will include 55 branches, 18 in Western Mass. (what would be considered the original United footprint) as well as seven in the Worcester area added through United’s acquisition of Commonwealth National, nine in Connecticut added through the merger with New England Bancshares, and 21 Rockville branches. There are also two loan-production offices.

The branches in Western Mass. and Connecticut are clustered along the I-91 corridor, said Sullivan, adding that the Rockville branches essentially fill in a gap between United locations in the northern and southern areas of the Nutmeg State. The new footprint (see map, page 17) closely approximates what economic-development leaders in both states call the Knowledge Corridor.

And this is a very attractive, stable market, said Crawford, one with strong potential.

“While these markets don’t grow rapidly, they are dense, they have high population, and they’re relatively high-income markets compared to a lot of the United States. These are good markets to be in, and ones where we can take share from the large banks; that’s how we grow both companies.”

There was considerable give and take in the negotiations between the two institutions, said Crawford, which involved everything from where the bank would be headquartered to what it would be called.