Pandemic Lessons

Rich Kump says the pandemic has forced people who had been reluctant to bank remotely to give it a shot.

It’s the wave of the future, Rich Kump said — and the COVID-19 pandemic simply cast that wave in sharper relief.

“We’ve had a goal of moving routine transactions out of the branch,” the president of UMassFive College Federal Credit Union told BusinessWest. “We’ve been educating our members for three years, trying to move them out of the branch, and there’s still a percentage of America who just likes to everything in person. You need to take a thoughtful approach; you can’t force people into it … although COVID did that, to some extent.”

A widely held vision of the bank (or credit union) branch of the future — one shared, to some degree, by other local banking leaders we spoke with — does indeed promote robust online and mobile tools for routine business like deposits and withdrawals, leaving less traffic in branches, but a greater percentage of that traffic given over to more complex or consultative matters.

“We’ve had a goal of moving routine transactions out of the branch.”

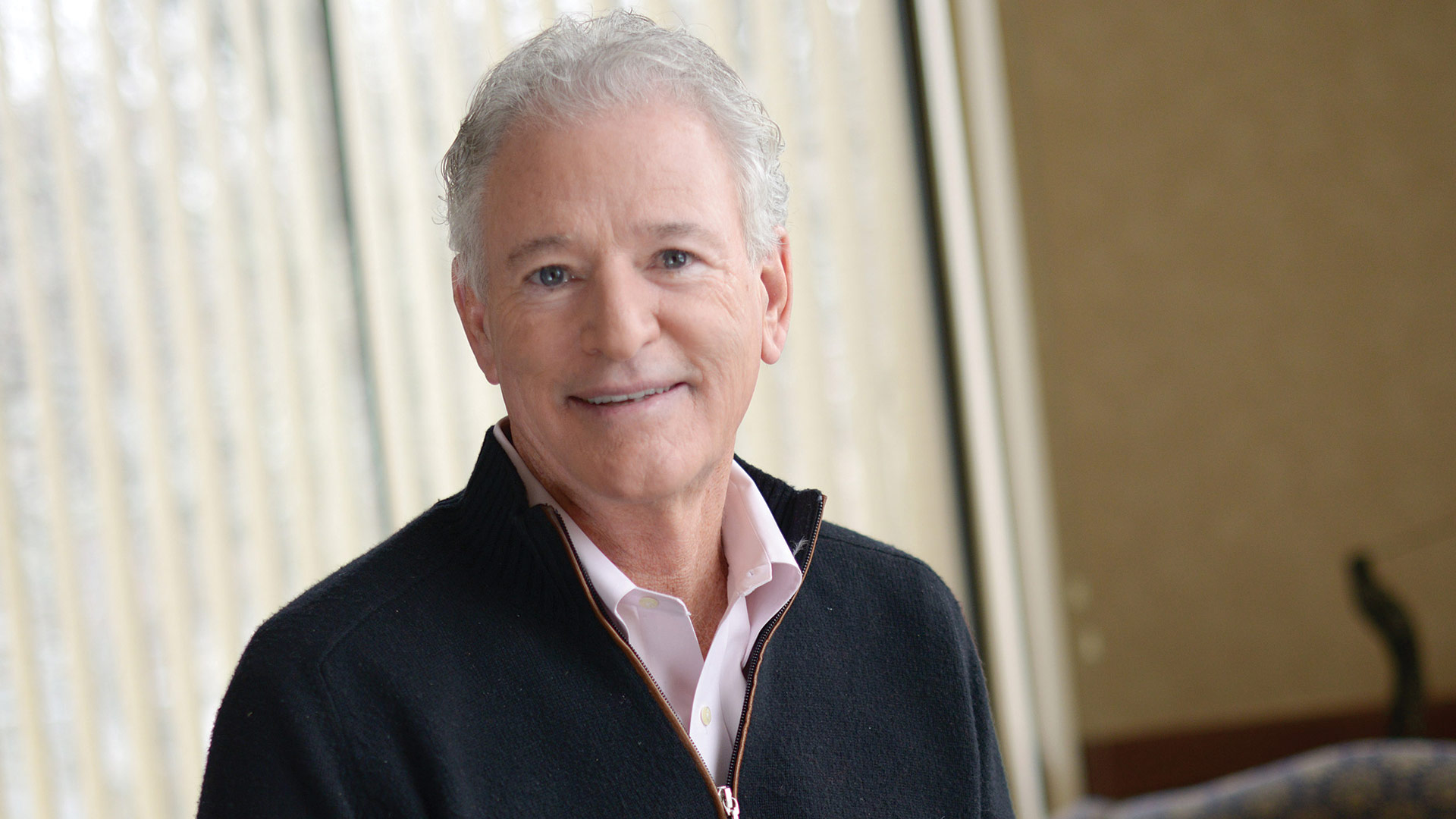

And many people who have long resisted online banking are singing a different tune, said Paul Scully, president of Country Bank.

“Customers, just because of the nature of the pandemic, with people staying at home, started exploring technology,” he noted. “An amazing number of people are using technology who, for a number of years, fought it.”

In most cases, it’s just a matter of breaking old habits, Scully said — “and old habits are comfortable habits. But I think people are becoming better acclimated to technology and getting over their fears. There are still people who think, ‘I have to go into the bank to make that transaction because what if the money doesn’t get there?’ But as an industry and as a bank, we’ve been able to alleviate the concerns some people have.”

Florence Bank President Kevin Day agreed.

“Banking in general is going to change. The stuff you need to do is the same, but how you’re going to do it will change,” he said, noting that lobby traffic has been declining for years, and what was already a high adoption rate of mobile tools only accelerated over the past three months as banks closed lobbies to most routine business. “People are starting to realize it’s probably more secure, so they’re getting more comfortable. It’s also way more convenient.”

And gaining momentum in these shuttered times.

“Customers realized they really can do all their banking online,” Scully said. “We’re no different than Macy’s or Amazon. You realize you can sit down with your laptop or phone and purchase something from a retail outlet, and you can also do your banking that way. People are becoming more comfortable with it — so we need to keep upgrading and enhancing it.”

That’s not all they’re doing. Banks and credit unions, despite a much higher reliance on drive-up lanes and mobile platforms lately, never really closed during the pandemic, and while they continued to serve customers — in some cases, helping them navigate sudden financial hardships — they were also learning lessons and conducting internal conversations about where the industry is heading and what the bank of the future should look like.

Some were discussions that had begun years ago but, again, were suddenly cast in sharp relief as the wave known as COVID-19 came crashing down.

Staying Connected

People have been starved for human contact, Kump said. He knows that from UMassFive’s call center, as calls over the past three months are 25% longer, on average, than last year.

“A lot of it is, people just want to talk,” he noted. “Yes, they call for a reason, but then they want to talk. It’s a bit of a community.”

Bolstering the call center was one of the success stories of late March, which he recalls as a tough time.

“I don’t think anyone was ultimately prepared for this; we were scambling,” he said, explaining that many retail personnel in the branches began covering the phones, often from home. “Within two weeks, 70% of our staff was working from home. That’s when the chaos evolved into routine.”

Like the other institutions we spoke with, UMassFive didn’t close completely, staying open by appointment for services that couldn’t be done remotely, from notary signings to certain loan closings to instant-issue debit cards. The week Kump spoke with BusinessWest, the credit union was operating a soft opening of sorts before announcing a shift to walk-in business.

“Financial wellness isn’t just for people with means; it’s everybody, from somebody with an entry-level job to someone doing college planning or estate planning.”

Day recalls a similar experience.

“In that first week, everything was shutting down, and people were saying, ‘you’re a bank. You can’t shut down,’” he said. But Florence transitioned to drive-up service where possible while witnessing an expansion of remote banking — as well as phone-call volume that was up 100% early on.

“We helped a lot of people transition to mobile and computer options. People have used the drive-ups. We opened the lobbies for people who needed to do something in person. We went out to cars in some cases,” he recalled. “You couldn’t come and go as you wanted, but we never really closed. If you called and the only way to do something was in person, we did it in person.”

Kevin Day says shifting most employees to remote work was one of the smoother transitions necessitated by COVID-19.

Still, the sudden, in many ways forced expansion of remote banking is just an extension of where the industry was already headed, Day explained. “We had already seen trends toward online, mobile, people doing much more on their computers and phones. The pandemic just really accelerated that.”

Scully said the transition to employees working remotely was one of the easier shifts.

“It wasn’t that difficult for us. We had all the technology in place that allowed us to immediately have all our non-branch staff working remotely, literally overnight. So that fell into place nicely for us; we didn’t miss a beat. Business was never impacted.”

For example, he said Country processed about 450 Paycheck Protection Program (PPP) loans remotely, while Zoom calls and Webex meetings became the order of the day. It has worked so well, in fact, that non-branch employees will continue to work from home until Aug. 31, even as branches begin opening up this week, which is a boon for parents still uneasy about — or unable to access — camps and day-care services.

“We closed a day or two before other banks, just recognizing what was happening, and moved people to drive-up or leveraging technology,” he said, noting that lines were sometimes long, but customers were able to access the services they needed, in some cases using interactive teller machines (ITMs) at two locations.

“We’ve walked a lot of people through the technology, and the customer care center reached out directly to help them. We had curbside service at some locations, and we also used that as an opportunity to talk about technology.”

Branch of the Future

All this enhanced technology goes hand in hand with what many banking leaders say is an evolving role for branches.

Branches are certainly needed, said Jeff Sullivan, president of New Valley Bank, which is opening a new branch on the ground floor of Monarch Place in downtown Springfield this summer. Like every other area bank branch, it will stress pandemic safety, with a mask requirement, six-foot distancing, and glass partitions between customers and employees.

But it will also reflect a move toward a role for branches that emphasizes financial wellness and consultative services more than routine business.

“That’s going to be the bigger component of what a community bank does — trying to help people navigate a lot of things,” he explained, before adding that there will be plenty to navigate in the coming year, when more customers than usual will be struggling to achieve stability. “Financial wellness isn’t just for people with means; it’s everybody, from somebody with an entry-level job to someone doing college planning or estate planning.”

The bank of the future will put greater emphasis on this consultative role, through personal interaction that can’t occur online.

Paul Scully

“Customers, just because of the nature of the pandemic, with people staying at home, started exploring technology. An amazing number of people are using technology who, for a number of years, fought it.”

“Obviously, if it was just about technology, the big-city, money-center banks could meet the needs of every single person,” Sullivan said. “If you don’t have the technology, you’re going to fall behind, but the extra, community-focused efforts are what’s really going to make an impact.”

Kump said UMassFive has eliminated tellers — or, more accurately, it has eliminated branch employees who handle only that role. Instead, employees are trained to be “universal agents,” able to tackle multiple roles, from traditional teller business to loans and other matters.

To achieve that, the credit union has tripled its training budget over the past few years, seeking to identify not only financial skills, but empathetic personalities with a real desire to help people.

“The face of banking is changing permanently. Branches in the future won’t be as critical, with fewer transactions coming in. But they will always be needed for key parts of financial life,” he explained, citing anything from home and auto loans to opening memberships to simply seeking financial advice.

“We won’t need the huge teller line anymore. We won’t need as many branches, and the services we’re providing in the branches are changing, he added, noting that customers are also discovering they can conduct routine business face to face — sort of — through ITMs. “Someone could be at the Northampton drive-thru, talking to someone working from home in Belchertown.”

That raises the question of how many workers need to be on the premises, both while COVID-19 is still a threat and afterward, considering how effectively operations have continued during the pandemic.

Jeff Sullivan

“Obviously, if it was just about technology, the big-city, money-center banks could meet the needs of every single person. If you don’t have the technology, you’re going to fall behind, but the extra, community-focused efforts are what’s really going to make an impact.”

“From a back-office standpoint, about half are working remotely,” Day said. “Can they continue to do that long-term? Yes, but there’s still the human element, and people can feel isolated. Feeling part of a team is important to some people, while some people are loners. But technology is certainly giving us some options.”

And the bank, which recently broke ground on its third Hampden County branch, this one in Chicopee, has certainly been discussing those options.

“More transactions are going online, but when you want to talk to a person to problem solve, especially with more complex transactions, that can certainly be done over the phone — and has been during the pandemic — but the way we’ve designed our branch of the future, there’s more consulting. If you want to come in and consult, we’ll talk to you — a lot. So frontline people will still need to be there to handle questions and solve problems.”

Getting Through the Pain

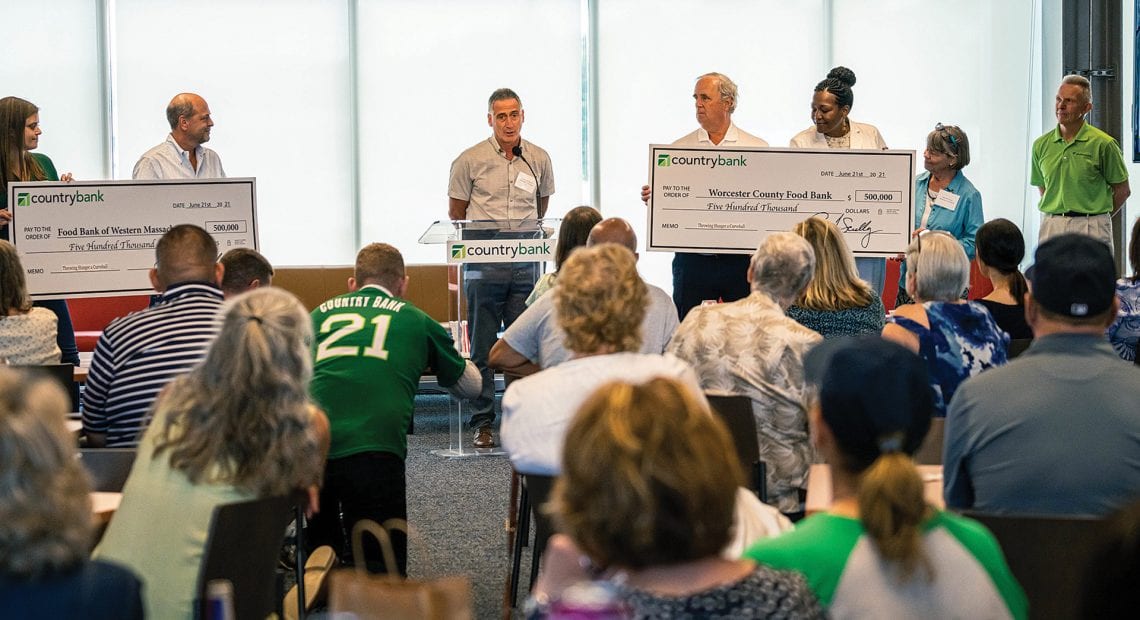

In fact, banks and credit unions never stopped solving problems over the past few months. Scully said Country, like other banks, was able to accommodate deferrals of loan payments for individuals who has been furloughed or were generally dealing with greater financial stress.

“I felt like this was a watershed moment,” Day added, noting that more than 200 mortgage borrowers and 200 commercial borrowers took advantage of three-, six, or 12-month deferrals, the latter being the most popular option. “Having been through downturns in my career, I knew that we needed to give people some time. People are resilient, businesses are resilient, but they needed some time. So we worked with residential and business customers on deferred payments.”

Kump said UMassFive issued forebearance on nearly 1,000 loans for people who were “furloughed or just worred,” as well as launching a small-loan program for those who just needed a little cash. “If you were furloughed, that didn’t change the decision to make a loan for you.”

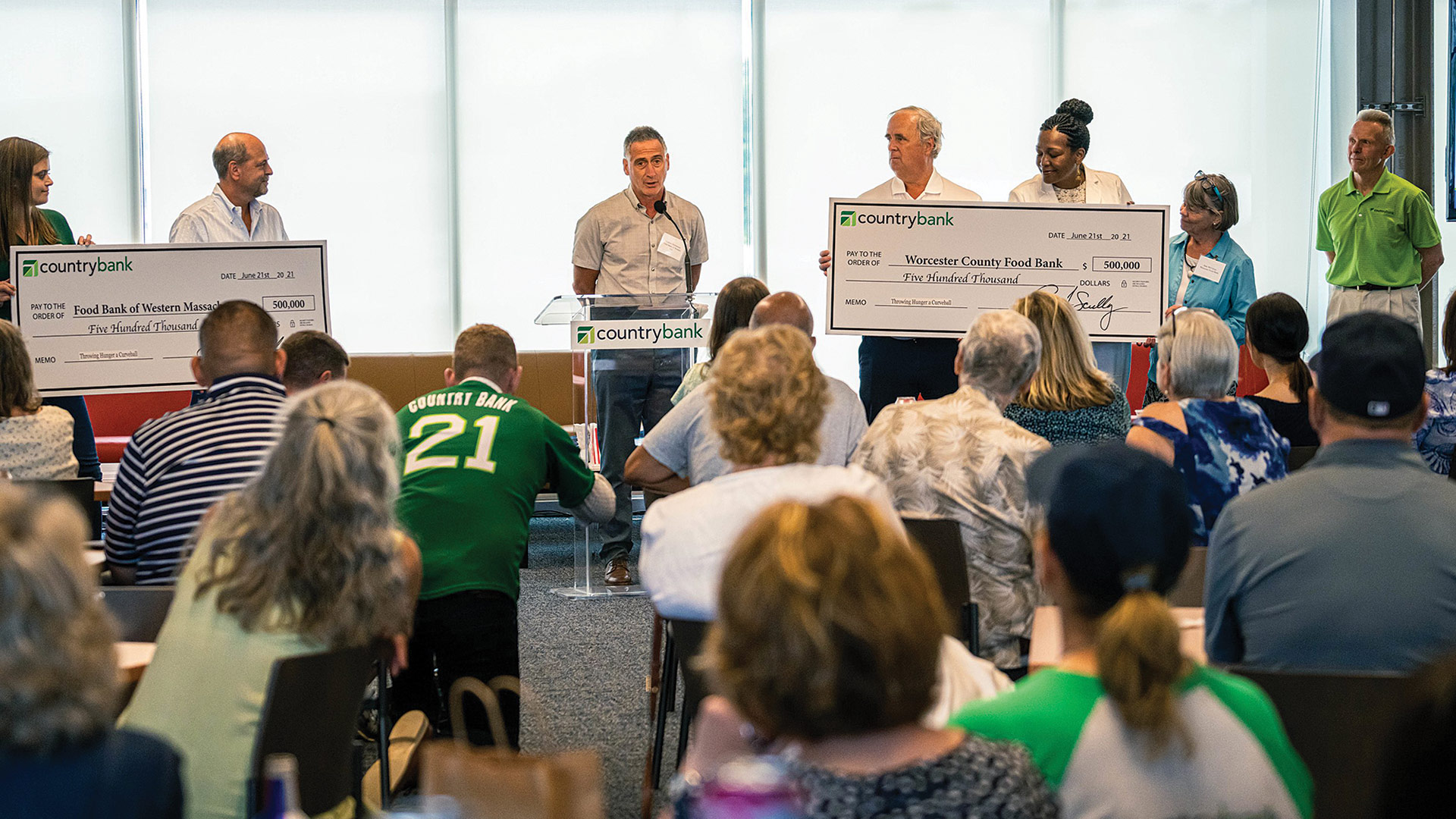

That was in addition to PPP loans, which the credit union approved for members and non-members in the community alike, 96% of those loans issued to employers of five workers or fewer. It also looked for other ways to support community needs, such as donations to food banks and organizations like Community Involved in Sustaining Agriculture, as well as donating meals to first responders.

Although those needs still exist, banks and credit unions are beginning to get back to normal operations, expanding branch operations under enhanced safety protocols — “it’s a great time to be in the plexiglass business,” Scully said — while considering the lessons learned during the months when most business was conducted remotely.

“Was there frustration at first? Absolutely,” he added. “At first, people were like, ‘what do you mean, a bank is closed?’ But as every industry started to close and people started working remotely, people began to understand.”

After all, a bank that saw a fire ravage its headquarters in 2008 and a tornado rumble through its home region in 2011 has no problem posting social-distancing reminders and directional arrows and getting back to branch business. “This is bigger than a tornado,” Scully said. “The lesson we’ve learned is to always be prepared and remain nimble.”

Even as it moved from a soft-opening week to broader branch service — where walk-in traffic is allowed but appointments are still advised to reduce the wait — Kump marveled at how the credit union’s members have adjusted to remote business. Especially new members, 90% of whom have been joining online, compared to 40% to 50% in a typical year.

“There’s a percentage of customers who will still be reluctant to walk into a business,” he added. “We’re seeing that with restaurants opening and people still not coming.”

It helps, of course, that many have discovered the power of digital banking.

“For a lot of folks, it’s generational; they’ve been intimidated by technology, of depositing a check with a picture on their phone,” Kump continued. “Now they’ve been forced to do it, and they’re asking, ‘why was I taking time out of my day to run over to the credit union to get cash or transfer money? I don’t have to do that.’”

Day also expects people to keep using those tools, but for those ready to return to the branch, even for matters as basic as depositing a check, they’ll do so protected by masks, shields, and any number of other precautions. “The pandemic isn’t over, and people are still going to get sick. We want to keep people safe.”

Bottom Line

Usually, when BusinessWest talks to local banks and credit unions, it’s about their own business outlook for the year ahead, but this is not a typical year, and talk of asset growth and loan portfolios has been pushed aside to some degree by the need to simply stay afloat — and keep customers afloat, as well.

“The outlook is generally positive, but it will not be without pain,” Day said, speaking for both Florence Bank and its customers. “We know it will get better. It’s just a matter of when.”

Joseph Bednar can be reached at [email protected]

“We had new requests coming in that we never had before because of agencies that were feeling an impact from a surge of families and individuals needing support because of the pandemic.”

“We had new requests coming in that we never had before because of agencies that were feeling an impact from a surge of families and individuals needing support because of the pandemic.” “During the pandemic, we were thinking creatively about what else can we do that’s different than what we’ve done in the past to support different folks. In some cases, it was really kind of doubling down on our efforts because the needs jumped more than expected.”

“During the pandemic, we were thinking creatively about what else can we do that’s different than what we’ve done in the past to support different folks. In some cases, it was really kind of doubling down on our efforts because the needs jumped more than expected.”

“From a business perspective, there are advantages and disadvantages to how a company classifies its workers.”

“From a business perspective, there are advantages and disadvantages to how a company classifies its workers.”

“Tax-loss harvesting works because capital losses are subtracted from capital gains when you file your tax return, so you pay taxes only on the gains in excess of losses.”

“Tax-loss harvesting works because capital losses are subtracted from capital gains when you file your tax return, so you pay taxes only on the gains in excess of losses.”