It’s Business, Not Nostalgia

Jeb Balise, left, and Jack Dill

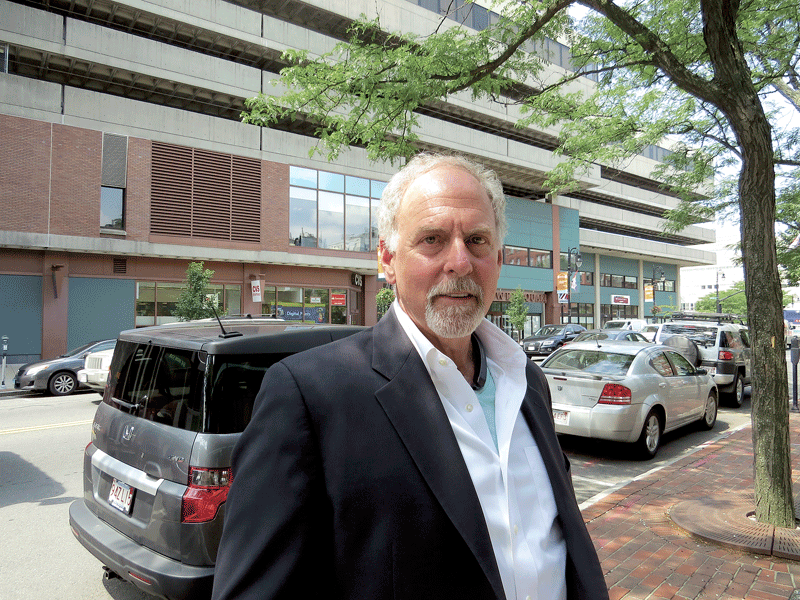

Jack Dill likes to say he’s been involved with the building at 1441 Main St. in Springfield since “before it was a hole in the ground.”

Indeed, Dill, now a principal with Colebrook Realty Services, was an employee at Colebrook back in the late 70s, when it was the real-estate arm of Springfield Institution for Savings (SIS), and was assigned to take the plans for building the bank a new headquarters at that address — plans that had been on the drawing board for some time but unable to move forward — and make something happen.

Dill looks back at that assignment, given to him by the bank’s then-President and CEO John Collins, with fondness, pride, and a large amount of self-deprecating humor.

“I don’t know how they ever let me do this,” he recalled. “John said, ‘look, we’ve spent a lot of money on this; we don’t think it’s going to work. We’re not paying you very much; take six months … before we throw the plans away, see what you can do.”

Long story short, he made it all work.

Dill recalls that the city of Springfield wanted some retail at that location (that sector was still a huge force in the downtown at the time, although not for much longer, as we’ll see), and the bank, as noted, wanted a headquarters building. He conceived something that served both masters.

And with the help of a $4 million Urban Development Action Grant from the Carter administration, the $20 million project did move off the drawing board. When finished, the complex boasted several stores and a few restaurants. Meanwhile, SIS had a large presence, and there were dozens of other business tenants in the office ‘tower.’

“I don’t know how they ever let me do this. John said, ‘look, we’ve spent a lot of money on this; we don’t think it’s going to work. We’re not paying you very much; take six months … before we throw the plans away, see what you can do.’”

Dill, as a principal at Colebrook, which became a private company in 1999, would go on to manage and lease the property for decades, steering it through changes in the business and commercial real-estate landscapes. And today, he does largely the same, but through a different lens and with a much-different title: co-owner.

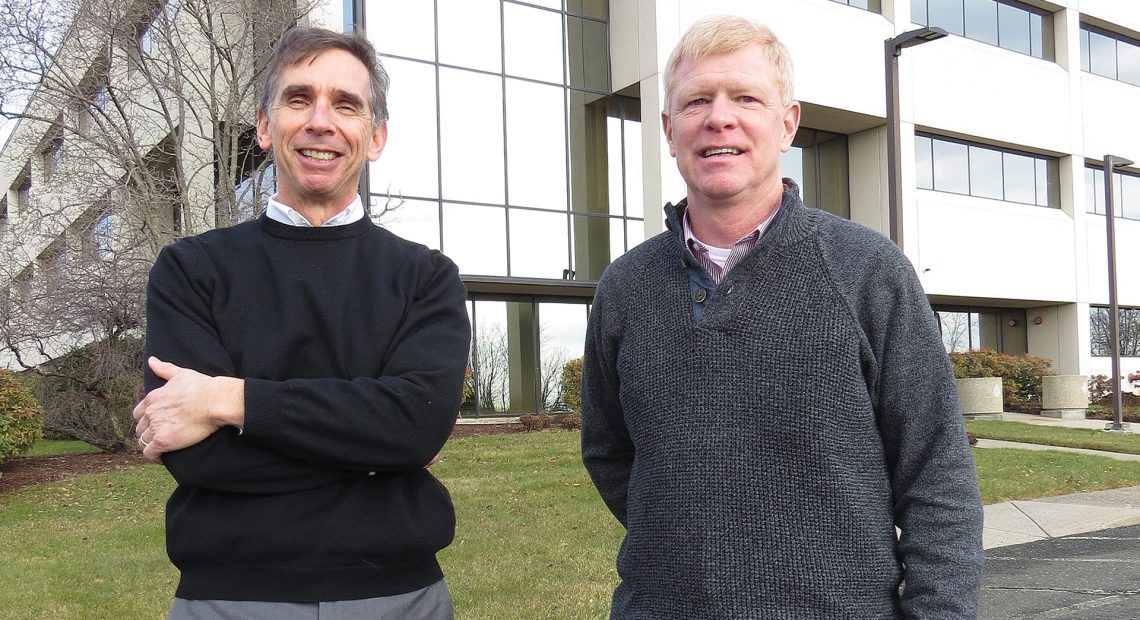

Dill, his partners at Colebrook (Mitch Bolotin and Kevin Morin), and Jeb Balise, president of Balise Motor Sales (soon to be based in Springfield, on the third floor at 1441 Main St.) partnered to acquire the 12-story office building in early 2022.

The ‘birdcage,’ erected in 1986 to camouflage closed retail at 1441 Main St., will soon be coming down, one of many changes coming to the downtown office complex.

They came together, they said, to bring the property under local ownership and make some changes to bring more vibrancy. The fact that Balise’s company has a new home for much of its operation (and roughly 55 employees) was always on the table, he said, but not a deciding factor in his participation in this venture.

“I went in with an open mind, and it was enticing, but I really had to do my homework, and one of the things I did was move my own office here and do a test drive,” he said, borrowing a term from his industry. “And what we found is that the location is incredibly convenient to all the places we go, between banks, attorneys, accountants, architects, and engineers that we deal with locally.”

That convenience extends all the way to Riverdale Street in West Springfield, where Balise has a handful of dealerships, he went on, noting that, because Riverdale is a divided street, employees can get to many of those dealerships from 1441 Main St. as quickly as they could from the current headquarters at Doty Circle, just off Riverdale.

Since taking ownership, the partners have undertaken several initiatives, including improvements to the elevators and recruitment of a new restaurant — Mykonos, one of the displaced tenants in the Eastfield Mall — with more in the planning stages, including replacement of an escalator (a remnant of sorts from the building’s retail roots) and extensive renovations to the mezzanine level, specifically the removal of its wooden façade and what Dill not-so-affectionately refers to as the ‘birdcage’ (more on that later).

For this issue and its focus on commercial real estate, BusinessWest talked with Dill and Balise about their acquisition of this downtown stalwart and what will likely come next for the property.

Building Momentum

Dill recalls with some fondness, and more of that humor, the first time he met Jeb Balise.

It was in 1976. Dill was 24 and looking for a new car, specifically a Camaro, a four-speed with a V8 engine. Balise was 17 and in his second year working as a salesman at the family’s Chevy dealership on East Columbus Avenue.

Dill liked the car, and the car liked him, but the sticker price was beyond his means at the time. So he stayed in his Volkswagen, the one with 112,000 miles on it and no heater.

Four and a half decades later, he did buy a car from Balise — a Volkswagen GTI, one of the few cars still on the market with a manual transmission, he noted. (Jeb stayed on the sidelines for that transaction.)

Over the years, Balise Motor Sales has been a client of the Colebrook company, and the parties have worked together on several projects. Meanwhile, at 1441 Main St., a succession of banks that had come into ownership had looked into selling the building, but ultimately decided not to, said Dill, because of the relatively low cost of owner occupancy; in short, being in that building was cheaper per employee than leasing space elsewhere.

But ultimately, TD Bank decided to sell what was the last building it owned, said Dill, adding that it went on the market in the spring of 2021. Soon thereafter, a unique and decidedly local buying group came together.

“Jack and his team approached me and said, ‘TD is probably going to put the building on the market, and we think it’s a great opportunity,’” Balise recalled. “I remember them being specific: Jack’s vision was, ‘we’d like to see it be Springfield-owned, and we’d like you to be a part of it.’”

It was at that point, he went on, that he first learned the story of how Dill had been involved in the building of SIS’s new home as a young employee of the bank.

“It was a great history lesson for me, and a fun history lesson, because I was reliving where I was at that time, and where Springfield was,” he went on. “So the way I would sum it up is … Jack, as the consummate sales pro, romantically lured me into wanting to be Colebrook’s partner.

“Jack and his team approached me and said, ‘TD is probably going to put the building on the market, and we think it’s a great opportunity. I remember them being specific: Jack’s vision was, ‘we’d like to see it be Springfield-owned, and we’d like you to be a part of it.’”

“I think it’s a timeless, beautiful building,” Balise added, “and I loved the notion of keeping it locally owned and jointly doing our part to help Springfield grow and prosper.”

Dill agreed, and stressed repeatedly that, despite his long history with the building, nostalgia was not a factor in this decision. Ultimately, this was a business deal.

“Obviously I’ve been involved with the building for a very long time, but we tried not to have an emotional decision,” he recalled. “We thought that having a good and reliable partner was a real plus; we’ve been in business a long time, and we’re friends; he’s a great partner.”

Elaborating, he said those at Colebrook and Balise were of one mind with regard to the property — that this would not be a buy-to-flip scenario, and that they were in it for the long haul, with Jeb Balise providing an invaluable “new set of eyes,” as Dill put it.

Signs of the Times

As he looked back on those 45 years of involvement with the property at 1441 Main, Dill jokes that there have been many times when he wished that he was in the sign business.

Indeed, the name over the front entrance and high on the façade has changed many times, usually taking on the name of the bank that owned the property. And that’s a long list, courtesy of a continuing wave of mergers and acquisitions in the financial-services industry that started in the early ’90s.

“I’m pretty sure we’ve had at least five or six signs on this building,” he said, listing Family Bank, First Massachusetts Bank, Banknorth, TD Banknorth, and then TD Bank. He admitted that it was hard to keep track, even for someone who managed the property.

But the letters on the building are not the only thing to have changed over the years.

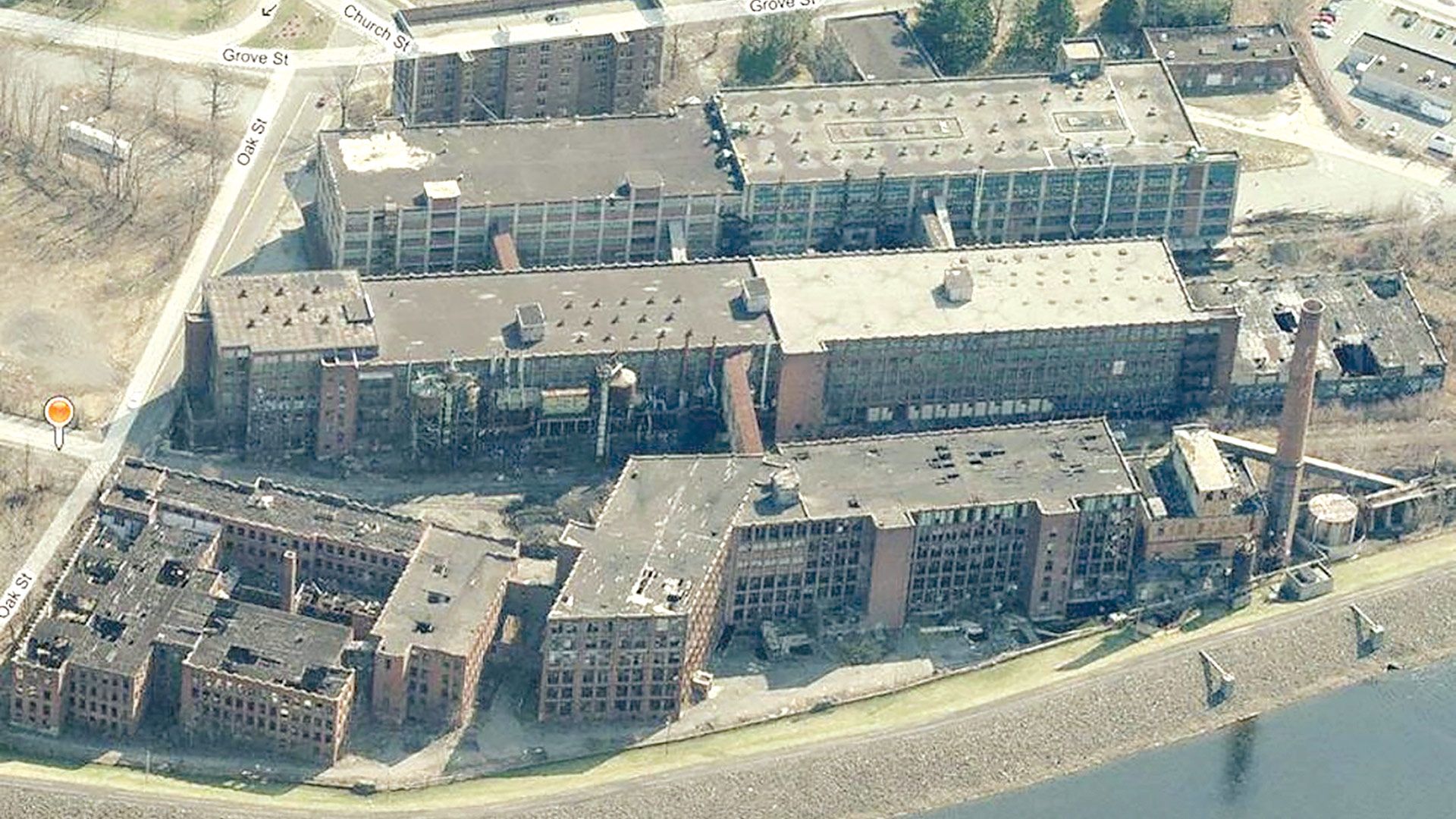

Indeed, the retail component of the building collapsed, as it did across the street at Tower Square, a byproduct of the malls, especially the one at Ingleside in Holyoke, said Dill. The property’s owners adjusted, converting a mezzanine that was retail into back-office space for the bank and erecting, in 1986, the ‘birdcage’ — a wooden façade that looks like … well, a birdcage — as “camouflage, so it wouldn’t look like closed retail,” he explained.

A framed portrait of John Collins, the man who gave Jack Dill the assignment of making 1441 Main St. a reality, is now displayed in the lobby of the building.

The Colebrook team answered an RFP, and the property eventually became the home of the Western Massachusetts Economic Development Council (EDC) soon after it was created in 1996. Meanwhile, space formerly devoted to retail — a Falcetti Music store and a CVS, among others — was soon occupied by several agencies, ranging from the Springfield Regional Chamber to the Greater Springfield Convention & Visitors Bureau to the entity now known as MassHire Hampden County Workforce Board.

Over the years, it also became home to several prominent nonprofits, including the United Way of Pioneer Valley and the Springfield Symphony Orchestra.

The office tower, meanwhile, has become home to several federal and state agencies, including the Federal Bureau of Investigation, the Drug Enforcement Agency, the Occupational Safety and Health Administration, the Office of the Attorney General, and others.

When the Colebrook/Balise partnership acquired the property, the occupancy rate was roughly 85%, said Dill, adding that it is now closer to 90%, with additions including a temporary office for Daniel O’Connell’s Sons, the general contractor for construction of the parking garage taking shape across Harrison Avenue.

That number won’t change when Balise moves its headquarters to the property early next year, but the number of people working in the building will, Dill said, noting that the 55 or so employees from Balise will bring more vibrancy to the property and more foot traffic to downtown service businesses, bars, and restaurants.

That includes Mykonos, which will occupy space on the first floor, Dill noted, adding that additional restaurants are certainly possible.

Meanwhile, on the second floor, to attract more office tenants, the new owners are opening up the back of the space, which faces the park where the Steiger’s department store once stood, by putting in a bank of large windows. There are also plans to remove the ‘birdcage’ and take out the escalator and replace it with a new staircase.

“With these new windows and the removal of the birdcage, we’ll have a lot more natural light on the second floor and first floor,” he said. “And we have some other ideas on new design and a new visual identity for those two floors.”

Looking long-term, both Balise and Dill believe they can retain current office tenants and add new ones, even at a time when work is in flux and the future of office buildings is more clouded than at any time in recent memory.

“Work is a social activity, and we’re seeing a lot of companies bringing people back,” said Dill. “Maybe not five days a week, 40 hours, but they’re coming back to the office, because work is a social activity.”

Bottom Line

Not long after the acquisition of 1441 Main St., Dill placed two portraits on easels in the building’s lobby, one of Richard Booth, another former president and CEO of SIS, and the other of John Collins; he considers both mentors and major influences in his life and career.

It was Collins who handed Dill the assignment to build a new headquarters building all those years ago. It led to what amounts to a lifetime of work stewarding the building through decades of change and positioning it for the decades to come.

Now, this work takes on new meaning and new urgency, because he has ownership of the matter — both literally and figuratively.

Rick Sullivan was talking about the pandemic … and about how it just might present some opportunities for this region to prompt companies currently located in expensive office buildings in pricey urban centers to at least look this way.

Rick Sullivan was talking about the pandemic … and about how it just might present some opportunities for this region to prompt companies currently located in expensive office buildings in pricey urban centers to at least look this way.

More of the same. That’s what the experts are predicting for this region, and the country as a whole, when it comes to the economy. And by more of the same, they mean growth that is steady if unspectacular — even with tax reform — and few if any signs of what could amount to real trouble. “Another boring year,” was how one economist put it. But for many businesses, boring is more than acceptable.

More of the same. That’s what the experts are predicting for this region, and the country as a whole, when it comes to the economy. And by more of the same, they mean growth that is steady if unspectacular — even with tax reform — and few if any signs of what could amount to real trouble. “Another boring year,” was how one economist put it. But for many businesses, boring is more than acceptable.

Since it opened nearly a half-century ago, Tower Square has been both a prominent part of the Springfield skyline and a barometer of sorts for the health and vitality of the city and its downtown. And this explains why there is so much anticipation and speculation accompanying the announcement that the property is being put on the market by owner MassMutual. Experts agree that this will be more than a real-estate transaction — it will likely also be a referendum on Springfield and its apparent resurgence.

Since it opened nearly a half-century ago, Tower Square has been both a prominent part of the Springfield skyline and a barometer of sorts for the health and vitality of the city and its downtown. And this explains why there is so much anticipation and speculation accompanying the announcement that the property is being put on the market by owner MassMutual. Experts agree that this will be more than a real-estate transaction — it will likely also be a referendum on Springfield and its apparent resurgence.