Changing Course

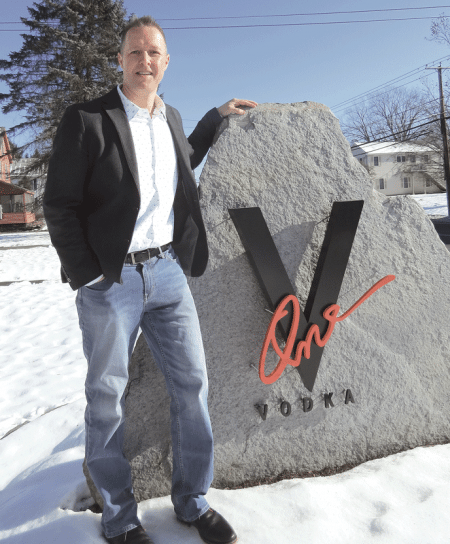

Susan Beaudry, founder of Beau Co. Wine

Among the many side effects of COVID and the so-called Great Resignation that has accompanied it has been a recognized surge in entrepreneurial activity. It has manifested itself in many ways, from soaring registration for the “Basics of Starting a Business” course at the Massachusetts Small Business Development Center to the absorption of many vacant storefronts, to area chambers filling their calendars with ribbon cuttings. Each story is different, but there are some common threads, including a desire to use the time and inclination provided by the pandemic to realize what’s important. And in many cases, it’s starting that business that one has always dreamed about.

Susan Beaudry says there’s a story behind every wine label she distributes.

That’s certainly the case with one called Sophie, a product of South Africa.

“The locals … their accents couldn’t pronounce sauvignon blanc,” she explained. “And it kept coming out ‘Sophie,’ so they named the wine Sophie. The wife of the husband-and-wife team that own it created this beautiful young woman that’s on the label — Sophie. The tagline is ‘the most beautiful woman that never was.’”

It is these stories — and, again, she has dozens of them — that go a long way toward explaining Beaudry’s fascination for wine, and her dream of creating a business that brings labels like Sophie to the 413.

It’s a dream she’s had for some time now, and one that became real because of COVID-19 — at least in some respects.

Beaudry, as many readers may know, was the executive director of the Springfield Symphony Orchestra, which was essentially shut down by COVID in early 2020, and there are now questions about when and if it will return to the place in regional culture it occupied before COVID arrived.

But that’s another story.

This one is about how Beaudry found the time — and the inclination — during COVID to move ahead and make that dream, called Beau Co. Wine, reality.

“Toward the end of 2020, we started seeing many people who were either laid off or who had left their jobs, for whatever reason, who wanted to start their own businesses.”

The wines she imports can be found, among other places, at the Springfield Wine Exchange, a new storefront in Tower Square owned by Carlo Bonavita, who is part of this movement, if we can call it that, as well. He decided a few years ago to go back into business — the liquor-selling business — for himself and found some additional motivation during the pandemic (more on that later).

Beaudry and Bonavita are far from the only ones to use this crack in time to pause, re-evaluate, and perhaps fulfill an entrepreneurial urge, said Samalid Hogan, executive director of the Massachusetts Small Business Development Center’s Western Mass. office. But not for much longer, which we’ll get to in a minute.

She told BusinessWest that, as a result of a number of colliding factors — from people losing their jobs to individuals losing interest in what they were doing, to remote workers not at all excited about orders to return to the office — there has been a surge in entrepreneurial energy.

“Toward the end of 2020, we started seeing many people who were either laid off or who had left their jobs, for whatever reason, who wanted to start their own businesses,” she explained. “And in 2021, we’re seeing a huge surge in people calling the office looking for help in starting a business. There were so many that we had to create another ‘Basics of Starting a Business’ class; we usually offer one a month, but we had to double up and increase the number of registrations from 30 people to 40 people.”

And now, she is part of this story, although she certainly doesn’t need the “Basics” course.

Indeed, she will be stepping down from her role with the MSBDC later this month to start her own consulting business.

Samalid Hogan says many people reached a crossroads during the pandemic and chose the road to business ownership — and she’s one of them.

She said that, like others during this time of COVID, she did a lot of thinking about what was important and what she wanted to do with her life. And she decided that now was the time to put her own name in the door.

Actually, that name will be Greylock Management Consulting, a nod to the highest mountain in the state, a venture that will be focused on both existing businesses and the agencies providing services to startups, especially minority-owned ventures.

Hogan said she is launching this venture with both eyes open, and full acknowledgement of the fact that consulting is often a challenging way to earn a living and a significant departure from a steady job with a steady paycheck. But it’s a gamble she’s ready to take.

Actually, she’s taking two gambles. In addition to her own business, she has become chief operating officer for the Latino Marketing Agency, launched by Veronica Garcia, who also fits the profile of someone who found time and inspiration during the pandemic to move ahead with an entrepreneurial venture.

A television producer, soap-opera actress, and influencer in the Latino community, she worked for many years at New England Public Media, where she was the host of a popular and award-winning bilingual series named Presencia. In April of this year, when NEPM announced it could no longer produce the show, she left the station to start to Viviendo Sin Limites (Living Without Limits), with the goal of having it become the go-to resource for mental health and emotional well-being for the Spanish-speaking population. She also started the Latino Marketing Agency, in conjunction with Hogan, to help Hispanic-owned businesses with that critical aspect of their operations.

“I now have the privilege to know many entrepreneurs in this region, and I’ve found that marketing is one of the areas where they need assistance, especially Latino businesses,” she said, adding that, like Hogan, she is confident that her change of course career-wise, from steady paycheck to the uncertainty of being a business owner, is the right course.

Proof Positive

As noted, Bonavita is no stranger to wines and the liquor business. Indeed, his family owned and operated several liquor stores in the area, including Riverside Liquors in Agawam, and he worked at them for a number of years.

When he left in 2002, he signed a non-compete agreement that was 15 years in duration. It wasn’t long before he started counting the years down, and after a decade or so of working in property management, specifically condominium projects, he was quite ready to go back to working for himself.

COVID only served to accelerate the process further.

Veronica Garcia has launched two new ventures, Latino Marketing Agency and a platform called Viviendo Sin Limites — Living Without Limits.

“When COVID hit, it changed the way we did business a zillion percent,” he explained. “It meant more hours, more everything, and at the age I was getting to, I was getting burned out and tired of this. I knew it was time to do what I wanted to do.”

And that was to open another business of his own, one he calls the Wine Exchange. He has a wide variety of labels with price tags from $7.99 to $115, and features a variety of gift baskets as well. He opened in October, good timing considering the approaching holidays, and said he’s off to a good start thanks to those who are returning to the office tower in his building and the others in the downtown area.

As for his decision to strike out on his own?

“I absolutely love it — I really do,” he said. “I’m not a guy who could retire completely, and I couldn’t sit at home. So this is perfect; it’s where I want to be at this point in my life.”

Beaudry, who provides most of the labels on his shelves and in his racks, said essentially the same thing, but her story — her dream of becoming a wine wholesaler, importer, distributor, and ‘enthusiast’ — is much different and took a lot longer to become reality.

“I was getting burned out and tired of this. I knew it was time to do what I wanted to do.”

She said her love of wine developed over time and especially when she was traveling extensively for her former employer, Simplex. Her travels would take her to its various branch offices around this country and other countries, and would inevitably involve visits to local attractions — and restaurants, preferably the ‘hole in the wall’ she asked to be taken to.

The good food she encountered was almost always accompanied by good wine as well. She would attempt to replicate what she encountered, food and beverage-wise, at dinner parties that would grow in size over time, with many of the attendees encouraging her to start her own restaurant or other related business.

She said she long desired to venture into wine importing and distributing, but life and family responsibilities made it difficult to leave a steady paycheck and take that leap.

“I think COVID presented the opportunity, with the symphony not performing and all the employees furloughed,” she explained. “Meanwhile, my daughter had just completed her first year of college, so the stars were aligned for me; I went ahead and got started.”

There are many stories like these being written in the region at this unprecedented time, when many have been sidelined by COVID and others have taken stock of their lives and decided they wanted — and needed — something different. The so-called Great Resignation (Bonavita and others we spoke to could be considered part of that) has prompted some to leave for other jobs, but others to absorb some risk and go into business for themselves, Hogan said.

The phenomenon has manifested itself in many ways, from new beer labels to the absorption of vacant storefronts, to area chambers of commerce giving their giant ceremonial scissors a workout with seemingly non-stop ribbon cuttings.

And also those soaring registration numbers for the MSBDC’s “Basics of Starting a Business” class, which is now offered online because of the pandemic, said Hogan, adding that she has seen a very diverse group of individuals gravitate to that offering.

By that she meant both older and younger men and women, those representing many ethnic groups, and people with varied backgrounds, from professionals to retirees, to some not far removed from the college classroom.

The class, as might be gleaned from its title, focuses on the basics — writing a business plan, legal considerations, licensing, insurance, business entities, and much more.

Many of the labels Susan Beaudry now distributes can be found at the Springfield Wine Exchange, founded by Carlo Bonavita, left.

“We don’t give advice during the class,” she stressed. “The goal is to give information to the attendees so they understand all that is involved with starting a business from an administrative, practical point of view; we don’t get into business models, and we don’t get into whether you have a good idea or not.”

Many who sign up for that class will eventually reach out for one-on-one advisory services from the agency, she said, adding that there has been a decided uptick in the number of people seeking such services.

Grape Expectations

As for her own venture, Greylock Consulting, Hogan is confident she has a good idea, one born from a desire help more small-business owners, especially minority-owned businesses. Her plan is to consult for individual businesses and also the various groups assisting such businesses and help streamline and improve the programs they provide.

She said she has several clients in the pipeline and is confident she can succeed in the challenging world of consulting.

“I’ve done consulting before,” she said. “You have to have a good, healthy pipeline of clients, there’s a lot of proposal writing involved, a lot of meetings prior to revenue-generating activities that you have to be willing to do and invest your time in. It’s a different world, but I like it.”

It’s a different world for Beaudry, as well, but one that she long desired to be in.

That said, she acknowledged that starting her importing and distribution company required more than time and inclination. It also requires capital, and a lot of contacts.

“It took a lot of tenacity — finding a warehouse, securing the insurances, the licenses, and everything else you need,” she told BusinessWest. “It’s really just been about working my contacts, people I know who tell me, ‘this is where we buy our great wines; the person who owns it is this … go introduce yourself.’ It’s been typical sales-call daily activity: going out, shaking hands, letting people know who I’m representing and some of the wines that I have available.

“It’s also very new — it’s just starting to gain momentum now,” she went on, adding that there have been distribution issues to contend with and other challenges, but, overall, she is making steady progress.

The next step is to create her own import activities, Beaudry said, adding that she will soon be traveling to Europe to meet with some small, boutique vineyard owners and winemakers, with the goal of importing some labels on her own.

She has a 2,000-square-foot warehouse in Westfield, one she hopes — and expects — to outgrow in only a year or two, and plans to distribute the wines she brings there to restaurants, country clubs, liquor stores, concert arenas, “anywhere you can buy a glass of wine.”

At present, she carries 58 different SKUs, and she’s connected with another distributor who will give her another 100, all them small, boutique winemakers that have a story.

“These are small businesses, family-owned, multiple generations for many of them,” she said. “I want to stick with these family-owned small options that have a lot of historic value — and they have interesting stories; the further back the history of the vineyard goes, the more interesting the story is, and a lot of people who love wines also love the stories.”

As for Garcia’s story, it’s another one where the opportunity and inclination were there to propel her to her current status as business owner.

She said she has long understood that, in general, and within the Hispanic community in particular, mental illness is something that isn’t talked about — or really understood. And she has long desired to create a forum where such issues could be discussed and both information and inspirational stories could be presented. So when NEPM announced that it would no longer produce Presencia, she gave her notice and created Viviendo Sin Limites.

Its stated mission is to “motivate, inspire, educate, and inform in a dynamic environment through interviews, blogs, conferences, sharing personal experiences related to our emotions and well-being, and offer tools to have an open, lively, positive, creative, and joyful mind,” and the goal is to be one of the first talk shows in New England for the Latino community through social media such as Facebook, YouTube, and Instagram.

As for the Latino Marketing Agency, it has already signed on a few clients to provide marketing and consulting services, she said, adding that she believes there is enormous potential for such a venture in this market — for both Hispanic-owned businesses and companies looking to market effectively to the region’s growing Hispanic community.

Dream Weavers

Summing up what she’s seeing, hearing — and doing herself, Hogan said that, because of the pandemic and issues springing from it, including those leading to all those resignations, many people are finding themselves at a crossroads.

And increasingly, they’re taking the road to entrepreneurship, one that certainly has its share of dangerous curves, speed bumps, hills, and dips. This road is not for the faint of heart, but in this climate, many people are finding they have what it takes to at least start down that road and pursue a long-held dream.

That’s how it is for Beaudry, who spends a good amount of time telling stories like the one about the Sophie label from South Africa and countless others now in her warehouse and on area shelves.

As for her own story, it’s still being written, and like the many others now generating some entrepreneurial energy, she’s finding each chapter to be everything she hoped it would be, and more.

George O’Brien can be reached at [email protected]

When he launched the

When he launched the