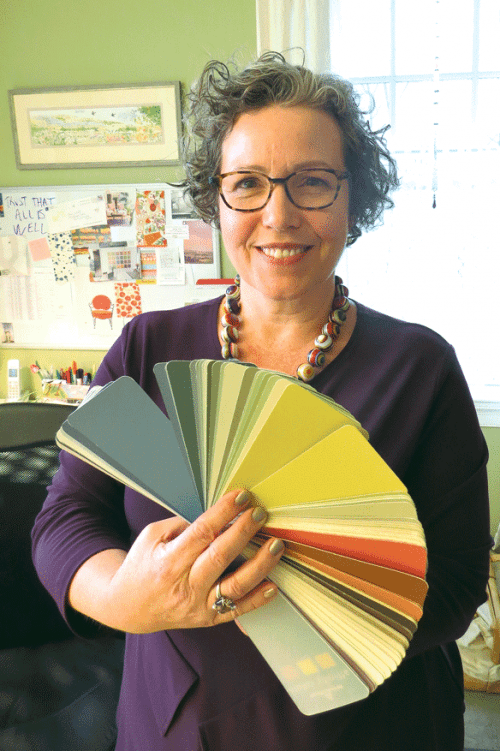

Principal, Deliso Financial Services

She Helps People — and the Community — Get Where They Need to Be

Jean Deliso likes to say she is part financial advisor, part therapist.

Jean Deliso likes to say she is part financial advisor, part therapist.

This description of her work as owner of Deliso Financial and Insurance Services in Agawam sums up not only what she does, but how she does it. Indeed, while the primary objective of her job is to provide financial advice to her clients, she is also committed to forming a personal relationship with each individual who sits in front of her in order to better understand exactly where they are financially and where they want to be — and help them get there.

This is especially true with women, a rewarding niche, if one chooses to call it that, for Deliso, who has, over the course of her 25-year career in this field, become a specialist in empowering women and positioning them for a solid financial future, as well as during times of transition, such as divorce and widowhood.

“I spend a lot of time trying to speak to women because I want them to not be afraid and get educated so they understand that the decision they make, or the lack of the decision they’re making, is going to make a difference in their lives,” Deliso told BusinessWest. “We deserve equality, but we as women need to believe that we deserve equality.”

But helping women — and all her clients — chart a course for a lifetime of financial stability is only one of many reasons why Deliso has been chosen as a Woman of Impact for 2019.

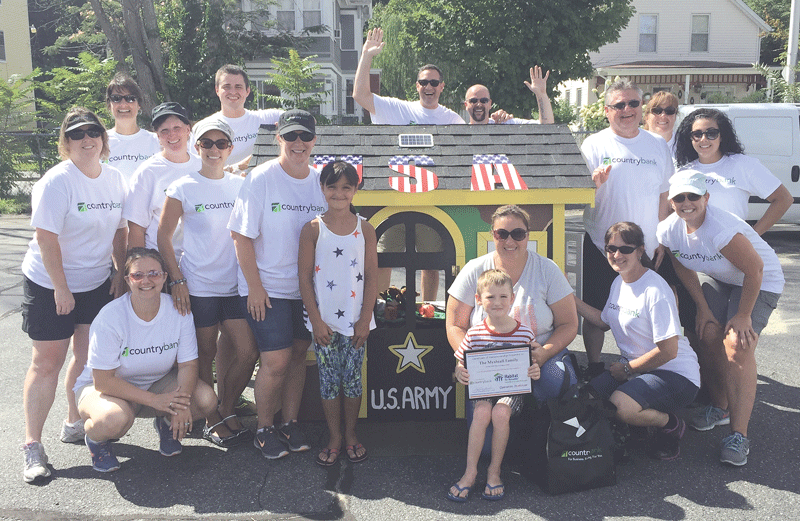

She is also heavily involved in the community, especially with groups and causes that impact children and families. She currently serves as chairman of the board of the Baystate Health Foundation, and is immediate past chairman of the Community Music School, for example, and is also past chair of the board of the YMCA of Greater Springfield and past trustee of the Community Foundation of Western Mass.

Meanwhile, as the daughter and granddaughter of entrepreneurs (more on that later), and a successful one herself, she is also a mentor to young entrepreneurs, especially women, through work with Valley Venture Mentors.

Talking about the various aspects of her life — her work, her involvement in the community, and her family life — Deliso said they all connect and flow together.

“Most people in life think they have it figured out and that they’re all set, but the reality is, they’re not. We’re all very busy people, and, because of that, we don’t take care of ourselves.”

“Some people are different at work than they are at home, but I’m the same way throughout,” she said. “I’ve really identified that my effort in my business matches what I do in the community, and matches who I am. All three components are aligned.”

Together, they make her a true Woman of Impact, as noted by Scott Berg, vice president of Philanthropy at Baystate Health, executive director of the Baystate Health Foundation — and a client of Deliso Financial Services, one of her several people who nominated her.

“Jean is an outstanding person, both professionally and personally. She has built a successful business focused on helping people reach their financial goals,” he wrote. “I believe the key to Jean’s business success has been her unwavering dedication to the community; she is a person, both in business and in the community, who leads by example.”

On-the-money Advice

Deliso told BusinessWest that her strong work ethic, commitment to the community, desire to help others, and, yes, leadership by example are all what she calls family traits.

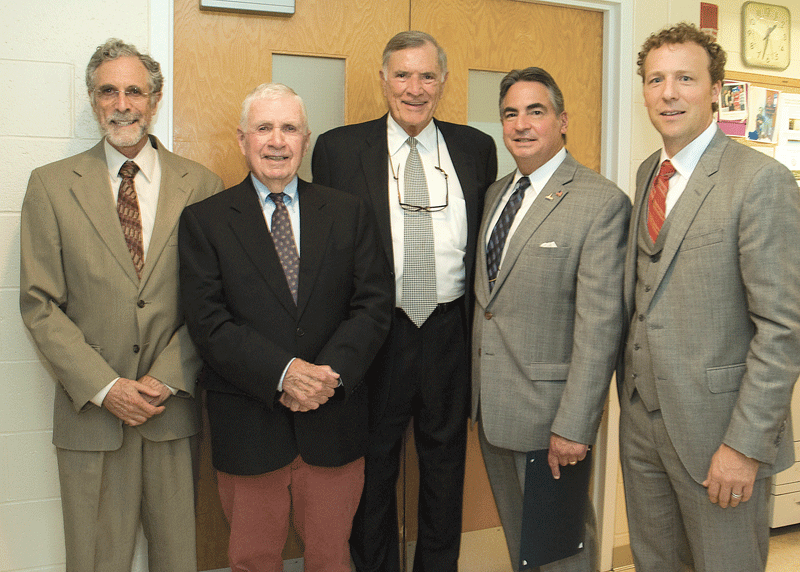

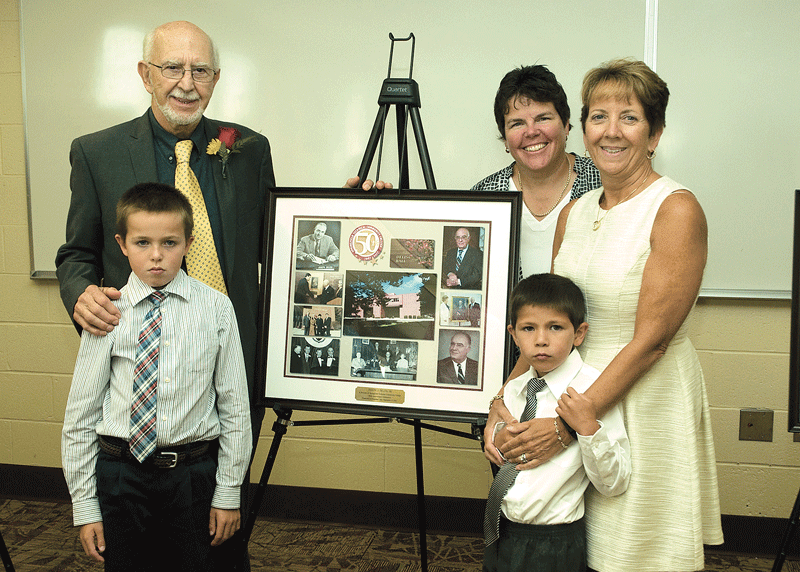

Indeed, she said she grew up in a family of entrepreneurs — her grandfather, Joseph Deliso Sr., founded HBA Cast Products, later run by her father — who made a point of donating time, energy, and talent to the community.

Her grandfather was one of the founders of Springfield Technical Community College, and his name is on one of the academic buildings on the historic campus.

Jean Deliso doesn’t have any buildings named after her — yet. But she is certainly following the lead of the generations before her when it comes to being an entrepreneur and giving back.

“My work at the YMCA, the Community Music School, and Baystate is all about helping children and helping those in this community who are not as fortunate as I was growing up,” she said. “I had wonderful parents, great role models, and grew up in an entrepreneurial family who were community-minded and taught me that hard work, dedication, giving back, and being kind to others was the way to live.”

With regard to entrepreneurship, Deliso said she knew early on that she wanted to work for herself, and she’s been doing that for 20 years now. After working in the family business in Florida, she relocated to Western Mass., where she consulted with small-business owners on financial operations and maximizing performance. She then segued into financial planning and has become a regional leader in that field.

Jean Deliso, seen here speaking with attendees at a Baystate Health Foundation event, has continued a family tradition of being active within the community.

She has been a New York Life agent since 1995, and is associated with the company’s Connecticut Valley General Office in Windsor, Conn. She is currently enjoying her seventh year as part of New York Life’s Chairman’s Council, ranking in the top 3% of the company’s sales force of more than 12,000 agents.

While such honors and accolades are rewarding, Deliso finds it more rewarding to assist individual clients, guide them through what can be a very difficult process at times, and help them make the right decisions to set them up for a financially stable future.

“Most people in life think they have it figured out and that they’re all set, but the reality is, they’re not,” she said. “We’re all very busy people, and, because of that, we don’t take care of ourselves.”

This is particularly true with women, she noted, adding that they often outlive their husbands and, too often, are not involved in the family’s financial planning.

“I like to educate women because I cringe when I hear the words, ‘oh, I’ll let my husband take care of that,’” Deliso said. “The value of a woman is so important, and I think we, as women, undervalue ourselves a lot.”

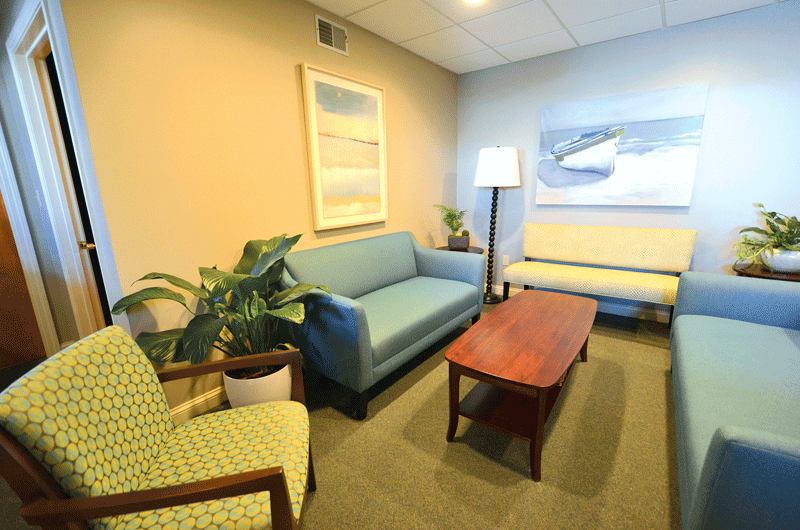

So, Deliso and her “small but mighty staff,” as she describes it, helps clients set goals and objectives, and then assists them with getting from point A (where they are) to point B (where they want to be, up to retirement and then through it).

“I will find the disconnects from where they are versus where they want to be, and I help them build this bridge to get them to where they want to be,” she said, adding that this sometimes includes asking difficult questions.

“She is a believer in developing positive assets for youth — whether through improved medical care, quality programs for children before, during, and after school hours, or gaining self-awareness through the power of music.”

These include ‘have you thought of the what-ifs?’ and ‘are you prepared?’

All too often, the answers the answer to those questions is ‘no,’ she went on, adding that she has a passion for turning ‘no’ into ‘yes.’

Balance Sheet

To get this point across, Deliso summoned a case from very early in her career — new clients who provided a critical lesson in being ready for one of those ‘what ifs.’

A young couple in their 30s had two young children and wanted to buy a house. Deliso sat down with them and talked about their goals and asked them those difficult questions mentioned above, especially the one about what would happen if something happened to one of them.

The couple decided they wanted college taken care of for their two children, and also wanted to take care of their mortgage. So, Deliso put them on a savings plan, bought them life insurance, and got them on track to start saving money.

Two years after she started working with this couple, she got a call from the husband: his wife passed away at the age of 32.

His first question, Deliso recalled, was ‘how am I going to do this?’ Her quick answer was that he could do it because of the plan she put in place for him.

“From that moment, those two children went to college because we put money aside for that college education,” she said. “We paid off most of the mortgage because I made sure that that family would be fine if one of those incomes went away, and that’s exactly what happened. This was so powerful that it cemented me in this career.”

Likewise, her family’s deep commitment to the community cemented in her the need to get involved and stay involved. And, as noted, this involvement often involves institutions and initiatives with missions focused on families and children.

Berg summed up this commitment in his nomination of Deliso.

“In addition to impacting the lives of her clients, she has influenced, both directly and indirectly, countless lives through her volunteer efforts at the Baystate Health Foundation, the YMCA, and the Community Music School,” he wrote. “As can be seen in the agencies with which she has given so much time, she is a believer in developing positive assets for youth — whether through improved medical care, quality programs for children before, during, and after school hours, or gaining self-awareness through the power of music. This dedication to our youngest community members is truly an investment in the next generation of our community’s leaders.”

Elaborating, Berg noted that how Deliso serves the community is as important as where she trains those efforts, specifically with enthusiasm that is contagious and strong leadership.

“When Jean presents to the Baystate Health Foundation board of trustees, she strives to make her words resonate, to encourage introspection, and to promote enthusiasm,” he wrote. “Her passion is a reminder to all trustees why they have chosen to commit themselves to moving the foundation mission forward and the true impact it has on its beneficiaries. Jean is exactly what you would want in a leader.”

Her leadership skills were recognized, and applauded, by the Professional Women’s Chamber, which named her Woman of the Year in 2013.

Investments in the Community

As noted, there were several nominations for the Woman of Impact honor with Deliso’s name on them. Collectively, they do a fine job of explaining why she was chosen.

In hers, Judy Moore, director of Client Management at Deliso Financial, noted that working for Deliso has given her an inside look at all the hard work she invests in order to ensure her clients get the best service possible.

“Working for her for 11 years, I can attest to the fact that her high level of professionalism and ethics is astonishing, and her clients reap the benefits of that on a daily basis,” said Moore. “She never tires of giving back to the community and making lives better through her various work, both professionally and altruistically.”

Those sentiments effectively sum up both Deliso’s life’s work and her commitment to the community. In both realms, she always has one eye on today, and the other on tomorrow.

“What I do for a living makes a difference in people’s lives,” she said. “If I can make an impact on someone’s life, that’s a good day.”

Kayla Ebner can be reached at [email protected]

Jean Deliso, CFP said she started calling her investment clients several days ago to gauge how they’re feeling amid some growing turbulence for the economy — and on Wall Street.

Jean Deliso, CFP said she started calling her investment clients several days ago to gauge how they’re feeling amid some growing turbulence for the economy — and on Wall Street.

Attorney Meaghan Murphy recently joined Skoler, Abbott & Presser, P.C., a labor and employment law firm serving employers in Massachusetts and Connecticut. Murphy has more than six years of experience in general litigation and labor and employment law. She will advise clients regarding all employment-related matters, including, but not limited to, compliance with state, federal, and local laws, and discipline of employees. She will also create workplace policies for clients and represent them in various forums, including at the Massachusetts Commission Against Discrimination, the Commission on Human Rights and Opportunities, government agencies, and in state and federal court. Murphy is a graduate of Amherst College and received her law degree from Western New England University School of Law. She was named to the Super Lawyers Rising Star list in 2018 and 2019. She has also been an active volunteer with Hampden County Big Brothers Big Sisters since 2018.

Attorney Meaghan Murphy recently joined Skoler, Abbott & Presser, P.C., a labor and employment law firm serving employers in Massachusetts and Connecticut. Murphy has more than six years of experience in general litigation and labor and employment law. She will advise clients regarding all employment-related matters, including, but not limited to, compliance with state, federal, and local laws, and discipline of employees. She will also create workplace policies for clients and represent them in various forums, including at the Massachusetts Commission Against Discrimination, the Commission on Human Rights and Opportunities, government agencies, and in state and federal court. Murphy is a graduate of Amherst College and received her law degree from Western New England University School of Law. She was named to the Super Lawyers Rising Star list in 2018 and 2019. She has also been an active volunteer with Hampden County Big Brothers Big Sisters since 2018.