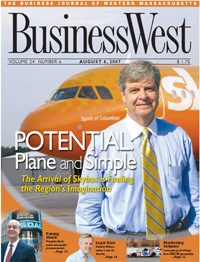

Skybus Airlines began daily flights to and from Westover Metropolitan Airport in Chicopee last month. Tourism and economic development leaders say it will take weeks, perhaps months, to effectively gauge the impact of the service on the local economy, but early evidence shows it could benefit several business sectors while putting the Pioneer Valley on the map.

Columbus, Ohio?

Allan Blair understands that these are usually the words, and the accompanying punctuation, that people utter when they first hear about Skybus, the self-proclaimed “next generation of low-fare airlines,” which uses that city’s airport as its hub, and its recent decision to initiate non-stop flights to and from Westover Metropolitan Airport in Chicopee.

But Columbus — Ohio’s capital, a city of 700,000 people, and home to Ohio State University’s main campus, the largest in the country with 100,000 students — isn’t the story, said Blair, executive director of the Economic Development Council of Western Mass. and director of the Westover Metropolitan Development Corp., who now knows much more about that municipality than he did a few months ago.

Well, it’s part of the story, because some people leaving Westover make that community their destination, he said. But the larger pieces involve where they can get to from there — and for rates that are only a fraction of what other airlines charge — and, even more importantly, the 100 or so people now arriving in Chicopee each night at or around 6:53 p.m.

Skybus now flies from Columbus to smaller airports outside several major cities — Burbank (Los Angeles), Bellingham, Wash. (Seattle and also Vancouver, British Columbia), Portsmouth, N.H. (Boston), and others — and is projected to add many more as it tries to replicate the hugely successful model pioneered by Europe’s Ryanair.

On July 16, Skybus started flying in and out of Westover, which, depending on the marketing material in question, makes the official destination Hartford, Springfield, Chicopee, or some combination thereof, which is a problem Blair is addressing. There were 101 people on the inaugural inbound flight and 86 on the outbound back to Columbus, including Blair and Westover airport director Michael Bolton.

Blair and others involved in economic development and tourism in the Pioneer Valley weren’t sure what all those people were going to do after they arrived in Chicopee that night, but they worked hard to find out. And they will continue to poll passengers as they arrive — and depart from Westover — because that’s how they’ll determine just how much of an impact Skybus and its new service will have on the region and its hospitality-related businesses.

Blair anticipates there will be boosts in hotel stays, restaurant visits, stops at area tourist attractions, and other benefits, because the airline’s ultra-low fares — the first 10 tickets for each flight sell for $10 each — will bring people to the area (at least to start their travels) who may not make it here otherwise.

“You’re going to be having roughly 700 people coming into the area every week,” said Blair, doing some quick math in his head as he talked. “We don’t know how many of them will be needing hotels, but if it’s 20%, which is probably a good estimate, that’s 140 room nights that you wouldn’t have had, which will make an impact.”

Chicopee Mayor Michael Bissonette has been doing some math of his own. Basing his calculations (from some unknown formula) on 80 of the passengers arriving each evening staying an average of three nights each and spending $200 a day, he pegs the potential windfall at a very unscientific $20 million a year. And he expects his city, which has several hotels, restaurants, and car rental agencies within a few miles of the airport, to get a good share of whatever the final number is.

Some quick polling revealed that some who arrived that first night, and on subsequent arrivals, were taking advantage of the low fares to see relatives in the region. Others were using Chicopee as a staging area for visits to Albany, the Boston area, the Cape, or other destinations within 100 miles or so. And still others were intent on exploring Western Mass. and its many attractions.

“This is another gateway into Western Mass., another way to get people here,” said Mary Kay Wydra, executive director of the Greater Springfield Convention and Visitors Bureau (GSCVB), who can’t hide her enthusiasm about the arrival of Skybus. “It’s a great opportunity for this region, and we have to take full advantage of it.”

In this issue, BusinessWest talked with Blair, Wydra, and others about how the Valley intends to do just that.

Flight Plan

Blair told BusinessWest that it will be at least several weeks and probably many months (meaning deep into the new school year at area colleges) before the EDC and the GSCVB have some working data to effectively gauge the economic impact of the Skybus flights, the first commercial activity at Westover in nearly 20 years.

In the meantime, there is some qualitative and anecdotal evidence that the airline is bringing some attention — and visitors — to the area, while also making Columbus and other points near and far from that city more accessible (meaning affordable) to area residents.

Wydra said her office has detected a noticeable uptick in the volume of calls from people inquiring about the region and what they can do here when they arrive. “As soon as this was announced [in the spring], the phone started ringing, and it hasn’t stopped since,” she said, adding that those at the GSCVB are tracking how many of the calls are Skybus-inspired, and it’s a good number.

“We’ve seen a real increase in inquiries coming out of the Columbus area, and lots of E-mails from Ohio, with people looking for visitor information,” she said. “In the beginning, we were getting deluged with calls about how to get transportation while at the airport.

“There were calls from people looking to come and visit family,” she continued, “and even some people who used to live here and are planning to come back because they want to go to the Big E.”

Meanwhile, Wydra, Blair, Bissonnette, and others are already compiling stories from friends, relatives, and area business people who are taking advantage of the Skybus service with scheduled trips to Ohio and elsewhere.

“I know someone who’s flying to Columbus and then heading to Cleveland to watch the Indians play the Red Sox,” said Bissonnette, adding that the excursion will be easier, and probably cheaper, than getting tickets for a game at Fenway. “I know someone else who’s flying out to Columbus to play Jack Nicklaus’s course [in nearby Dublin]; he’s paying much more for the green fees than for the flight, but Skybus is what’s making it doable.”

Such stories are at the heart of what inspired the no-frills airline, which starts with those $10 seats and moves on from there, with the price of tickets getting progressively higher as the date of the flight in question draws closer and the number of available seats dwindles. Overall, fares run roughly 50% of the going rate of other carriers serving the same markets. Already, the lowest price available for most tickets for the Columbus-to-Chicopee run over the next few months is at or more than $70, which area tourism leaders interpret as solid interest in the Pioneer Valley.

On the drawing board since the late ’90s, Skybus takes its cue from Ireland-based RyanAir, which uses smaller airports, modern equipment, outsourced services, fees for everything from luggage service ($5 for the first bag, $50 and more when it gets past two) to pillows and blankets, and placing ads on the side of its planes in order to keep fares low. The 150-seat Airbus 319 that landed at Westover on July 16, painted in the company’s bright orange color, came practically out of the box, as did others in the growing fleet, which helps keep maintenance costs down.

The company’s operations took flight on May 22, with initial service offered to Burbank, Portsmouth, and Kansas City, Mo. Flights to Richmond, Va.; Fort Lauderdale, Fla.; Greensboro/Winston Salem, N.C.; Bellingham; Oakland; and a second flight to Burbank were added over the next month.

The next wave came in mid-July, with Westover, San Diego International Airport, and St. Augustine, Fla. (providing access to Jacksonville and Daytona Beach) added to the mix.

More cities and flights to each destination will be added as the market dictates, said Denis Carvill, vice president of Ground Operations for Skybus. While waiting for the inaugural inbound flight to arrive, he told BusinessWest that the company became attracted to Westover for its location (close to Springfield and Hartford, but also not far from Boston and New York), facilities, infrastructure, runway length — and apparent interest among Columbus-area residents.

“Our research showed that this one of the places to which people wanted to go,” he explained, listing everything from colleges to attractions to family as reasons why.

While the airport was a good fit for the company, much work, following some lengthy negotiations, had to be done to make it ready for the July 16 startup.

Bolton said talks between Westover administrators and Skybus officials started in late 2005. The airline was looking for deals — meaning it wanted everything for free — so the talks never really got off the ground. But there were subsequent rounds of negotiations that eventually led to a deal late last year.

Terms of the agreement between the airport and the airline were not disclosed, but Bolton said a three-year contract was inked that included several of what he called “introductory rates” on such things as landing fees, parking fees, and handling fees. There were many logistics to be worked out over the past several months, including Skybus’s hiring of an outside company called Quickflight to handle ticket counters, baggage handling, and other tasks; a staff of roughly 15 works a three-hour shift each day. Meanwhile, the airport hired additional personnel to handle obviously larger auto parking operations.

New signage, a temporary baggage-claim area on the tarmac, and other additions were made, said Bolton, who told BusinessWest that, with revenues from parking and the assorted fees paid by the airline, the airport should at least break even the first year, with expectations of higher profits down the road.

Beyond the revenue, however, the airport will — after 10,000 paying passengers have filed through it (probably late this year) — qualify for Federal Aviation Administration entitlements that will pay for a new baggage area and new restrooms.

Winging It

In addition to his many duties with Westover and the EDC, Blair has also been monitoring the passenger volume on incoming and outbound Skybus flights, checking rental car business activity, and trying to gauge any increase in hotel room stays.

In time, said Blair, the Skybus service will increase awareness of the Hartford-Springfield area on a national level. “It will put us on the map — that’s what air service does,” he explained, adding that from this there will be benefits to the tourism sector and perhaps broader economic development initiatives. “This can only help this region grow.”

Measuring the direct impact from the visitors will be difficult, said Wydra, noting that it’s much easier to track the spending of convention-goers than it is for people coming in to see friends or family or moving on to other destinations like the Cape.

“When they come for a convention in Springfield, you can see the added number of rooms at the Marriott and the Sheraton,” she explained. “But when they come in to see family or to take in Six Flags, you don’t know where they’re staying — and many are staying with family.”

But over time, and probably not much of it, Wydra believes the Skybus service will have measurable results on several types of businesses, because the low fares will bring travel (or more travel) within reach for more people.

“I think you’ll see more people coming in to the area colleges for parents’ weekends’ and others coming in for homecoming that might otherwise have stayed home,” she said. “There will be more people coming in to visit family members, and others making two visits instead of one. These are the kinds of things those lower fares will do.”

A quick visit to the Skybus Web site reveals that early bookers on flights to Columbus are not thinking too far out — not yet, anyway. While most dates in August had the cheapest seats remaining going for $90 or $110 (there were some with $70 seats available), the November calendar shows many dates with $10 seats still there for the taking, including the days around Thanksgiving; the Christmas season seats seem to be going much faster. As for flights from Columbus to Chicopee, there are only a few dates remaining on the 2007 calendar when $10 seats can be had, and, on most days, the lowest-priced ticket is moving toward $70.

The 7:21 p.m. departure time for the outbound flight has passengers in Columbus by around 9, making it difficult to get connecting flights until the next morning, said Bolton, adding quickly that, even with a hotel stay factored in, Skybus allows travelers to get from Hartford/Springfield to Los Angeles, San Diego, and other destinations for far less than they could on other airlines.

There was no negotiation about the departure time from Westover, he continued, adding that the airport, like most others now hosting Skybus service, is already lobbying for earlier flights and additional flights.

While already enthused about the potential gains from the Skybus flights, area officials know there is work to be done to help maximize the impact.

For starters, Wydra said she’s working with Bolton and others at the airport to place more material about the region in the hands of those arriving from Columbus. Those on the inaugural flight were given gift bags complete with tourism guides to the region, a luggage tag with the Pioneer Valley logo on it, a coupon book, and a map. Budgetary considerations won’t permit all incoming passengers to get the same treatment, but Wydra said racks could be placed at the terminal with some information.

Meanwhile, Wydra is also exploring ways to create greater awareness of the Pioneer Valley in the Greater Columbus area to more effectively leverage the Skybus service to Chicopee. Advertising in Columbus-area media outlets will be expensive given the size of that market, she explained, but she is looking at ways to gain additional funding from the state for such marketing efforts while also exploring possible collaborations — with groups like the Springfield Business Improvement District and area tourist attractions and hospitality facilities — to share those costs.

During his short stay in Columbus, Blair took in some of the sights — “there really is a lot to do there” — while also meeting with Skybus officials to discuss ways to give Western Mass. possibly greater play in marketing of the Chicopee service. The map on the company’s Web site identifying service areas lists the Westover stop as “Hartford,” in a likely nod to current awareness of that city among travelers who use Bradley Airport, while some marketing and press advisories list the stop as “Hartford/Springfield.”

“There is a connection to Hartford, which is understandable,” he said, “but we want there to also be a connection to Springfield and Chicopee.”

Blair says there is also work to be done as far as ground transportation from Westover for arriving passengers. While the demand for rental cars is being met, he told BusinessWest, taxi service could be improved, and public transportation to downtown Springfield or perhaps area colleges would be a good addition.

Flights of Fancy

As the ‘Spirit of Columbus’ taxied to the terminal area at Westover on July 16, water cannons from two fire trucks based at the airport created an arch and a rainbow.

And as passengers disembarked, some in a large crowd gathered nearby started clapping. T

e assembled included elected officials, economic development leaders, press, military personnel from Westover Air Reserve Base, and some who were just curious.

Actually, that word pretty much describes everyone in attendance, as uncertainty and intrigue abound when it comes to this venture and what it will eventually mean for the region and its hospitality-related businesses.

Blair, for one, is certainly confident that the flights will have an impact, that the region will register gains in visibility and tourism-related spending — and that people will soon stop saying, “Columbus, Ohio?”

George O’Brien can be reached at[email protected]