Claudio Guerra Elevates Pub Fare at Paradise City Tavern

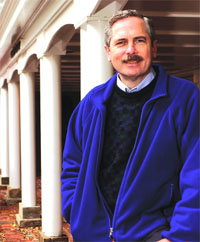

Claudio Guerra, left, with Operations Manager Bill Collins, says Northampton’s combination of sophistication and fun make it the ideal setting for upscale pub food and cask ale.

They came first out of loyalty.

When we first opened for business, we had a couple come in from Amherst, who wanted to check it out, said Claudio Guerra, referring to Paradise City Tavern, the prolific restaurateurs latest venture, which opened in Northampton in July. The couple had been fans of the now-closed Del Raye Bar & Grille, a far more elegant restaurant that was closed to make way for this new, upscale pub.

As they looked at the menu, I said, how do you like it? Guerra said. They said, we dont. So I asked why. They said, why would we cross the bridge for hamburgers and beer?

But they stayed and ordered: a burger, a flatbread pizza, and a couple of draughts. I walked over later and asked how everything was, and they said, OK, this is worth crossing the bridge. Thats my favorite moment here.

That satisfaction derives, no doubt, from the challenge of convincing people that quality food is quality food, no matter the price or décor. Because a tavern this is albeit one with a few twists.

Were trying to provide the most delicious but affordable pub food we can produce, Guerra explained. A burger is not just a burger; were trying to do the best hamburger you can find. The french fries are cut every day from raw potatoes. And the flatbread pizzas are made with some whole wheat in them, not some generic garbage.

Generic, in fact, is not a word that comes to mind when perusing the flatbread options. Sure, the Gumba is loaded with traditional pepperoni, meatball, and sausage, but more adventurous palates might appreciate the Frenchy, with duck confit, melted leeks, and goat cheese; or the Ham & Gruyere, which features those two toppings along with green grape slices.

Somehow, the ingredients fit together just like the diverse destinations that make up Guerras ever-expanding chain.

Finding a Home

Born in Germany to Italian parents, he emigrated to New York City as a boy in 1963, and literally grew up around the restaurant business. His father first worked seven days a week between two jobs as a head waiter for a top French restaurant, and as the night manager for a second, 24-hour French eatery. After 10 years, he had saved enough money to move to Long Island, where he opened his own restaurant, eventually expanding that endeavor to four establishments.

The younger Guerra, meanwhile, spent his boyhood checking coats, busing tables, and washing dishes, and after high school, he decided to follow in his fathers footsteps. He underwent a two-year apprenticeship in Bavaria, Germany, then returned to America in the early 1980s to help his father open a restaurant in Hartford, Conn. called the Mill on the River.

On his days off, he took road trips to find a place where he could launch an enterprise of his own. When he arrived in Northampton, he fell in love with it even though the town was far from the bustling center of arts and culture it is today. He ate that first night at the Eastside Grill, which was packed, but didnt have a lot of competition.

Guerra started to see possibilities, realizing in short order that Northampton was populated by educated, progressive-minded people who appreciated quality and creativity in a restaurant. Pizzeria Paradiso was his first venture there, followed in the next several years by two additional downtown ventures, the more upscale Spoleto and Del Raye.

Over the past several years, Guerra expanded his empire further, opening two more Northampton restaurants Spoleto Express, a lunch-oriented Italian eatery; and Mama Iguanas, serving Mexican fare and a second Spoleto in East Longmeadow. But while the lower-priced establishments have been humming along fine, he noticed a trend at the Del Raye.

For years, it was a home run, he told BusinessWest. But, to be honest, after 9/11 we saw a gradual slowdown in business, which accelerated in the middle of last year. The Del Raye opened up 10 years ago, but its a completely different economic environment today. When people are starting to put $60 or $70 in their gas tank, they think twice before they spend $60 or $70 for dinner. So the writing was on the wall.

Paradise City Tavern is a different entity altogether, although the culinary staff from the Del Raye is largely intact. In addition, the restaurant features 12 microbeers on tap (Guerra said he could offer more, but wants the kegs drained quickly to keep the beer fresh), and is also among just 500 or so locations in the U.S. to serve up whats known as cask ale, which is beer brewed right in the barrel from which its eventually tapped.

Cask beer is called real ale in Europe, said Bill Collins, operations manager of Guerras restaurant chain. All the yeast is still there, so its naturally carbonated. Its got a much different flavor than other beer, and its served at about 59 degrees, not ice-cold. Its got a cult following its the way beer was first drank.

Guerra agreed. Its closer to the pure taste of what the brewer intends, he told BusinessWest. I come from a philosophy that the less food is handled and futzed with, the happier I am with it. And this is as real as it gets. The customers here are really educated about beer, and theyre really thrilled about the casks.

Unlike other restaurants hes operated, this one doesnt cater to one niche, said Guerra. We get an early family-dinner crowd because were family-friendly, and then theres a normal dinner crowd, and then after they leave, we get the drinking crowd. In fact, were open from 4 to 2, and half our sales here are after 11. Well bring in bands and DJs, and it turns into a spontaneous party.

All in all, hes happy with his latest venture, although he was nervous about turning the Del Raye an elegant, white-tablecloth type of establishment into a tavern. But it was a move he felt he had to make.

A lot of people hang onto a model theyre familiar and comfortable with, Guerra said. I think a lot of people, in my shoes with the Del Raye, would have tried to stick it out, and probably not successfully. The Del Raye was special to me; I met my wife there. But, while it was painful, I made the decision to get rid of it.

In business, he continued, you have to stay up on the times and be hyper-aware of the realities of your competition, the economy, and the mood of the customers. You have be flexible like Play-Doh and keep moving if youre going to be successful.

Having a Ball

Besides the music, Paradise City Tavern strives to throw other creative entertainment at guests. The day Guerra spoke with BusinessWest, the staff was getting ready to show the cult stoner-bowling flick The Big Lebowski on one of the five large-screen TVs, and giving away 50 games courtesy of Northampton Bowl.

And next spring will see the addition of an outdoor deck, which will add about 100 seats. One reason Guerra didnt build one right away is that he knew business would be strong when the restaurant first opened, and wants to extend the excitement into next year by creating a second buzz around the deck.

Guerras philosophy has always been simple you have to treat your customers and your employees they way youd like to be treated, he said but his strategy in such a crowded restaurant market is more complex. It comes down to knowing what a community needs, he said, and then providing it.

If youre driving into town and you want a place that has good food, microbeers, a lot of sports on TV, now youve got a place, he continued. Its filling a niche; its not rocket science. And today, the lower you can charge for quality food, the busier youre going to be. Its a function of the economy. People are nervous as they should be.

All the more reason to escape from stress with a flatbread pizza and a drink even if you have to cross a bridge to do it.

Joseph Bednar can be reached at[email protected]

[/caption]

[/caption]

Carolyne Hannan has been named Vice President of Sales and Marketing for Comcast in Western Mass., Connecticut, and New York. In this role, Hannan will oversee all marketing and sales initiatives in the 128 communities that comprise the region. Hannan has 15 years of experience in the communications industry, including four years with Comcast.

Carolyne Hannan has been named Vice President of Sales and Marketing for Comcast in Western Mass., Connecticut, and New York. In this role, Hannan will oversee all marketing and sales initiatives in the 128 communities that comprise the region. Hannan has 15 years of experience in the communications industry, including four years with Comcast.

An App a Day

An App a Day BlackBerry Cordial

BlackBerry Cordial However, this is not to say that design and lifestyle dont still play a part in which phone or accessories are purchased. High-end phones like the BlackBerry and iPhone are larger than some of the tiny devices of years past, and more complicated to replace or repair. Thats why many manufacturers are now striving to offer a multitude of options in terms of capabilities and space for added applications, while still taking into account the varied lifestyles of consumers.

However, this is not to say that design and lifestyle dont still play a part in which phone or accessories are purchased. High-end phones like the BlackBerry and iPhone are larger than some of the tiny devices of years past, and more complicated to replace or repair. Thats why many manufacturers are now striving to offer a multitude of options in terms of capabilities and space for added applications, while still taking into account the varied lifestyles of consumers.