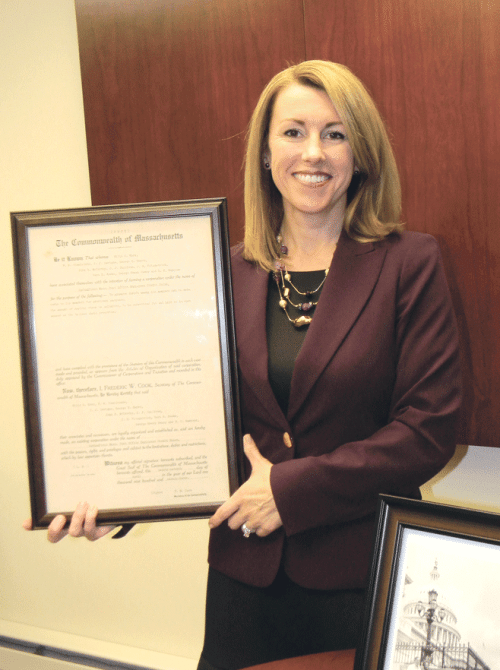

WESTFIELD — Westfield State alumna Jessica Kennedy, assistant principal at South Middle School in Westfield, was one of eight educators to receive the Massachusetts State Universities Alumni Recognition Award for 2014. The State Universities of Massachusetts honored eight of the Commonwealth’s outstanding K-12 educators who graduated from the system’s teacher preparation programs in a ceremony held in Boston on Tuesday. Kennedy was selected by Westfield State University in recognition of her accomplishments as a teacher and as a role model for students for service to the community. “Jessica Kennedy reflects the very best of Westfield State and the State University system, which has a proud tradition of developing and graduating educators of excellence,” said Elizabeth H. Preston, president of Westfield State University. “Jessica is deeply dedicated to helping students achieve more and reach higher, leading to stronger schools and communities in the Commonwealth.” Kennedy received her B.A. and M.A. at Westfield State in 2008 and 2010. Her first teaching job was as an English teacher at Powder Mill Middle School in Southwick, where she also served as mentor teacher, team leader, and pre-advanced placement lead teacher. In 2013, she was hired as assistant principal at South Middle School. Kennedy was nominated by Susan Dargie, director of Curriculum and Instruction at Westfield Public Schools. Dargie said that Kennedy has made quite the impression during her first year as assistant principal. “Jessica possesses the unbeatable combination of supportive supervision and true enthusiasm for the work that makes her an effective administrator,” Dargie said. “It is clear that Jessica is a rising star that will continue to have a positive impact on students for years to come.”

SPRINGFIELD — The Grainger Foundation, an independent, private foundation located in Lake Forest, Ill., has donated $5,000 to the Springfield Technical Community College (STCC) Foundation in support of its Foundation Innovation Grant program. “This grant will be used to help us continue to support faculty and staff innovation here at STCC,” said STCC President Dr. Ira H. Rubenzahl. “The Foundation Innovation Grant program helps us to improve excellence in the delivery of academic or student retention services at STCC. We are grateful to The Grainger Foundation for its generosity and in helping us to continue our mission.” In addition to the contribution from the Grainger Foundation, the STCC Foundation will match Grainger’s $5,000 contribution this year. Foundation Innovation Grants are awarded in the spring. “We want to thank the Grainger Foundation for its generous support,” said STCC Foundation President Kevin Sweeney. “With their assistance, the STCC Foundation will continue its commitment to support innovative projects at the College that promote community impact, economic growth, workforce development, and quality of life in our region.” The donation to the STCC Foundation was recommended by John Duffy, market manager of W.W. Grainger Inc.’s, Springfield location. Grainger has been a part of the Western Massachusetts business community for nearly 40 years as the leading broad line supplier of maintenance, repair, and operating products. “We are proud to recommend the programs offered by STCC,” said Duffy. “We understand the need for active engagement and partnership between our technical education providers, businesses and the community.” The Grainger Foundation, an independent, private foundation based in Lake Forest, Ill., was established in 1949 by William W. Grainger, founder of W.W. Grainger Inc.

SPRINGFIELD — Access to Baystate Medical Center, including Baystate Children’s Hospital and the Medical Office Building, via the hospital’s Medical Center Drive entrance off Springfield Street will be temporarily closed to both vehicular and pedestrian starting Nov. 22 for one month.

The closure will not affect access to the hospital’s Emergency and Trauma Center, Wesson, and Chestnut Buildings, all of which remains the same.

The change in traffic pattern is necessary in order to provide space on Medical Center Drive, between the Daly Building main entrance and Springfield Street, for a large crane required for the installation of a new air handling unit, part of the hospital’s continuing efforts to upgrade its facilities.

During the approximately four weeks of construction and installation of the air handler on the hospital roof, access to Baystate Medical Center will be via the Chapin Terrace end of Medical Center Drive. Signs off both I-91 north and southbound will direct vehicle traffic south on Springfield Street to Chapin Terrace. The project is expected to be complete on or about Dec. 20. Also, the PVTA will temporarily suspend service to its bus stop on Medical Center Drive, and will bring riders to its stop on Chestnut Street, where they will be directed to enter the hospital through the Wesson Building. “Our goal is to continue to provide easy access to Baystate Medical Center and the Medical Office Building, and to ensure patients, visitors, and employees can safely get where they need to go. We’ll put in place plenty of signage, police redirecting traffic at the closed-off entrance on Springfield Street, and valet parkers who will further assist people in reaching their destination,” said Louis Faassen, manager of Construction Services, Facilities Planning and Engineering, Baystate Medical Center.

For more information on Baystate Medical Center, visit baystatehealth.org/bmc.

SPRINGFIELD — Dakin Humane Society has announced the successful conclusion of its Fall Matching Challenge Campaign, in which an anonymous donor agreed to match, dollar-for-dollar, all monetary donations up to $125,000. Thanks to contributions from more than 1,700 people, the final tally came in at more than $153,000. “We couldn’t be more pleased about this outcome,” said Dakin’s Executive Director Leslie Harris. “The initial goal was to meet a $100,000 level, which our donors did one week prior to deadline. Our amazing benefactor then added another $25,000 incentive in the remaining days, and our donors rallied to meet – and exceed – that amount as well. The dedication of our supporters is incredible, and their generosity will make a difference in the lives of countless animals.”

On Nov. 22, Dakin will welcome 16 “Dixie Dogs” from Kentucky, all rescued in conjunction with the Paris Animal Welfare Society (PAWS) of Paris, Kentucky. The intake is part of the national Subaru “Share the Love”/ASPCA Rescue Ride program that distributes grant funding to animal welfare organizations across the country to fund the safe transport of sheltered dogs from overcrowded shelters to those with space and a higher demand for adoptable animals. PAWS will be one of 19 animal welfare organizations sharing the $100,000 grant total. The program is projected to transport over 2,000 animals to locations where they will have a better chance of finding a home. Dakin’s “Dixie Dogs” program involves the transportation of dogs from overcrowded shelters in southern states (mostly Kentucky and Texas) to Dakin so they can receive a second chance at a new life here in New England. Dakin is also preparing for its annual “Black Friday” adoption event on Nov. 28 from 12:30 p.m. to 5:30 p.m. at its Springfield and Leverett locations. Cats five years and older will be available for a $5 adoption fee, and there will be a 50% discount on adoption fees for small animals including bunnies, doves, mice, chinchillas, hamsters, guinea pigs and rats. Dakin’s Diamonds in the Ruff Thrift Store will also offer its variety of pet and gift items at half price on that day. On Dec. 10, Dakin will participate in “Valley Gives,” a day-long online philanthropy event, hosted by the Community Foundation of Western Massachusetts that encourages participants to log on and contribute to their favorite charitable organizations.

SPRINGFIELD – The Springfield Boys & Girls Club will host a Premiere Party for the 14th Annual Festival of Trees on Nov. 23 from 2 p.m. to 4 p.m. at Tower Square, 1500 Main St. The Premier Party is an invitation-only event, held to provide a sneak peek of the Festival of Trees for sponsors, VIPs, members of the media, and volunteers. In addition to great food – and the 142 spectacular trees – the event includes a visit from Santa and Mrs. Claus. The official opening for this year’s Festival of Trees will take place in conjunction with the Parade of Big Balloons on Friday, Nov. 28 and will run through Dec.14. On Nov. 28, the Festival will open at 10 a.m. Visitors can purchase raffle tickets to win the trees, which includes everything on and under it. These items are often worth hundreds of dollars, and can include electronics, gift certificates and more. The winners will be chosen at the close of the Festival, just after 5 p.m. on Dec 14. Proceeds from Festival of Trees benefit the Springfield Boys & Girls Club, providing memberships, programs, enrichment activities, field trips, and other aspects of the Springfield Boys & Girls Club experience for 1,500 youths each year. Hours for the Festival of Trees are Wednesdays, 11 a.m. to 3p.m.; Thursdays through Saturdays from 11 a.m. to 8 p.m., and Sundays from 11 a.m. to 5 p.m. The cost for adults is $5, seniors are $4, and children 12 and under are free. Free parking is available in the Tower Square garage with admission. For more information about the Festival of Trees, visit www.sbgc.org or call (413) 785-5266.

GREENFIELD — Baystate Franklin Medical Center’s Community Benefits Advisory Council (CBAC) has issued a request for proposals to not-for-profit and governmental organizations serving Franklin County and the North Quabbin area, to address one or more of the unmet health needs identified in the hospital’s 2013 Community Health Needs Assessment. Specific areas of focus include: projects that create systems of improved coordination of care; implementation of evidence-based primary prevention curriculum in schools; Screening, Brief Intervention and Referral to Treatment (SBIRT) training for school staff and coaches; chronic disease prevention and/or self-management; substance abuse prevention and support of mental health; and nutrition and physical activity system change projects. Deadline for grant applications is Dec. 19 at 3 p.m. Funding for these community health initiatives is being made available as part of the hospital’s Determination of Need (DON) process related to capital expenditures for its new surgery modernization project, per Massachusetts Department of Public Health (DPH) requirements. The Baystate Franklin CBAC is using these funds to address demonstrated needs in Franklin County and the North Quabbin region. The CBAC will prioritize funding of projects that will have broad-based, lasting impact. To request a grant application and guidelines, contact Amy Swisher, director of Public Affairs & Community Relations at Baystate Franklin Medical Center: [email protected] or (413) 773-2268.

SPRINGFIELD — The construction project to expand the Sister Caritas Cancer Center at Mercy Medical Center is on schedule, and a ‘topping off’ ceremony will be held Nov. 20 to mark the completion of the project’s main structure with the placement of the top steel beam. A topping off ceremony is a tradition within the construction industry and is held when the highest structural point in the building construction is attained. To celebrate this event, the last steel girder is signed, lifted into place and welded to the structure. A small evergreen tree and the American flag are also secured to the girder as it is hoisted to the top of the structure. The tree is meant to represent the strength of the new building and the desire for the construction project to remain injury-free. The $15 million expansion of the Sister Caritas Cancer Center, which will add an additional 26,000 square feet of space on two levels, is designed to provide more comprehensive care delivery and added convenience for patients. In addition to Radiation Oncology services, Medical Oncology offices, physician offices and exam rooms will be located on the first floor. Medical Oncology treatment and infusion space, an oncology pharmacy and laboratory space will be located on the second floor.

SPRINGFIELD — In response to ongoing concerns about limited parking in the city’s downtown, the Springfield Business Improvement District has launched a ‘Park with Ease’ program for the upcoming Thanksgiving holiday weekend. Two valet stations will be set up along Main Street for the convenience of visitors. The first will be located by Court Square and the MassMutual Center, and the second will north on Main Street at the corner of Washington Street in he heart of the dining district. The BID is underwriting the service, with a cost of only $5 for each car. The ‘Park with Ease’ program will be in effect on Thanksgiving Eve, Nov. 26, as well as Friday and Saturday, Nov. 28 and 29. Car acceptance is from 5-9 p.m., with retrieval until midnight. For more information, visit www.SpringfieldDowntown.com/ParkwithEase.

Casino Project Generates Challenges, Anticipation

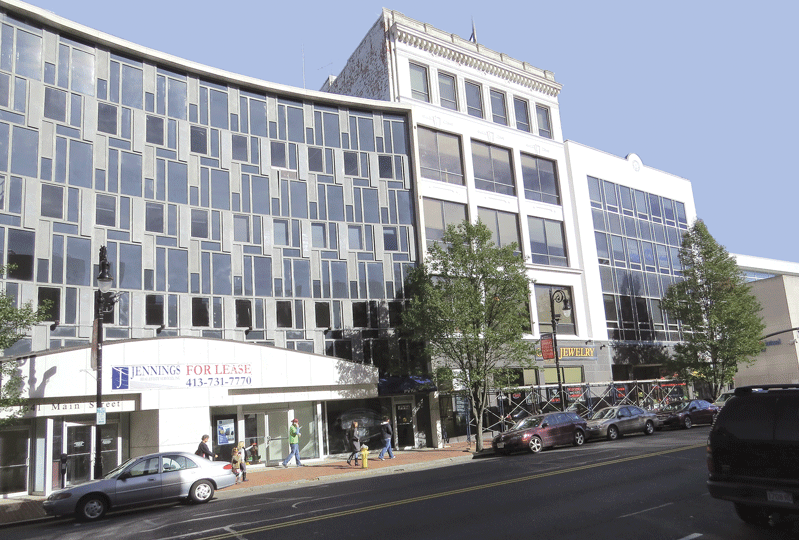

A panoramic view of the section of Springfield’s South End that will be transformed into MGM’s $800 million casino complex.

That’s how long MGM Resorts International has to complete construction on its $800 million casino complex in Springfield’s South End, according to the host-community agreement inked early this year.

That means August 2017, if you haven’t already done the math.

Kevin Kennedy, Springfield’s chief development officer, said the city (or MGM) might eventually erect one of those digital displays that counts down the months, days, hours, minutes, and seconds until something starts, as cities hosting the Olympics have done. But even without such a device, everyone involved will know that the clock is ticking — and that time, as that old saying goes, is money.

That’s why MGM didn’t put this project aside during the four months between when it was announced that a measure to repeal the state’s gaming law would appear on the election ballot and when it was soundly defeated, said Mike Mathis, president of MGM Springfield.

“There was a mandate from our chairman, Jim Murren, and our president, Bill Hornbuckle, an attitude that ‘we’re going to win this on Nov. 4, so let’s keep the intensity up so we don’t lose that time,’” said Mathis, adding that work pressed on with everything from final design to workforce-development issues to the overall timetable for what will easily be the largest construction project in this region’s history.

In some ways, this initiative will look like one of those 1960s-style urban-renewal projects, said those we spoke with, noting that several buildings, many of them damaged by the June 2011 tornado, will be torn down within the 14.5-acre site, and a number of businesses will be relocated to make way for the casino project. But it will also be different in many respects.

Indeed, this will be a private project, one that won’t bulldoze an area, but rather preserve many buildings within it, including historic 101 State St. — the original home of MassMutual — as well as First Spiritual Church and the façade of distinctive 73 State St. And instead of taking taxpaying properties off the rolls, as many of those massive urban-renewal projects did, this one will raise the amount of taxes generated within those 16 acres from $634,000 at present to $17.6 million when the casino opens its doors.

Mathis, who has been involved with several MGM casino initiatives, in this country and abroad, said the Springfield project presents some distinctive challenges — and opportunities — with its urban setting, its location in a state that has no experience with gaming at this level, and its so-called inside-out design.

“They’re all unique, but this is particularly unique, because of the integration with the existing downtown environment; this is not a greenfield project,” he explained. “There’s no template in our portfolio for a project like this, but that said, we’ve built in challenging environments at major scale, so this is certainly within our wheelhouse.”

Mike Mathis says MGM’s Springfield casino complex is unique in many respects, and thus it presents a number of challenges.

Next will come the hotel tower, which will incorporate the façade of 73 State St. into its design, as well as other components on what Mathis called “parallel tracks.” These include retail areas, a projected 50 units of market-rate housing near the casino site, and other facilities. Many of those components will be preceded by demolition of existing structures, including the school, the Western Mass. Correctional Alcohol Center on Howard Street, and a retail complex on Main Street, among others, and the relocation of roughly 20 businesses.

Meeting that 33-month mandate will be challenging on many levels, especially if the planned I-91 viaduct reconstruction project takes place at the same time, as expected. But all parties involved — MGM, the city, and the state — have no shortage of incentives to meet that timetable.

For this issue, BusinessWest talked with Mathis, Kennedy, and others about what the next 33 months might be like. The words heard most often were ‘challenging’ and ‘exciting.’

The Suspense Is Building

Kennedy, who has played a role in several development projects — from the new federal courthouse to significant improvements to State Street to Union Station — in his current role and also as aide to U.S. Rep. Richard Neal, said the casino will be like those initiatives in some ways, but there are important differences that might actually make the MGM complex a smoother, easier undertaking.

“The scale is obviously much different than anything we’ve ever done here in Springfield before — there haven’t been any $800 million projects,” he told BusinessWest. “However, the nature of the projects and how a project gets done … they’re all pretty similar in terms of permitting, demolition, and all the things that will happen here.

“But in terms of complications, while this is the largest economic-development project we’ve undertaken, the complexity of it, from a government standpoint, is actually less than either the U.S. courthouse and State Street,” he went on. “On the courthouse, not only did we have to make deals with property owners, tear down a portion of Technical High School, and move the Alexander House, but this was a three-tiered governmental project — there was federal, state, and local involvement, and everyone has their regulatory issues. And when you’re redoing 3.2 miles of State Street, we were two years in the planning process alone.”

But the casino project will undoubtedly have its challenges, said Kennedy, adding that one matter of particular concern is infrastructure and, more specifically, old and deteriorating water and sewer lines in that part of the city.

“When we had our negotiations with MGM, we talked to them extensively about these infrastructure issues, and they are very much on board for this because they can’t afford to have a water or sewer problem,” Kennedy noted. “And we don’t want them to have a breakdown, either, because some of our funds are attached to their ability to do business.”

The Western Mass. Correctional Alcohol Center on Howard Street will be one of the buildings demolished to make way for the casino.

“We’ll start to scope out what the issues are, how we’re going to do this, and who needs to be assembled on either side of the table in order to coordinate this and deliver the project by August 2017,” he explained.

Mathis acknowledged that building an urban casino — and building one in a heavily regulated state like Massachusetts — will be a different experience for himself and MGM, but lessons learned during other projects will serve the company well.

“We’ve built City Center, an 18 million-square-foot project in Las Vegas, one of the largest private developments at that time in the entire country, so we know how to do sophisticated construction in tough environments,” he said. “So we’re confident we can hit our time period. But it takes a lot of work, it takes a lot of preparation, and our group recognizes that.”

Meanwhile, all the principal parties involved — MGM, the city, and the state — have plenty of motivation to help this project proceed on schedule.

“The great thing is that the state is our partner on this, as is the city,” said Mathis. “We all have the common goal to get this facility up and start generating revenue and putting people to work.”

Overall, he said he hopes to harness the considerable energy present at a gathering at the Basketball Hall of Fame on election night to move the casino project from the drawing board to reality.

“The energy in the room was palpable — everyone wanted to be a part of this,” he told BusinessWest, adding that this level of support and enthusiasm should help the company navigate the many kinds of challenges that will present themselves over the next 1,000 days or so.

Placing Their Chips

Indeed, while the transformation of the site in the South End will be the focus of most of the region’s attention over the next three years, there are many other matters to address to ensure a successful opening in the summer or fall of 2017, said Mathis, adding that MGM and its many types of partners in this region are already working on some of them.

Relocation of businesses to be displaced by the casino complex is one such matter, said Mathis, noting that uncertainty in the wake of the referendum vote has delayed this process somewhat and has now generated a new sense of urgency (see related story, page 43).

“One of the things that we negotiated with the city was to provide incentives — we’ll pay the moving costs for tenants if they relocate in the downtown Springfield area,” he explained. “For those who take us up on that offer, we’ll be happy to subsidize that move and keep the energy downtown. We’re already talking with other commercial property owners about space that they can make available that we can provide a pre-agreed group rate to and make this transition as easy as possible.”

Meanwhile, MGM is preparing to close on roughly $35 million worth of real estate it has acquired in the South End for the project, he went on, adding that designs for the project, while not final, are close, and at this moment they do not require any additional acquisitions.

As designs are completed, the company will also go about hiring a general contractor for the massive project, he went on, adding that there are a number of developments happening simultaneously.

“We’re excited about our preparedness to move forward with the project with our different contractors and suppliers,” he said, adding that workforce development is another focal point moving forward. And there are challenges in this regard, Mathis told BusinessWest, because gaming is new to the Bay State, and thus there is no trained workforce in place, as there would be in Las Vegas, Atlantic City, or Macau.

“There is a significant amount of training that needs to take place in a market like this that doesn’t have casinos or gaming,” he said, adding that MGM is working with a host of parties, including the area community colleges and regional employment boards, to identify and then train a workforce.

Another partner is the American Red Cross and its Boots to Business program. As part of that initiative, several area veterans will go to Las Vegas to be trained on table games. After eight months of training and honing their skills, they will return to this region and train others who have been identified as good candidates for those positions.

Other priorities for MGM and various partners are to develop a comprehensive marketing strategy for MGM Springfield — one that focuses on the Bay State as well as surrounding states with competing casinos — and work to sell Springfield (and its new casino) as a destination for meetings and conventions.

“A casino is one of the things that meeting planners look for, but they also look for the things that come with a casino, like four-star hotel rooms, which this market doesn’t have. They look for high-end restaurants and diverse entertainment experiences,” he said, adding that MGM’s complex will make this region that much more attractive to those booking conventions.

“We’re one of the largest convention-space operators in the world — our Mandalay Bay events center is the fifth-largest convention facility in the country — so we know as much about conventions as we do about gaming,” Mathis went on, adding that MGM has a huge database of current and potential clients, including some groups that are too small to consider Las Vegas, but would find Springfield a good fit.

Mary Kay Wydra, director of the Greater Springfield Convention & Visitors Bureau, said that, with the defeat of ballot Question 3, Springfield and the region as a whole can now market themselves as the future home of a gaming complex, a considerable addition to the current list of amenities.

“If we can capture a fraction of their [MGM’s] national and international database and get the regional groups that those entities represent, those will be obvious targets as the building opens and the casino comes online,” she told BusinessWest. “They’re already familiar with MGM — they know what that brand stands for — and they know its quality and what they’re going to get. We’re excited about starting our work with them in that matter.”

Not Hedging Their Bets

That excitement, coupled with large doses of anticipation, should make the next 33 months an intriguing time for the region, one that will test the imagination — and sometimes the patience — of all those involved.

“It would not be wise to think that we’re not going to have some challenges as we go through this,” Kennedy told BusinessWest. “There will be some bumps in the road. We have a partnership with MGM, and any partnership will have some tension built into it. There will be some issues as we move through this process.”

But as all those we spoke with noted, there is more than enough incentive to get through those issues and clear those bumps.

August 2017 will no doubt arrive quickly, and the countdown has already begun.

George O’Brien can be reached at [email protected]

Southampton’s Building Boom Brings Challenges

Although the downturn in the economy in 2008-09 caused building to come to an abrupt standstill in most cities and towns across Western Mass., Southampton was an exception.

“Building never came to a halt here, and new housing continues to go up,” said Ed Cauley, vice chair of the Board of Selectmen.

“Right now, there are four new subdivisions with 35 lots in various stages of development, plus a half-dozen single lots where new homes are being built; there is a lot of growth going on,” he continued, adding that the new homes are priced between $400,000 and $500,000.

Town Administrator Heather Budrewicz agrees. “We’ve already issued 24 building permits for new homes this year. The market turns over very fast, and I don’t know of any new houses that are sitting empty,” she said, noting that, in 2009, 26 new homes were built; in 2010, the number increased to 32, and since that time, at least two dozen houses have been built every year.In fact, Selectman David McDougall calls home ownership in Southampton “the dream,” explaining that, as people become successful, they want to build a home in the country on an expansive lot.

“But if you work in Springfield or the surrounding cities, your options are limited,” he said. “You can buy land in Montgomery or Huntington, but they are farther out and require longer commutes. Southampton is one of the last areas that is convenient to I-91 and has reasonably priced land that people can build a dream on.”

Cauley also cites Southampton’s location and adundance of land as attributes that have led to the town’s popularity, but said the school system, large amount of open space, and opportunities for recreation also attract homeowners, who often move to the town from Holyoke and Westfield.

“Route 10 runs through Southampton, and we’re close to I-91 and exits 3 and 4 off the Massachusetts Turnpike; we’re a bedroom community, but are close to Northampton and Easthampton, which have a lot to offer in the way of arts and restaurants,” Cauley said, explaining that residents are able to enjoy living in a rural atmosphere but also benefit from nearby shopping and entertainment venues.

“Southampton is a beautiful place. It’s picturesque, people are friendly, we have a great school system, the taxes are reasonable, and we provide good services,” he went on.

The town was once an agricultural community, and although there are still two working dairy farms, several equestrian operations, and a number of small farms, former farmland has become a prime focus for developers, and because there is so much of it, Cauley said the majority of lots in new subdivisions are at least an acre in size.

“Plus, we have 14 conservation areas that contain 600 acres. They range from 9 to 200 acres and are under the jurisdiction of the Conservation Commission,” Budrewicz said. “We also have three parks, including Labrie Field, which contains 19.4 acres and is a multi-field athletic complex that is so new, we are still waiting for the grass to reseed itself so the soccer fields can be fully utilized.”

Growing Pains

However, rapid growth in Southampton has led to significant financial problems as voters have repeatedly turned down proposals to increase taxes.

In July, a Proposition 2½ override was rejected by voters. Town officials were hoping to raise $1 million to avoid budget cuts, and said if the override was passed, $200,000 would have gone into two dwindling stabilization accounts and $40,000 would have gone into a fund to pay future employee benefits.

But it didn’t happen, and there have been repercussions, which include a change in the student/teacher ratio at Norris Elementary School. “It’s a very small school, and for many years the ratio of students to teachers was 17/1, which is what you find at many private schools,” Budrewicz said. “But this year, we had to change, and it is now 24/1.”

Town officials say they may also have to close the library, and although Cauley says the town’s police officers, firefighters, and other service providers are doing an excellent job, the growth in population indicates a need for more feet on the street.

“We’re a small town that is growing faster than other communities, and we would like to be able to do more, but we have been forced to tighten our belts,” he said.

McDougall said there has been significant controversy surrounding the budget, but what new residents often don’t realize is that the town spends $1.19 in services for every dollar it takes in, with 60% of the annual budget allocated for educational expenses.

The shortfall and differing opinions in the community led the selectmen to request a review of their budget process this summer by the Department of Revenue’s Division of Local Services. The results were released last month, and state inspectors said the town is in a “vulnerable financial condition,” and noted that voters have failed to pass every Proposition 2½ override proposal on the ballot since 1991, although 39 override questions have been put before them during that time period, ranging from $1,500 to the recently requested $1 million.

In addition, a recent report from the Pioneer Valley Planning Commission shows the number of housing units in Southampton grew by 47% between 1990 and 2010, and the population increased by 93% between 1970 and 2012.

And therein lies the problem, said McDougall.

“Proposition 2½ was passed in the early ’80s when the town’s population was between 1,500 and 1,900 people. At that time, the town was a small farming community, but since then it has become a bedroom community of about 6,000 people, and the budget has not kept pace with the growing cost of services,” he noted, explaining that the town is losing money on new homes.

“When new roads go in, they have to be plowed, which requires trucks and manpower. The police need to patrol these roads, but the police force has shrunk in size in the last decade due to a lack of funds. We only have one full-time firefighter, our chief, with the rest working part-time or on-call. People complain that we are slow to plow the roads, but we just don’t have the resources,” he went on. “Our Finance Committee has been advocating for an override to Proposition 2½ for six years to reset the financial equation, so it’s not a new problem, but one that has slowly grown. No one wants to pay more taxes, but we have gone from having $670,000 in our stabilization fund in 2007 to $90,000 today in two accounts, and although some people say we are mismanaging the money, it’s hard to do when you don’t have any.”

The Department of Revenue also noted the difficulty of balancing the town’s budget due to the shortfall, but recommended a number of changes, which the selectmen have begun to implement.

Moving Forward

However, town officials don’t expect the growth to stop or even slow down, and Cauley says the town is a great place to live because there is a lot to do, including activities staged by the school and a wide variety of sports teams for children.

Recreation includes fishing on the Manhan River, along with an endless number of hiking trails. “We’re in the foothills of Pomeroy Mountain, and hikers who go to the top can see UMass Amherst on one side and Mount Tom on the other side,” Cauley said, adding that other enjoyable venues include concerts at Conant Park held throughout the summer and fall, as well as the annual Celebrate Southampton event that evolved from the former Old Homes Day.

“One-third of the area that makes up Hampton Ponds is in Southampton, and we also have a Memorial Day parade with ceremonies that a large number of people march in,” Cauley told BusinessWest.

Residents also enjoy the Manhan Rail Trail, which starts on Coleman Road and continues through Easthampton into Northampton. In fact, it is so popular that a new greenway project is underway that would connect to the trail and extend in the opposite direction toward Westfield.

Charlie McDonald, chairman of the Conservation Commission, said a group called The Friends of Greenway has kept the idea moving forward over the past few years. The initiative involves purchasing 4.25 miles of old railroad track owned by Pioneer Valley Railroad and transforming it into a bike path.

Two years ago, after the section of rail corridor was appraised at $340,000, the Conservation Commission applied for and received a state Local Acquisition for Natural Diversity Grant. It will pay for 80% of the land, and the town will be responsible for the remaining 20%, which will come from Community Preservation Act funds.

“In November of 2012, 80% of the residents at a town meeting voted in favor of purchasing the track,” McDonald said, adding that the Mass. Department of Transportation has been supportive, and the town is currently in negotiations with the railroad to purchase the property.

After that occurs, officials will find a company to remove the rails in exchange for keeping and selling them. “The final step will be to develop a design for a permanent, paved trail,” McDonald said.

He believes the project will enhance quality of life in town and may lead to economic growth, because it will bring new people into Southampton. “This is a residential community, and many people like to bike and take their children with them. So the new trail will make it safer and give people a great place to exercise, as well as connecting the town to a variety of cities through a network of trails, he explained.”

Continuing Process

In short, although Southampton is primarily a residential town, it has a balanced slate of offerings. “We don’t have a lot of restaurants and businesses, but we have enough,” Cauley said.

McDougall agreed. “People move here to escape the noise and crowds in nearby cities,” he said.

Still, both say it is a mixed blessing, due to the budget situation. “People want a simple answer, but it’s a complicated issue, and it will take earnest, open discussions to solve it,” McDougall said. “But it’s not a new problem, and the dream of owning a country home with a long driveway in Southampton will continue.”

Southampton at a glance

Year Incorporated: 1753

Population: 5,792 (2010)

Area: 29.1 square miles

County: Hampden

Residential Tax Rate: $15.20

Commercial Tax Rate: $15.20

Median Household Income: $61,831

Family Household Income: $64,960

Type of government: Town Meeting; Board of Selectmen

Largest Employers: Town of Southampton/Norris Elementary School, Big Y

* Latest information available

Americans Repudiate Obama, Finally

At an address last month at Northwestern University, President Barack Obama gave his critics a present and the voters a unique opportunity, one they certainly seized.

“I am not on the ballot this fall … but make no mistake: these policies are on the ballot. Every single one of them,” said the president in words that would come back to haunt him, apparently referring to everything from his administration’s foreign policy (whatever that is) to Obamacare.

With those words, Obama made the election all about him — not the Democrats who have faithfully carried his water for six years, but him. And in many ways, the voters made it all about him as well. By giving the Republicans full control of the House and Senate and handing the Democrats one of their worst defeats in decades, the voters spoke loudly, and what they said was that this president is not a leader and his administration is failing the country.

Indeed, from the government’s ill-fated takeover of what most consider the best healthcare system in the world to its policies that allow illegal aliens to have more and better benefits and healthcare than U.S. veterans, the Obama presidency has been a disaster, and the voters finally, and thankfully, acknowledged this on election night with a stern repudiation.

On Nov. 4, Americans rejected Obama’s policies, which have left so many of America’s middle class and poor worse off now than they were six years ago and this nation going backward, not forward, on a changing global stage.

The message was sent, loud and clear, that progressive liberalism is certainly not the answer. Rewarding the takers (those staying home taking a government handout while fully capable of working) over the givers (those who go to work every day, pay taxes, and balance a family budget with no expectation of a government handout) has no sustainable path in a free-market economy.

But it’s not just the substance of this president and his administration (or the lack thereof) that clearly rankled voters. It’s also the arrogant style.

It’s best summed up by presidential historian Jonathan Turley, who said, “Barack Obama is really the president Richard Nixon always wanted to be … he’s been allowed to act unilaterally in a way we’ve fought for decades.” He’s right. From actions that most see as ordering the IRS audits of conservative groups for political purposes to tapping the phones of journalists (and untold others) and monitoring their e-mails, to allowing illegal aliens to step in front of the line and grab jobs from U.S. citizens through executive amnesty, to ignoring the U.S. Constitution, this administration has embarked on an attack against everything America stands for.

And when it comes to foreign policy, well, this administration doesn’t have one — or at least one that works. The infamous Hillary Clinton ‘reset button’ with Russia has reset relations back to Cold War status. Meanwhile, the Arab Spring has turned into the Arab Fail, with Muslim extremists taking control of Libya and many parts of Syria and Iraq, forcing our hand into fighting a new foe that this administration allowed to take hold: ISIS.

When the president told reporters in early September that “we don’t have a strategy yet,” he was referring specifically to ISIS, but he might as well have been talking about his foreign policy since he was elected. The world is on fire, and it is a direct result of the greatest power leading from behind on virtually every major world issue.

As the president said in 2009, just after he was swept into office, elections have consequences. In his post-election news conference just two weeks ago, our so-called chief executive must have forgotten that phrase he so triumphantly uttered. The hubris, arrogance, and ineptness that has characterized this administration was indeed a sight to behold as Obama so indigently dismissed what had just happened the night before. It was inarguably one of the worst Democratic landslides in recent memory, and the president was in total denial.

It is our hope that the November election results will remind the president that the consequence of this election is to change course. Yes, elections do have consequences.

How to Repurpose Your Thanksgiving

By BAYSTATE HEALTH PROFESSIONALS

Thanksgiving is about more than just enjoying a delicious holiday feast of turkey with all the trimmings, then heading out the door before the day is over to get a jump start on Black Friday bargains. Enjoying a healthy Thanksgiving also means sharing time with others and nurturing the mind and spirit as part of the holiday. In that spirit, Baystate Health professionals offer the following five tips to repurpose your Thanksgiving.

Get unplugged. “With our hectic lifestyles, many families find it increasingly difficult to maintain the valuable routine of having a family meal. Fortunately, the tradition of families eating a meal together is preserved on Thanksgiving. In order to make the most of this, it’s helpful for both young people and adults to strive to be truly present at the Thanksgiving table.

Consider adopting a new tradition which may not have been relevant in previous generations: as the food is being served, ‘un-serve’ all of the smartphones by asking everyone to put them onto a tray and remove them from the room. This will eliminate the temptation of checking e-mail and texting during the meal and help everyone to get the most out of the precious time of sharing a meal together and valuing the relationships and traditions of the family.” — Dr. Barry Sarvet, chief of Child Psychiatry and vice chair of Psychiatry, Baystate Medical Center

Exercise in the name of family and health. “It’s well-known that exercise has many health benefits, from lowering your blood pressure and cholesterol to helping prevent heart disease, to uplifting your spirits and managing depression.

Instead of plopping down on the couch and watching football all day on Thanksgiving, why not consider continuing quality family time after leaving the dinner table and taking a nice family walk, or even playing touch football outdoors? Other outdoor sports like soccer, or anything that gets you moving, such as turning up the music and dancing after your Thanksgiving feast, is good for your health.” — Dr. Quinn Pack, Heart & Vascular Program, Baystate Medical Center

Remember, it’s a time for giving. “Faced with the over-consumerism of today, especially on Thanksgiving, when some children may see a parent heading out the door even earlier now to grab up all the Black Friday bargains, it’s important to remember that our national holiday is made up of two words, thanks and giving. Adults need to remember what they were hopefully taught as youngsters, that it is better to give than to receive, and to pass that same wisdom onto their children.

Whether adult or child, scientific studies show that there are pleasure centers in the brain that are stimulated when we connect with someone in a meaningful way, such as volunteering at a homeless shelter or providing food for a family in need at Thanksgiving. Other research points to the fact that we are happier when giving and not focusing on the ‘me,’ and that can lead to both better physical and mental health.” — Dr. Laura Koenigs, interim chair, Baystate Children’s Hospital

Be thankful and mend relationships. “The ‘thanks’ in Thanksgiving reminds us to be thankful for being together on the holiday. But what about those loved ones and friends we might be estranged from? Thanksgiving is a time to reflect on ways to improve family relationships. And eliminating latent feelings of disappointment and sadness over a stressed relationship can also benefit both one’s mental and physical health.” — Dr. Benjamin Liptzin, chair, Department of Psychiatry, Baystate Medical Center

De-stress your Thanksgiving. “Sure, you want everything to be just right for Thanksgiving, from a perfectly cooked Turkey to avoiding any conflict among relatives who might not always see eye-to-eye. It’s stress, holiday style. Making sure you get enough sleep leading up to the holiday can benefit your immune system and help keep you free of illness. Getting a good night’s sleep can also help to relieve stress and keep you alert, productive, and focused on the true meaning of the holiday.” — Dr. Karin Johnson, director, Sleep Clinic, Baystate Medical Center

A Primer on the New Law Requiring Employers to Provide Sick Leave

By JEFFREY TRAPINI and HUNTER KEIL

Through a ballot intitiative in the November election, voters in Massachusetts decided to require employers to provide sick-time benefits to all workers. The law passed by a margin of approximately 60% to 40%, and it goes into effect on July 1, 2015.Here what employers need to know about this measure and how it will impact their business.

What the Law Requires

The law applies to all employers, regardless of size. If the employer has 11 or more employees, then the sick time must be paid, and if the employer has fewer than 11 employees, it may be unpaid.

Regardless of the size of the employer, the law has the same requirement for accrual. Employers must provide a minimum of one hour of sick time for every 30 hours worked by an employee, up to a maximum of 40 hours of sick time per year. The law applies to both full-time and part-time employees, although obviously part-time employees will not accrue sick time as quickly as full-time employees. Employees who are exempt from overtime requirements are presumed to work 40 hours per week for the purposes of accrual, unless their normal work week is fewer than 40 hours, in which case it will accrue based on their normal work week.

Employees are allowed to carry up to 40 hours of sick time accrued in one calendar year over to the next calendar year, but employers are not required to allow employees to use more than 40 hours of sick time in one year. For that reason, this carry-over provision affects when an employee can take his or her sick time, but not the total amount of time that can be taken in a year.

Sick time may be used by employees for a number of reasons. In addition to caring for an employee’s own health, it can be used for caring for the employee’s child, spouse, parent, or parent of a spouse. Sick time can be used for both unforeseen illnesses and for routine medical appointments. If the use of earned sick time is foreseeable, the employee is required to make a good-faith effort to provide notice to the employer. Finally, sick time can be used to address the psychological, physical, or legal effects of domestic violence.

Employees will begin accruing sick time under this law on July 1, 2015 or on the date of their hire, whichever is sooner. Although employees begin accruing sick time upon hire, there is a 90-day waiting period for use of the sick time. Therefore, employees cannot use accrued sick time until they have been employed for 90 days or more by the employer, but they begin accruing it immediately.

The law does not require accrued sick time to be paid to an employee upon termination or resignation. Employers should be careful, however, if they have a paid-time-off (PTO) policy that grants employees a certain amount of paid time off that can be used as either vacation or sick time. The law does not require an employer to provide paid sick time in addition to PTO, provided that the PTO policy meets the minimum criteria of the law.

The Massachuetts Wage Act, however, requires employers to pay employees for all of their accrued vacation time upon termination or resignation. If an employer does not differentiate between vacation time and sick time, then it arguably must pay all accrued PTO at the time of the employee’s departure. If a policy is unclear, the courts may construe it against the employer, so it would be wise for an employer to make sure it is clear on this point.

The Law Is a Floor

The new law, which will be codified as Chapter 149, §§ 148C, 148D, acts as a floor below which employers may not drop, but nothing in the law forbids employers from granting more benefits to employees than the law requires. If an employer’s existing policy grants more generous sick-time benefits to its employees than the law requires, the employer does not need to modify its policy in reaction to this law. However, employers should be cautious in assuming that their policy is in compliance with the law, and it would be prudent to seek advice.

While an employer’s sick-time policy may be generous, it may still have details that are not in compliance with this law. For example, an employer may grant more than 40 hours of sick time per year, but if it does not allow up to 40 hours per year to be rolled over to the next calendar year, it may not be in compliance. Likewise, if an employer does not provide benefits, including sick time, to part-time employees, it will not be in compliance with the law regardless of how generous its sick-time policy may be for full-time employees.

Potential Liability for Employers

Both individual employees and the Massachusetts attorney general have the right to enforce the provisions of the law. Like other statutes relating to employment discrimination and wages, employers may be sued for interfering with or denying an employee from using earned sick leave, or for retaliating against employees for asserting their rights to sick leave or for supporting the rights of another employee. If the employer is found to have engaged in such conduct, it can be liable for any lost wages or other damages resulting from the adverse employment action. Further, it also appears that an employer’s decision maker may also be liable to the employee.

Employers should take special note of the retaliation provision of the statute. Where damages are awarded, they must be automatically tripled, and the employee may also recover attorney fees and costs. The mandatory tripling of damages and the availability of attorney fees for a successful plaintiff pose the possibility of surprisingly large awards, creating an incentive for attorneys to represent employees in these cases. It would be wise for employers to be meticulous in ensuring that their sick-time policies comply with the law, and that their policies are uniformly followed.

Attorney General Regulations

The law requires the attorney general to promulgate regulations on a number of the provisions in this law. These regulations will clarify ambiguities, and employers will have to make sure that they are in compliance with these as well. Employers should be aware that further modifications to their policies may be necessary when this occurs.

Jeffrey Trapani and Hunter Keil are attorneys with Springfield-based Robinson Donovan, specializing in employment law and litigation; (413) 732-2301.

Banks Navigate a Rapidly Changing Chess Board

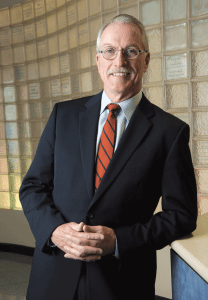

In assessing the many ways banking in Massachusetts has changed, Dan Forte summons two numbers: 338 and 175.

In assessing the many ways banking in Massachusetts has changed, Dan Forte summons two numbers: 338 and 175.

The first, said Forte, president of the Mass. Bankers Assoc., is the number of banks with offices in the Bay State in 1990. The second number is the same tally at the end of 2013.

“That’s a 48% drop, which, annualized, is a 2% drop per year,” Forte said. “There have been some periods where the consolidation was slower, while in some periods, it has been a little faster. We’re coming out of an economic trough, albeit slowly, and as the economy gets stronger, you’ll see mergers pick up over the next few years.”

Indeed, after a few relatively — but never totally — quiet years on the bank-merger front, 2014 has brought a rush of movement, most recently Berkshire Bank bringing Hampden Bank under its banner (see sidebar, page 19).

“It’s a combination of things,” Forte said, noting that the region’s most recent big moves — Berkshire’s in-market acquisition of Hampden, the interstate ‘merger of equals’ between United Bank and Rockville Bank a year ago, and Connecticut-based Farmington Bank’s plan to expand into Massachusetts — are very different from each other.

“The community banks are going to remain strong, but, like every other industry, there’s going to be a lot of change, and this is part of the change,” he said. “It’s really nothing new.”

Or, as Brian Corridan put it, “we have a lot of very good banks here in Western Massachusetts. But the world is changing, and the checker game in banking has become a chess game.”

Corridan, a local expert on the financial-services industry and president of Corridan & Co. in Chicopee, emphasized that not only are mergers and consolidations par for the course these days, they’re not the biggest story.

Berkshire Bank leaders are discussing whether to retain, consolidate, or close Hampden Bank branches that overlap Berkshire branch footprints — including Hampden’s headquarters in downtown Springfield.

“Look around — people have accounts at Citizens, TD Bank, and Santander. We’re not just talking about regional banks anymore, but foreign banks. They see the value of retail banking in our area,” Corridan said. “And it’s just the tip of the iceberg; there’s a lot of consolidation to come as banks look for economies of scale.”

That’s one of the reasons offered by Sean Gray, Berkshire Bank’s executive vice president of retail sales, in explaining why his institution is “doubling down on Springfield,” where Hampden Bank is headquartered, and where Berkshire already has a significant presence.

“Ultimately, there are economies of scale that come with larger size,” he said. “We believe we have to be big enough to do all the things larger institutions can do, but we feel we need to keep our roots in local decision making, and stay active in foundations and volunteerism and all the things you want a community bank to do at the end of the day.”

When it comes to making moves on this massive chessboard, how does a bank become more efficient, more profitable, and offer expanded services and a broader range of loans, while also maintaining the community involvement and high-touch environment long valued by retail customers in Western Mass.? For this issue’s focus on banking and financial services, BusinessWest examines how creating this balance has become, for banks large and small, the name of the game.

In the Red Tape

Ironically, much of the recent movement among banks to grow larger, quickly, has come as a result of new regulations in the wake of the 2008 financial collapse — a crisis in which the largest banks shouldered much more blame than smaller community banks.

“Since Obama came to town, it’s been a regulatory jungle, and the departments within individual banks experiencing the highest growth rate are the compliance departments,” Corridan said. “In response to more complicated regulations, the federal government is demanding more reports, and that rocks your bottom line. If you have to put $400,000 to $500,000 into your compliance department, that may upset the balance of whether you had a profitable balance or you’re in the red.”

Forte agreed, citing the way ‘call reports’ — the condition reports banks issue to regulators at the end of each quarter — have become much more onerous.

“The costs of doing business are clearly increasing,” he told BusinessWest. “As of 2012, there were 1,995 items in a call report. In 1990, there were 569 items. And the regulations coming out of Dodd-Frank are going to increase them even further; they’re looking now at increasing the number of reporting requirements by 63 elements. Every item takes time and costs money, and the risk of not completing these forms correctly is significant.”

Therefore, he said, banks aren’t just expanding their brand when they merge; they’re spreading these regulatory costs over a larger footprint.

For William Crawford IV, CEO of Rockville Bank, the decision to merge United with Rockville was about investing smartly in an aggressive growth plan.

“Getting to $5 billion in assets, getting to that scale, was very important,” he said. “We’re seeing a lot of small banks seek out strategic partners, much as we saw with Hampden, simply because the economics of being a very small community bank — say, under $1 billion — is very difficult when you look at the interest-rate environment out there. It makes it very difficult to lend money, and, unfortunately, we may be in this environment for an extended period of time.”

Still, he emphasized the importance of maintaining community ties, particularly in the realm of long-established charitable and volunteer efforts.

“Both companies, United and Rockville, have significant foundations that will continue to invest here as we always have,” he said. “And because of our increased size and scale, we have more resources to do those things. So, from a community perspective, two companies coming together is definitely a plus.”

While customers might occasionally feel disoriented by changes in bank ownership, Forte noted that banks have been contracting nationally at a 3% annualized rate, putting Massachusetts behind the U.S. pace. Some of that has to do with the fact that 70% of the banks in Massachusetts are mutual banks, which are limited in how they can merge.

“It requires the right alignment of planets — the board, management, succession timing, etc.,” he said. “Clearly, the trend from this year is a little faster than three years ago, which is not surprising, given all that’s been going on economically.”

The loosening of state laws across the U.S. governing interstate banking, starting around 30 years ago, created a much more nurturing environment for mergers, leading to the remarkable contraction in Massachusetts-based banks since 1990, Forte said.

“State lines are fairly arbitrary; you’re looking more at economies. That’s why interstate banking is so critical; it gave banks large and small the ability to expand geographically, regardless of state boundaries.”

Cache and Carry

Forte emphasized, however, the vigilance with which merging banks protect their reputation as local institutions.

“Community banks are a vibrant sector of the economy, and they help their local communities,” he said. “Their biggest strength is being high-touch. If they can maintain the high-touch aspect and be quick followers of technology and keep costs down going forward, they will continue to confound the pundits who have long predicted their demise.

“I believe there will continue to be a strong community-bank sector of the industry, and we’re not going to become like Canada, with six large banks and 100 credit unions that serve as the local banks,” he added. “We have vibrant community banks here in Massachusetts.”

That said, Corridan noted, “we’re down two publicly traded banks in the Pioneer Valley — Chicopee and Westfield. Look back 25 years, when we had BankBoston, Shawmut, Bank of New England, Baybank … we had smaller banks, and dozens of them.”

With their gradual fade, he predicted that the next 10 to 15 years will see a rapid ascent in credit-union membership. “If you want to bank locally, you’ll see credit unions get stronger, because they’re going to be the local banking entity.”

Springfield resident Morriss Partee, creator of EverythingCU.com, an online source for credit-union information and advocacy, hopes that’s the case, but admitted progress toward that goal has been gradual at best.

“Consolidation in banking has been going on for a very, very long time, and people always say the credit unions stand to benefit from that, and they certainly have to some extent,” Partee said. “At the same time, it’s surprising that they haven’t benefited even more than they have.

“The option of banking locally is just not that important to a lot of people,” he continued. “Of course, it’s important, but a lot of people don’t think deeply about their bank relationship. They say, ‘OK, I have checking; I have a big bank with lots of ATMs around; I can be functional in society.’”

Partee says there’s still plenty of untapped potential for credit unions, but they have to convince people it’s easy to switch over. EverythingCU.com has long offered a ‘switch kit’ to make that task easier and, in recent years, help people do it online. “People hear about credit unions from their friends or see representatives at a trade show and say, ‘OK, your credit union sounds great, but it’s not worth the hassle of moving.’”

Partee, who has been a vocal opponent of a Springfield casino, puts large national and international banks in the same category — businesses, he says, that want to benefit from Springfield but who, at the topmost levels, don’t care about detrimental effects on the community because they don’t live here.

“When lending decisions are made locally, that’s going to help the local community,” he said. “There are still local community banks that are staying local, and a lot of people feel just as passionately about their local community bank as they do about their credit union. With the largest banks — the internationals, especially — it seems like doing business with them is not necessarily helping the local economy; they’re not as responsive to entrepreneurs or people who don’t fit into neat little boxes they can check off in their system.”

Pittsfield-based Berkshire Bank, for its part, has been careful to characterize its acquisition of Hampden as a way of doubling its commitment to Greater Springfield, not uprooting a locally headquartered bank with a 162-year presence.

“We are keeping local leadership and local decision making right here,” Gray said, noting that Hampden Bank President Glenn Welch will remain the combined bank’s regional president for the Pioneer Valley. “We are the largest bank headquartered in Western Mass., and when we look at our overall investment in the region, Springfield has to be a part of that. We are very committed to Glenn and his leadership and his commitment to this region.”

Checking the Landscape

Partly because of the economies of scale produced by the merger, Gray said the combined institution would grow more quickly than the two would have separately. The fate of individual branches, some of which now have overlapping footprints, is still being discussed, though Berkshire is determined, he added, to keep as many current Hampden employees in place as possible.

That brings up a common concern in the industry — overbranching. Strikingly, while the number of banks in the Bay State has been cut in half over the past 25 years, the number of total branches has risen by 12%. “You’ve got a lot more branching,” Forte said, “as well as more services that provide easier access to customers, like remote deposit capture, online banking, and mobile banking.”

Considering these trends, and the fact that real-estate is the second-highest cost for banks after personnel, one would expect banks to start closing branches, rather than open more, he noted. But that hasn’t happened yet.

“New England is overbanked in terms of the number of branches per household,” Crawford said. “And it’s higher than it needs to be. Look at the transaction levels, and look at how frequently people conduct business inside a branch, versus using a mobile device for bill pay, or even a call center. The reality is, there are probably too many bank branches right now, and that structure can’t be supported by the way customers do their banking these days.”

Perhaps that’s the next phase of what has become an intriguing and unpredictable game.

“Think of how much change banks have gone through, and imagine what they will look like in three years, seven years, or 10 years,” Crawford told BusinessWest. “We need to have leadership that can figure out what’s working and work with vendors to get there — and do it in a way that’s attractive to customers and cost-competitive with much larger players. That’s the challenge.”

Berkshire Hills Acquisition of Hampden Bank Creates $7B Institution

Berkshire Hills Bancorp’s recent acquisition of Hampden Bancorp — bringing Hampden Bank under the Berkshire Bank banner — means that, for the first time in generations, no bank will be headquartered in Springfield. But Berkshire leaders say customers and the community will both benefit from the merger.

“This in-market partnership will create a strong platform for serving our combined customers, while producing attractive returns for both our existing shareholders and the new shareholders from Hampden joining us in this transaction,” said Michael Daly, president and CEO of Pittsfield-based Berkshire Bank. “This merger complements our expansion initiatives in Central Massachusetts and Hartford, a combined market area that is the second-largest in New England.”

Berkshire Hills Bancorp and Hampden Bancorp have signed a definitive merger agreement under which Berkshire will acquire Hampden and its subsidiary, Hampden Bank, in an all-stock transaction valued at approximately $109 million. Berkshire’s total assets will increase to $7.1 billion, including the $706 million in acquired Hampden assets.

Sean Gray, Berkshire’s executive vice president of retail banking, said the move “deepens our investment and commitment to the marketplace. We’re already in Springfield and the surrounding communities, so this gives us better economies of scale in that marketplace, which allows is to do more, and we’re excited about that opportunity.”

The in-market merger is expected to create efficiencies, strategic growth, and market-share benefits for the consolidated operations of the two banks in the Springfield area. Hampden operates 10 branches in the Greater Springfield area and reported $508 million in net loans and $490 million in deposits as of Sept. 30, 2014. Berkshire operates 11 branches with $627 million in deposits in the same market area.

“We will move into the top-five position in deposit market share,” Daly said, “and plan to use this opportunity to further capitalize on our strong product set and culture of customer engagement.”

Gray echoed the concept of culture. “I think we started with like values. We believe that a community bank has a responsibility to the community, and I think Hampden Bank thinks about it the same way. There’s a mutual respect there,” he said, adding that “our CEO has a great relationship with their CEO, and they both felt that the time was right.”

He also noted that Berkshire, like Hampden, has a culture of community involvement through donations — $269,852 since 2013 — and employee volunteerism.

Glenn Welch, president and CEO of Hampden Bank — who will become Berkshire’s regional president for the Pioneer Valley — said he is “delighted to be joining the Berkshire franchise. Our two banks share rich histories, consistent core values, and a strong commitment to customers and communities. I’m proud of our 162 years of serving customers in our markets and believe the combination created by our two companies will benefit our clients, communities, and shareholders.”

Under the terms of the merger agreement, each outstanding share of Hampden common stock will be exchanged for 0.81 shares of Berkshire Hills common stock. The merger is valued at $20.53 per share of Hampden common stock based on the $25.35 average closing price of Berkshire’s stock for the five-day period ending Nov. 3, 2014. The $20.53 per-share value represents 133% of Hampden’s $15.49 tangible book value per share and a 6.0% premium to core deposits based on financial information as of Sept. 30, 2014.

Gray conceded that the merger could lead to closings where Berkshire and Hampden have an overlapping branch presence, but nothing has been decided yet.

“Right now, we’re in the evaluation process,” he said. As for employees, “obviously, there will be some redundancy in jobs. But Hampden has 126 employees, and Berkshire right now has 102 openings. Will each of those employees map directly to these openings? We don’t know yet, but we do have a track record here.”

Specifically, he referred to Berkshire’s acquisition of Legacy Bancorp in 2010. “We were able to retain a good majority of those jobs. We put a lot of emphasis on that part of the evaluation process.”

Meanwhile, “from a customer perspective, they will have more branches,” Gray said. “We’ll be looking at what makes sense moving forward, but at the end of the day, the customers of this region will have enhanced services and more total branches.”

Joseph Bednar can be reached at [email protected]

Pioneer Valley Credit Union Takes a Service-focused Approach

By KEVIN FLANDERS

In her 30 years with PVCU, Anabela Pereira Grenier has seen assets rise from $2 million to $52 million.

Celebrating her 30th year with the institution, President and CEO Anabela Pereira Grenier has witnessed most of this growth just during her tenure. Since she started with PVCU, the credit union has increased its assets from $2 million to $52 million, in addition to expanding from 900 members to 7,500. It wasn’t always easy — especially during the recent recession — but PVCU has weathered the storm, she said, and emerged even stronger.

“We are the oldest operating postal credit union in the nation,” Pereira Grenier said of PVCU, which began as an institution exclusively for postal workers nearly a century ago. “It took a while, but once membership grew, we really took off.”

In 2008, right after the financial-industry collapse, PVCU officials decided to reach out to major Western Mass. employer groups in an attempt to stabilize business through a turbulent period. The decision not only provided an infusion of short-term momentum, but ultimately helped the member-owned credit union steer a course toward sustained success.

Baystate Health added PVCU as its credit union in 2008, followed by Westover Air Reserve Base. Later, Westfield’s Savage Arms and other prominent employers came on board, and the credit union now serves several other large companies and organizations, as well as federal employees in Springfield.

“We have increased our staff by more than 50% to keep up with the demand of the programs we offer,” said Trecia Marchand, vice president of marketing and business development. “Everyone is excited about the growth we have experienced. People know they can trust us when they see that these large employers have entrusted us with their most valuable assets — their employees.”

Creating Solutions

For Pereira Grenier and her team, the impetus behind every decision is member satisfaction. She said her staff understands the constraints of a challenging economy and strives to make it as easy as possible for members to navigate their finances, which has led to the creation of several innovative approaches.

For example, the CU on the Go Mobile Branch Solution was launched to enable members to use PVCU’s financial services at their workplaces. The project has been successful, she said, especially for people whose schedules don’t allow them to visit the credit union during normal business hours.

“When people see that their credit union is there to help them and provide services, they really appreciate it,” added Marchand, who has been with PVCU for eight years. “Employers don’t have to pay to offer this employee benefit. We bring the services to them — it’s a win-win situation for everyone.”

To ensure that members understand their options, PVCU has also developed a training system that elevates loan officers to certified financial life coaches. The certification process takes about one year, during which time loan officers learn how to familiarize members with financial practices and explain complex procedures in coherent, easily understandable presentations.

A session between a member and a financial life coach, Pereira Grenier said, is usually a one-on-one meeting tailored toward the member’s individual needs. From teaching people about their credit scores to analyzing how their budgets can be improved, the goal of every life coach is to help people save money and gain knowledge.

Additionally, the credit union offers financial-literacy courses for larger audiences, usually a few times yearly. PVCU is also amenable to visiting employers upon request for large group presentations.

“We are very dedicated to financial literacy,” Pereira Grenier told BusinessWest, “and have invested a lot of time and money into training our financial life coaches.”

Solid Services

In a competitive industry, Pereira Grenier said, PVCU has tried to set itself apart through consistent, ever-expanding member services. For individuals looking to improve their homes’ energy efficiency, PVCU has partnered with the Mass Save Heat Loan program to offer 0% loans. And for members who step through the doors with a loan application, it’s possible for them to come out with a check in a half-hour or less.

To accomplish that goal, the PVCU staff processes everything in-house, with no outsourcing or external complications, improving efficiency and keeping members coming back for additional programs.

“When others are trying to take money away from people, we are offering services that put money back into their pockets,” Marchand said, noting that the credit union’s investor-rewards checking program pays eight times more than the national average for interest-bearing accounts of its kind.

Moreover, the credit union pays money on debit transactions and also provides members an opportunity to donate their cash-back rewards to charity. The institution has partnered with Baystate Health Foundation, the Children’s Study Home, and the Soldiers Home in Holyoke as charitable partners for this program. For members interested in participating, they can choose which charity they will benefit with their rewards. In addition, PVCU is engaged in a number of other charitable and community-outreach efforts, including an annual essay contest for seventh- and eighth-graders and college scholarships for high-school seniors.

PVCU also offers online banking, express banking, mobile banking, online information about financial coaching, and myriad other services and programs. It’s all about keeping up with technology and utilizing it in advantageous ways, Pereira Grenier says.

Speaking of technology, the credit union’s marketing team continues to employ everything from social media to radio ads to promote PVCU’s services. The staff also works closely with human-resources departments of member companies to keep their employees apprised of upcoming events and opportunities. Whether someone is buying a used car, applying for a student loan, purchasing a home, or simply trying to learn how best to manage money, the staff is always available to help members create a plan to achieve sustainable financial security.

Total Team Effort

Originally chartered to “promote thrift among its members and to make loans to its members for provident purposes,” PVCU previously operated on Dwight and Main streets in Springfield before eventually shifting to its main office to 246 Brookdale Dr. in 1991. But continued staff growth has necessitated major restructuring and rearranging within the building, which the leadership team agrees is a great problem to have, especially at a time when many businesses have needed to make cuts to services.

Pereira Grenier remembers how spacious the main office was back in 1991, when PVCU had only a handful of employees working in the building. But with major staff increases over the last 20 years, the building has undergone a makeover to ensure that the office remains comfortable and welcoming to both employees and members. The basement, once used solely for record retention, now houses offices for the HR, marketing, and operations departments, as well as the credit union’s call center. Loan officers and service representatives, meanwhile, occupy the main floor for ease of member accessibility.

“We feel it is important to have our loan officers right there on the main floor where they are easy for members to reach,” Marchand said. The credit union strives for a similar environment at its other locations: at Baystate Medical Center and at 1883 Main St. in Springfield; at Westover Air Reserve Base in Chicopee; and at Savage Arms in Westfield. PVCU also operates a number of ATM locations in Springfield, Chicopee, and Holyoke.

“In the three years I have been here, the morale is at an all-time high,” said Human Resources Coordinator Jennie McPherson. “We have gone from a transaction culture to a consultative culture, and everyone is excited about what we are doing for our members. We all work well together as a team, and it’s a very inclusive environment. When we do off-site team-building exercises, staff members are happy to attend.”

McPherson and Marchand agree that PVCU’s success starts from the top, with the leadership Pereira Grenier has provided for three decades, and especially since taking over as president and CEO in 1998. They say employees have been inspired by how hard she works and her commitment to achieving success.

“She is a leader who really believes in what she’s doing every day, and the team comes together because of that,” Marchand said.

Guided by an 11-member board of directors that sets policy, governed by its members, and led by a dedicated staff, she added, PVCU is poised to continue its success into 2015. Invested in far more than its bottom line, Pereira Grenier and her team understand that, in this business, everything starts and finishes with member satisfaction.

Know the Rules to Understand If You Qualify for Deduction