Dollars & Sense

Effective Tax Planning Is a Saving Grace

April is generally regarded as ‘tax time,’ but experts say that tax planning is a year-round exercise, if people want to do it right. With that in mind, year end is a time to look at strategies that can minimize your tax burden and put an effective game plan in place.

April is generally regarded as ‘tax time,’ but experts say that tax planning is a year-round exercise, if people want to do it right. With that in mind, year end is a time to look at strategies that can minimize your tax burden and put an effective game plan in place.

As the end of 2011 approaches, now is a good time to start year-end tax planning to minimize your individual and business tax burden. Generally, year-end tax planning involves considering at least two years — in this instance, 2011 and 2012. With tax changes on the horizon, you should consider the likelihood of future changes. Tax planning is a dynamic process and is best accomplished with forethought and assistance from your tax adviser.

Before going into more specific, detailed planning tips, here are two basic principles that can help guide your overall thinking:

• If you expect your tax rate will be higher in 2012, you may benefit from accelerating income into 2011 and deferring deductions into 2012; and

• If you think your tax rate might be lower next year or will be unchanged, consider deferring income to 2012 and accelerating deductions into 2011.

Remember, the focus is on yours or your company’s marginal tax rate. That is the highest rate at which your last, or marginal, dollar of income will be taxed. Even though overall tax rates may rise in the future, if your income will be substantially lower in 2012 than in 2011, your marginal tax rate may decrease because of our graduated tax-bracket system.

In this article, we will focus on tax-planning opportunities that involve actions you can take during the remainder of 2011. This article does not include every tax-planning opportunity that may be available to you, and it is advised that tax projections confirm planning strategies.

First, some business tax-planning strategies.

Retirement Plans for Your Business

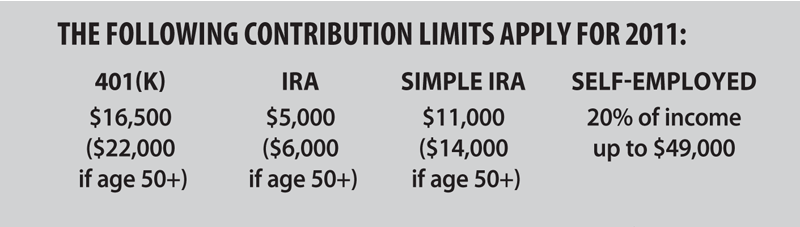

Retirement plans have significant tax advantages. Employer contributions are deductible from the employer’s income, employee contributions are not taxed until distributed to the employee (for plans other than Roths), and investments in the program grow tax-free or tax-deferred. Further, the tax law offers a small incentive of a $500-per-year tax credit for the first three years of a new SEP, SIMPLE, or other retirement plan to cover the initial setup expenses.

Depreciation

Certain enhancements to business-depreciation provisions are scheduled to expire on Dec. 31, although President Obama has proposed an extension through 2012.

Section 179: A $500,000 expensing election limit applies to qualifying property purchased and placed in service during 2011. As a result, many businesses will receive an immediate tax writeoff for the cost of most new and used tangible personal property. Unless Congress acts to further extend the higher limit, it will drop to about $134,000 in 2012. Companies that purchase more than $2 million of qualifying property during 2011 have their deduction amount reduced, dollar for dollar, for purchases in excess of $2 million.

Bonus depreciation: Property that does not qualify for an immediate tax write-off under the expensing election may qualify for an increased first-year depreciation deduction under bonus depreciation rules. Unlike the Section 179 deduction, there are no restrictions on the amount of qualifying property, and there is no taxable-income limit. The deduction is 100% of the cost for new property purchased and first placed in service during 2011. Unless Congress acts to extend the bonus depreciation (now proposed by the president), it will not be available for 2012.

Cost Segregation

Buildings and other real estate generally do not qualify for bonus depreciation or the expensing election. However, a cost-segregation study may be able to identify qualifying property within the overall project, which can often significantly increase your deduction.

Research and Development Tax Credit

Many business owners in nearly every industry are unaware that federal and state research and development (R&D) tax-credit programs exist that may reward their day-to-day efforts aimed at producing an improved product. Consider consulting an R&D expert. This credit applies to more than manufacturers.

Health Insurance Tax Credit

To encourage smaller businesses to offer medical insurance coverage for their employees, the law offers a tax credit to offset all or part of the cost. If your business qualifies as a small employer, meaning fewer than 25 employees and average annual wages of less than $50,000, you could be eligible for a credit of up to 35% of non-elective contributions you make on behalf of your employees for medical-insurance premiums. The credit requires minimum non-discriminating contributions and varies based on the numbers of employees and average compensation.

Credit for Hiring New Employees

Businesses that hire workers who are members of certain target groups, such as disabled veterans, food-stamp recipients, and ex-felons, can claim a credit up to 40% of the first $6,000 of wages paid to each such employee.

Losses from Pass-through Entities

If the business entity is operating as a partnership, LLC, S corporation, or trust, and the business will incur a loss in 2011, you may need to plan ahead to be sure the owners can take advantage of that loss on your personal tax return. These rules can be complicated, and you should consult with your tax adviser; there are steps you can take to deduct passive losses or increase your basis.

Paying Corporate Dividends

Profits of traditional C corporations (those that have not elected S-corporation pass-through status) are taxed twice: once when earned by the corporation, and again when distributed as a dividend to the shareholders. Many have seen the current 15% tax rate on qualified dividends as an opportunity to pay out accumulated earnings at relatively low tax rates. It is likely that the tax rate on dividends will increase in the future, so you may wish to discuss with your tax adviser the possibility of distributing profits to lock in the current 15% rate.

Compensation and Billing

Compensation earned in 2011 can sometimes be paid in early 2012, and the business may be entitled to the tax deduction in 2011. If your business operates on the cash method, you can delay (within reason) sending out bills for 2011 work until late in the year, so payment comes in 2012. Alternatively, you can offer a discount to a client who prepays if you are trying to increase 2011 income.

Next, we’ll consider some personal tax strategies.

Capital Gains and Losses

• Long-term capital gains from the sales of assets with a holding period greater than one year are taxed at 15%;

• Short-term capital gains are taxed as high as 35%;

• Sales at a loss can reduce other capital gains;

• Excess capital losses can be deducted to offset up to $3,000 of other income, with the balance carried forward. When selling to recognize a loss, be careful of the wash-sale rules; and

• Consider any capital-loss carry-forward that may be available to you in 2011.

Installment Sales

Selling an asset at a gain and collecting the proceeds in future years may allow you to defer part of the income until the years in which you receive the payments. Consider the fact that you will be financing the sale yourself and may face the risk of collection problems.

Also, consider the possibility that capital-gains tax rates could be higher in future years when you collect the payments because those gains are taxed at the rates in effect the year the gains are recognized. You may wish to elect out of the installment-sale method in the year of sale to lock in the 15% rate.

Credit-card Payments

Paying tax-deductible expenditures — including charitable contributions — with a credit card secures the deduction, even if you do not actually pay the credit card company until the following year.

Suspended Passive Activity Losses

If you own a passive activity with a suspended loss, and you do not have sufficient passive income in 2011 to allow you to deduct the suspended loss, consider disposing of the activity before Dec. 31.

Appreciated Assets Given to Charity

Consider fulfilling your charitable goals by contributing appreciated assets instead of cash. You can deduct the fair market value of long-term capital gain property, such as stock, contributed to charity, and you avoid paying taxes on the appreciation.

Tax Credits for Home Improvements

A tax credit for qualifying home improvements may be available for improvements placed in service during 2011 but not in 2012. The credit applies to energy-efficient improvements such as insulation, exterior windows, and heating and air conditioning systems. You will need to complete your purchase before Dec. 31 to qualify for the credit in 2011. The new energy-efficiency tax credit is a 10% credit, up to a lifetime maximum of $500. The prior cap had been up to $1,500, so check to see whether you have claimed this credit in prior years.

Income-tax Prepayments

If your estimated tax payments and withholding are not high enough to avoid penalties, increase payments. Even better, if you receive wages, IRA distributions, annuity payments, or other payments, have the additional taxes withheld because withholding is deemed to be ratable throughout the year.

If you have a fourth-quarter state estimated tax payment due Jan. 15, 2012, consider making the payment late in December if you need additional itemized deductions in 2011.

Alternative Minimum Tax

An increasing number of middle-income earners, especially retirees, are subject to the AMT. High itemized deductions (other than charitable contributions), high personal exemptions, and large capital gains, among other items, can trigger the AMT. Be sure to consider the effect of AMT in your year-end planning. For example, if you know you’ll be in AMT, prepaying state taxes or real-estate taxes will not give you any benefit.

Your Retirement Plans

Roth IRA Conversion: Roth IRAs have a number of advantages over traditional IRAs, including no tax when the money is withdrawn. Consider the following:

Roth IRA Conversion: Roth IRAs have a number of advantages over traditional IRAs, including no tax when the money is withdrawn. Consider the following:

• The conversion results in taxable income;

• The benefits of tax-free withdrawals in the future may be greater than the current tax you will pay;

• There is no longer an income limitation prohibiting high earners from converting; and

• If you are expecting a business loss or have high itemized deductions in 2011 that could offset the income effect of the conversion, your tax consequences may be minimized.

Additional Taxes Coming in 2013

Some future tax changes have already been enacted but have yet to take effect:

• Effective Jan. 1, 2013, a new Medicare Hospital Insurance (HI) tax applies to high-income individual taxpayers:

— The tax is 0.9% of earned income in excess of $200,000 for single filers ($250,000 for joint returns); and

— A 3.8% tax applies to investment income (including dividends, annuities, royalties and rents, etc.) for the same individuals.

Consider talking with your tax adviser about strategies for minimizing this tax.

• In 2013, the threshold for the itemized deduction for unreimbursed medical expenses is increased to 10% of adjusted gross income from the current 7.5%. You may want to plan for unreimbursed medical procedures in 2011 or 2012 to maximize your tax benefit. There is a break for older taxpayers. If an individual or spouse is age 65 or older, the threshold remains at 7.5% of adjusted gross income through 2016.

Finally, let’s discuss some estate- and gift-tax planning strategies.

Estate Planning

The estate- and gift-tax exemption amount for 2011 is $5 million — essentially $10 million for a married couple. Again, there is uncertainty in the future about where the estate-tax exemption and tax rates will end up. And with the recent changes, it is a good idea to review your plan to ensure it is up to date.

Because the estate and gift tax exemptions were recently reunified, now may be an appropriate time to make gifts to take advantage of the $5 million/$10 million lifetime exemption. Making large gifts under the exemption amount removes not only the value of these gifts from your estate, but also future appreciation of the gifted assets.

Gift Tax

The annual gift-tax exclusion for 2011 remains at $13,000 per person. If you are married, you can gift up to $26,000 per donee per year by using the gift-splitting rules, without any federal gift-tax ramifications. Gifting reduces your taxable estate and may be important in an effective estate plan.

Conclusion

When Congress dealt with the Bush tax cuts at the end of 2010, the effect was to delay a ‘permanent’ decision for another two years. These provisions, originally enacted in 2001, reduced marginal tax rates for all taxpayers, provided relief from the marriage penalty, increased child tax credits, expanded education-related tax benefits, and phased out the estate tax.

The current laws, including the recently enacted estate-tax changes, are now set to expire, or sunset, on Dec. 31, 2012. If Congress does not act, most of these tax benefits will disappear, and taxes will automatically increase to pre-2001 levels on Jan. 1, 2013. Although we have covered a number of topics in this article, we undoubtedly did not address every issue relating to your specific situation. Tax projections are recommended to determine your greatest tax savings.

Kristina Drzal-Houghton, CPA, MST is the partner in charge of Taxation at Holyoke-based Meyers Brothers Kalicka, P.C.; (413) 536-8510.