Keep on Truckin’

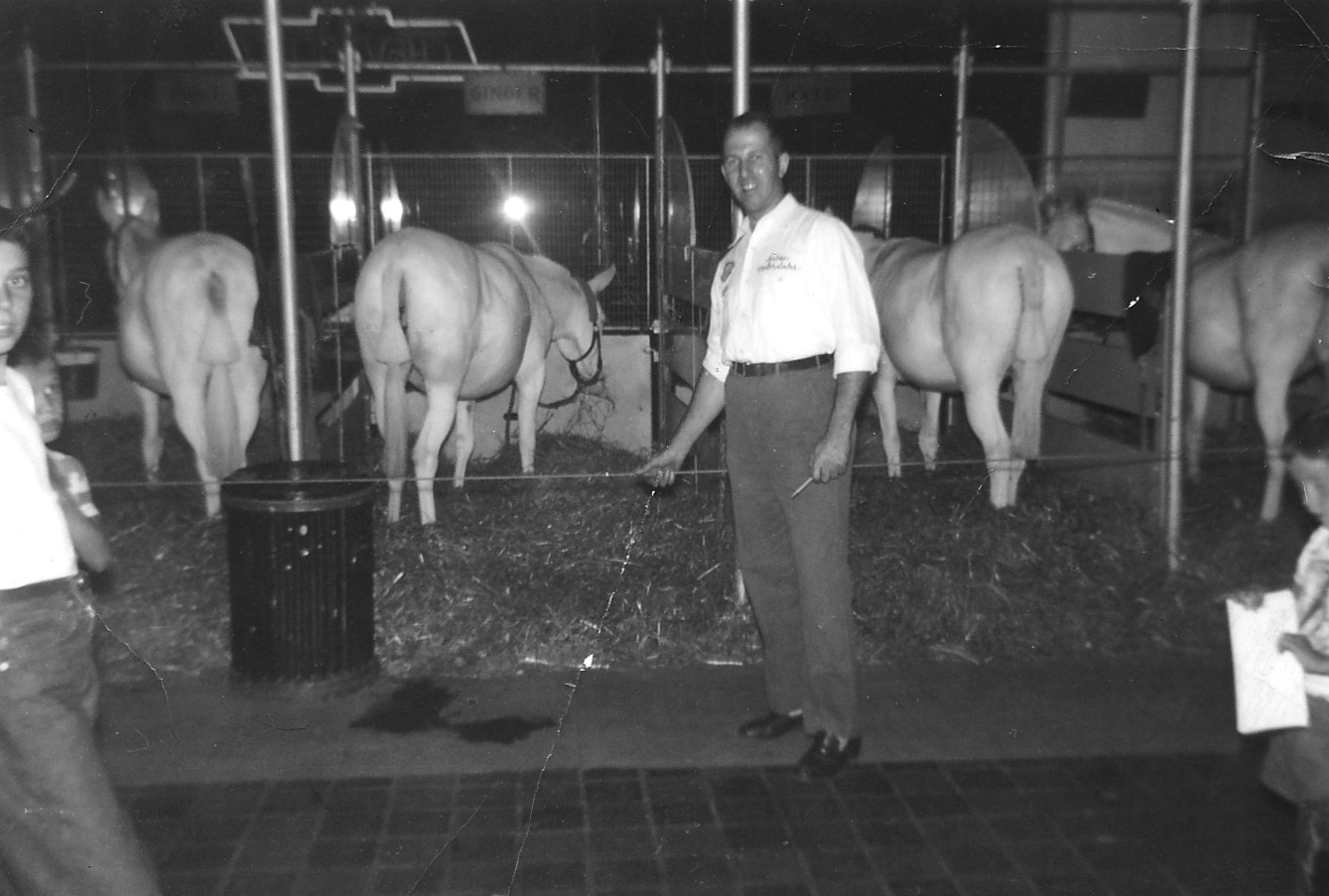

Ben Sullivan, seen here beside the Chevy Silverado ZR2 he’s now driving, says demand for trucks is up across the board, especially in the compact category.

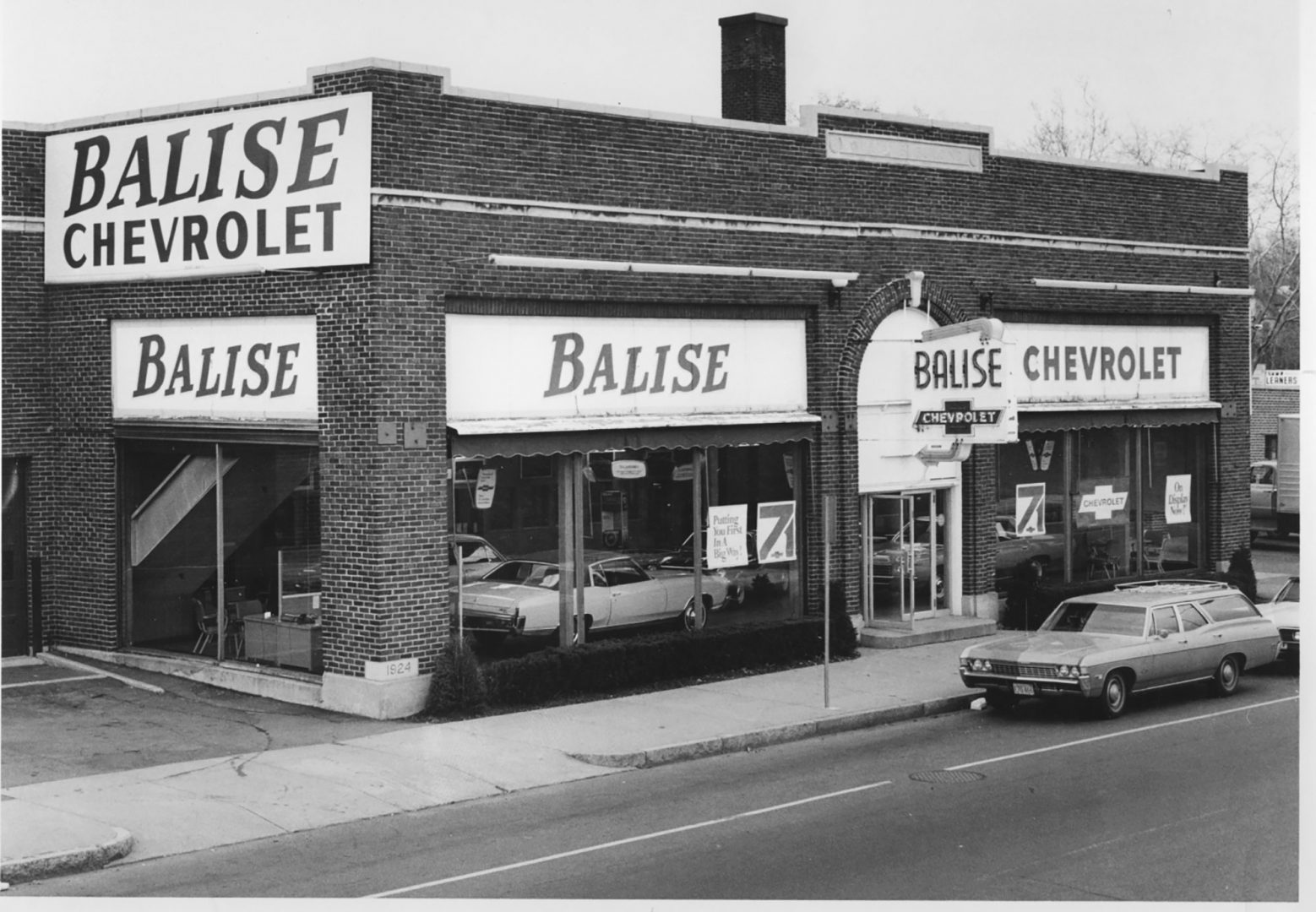

Before relocating to the 413 and a job with Balise Motor Sales, Ben Sullivan lived in Texas for 15 years.

In the Lone Star State, he said, one of every four vehicles sold is a half-ton pickup or larger. There, parking lots and parking garages are designed specifically to accommodate large pickups, with wide-open spaces and yellow lines that are farther apart. Pickups, he said, are part of the culture.

“Here, people drive diesel, heavy-duty trucks because they’re pulling a landscape trailer behind them or they’re going to a construction site,” said Sullivan, chief operating officer at Balise. “In Texas, people drive them because they want to look cool.”

Western Mass., and much of the rest of the country, is a long way from Texas — at least when it comes to pickups — but there is considerable movement in that direction, he said, adding that pickups are becoming increasingly popular with just about all age groups, and especially young people.

And part of the reason why is the wide range of options now on the market — from large trucks to the mid-range, half-ton offerings, to a growing number of smaller, modestly priced trucks that are especially popular with active, outdoor-loving young people.

These include Ford’s Maverick, which came out in 2022. This is a compact truck that seats five, boasts hybrid power, and has an XL trim with a base sticker price of $23,400, but also offers a Lariat model with leather seats.

“When you look at the truck market, there’s work trucks, there’s people who need them for towing boats, you have people who use them for leisure activities, and then, you have people who drive them for lifestyle — ‘I like the look of a truck.’”

That makes this an attractive option for people who don’t necessarily want to tow a boat or trailer and don’t work in construction, but do want everything else a pickup can provide, said Mike Marcotte, president of Holyoke-based Marcotte Ford.

“It’s been doing really well since it came out,” he said, adding that it’s become a solid option for many constituencies. “It’s popular with people right out of college, but also with contractors who want a vehicle they can go out and quote with, or people who may not need the size of F-150; it has the capability for multiple purposes.”

Marcotte said he’s selling a lot of Mavericks, but also a number of Rangers (another smaller truck) and F-150s, the ever-popular half-ton truck; the larger 250s and 350s; and even the Lightning, the all-electric version of the F-150, as well. With inventories improving, sales have been strong across the board.

Sullivan, whose company, Balise, sells several different nameplates, concurred, noting that there are a number of increasingly popular truck models on the market, with standard bearers Ford, Chevy, and Ram leading the way, but many others also doing well in this space, including Hyundai, Toyota, and Honda, especially with the smaller models.

Many of these ‘compact’ offerings now come with the descriptive phrase ‘adventure truck’ attached to them, said Sullivan, adding that, when these vehicles are on area lots, they’re usually not there for long.

In many ways, the current scene is reminiscent of the early and mid-’80s, when the market was flooded with smaller truck models.

“There were little trucks everywhere,” he said of those days. “Cheap little trucks, get-around trucks were very, very popular back then, and we’re seeing a return to those times; these smaller trucks are getting a lot of interest from young people.”

Mike Marcotte says Ford’s Maverick, a smaller truck, has been a hot seller, but there is demand for trucks in every category.

There are some differences between now and then, though, especially when it comes to accessibility. Indeed, while some makes and models are readily available — Marcotte said he has more than 150 trucks on his lot — others are not.

Indeed, Rob Pion, president of Bob Pion Buick GMAC, said he’s on his fourth year of struggles with truck inventory, especially the larger models needed by contractors and snow plowers, and especially toward year-end, when their accountants are urging them to make such purchases to take advantage of tax incentives, rather than in the new year.

“I have inventory, but not the right inventory,” he said, noting that he has several half-ton models, such as the Sierra 1500, on the lot. These are not what most of his contractor and snow-plowing customers are looking for. Meanwhile, what he does have is generally vanilla when most of his customers want something specific.

He said the market for the 1500 is somewhat soft at the moment, with those vehicles being “more of a want than a need.” Meanwhile, GM continues to struggle to supply him with the trucks for which there is a need, such as the larger 2500s and 3500s.

For this issue and its focus on auto sales, BusinessWest takes an in-depth look at the burgeoning truck market and what will happen down the road, as they say.

Bedding Down

Sullivan isn’t a dealer, per se, but like most executives in the auto-sales business, he takes full advantage of an industry perk — driving some of the latest models with dealer plates attached.

He has a hard and fast rule that he follows, though: “I drive what doesn’t sell,” he said, noting that he’s not going to hamstring any of the GMs at Balise by driving a vehicle that is in demand and could be easily sold.

So right now, he’s driving a white Chevy Silverado ZR2, which is, as they say in this business, fully loaded.

“It has the 6.2-liter engine, the big tires, the big wheels — it gets up and goes,” he said, adding that the price tag is roughly $80,000, which, in these days of higher interest rates and less-readily-available incentives, helps explain why it had been in inventory for more than six months at Balise’s Chevy story in Rhode Island and became a prime candidate for his next ride.

But while this particular Silverado wasn’t moving off the lot, trucks in many different categories (especially the smaller trucks) and across most makes and models are.

That’s because the manufacturers are making models that are, in some cases, affordable, versatile, comfortable, and fun to drive.

Rob Pion says demand for trucks is growing, but there are still issues with availability.

All those adjectives apply to several Ford models, said Marcotte, adding that he’s enjoying robust sales of the Maverick, the Ranger, the F-150, and most other truck lines put out by Ford, which has been the top seller of trucks for 46 years running, he said — and, with just a few days left in 2023, appears to be headed for a 47th.

Sullivan agreed, noting that, while soaring interest rates and higher price tags — several higher-end models now go for $100,000 or more — have slowed some segments of the market, pickup sales are still strong across the board.

“When you look at the truck market, there’s work trucks, there’s people who need them for towing boats, you have people who use them for leisure activities, and then, you have people who drive them for lifestyle — ‘I like the look of a truck,’” he said, adding that all these elements are fueling sales.

Marcotte agreed. “Trucks are more versatile now — you can use them for multi-purposes,” he said. “You can use them for casual driving or also for work; the F-150 drives like a car these days.”

Meanwhile, many of the incentives that made trucks a ‘value play,’ as he called it, such as low lease rates, attractive financing offers, and more, are coming back — slowly — and availability is improving as well.

Perhaps the biggest growth in this segment is in the mid-size and smaller categories, he went on, adding that these are for people who don’t necessarily use a truck for work or towing, but for adventures and “utilitarian use.”

“They don’t need the big platform and the big motors,” he said, adding that there are many models now in the mid-size category — the Tacoma, Chevy’s Colorado, GMC’s Canyon, Nissan’s Frontier, Ford’s Ranger, and others.

And there is perhaps even more growth in what he called the “compact truck” segment — trucks built essentially on a car platform — with models like the Maverick, the Hyundai Santa Cruz, the Honda Ridgeline, and others, said both Sullivan and Marcotte.

“Those Mavericks sell the day that they land. It’s a small truck, it’s got a hybrid powertrain in it, it can carry stuff in the back, but it’s less expensive, it gets better gas mileage, and it rides better,” Sullivan noted, adding that the same things can be said of other trucks in this category; indeed, there is a lengthy waiting list for Santa Cruzes at Balise’s Hyundai store. “These trucks are a good value play, they’re not overly expensive, they’re good-looking … and there are a lot of young people who like all that they have to offer.”

And given the popularity of this segment, there will certainly be more of them in the future, said Sullivan, adding that Toyota is expected to come out with a smaller truck soon, and other makers will likely follow.

Meanwhile, with the larger trucks, there are still some lingering supply issues, said those we spoke with, citing everything from supply-chain issues — yes, still — to the recent UAW strikes.

For Pion, inventory has been a long-standing problem. He told BusinessWest that, if a customer isn’t too specific with their needs, he can probably find them something on the lot or order it, but the narrower the request, the more difficult it gets.

“If someone’s willing to work with you and just wants a 1500 pickup, you can probably find something,” he said. “But if they want something specific, like a Sierra Denali with a specific motor and a specific package, that can be very difficult to get, still.”

This environment has created great demand — and higher prices — for used trucks, he said, adding that “the value on a used one is almost as much as brand-new one because you can’t find a new one.”

With Ford, availability has greatly improved over the past year or so, said Marcotte, noting that they are, by and large, back to pre-pandemic levels. The recent UAW strikes certainly threw a scare into all dealers, he added, but production seems to already be back to what would be considered normal, meaning there are trucks being delivered regularly.

Towing the Line

Referencing the long-standing ‘truck war’ between Ford and Chevy — with Ram a close third — Sullivan said those hostilities took on much quieter tones during the pandemic and its aftermath as availability became a lingering issue.

“During COVID, there was no reason for a pickup-truck war; every truck that they could make — and they could only make some percentage of what they used to make — was sold before it hit the lot,” he said, adding that, as availability improves and the portfolio of in-demand models increases, the truck wars will heat up again.

And that’s only one aspect of a developing story in the truck market, one with some ongoing shifts and movement to a higher gear when it comes to overall interest and the laws of supply and demand.

Western Mass. probably won’t ever be like Texas when it comes to pickups, but there is movement in that direction.

As the 2019 models continue to roll into area showrooms, area auto dealers report that sales remain brisk, at something approximating the levels of 2017, which was a very robust year for the industry. Meanwhile, a host of trends have continued or accelerated, including torrid sales of SUVs and trucks, a high volume of used-car transactions, and a heavy emphasis on improving the overall consumer experience.

As the 2019 models continue to roll into area showrooms, area auto dealers report that sales remain brisk, at something approximating the levels of 2017, which was a very robust year for the industry. Meanwhile, a host of trends have continued or accelerated, including torrid sales of SUVs and trucks, a high volume of used-car transactions, and a heavy emphasis on improving the overall consumer experience.