Battle Fatigue

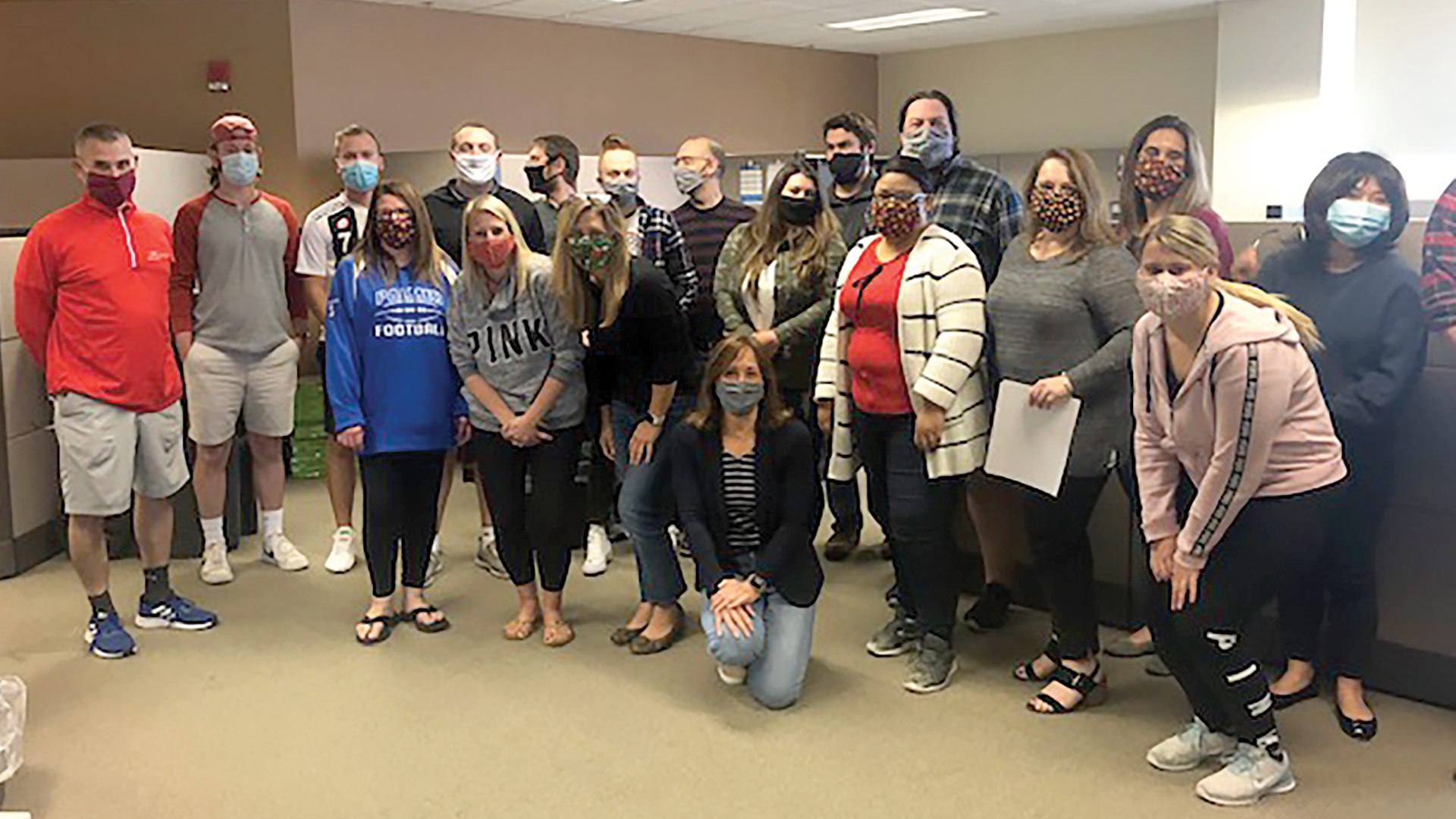

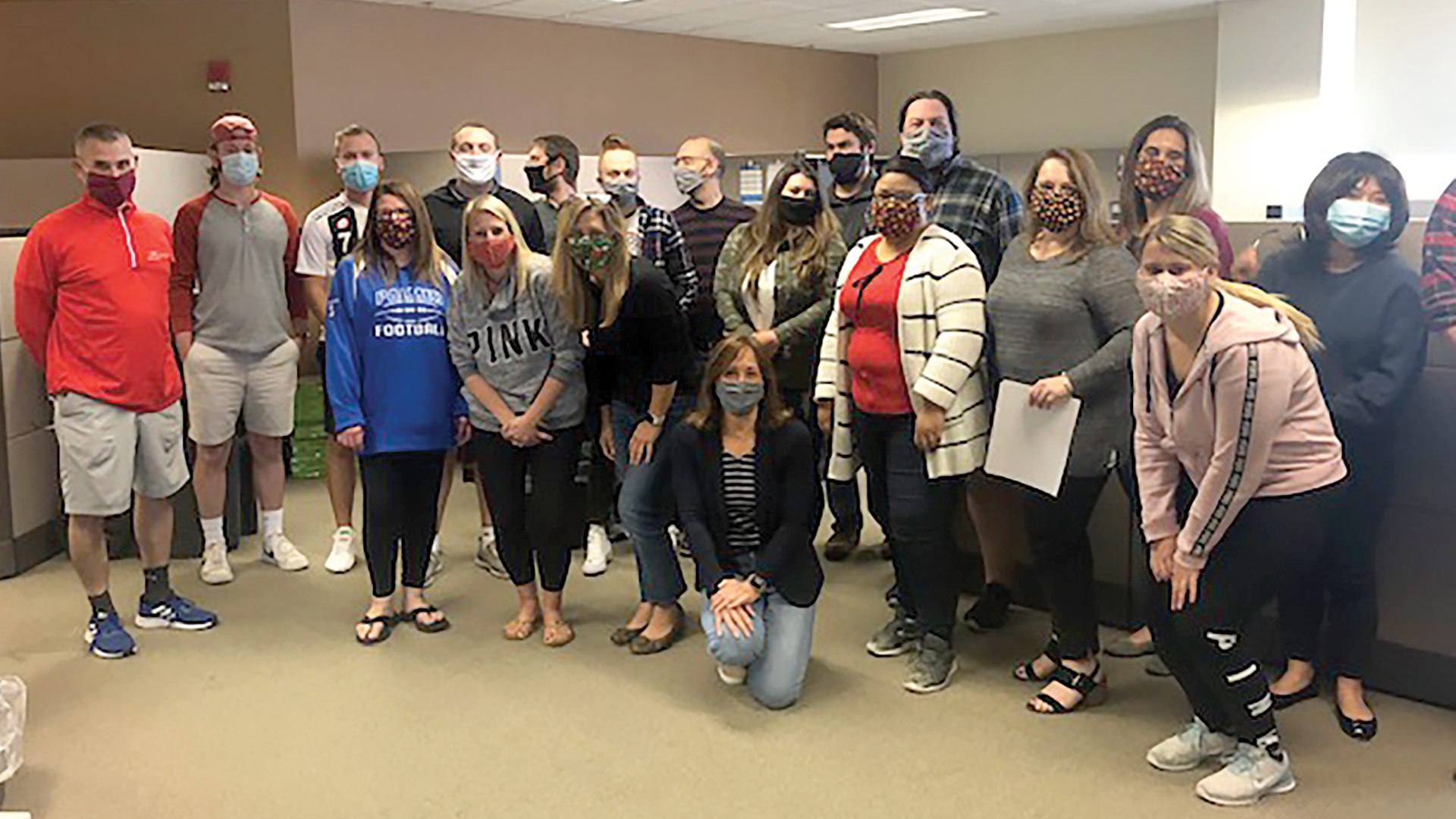

Employees at Meyers Brothers Kalicka crowd around a food truck offering gourmet grilled cheese, one of many initiatives on the part of the company to help boost morale during the pandemic — and a long, difficult tax season.

The food truck from the Log Cabin Banquet & Meeting House pulled into the north parking lot of the PeoplesBank building in Holyoke around 2 p.m. on Oct. 15.

By 2:30, a large number of employees from the accounting and tax-planning firm Meyers Brothers Kalicka had gathered to enjoy gourmet grilled cheese, tomato soup, hard cider, and some pumpkin beers, and to play a little cornhole.

The occasion? The last day of filing for those who sought extensions on their tax returns, and thus another milestone during what has been labeled by those in the accounting realm as the ‘never-ending tax season of 2020.’

But in many ways, the grilled cheese, trimmings, and camaraderie were part of what has become a multi-pronged effort at MBK to help employees cope with all the stress and strain — the battle fatigue, if you will — of what has been the most trying year anyone can remember.

And the company is certainly not alone in this mindset.

Indeed, businesses and nonprofits large and small have been addressing this matter of fatigue and helping employees cope with stress in ways that range from loosened dress codes to those food trucks; from pumpkin-decorating competitions to the ‘concert T-shirt day’ — no explanation needed — staged by MBK.

“There’s a lot of stress, and initially, people were trying to do everything and be 100% in everything, and I think most are now acknowledging that this is not realistic or sustainable.”

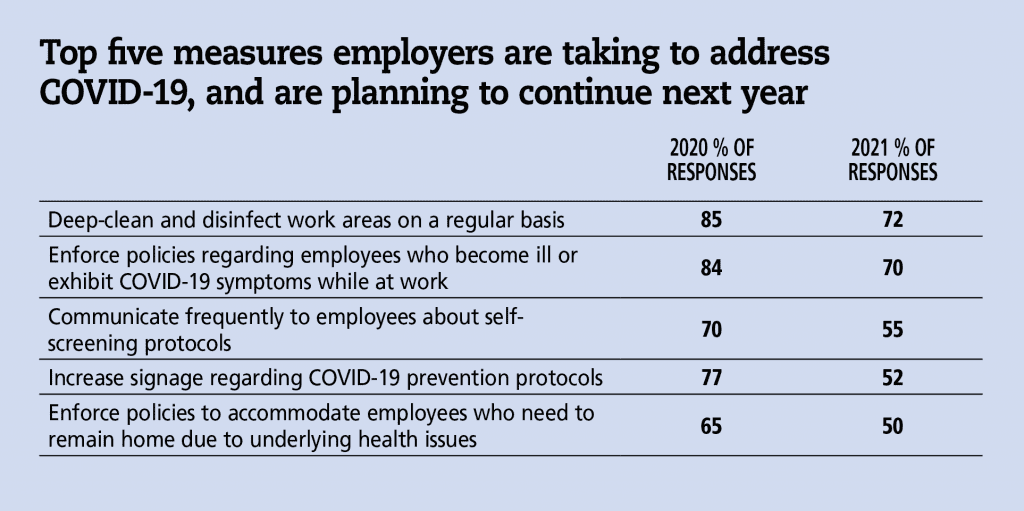

Overall, business owners and managers are recognizing that their valued employees — the ones who remain after many others have been furloughed or laid off — are tired, worried about the future, ‘Zoomed out’ (another phrase you hear a lot these days), unable or unwilling to take paid time off, and unable or unwilling to leave work behind when they leave work — whether they’re at the office or at home, said Meredith Wise, president of the Employers Assoc. of the NorthEast (EANE).

And they’re responding, as she is responding herself (EANE has 22 people on its payroll), with policies, formal and informal, and action plans focused on providing some stress relief and perhaps a sense of normalcy in a year when some companies and agencies are offering ‘mental-health days’ in the office instead of at home.

“Our team is feeling it,” said Wise, using ‘it’ to refer to the sum of the stress incurred at work and at home. “We’re having a difficult year here, and everyone is pushing for the numbers and pushing for the registrations and pushing to connect with our members and provide the best service. And then, at home, it’s not like they’re going home and then relaxing and getting away from the pressures and having time to rest and refuel. They’re going home, whether they’re working remotely or working at the office, and they’ve got all the stuff in their personal life.”

Elaborating, she said this collective ‘stuff’ constitutes everything from fear of contracting the virus to negativity on the nightly news, to the inability to do the things they want to do and go to places they want to go.

Add it all up, and it’s exhausting and often overwhelming, she said, adding that, as an employer, she considers it her responsibility to help valued employees cope with all this.

Amy Roberts, senior vice president and chief Human Resources officer at PeoplesBank, agreed. She told BusinessWest that the focus for businesses over the past few months has shifted from dealing with an emergency — getting everyone home and making sure they’re safe — and setting up people to work from home if needed, to coping with this fatigue that has settled in.

The dress code has been thrown away at MP CPAs in Springfield, one of many steps taken to help employees feel more comfortable in the office during these uncertain times.

“One of the things we’ve tried to do through the whole situation is be flexible and creative in working with each person as their own needs evolve,” she explained. “You have parents who have kids in school or at home, or a combination of both, and then you have employees with significant others who are exposed or working in situations that put them in potential harm. There’s a lot of stress, and initially, people were trying to do everything and be 100% in everything, and I think most are now acknowledging that this is not realistic or sustainable.”

“We don’t meet with people in the office generally — we’ve closed our doors. So as long as you’re looking good from the waist up on Zoom meetings, it doesn’t really matter what else you’re wearing.”

As companies continue to find ways to assist employees, they acknowledge that, as the pandemic continues, fall turns to winter, the holidays and all the additional stress they bring on approach, and the days get shorter and darker, these efforts will have to continue and probably expand.

Forever in Blue Jeans

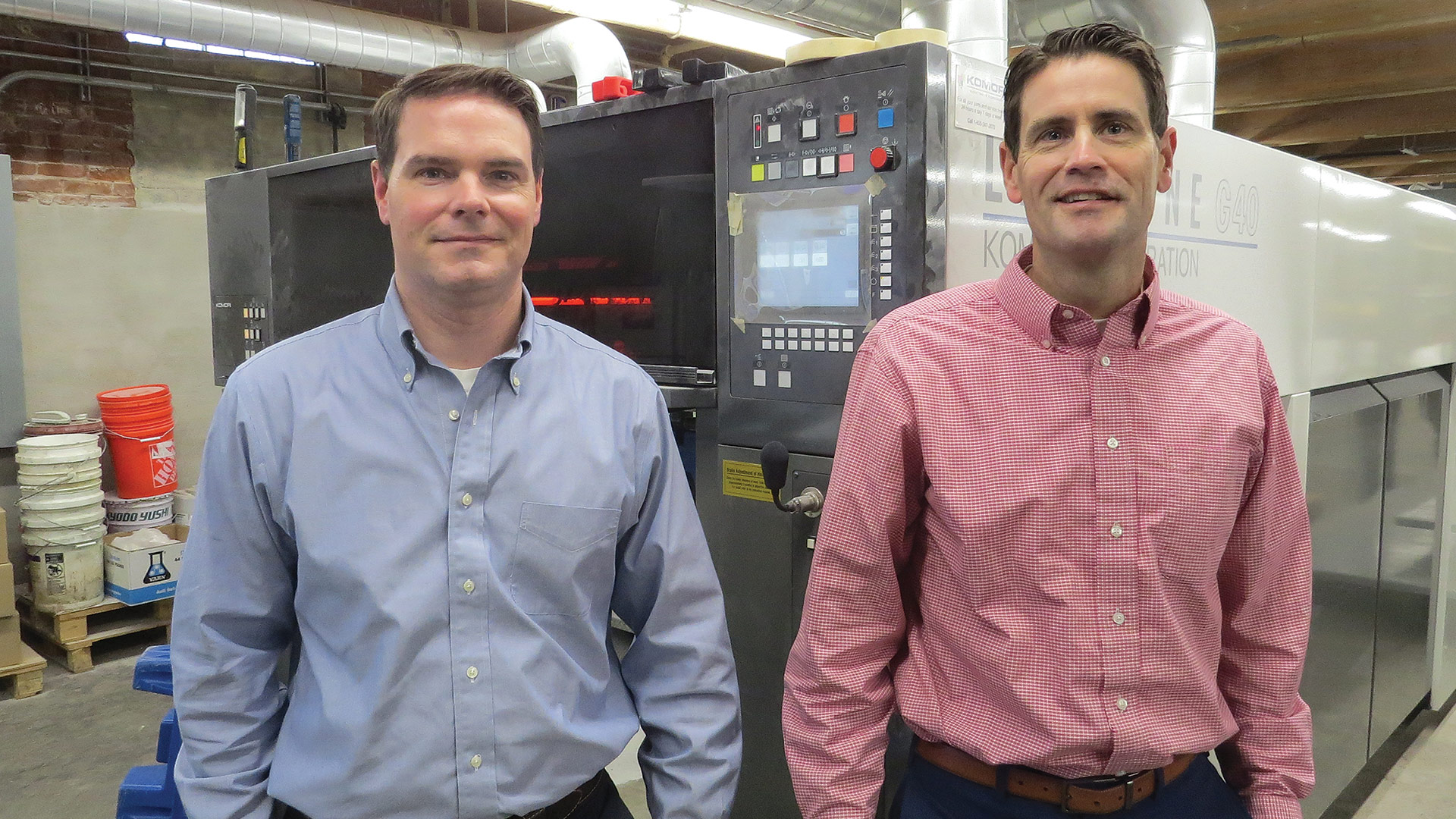

Doug Theobald says MP CPAs, the Springfield-based accounting firm, has long had a casual-Friday policy, and it has become quite popular.

These days, though, every day is casual as the company tries to make employees feel happier and more comfortable during this stressful time. And allow them to dress like their colleagues, who are working at home.

“We’ve thrown our dress code out — people have been in shorts and sweats since we came back in May,” Theobald, a principal and president of the company, explained. “We’ve always been business casual, and one of my biggest concerns was that people would be nervous coming back to the office; we wanted to make it as comfortable an environment as possible. We don’t meet with people in the office generally — we’ve closed our doors. So as long as you’re looking good from the waist up on Zoom meetings, it doesn’t really matter what else you’re wearing.

“That’s probably been the most beneficial thing we’ve done,” he went on. “If we get back to a new normal at some point, that might be my biggest hurdle — putting business casual back in place once client meetings start again.”

Meagan Tetreault, standing outside Big Y’s West Springfield store, says the company has taken an individualized approach to helping its thousands of employees cope with the stress and strain of the pandemic.

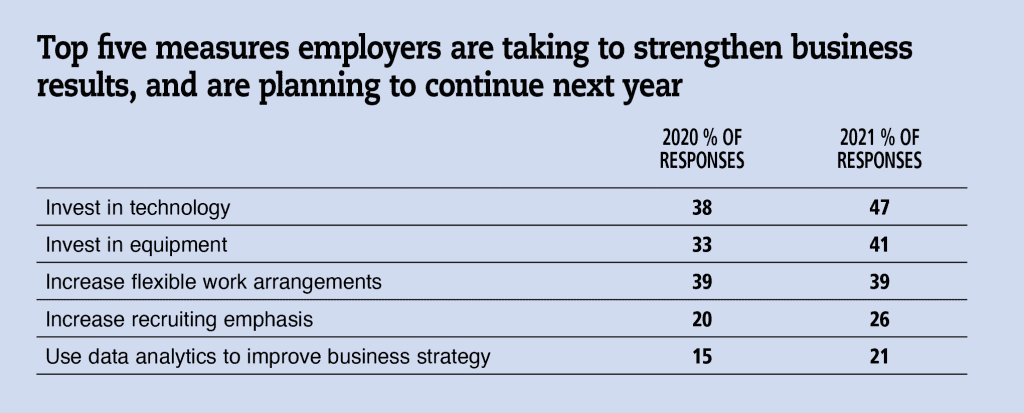

In some ways, this new dress code, or lack of one, is merely an extension of strategies put in place before the pandemic, aimed at creating a more appealing workplace at a time when attracting and retaining employees, especially in this sector, was becoming increasingly difficult as the job market tightened.

But it’s also part of a broad effort to help employees cope with all that 2020 is throwing at them, including that never-ending tax season, which will soon give way to the next tax season.

“My team is wiped,” Theobald said on Oct. 15 — again, the last day for those who sought extensions, and there were many in that category this year. “They work hard, and we are the one firm in this area that has a really, really busy fall season; it’s almost busier than April.”

He was planning to close the office down for a few days and give his team a break, another attempt to help them get rest and recreation in a year when there has been much less of both.

“There’s so much stress going on in this world right now, we’re just trying to make it as stress-free in the office as we can,” Theobold went on, noting that efforts ranging from the new dress code to flexible hours; from bringing food into the office more often (even if people can’t eat together) to delivering care packages (mostly snacks) to those working remotely, are efforts that will have to continue as the pandemic wears on.

“A lot of places are scaling back on these kinds of things for various reasons, and I don’t think it’s the time to do that. I think it’s time to put a little more gas on the fire because you don’t want to lose engagement or enthusiasm with your organization.”

Wise agreed, noting that, between work and home, many employees simply don’t seem to be able to get a break from the pressure and stress.

This leads to lack of sleep and even more mental and physical fatigue, she said, adding that matters are compounded by the fact that traditional vacations have become far more difficult to undertake. Indeed, trips to Disney World, cruises to Europe, weeks on the Cape, and even visits to relatives in other states have become daunting, if not impossible, because of the pandemic.

As a result, people are vacationing at home, which is good for the region and its tourism venues — the ones that are open, anyway; Six Flags, the Big E, and many others have not been — but the time off is, in many cases, not as relaxing and therapeutic. Meanwhile, with technology and the pandemic both being what they are, time off is usually not time off from many work stresses.

As a result, Wise and others in positions of leadership are strongly encouraging employees to completely unplug when they are taking a day or a week off.

“We try to encourage people to take their time off and to completely disconnect from the office,” she said. “We’re requiring people, when they’re taking a day off or a half-day off or a week off, to put an ‘out-of-office’ message on all of their devices. And that message should say that they will not be responding to e-mails. I don’t necessarily want to cut off people’s access, but we’re saying, ‘put that out-of-office message on, and don’t respond to anything.’ I can’t stop you from checking, but don’t respond.”

Roberts agreed, and said PeoplesBank has been pushing its workers to use their paid time off.

“When there’s nowhere to go, people are inclined to say, ‘I’ll just work,’” she said. “But over the summer, we were encouraging, and in some ways pushing, people to just take a staycation and unplug from work.”

Stressing Some Points

Roberts told BusinessWest it was only a few months into the pandemic when upper management at PeoplesBank recognized that fatigue was becoming an issue and needed to be addressed.

“We’ve had some pretty deliberate management conversations where our president, Tom Senecal, has said to team managers, ‘make sure you’re paying attention to the fatigue factor and that you’re communicating with people in a way that they know you understand that this is a very unique and evolving situation.’

“While we want obviously to meet the needs of the customers and do everything we need to do as a business, we recognize that there’s another side to this,” she went on. “Just acknowledging this and having that conversation with managers gives them that awareness and pushes them in a direction where they’re taking a more flexible approach with their people.”

Meagan Tetreault, senior Employee Services field manager for Big Y Foods, agreed. She told BusinessWest that, as an essential retail business, the company has obviously been open for customers and focused on their safety. But it has been focused on employees and their various needs as well — everything from steps taken to keep them safe to flexibility with schedules to enable them to successfully balance work and life.

“Our first priority was making sure we’re putting in place different protocols to make sure that the environment is as safe and secure as possible — from sanitizing and cleaning to plastic barriers to maintaining that social distance,” she explained. “And at certain points, we limited our staff to maintain that social distancing; in retail, it’s natural that you have to have that interaction with the public, and that can be scary. How do you support them through that? It starts with safety and wellness, and promoting that wellness.”

But, as noted, support has come in many different forms, she noted, including efforts to help the company’s 12,000 employees manage the pandemic. And as she talked about it, Tetreault stressed the need to address each employee individually and, when possible, customize a response.

“We found that it comes down to each individual employee’s needs and wants, and our store teams are a big part of that,” she said. “Our employee-services representatives are in each store to assist with employee needs, identifying opportunities and having some of those individual conversations to find out what works for that particular individual.”

Elaborating, she said the company amended its attendance policies; established something called ‘COVID leave,’ which enabled employees to take time off without losing their status; and created more flexibility for workers.

“Our store hours are 7 a.m. to 9 p.m., but we have people who come in and work overnight shifts as well,” she explained. “And we’re able to work with employees to find a schedule and position them to support their individual needs, be it childcare or even wishing to limit contact with customers.”

COVID Coping

Overall, while morale is an issue some companies address at least some of the time, it has become more of a front-burner topic during the pandemic, out of necessity, said those we spoke with.

“We’re seeing morale dip a bit; people are trying to put a good face on it, but it’s becoming harder and harder to do that,” Wise told BusinessWest. “So we’re trying to find things we can be doing to raise morale.”

Such efforts include e-mails on Wednesday reminding people that they can almost see Friday, and other e-mails on Friday telling people to turn their computers off at 4:30, go home, and not think about work over the weekend, or even watch the news.

PeoplesBank conducted its annual Employee Fest this year, but it was decidedly different, with many of the activities carried out remotely.

Region-wide, morale-building efforts run the gamut from food and games to team-building exercises, either in person or the remote variety.

At PeoplesBank, the week-long event known as Employee Fest was staged as always, but it did look and feel different, said Roberts, noting that many activities were carried out remotely, with gifts delivered to all employees, whether they were working at the office, in one of the branches, or remotely.

At MBK, morale-building has been a year-long priority, said Sarah Rose Stack, Marketing & Recruiting manager, adding that it comes in several forms, from so-called social-media holidays, where people post pictures of pets, children, or travel destinations; to the concert T-shirt day, flip-flops day, and alma-mater day; to food trucks, which have come on several occasions.

The company has traditionally done such things, and it has long had what’s been called the ‘Fun Committee,’ which arranged an axe-throwing competition and visit to a brewery last year, for example. This year, the activities are different, but there are more of them, with good reason.

“A lot of places are scaling back on these kinds of things for various reasons, and I don’t think it’s the time to do that,” she noted. “I think it’s time to put a little more gas on the fire because you don’t want to lose engagement or enthusiasm with your organization.”

Many of the initiatives at MBK and elsewhere fall into the broad category of connectivity, an important ingredient for success at any business, and something that’s been lacking due to the pandemic.

Monica Borgatti, chief operating officer for the Women’s Fund of Western Massachusetts, said the small staff of three full-time and three part-time employees has mostly been working remotely since March. That means no water-cooler talk — literally, anyway, she said, adding that the nonprofit has tried to incorporate those types of discussions into the regular Zoom meetings in an effort to help people connect in ways beyond what they’re doing for work every day.

“We always, always make sure to start those weekly meetings with a virtual water cooler,” she told BusinessWest. “Everyone takes turns sharing something, whether it’s an article they’ve come across over the past week or something personal — they got a new dog and they want to show off the pictures, or some household project that they’ve finally completed.

“We make sure to create time for that at all those staff meetings, so we’re connecting with each other as people and not just as co-workers,” she went on, adding that the agency also allows for very flexible schedules and encourages employees to stop and step away from their work when they need to, and not stare at a computer screen for hours on end.

At MBK, one of the partners, Jim Krupienski, stages a monthly check-in social, Stack said, during which the company has a cocktail hour of sorts where those working from home can join in remotely. “It’s just really to check in and talk about anything other than work,” she noted. “It’s a mental-health check-in with adult beverages.”

Scanning the landscape, Wise believes many companies are struggling in their efforts to maintain morale among their employees. It’s easier for a smaller business to undertake initiatives in this regard than those with several hundred employees, she noted, but most are trying to do something.

It might be a food truck or two coming to the parking lot — even sharing a large pizza box can be risky during a pandemic — or more communication from the C-suite, she said, adding that there is more ‘management by walking around’ in this environment, or at least there should be.

Meanwhile, employers are pushing people to take time off and providing more one-on-one employee counseling, duties now falling in many cases to human-resources professionals, especially at smaller companies that do not have employee-assistance programs.

“They’ve had to put on their social work, psychologist’s hat,” she noted. “And it’s not something that they’re used to. But some employees just need to vent; they’re saying, ‘I don’t know what to do or where to go.’”

Bottom Line

While no one really knows when the pandemic will subside and something approaching normal returns to the workplaces of Western Mass., what most business owners and managers do know is that their valued employees will need some help getting to that point.

At a time when most e-mail messages end with the message ‘stay safe and stay sane,’ or words to that effect, achieving those goals has been anything but easy.

Addressing this battle fatigue has become an important, and ongoing, assignment for many businesses, and the smart ones understand that the fight is far from over, and they need to keep finding ways to be attentive and creative — and even fun.

George O’Brien can be reached at [email protected]

“This is something that hits close to home for each individual; at the end of the day, it’s all about their jobs and our business functioning, and people are responsible for doing their part.”

“This is something that hits close to home for each individual; at the end of the day, it’s all about their jobs and our business functioning, and people are responsible for doing their part.”

The story is a familiar one by now: hospitals across the U.S., hammered by COVID-19, began directing resources toward fighting the pandemic last spring and curtailed elective and non-emergency procedures. Meanwhile, patients, even when sick, stayed away from medical practices out of fear of infection.

The story is a familiar one by now: hospitals across the U.S., hammered by COVID-19, began directing resources toward fighting the pandemic last spring and curtailed elective and non-emergency procedures. Meanwhile, patients, even when sick, stayed away from medical practices out of fear of infection.