Bank Branches Evolve to Meet 21st-century Needs

Not Business as Usual

PeoplesBank’s new Northampton branch models some of the latest innovations, from ‘green’ construction to two-way video in the drive-up lanes to iPad stations.

When innovations like online and mobile banking began to emerge, banking leaders pondered how they would impact the role of brick-and-mortar branches. Specifically, would customers simply have no need to stop by? The answer to that question, at least so far, has been a resounding no. However, that doesn’t mean branches should stop evolving, say area bank executives who have seen their institutions alter customer interaction in ways both big and small, aiming to provide a more high-tech, yet still highly personalized, experience.

When customers engage the drive-up tellers at PeoplesBank in Northampton, they’re communicating via a video screen. That in itself may not be innovative, but the bank is intrigued by what it could eventually lead to.

“We still have drive-up like a traditional bank, but we have two-way video,” said Stacy Sutton, senior vice president, retail administration. “It’s almost a stepping stone for a future technology — a remote teller. This would be the first step in that process. The customer is getting the personal touch by seeing a teller, but the teller is not necessarily there — they could be back at corporate headquarters in Holyoke, but serving customers here.”

Matthew Bannister, the bank’s vice president, corporate responsibility, compared the idea to how the NFL runs instant replay from one location in New York, with referees from multiple cities around the country communicating with that site.

“It would allow us to have longer branch hours and, from a staffing point of view, more tellers without having to spread them around the area,” he noted.

That’s just one way the bank is looking to the future, discussing concepts and testing out ideas in its customer innovation lab, ideas that may someday be instituted in the branches.

“Technology is always changing, and we’ve got to stay at the forefront of that,” Sutton said. “Of course, not everything we throw against the wall is going to stick or be the best thing for customers or the bank.”

In recent years, questions have arisen in the banking industry about the need for new branches, given the emergence of online and mobile services for customers. But the way PeoplesBank and others see it, branches may be evolving in how they’re designed and what the customer experience is like, but they’re not going away.

“Every customer survey we do says that branches are important to the customer,” Sutton said. “They feel that the brick-and-mortar presence is important. And we do find that they like to come in and see people, have that conversation. That’s why we’re making these offices more inviting places they’ll want to come and stay.”

For example, newer PeoplesBank branches have eliminated teller lines in favor of smaller teller ‘pods’ for a more personal touch. In addition, a quick look around the Northampton branch on King Street — the bank’s newest — reveals refreshment and coffee stands and iPad stations for customers to use, drawing on the facility’s Wi-Fi.

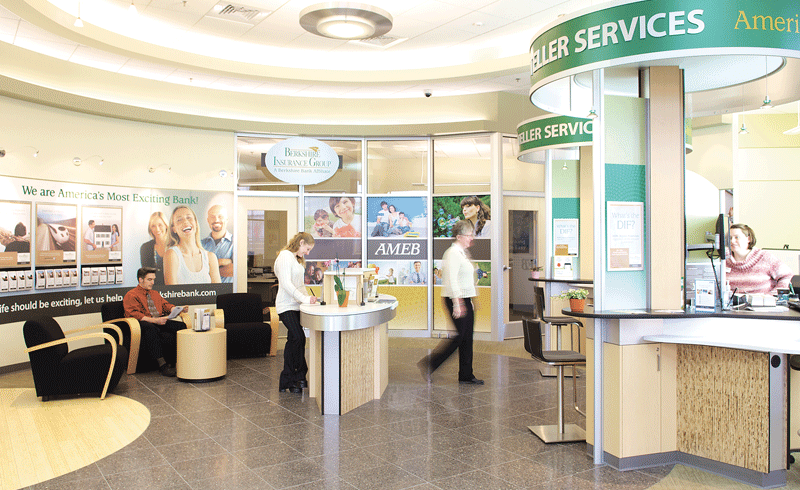

Berkshire Bank has adopted many modern branch-design elements, including teller pods to eliminate counters and lines.

Berkshire Bank has incorporated similar changes in its new branches, said Tami Gunsch, executive vice president, retail banking.

“We’ve enhanced our branch design over the past five years; the new design includes smaller square footage, which allows for a more-personalized experience, greater site-selection opportunities, and overall lower operating costs,” she noted, adding that kiosk-like pods allow customers and tellers to interact quickly without the physical barrier of a teller line. Also like at PeoplesBank, Berkshire customers take advantage of in-branch cafés for coffee and refreshments.

“We have seen the needs of our customers change, with the desire to bank when and where it is convenient for them,” Gunsch noted, explaining why it’s important to make branches more inviting spaces. “Customers want to take advantage of multiple channels to do their banking inclusive of online, mobile, ATM, and branch visits. Meeting their needs is an important component in driving the relationship.”

Checks and Balance

When Connecticut-based Farmington Bank moved into the Western Mass. market, it incorporated some of the same trends adopted by PeoplesBank and Berkshire Bank, including open floor plans and replacing counters and lines with personal bankers serving customers at pods. Its first two offices in the region opened in the fall in West Springfield and East Longmeadow.

Click HERE to view a PDF listing of Banks in Western Mass.

Ken Burns, executive vice president at Farmington, said it was important to get the branch design right because physical locations are critical to a bank’s growth, particularly one new to a region.

“We find that well over 80% of our customers believe branch location in proximity to their house or their work is important for them,” he told BusinessWest. “It’s well-documented that it is very difficult to compete and grow through a geographic area and get new accounts — unless you’re a national competitor with a huge marketing budget — without some sort of physical location, some physical proximity to where your customers are. A lot of statistics drive that; it’s not just a guess.”

That said, Sutton noted, the customer experience is changing as the industry moves to online banking, mobile banking, mobile check deposit, Apply Pay, and other innovations, and those factors are influencing branch design — for example, with the iPad stations.

“We wanted to do something different, and we did a lot of research and looked at a lot of national companies; Apple was one of them,” she said. “We went to the West Coast to see what they’re doing; we took ideas from everyone and have tried to incorporate them into PeoplesBank. We want to be innovative, to introduce new technology to customers, make it inviting to them; we want them to come visit PeoplesBank.”

One shift that has more to do with training than technology is the concept of ‘universal bankers,’ who are able to help customers with a range of tasks, from deposits to loan applications, as opposed to the traditional model, which separates those roles.

“Any one of the employees can help with anything; it doesn’t matter who the customer sees here,” Sutton said, noting that the new Northampton branch is modeling the idea, and other concepts, that will eventually move to other locations. “We hope to take elements of this building and incorporate them in other buildings, such as teller pods, two-way video, anything we see coming down the pike in the future. That is the plan.”

Berkshire Bank has begun to adopt the universal-banker model as well, Gunsch said, emphasizing the need for 21st-century branches to be both high-tech and high-touch.

“The new branch design has evolved to leverage new technology to enhance the customer’s experience in conjunction with our shift to staffing our branches with more universal-banker roles who can address any needs a customer may have, versus needing to deal with multiple team members,” she noted. “This maximizes teamwork through an efficient floor plan.”

Another shift in branch design is actually one being incorporated in myriad types of business — going ‘green’ to maximize energy efficiency and minimize environmental impact. In recent years, PeoplesBank has opened three offices certified by the national LEED (Leadership in Energy and Environmental Design) program.

Indoor and outdoor LEED elements at the King Street location include large windows allowing plenty of natural light, an energy-efficient HVAC system, carpeting and paint products that emit low levels of VOCs (volatile organic compounds), drought-resistant plantings, a rain garden directing water runoff back into the ground as opposed to drainage systems, and, car-charging stations free to anyone.

In addition, the bank built on an existing site instead of clearing trees from a new property, recycled 98% of all materials from demolishing the existing building, and brought in new building materials from within 500 miles. Other banks in the region have also targeted existing sites for new branches, such as Farmington Bank, which revitalized a landmark building in West Springfield once occupied by the West Springfield Trust Co.

Stacy Sutton says PeoplesBank’s customer innovation lab is always discussing ways to improve the customer experience.

For Peoples, the LEED efforts are part of its well-known environmentally conscious culture. “That’s a core value of PeoplesBank — to be sustainable and eco-friendly,” Sutton said. “It’s great for staff and customers who come into the building.”

She expects other banks to make similar efforts as time goes on, if only because building codes are moving toward green design as a baseline.

“We’ve had positive response to doing these offices,” she added. “I’m sure we’ll continue to ramp up, and we’ll see other people incorporate aspects of this type of building going forward.”

Earning and Learning

Finally, Sutton noted, some branch-design elements are aimed simply at making a bank a community meeting place of sorts. Moveable furniture in the Northampton branch allows the staff to conduct customer-education seminars on anything from first-time homebuying to financial strategies to, yes, environmental topics.

Similarly, Berkshire Bank has incorporated community rooms in many branch locations, available to be used for anything from PTA meetings to birthday parties to Little League sign-ups. “The community room is equipped with Wi-Fi, a large presentation monitor, a conference phone, and the newest gaming systems, all at no cost to the group,” Gunsch said. “This has been a differentiator in our local markets.”

It’s all part of efforts to get people into the branches, she noted.

“Customers have shifted away from being solely reliant on the branch to conducting their banking online. However, the majority of customers still visit a branch location at least monthly,” she told BusinessWest. “Person-to-person interaction remains important to the customer and the financial institution. We believe the branch still matters; we just needed to redefine the branch experience.”

Joseph Bednar can be reached at [email protected]