Year-end Tax Planning

By Kristina Drzal Houghton, CPA, MST

As another tumultuous year draws to a close, both individuals and small-business owners are advised to assess their current tax situation, with an eye on maximizing available tax breaks and avoiding potential tax pitfalls. Planning should be based on the latest laws of the land.

Just look at the significant legislation enacted in recent years. Following the massive Tax Cuts and Jobs Act (TCJA) of 2017, the Coronavirus Aid, Relief, and Economic Security (CARES) Act addressed various pandemic-related issues in 2020. In quick succession, the Consolidated Appropriations Act (CAA) extended certain CARES Act provisions and modified others, while the American Rescue Plan Act (ARPA) created even more tax-saving opportunities in 2021.

This series of new laws culminated in the Inflation Reduction Act (the IRA), passed in August 2022. The IRA, which is generally effective next year, includes several provisions that could have a big tax impact on individuals and business entities.

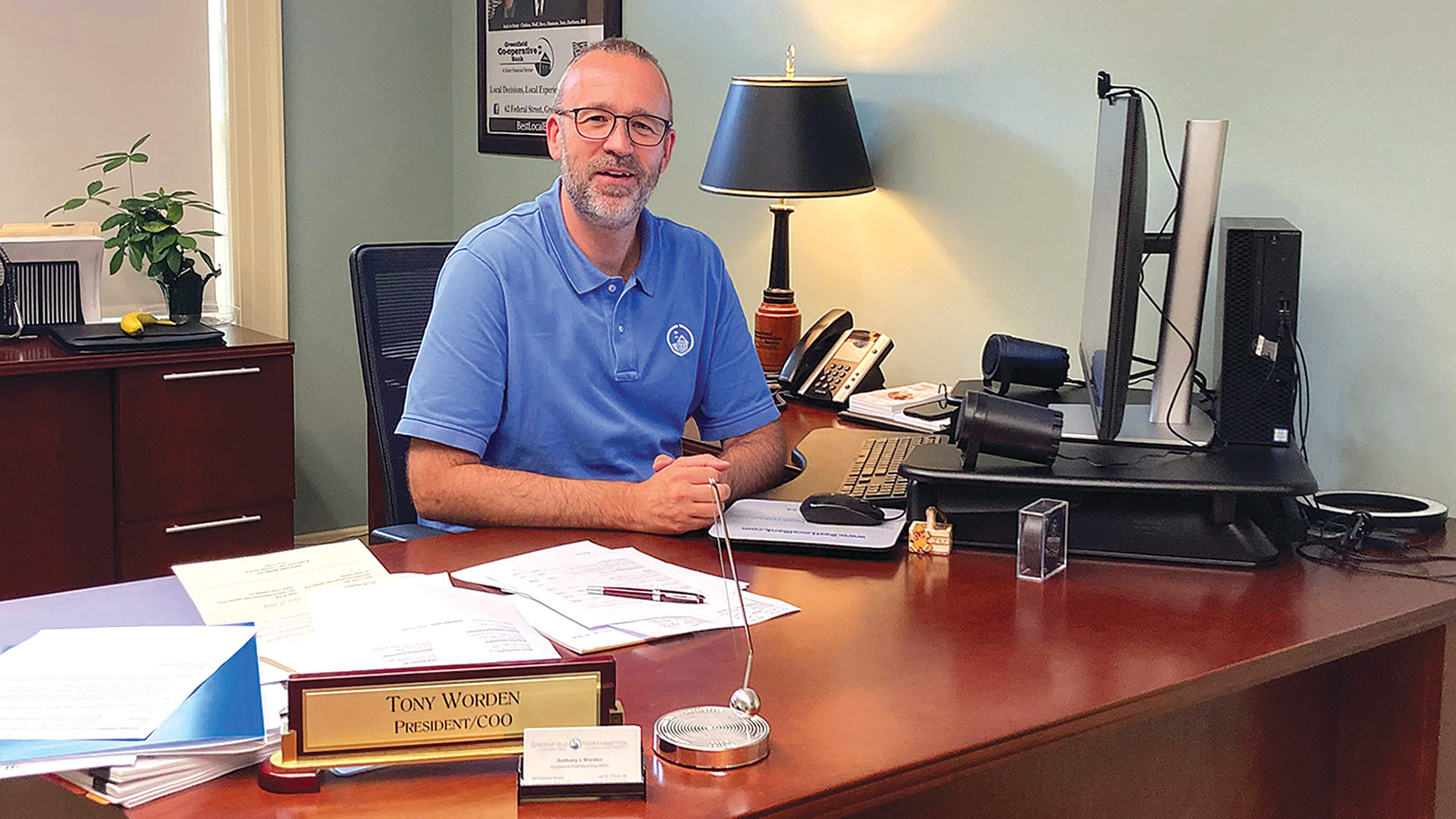

Kristina Drzal Houghton

“We still might not be done. More proposed legislation has been introduced in Congress. If another new law featuring tax provisions is enacted before 2023, it may require you to revise your year-end tax-planning strategies.”

And we still might not be done. More proposed legislation has been introduced in Congress. If another new law featuring tax provisions is enacted before 2023, it may require you to revise your year-end tax-planning strategies.

BUSINESS TAX PLANNING

Depreciation-based Deductions

As we head into year-end, a business may benefit from one or more of three depreciation-based tax breaks: the Section 179 deduction; first-year ‘bonus’ depreciation; and regular depreciation. In consideration of this, consider the following:

Place qualified property in service before the end of the year. If your business does not start using the property before 2023, it is not eligible for these tax breaks.

Section 179 deduction: under Section 179 of the tax code, a business may ‘expense’ (i.e., currently deduct) the cost of qualified property placed in service any time during the year. The maximum annual deduction for 2022 is $1.08 million and is phased out on a dollar-for-dollar basis when total additions exceed $2.7 million. Be aware that the Section 179 deduction cannot exceed the taxable income. This could limit your deduction for 2022.

First-year bonus depreciation: the TCJA authorized a 100% first-year bonus depreciation deduction through 2022. This includes used, as well as new, property. Be aware that most states do not allow this special bonus depreciation.

Regular depreciation: if any remaining acquisition cost remains, the balance may be deducted over time under the Modified Accelerated Cost Recovery System (MACRS).

If you buy a heavy-duty SUV or van for business, you may claim a first-year Section 179 deduction of up to $25,000. The ‘luxury car’ limits do not apply to certain heavy-duty vehicles.

The first-year bonus depreciation deduction is scheduled to phase out over five years, beginning in 2023. Take full advantage while you can.

Business Meals

Previously, a business could deduct 50% of the cost of its qualified business entertainment expenses. However, the deduction for entertainment costs, including strictly social meals, was eliminated by the TCJA beginning in 2018.

The ARPA doubles the usual 50% deduction for allowable meals to 100% for food and beverages provided by restaurants in 2021 and 2022. This tax break is not expected to be extended.

Business Repairs

As more remote workers return to your regular workplace, the business may need to fix up the place. While expenses spent on making repairs are currently deductible, the cost of improvements to business property must be capitalized.

When appropriate, complete minor repairs before the end of the year. The deductions can offset taxable income in 2022.

As a rule of thumb, a repair keeps property in efficient operating condition, while an improvement prolongs the life of the property, enhances its value, or adapts it to a different use. For example, fixing a broken window is a repair, but the addition of a new wing to a business building is treated as an improvement.

State Income Taxes

Many states, including Massachusetts, have enacted so-called ‘work-arounds’ whereby flow-through entities such as Subchapter S corporations and partnerships can elect to pay the state tax at the entity level on behalf of the shareholders. The benefit comes from reduced federal taxable income flowing to the shareholder, which serves to circumvent the $10,000 cap for state and local taxes when calculating itemized deduction, which is discussed later. Most states do not give a dollar-for-dollar credit for the tax paid by the entity, but the federal tax benefit is typically larger than the reduced state credit.

The actual benefit will vary for each shareholder or parter and should be reviewed to determine the actual savings. If deemed to be beneficial, don’t miss any deadlines for electing to pay these taxes.

Miscellaneous

Stock up on routine supplies (especially if they are in high demand). If you buy the supplies in 2022, they are deductible in 2022 — even if they are not used until 2023.

If you accrue in 2022 but pay year-end bonuses to employees in 2023, the amounts are generally deductible by an accrual-basis company in 2022 and taxable to the employees in 2023. A calendar-year company operating on the accrual basis may be able to deduct bonuses paid as late as March 15, 2023 on its 2022 return.

Keep records of collection efforts (e.g., phone calls, emails, and dunning letters) to prove debts are worthless. This may allow you to claim a bad-debt deduction.

INDIVIDUAL TAX PLANNING

Itemized Deductions

Due to several related provisions in the TCJA, generally effective for 2018 through 2025, more individuals are claiming the standard deduction in lieu of itemizing deductions.

Make a quick analysis of your situation. Depending on the results, you may decide to accelerate certain expenses into 2022 or postpone them to 2023.

For instance, you may want to ‘bunch’ charitable donations in a year you expect to itemize deductions. (There is more on charitable deductions below.) Similarly, you might reschedule physician or dentist visits to provide the maximum medical deduction. The deduction for those expenses is limited to the excess above 7.5% of your adjusted gross income (AGI). If you do not have a reasonable shot at deducting medical and dental expenses in 2022, you might as well postpone non-emergency expenses to 2023.

Note that the TCJA made other significant changes to itemized deductions. This includes a $10,000 annual cap on deductions for state and local tax (SALT) payments and suspension of the deduction for casualty and theft losses (except for qualified disaster-area losses). Since a repeal or modification of this cap is unlikely for 2022, wait to pay state estimates or real-estate taxes until January 2023 if they are not due in December.

The standard deduction for 2022 is generally $12,950 for single filers and $25,900 for joint filers.

Charitable Donations

If you still expect to itemize deductions in 2022, you may benefit from contributions to qualified charitable organizations made within generous tax-law limits.

Consider stepping up your charitable gift giving at year-end. As long as you make a donation in 2022, it is deductible on your 2022 return, even if you charge the donation by credit card as late as Dec. 31.

Note that the deduction limit for monetary contributions was increased to 100% of AGI for 2021, but the limit reverted to 60% of AGI for 2022. Nevertheless, this still provides plenty of flexibility for most taxpayers. Any excess may be carried over for up to five years.

Furthermore, if you donate appreciated property held longer than one year (i.e., it would qualify for long-term capital-gain treatment if sold), you can generally deduct an amount equal to the property’s fair market value (FMV). But the deduction for short-term capital-gain property is limited to your initial cost. Your annual deduction for property donations generally cannot exceed 30% of your AGI. As with monetary contributions, any excess may be carried over for up to five years.

The CARES Act established a maximum deduction of $300 for charitable donations by non-itemizers in 2020. The special deduction was then extended to 2021 and doubled to $600 for joint filers. As of this writing, this tax break is not available in 2022.

Electric Vehicle Credits

The IRA greenlights tax credits for purchasing electric vehicles and plug-in hybrids over the next few years. But certain taxpayers will not qualify. Map out your plans accordingly.

Notably, the IRA includes the following changes:

The credit cannot be claimed by a single filer with a modified adjusted gross income (MAGI) above $150,000 or an MAGI of $300,000 for joint filers.

The credit is not available for most passenger vehicles that cost more than $55,000, or $80,000 for vans, sports utility vehicles, and pickup trucks.

The vehicle must be powered by batteries whose materials are sourced from the U.S. or its free-trade partners and must be assembled in North America.

The current threshold of 200,000 vehicles sold by a manufacturer is eliminated.

In addition, the IRA authorizes a credit of up to $4,000 for used vehicles if you are a single filer with an MAGI of no more than $75,000, or $150,000 for joint filers.

Residential Energy Credits

The IRA generally enhances the residential energy credits that are currently available to homeowners. Under the new law, you may benefit from two types of residential energy credits:

1. The 30% ‘residential clean-energy credit’ can generally be claimed for installing solar panels or other equipment to harness renewable energy like wind, geothermal energy, and biomass fuel. This credit, which was scheduled to phase out and end after 2023, is preserved at 30% from 2022 through 2032 before phasing out.

2. The 30% ‘non-business energy property credit’ can generally be claimed for up to $1,200 of the cost of installing energy-efficient exterior windows, skylights, exterior doors, water heaters, and other qualified items through 2032 before phasing out. For 2022, the credit remains at 10% with a maximum of $500.

Miscellaneous

Pay a child’s college tuition for the upcoming semester. The amount paid in 2022 may qualify for one of two higher education credits, subject to phaseouts based on your MAGI.

Avoid an estimated tax penalty by qualifying for a safe-harbor exception. Generally, a penalty will not be imposed if you pay 90% of your current year’s tax liability or 100% of your prior year’s tax liability (110% if your AGI exceeded $150,000).

Minimize the kiddie-tax problem by having your child invest in tax-deferred or tax-exempt securities. For 2022, unearned income above $2,300 that is received by a dependent child under age 19 (or under age 24 if a full-time student) is taxed at the top tax rate of the parents.

Empty out flexible spending accounts (FSAs) for healthcare or dependent-care expenses if you will forfeit unused funds under the ‘use-it-or-lose it’ rule. However, your employer’s plan may provide a carryover to 2023 or a two-and-a-half-month grace period.

Make home improvements that qualify for mortgage-interest deductions as acquisition debt. This includes loans made to substantially improve your principal residence or one other home. Note that the TCJA suspended deductions for home-equity debt for 2018 through 2025.

If you own property damaged in a federal disaster area in 2022, you may qualify for quick casualty loss relief by filing an amended 2021 return. The TCJA suspended the deduction for casualty losses for 2018 through 2025, but retained a current deduction for disaster-area losses.

FINANCIAL TAX PLANNING

Capital Gains and Losses

Frequently, investors ‘time’ sales of assets like securities at year-end to produce optimal tax results. It is important to understand the basic tax rules.

For starters, capital gains and losses offset each other. If you show an excess loss for the year, it offsets up to $3,000 of ordinary income before being carried over to the next year. Long-term capital gains from sales of securities owned longer than one year are taxed at a maximum rate of 15% or 20% for certain high-income investors. Conversely, short-term capital gains are taxed at ordinary income rates reaching as high as 37% in 2022.

Review your investment portfolio. If it makes sense, you may harvest capital losses to offset gains realized earlier in the year or cherry-pick capital gains that will be partially or wholly absorbed by prior losses.

Net Investment Income Tax

Investors should account for the 3.8% tax that applies to the lesser of net investment income (NII) or the amount by which MAGI for the year exceeds $200,000 for single filers or $250,000 for joint filers. The definition of NII includes interest, dividends, capital gains, and income from passive activities, but not Social Security benefits, tax-exempt interest, and distributions from qualified retirement plans and IRAs.

Make an estimate of your potential liability for 2022. Depending on the results, you may be able to reduce the tax on NII or avoid it altogether.

Required Minimum Distributions

As a general rule, you must receive required minimum distributions (RMDs) from qualified retirement plans and IRAs after reaching age 72 (recently raised from age 70½). The amount of the distribution is based on IRS life-expectancy tables and your account balance at the end of last year.

Arrange to receive RMDs before Dec. 31. Otherwise, you will have to pay a stiff tax penalty equal to 50% of the required amount (less any amount you have received) in addition to your regular tax liability.

Do not procrastinate if you have not arranged RMDs for 2022 yet. It may take some time for your financial institution to accommodate these transactions.

Conversely, if you are still working and do not own 5% or more of the business employing you, you can postpone RMDs from an employer’s qualified plan until your retirement. This ‘still working exception’ does not apply to RMDs from IRAs or qualified plans of employers for whom you no longer work.

Installment Sales

Normally, when you sell real estate at a gain, you must pay tax on the full amount of the capital gain in the year of the sale.

If you sell it under an arrangement qualifying as an installment sale, the taxable portion of each payment is based on the gross profit ratio, which is determined by dividing the gross profit from the real-estate sale by the price.

Not only does the installment sale technique defer some of the tax due on a real estate deal, it will often reduce your overall tax liability if you are a high-income taxpayer. That is because, by spreading out the taxable gain over several years, you may pay tax on a greater portion of the gain at the 15% capital-gain rate as opposed to the 20% rate.

If it suits your purposes (e.g., you have a low tax year), you may ‘elect out’ of installment sale treatment when you file your return.

Estate and Gift Taxes

During the last decade, the unified estate- and gift-tax exclusion has gradually increased, while the top estate rate has not budged. For example, the exclusion for 2022 is $12.06 million, the highest it has ever been. (It is scheduled to revert to $5 million, plus inflation indexing, in 2026.)

In addition, you can give gifts to family members that qualify for the annual gift-tax exclusion. For 2022, there is no gift-tax liability on gifts of up to $16,000 per recipient (up from $15,000 in 2021). The limit is $32,000 for a joint gift by a married couple.

You may ‘double up’ by giving gifts in both December and January that qualify for the annual gift-tax exclusion for 2022 and 2023, respectively. The IRS recently announced that the limit for 2023 is $17,000 per recipient.

Miscellaneous

Watch out for the ‘wash sale’ rule that disallows losses from a securities sale if you reacquire substantially identical securities within 30 days. Wait at least 31 days to buy them back.

Contribute up to $20,500 to a 401(k) in 2022 ($27,000 if you are age 50 or older). If you clear the 2022 Social Security wage base of $147,000 and promptly allocate the payroll-tax savings to a 401(k), you can increase your deferral without any further reduction in your take-home pay.

Weigh the benefits of a Roth IRA conversion, especially if this will be a low-tax year. Although the conversion is subject to current tax, you generally can receive tax-free distributions in retirement, unlike taxable distributions from a traditional IRA.

Skip this year’s RMD if you recently inherited an IRA and are required to empty out the account within 10 years. Under new IRS guidance, there is no penalty if you fail to take RMDs for 2021 or 2022. The IRS will issue final regulations soon.

If you rent out your vacation home, keep your personal use within the tax-law boundaries. No loss is allowed if personal use exceeds 14 days or 10% of the rental period.

Consider a qualified charitable distribution (QCD). If you are age 70½ or older, you can transfer up to $100,000 of IRA funds directly to a charity. Although the contribution is not deductible, the QCD is exempt from tax. This may improve your overall tax picture.

Conclusion

This year-end tax-planning article is based on the prevailing federal tax laws, rules, and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

Finally, remember that these ideas are intended to serve only as a general guideline. Your personal circumstances will likely require careful examination. Consult with your tax adviser.

Kristina Drzal Houghton, CPA, MST is a partner at the Holyoke-based accounting firm Meyers Brothers Kalicka, P.C.; (413) 536-8510.