Living the Dream

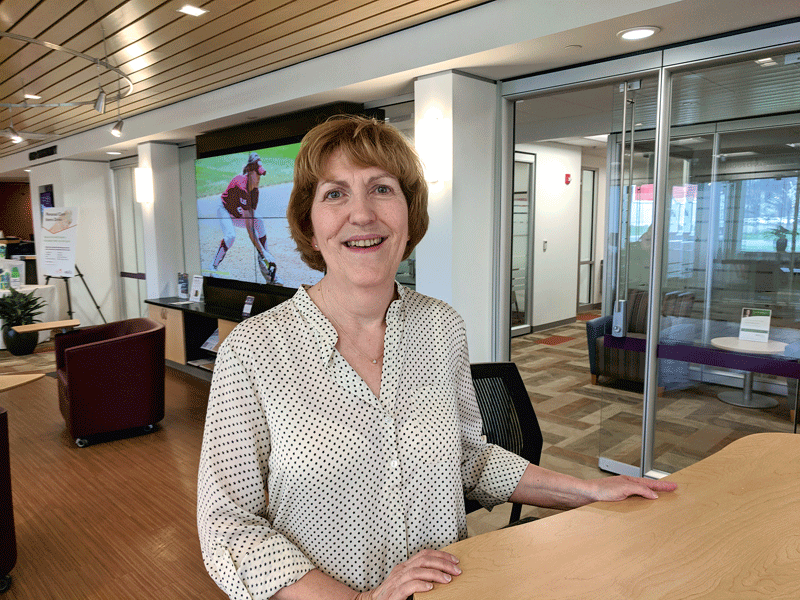

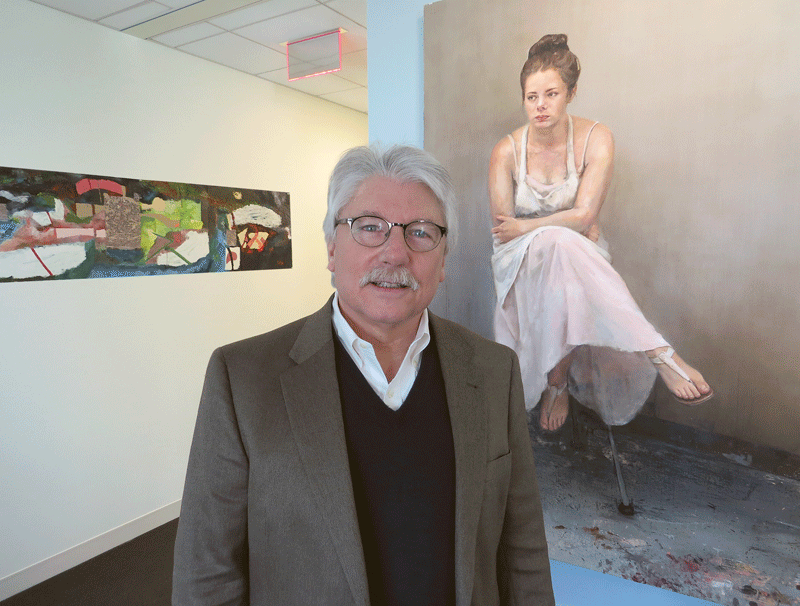

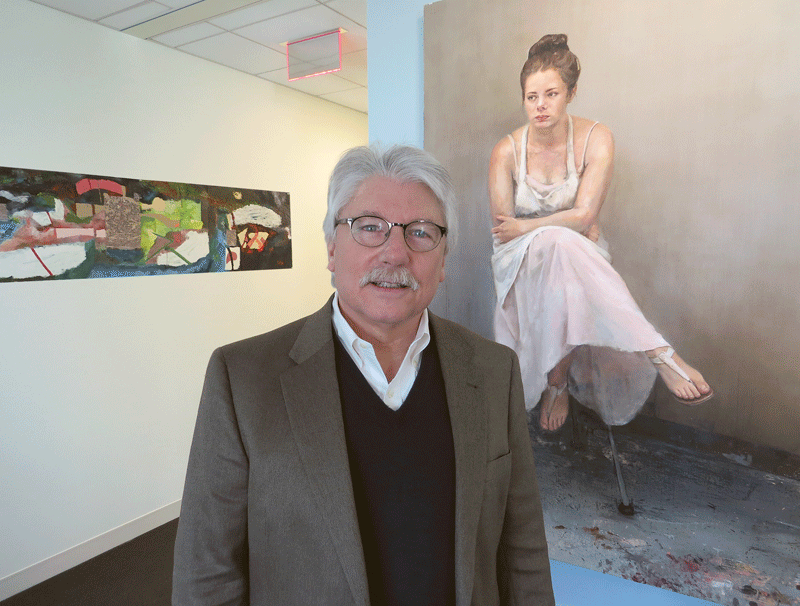

Seen here with two of many works of art created by GCC students and faculty, Bob Pura says he knew early on that he wanted to make the community-college mission his career.

Bob Pura couldn’t help but laugh and shake his head as he talked about it. And that’s because the whole idea of it was so, well, foreign to him — in every way.

He and his wife will be flying into Edinburgh, Scotland in July to visit their daughter, who’s studying there. “And we bought one-way tickets,” he said, uttering those last three words slowly for emphasis and in a voice that conveyed as much as three exclamation points.

“We might stay a week, we might stay two … we don’t know,” said Pura, president of Greenfield Community College (GCC) since 2000, adding that this is one of the many perks of a retirement that will start in two months — and a radical departure from a 40-year career marked by crammed calendars, countless appointments, and rigid schedules.

And something else as well — extreme devotion to the community-college mission.

In fact, you might say Pura bought the equivalent of a one-way ticket to a career in the community-college realm back in 1980 when he came to the Bay State and took a job on the Massachusetts Board of Regional Community Colleges.

By the time he was working toward his doctorate in educational administration at the University of Texas in Austin a dozen years later (a setting chosen specifically because of its commitment to work in the community-college domain) he was, as they say at that school, hooked.

“I knew by then that this is what I wanted to do for the rest of my career — the community-college mission,” he told BusinessWest. “That mission about opening your doors to everyone and holding our high standards is a noble mission, and people who are part of the community-college movement feel a special passion for social and economic mobility.

“It’s a bit of a cliché, but it still brings great meaning to many of us —that American dream where someone can start without much of a background and still have an opportunity to create a better life for themselves and their families,” he went on. “It’s part of what motivates us every day.”

Pura said his passion for the community-college mission stems in large part from the fact that he is a product of that system. In fact, he calls himself the “classic community-college poster child of the Baby Boom age.”

“My father was an immigrant; he never graduated from high school — worked in a deli his whole life,” Pura told BusinessWest, adding that he was the first in his family to attend college — Miami Dade Community College in Miami, to be more specific.

It was, in large part, the only door open to him at the time, he went on, and once through it, he created a host of career options and paths to follow.

It started by going through that door, he said, adding that, for millions of people across the country, it’s the same today. But aside from opening doors for students, community colleges play a huge role in their respective communities, he said, listing everything from workforce-development initiatives to simply being one of the area’s largest employers. And in Franklin County, it goes well beyond that, to a realm that couldn’t be appreciated anywhere else in the state.

Indeed, as he talked with BusinessWest during spring break, Pura, asked about a parking lot half-full of cars, replied that students and other members of the community were on campus simply because they can’t get Internet access at home.

“So much of our West County still doesn’t have service,” he said matter-of-factly, referring to communities such as Heath, Rowe, and Conway. “You can’t get connectivity up there, so people come here more. It’s a serious challenge to the economic and social development of the area; it’s hard to get young families to move here if they can’t have high-speed Internet access.”

“Community colleges have a most significant impact on the communities they serve,” he explained while putting that aforementioned mission, and his career, into some proper perspective. “A long time ago, a college friend of mine said that if Amherst or Williams College were to close, those students would find somewhere else to go. If a community college were to close…”

He didn’t give a full answer to that question because he didn’t have to. And in retrospect, he’s spent his whole career reminding people of the answer.

For this edition and its focus on Franklin County, BusinessWest talked at length with Pura as he winds down that career. There were many talking points, including GCC and its ever-widening role, the community-college mission, and, yes, that one-way ticket he bought. Actually, both of them.

Class Act

The unknown student might have been born almost 30 years after they broke up, but he or she obviously knows the Beatles and their song lyrics.

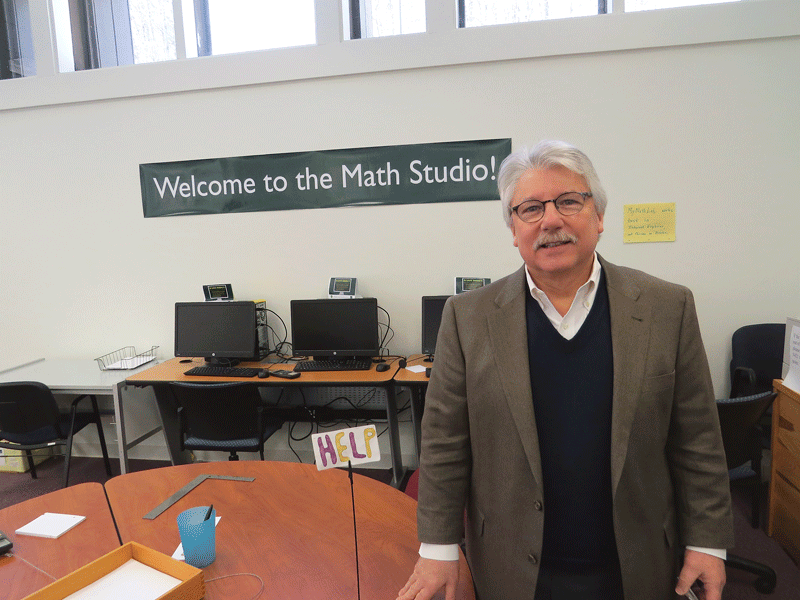

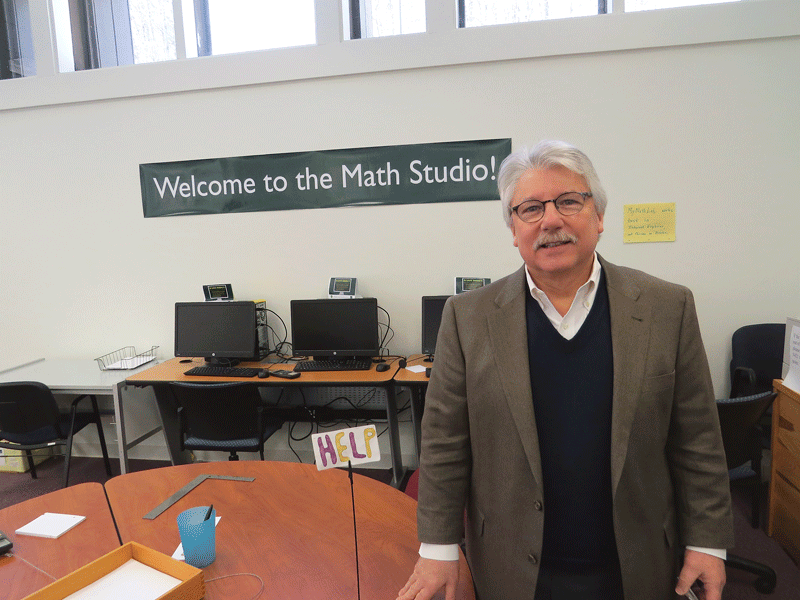

“Help! I need somebody,” it said on one side of the card positioned on a stand sitting on a table in GCC’s Math Studio, with “Help! Not just anybody” on the other side.

That message was eventually seen by one of the math professors at GCC — not just anybody — and help was administered, said Pura, adding that this was just the scenario that was envisioned when this studio (actually the second such facility at the college) was created several years ago.

“This is a unique learning environment,” said Pura as he stopped at the studio during an extensive tour of GCC’s facilities, noting that the studio model, envisioned by the math faculty, creates a learning area surrounded by faculty offices.

Bob Pura says the learning studios at GCC are symbolic of broader efforts at the institution to build community and come together to solve problems.

“Those faculty members said, ‘we want to have our math students with us, with our offices right around that room, so we can check in on them,’” he explained. “They embraced their commitment to having students close to them; the students didn’t have to make appointments or wait two weeks — the faculty were right there. And then the Business Department said, ‘hey, we want one of those,’ and then the sciences, and on it went.”

The college now has studios all throughout the campus, said Pura, adding that these facilities have become symbols of the community-building work that has more or less defined his administration at GCC (more on that later).

First, Pura likes to tell the story about how a group of students were enjoying their time at the Math Studio so much, they didn’t want to leave — and didn’t — prompting security to call the president’s office and request instructions on what to do.

“I got the call at 5 o’clock on a Friday night — and no president wants to get a call from security at 5 o’clock on Friday night,” he recalled. “They said students in the studio don’t want to leave; they have a math test on Monday, and they just ordered a pizza. I said, ‘that’s exactly the kind of problem we want.’”

Pura has a large collection of stories amassed from more than four decades of work in higher education, all of it in Massachusetts.

But our story, as noted earlier, begins in Florida. After graduating from Miami Dade Community College, he transferred to the University of South Florida in Tampa, where he earned a bachelor’s degree in psychology in 1973. Four years later, he would add a master’s in human resources administration at St. Thomas University in Miami.

As he contemplated where to pursue a career in higher education, he applied some logic to the process.

“If you’re in theater, you go to Broadway; if you’re in movies, you go to Hollywood,” he explained. “If you want to be in higher ed, you go to Massachusetts.”

He did, starting in 1978 at the Massachusetts Board of Regional Community Colleges as program coordinator of something called Title XX. Based in Boston, he worked with all 15 community colleges. Later, he joined one of them, Massasoit Community College in Brockton, as chair of the Division of Career Studies, and over the next 14 years, he worked his way up to chair of the Health and Human Services Division and then assistant dean of Academic Affairs.

In the summer of 1995, he became dean of Academic Affairs at Berkshire Community College in Pittsfield and served in that capacity for five years, until he was urged to apply for the position of interim president at GCC. He did, and he prevailed in that search and later earned the job on a permanent basis.

Over the past 18 years, he’s presided over a number of impressive changes to the campus infrastructure, while broadening its already considerable role within the community.

A major expansion of the core building roughly a decade ago, which includes a new dining commons, a new library, considerably more glass (and, therefore, natural light), and works of art created by students and faculty on every wall (the school is renowned for its art programs), is a very visible transformation, he said.

But he put things in perspective, while also bringing the discussion back to where he likes it — the community-college mission — by saying, “we finally have a building that matches the excellence of our faculty and staff.

“The values of the institution are found in the design of the building,” he went on. “We had great architects to work with, and they listened, but it was all about the values of the institution.”

School of Thought

And this brings Pura back to those studios he mentioned and the community mindset they symbolize.

“There’s a clarity of focus on relationships and community here,” he explained, referring to the studios but also the college as a whole. “And when relationships are powerful and community is powerful and people know they belong somewhere, then learning is powerful.

“The transformative nature of higher education is at its best in that environment,” he went on. “And we’ve been able to crystalize that here; it’s always been part of the core, but we were able to really make it an explicit part of our commitment.”

Continuing with that theme of the studio as a microcosm of what goes on at GCC, he said students in them work together in teams, helping each other work through problems.

“They realize they’re not alone in their learning,” he explained. “And so, when you think about that, it reinforces what will happen when they leave the higher-ed environment; they’re going to go into a work environment where they’re going to work with others in teams and solve problems.”

The progress GCC has made in this regard — in building community and forging relationships within the campus and across the region it serves — bodes well for the school and the president who will succeed him, said Pura. But there are some considerable challenges ahead — for that school, all the community colleges, and public higher education itself, he went on.

Most of these challenges involve resources, he continued, adding that all public schools suffer as the state’s commitment to public higher education wanes, but especially the smaller ones like GCC.

“The struggle is to maintain the kinds of services that are needed for each student,” he explained. “Right now, the strength of the college is that we still have the capacity — and the passion — to form-fit education around each individual; we don’t believe that one size fits all.

“Somewhere along the line I heard that getting an education at GCC is like getting a suit from a tailor and not one off the rack, and I think that’s a special privilege that comes from a small school,” he went on, adding that maintaining this type of custom-tailored education will become ever more challenging in the future, especially as the state continues to shift the cost of public education to students and their families.

As for community colleges as a whole and that mission he embraced 40 years ago, Pura said these institutions have certainly found their place in higher education today. The assignment moving forward is to build on the momentum that has built and make community colleges an attractive option not only to first-generation college students, but second- and third-generation students as well, especially as the cost of higher education continues to soar.

To get his point across, he went back 45 years to when he was a community-college student, a situation that gave him an opportunity to “explore,” as he put it, while trying to chart a path.

“When you’re paying $70,000 a year for a bachelor’s degree, it’s hard to explore,” he said. “At $5,000 or $6,000 a year, you have a lot more breathing space.”

Overall, he’s more than content with how community colleges have registered gains when it comes to overall acceptance and their role within society and the economy. And he’s proud to be a part of it.

“We’ve been accepted in the higher-ed landscape,” he told BusinessWest. “We have a seat at table; great gains have been made over the years, and the future of work is going to be honed and shaped by good conversations at community colleges in consult with the employers in their communities.

“We’ve come a long way,” he said in conclusion. “But there’s more work to be done, because, in many ways, the associate’s degree has become the new entry level into society and work; 12 years and a high school is not enough to develop the kinds of skills needed to succeed given the way society has changed and technology has changed.”

Plane Speaking

As he was wrapping up his tour, Pura noted that, while he has only a few months left at the helm at GCC, his talk with BusinessWest amounted to his first real exercise in reflection upon his career.

“I haven’t given myself the opportunity to look back much — there’s still too much to look forward to,” he said. “But it’s been a privilege to be part of that mission — a real privilege.”

With that, he noted that, despite their differences in education and career paths, he shares something very important with his father — love for their respective chosen fields.

“I have a picture of my dad — one picture of him on our wall,” he said. “It’s a picture of him at work with five salamis in his arms behind the counter, and the most natural, wonderful smile on his face. The man was happy. So I tell students at orientation that I’m going to look for that smile — that authentic, real, ‘I’m happy, I’ve found what I want to do’ smile.”

Pura’s been wearing one of those for about 40 years now, ever since he bought his first one-way ticket — the one to a career fulfilling the community-college mission.

George O’Brien can be reached at [email protected]

“What’s my phone book? What’s the thing in my business that is still antiquated and should have been replaced by now?”

“What’s my phone book? What’s the thing in my business that is still antiquated and should have been replaced by now?”

The design trend known broadly as home automation comes in many forms, from a command to Amazon’s Alexa to turn off the lights to a smartphone app that controls door locks and room temperature — and a dozen other functions — from across the country. This technology is attractive, says one local expert, because it solves problems in a very individualized way — and people like technology that makes their lives easier.

The design trend known broadly as home automation comes in many forms, from a command to Amazon’s Alexa to turn off the lights to a smartphone app that controls door locks and room temperature — and a dozen other functions — from across the country. This technology is attractive, says one local expert, because it solves problems in a very individualized way — and people like technology that makes their lives easier.

As its name notes, You Need a Budget, or YNAB, “makes no bones about the fact you need to manage your money rather than the other way around,” according to PC World, noting that the popular program, which started life more than a decade ago as manual-input desktop software, is now a subscription-based web app that can sync with users’ financial accounts.

As its name notes, You Need a Budget, or YNAB, “makes no bones about the fact you need to manage your money rather than the other way around,” according to PC World, noting that the popular program, which started life more than a decade ago as manual-input desktop software, is now a subscription-based web app that can sync with users’ financial accounts. For people who find it difficult to track their expenses while trying to reach their savings goals, Wally might be able to help, by giving users a total view of their finances.

For people who find it difficult to track their expenses while trying to reach their savings goals, Wally might be able to help, by giving users a total view of their finances. Finally, Acorns is modernizing the old-school practice of saving loose change, rounding up the user’s purchases on linked credit or debit cards, then sweeping the change into a computer-managed investment portfolio.

Finally, Acorns is modernizing the old-school practice of saving loose change, rounding up the user’s purchases on linked credit or debit cards, then sweeping the change into a computer-managed investment portfolio. One of the most popular nutrition apps is MyFitnessPal, which offers a wealth of tools for tracking what and how much the user eats, and how many calories they burn through activity, explains PC Magazine. “Of all the calorie counters I’ve used, MyFitnessPal is by far the easiest one to manage, and it comes with the largest database of foods and drinks. With the MyFitnessPal app, you can fastidiously watch what you eat 24/7, no matter where you are.”

One of the most popular nutrition apps is MyFitnessPal, which offers a wealth of tools for tracking what and how much the user eats, and how many calories they burn through activity, explains PC Magazine. “Of all the calorie counters I’ve used, MyFitnessPal is by far the easiest one to manage, and it comes with the largest database of foods and drinks. With the MyFitnessPal app, you can fastidiously watch what you eat 24/7, no matter where you are.” Seven-minute workout challenges have become popular for their ease of use, and the 7 Minute Fitness Challenge app is among the more popular apps promoting this activity.

Seven-minute workout challenges have become popular for their ease of use, and the 7 Minute Fitness Challenge app is among the more popular apps promoting this activity. Strong offers many features found in scores of other apps — creating custom routines, logging workouts, and tracking weight over time — but does some things that are particularly useful, according to the Verge.

Strong offers many features found in scores of other apps — creating custom routines, logging workouts, and tracking weight over time — but does some things that are particularly useful, according to the Verge. What about emotional wellness? There are plenty of meditation apps available for that. For example, “the moment you open the Calm app, you might feel a sense of … calm. Relaxing sounds of falling rain play automatically in the background, but you could also opt to be greeted by a crackling fireplace, crickets, or something called ‘celestial white noise,’” according to Mindful.

What about emotional wellness? There are plenty of meditation apps available for that. For example, “the moment you open the Calm app, you might feel a sense of … calm. Relaxing sounds of falling rain play automatically in the background, but you could also opt to be greeted by a crackling fireplace, crickets, or something called ‘celestial white noise,’” according to Mindful. Meanwhile, Brainscape promises to help students learn more effective ways to study with their classmates, while helping teachers track and create better study habits for students. “This app is a very effective way of using and creating flashcards in a digital manner,” Education World notes. “It’s not much different in terms of creating flashcards and learning from them; however, one cool feature is the ability to set up study reminders, which slightly deters you from procrastination.”

Meanwhile, Brainscape promises to help students learn more effective ways to study with their classmates, while helping teachers track and create better study habits for students. “This app is a very effective way of using and creating flashcards in a digital manner,” Education World notes. “It’s not much different in terms of creating flashcards and learning from them; however, one cool feature is the ability to set up study reminders, which slightly deters you from procrastination.” For older students and adults, The Great Courses is one of the more venerable services out there, created by the Teaching Company during the 1990s with the goal of gathering educational lectures on a video format.

For older students and adults, The Great Courses is one of the more venerable services out there, created by the Teaching Company during the 1990s with the goal of gathering educational lectures on a video format.