Lines of Defense

Insurance Is Personal — and Business, Too — at Moulton

By CLARK HOWELL

It has been exactly four years since tornadoes struck Western Mass. on June 1, 2011, an event that insurance agents remember well.

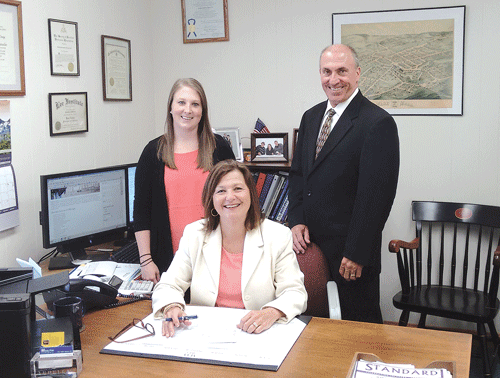

Cindy Moulton St. George (center), daughter Katie Gagner, and husband Roy St. George represent the second and third generations of this family business.

“We had gotten authority from our companies,” Moulton St. George said, “and they would refund our accounts. And we would just go and write checks … because people had nothing.”

She added that some people victimized by the twisters had everything “sucked right out of their house — if their house was even there.”

Katie Gagner, who manages the company’s Belchertown office — Moulton has additional offices in Palmer and Ware — added that “it was crazy” in those hectic first days of writing checks and consoling clients and residents after the disaster.

As a third-generation family business launched by Moulton St. George’s father in 1952 (Vice President Roy St. George is her husband, and Gagner is their daughter), they say they understand the needs of both families and businesses — a commitment put to the test by the tornadoes, but one in play every day.

“We are an advocate for our clients,” Moulton St. George said, adding that the image of agents sitting behind a desk is inaccurate, and that getting out into the community — though usually not scrambling over tree branches — is every bit as important as doing the paperwork of a claim.

Moulton St. George said it’s that personal connection to the community that sets independent agents apart from the large, national direct sellers of insurance.

For example, she went on, many auto service centers, and especially auto-body repair shops, won’t even do business with motorists who have direct-seller auto insurance. “They have signs right in the shops, many of them, that say, ‘if you have XYZ Insurance, don’t bother asking us to do your repairs.’”

Independent agencies like Moulton are different for many reasons, she said, but especially because they actively advocate for clients, particularly “when it comes to the claim, which is why you buy insurance.”

Setting Their Sites

When she and St. George sat down with BusinessWest, the company was both celebrating some recent successes and taking steps to further raise its profile.

Specifically, the agency had just received the Long Term Service Award from the Quaboag Hills Chamber of Commerce, and was preparing to launch a new, content-rich website.

The website — which will offer more information on business and commercial lines of insurance — is important, Moulton St. George said, because people don’t always associate the company with those areas of expertise, even after 63 years in business.

“Businesses may not look at Moulton Insurance as the go-to agency for commercial lines,” St. George said, but added that perceptions will change once people become aware of the extensive list of business and commercial products offered by their company.

However, he explained, auto, home, and life insurance will continue to play a vital role in the overall mix of products Moulton offers to residents of Massachusetts, Connecticut, New Hampshire, and Vermont.

A stronger web presence is important for an agency based in the Quaboag region that aims to reach across Western Mass. and beyond. St. George said the company probably could have better advertised its experience with commercial lines in the past, which is one reason the website is getting an overhaul.

“We can handle anything from a Main Street type business to a manufacturing facility,” as well as the fleet of vehicles associated with that company, he said, adding that Moulton represents more than 15 insurance carriers, both regional and national, to provide options should a situation require specialization.

St. George is equally proud of the employees representing those products. He noted that many agencies in Western Mass. have relatively low ratios of full-time licensed agents to total employees. In other words, an agency might have three licensed agents and a total number of 14 employees, meaning that the majority of employees can only handle administrative work, and not the actual work of determining the best insurance product for a given situation.

Of Moulton’s 16 employees, however, 14 are licensed agents, ranking in the top 20% of agencies in the region by ratio of agents to employees. Further, the agency boasts five certified insurance counselors (CICs), three in the commercial area alone.

The CIC designation, he explained, is a mark of distinction that represents a commitment to professional excellence and leadership within the industry. CICs are recognized as among the best and most knowledgeable insurance practitioners in the nation. The designation is earned by attending five intensive CIC Institutes: agency management, commercial casualty, commercial property, life and health, and personal lines. The formal training required to become a CIC includes 100 classroom hours and the successful completion of comprehensive exams in these five areas of expertise.

Moulton also boasts eight certified insurance service representatives (CISRs). These agents have gone through a program that offers additional learning opportunities in the commercial-lines and personal-lines arenas, as well as courses in health and risk management.

Earning Trust

However, St. George and Moulton St. George both stressed, knowledge of insurance products alone won’t make an agency a trusted entity within its region. That comes from years of dedication and service to a community.

“Our reputation is a big part of what we do,” Moulton St. George said, noting that her father, Charles Moulton, had the foresight in 1952 to start an insurance agency that strived to bring personal service and cost-effective insurance coverage to area customers. Since then, she said, the company’s agents have made deep connections to the community.

The new website, they say, is just one way of raising the agency’s profile and letting insurance shoppers know what Moulton can offer to protect against the storms of life and business. Sometimes literally.