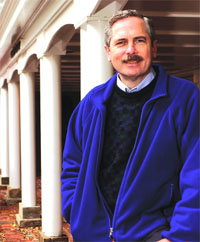

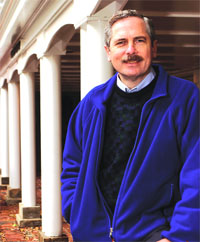

Marty Dunn first started noticing a slight slurring of his speech about a year ago. Soon, others noticed as well. Eight months later, he would be officially diagnosed with ALS amytrophic lateral sclerosis, or Lou Gehrigs disease. Its been a strange, almost surreal 2008 for Dunn, vice president of contracts for Chicopees Turbocare and a well-known attorney in the region. But the past is certainly not his focus. Instead, its the present and especially the future. There is much planning to do for Dunn, who wants to be an inspiration, not the object of pity, and a determination to make the very most of the time he has left especially this time.

Marty Dunn extended his right arm and started shaking and flexing his hand, as if to provide some visual effects for some comments about his thumb.

Its simply not as opposable as it was or should be, said Dunn, adding that a lack of mobility and resistance in his thumb has affected, to one degree or another, his ability to eat, write, brush his teeth, turn the car key in the ignition, or do any of those myriad other things that one does with their dominant hand. It really messes things up.

Aside from a slurring of his speech, which has become progressively worse over the past year or so, these thumb problems are the first outward manifestations of amytrophic lateral sclerosis, or ALS, otherwise known as Lou Gehrigs disease.

Dunn knows there will be more.

Many more.

He just doesnt know when theyll appear, or where, or to what degree they will impact that intangible known as quality of life for himself and those around him, especially his wife, Anne Marie, daughter, Kellis, and son, Ryan.

This is one of the exceedingly cruel aspects of ALS a progressive neurodegenerative disease that affects nerve cells in the brain and spinal cord and there are many. There is no cure for this menace, named after the New York Yankees star who contracted it, and no one really knows definitively what causes it. A diagnosis is, in most all cases, a death sentence. But those who have it just dont know how long that sentence is or what the weeks, months, and years ahead of them will be like.

All they can do is think and hope and prepare for what they know, or think, is coming which most people would find incomprehensible and exceedingly depressing.

But Dunn, an attorney, vice president of contracts with Chicopee-based Turbocare, and former associate with the Springfield-based firm Bacon Wilson, isnt sitting around feeling sorry for himself. He has much better things to do with his time especially this time, before ALS takes from him his ability to speak, eat, write, type, walk, and be independent.

He knows those days are coming. He just doesnt know when.

I never miss an opportunity to spend time with the kids now, he told BusinessWest. Id like to think that it was always like that, but it wasnt. Now, it means so much more to me.

One thing Dunn wants to do with this time is try to raise awareness of ALS in the hope that maybe someday the causes will be known and a cure can be found. ALS is relatively rare, and it doesnt get the federal money that other, more widespread diseases do, so anything I can do to draw attention to it will help.

Hes not going to climb a mountain, stage a telethon, or even blog about his experiences, but he will try to help people understand this disease and perhaps comprehend the many ways it impacts the lives of its victims and all those around them. Ultimately, he doesnt want to be a victim and object of pity, but rather an inspiration to others fighting battles like his own.

And one way of doing that is agreeing to sit with BusinessWest and talk about ALS, what hes experiencing, and what he wants to do before its too late, a phrase he used on a few occasions to convey his determination to make the most of what is now a truly precious commodity.

Indeed, as he recalled a time recently when Anne Marie said, why did this happen to us? weve always done everything right

were good people, Dunn said he replied, why not us? What makes us so special? Life isnt fair, and Ive been pretty lucky through my life.

That was his way of acknowledging that ALS strikes indiscriminately, and that time spent asking why? isnt time spent wisely.

And hes becoming quite an expert on that subject.

Body of Evidence

It was a Sunday-afternoon football party with some of his neighbors in East Longmeadow, like so many before it, until

Dunn recalls that it was quite cold that day late last fall, and that the New England Patriots triumphed (they won every regular-season game last year). But by days end he would have something much different and far more menacing to remember the occasion by.

This was the first time someone made reference to his speech and that it didnt seem right. Someone said, your voice sounds funny, he recalled, adding that he had noticed something himself, a slight slurring, in the days preceding, but didnt think much of it. But with this second reference, he began to think that maybe something was wrong. And with some hard prompting from Anne Marie, he would eventually seek out some answers.

As he would find out much later, the ALS had actually invaded his body several months earlier, and this lengthy time before the first visible manifestation of the disease is part and parcel to ALS.

This was just one of the many things Dunn would learn during an almost surreal 2008 for the Springfield native, Cathedral High School and AIC graduate, and Navy veteran who once worked for the late Congressman Edward Boland as an aide in the mid-80s, first in Springfield and then in Washington.

That was a fantastic experience, he said of his time in D.C., adding that it helped propel him into a career in law, one that would take some time to develop.

Indeed, after leaving Bolands staff, he went to work to what was then Continental Cablevision (there have been several new owners and names since) as government affairs manager, and later at MassMutual and Aetna in what he called systems jobs.

During his time with Aetna, he attended Western New England College Law School part-time. Upon graduation in 1998, he went to work for Bacon Wilson, where he specialized in corporate law, especially commercial transactions. He also handled some immigration work and residential real estate.

In 2006, he left the firm for Turbocare, a subsidiary of Siemens that makes replacement parts for steam and gas turbine engines manufactured by Siemens and other makers. His work involves international contracts, as the title suggests, but Dunn also serves as in-house attorney for the company, handling a broad array of duties that he categorized as office work.

But this was the kind of behind-the-scenes, transactional legal work that appealed to him, and he had settled into the job nicely by late 2007. Soon, though, things would become rather unsettled.

Questions, but No Answers

There are many things that medical science doesnt know about ALS, said Dunn. What causes it and how to cure it are at the top of the list, but it is also not easy to diagnose.

In fact, it was actually late summer, more than eight months after that first reference about his voice and nearly two months after Dunn finally went in for tests, before doctors could actually, and officially, confirm that this was the problem.

A diagnosis of ALS is a diagnosis of exclusion, said Dunn, noting that there are several neurological disorders that could have been the cause of his slurred speech. They start out with a list a mile long and they slowly eliminate things; the thing at the bottom is ALS.

He remembers several procedures, none of them pleasant, as doctors worked their way down that long list. They shock you with electric shock, and stick needles in you all over the place, he recalled, in the tongue, in the extremities, anywhere and everywhere.

Before any of that, doctors found something else to be concerned about an abnormal heartbeat, which required some immediate attention. By the time a measure of control with his heartbeat had been achieved, doctors were making some headway in their process of elimination.

But it would be Aug. 29, a date Dunn wont ever forget, when he received not only the official word, but a letter that he would have to use as he sought benefits from the Veterans Administration and other agencies. Thats my kick-off date.

He told BusinessWest he greeted the news with shock and horror, with thoughts soon returning to some recent experiences, when he watched a boyhood friends mother suffer from and then succumb to ALS.

It was horrifying

it was very hard to watch it unfold, he recalled of this exposure to ALS, which played itself out over the course of four or five years. I heard from my friend frequently; I would visit him and see his mother. I could see what it was doing to her, so theres some tragic irony to all this.

When all was said and done and ALS was confirmed, Dunn said he actually felt sorry for the neurologists who made the diagnosis, who feel helpless in such situations. Once they come away with this diagnosis, they shift from a curative type of consultation to saying, well, you should make the most of the time you have left.

Upon learning that he was afflicted with ALS, Dunn then did what people do these days when they want information; he googled the acronym.

Then he started reading, a sobering experience, to say the least.

Among the things hes learned is that ALS strikes about 30,000 people a year. Thats a big number, but not big enough, apparently, to drive the pharmaceutical companies to invest large amounts of time and money to finding a cure; theres simply not enough of a payback.

Hes also learned that while life expectancy varies, most victims have between two and five years to live. But what none of the sites he clicked on could tell him was just how quickly this disease will take over his body and what he can expect next. Hes not sure exactly why, but he believes his progression will be slow, which is both good and bad.

Dunn has learned that there are essentially two informal types of ALS. One starts from the head, or top, and works its way down the body. The other moves in reverse, striking the legs and then heading north.

He has the former, which explains why his speech was the first thing to be impacted. The thumb problems followed, he said, adding quickly that while its not getting any worse yet its not getting better, impacting myriad daily activities.

My writing is getting really sloppy, he said. I have trouble holding a fork I really have to grab it and I cant really turn the ignition in the car.

No one really knows exactly what will happen next or when, but Dunn is pretty much resigned to the fact that soon (a decidedly relative term for those with ALS), he will lose his speech altogether, and he will need to communicate via a computer. Next, or maybe simultaneously, he will lose the ability to swallow, meaning he will need a feeding tube for nourishment.

Knowing that such things are coming, but not knowing when, is difficult, he said, adding that he is determined to make good use of his time before such quality-of-life-limiting things happen.

Desire to Inspire

Dunn said that putting the acronym ALS together with the word blessing in the same sentence is awkward and somewhat perverse.

But thats the term he chose to describe one aspect of this disease: time to think and reflect and relish and maybe do some of the things one might do if he or she knew there was only so much time, or quality time, left. And also time to get ones affairs in order and make sure that people are taken care of to the best of his ability. Dunn has been doing all of that, and he noted that many people dont have that luxury.

First and foremost, I wanted to do those things they say you should do for your family, he said, listing a will and a health care proxy, among others. There are a lot of business-related issues that have to be addressed, and you want to make sure everythings been done right.

His situation improved in September, he said, when the Veterans Administration, acting upon statistics showing that those who served time in the military had a much greater chance of contracting ALS than non-veterans, altered its policy on the disease. Before that, Gulf War and Vietnam-era veterans who contracted the illness would be eligible for service-connected pensions. However, that policy now includes everyone.

That opens up some new avenues of help for me and other veterans who have it, he explained, adding that his wife will now receive a small pension because of that policy change and that service-connected designation attached to his ALS.

Dunn said he doesnt have any firm plans for the future, but he is mulling a host of possibilities. He intends to take the family on a vacation to Disney World itll be the 100th time, but if it makes them happy, thats all I care about and is thinking about a visit to Ireland, something his wife wants to do.

I have to take advantage of the time I have, meaning while Im still mobile and can still speak, he explained. Hopefully, Ill be around for quite a few years, but there will come a point where there will be wheelchairs and other things Ill need, and it just wont be the same.

In the meantime, Dunn is taking inspiration and support wherever and whenever he can find it.

Hes been given a number of books on the subjects of death and dying, including Randy Pauschs The Last Lecture, from which hes gained determination to honor the late educators call for those staring at death to be Tiggers and not Eeyores (characters from Winnie the Pooh) as they live out their lives.

He says you can either be an Eeyore and sit in the corner and say, oh, woe is me, or you can bounce around like Tigger and just enjoy life. Thats what I plan to do.

Overall, he doesnt dwell on the hand hes been dealt or rant at his misfortune. Sometimes the ball bounces in your direction, which it usually has for me, and sometimes it doesnt, he said. Ive been more fortunate than most.

Dunn was honored this past Veterans Day with the role of grand marshal in Springfields Veterans Day Parade, and a few days later he was the guest of honor at a huge fundraiser at the Basketball Hall of Fame. More than 500 friends, family members, colleagues, and former colleagues gathered at an event that had the look and feel of a Frank Capra movie and drove home the point that Dunn will have plenty of support as he battles ALS.

Doug Guthrie, now vice president of the Connecticut-West Region for Comcast, with whom Dunn had worked at Continental Cablevision some 20 years earlier when both were just getting started in their careers, organized many of details of the event (which raised more than $25,000 by some very early estimates) and introduced Dunn to those gathered. Meanwhile, attorneys at Bacon Wilson sold hundreds of tickets to the event, and organizers collected raffle prizes from dozens of area businesses and attractions.

AnnMarie Harding, marketing director for Maxs Tavern and hostess of that football party in East Longmeadow 11 months earlier, handled most of the logistics, with help from some interns at WNEC, Dunns alma matter.

Dunn wrote out his remarks, telling those assembled that by doing so, someone else might finish if he couldnt. He had to stop several t

mes, with each pause pierced by a cry of we love you, Marty, or were here for you, Marty, always from a different corner of the room, and each time providing enough to give Dunn whatever it took to read on.

He told those gathered what he later told BusinessWest that he intends to be around for a while, and for the time being, it will be business as usual or as usual as it can get when ones been handed a death sentence.

He doesnt know for how long, but one more thing Dunn has learned about ALS is that one lives for the moment and prepares for the future.

Hes got that part down.

Lasting Impressions

When asked if he could ever truly put aside his plight and not think about it, Dunn said there are actually some times when he can forget he has ALS.

But its not easy, he said, not when every time you start to talk youre reminded. The only respite you get is when youre sleeping.

And now, theres the thumb.

Returning to that subject, he flexed his hand a few more times. Dunn said that from that all hes read and all he knows, it will slowly get worse and that this will impact so many aspects of his life and those around him.

Its really going to sink in when I cant hold a football anymore and I wont be able to play catch with Ryan, he said, stopping for a minute as if to let that eventuality wash over him. And in a very rare display, you could see the pain on his face.

Thats because he knows that day is coming.

He just doesnt know when.

And thats the curse of ALS.

George OBrien can be reached at[email protected]

Justin H. Dion is an associate at Bacon Wilson, P.C., where he concentrates on business and personal bankruptcy, real estate, and general business matters; (413) 781-0560; [email protected]

Justin H. Dion is an associate at Bacon Wilson, P.C., where he concentrates on business and personal bankruptcy, real estate, and general business matters; (413) 781-0560; [email protected]

James E. Majka, CRPC, has joined Bancnorth Investment Group Inc. as a Financial Advisor based in the TD Banknorth branch in Westfield. Majka provides individualized retirement and financial planning, including individual retirement accounts, investment and managed-money programs, portfolio review, annuities, mutual funds, life insurance, long-term care insurance, wealth accumulation, and retirement plans for individuals, families, and small businesses.

James E. Majka, CRPC, has joined Bancnorth Investment Group Inc. as a Financial Advisor based in the TD Banknorth branch in Westfield. Majka provides individualized retirement and financial planning, including individual retirement accounts, investment and managed-money programs, portfolio review, annuities, mutual funds, life insurance, long-term care insurance, wealth accumulation, and retirement plans for individuals, families, and small businesses.  Shatz, Schwartz and Fentin, P.C., with offices in Springfield and Northampton, announced the following:

Shatz, Schwartz and Fentin, P.C., with offices in Springfield and Northampton, announced the following: David Stanley Anton recently achieved membership in the prestigious Million Dollar Round Table (MDRT), the premier association of financial professionals. Anton is a one-year MDRT member. Attaining membership requires professionals to adhere to a strict code of ethics, focusing on providing top-notch client service, and continuing to grow professionally through involvement in at least one other industry association. Attaining membership in MDRT is a career milestone achieved by fewer than 1% of the world’s life insurance and financial services professionals.

David Stanley Anton recently achieved membership in the prestigious Million Dollar Round Table (MDRT), the premier association of financial professionals. Anton is a one-year MDRT member. Attaining membership requires professionals to adhere to a strict code of ethics, focusing on providing top-notch client service, and continuing to grow professionally through involvement in at least one other industry association. Attaining membership in MDRT is a career milestone achieved by fewer than 1% of the world’s life insurance and financial services professionals.

PeoplesBank in Holyoke announced the following:

PeoplesBank in Holyoke announced the following: Attorney Richard T. O’Connor has joined Bacon Wilson P.C. in Springfield. O’Connor is a member of the Health Care Department and will focus on matters involving medical groups, regulatory compliance, and managed-care agreements.

Attorney Richard T. O’Connor has joined Bacon Wilson P.C. in Springfield. O’Connor is a member of the Health Care Department and will focus on matters involving medical groups, regulatory compliance, and managed-care agreements.

Greta LaMountain has joined the law firm of Bacon Wilson, P.C. of Springfield. LaMountain, a general practitioner with a focus on financial and real estate matters, will work out of the Amherst office.

Greta LaMountain has joined the law firm of Bacon Wilson, P.C. of Springfield. LaMountain, a general practitioner with a focus on financial and real estate matters, will work out of the Amherst office.

An App a Day

An App a Day BlackBerry Cordial

BlackBerry Cordial However, this is not to say that design and lifestyle dont still play a part in which phone or accessories are purchased. High-end phones like the BlackBerry and iPhone are larger than some of the tiny devices of years past, and more complicated to replace or repair. Thats why many manufacturers are now striving to offer a multitude of options in terms of capabilities and space for added applications, while still taking into account the varied lifestyles of consumers.

However, this is not to say that design and lifestyle dont still play a part in which phone or accessories are purchased. High-end phones like the BlackBerry and iPhone are larger than some of the tiny devices of years past, and more complicated to replace or repair. Thats why many manufacturers are now striving to offer a multitude of options in terms of capabilities and space for added applications, while still taking into account the varied lifestyles of consumers.

Adam Raczkowski of W.F. Young Inc. in East Longmeadow has been elected to serve on the Board of Directors of the Consumer Healthcare Products Assoc. He also holds the positions of Executive Vice President, COO, CFO, and General Manager.

Adam Raczkowski of W.F. Young Inc. in East Longmeadow has been elected to serve on the Board of Directors of the Consumer Healthcare Products Assoc. He also holds the positions of Executive Vice President, COO, CFO, and General Manager.  United Bank announced the following:

United Bank announced the following: Michael D. Ravosa of the Burke Ravosa Group, a Morgan Stanley Financial Advisor, has obtained the Certified Financial Planner designation from the Certified Financial Planning Board of Standards Inc.

Michael D. Ravosa of the Burke Ravosa Group, a Morgan Stanley Financial Advisor, has obtained the Certified Financial Planner designation from the Certified Financial Planning Board of Standards Inc.