Milestone Matters

GSB’s New President Is Focused on Next 150 Years

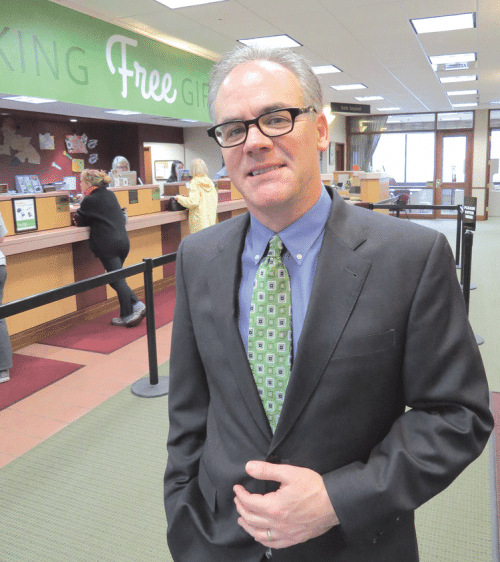

John Howland says he recently had the opportunity to get in a photo with his three immediate predecessors as president of Greenfield Savings Bank — the recently retired Rebecca (Becky) Caplice, Joe Poirier, and Ed Tombs.When asked what the occasion was, Howland, who took the helm roughly seven weeks ago, shrugged and said there really wasn’t one.

“They’re all around, they all live here — Ed is living in the same house he’s lived in for 40-something years … it doesn’t take much to get them together,” he told BusinessWest, adding that this fact reflects the stability, continuity, and community-centered flavor of this institution.

These qualities certainly helped pique his interest early last fall when an executive search firm called to gauge his interest in succeeding Caplice.

“This is an amazing institution, and positions like this — well, let’s just say it’s the kind of job you don’t leave,” Howland said, adding that by ‘this’ he meant positions leading institutions with long histories, stability, and a future that will look very much like the past and present — with some needed refinements to keep up with the times.

“They asked me when I was being interviewed if this was going to be a stepping stone to the next position,” he went on, adding, without any hesitancy in his voice, that he fully expects this to be the last line on his résumé. “I told them I’d love to be here for the rest of my career. I find it difficult to conceive of something materially better than what I have here.”

Of course, there soon will be another occasion to bring the former presidents — and many others — together. This will be the bank’s 150th anniversary, due to be celebrated some time in 2019.

The exact date of the festivities isn’t known, and hard planning is yet to commence, although discussions are certainly underway for what will be a momentous occasion in Greenfield.

Meanwhile, Howland considers it his unofficial job description to see to it that this institution can and will be around for another 150 years.

Fulfilling that mission is a simple yet critical function of doing what the bank has always done — meeting the many needs of the community it serves, and not attempting to be something it isn’t, or shouldn’t be.

Howland told BusinessWest that this strategy extends to the name over the door and the pocket of the shirt he was wearing.

Indeed, GSB is one of the banks left in this region that has kept the ‘S’ as part of its brand — many consider it somewhat anachronistic and not entirely reflective an institution’s full range of services — and he has no plans to lose it.

“I don’t have any interest in changing that,” he said with a dose of defiance, if it can be called that, in his voice. “I’m not embarrassed by that name … I’m about tradition in this organization, we’re all about tradition, we’re proud of being 150 years old in the same town with the same name, and I don’t see any reason to change it.”

For this issue and its focus on banking and financial services, BusinessWest talked at length with Howland about his new assignment and his outlook on the future.

Interest Bearing

Howland majored in physics in college, but soon determined that this wasn’t his calling and went into finance instead. He went to work for Merrill Lynch in New York City, working specifically with banks, especially small, community institutions, on investment-banking services.

But he soon decided he wanted to work for one of those institutions, not provide them with services.

“I consistently saw that people that ran banks like this seemed to derive significant personal and professional satisfaction from their positions,” he told BusinessWest. “Going back to the 1980s, I knew that this is what I wanted to do.”

So, in 2005, he accepted a position as executive vice president of the Bank of Southern Connecticut in New Haven.

The bank had some fairly significant regulatory issues at the time, said Howland, and he was hired to help clean up that mess. There was a father and son team ahead of him on the leadership ladder, but when the father retired and the son decided he wanted to do something else, Howland became president in 2008 and orchestrated a successful turnaround.

The bank was sold in 2010, and Howland interviewed for and then accepted a position as president of the First Bank of Greenwich, where a similar scenario unfolded.

The bank was sold in 2010, and Howland interviewed for and then accepted a position as president of the First Bank of Greenwich, where a similar scenario unfolded.

“Greenwich was in very difficult shape with the regulators — it was under what was known as a consent order, which I tell people is the outer marker for failure at an institution,” he explained, adding that he was able to right the ship there and put the bank on solid ground.

He said he’d fielded a few calls from recruiters assessing his interest in other jobs, but wasn’t driven to pursue anything aggressively until the GSB presidency came onto his radar screen.

The job was appealing because, unlike his past two stops, this bank wasn’t troubled, it wasn’t destined to be sold to a larger institution, and it was, in many ways, part of the bedrock of Greenfield.

“Having come from two companies that were in a lot of trouble, this is an appealing change,” he explained. “There’s a reason this company is so strong — it has great people in the right positions.”

Moving forward, Howland says his basic strategy is not to fix anything that isn’t broken — and that covers just about all facets of this operation — and thus continue dealing from a position of strength.

Greenfield is a dominant player in the Franklin County market, he said, adding that the primary competition comes from Greenfield Co-operative Bank, which recently merged with Northampton Cooperative Bank, and several larger regionals and super-regionals.

GSB has a presence in Northampton and Amherst, where there is considerably more competition from mutual banks, he went on, but has a good franchise — “we have, for the most part, very well-positioned locations in the various markets that we serve, with seven branches and solid market share.”

Other branches are in Shelburne Falls, Turners Falls, South Deerfield, and Conway, he went on, adding that he sees little need to put more push pins on a map, even if many banks seem to be in a frenzy to add locations.

“Our decision to open in Northampton and Amherst was really more an accommodation to those customers who commute back and forth to those locations — people who live here and work there and vice versa,” he explained. “We’d have to look closely at things, but there’s no obvious expansion that would be an easy one and make sense to our franchise at this point.”

Change Agent

Still, one of the items on Howland’s to-do list is a long-range strategic plan, an undertaking that usually accompanies a change in leadership, and one that will commence shortly.

One of the focal points of that plan will be developing strategies — and there are few obvious ones other than increasing market share — for becoming more profitable in an ever-more-challenging operating environment for banks of all sizes. The biggest challenge at the moment involves historically low interest rates and the manner in which they are making margins razor-thin.

“The biggest risk that we face right now is interest-rate risk and what happens if rates change drastically,” he said. “We use one of the leading firms in the country to assist us with that endeavor, and we feel we’re well-positioned for changes in interest rates that will mitigate the impact on our bottom line as best as can be expected.

“It’s challenging that every time you get together and have a meeting with a professional to talk about the future of interest rates, it’s going to be two quarters out before the fed starts easing,” he went on.

“This makes it challenging for banks; it’s a tough, tough time for us, and in many ways, it’s like a person on a fixed budget,” he continued. “You have a pile of money, and 10 years ago you were making 5% on your money, and now you’re making 25 basis points — you lost 90% of your income. That’s the easiest way to look at what’s happened to banks and why their profitability has gone down so much.”

This tight squeeze on profits certainly helps explain the recent surge in mergers and acquisitions, said Howland, adding that acquiring banks, through efficiency efforts and economies of scale, can eventually bolster their bottom lines.

But GSB doesn’t see any critical need to expand at this juncture or go public, he noted, adding that it has plenty of capital and can better serve its customers by maintaining the status quo.

“I don’t see how going public is consistent with the notion of sticking around for another 150 years — it takes control away from the community and puts it in someone else’s hands, and we don’t want to do that,” he told BusinessWest. “The mission of this organization is not to expand and drive the bottom line; it’s to serve the community. How does raising capital help with that? If we start down that road, we’ll never be here for another 150 years.”

Photo Finish

Returning to that photo op with his immediate predecessors, Howland said there were a number of stories exchanged at that gathering, as well as a great deal of pride in the history and continuity of the institution.

This is something he certainly doesn’t take lightly.

Indeed, keeping GSB around for another century and a half isn’t a goal as much as it is a responsibility, one he takes very seriously.

Being around for that milestone was one of the motivations for taking this job, he said, adding quickly that the real reason was not to mark history, but to write more of it.

George O’Brien can be reached at [email protected]