Gifts for Every Season

By Manon L. Mirabelli

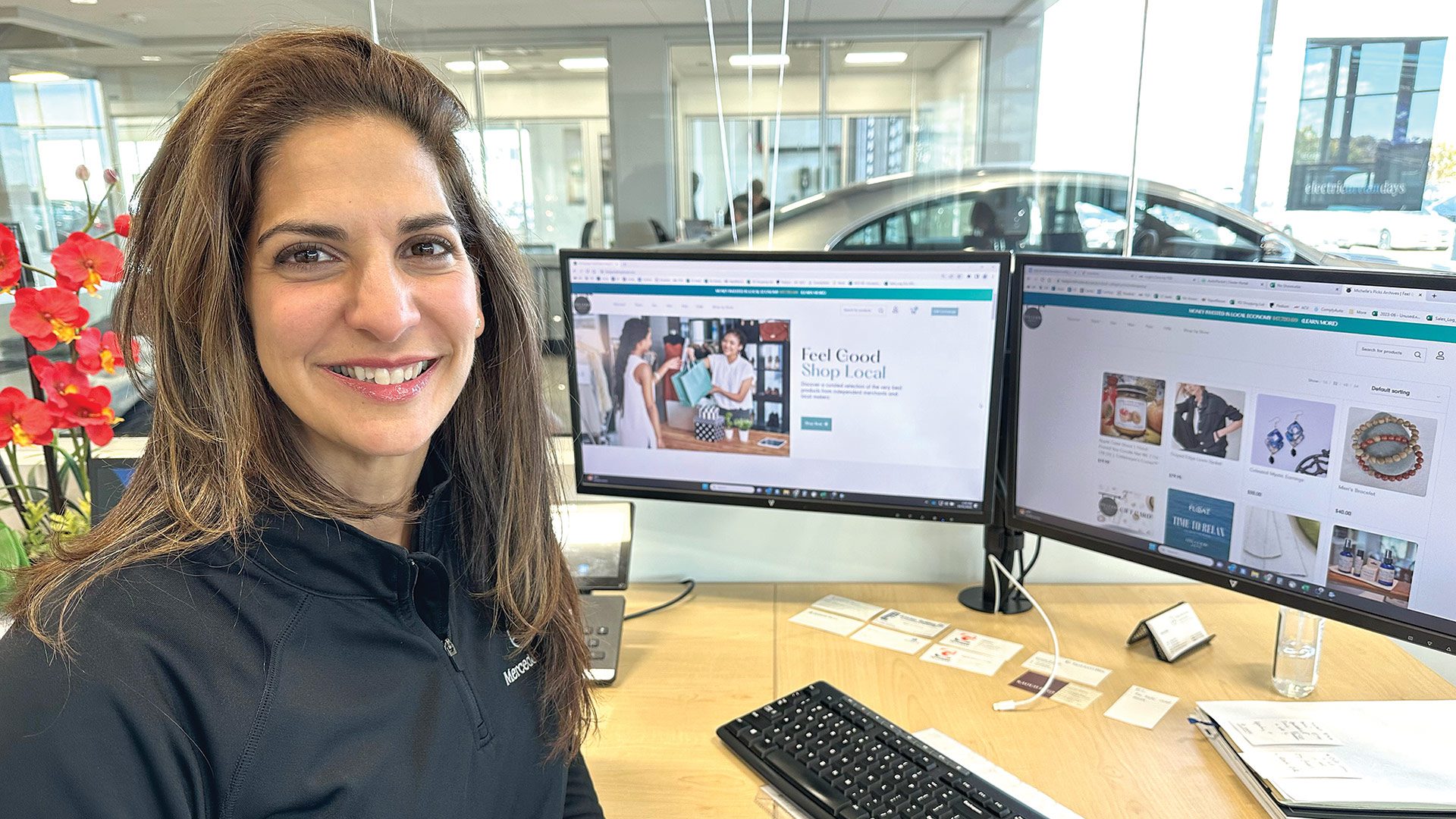

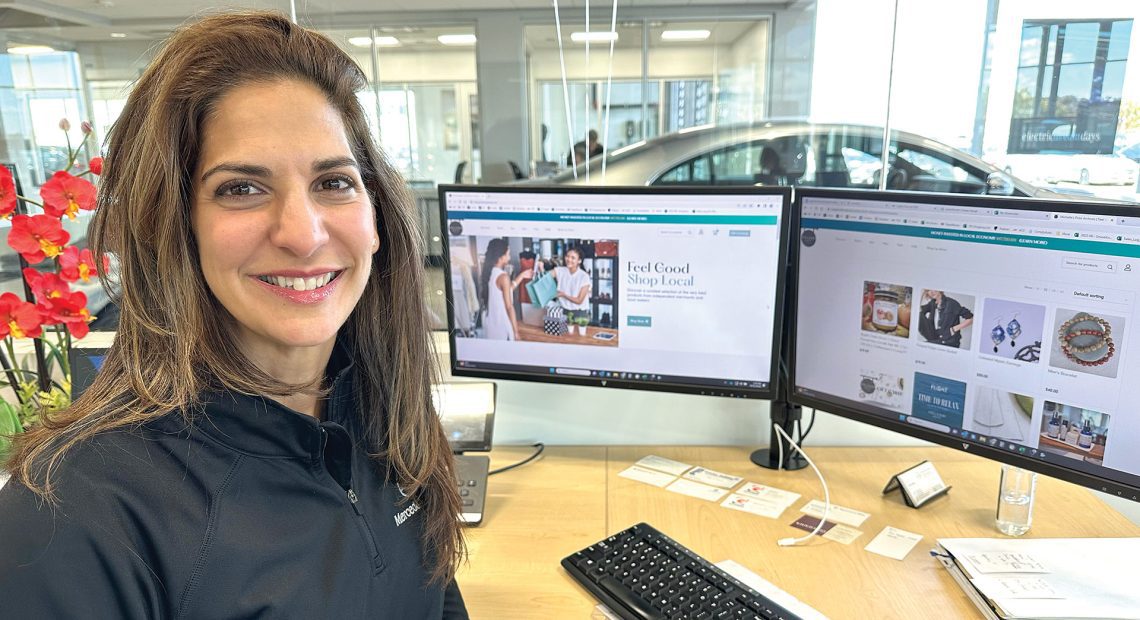

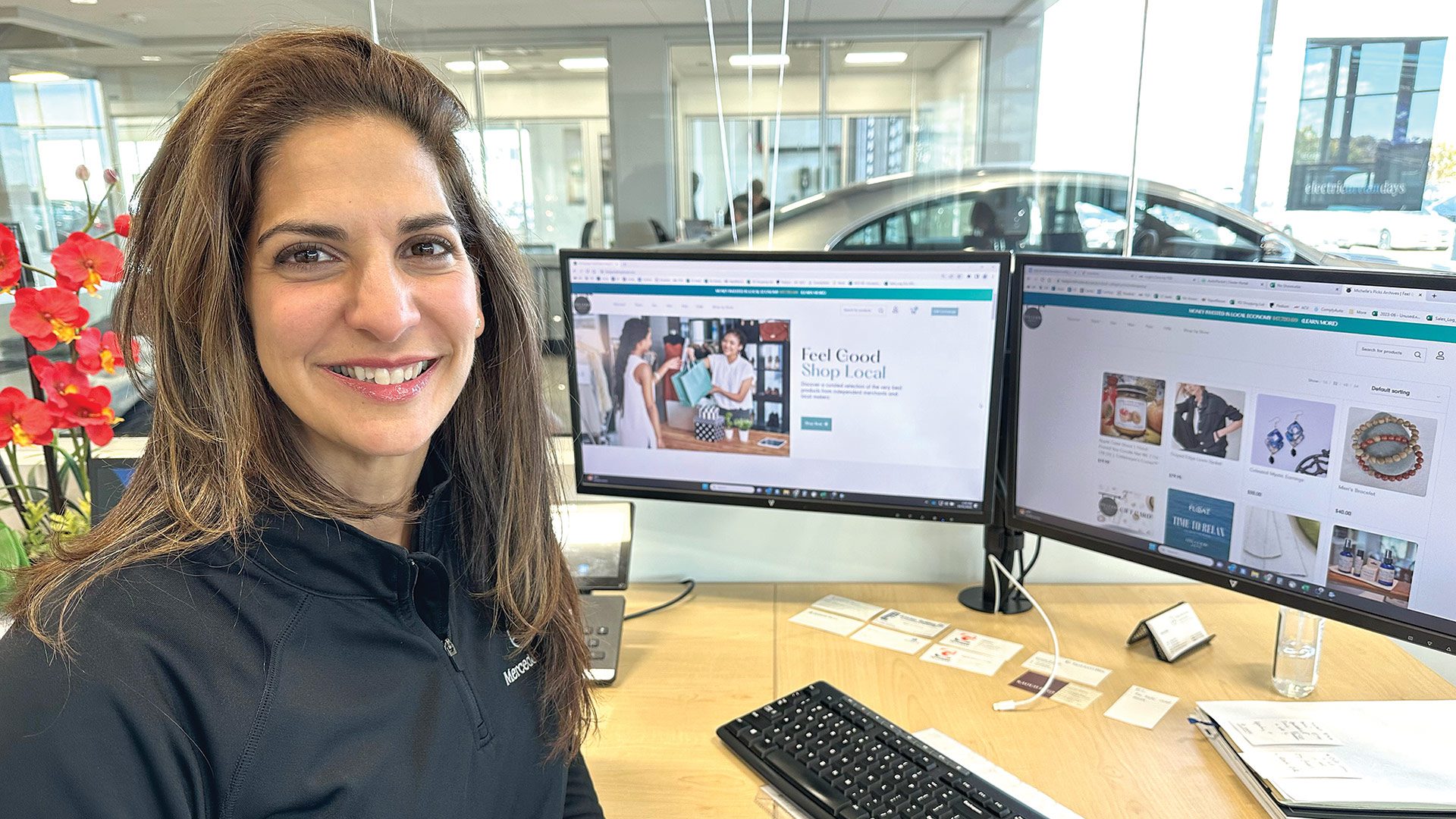

Michelle Wirth says the Feel Good Shop Local website gives area merchants access to many more shoppers.

The gift-giving season is quickly approaching, and the business of everyday life can make it difficult to find the perfectly thoughtful gift. Fortunately, the 413 is full of good ideas.

Michelle Wirth, founder and CEO of Feel Good Shop Local — and a believer in the importance of supporting local retailers — has been working with area merchants since 2020, when the COVID-19 pandemic halted business as we knew it.

A successful marketing executive and entrepreneur, Wirth — who, with her husband, Peter, brought Mercedes-Benz of Springfield to the region — said she has always been passionate about supporting local, independent businesses.

“People today are busy and don’t have time to do research to find small businesses,” she said. “But we can’t have a vibrant downtown if we don’t support small businesses throughout the year so they can survive.”

Wirth established Feel Good Shop Local (FGSL) and its website, www.feelgoodshoplocal.com, to support independent merchants and empower conscientious consumers by offering a simple online solution for those who want to shop locally and/or to support small businesses, she explained.

“Small business is the backbone of any thriving community, and FGSL wants to create an elevated online experience so shopping locally becomes the go-to solution when trying to find great products easily.”

Not only does FGSL support local commerce, the nonprofit organization also increases sales for small-business merchants by making its online store available to them to sell their goods. The concept behind the website is to offer consumers an alternate shopping stream while boosting sales for the businesses.

The website, Wirth noted, gives merchants access to a significantly greater number of shoppers. It started with 20 businesses and has increased to 50 this year, offering consumers a wide array of shopping options.

“Our online e-commerce website shop is a one-stop shop that gives small, local business access and exposure to new consumers who would not otherwise know about the business,” she said. “We’re giving these businesses access to sales, vitality, and exposure. We’re doing the heavy lifting for business and the consumer.”

As a busy mom of four and business owner, Wirth understands the challenges consumers face when balancing the need for convenience and the desire to make value-driven purchasing choices. She personally curates a selection of the best products from independent merchants and local makers.

The shopping convenience and variety of choice, as well as the benefits to business owners, make up just some of the bigger economic picture. The importance of shopping locally benefits the long-term success of any community’s downtown offerings and can make the difference between a stagnant town center and one that thrives with activity.

“It’s important to shop local,” Wirth said. “We all want a vibrant downtown community. When people shop local, they are voting with their wallets and making dreams come true for the business owner.”

Just as important, the consumer benefits by having the opportunity to purchase unique items, she added. “There is a higher propensity of finding something unique while providing economic growth in the community. We pride ourselves on providing a personalized experience. We know the owner, remember what you like, and the money is going to a person, not a faceless corporation. We offer a higher level of customer experience.”

Claudia Pazmany, executive director of the Amherst Area Chamber of Commerce, echoed Wirth’s sentiments on how critical supporting local business owners can be to a community’s success.

“They create the fabric of our community. Entrepreneurship is soaring since the pandemic, and as a result, Amherst alone has an array of new retail offerings and many new restaurants and food establishments,” Pazmany said. “When you support local, you are directly investing in positive social and economic impact. We developed our Amherst Area Gift Card program to showcase local and remind our community that these small businesses should be your first place to turn for gift giving.”

For our annual Shop Local Gift Guide, BusinessWest offers up 18 such options, whether you’re looking for a physical gift to wrap up, a service, or an always-welcome gift card.

Arts Unlimited Gift Gallery

25 College St., South Hadley

(413) 532-7047

www.arts-unlimited.com

Arts Unlimited was founded with one goal in mind: to provide customers with a high-quality, smart, and reliable gift shop. Offerings include a wide variety of art, accessories, and decorations, and gifts for birthdays, retirements, weddings, holidays, and more.

The Baker’s Pin

34 Bridge St., Northampton

(413) 586-7978

www.thebakerspin.com

This extensive kitchen store carries a wide range of cookware, cutlery, electric devices, bakeware, kitchen tools, home goods, cookbooks, and food products as well. But it also offers an array of cooking classes, both online and in person, exploring different foods and techniques appropriate for the season.

Berkshirecat Records

63 Flansburg Ave., Dalton

(413) 212-3874

www.berkshirecatrecords.com

Berkshirecat Records is an independent record store located inside the Stationery Factory building, selling quality vintage and new vinyl records of classic rock, blues, jazz, psychedelic, garage rock, folk, indie, pop, and metal recordings.

The Bookstore and Get Lit Wine Bar

11 Housatonic St., Lenox

(413) 637-3390

www.bookstoreinlenox.com

The Bookstore, a fixture in Lenox for more than 40 years, was actually born in the neighboring town of Stockbridge, in the living room of a small rented house behind an alley that housed a then little-known café that later came to be known as Alice’s Restaurant. The bar is open whenever the bookstore is, and the bookstore stays open later some nights when the bar is open as well.

The Closet

79 Cowls Road, Amherst

(413) 345-5999

www.thecloset.clothing

The Closet’s mission goes beyond connecting shoppers to the perfect black dress or favorite pair of shoes. Environmentally conscious, the shop wants to do its part to prevent clothing from being thrown away. Buying previously loved apparel stops the further use of natural resources and prevents clothing from wasting away in landfills.

Fresh Fitness Training Center/Fresh Cycle

320 College Highway, Southwick

(413) 998-3253

Fresh Fitness is a new, full-service, state-of-the-art gym with brand-new equipment and training for all fitness levels, from beginner to advanced, and is located in the same building that houses Fresh Cycle, one of the region’s premier indoor cycle studios, with more than 25 classes per week led by certified instructors.

Glow Studio Suites

2260 Westfield St., West Springfield

(413) 579-8455

Glow Studio Suites features individual beauty experts in one location. Walk in the door and find a lash artist, nail technician, esthetician, and injector. In addition, spray tan and waxing services are available.

Highlands Cards and Gifts

303A Springfield St., Agawam

(413) 315-3442

www.highlandscardandgift.com

Highlands Card and Gifts features a large selection of Irish and Celtic products, Irish knit sweaters, and Irish saps year round, as well as Celtic jewelry, Emmett glassware, Irish and Celtic themed sweatshirts and tees, wool capes, handbags, mugs, teapots, wall hangings, lamps, Irish foods, and much more.

Julie Nolan Jewelry

40 Main St., Amherst

(413) 270-6221

www.julienolanjewelry.com

Julie Nolan’s work blends traditional techniques of wax carving, diamond setting, and goldsmithing with a modern sensibility for design and composition. She sells her own handcrafted, one-of-a-kind heirloom pieces by hand in her studio and boutique, alongside a curated selection of home and gift items by Western Mass. makers.

Pilgrim Candle

36 Union Ave., Westfield

(413) 562-2635

www.pilgrimcandle.com

Pilgrim Candle Co. opened its doors in 1992 and expanded its already-busy operation in 2000 by acquiring Main Street Candlery. In 2007, Pilgrim expanded into private-label manufacturing. Since its first sale more than 30 years ago, Pilgrim Candle has developed a high-quality line of scented candles for candle lovers all around the world.

Pioneer Valley Food Tours

(413) 320-7700

www.pioneervalleyfoodtours.com

This enterprise creates walking food tours that explore local flavors from Northampton and around the region. It also creates gift boxes sourced from the region’s fields and farms, as well as Pioneer Valley picnic baskets of selections ready to bring on an outdoor adventure. Choose a pre-set tour itinerary, or create a custom tour to suit your tastes.

Pottery Cellar

77 Mill St., Westfield

(413) 642-5524

www.potterycellar.com

Located in the Mill at Crane Pond, the Pottery Cellar offers the largest selection of authentic Boleslawiec pottery in New England. From holiday-themed seasonal pieces to full dining sets, Pottery Cellar is a regional destination for authentic Polish pottery.

Renew.Calm

80 Capital Dr., West Springfield

(413) 737-6223

www.renewcalm.com

Renew.Calm offers an array of both medically based and luxurious spa treatments, with services including skin care, therapeutic massage, nail care, body treatments, yoga, hair removal, makeup, and lashes. Multi-treatment packages make great gifts.

The Shot Shop

722 Bliss Road, Longmeadow

(413) 561-7468

www.ssmedspa.com

The Shot Shop medical rejuvenation spa offers medical rejuvenation treatments for a wide variety of needs. Anyone feeling run down and tired, noticing visible signs of aging, or with other concerns that need to be addressed may find a medical rejuvenation treatment here that will help.

Springfield Thunderbirds

45 Bruce Landon Way, Springfield

(413) 739-4625

www.springfieldthunderbirds.com

A great deal for big-time hockey fans and folks who simply enjoy a fun night out with the family, Thunderbirds games are reasonably priced entertainment in Springfield’s vibrant downtown. The AHL franchise plays home games through April at the MassMutual Center, with a constant stream of promotions.

Springfield Wine Exchange

1500 Main St., Springfield

(413) 733-2171

Located on the ground floor of downtown Tower Square, the Springfield Wine Exchange offers customers local select craft beers and wines imported from around the world, providing a wide array of options for any occasion.

Visual Changes Salon

100 Shaker Road, East Longmeadow

(413) 525-1825

www.visualchangesinc.com

With more than 30 years dedicated to all dimensions of the hair industry, salon owner Mark Maruca is widely respected for his innovative approach hair styling. Services and products are individualized to suit client needs.

Zen’s Toyland

803 Williams St., Longmeadow

(413) 754-3654

www.zenstoyland.com

Zen’s Toyland sells a variety of items ranging from baby teethers to adult puzzles, including high-quality, unique items that aren’t available elsewhere. All the toys are handpicked, and the shop also has a playroom for children to ‘test drive’ items.

“Recently, two very important changes were announced regarding the PFML law. As a result of those changes, employers need to take action in the coming weeks.”

“Recently, two very important changes were announced regarding the PFML law. As a result of those changes, employers need to take action in the coming weeks.”

“Put in plain, non-legalese terms, the decision significantly increases the likelihood that one or more of your handbook policies are unlawful in the eyes of the NLRB. It also applies to all private-sector employers — including those without a union presence.”

“Put in plain, non-legalese terms, the decision significantly increases the likelihood that one or more of your handbook policies are unlawful in the eyes of the NLRB. It also applies to all private-sector employers — including those without a union presence.”