Planning Is Key

By Kristina D. Houghton, CPA

Surprisingly, 2023 was a year with no tax-law changes. Congressional members of both parties introduced major tax policy legislation, but so far, most of those bills were partisan. For Congress to pass tax legislation, it will need to be the product of bipartisan compromise. Any tax-policy legislation should also adhere to core values of fostering domestic economic growth, providing support for workers and their families, and prioritizing fiscal responsibility.

Despite the lack of legislation, year-end is still the optimal time for tax planning. But you must be careful to avoid potential pitfalls along the way.

We have prepared the following 2023 year-end tax article divided into three sections:

• Individual Tax Planning;

• Business Tax Planning; and

• Financial Tax Planning.

Be aware that the concepts discussed in this article are intended to provide only a general overview of year-end tax planning. It is recommended that you review your personal situation with a tax professional.

“If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023.”

“If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023.”

INDIVIDUAL TAX PLANNING

Itemized Deductions

When you file your personal 2023 tax return, you must choose between the standard deduction and itemized deductions. The standard deduction for 2023 is $13,850 for single filers and $27,700 for joint filers. (An additional $1,850 standard deduction is allowed for a taxpayer age 65 or older.)

YEAR-END MOVE: If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023. For example, consider the following possibilities:

• Donate cash or property to a qualified charitable organization.

• Pay deductible mortgage interest if it otherwise makes sense for your situation. Currently, this includes interest on acquisition debt of up to $750,000 for your principal residence and one other home, combined.

• Make state and local tax (SALT) payments up to the annual SALT deduction limit of $10,000.

Charitable Donations

The tax law allows you to deduct charitable donations within generous limits if you meet certain record-keeping requirements.

YEAR-END MOVE: Step up charitable gift giving before Jan. 1. As long as you make a donation in 2023, it is deductible in 2023, even if you charge it in 2023 and pay it in 2024.

• If you make monetary contributions, your deduction is limited to 60% of your adjusted gross income (AGI). Any excess above the 60%-of-AGI limit may be carried over for up to five years.

• If you donate appreciated property held longer than one year (i.e., it would qualify for long-term capital-gain treatment if sold), you can generally deduct an amount equal to the property’s fair market value (FMV) on the donation date, up to 30% of your AGI. But the deduction for short-term capital-gain property is limited to your initial cost.

Higher-education Credits

The tax law provides tax breaks to parents of children in college, subject to certain limits. This often includes a choice between one of two higher-education credits.

YEAR-END MOVE: When appropriate, pay qualified expenses for next semester by the end of this year. Generally, the costs will be eligible for a credit in 2023, even if the semester does not begin until 2024.

Typically, you can claim either the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), but not both. The maximum AOTC of $2,500 is available for qualified expenses for four years of study for each student, while the maximum $2,000 LLC is claimed on a per-family basis for all years of study. Thus, the AOTC is usually preferable to the LLC.

Both credits are phased out based on your modified adjusted gross income (MAGI). The phase-out for each credit occurs between $80,000 and $90,000 of MAGI for single filers and between $160,000 and $180,000 of MAGI for joint filers.

TIP: The list of qualified expenses includes tuition, books, fees, equipment, computers, etc., but not room and board.

Miscellaneous

• Install energy-saving devices at home that result in either of two residential credits. For example, you may be able to claim a credit for installing solar panels. Generally, each credit equals 30% of the cost of qualified expenses, subject to certain limits.

• Avoid an estimated tax penalty by qualifying for a safe-harbor exception. Generally, a penalty will not be imposed if you pay 90% of your current year’s tax liability or 100% of your prior year’s tax liability (110% if your AGI exceeded $150,000).

• Empty out flexible spending accounts for healthcare or dependent-care expenses if you will forfeit unused funds under the ‘use it or lose it’ rule. However, your employer’s plan may provide a carry-over to 2024 of up to $610 of unused funds or a two-and-a-half-month grace period.

BUSINESS TAX PLANNING

Depreciation-based Deductions

As the year draws to a close, a business may benefit from one or more of three depreciation-based tax breaks: the Section 179 deduction, first-year ‘bonus’ depreciation, and regular depreciation.

YEAR-END MOVE: Place qualified property in service before the end of the year. If your business does not start using the property before 2024, it is not eligible for these tax breaks.

Section 179 deduction: Under Section 179 of the tax code, a business may currently deduct the cost of qualified property placed in service during the year. The maximum annual deduction for 2023 is $1.16 million, provided your total purchases of property do not exceed $2.89 million.

Be aware that the Section 179 deduction cannot exceed the taxable income from all your business activities this year. This rule could limit your deduction for 2023.

First-year bonus depreciation: The first-year bonus depreciation applicable percentage for 2023 is 80% and is scheduled to drop to 60% in 2024.

Qualified Retirement Plans

The new SECURE 2.0 law includes a number of provisions affecting employers with qualified retirement plans.

YEAR-END MOVE: Position your business to maximize available tax benefits and avoid potential problems. Consider the following key changes of particular interest:

• For 401(k) plans adopted after 2024, an employer must provide automatic enrollment to employees. Certain small companies and startups are exempt.

• Beginning in 2023, employers with 50 or fewer employees can qualify for a credit equal to 100% of their contributions to a new retirement plan, up to $1,000 per employee, phased out over five years. The 100% credit is reduced for a business with 51 to 100 employees. This tax break is in addition to an enhanced credit for plan startup costs.

• Beginning in 2024, employers may automatically provide employees with emergency access to accounts of up to 3% of their salary, capped at $2,500.

• Beginning in 2024, an employer may elect to make matching contributions to an employee’s retirement-plan account based on student-loan obligations.

• The new law shortens the eligibility requirement for part-time workers from three years to two years, beginning in 2023, among other modifications.

• Any catch-up contributions to 401(k) plans must be made to Roth-type accounts for employees earning more than $145,000 a year (indexed for inflation).

TIP: This last provision was initially scheduled to take effect in 2024, but a new IRS ruling just delayed it for two years to 2026.

Employee Bonuses

Generally, employee bonuses are deductible in the year that they are paid. For instance, you must dole out bonuses before Jan. 1, 2024 to deduct those bonuses on your company’s 2023 return. However, there’s a special rule for accrual-basis companies. In this case, the bonuses are currently deductible if they are paid within two and a half months of the close of the tax year.

YEAR-END MOVE: If your company qualifies, determine bonus amounts before year-end. As a result, the bonuses can be deducted on the company’s 2023 return as long as they are paid by March 15, 2024. Keep detailed corporate minutes to support the deductions.

This special deduction rule does not apply to bonuses paid to majority shareholders of a C-corporation or certain owners of an S-corporation or a personal-service corporation.

TIP: Note that the bonuses are taxable to employees in the year in which they receive them — 2024. Thus, the employees benefit from tax deferral for a year even if the company claims a current deduction.

Miscellaneous

• Stock the shelves with routine supplies (especially if they are in high demand). If you buy the supplies in 2023, they are deductible this year even if they are not used until 2024.

• Maximize the qualified business interest deduction for pass-through entities and self-employed individuals. Note that special rules apply if you are in a ‘specified service trade or business.’ See your professional tax advisor for more details.

• If you buy a heavy-duty SUV or van for business, you may claim a first-year Section 179 deduction of up to $28,900. The luxury-car limits do not apply to certain heavy-duty vehicles.

FINANCIAL TAX PLANNING

Securities Sales

Traditionally, investors time sales of assets like securities at year-end to maximize tax advantages. For starters, capital gains and losses offset each other. If you show an excess loss for the year, you can then offset up to $3,000 of ordinary income before any remainder is carried over to the next year. Long-term capital gains from sales of securities owned longer than one year are taxed at a maximum rate of 15%, or 20% for high-income investors. Conversely, short-term capital gains are taxed at ordinary income rates reaching as high as 37% in 2023.

YEAR-END MOVE: Review your portfolio. Depending on your situation, you may want to harvest capital losses to offset gains, especially high-taxed short-term gains, or realize capital gains that will be partially or wholly absorbed by losses.

Be aware of even more favorable tax treatment for certain long-term capital gains. Notably, a 0% rate applies to taxpayers below certain income levels, such as young children. Furthermore, some taxpayers who ultimately pay ordinary income tax at higher rates due to their investments may qualify for the 0% tax rate on a portion of their long-term capital gains.

However, watch out for the ‘wash sale rule.’ If you sell securities at a loss and reacquire substantially identical securities within 30 days of the sale, the tax loss is disallowed. A simple way to avoid this adverse result is to wait at least 31 days to reacquire substantially identical securities.

Note that a disallowed loss increases your basis for the securities you acquire and could reduce taxable gain on a future sale.

Net Investment Income Tax

When you review your portfolio, do not forget to account for the 3.8% net investment income tax, which applies to the lesser of net investment income (NII) or the amount by which MAGI for the year exceeds $200,000 for single filers or $250,000 for joint filers. (These thresholds are not indexed for inflation.)

The definition of NII includes interest, dividends, capital gains, and income from passive activities, but not Social Security benefits, tax-exempt interest, and distributions from qualified retirement plans and IRAs.

You may consider investing in municipal bonds (‘munis’). The interest income generated by munis does not count as NII, nor is it included in the MAGI calculation. Similarly, if you turn a passive activity into an active business, the resulting income may be exempt from the NII tax.

TIP: When you add the NII tax to your regular tax, you could be paying an effective 40.8% tax rate at the federal level alone. Factor this into your investment decisions.

Required Minimum Distributions

For starters, you must begin ‘required minimum distributions’ (RMDs) from qualified retirement plans and IRAs after reaching a specified age. After the SECURE Act raised the age threshold from 70½ to 72, SECURE 2.0 bumped it up again to 73 beginning in 2023 (scheduled to increase to 75 in 2033). The amount of the RMD is based on IRS life-expectancy tables and your account balance at the end of last year.

YEAR-END MOVE: Assess your obligations. If you can postpone RMDs still longer, you can continue to benefit from tax-deferred growth. Otherwise, make arrangements to receive RMDs before Jan. 1, 2024 to avoid any penalties.

Conversely, if you are still working and do not own 5% or more of a business with a qualified plan, you can postpone RMDs from that plan until your retirement. This ‘still-working exception’ does not apply to RMDs from IRAs or qualified plans of other employers.

Previously, the penalty for failing to take timely RMDs was equal to 50% of the shortfall. SECURE 2.0 reduces it to 25% beginning in 2023 (10% if corrected in a timely fashion).

TIP: Under the initial SECURE Act, you are generally required to take RMDs from recently inherited accounts over a 10-year period (although previous inheritances are exempted). These rules are complex, so consult with your tax advisor regarding your situation.

Estate and Gift Taxes

During the last decade, the unified estate- and gift-tax exclusion has gradually increased, while the top estate rate has not budged. For example, the exclusion for 2023 is $12.92 million, the highest it has ever been. (It is scheduled to revert to $5 million, plus inflation indexing, after 2025.)

YEAR-END MOVE: Reflect this generous tax-law provision in your overall estate plan. For instance, your plan may involve various techniques, including bypass trusts, that maximize the benefits of the estate- and gift-tax exemption.

In addition, you can give gifts to family members that qualify for the annual gift-tax exclusion. For 2023, there is no gift-tax liability on gifts of up to $17,000 per recipient (up from $16,000 in 2022). You do not even have to file a gift-tax return. Moreover, the limit is doubled to $34,000 for joint gifts by a married couple, but a gift-tax return is required in that case.

TIP: You may ‘double up’ again by giving gifts in both December and January that qualify for the annual gift-tax exclusion for 2023 and 2024, respectively.

Miscellaneous

• Contribute up to $22,500 to a 401(k) in 2023 ($30,000 if you are age 50 or older). If you clear the 2023 Social Security wage base of $160,200 and promptly allocate the payroll tax savings to a 401(k), you can increase your deferral without any further reduction in your take-home pay. Note that SECURE 2.0 further enhances catch-up contributions for older employees after 2023.

• If you rent out your vacation home, keep your personal use within the tax-law boundaries. No loss is allowed if personal use exceeds the greater of 14 days or 10% of the rental period.

• Consider a qualified charitable distribution (QCD). If you are age 70½ or older, you can transfer up to $100,000 of IRA funds directly to charity, free of tax (but not deductible). SECURE 2.0 authorizes a one-time transfer of up to $50,000 to a charitable remainder trust or charitable gift annuity as part of a QCD.

CONCLUSION

This year-end tax-planning article is based on the prevailing federal tax laws, rules, and regulations. Of course, it is subject to change, especially if additional tax legislation is enacted by Congress before the end of the year.

Finally, remember that this article is intended to serve only as a general guideline. Your personal circumstances will likely require careful examination.

Kristina D. Houghton, CPA is a partner at the Holyoke-based accounting firm Meyers Brothers Kalicka, P.C.

“As planners, these changes often prompt investigating alternative ways to pass on wealth earlier to heirs, including layering in additional diversification with investments spread between retirement accounts, Roth IRA/401(k) plans, and non-retirement assets.”

“As planners, these changes often prompt investigating alternative ways to pass on wealth earlier to heirs, including layering in additional diversification with investments spread between retirement accounts, Roth IRA/401(k) plans, and non-retirement assets.”

“Many people today do not have access to pensions like the generation before us. So that means investing early and wisely is paramount to building the wealth needed to achieve your retirement dreams.”

“Many people today do not have access to pensions like the generation before us. So that means investing early and wisely is paramount to building the wealth needed to achieve your retirement dreams.”

“If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023.”

“If you come out ahead by itemizing, you may want to accelerate certain deductible expenses into 2023.”

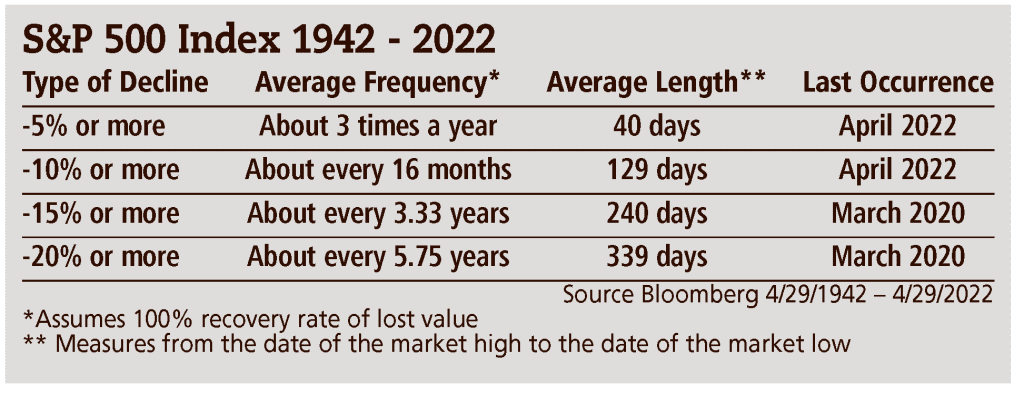

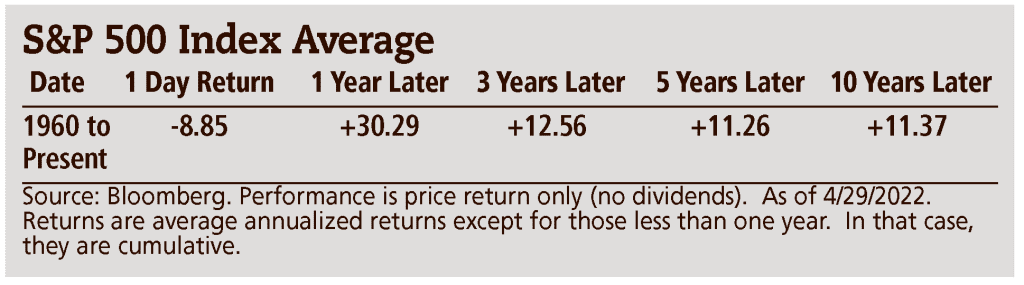

“It is a tough time to be an investor during this scenario but, eventually, the market finds a bottom and investors feel comfortable once again to begin buying, putting an end to the bear market.”

“It is a tough time to be an investor during this scenario but, eventually, the market finds a bottom and investors feel comfortable once again to begin buying, putting an end to the bear market.”

“I am convinced that your money myths limit your thinking and impact how you approach your life and your finances.”

“I am convinced that your money myths limit your thinking and impact how you approach your life and your finances.”

Jean Deliso, CFP said she started calling her investment clients several days ago to gauge how they’re feeling amid some growing turbulence for the economy — and on Wall Street.

Jean Deliso, CFP said she started calling her investment clients several days ago to gauge how they’re feeling amid some growing turbulence for the economy — and on Wall Street.