Distributing Tangible Personal Property Can Cause Conflict

By Hyman G. Darling, Esq.

Very often in preparing an estate plan, issues arise over the tangible personal property, also known as ‘the stuff.’ This may include cars, collectibles, the dining-room furniture, Waterford china, and basically any other item in a house that is not attached to the walls. These tangible personal property items are often dealt with separately from other assets, such as stocks, bonds, real estate, cash, etc.

Unfortunately, when the client has not provided enough detail in listing the distribution of assets, the tangible property becomes a major issue. Arguments may ensue, and often, the family brings the case to litigation to argue about all these items. In some cases, the family has significant assets to be distributed, but these tangible items become contentious and cause the estate to be litigated and prolonged.

Hyman G. Darling

“Arguments may ensue, and often, the family brings the case to litigation to argue about all these items.”

There are several ways in which this matter may be resolved, but the clients need to take the time to prepare properly for the distribution. The first way would be to have a complete listing of the items that may have either sentimental value or material value. The client can either list these items in the will, in which case they may have to be probated, or in other cases, the client can sign a memorandum.

The memorandum is fairly new in Massachusetts, as determined in the Uniform Probate Code, which was enacted in 2013. A client may now make a listing of assets and the individuals to receive the assets, which may be memorialized in writing and signed by the client, and then merely referred to in the will. In this manner, if the client desires to change the memorandum, they may merely write up a new memorandum and have it signed and dated and placed with the will, as opposed to having the entire will rewritten.

It is very important in this memorandum to be clear about what items are listed. For example, a mention of a ring or a watch may not be clear enough; perhaps the ring should be listed as the engagement ring with two small diamonds, and the watch could be listed as the Timex watch with rhinestones.

If there are items that are to be identified more clearly, they also should be listed, so that a painting or picture should state the setting or picture, as well as where it may have been hanging in the house, such as in the den above the piano.

Some clients have made lists and put stickers on the back of items or underneath them with identifying colors such as a yellow sticker for daughter Susie, a white sticker for son John, and green stickers for all the grandchildren. This is acceptable so long as the stickers are still on the items at the time of the client’s death and if someone doesn’t get to the items and move the stickers to different items.

In cases where the client was not clear, there are several alternatives to litigation. The first would be to have all parties make a list of the items that are important to them and then allocate an item to each person from their lists, taking turns between the beneficiaries. In some cases, clients have had to draw straws in determining who makes the first selection. Once they are finished choosing all of the items, they can then do their own ‘horse trading’ between themselves, but at least some of the beneficiaries will receive some of the items they want.

If this does not work, it may be necessary to gather the lists of the desired items by the family and engage the services of a mediator to attempt to resolve the differences. The problem then becomes whether the items are more valuable in terms of material value or sentimental value. If the sentimental value isn’t as great as the material value, then a client might decide to choose a larger, more valuable item and hope to trade it later for the more sentimental item.

If the resolution is not able to be made voluntarily, then an inventory of all items will have to be filed with the court, and perhaps an appraiser or two will have to be hired by the estate to value all the items. Some items without much value may be included in a ‘lot,’ which will be valued as a commingling of these items and valued as such.

Once these are all valued and listed on the inventory, one party might have to petition the probate court to determine the proposed distribution of these items, which is unfortunate, as they will be utilizing valuable court time merely to divide the tangible items. The court has the discretion to appoint a master, who will be an experienced lawyer, to hold the hearing at the expense of the estate, and then each party will also be paying their own lawyer to argue over who will receive what items.

In many cases, when this matter is over and resolved, none of the parties are pleased with the result, which means it was probably a fair and equitable decision.

Very often, clients are convinced that the children will have no problem distributing the assets and dividing the items; the client will merely state that nobody will want anything, as they have their own items. This is not always the situation; when a person passes away, not only do the children have a say in what will be distributed, but their spouses may wish to intervene and strongly suggest what their spouse should take. It is usually helpful to keep these in-laws (often called out-laws) out of the decision-making process, as this only causes more people to be involved and greater dissent between the parties.

When completing your own estate plan, consider the potential use of the memorandum with specific detail for the items you wish to distributed. Be careful in considering and discussing these issues with the children since, if you ask them all what they want and they all state that they want the same items, you will then be faced with the decision of having to tell some of them they will not be getting certain items. This can easily cause conflict, and family dinners and holiday occasions may prove to be less than pleasant.

Hyman G. Darling is a shareholder and the head of the probate/estates team at Bacon Wilson; (413) 781-0560; [email protected]

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time.

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time. “Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.”

“Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.” “Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.”

“Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.” “Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

“Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

“The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.”

“The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.” “As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

“As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”

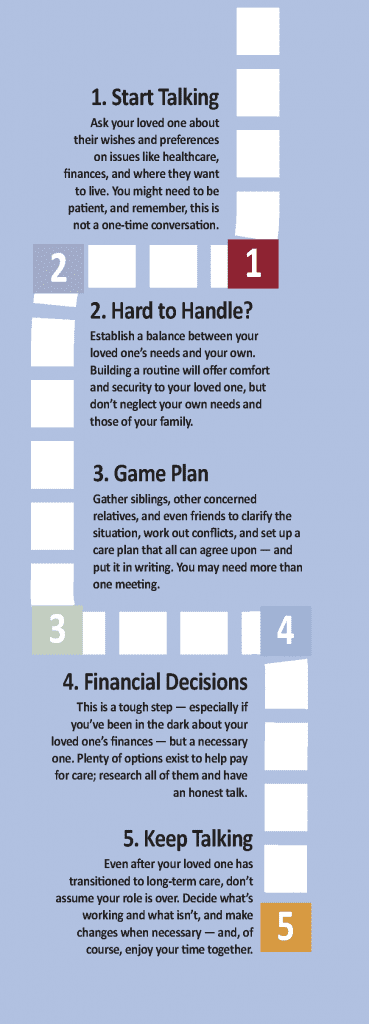

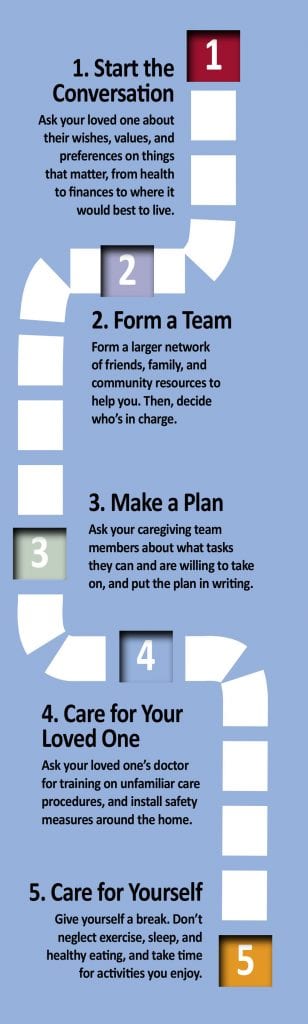

Whether you’re taking care of a family member full-time or just beginning to anticipate a need, the American Association of Retired Persons recommends a series of five steps to make the process easier for both you and your loved one. Just take it one step at a time.

Whether you’re taking care of a family member full-time or just beginning to anticipate a need, the American Association of Retired Persons recommends a series of five steps to make the process easier for both you and your loved one. Just take it one step at a time.

By Joe Gilmore, Landmark Senior Living

By Joe Gilmore, Landmark Senior Living

By the Massachusetts Senior Care Assoc.

By the Massachusetts Senior Care Assoc.