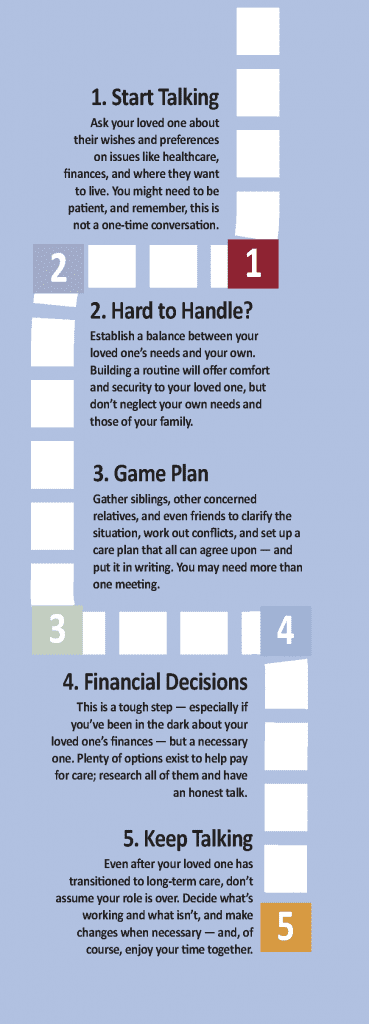

Follow These Five Steps When It’s Time to Talk About Care

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time.

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time.

1. Start the Conversation

“Talking with your parents about their future will not be a one‐time conversation, but an ongoing process,” says Catherine Hodder, author of Estate Planning for the Sandwich Generation: How to Help Your Parents and Protect Your Kids. “You must be patient and willing to wait until your parents feel comfortable. They will need to be ready to talk with you or to make certain decisions about their future. The hardest part will be for them to admit they need help and that you will be taking on more responsibility for them. Understand they still see you as their child who they should be helping, not the other way around. Try to feel out the right times to talk about healthcare concerns and when to talk about finances. Depending on your parents’ personalities, one may be an easier conversation than the other.”

2. Consider How Much You Can Take On

“For many, our responsibilities extend beyond the needs of our aging parents and carry over to our own families,” says Amy Osmond Cook, author of Things to Discuss with Aging Parents Before Becoming Their Caregiver. “Those obligations don’t end when a parent needs extra care. By discussing a schedule with your loved one, you can establish a balance between his needs and the needs of your family. For example, you may have a nurse stay in the home on certain days with an understanding you will take your aging parent to all of the doctor’s appointments. A routine can provide comfort to your loved one because he will know when to expect you or other helpers when care is needed.”

3. Build a Team and Make a Plan

“Family meetings are a way for siblings, parents, and other concerned relatives or friends to try to clarify the situation, work out conflicts, and set up a care plan that, ideally, all can agree upon,” says Bonnie Lawrence, author of A Sibling’s Guide to Caring for Aging Parents. “If the meeting is likely to be contentious, or if you want an experienced, objective voice to guide it, involve a facilitator such as a social worker, counselor, geriatric care manager, or trusted outside party who will ensure that all participants have a chance to be heard. You may need more than one meeting.”

4. Discuss How You Will Pay for Care

“What is the truth about your parent’s situation — finances, health, and what they want for care?” asks Catherine Flax, author of Aging Parents and Money: Difficult Conversations That Need to Be Had. “The reality is that, when it comes to finances, most people (parents and their children) are largely in the dark. What are the rules around Social Security? How much do they currently spend on healthcare, and how do Medicare and insurance supplements work? What is the optimal, tax-efficient draw-down schedule for their retirement assets — and how far will these assets take them? Do they have other assets that they could manage to their advantage (like a home that could be downsized) to give them a higher quality of life, and would they want that?”

5. Make the Transition — and Follow Up

“Once your mother selects a place and settles in, visit frequently — by whatever means possible,” says Kerry Patterson, author of Preparing for a Crucial Conversation with an Aging Parent. “Check to see what is working and what isn’t. Where possible, make further changes to match her needs to the facility. Finally, live up to the promise you made to yourself. You meant it when you decided that you wanted what’s best for your mom/dad or loved one. Whether this turns out to be true depends a great deal on how often you make contact with him/her once she’s/he’s found a new place to live.”

“As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

“As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”