After the Green Rush

The numbers are impressive, to be sure.

Adult-use cannabis shops in Massachusetts posted close to $1.5 billion in sales in 2022, up from $1.33 billion in 2021. Since recreational sales began in late 2018, the total figure is closing in on $4 billion.

That’s a big pie.

The problem, for the hundreds of dispensaries already open and many more at various stages of planning and development, is that each slice of that pie is getting smaller. As a result, prices are crashing, with some products selling for half of what they did a year or two ago.

That’s great for cannabis consumers. For businesses? Not so much.

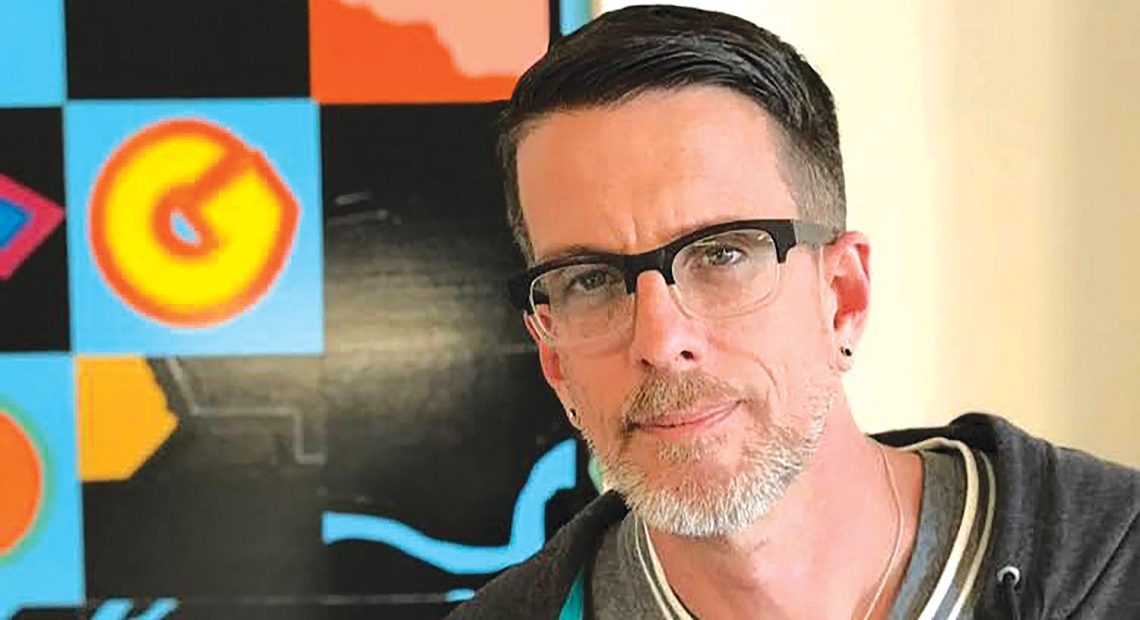

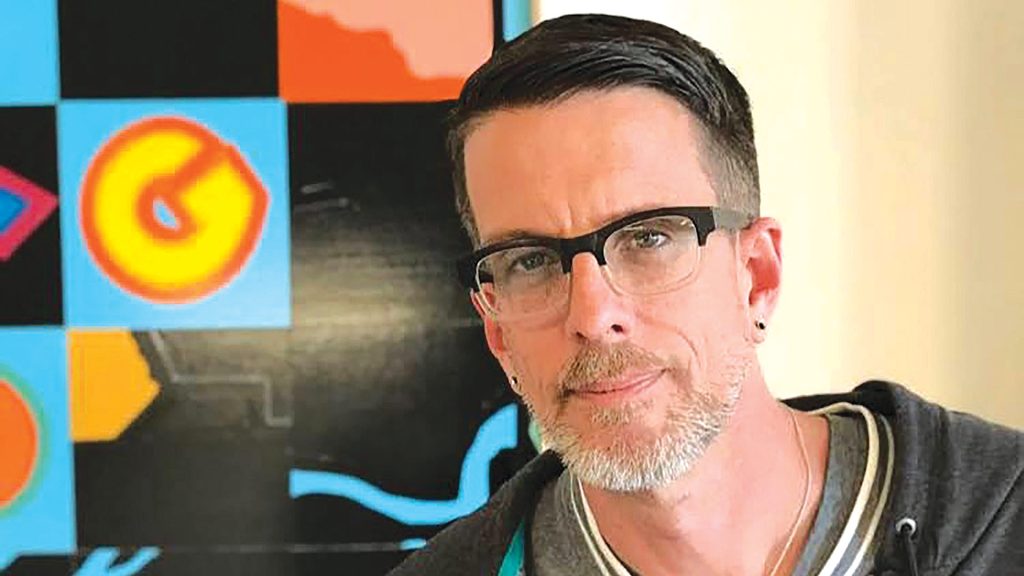

But it’s not an unexpected development, not is it any sort of crisis, said Michael Kusek, publisher of Different Leaf magazine and one of the nation’s leading experts on the cannabis industry. But it’s certainly a challenge, one that promises to weed out some of the current players.

“You can’t solve the overabundance of product in the marketplace by transferring it to another market,” Kusek told BusinessWest. “You can’t make the product go away, so the price bottoms out. This has happened in every other market, so it’s not a shock.”

It will, however, require business owners to think smarter, focusing on quality, the customer experience, and other ways of differentiating themselves in an increasingly crowded marketplace. And the situation already has municipalities revisiting old concerns about a saturated market.

Northampton, where one of the city’s 12 dispensaries, the Source on Pleasant Street, recently closed, is the most notable case, as its City Council voted 6-3 last month to cap the number of retail cannabis shops at 12 going forward.

At press time, Northampton Mayor Gina-Louise Sciarra said she would not sign off on the cap, but with a two-thirds vote of the City Council needed to overcome any veto, the measure will likely still become law.

“We are not anti-business,” Councilor Marianne LaBarge said before the vote, as reported by the Shoestring. “We have a job, and we have heard from so many people to place a cap.”

Some residents at a hearing days before the vote expressed concerns about the impact of so many cannabis shops on the city’s youth, while councilors like LaBarge said they want to protect existing businesses from being crowded out.

Council President Jim Nash, one of the dissenters, said he favored a cap when recreational cannabis first became legal, but now believes the maturing marketplace is providing a natural cap, as evidenced by the Source’s closing and declining sales at other shops. He argues as much in a recent column in the Daily Hampshire Gazette, co-written with former City Councilor Dennis Bidwell.

“Since when does local government step in to protect the bottom line of existing businesses by excluding the entry of competition?” they wrote. “We don’t do that for beauty salons or pharmacies or anything else. It’s one thing to put a cap in place in the early stages of an industry’s development, before anyone has opened their doors. It’s another thing entirely to enact a cap that would freeze the market where it is, prohibiting further competition.”

What isn’t up for debate is that it’s getting tougher to turn a profit in an industry that’s already taxed about 70% and can’t claim many normal deductions. That reality, plus an ever-more-competitive marketplace, both inside Massachusetts and from surrounding states, is creating an environment that’s not unexpected for those who have followed the industry’s maturation in other states.

“So many people think, ‘if I get a license, I’m going to be a kajillionaire.’ Sorry, that’s not the case. If you’re in it because of the money, it’s going to be a tough road for you.”

People like Meg Sanders, CEO of Canna Provisions in Holyoke and Lee, who was in Colorado when that state, one of two, along with Washington, to pioneer legal adult-use cannabis in 2012, experienced its own ‘green rush,’ with a quickly saturated market causing prices to plummet. What Massachusetts cannabis businesses need to do, she said, is to focus on differentiating themselves in the right ways (see story on page 35).

“I think it’s going to be a painful year, but a necessary year. Honestly, it’s important,” she said. “So many people think, ‘if I get a license, I’m going to be a kajillionaire.’ Sorry, that’s not the case. If you’re in it because of the money, it’s going to be a tough road for you. We believe money is a byproduct, not a goal. We believe in running a good business, a responsible business, serving customers thoughtfully and respectfully and providing an amazing experience with lots of options on the menu. A cannabis purchase should be fun.”

Certainly more fun than selling the product at a time when economic realities in the industry are dramatically shifting.

Growth Potential

There’s no doubt that legal cannabis has been a boon to not only sellers, growers, and manufacturers, but to state and local coffers. Massachusetts imposes a 10.75% excise tax on purchases, while recreational cannabis purchases are also subject to the state’s 6.25% sales tax, and most municipalities levy 3% more.

David O’Brien, the president of the Massachusetts Cannabis Business Assoc., recently told the Boston Globe that the industry will remain strong despite its current challenges.

“Legalization has brought about change people can see. You can see it in the tax revenue, in the jobs that have been filled, in the dispensary storefronts that used to be empty, in the old warehouses that now host manufacturing companies — it’s all growth, it’s all progress, and the sky did not fall.”

Michael Kusek says the cannabis industry’s tightening profits are a natural evolution that has occurred in other states.

As for those jobs, about 22,000 workers were authorized by the state to work at licensed cannabis facilities as of December, making it an attractive field to enter, Kusek said. “Once they get a little experience under their belt, they’re infinitely more marketable. Head growers are making $100,000 to $120,000 a year.”

The problem, he noted, is that players coming into the market now are dealing with product prices that are much different than when they established their first business plans. And the regulatory hoops remain challenging in many cases, as is the decision of where to locate: in a community with limited licenses that are difficult to secure, or a community with a more laissez-faire approach, but also, as a result, much higher competition?

“I just talked to a couple of lawyers, and they’re not working as many licenses as they were two years ago,” Kusek said, and there could be several reasons for this, foremost being access to capital, which is still limited because most banks won’t lend for cannabis enterprises.

“If they can’t access capital, they’re forced to shoulder the ups and downs of the industry by daily revenues,” he added. “If you open a successful restaurant and want to open a second location, you can go back and get a loan to do that. If you want to open a second cannabis location to sell all this product you have, you can’t easily do it.”

“Regular businesses still get normal deductions, but we can’t deduct anything except the cost of goods. That creates a real challenge for overall profitability and cash flow.”

Meanwhile, cannabis investors in the Northeast are increasingly looking to what Kusek calls “the shiny new object” — New York, where shops started selling legal recreational cannabis just a few weeks ago. “That’s where the capital is going, which starves out the businesses we have here.”

And when capital dries up, it’s the mom-and-pop entrepreneurs that suffer, as well as social-equity candidates.

“The companies that operate in multiple states have more of a cushion; they can continue to roll forward,” Kusek said. “Who’s going to get hurt by this [competition]? People who have been trying to get a license for a long time. This just makes it harder for them if they didn’t get more of a leg up in the beginning.”

Sanders said the businesses that survive, both those currently operating and those just setting up shop, will be those that “hunker down a little bit and are super thoughtful with every dollar.”

“This is a business that has zero deductibility, except the cost of goods,” she added. “We have to be way more careful than any other business going through this recession. Those regular businesses still get normal deductions, but we can’t deduct anything except the cost of goods. That creates a real challenge for overall profitability and cash flow.”

Without examples from other states to consult, Sanders recalled, Colorado was immediately saturated, prices cratered, and the market became what she called “a race to the bottom,” with price trumping everything. “But as things got more sophisticated in Colorado, a lot of good operators started telling compelling stories about why you should spend money with this dispensary rather than that dispensary.”

That’s why she focuses on the stories behind Canna’s products and also on giving back to the communities in which she operates.

“Businesses need to be as lean as possible and as thoughtful as possible, and make sure you’re telling a compelling story about why people should buy your brand.”

Legitimate Concerns

In their recent column, Nash and Bidwell argued that public-safety and public-health concerns that motivated discussion about a cap on dispensaries in Northampton five years ago have not come to pass.

“There is, and always will be, an underground market for unregulated, uninspected marijuana. This black market is fraught with crime and suspect product,” they wrote. “The availability of legal marijuana puts a dent in this market, tilting the share of sales toward legal purchase rather than black-market ones. To the extent the market allows, additional regulated cannabis retail outlets will further reduce the use of unregulated, dangerous cannabis.”

And falling prices in legal shops may entice many long-time black-market customers to try different types of strains and products, Kusek said. “As prices come down, people will try and buy more. This is great for consumers; in some circumstances, it costs half of what it did. For consumers, that’s great.”

That’s even more true for medical users, he added, as they tend to be more price-sensitive than recreational users, since they often have to maintain regular usage with finite resources, since insurance won’t cover the product.

“This is still a young market, and consumers are still developing their preferences. It’s only been a couple of years, and people will develop brand loyalty and particular consumption methods, and they will spend their money to get those particular brands or products.”

Kusek agreed with Sanders that product quality is important, especially as consumers are still discovering what they like.

“This is still a young market, and consumers are still developing their preferences,” he told BusinessWest. “It’s only been a couple of years, and people will develop brand loyalty and particular consumption methods, and they will spend their money to get those particular brands or products. That will come over time.”

Kusek also believes the consumer base has room to broaden.

“People become cannabis consumers for a wide variety of reasons. We have a medical market and people for whom cannabis is a significant part of their medical treatment, and you have more people coming into the market and exploring cannabis for treating pain and sleeplessness. Those people are always going to be coming into the market, as well as people who are curious about it.

“I think one of the challenges in cannabis is connecting and finding consumers; with each new market that comes online, you get the people who are curious, or who are coming back to cannabis after not using it for a long time, people whose life circumstances have changed. There will always be new consumers.”

In other words, it may be a tougher business to navigate than when there were only a few dozen shops open in Massachusetts, but it’s still a dynamic field.

As Kusek put it, “it’s never dull, that’s for sure.”