Driven by Millennial Demand, Mobile Banking Surges

Business at Hand

Steve Lowell says a surge in usage of Monson Savings Bank’s mobile offerings has coincided with a downturn in branch traffic.

You never know what will persuade any given customer to switch banks, Karen Buell says.

Buell, vice president of Customer Technologies at PeoplesBank, recalled a couple of non-customers who recently visited a branch to cash checks. When they saw the bank had recently introduced Apple Pay, Android Pay, and Samsung Pay for its customers, they returned — to open accounts.

“Wow. What a win,” said Buell, who has been tracking the usage rate of the bank’s electronic and mobile banking offerings for years. PeoplesBank launched its first mobile app for iPhones in 2009, one of the first 50 financial institutions in the U.S. to do so. Today, 34% of all the institution’s checking-account holders use mobile services. But it was still pleasantly surprising to see those services create a customer on the spot.

Maybe it shouldn’t be a surprise, particularly among the younger crowd. A study last year by the Federal Reserve reported that 67% of Millennials now use mobile banking, compared to 18% of consumers age 60 or over. This usage gap is projected to widen further as the youngest of the 85 million-strong Millennial generation enters the workforce.

Steve Lowell, president of Monson Savings Bank (MSB), says about half of that institution’s customers bank online, and of this group, more than half, about 60%, use the mobile app — up from 31% three years ago and 8% in 2011, the year the app launched.

Customers can perform a number of banking tasks on their mobile devices, Lowell said, including transferring funds between accounts, making loan and bill payments, taking pictures of their checks to make deposits online, and sending money to other banks through an app called Popmoney.

He said adoption has been strong by customers of all ages, but especially Millennials, who have come to expect robust online and mobile services in many areas of life.

“If you don’t have mobile banking, you won’t get the Millennial generation. That said, we have people in their 80s using their smartphones to do their banking. It’s definitely skewed toward the younger generation, but we see it across all age groups,” he said, noting that he uses the function himself. “It’s so easy to use.”

Buell reports similar momentum driven by younger customers at PeoplesBank, noting that 51% of Millennial customers use mobile check deposit, a service the bank began offering in 2014, compared to 24% of the bank’s Gen-X customers and 16% of Baby Boomers. Given those demographics, it seems like demand for mobile banking will only rise.

“Our customer base has enjoyed this for a while, and we’ve had great adoption of it,” Buell said. Specifically, mobile check deposit has grown 140% in overall usage between 2014 and 2016, and total checks deposited rose by 133%. At the same time, total dollars deposited through mobile check deposit went up 202%, partly because the bank increased the dollar-amount limits for that service for many customers based on their balances and relationship with the bank.

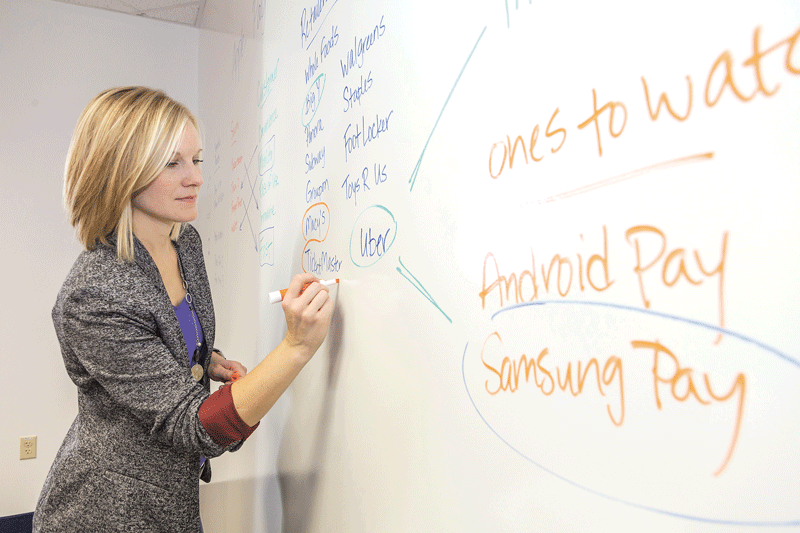

Karen Buell, seen here in PeoplesBank’s Customer Innovation Lab, says the bank has made just about all its e-banking activities accessible on mobile devices, with more to come.

“We’re constantly looking at data to determine how to serve customers better,” said Buell, who also oversees PeoplesBank’s Customer Innovation Lab, which, as the name suggests, develops new products for retail and business customers. “We saw that some mobile-deposit users were still coming to the branch for larger items, so we made some changes and gave them significantly higher limits to accommodate their needs.”

Making Change

Industry analysts have long noted that adoption of mobile banking followed a path similar to online banking, with some customers enthusiastic early adopters, and others initially reluctant for a variety of reasons, often having to do with security, or perceptions thereof.

“I think that’s absolutely the case,” Lowell said. “You still have to have that discussion with people who are concerned about security. But once we run through the precautions we have, and the logins they have to go through, they get pretty comfortable with it. And once they’ve tried it for a while, they get hooked on it. It’s such a convenience; it makes life easier. Of course, people have the right to be concerned about cybersecurity. But the more they learn about it, the less of a concern it is.”

Surging use of mobile banking has, naturally, raised questions about the future of physical branches — or, at least, their rate of expansion — but these are the same questions that arose when desktop online banking was introduced, and institutions have long asserted there will always be a need for brick-and-mortar offices. But Lowell says it’s something to keep an eye on.

“It’s a really important consideration. From 2013 to 2015, we didn’t see a significant decline in branch traffic — maybe 5% year over year — but from 2015 to 2016, we saw a 19% decrease in branch traffic; we went from roughly 555,000 transactions at our branches in 2015 to 452,000 transactions in 2016,” he explained, noting that, at the same time, the overall customer base has increased.

“We definitely see a transition — not just in mobile banking, but in electronic banking in general — and we’ve adjusted our staffing levels as a result of that, and we’re looking at adjusting our hours. We may not need to be open as many hours as we used to be. It’s something we’re watching really closely.”

Industry analysis is mixed on this topic. The Federal Reserve study indicated that even regular users of mobile banking still want to use other banking channels, from visiting an ATM or branch to withdraw cash to speaking with a customer-service representative or loan officer.

Specifically, survey respondents were asked about their use of five distinct banking channels. In the previous 12 months, 83% of smartphone owners with bank accounts visited a branch, 82% used an ATM, 82% used online banking, 53% used mobile banking, and 29% used telephone banking.

But electronic channels have had an impact on branch growth across the U.S. More than 1,600 branches shut down during 2015, the last year for which full figures are available, and several large, national institutions continued to shed offices in 2016.

The branches that remain boast fewer staff as well, from an average of 13 full-time employees per branch in 2004 to fewer than six last year. A recent study by Citi, “Digital Disruption,” predicts that new technologies could cause up to 30% of branch positions to disappear by 2025.

“People find it more convenient to do their banking from home,” Lowell said. “Our strategy is to do whatever is easy for them — they’re the customer, and we want to develop our relationship with them and make things as easy as possible.”

More to Come

Still, despite the concerns, mobile technology has stirred plenty of excitement in the industry. Lowell is enthusiastic about some advances just around the corner for MSB customers, including CardValet, technology that allows users to turn a debit card on and off with their phones, rendering it useless if stolen, and set custom-designed alerts for things like low balances and cleared checks, instantly transferring money between accounts to protect against overdraws. Another upcoming function is the ability to pay bills by taking photos of the invoice and the check.

“At this point, we’ve really put most of what you can do from your desktop onto your phone,” Buell said, noting that 60% of all electronic-banking logins at PeoplesBank are now made from mobile devices. Last fall, the bank launched fingerprint authentication, which allows users to log in without needing a username or password. The bank is also looking to introduce technology that uses the GPS function on smartphones to shut down a debit card when it’s not in the vicinity of the phone, to combat use of stolen cards.

“We want to be first to market with these things for our customers,” she told BusinessWest. “We’re really committed to being early adopters of technology, so they can get all the functionality of of a national bank, but the personal customer experience of a local bank.”

Joseph Bednar can be reached at [email protected]