Despite Ambiguity, This Is Still a Time for Tax Planning

We have a challenging year before us on the tax-planning front, with expiring provisions leading to uncertain future rates and pending elections leaving us with little in the way of legislative expectations.

We have a challenging year before us on the tax-planning front, with expiring provisions leading to uncertain future rates and pending elections leaving us with little in the way of legislative expectations.

Historically, the last few months of the year are used to implement tax-planning techniques to manage individuals’ tax liability for the current year with the relative certainty that comes from having the majority of the year behind us. This year, the only certainty appears to be everyone’s uncertainty.

Ambiguity in the tax realm can have a paralyzing effect on planning, but a wait-and-see approach can lead to lost opportunities or last-minute scrambles to seize the remains of an opportunity. Although the tax future remains unclear, planning opportunities remain. There are gifting provisions that are largely considered once-in-a-lifetime opportunities and rates that may be the lowest to be seen in a while. They provide an opening to make meaningful tax-planning decisions before 2012 comes to a close.

The focus in this piece is on tax-planning techniques that can be initiated during the remainder of 2012. But, depending on one’s facts and circumstances, these are just the beginning of the opportunities that might be available. If you think any of these strategies apply to you, be sure to contact your tax professional or advisor.

Changes on the Horizon

Despite the quiet year for tax legislation, significant changes are before us for 2013. Two years ago, when faced with a comparable series of expiring provisions, the can was legislatively kicked down the road. Conclusive action was deferred in favor of short-term extension solutions.

Here we stand, nearly two years later, with a similar collection of rate reductions, deductions, credits, and incentives set to expire as the calendar flips from one year to the next. In addition, two new taxes stemming from healthcare-reform legislation become effective in January.

Absent any late-year legislation, the significant changes on the horizon in 2013 are as follows:

• Two new taxes established under the Patient Protection and Affordable Care Act will go into effect on Jan. 1 — a 0.9% tax on wages and self-employment income, and a 3.8% contribution tax on investment income;

• Individual tax rates will universally climb, with the highest rate rising from 35% to 39.6% before accounting for the new taxes stemming from the act. Including the 3.8% UIMC tax, the top rate on investment income will rise to 43.4%. The current 10% rate bracket expires, reverting back to 15% as the lowest tax rate. The UIMC tax is explained below;

• Federal estate and gift-tax rates will increase from 35% to 55%, and the exclusion amount will drop from $5.12 million to $1 million;

• A series of tax rules designed to reduce what is commonly referred to as the ‘marriage penalty’ will sunset at the end of this year, raising taxes for many dual-income couples;

• Preferential tax rates on capital gains and dividends, currently 15% for most individuals, will expire at the end of the year, with the tax rate on long-term capital gains returning to 20% and qualified dividends losing preferential treatment altogether, returning to the ordinary income rates of up to 43.4%;

• Limitations on itemized deductions and personal exemptions will return in 2013 for higher-income taxpayers;

• It is anticipated that millions of additional taxpayers will become subject to the alternative minimum tax (AMT) with the expiration of the ‘AMT patch’; and

• The child tax credit will be reduced by half for 2013.

Business Tax Strategies

• Section 179 Expensing: IRS Code Section 179 provides businesses the option of claiming a full deduction for the cost of qualified property in its first year of use rather than claiming depreciation over a set period of years. For 2012, the Section 179 dollar limitation is $139,000, with a $560,000 investment limitation.The dollar limitation for 2013 is scheduled to drop to $25,000, with a $200,000 investment limitation. Businesses might want to consider accelerating scheduled purchases into 2012 to take advantage of the higher limits.

Businesses with a fiscal year-end should note that the $139,000 deduction limit applies to property purchased and placed in service during tax years beginning in 2012.

• Bonus Depreciation: Property not qualifying for an immediate tax write-off under the expensing election may qualify for an increased first-year depreciation deduction under bonus depreciation rules. This deduction is equal to 50% of the cost of qualifying property purchased and placed in service by Dec. 31, 2012.

Unlike the Section 179 deduction, bonus depreciation is not limited in amount or by an investment limitation, and it can create a current-year net operating loss.

• Changes to Repair Regulations: Comprehensive repair and capitalization regulations issued by the IRS late in 2011 may open up planning opportunities.

A new de minimis expensing rule allows a business to deduct certain amounts paid or incurred to acquire or produce a unit of tangible property if the company has an allowable policy. There is an overall ceiling limiting the total expenses a company may deduct under the de minimis rule. Accounting policies and existing depreciation schedules should be reviewed to determine whether changes in accounting methods should be filed and adjustments taken. In many cases, the change will result in accelerated expensing.

• Corporate Dividends: Traditional C corporations face double taxation on distributed earnings. Profits are taxed at the corporate level, and dividends paid out to shareholders are again subject to tax at the individual level. With the maximum 15% tax rate for qualified dividends during 2012 rising to 43.4% for 2013, this may be the year to consider paying out accumulated earnings that the corporation is not otherwise using.

• Health Insurance Tax Credit: A tax credit is available for an eligible small employer to purchase health insurance for employees. To qualify as an eligible small employer, the company must:

— Pay for at least 50% of the premium cost for employees;

— Generally have no more than 25 full-time equivalent employees employed during the year; and

— Pay its full-time equivalent employees annual wages averaging no more than $50,000.

Individual Tax-planning Strategies

• Planning for the New Healthcare Taxes: Effective Jan.1, a 0.9% hospital insurance (HI) tax applies to wages and self-employment income, while a 3.8% Medicare contribution (UIMC) tax applies to investment income. Neither tax becomes applicable until income exceeds the established threshold noted in the table below.

The HI tax may be managed through withholding for employees, but in certain circumstances, such as for dual-income households or in years of employer transitions, withholding may not fully cover the wages subject to the HI tax.

For the purposes of the UIMC tax, net investment income has been defined to include dividends, rents, interest, passive-activity income, capital gains, annuities, and royalties. Specifically excluded from the definition are self-employment income, income from an active trade or business, gain on the sale of an active interest in a partnership or S corporation, IRA or qualified plan distributions, and income from charitable remainder trusts.

For individuals, the amount subject to the UIMC tax is the lesser of your net investment income, or the excess of your modified adjusted gross income, which is generally your adjusted gross income with certain foreign earned-income adjustments, over the applicable threshold amount.

For both taxes, the applicable thresholds are as follows:

Keep in mind that the UIMC tax applies if you have net investment income and your modified adjusted gross income is above the threshold. The impact of the tax may be minimized through shrewd management of your net investment income, proximity to the thresholds, or both.

Year-End Tax Planning Strategies

Bearing in mind the new Medicare taxes and the scheduled changes in tax rates, traditional year-end tax planning techniques may need to be reversed to take advantage of the known lower rates of 2012.

• Shifting Taxable Income Between Years: When you’re expecting stable rates in the future, the traditional year-end strategies are largely focused on deferring income and accelerating deductions. But with the rates set to rise for most taxpayers, the better tax answer may come from an opposite approach.

Income accelerated into 2012 could potentially result in a significantly lower rate than the same income recognized during 2013. Because rates remain relatively uncertain, now may not be the time to accelerate income. But having a plan in place should the rates hold will allow taxpayers to act deliberately as the rates become more certain.

• Managing the AMT: When undertaking tax planning, both regular and AMT tax liabilities need to be evaluated. At times, certain deductions may need to be shifted between years to manage the alternative minimum tax.

• Paying Estimated State Income Taxes: The payment timing of the fourth-quarter estimated state-tax payment, generally due Jan. 15, 2013, has some flexibility. It may be paid before year end for a current-year federal itemized deduction. The alternative minimum tax should be considered before employing this tax-planning tool because state income taxes are not deductible for AMT purposes.

• Fulfilling Charitable Goals: An alternative to cash donations is the contribution of appreciated assets. When contributing assets, you can deduct the fair market value of certain property and avoid paying taxes on the appreciation. However, if you would like to donate securities that have declined in value, you will likely want to sell them first to realize the loss and then gift the proceeds to your organization of choice. In some circumstances, particularly when there is expiring capital loss, a direct donation may not be the most effective tax-planning tool.

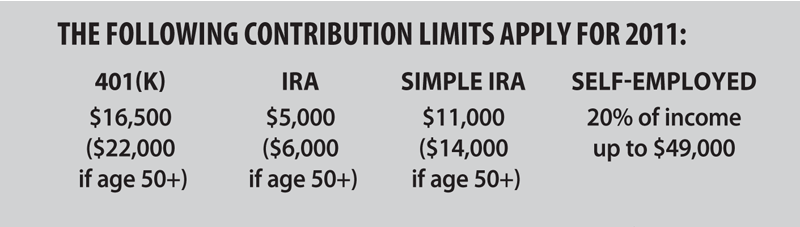

• Funding Retirement Plans: For retirement contributions to qualify for a deduction in 2012, contributions must be in place usually before the end of the year. The exceptions to the rule are IRAs and SEP (simplified employee pension) plans. An IRA can be created and funded by April 15, 2013, and a SEP by the extended due date of your tax return.

• Converting to a Roth IRA: Roth IRAs have long-term advantages over traditional IRAs because money grows and can be distributed tax-free. Some taxpayers find that the benefits of tax-free withdrawals in the future are in line to be greater than the tax cost on conversion.

Converting before-tax earning plans — 401(k)s, traditional IRAs, etc. — to the after-tax Roth IRA creates taxable income in the year of conversion. The upfront tax cost does not make conversion the right answer for every taxpayer, but for taxpayers with certain circumstances, conversion can be an extremely powerful tool.

• Paying with Credit Cards: As a reminder, paying tax-deductible expenditures, including charitable contributions, with a credit card secures the deduction in the current year, even if you do not actually pay the credit-card company until the following year.

• Deducting Losses from Pass-through Entities: If you are expecting a 2012 loss from a partnership, LLC, or S corporation, ensuring that you have sufficient tax basis will help to secure your ability to deduct the loss. You may be able to increase your tax basis prior to year end, but given the rates for 2013 as enacted, you might want to purposely avoid doing so until 2013 to push the loss into the higher rates of 2013.

Capital Gains and Losses

You should consider a few basic rules when planning for capital gain or loss transactions:

• Gains and losses from securities sales generally are recognized on the trade date as opposed to the settlement date. So a December trade will be a 2012 transaction, even if the settlement date is in the following year;

• Sales at a loss reduce other capital gains, and a net capital loss in excess of capital gains of up to $3,000 is available to be used to offset other income, with excess losses being carried forward to future years; and

• Before you sell an asset to recognize a gain, check your holding period. Capital assets held for over a year are eligible for a significantly lower tax rate than those held less than a year.

Estate- and Gift-tax Planning

Absent congressional action, the $5.12 million estate and gift-tax exemptions and current top tax rate of 35% will revert to a $1 million exemption with a top tax rate of 55% beginning Jan. 1, 2013. Moreover, the estate-tax exemption will no longer be portable between spouses.

Because of the reversion to a lower exemption and a higher tax rate, what could be a once-in-a-lifetime opportunity exists to transfer significant assets to the younger generation without incurring any estate and gift tax. Also note that:

• The annual gift tax exclusion for 2012 remains at $13,000. It is expected to rise to $14,000 for 2013;

• If you are married, you can avoid federal gift-tax ramifications by gifting up to $26,000 per donee, or recipient, in 2012 under the gift-splitting rules. Annual gifting is a relatively simple method to reduce your taxable estate; and

• Along with the high gift-tax exemption, the generation-skipping transfer-tax exemption is also $5.12 million during 2012. So, the door is open to bypass children and transfer significant wealth to future generations.

Developing an overall tax strategy under ambiguous circumstances can feel daunting. But the deliberate, informed implementation of a plan for what is known now can also protect against what remains to be seen — as what is unknown becomes known.

Kristina Drzal Houghton, CPA, MST, is partner-in-charge of Taxation at Meyers Brothers Kalicka, P.C. in Holyoke; (413) 536-8510.