Investing Is About Having the Proper Frame of Mind

It’s Not Just About the Money

By Pat Grenier

We have a well laid out plan for how our wealth-building investment portfolios will provide us with the lifestyle we want, confidence in our financial strategy that we believe we deserve, and the legacy we want to leave our loved ones.

Inflation, rising interest rates, high gas prices, the war in Ukraine are non-trivial distractions that test our ability to stay calm and focused. As Mike Tyson once said, “everyone has a plan ‘till they get punched in the mouth.”

Pat Grenier

For many depending on their 401k plans, their IRAs and/or their investments, this is a gut-wrenching feeling. It certainly is painful to watch the value of our monies depreciate — especially in an inflationary environment. Emotions can take over and cause anxiety, nervousness, and fear. You are not alone. These feelings are real and may drive the person into a decision that may be irrational, absolutely the wrong one at the wrong time.

Until we address these feelings with facts and common sense, we will not be able to make rational decisions about our investments and the impact it will have on our lives.

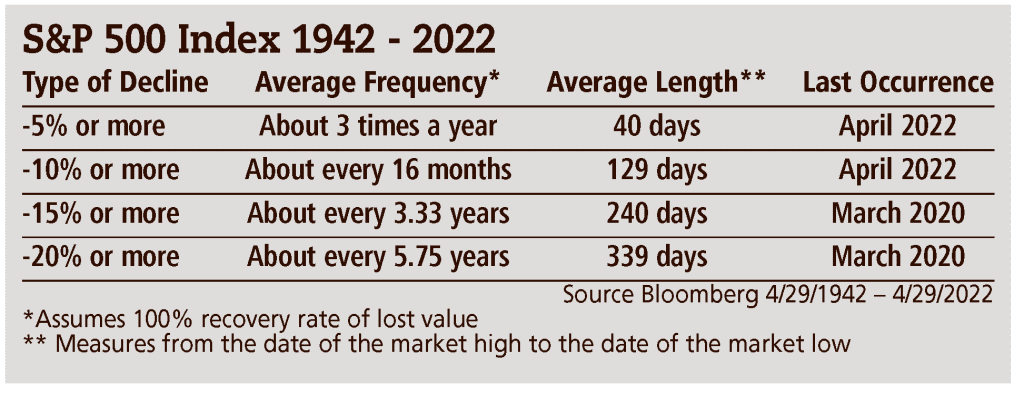

As a start, let’s put the current market environment in perspective. As with any market decline, we don’t know when it will hit bottom or how long it will take for markets to come back. What we do know, and history has proven, is that market corrections occur periodically and have been short-lived:

As much as anyone would like to avoid these declines, they are an inevitable part of investing.

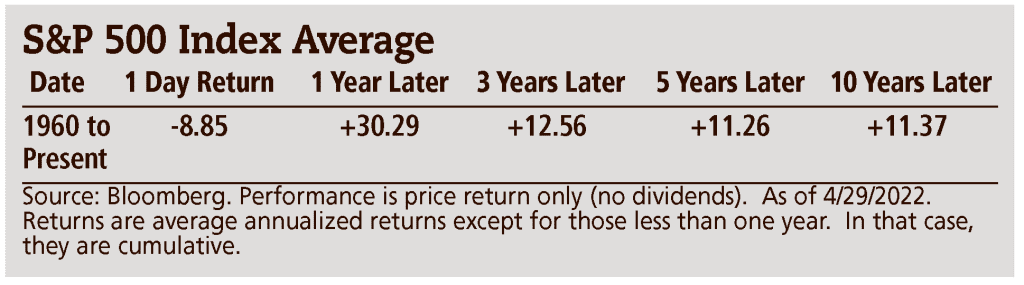

Looking back at the 15 largest single-day percentage losses in the S&P 500 since 1960, we see that investors are rewarded for staying the course:

Warren Buffett said it best “American magic has always prevailed, and it will do so again.” Can you think of a year where there was not an event that had a negative impact on the economy and investments? It is reassuring to know that despite these annual headwinds, the U.S. economy is resilient and has always recovered.

As much as the fearmongers want us to believe the world is falling apart, we should know better than to listen to the 24/7 negative news cycles. For our own sanity, we need to focus on the positive. Our economy continues to open after the closures due to the Covid pandemic, there are plenty of jobs for anyone that needs one and consumers are still spending. To our surprise many corporations for the first quarter of this year reported higher-than- expected earnings. In addition, in spite of higher mortgage interest rates, pending home sales rose in May. This should provide us with optimism for the economy, even if the ride is bumpy.

Famed British Banker, Sir Baron Nathan Rothchild, is credited with the phrase “buy on the sound of canons, sell on the sound of trumpets.” The old adage ‘buy low and sell high’ makes sense but is one of the most difficult principles to follow and act upon.

Markets decline on negative news. The negativity creates fear, but the decline presents an opportunity to reassess our investments, our allocation, our risk tolerance and to take advantage of quality investments that may have been beyond our reach. If time is on your side, buying on sale makes sense.

It is not just about the money. Investing is about having the right frame of mind to make our money work efficiently and effectively.

Pat Grenier, CFP® is president and founder of Springfield-based Grenier Financial Services; (413) 736-6712; [email protected]

Securities and advisory services offered through Cadaret Grant & Co., an SEC Registered Investment Advisor and member FINRA/SIPC. Grenier Financial Advisors and Cadaret Grant are separate entities.