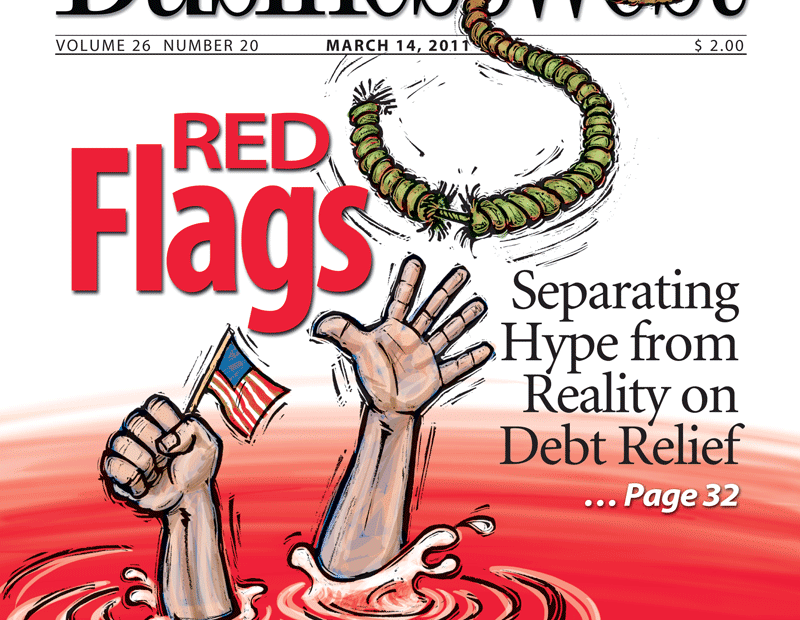

Red Flags

Separating Hype from Reality on Debt Relief

Millions of Americans are drowning in debt and desperate for a lifeline, so it’s no wonder ads touting easy debt relief are so alluring. But they can also be deceptive, glossing over the harsh realities and limitations of the debt-settlement industry; in fact, these programs leave many customers worse off than when they enrolled. Solutions to spiraling debt — bankruptcy among them — do exist, financial experts say, but finding the right remedy takes an understanding of all the options and a willingness to accept that there are no easy answers.Michael Katz keeps a box of tissues behind his desk. And they get a lot of use from the people who sit down to talk with him about their crippling debt, and the reasons — unemployment, divorce, medical bills, or perhaps plain old bad decisions — it has spiraled out of control.

It’s not just feelings of anxiety and helplessness, but often a sense of desperation that brings them to tears — and to promising-sounding solutions, like debt-settlement companies that promise to drastically reduce or eliminate that crushing red tide.

Reality, they often find, paints a far different picture.

“So many people I talk to found these agencies through a television commercial or on the Internet, and in a very high percentage of cases, they have no idea about the legitimacy of the agency,” said Katz, an attorney with Bacon Wilson, P.C. who specializes in business and insolvency law and co-chairs the firm’s bankruptcy department.

“Most people who come to see me who have been in one of these programs found them to be unsuccessful and basically worthless,” he continued, explaining that many of them charged membership fees in the hundreds of dollars, followed by a monthly maintenance fee. This monthly payment typically goes into a ‘dedicated account’ which builds up over time, and is eventually used to make ‘full and final’ settlement offers to one or more of a customer’s creditors.

Thom Fox says people should be wary of companies that want to enroll them in a program without offering credit counseling.

That anecdotal evidence is backed up by a Federal Trade Commission (FTC) study determining that 65% of people who leave debt-settlement programs do so without receiving any settlements whatsoever. Overall, during the survey period, they paid $55.6 million in fees while receiving just $58.1 million in savings from settlements — essentially a wash.

However, the FTC points out, those figures don’t include other costs typically associated with debt-settlement programs, such as late fees and interest charges from creditors, meaning the cost of using such a program, in many cases, far outweights the benefits.

“The FTC received a couple thousand complaints about these services, and that put them on the radar,” said Thom Fox, community outreach director at Cambridge Credit Counseling Corp. in Agawam. “When the FTC did its report, the findings were startling to many people.”

The data eventually led the FTC to amend its Telemarketing Sales Rule. The new regulations, which went into effect in October, set tighter restrictions on how debt-settlement companies — specifically those that solicit customers by phone or receive phone calls in response to ads — conduct their business.

But consumers must still be wary of the remedies they seek to get out of debt, Fox said. In this issue, BusinessWest examines what those options are, and why becoming debt-free is almost never as easy as a TV commercial might make it sound.

Cards on the Table

For instance, Fox said, a consumer might owe $10,000 on a credit card, and the creditor might accept a $7,000 settlement. But while payments to a debt-relief firm are amassing in escrow, that $10,000 can rise at an alarming rate. “Your creditor’s not being paid during that time, the bills pile up, you fall behind, and maybe you get sued,” he said, adding that debt-settlement programs have rarely explained that to clients, but now they have to lay it all out.

Under the new FTC rule, debt-relief companies that run ads or engage in telemarketing will not be able to charge upfront fees until three conditions have been met: the service successfully renegotiates, settles, reduces, or otherwise alters the terms of at least one debt; a written settlement, debt-management plan, or other agreement is worked out between the consumer and the creditor; and the consumer has made at least one payment to the creditor as a result of this agreement.

Also, debt-relief services cannot require that consumers set aside payments in a dedicated account unless the account is maintained at an insured financial institution; the consumer owns the funds (including any interest accrued); and the consumer can withdraw the funds at any time without penalty. In addition, the debt-relief firm cannot own, control, or have any affiliation with the company administering the account, nor receive any referral fees from it.

Finally, before the consumer signs up for any debt-relief service, the company must disclose certain aspects of their services, including how long it will take for consumers to see results, how much it will cost, the negative consequences that could result from using debt-relief services, and detailed information about dedicated accounts if they require them.

The Better Business Bureau (BBB) heartily supports the changes. From December 2007 — roughly the start of the Great Recession — through late 2010, the BBB received more than 6,000 complaints from consumers about debt-relief or debt-settlement companies. Complainants typically said they were charged large up-front fees in exchange for a promise — soon proven empty — to significantly reduce or eliminate their debt.

But consumers aren’t out of the woods because of a rule change, the bureau stresses, and still need to use caution when enlisting a third party to help them get out of debt.

“The debt-relief industry has flourished in the current economy, and you can bet that many unscrupulous companies are feverishly trying to figure out ways to get around the new laws, such as relying less on telephones to solicit new customers,” said Alison Southwick, BBB spokesperson. “While these new rules provide effective new protections, consumers still need to be on the lookout for deceptive debt-relief services.”

Fox said the rule takes aim at all sorts of misleading marketing practices, from promising to cut personal debt by 75% to using President Obama’s image in ads, giving the debt-relief service the appearance of government approval.

“A lot of these things are going away” with the new rules in place, Fox told BusinessWest. “They’re trying to get rid of deceptive advertising, give people proper disclaimers, and empower people with knowledge. Debt settlement can hurt people as well as help them.”

Katz added that people facing debt issues have local options — banks, lawyers, and agencies like Cambridge, to name a few — that provide a level of security that an out-of-state debt-relief firm might not.

“That way, if you have issues or problems, you know where to find someone to help you,” he said. “You can go to a local office and sit down with someone to talk about a program, rather than doing business with someone you and I and, frankly, sometimes Google has never heard of, who has no desire to be a responsible citizen or work out your concern.”

Problem Not Solved

Mike Katz says bankruptcy can be preferable to debt relief because it erases all the debt at once so that an individual can begin to rebuild his credit rating.

Another issue, he explained, is the problem of ‘phantom income.’ It can take several forms.

“If you owe the bank $200,000 on your home and the bank forecloses on the house, and the house sells for $100,000, by law the bank is required to report the money being written off to the taxing authorities, including the IRS and the Mass. Department of Revenue, and they issue a 1099 to you as well as to the IRS,” he said. “Therefore, you owe federal and state income tax on the amount of debt being written off by the lender, and must pay taxes on it at the same rate as your own personal income tax.”

Similarly, Katz explained, “any debt that’s settled through one of the debt-settlement agencies will result in phantom income being produced. And we have found that, in virtually every agency we have dealt with, that fact has never been disclosed to people until the end of the term.”

As an example, he noted that someone with $50,000 in debt who settles for $25,000 might be taxed 30% on the $25,000 written off, or $7,500.

Opting instead for Chapter 7 bankruptcy proceedings, he noted, does not produce any phantom income and might cost as little as $2,000 to erase the entire debt, and the individual can start rebuilding his ruined credit score immediately, especially if he’s diligent about paying other bills, such as a mortgage or car payment. Choosing debt settlement can be equally devastating to one’s credit rating — again, something customers weren’t always told in the past — with little chance of improving it during the life of the plan, which might be three years or more.

“You don’t get any extra credit unless you pay your creditors in full,” Katz said. “So it’s better to do the Chapter 7 and start building your credit back three years earlier than not having it paid in full and still having a black mark on your credit. That’s the reality.”

That’s not to say bankruptcy is the only answer — “it’s not a good thing for anybody,” he said — but he recommended at least talking to a lawyer with expertise in that field.

If someone is considering using a debt-relief agency, Katz said, at minimum they should go online and search for positive or negative comments about that firm. But even then, they should be aware that companies often hire people to post false comments on message boards, praising their services or blasting a competitor’s, a practice that extends to other service industries as well, such as restaurants and hotels.

“So when you see reports online, you have to take them with some skepticism because you don’t know who’s writing them,” he noted, adding that the Better Business Bureau is often a more reliable resource to investigate customers’ experience with various agencies.

A good start, Fox said, is to seek help from a nonprofit agency, which is more likely to focus on the needs of each client, and not just the bottom line.

“Let’s say 100 people call me tomorrow; we’ll offer a debt-management program to roughly 20 of them. That’s about how many would qualify. But the remaining 80% receive personalized advice regarding their situation. Our average employee has been here eight years and has made a career out of helping people with their finances.”

No Quick Fix

The mistake many consumers make, Fox said — and one that has been exacerbated by those ads trumpeting quick, dramatic debt reduction — is relying on a one-size-fits-all program to solve their problem quickly. But the first step in the journey out of the red has to be a serious study and understanding of their own situation, how it developed, and what it will take to avoid future setbacks.

To that end, Cambridge Credit Counseling conducts hundreds of seminars each year — reaching about 7,000 people in Western Mass. annually — in addition to issuing publications and maintaining a weekly YouTube show called Your Money. That’s in addition to spending hours at a time providing free, intensive counseling services to its clients, whether they’re among the 20% referred to debt-management programs or the 80% who aren’t.

“Our goal is empowerment. Maybe 90% of the people who call us have never put a budget into play. They understand their income, but they don’t understand their expenses,” he said — and, specifically, which ones can easily be reduced or eliminated.

“The best learning experiences are the mistakes you make, not the triumphs you have,” Fox continued. “But people aren’t learning financial literacy in their school systems, although that philosophy started changing after the financial collapse. Money is a central aspect of life, and people need to know how to manage it.”

It’s an issue close to the heart of Brady Chianciola, assistant vice president and regional manager at PeoplesBank, who has initiated a series of financial-literacy programs for area students.

“Locally, we’re trying to start young and educate the youth of the region with financial-literacy initiatives,” he said of the school-based programs in Springfield and other Pioneer Valley communities — from budgeting and recognizing the difference between needs and wants to seminars on mortgages and mutual-fund investing.

“No matter what, you need to know about the complex financial landscape we live in,” Chianciola said. “We certainly understand how easy it is to get into trouble, and we hope that, by the time they get out into the real world, they’ll understand these concepts and not fall into some of the traps and scams out there.”

In talking to parents, Chianciola is encouraged by their support of the program. “They say they didn’t have this education,” he told BusinessWest, “but they’re excited about their kids starting young and not falling into the same pitfalls they did.”

Fox said his agency is providing a crash course to people who are learning the hard way. “Our counseling sessions can be an hour and a half, two hours. We do an in-depth budget analysis. We can’t give anyone advice without a full understanding of their goals and situation and aspirations. We can’t build a plan from nothing.”

While making sure any solution fits the individual is simple common sense, he said, it’s a practice that has been neglected by debt-relief services and people who are clamoring for an easy way out — when one usually doesn’t exist.

In most cases, Fox said, “there’s not going to be a quick answer. If anyone gives you a quick answer just to enroll you in their program for debt settlement or debt management, you’re with the wrong agency. Walk away; nobody benefits from that. They’re not providing value if they’re pushing you into a program that’s going to hurt you.”

In too many cases, the end result is more debt — and more tears to wipe away.

Joseph Bednar can be reached at [email protected]