Saving for Retirement

You Can’t Start Too Early, but You Can Certainly Start Too Late

By PATRICIA M. FAGINSKI

It’s highly likely that you started working sometime in your 20s with a retirement goal that was 40 years or so away. It’s also likely that you saved very little toward retirement in those years. For most Americans, that means they started too late.

But wait — you say you started saving in your 30s. Isn’t that pretty good? Well, it’s certainly better than nothing, but it’s still late. Why do I say that? The numbers don’t lie, and to prove it, let’s see what happens to two savers, assuming an annual 8% return.

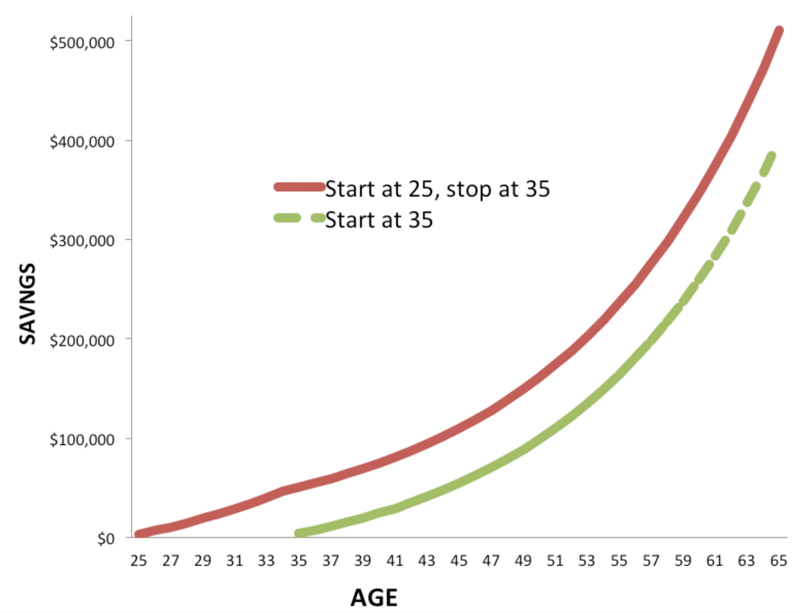

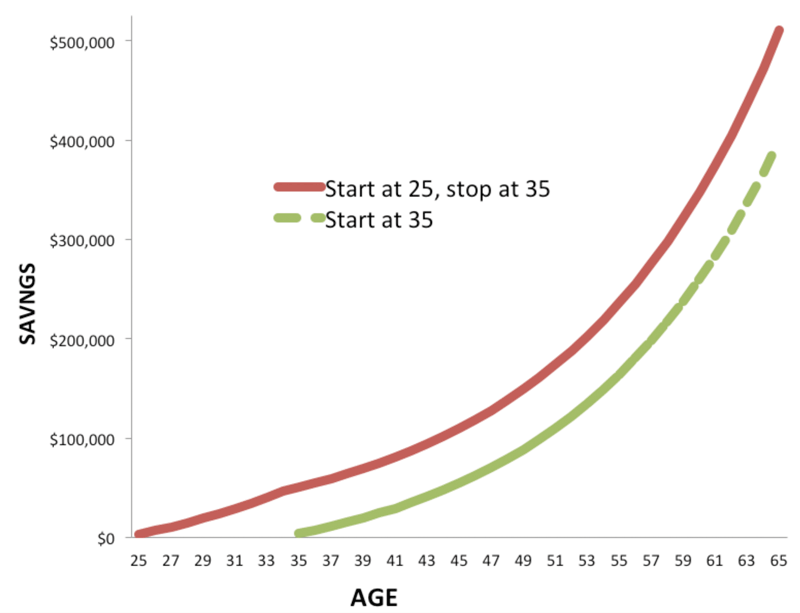

Both save $3,000 per year, but one starts at 25 and stops saving at 35. The other starts at 35 and continues to save for the next 30 years (see chart below).

Surprisingly, the early saver outpaces the later saver. Why? The magic of compound interest.

As a financial planner now approaching age 40, the implications of this data certainly resonate with me. It certainly doesn’t mean things are hopeless for those 40 and above, but it does mean you probably need to budget, dig deep, and find places to help you meet your retirement goals.

Understanding the best ways to start saving, including the need to start early, is key to saving enough for retirement. Here are some other points to consider:

• Contribute to your 401(k), as much as you can to the maximum, which will lower your current income taxes;

• Take full advantage of your company retirement plan;

• Create a monthly budget so that you fully understand where you are spending your money; and

• Within your budget, set aside a specific dollar amount for an emergency fund. You should have at least three to six months of savings set aside.

No matter where you find yourself on the age spectrum, it’s essential to take a hard look at your finances. Yes, it’s daunting, but retirement will be the most expensive thing you ever do. With that said, I find that most people spend more time researching a new car purchase than they spend on retirement planning.

No matter where you find yourself on the age spectrum, it’s essential to take a hard look at your finances. Yes, it’s daunting, but retirement will be the most expensive thing you ever do. With that said, I find that most people spend more time researching a new car purchase than they spend on retirement planning.

If it’s too overwhelming, call a planner and get some help. They will work with you to figure out where you stand now, establish your vision of a successful retirement goal, and formulate a plan to get you there. The work isn’t over, though — you still need to put the plan into action and monitor it for any deviations.

A good retirement plan will likely have a robust mix of investments, as well as insurance, pension plan/IRA/qualified funds, planning to maximize and integrate Social Security, and tax sensitivity.

Daunting? Sure, but with proper guidance it is manageable, giving you peace of mind that you are on the right track. A plan started late is better than no plan at all — but it really pays to start early.

Patricia M. Faginski is vice president and financial advisor at St. Germain Investment Management in Springfield; (413) 733-5111.