Talking the Talk

As part of its annual Economic Outlook, BusinessWest put together a roundtable of area business leaders to discuss the issues facing the region and its business community and the outlook for the year ahead. The panel represents several sectors of the economy, and both small and large businesses. It includes: Harry Dumay, president of Elms College in Chicopee; John Falcone, director of Merchandising for Rocky’s Ace Hardware; Spiros Hatiras, president and CEO of Holyoke Medical Center; Susan Kasa, president of Boulevard Machine in Westfield; Tanzania Cannon-Eckerle, an attorney with the Royal Law Firm and co-owner of Brew Practitioners; and Tom Senecal, president and CEO of PeoplesBank. They were candid and, overall, cautiously optimistic in their answers to a series of questions about the economy and what comes next.

Watch the video of the roundtable here:

BusinessWest: What is your outlook for 2023?

Kasa: “We’re excited for 2023; we’ve really seen an uptick in military and defense work, so we’re really excited about where our year is going to go.”

Senecal: “Increased business confidence is the biggest thing, I think, with all the negative press we hear on the economy. Increased confidence is big, and in my industry, and with the people we do business with, lower interest rates will have a significant, positive impact on our environment.”

Cannon-Eckerle: “We’re excited about some of the fallout that we got legally from COVID; it has started to settle down a little bit — we’re starting to see those issues become isolated, and opportunities for us to create some guidance and counsel about preventive measures. On the employment side, instead of seeing people float from job to job, I think we’re going to see a little more staying power.”

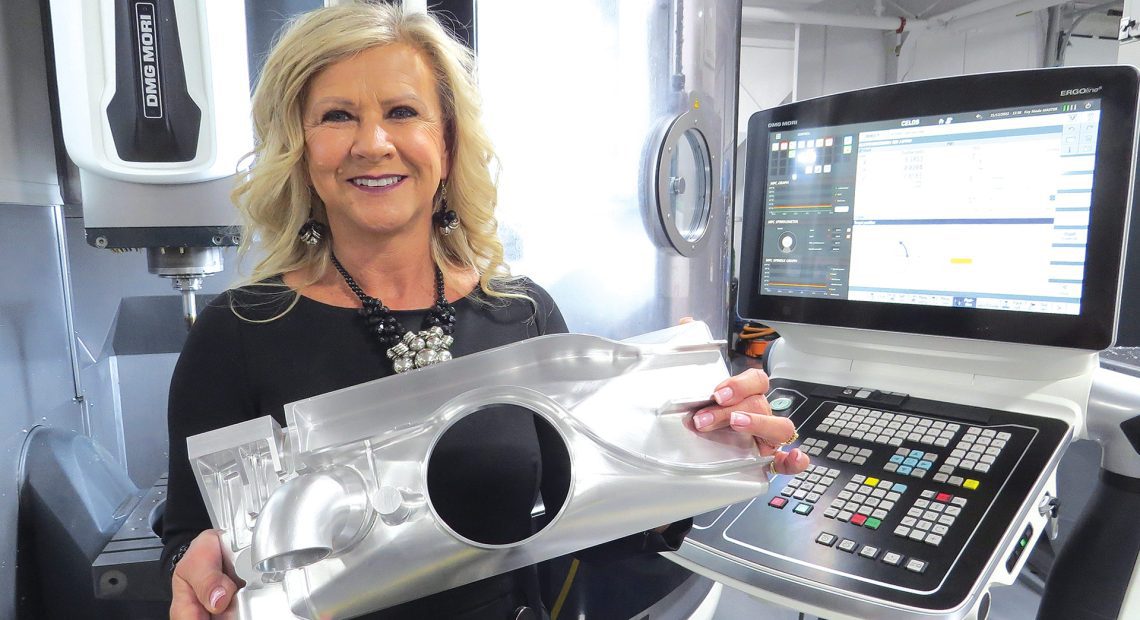

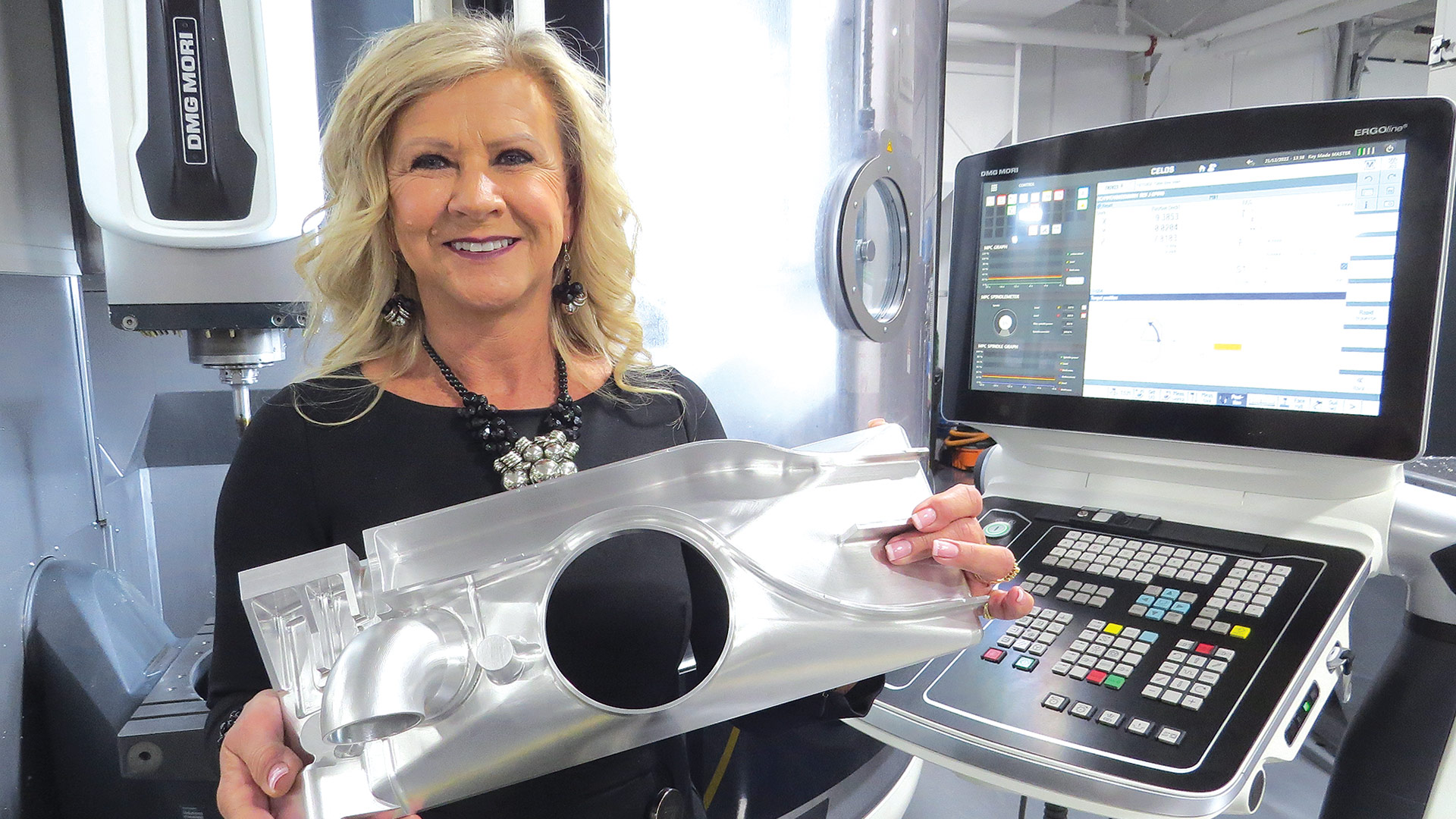

Susan Kasa says the war in Ukraine, while bringing hardship to many, has helped the fortunes of her company, Boulevard Machine, which specializes in work for the defense, military, and aviation industries.

Falcone: “We really track consumer sentiment, and what we’re expecting is a really soft Q1, but then when Q2, Q3, and Q4 hit, we’re expecting that consumer sentiment will increase slightly, and that we’re going to have some sort of recovery come the back half of the year.”

Hatiras: “With ARPA funds drying up, we’re going to have pull ourselves up by our bootstraps. So our emphasis is on closing the staffing gap. If we can do that, and not bleed money on the expense side, I think we’ll be OK; I think we’re poised to have a good year, as long as we’re able to attract nurses here.”

BusinessWest: What are the major challenges facing businesses in the year ahead?

Kasa: “For us, it’s the same old, same old — trying to get people into manufacturing. We’ve dealt with the generation gap for years, and are getting more involved with the vocational schools and getting parents to understand that manufacturing is a viable option for young people. It’s not just manufacturing; they can be their own entrepreneur in plumbing or electrical, whatever it might be. Also, holding onto folks; ever since COVID came through, it just seems harder and harder to find people who want to work, and want to work the extra hours that we’re giving them. Workforce is key for us — building on the workforce.”

Hatiras: “In healthcare, there is a great deal of concern, and the most concerning part is the continuing shortage of personnel, which has created this market for temporary staffing at rates that are truly outrageous. To put things in perspective, we have about 20 nurses on temporary staff that we get through agencies. Those 20 nurses, on an annual basis, cost us $5 million; each nurse costs us $250,000, because the rates are exorbitant — the nurses get a lot of money, but there’s also a middleman that makes untold amounts of money from this crisis.

“As a nation, the federal government is doing a lot of things — they did some things with railroad workers, they’re helping Ukraine, they’re talking about a lot of things. They should have stepped in and regulated this and said, ‘the pandemic created a tremendous amount of shortage; we cannot allow private companies to go out and profit from that shortage of staffing and bring hospitals to their knees.’ With all this, it’s going to be very difficult for hospitals to cope, and that’s why all our strategy centers around finding a way to attract nurses here.”

Falcone: “Number one would be interest rates; we keep seeing interest rates increase, and not increasing at a rate that we would expect compared to supply chain. The supply chain is still not fully intact, so we’re still struggling to find those products that we want to make strategic investments in. Also, the job market is going to be difficult for us, primarily on the service, retail, restaurant industry. We very much struggle with our workforce.”

Tom Senecal notes that the Fed’s actions to boost interest rates have not yielded much improvement on the inflation front, something to watch in 2023.

Senecal: “I would agree with Susan on the labor force. We’re all in different industries, but we’re seeing the same challenges, whether it’s manufacturing, skilled labor, retail labor, banking and financial services … COVID killed the participation rate of how people want to work or, quite frankly, don’t want to work. It seems like it’s across all industries — the participation is so low, and people just don’t want to work. That’s a huge challenge for next year.

“Another one is inflationary pressures; the Fed has raised rates at unheard-of levels, and it’s having very little impact, which is kind of scary. The last increase wasn’t as high as the others, but it’s still unprecedented. They used to be a quarter-point; three or four 75-basis-point raises is a shock to the system, and it’s not having the immediate impact you might think it would have. That’s going to be a challenge for a lot of business, as well as for us in the banking industry.”

Dumay: “In higher education, there are many challenges related to enrollment and finances; we’ve been talking for a while about what is known as the ‘demographic cliff,’ which is the fact that there are fewer high-school graduates, fewer 18-year-olds that are ready to enroll in college, and this has been exacerbated during the COVID years. This is creating enrollment challenges for all higher-ed institutions. On the finance side, everyone here has mentioned the challenge of inflation, as well as the tight workforce. Higher education is also challenged by the fact that some of the stimulus funding that has helped during COVID is no longer available. All of these are going to create challenges for the higher-ed sector in general, and Elms College in particular. But they also present opportunities.

BusinessWest: What are the forces that will determine what will happen with the local and national economies in 2023 and what we’re all talking about a year from now?

Kasa: “For us, what’s happening in the world politically and the war in Ukraine; we’re really seeing an increase in military spending and orders for the military and defense. That’s going to be very helpful for us, and I do see that continuing. There’s a tremendous amount of talk about upgrades to engines, the F-35 … and being in the aerospace alley and having so many of these large OEMs right in the corridor, in the Hartford area, is beneficial for us. I do foresee things continuing to move up and onward for us.”

Cannon-Eckerle: “One of the things bubbling up in the legal sphere is something they call ‘litigation investment,’ which is essentially large companies investing in litigation against larger corporations that normally they wouldn’t be able to afford. It’s like a venture-capital-like investment, and we’re starting to see large companies spread their wings. I think that might have an effect on litigation down the line.”

Harry Dumay says COVID provided many important lessons that are serving Elms College well as it moves on from the pandemic.

Dumay: “I think some of those challenges that I spoke about that are related to enrollment will lead to some of the forces and trends that will shape things in 2023. I expect institutions to tailor their pricing and courses accordingly; there is a trend in higher education to look for shorter types of certificates to help max the credentialing needs of the workforce. I expect we’ll see that. But also, the workforce issues are providing a lot of opportunities for institutions to partner with businesses to address some of these workforce issues, and I expect that we’ll see more collaborations and partnerships between higher-ed institutions and businesses to address some of these workforce challenges.”

Senecal: “I see two things. One is supply chain; I think the pressure seems to be coming off, and if that trend continues, that will have a really positive effect on the economy. Two, I think higher energy prices are not going to go away. With the war in Ukraine and Russian energy and what is being supplied to Europe and all … many people don’t think it impacts us. I think it will have a huge impact going into 2023. When you look at the supply of energy in Europe, they have enough to get through the winter to sustain themselves. What they don’t have is the ability to replenish those supplies by next winter, and I think Russia knows this, and I think their strategy is to put a huge amount of pressure on to get to next year, because when you get to next winter, there’s not going to be any energy-supply reserves, and that’s going to have a huge impact worldwide on energy supplies, and that trickles throughout the economy.”

Falcone: I very much agree with Tom. The overall political and economic environment created by that war has affected our business dramatically, whether it’s fuel costs, energy costs that directly impact the supply chain and lead to inflation, or interest rates, because the overall cost of carrying our inventory is higher, and the cost of the product we’re procuring is higher. So with that, our overall cost of business has increased.”

John Falcone says supply-chain issues have improved in recent months, one of many reasons for optimism heading into 2023.

Kasa: “I agree with John. In manufacturing, our supply chain has really been impacted by this war; we’re not able to get material as we did some time ago, and those costs continue to rise. Being in manufacturing, we’re held to long-term agreements, master agreements, and it just continually squeezes the small guy.”

BusinessWest: How has your business or institution coped with the recent workforce challenges? Do you have a success formula?

Senecal: “Before COVID hit, we would never let an employee work from home; from a security perspective, from a collaborative perspective, it just wouldn’t work. Two weeks into the pandemic, we had 80% of workforce working from home without a hitch. I still think the collaboration, or culture, side of it has to occur within the office, but we’ve pivoted from that perspective, and we’re pushing the ability to work from home a whole lot more.

“To tackle the workforce issue and spread our wings and look beyond Western Mass., we are advertising positions as ‘80% work from home,’ something you would have never thought of or heard of in years past. We have an employee now who works 100% out of Chicago. As a local community bank, we would have never considered that. It’s increased our ability to attract talent, and we’ve found some success, but I know it’s still going to be a challenge moving forward.”

Kasa: “We’re looking for exposure, and being in our bright new building certainly helps. So does using social media to attract young machinists; we’re using Instagram and Facebook … it really does work with the young people that follow you. And being a family-owned business also resonates with many people; there have been so many capital acquisitions in recent times in this area.

“We spend a lot of time talking to parents about manufacturing and the opportunities that are available to young people. Manufacturing is coming back, and now parents are realizing that not everyone is meant for a college degree, and they don’t have to spend $100,000 or $200,000 on education; they are coming into machining and electrical and plumbing. The parents are really starting to see us as a viable option.”

Dumay: “We’re paying a lot of attention to employee morale and employee satisfaction, and being flexible where we can. Part of the promise of Elms College as a small, liberal-arts institution is that students will be in contact with people and one another, so having a presence on campus is important. But we’re trying to work creatively to include flexibility for employees in terms of where they can work and the time they can work, to the extent that this can be done.”

Hatiras: “We’re doing OK because we had to respond to what was going on in the market by creating even more attractive reasons for coming here — we raised our rates, we’re enhancing benefits, and at the same time, we’re looking at economic assistance for the lower-earning employees. Where it’s more difficult is with the professionals, because the dollars are significantly more, so competing just on price is difficult. The key for success — what keeps people here and makes them come here — is the culture of the place, so we put a tremendous amount of effort in the 10 years I’ve been here on creating a good culture. Now, it’s become a differentiator, and we’re pushing it even more. We’re an employer that listens to employees, responds to their needs, and cares. That’s what people want.”

Spiros Hatiras says the “truly outrageous” cost of agency nurses is one of the many stern challenges facing all hospitals today.

Falcone: “We put a big focus on our company culture. Right in our strategic plan, it says ‘invest in people, personally grow, and have fun.’ There’s no doubt about it … the people we have are our biggest asset, so what we want to do is make sure that we’re taking care of them. In this ever-competitive job market, it’s really easy to jump jobs for an extra dollar or two an hour, but for us, we really want to focus on employee engagement and employee satisfaction.”

BusinessWest: Provide us with at least one, and maybe a few, reasons for optimism regarding the year ahead.

Falcone: “The supply chain is becoming more intact. Two years ago, our fill rates as a company were about 60%; December marked the first time our fill rates recently broke the 80% mark. They’re still not back to 2019 levels of roughly 90%, but it’s slowly getting better, and I think the numbers will continue to increase. For the consumer, it’s the availability of product at a reasonable price. Also, we’re starting to see a little bit of deflation … I think we’re still going to have inflation, but it is going to level off.”

Kasa: “The war, which is terrible for the world, and the politics going on are only going to make more work for us because we’re military and defense-heavy. Meanwhile, space is another huge one for us, because it’s been years since the U.S. has gone to space. And with all the competition going on for space travel now between Blue Origin, SpaceX, and others … it’s a a market the U.S. hasn’t been involved in for years, and it bodes well for us.”

Tanzania Cannon-Eckerle says many converging forces will bring change to the employment-law scene in 2023.

Cannon-Eckerle: “Now that COVID is a little bit behind us … we have some clarity. I think there was a period of time when employers, employees, people who don’t work, everyone in this world went through a period of time when they just didn’t know what the future would hold. Now, people can start making decisions and moving forward, in whatever direction that might be. Also, green technology. I think that technology is getting a huge boost, even moreso than it had before, and I think we’re going to start making some big strides in green technology, and I’m really excited about that.”

Hatiras: One of the good things for Holyoke, and this is one of the reasons I’m optimistic about our path here, is that we have this new waiver in Massachusetts, a five-year waiver with Medicare, which puts a lot of emphasis on safety-net hospitals. So, despite the many challenges I mentioned — and we’re going to have to meet those challenges — I think we’re going to be in a very good position to continue to provide the services we do now, and even better; it’s a good deal for Massachusetts and safety-net hospitals.”

Dumay: “We had a Christmas party at the college recently, and everyone was shaking hands — no one was fist-pumping, no one was six feet apart. It’s easy to forget where we were a year ago. I’m encouraged when I look at what happened during the past semester, when students were happy to be with one another; this is the generation where students finished their high school on Zoom and already had some difficulty with social skills. This ability to come back together … people are appreciating that.

“Another reason for optimism is that we learned a lot of lessons during COVID. We endured considerable hardships, but we also learned some valuable lessons as well. In higher education, for example, we learned about online learning and providing students with maximum flexibility. This is something we were forced into by COVID, but now, those lessons are settling down and providing both flexibility and efficiency in terms of teaching and learning. From a human-relations perspective, we’ve learned some lessons that are becoming part of our operations, and for the better.”