There’s Uncertainty, but Also General Optimism About the Year Ahead

Brooke Thomson says the Business Confidence Index issued each month by Associated Industries of Massachusetts (AIM), does a fairly effective job of conveying what business owners are thinking.

When the index is consistently below 50, it indicates general pessimism about the economy in general. Conversly, when it’s above 50 and trending north of that mark, it conveys overall optimism and, as the name on the index indicates, confidence about what is to come.

And … when the index is right around 50 and hovering there, as it has been for the past several months, well, that generallly communicates the sentiment that business owners aren’t exactly sure what to think, and are, by and large, neither overly optimistic nor pessimistic, said Thomson, who took the reins as CEO of AIM on Jan. 1.

“What this tells me is that there’s a moderating that’s happening,” she told BusinessWest. “The good thing that you can draw from the index is that when you see it around 50 for several months in a row, there’s some consistency, which is critical for business to be successful; uncertainty is the worst thing that you can see in business. But it also indicates to me that businesses aren’t quite sure if we’re headed to a good place or a bad place. Businesses need to have a sense of being able to forecast wh at’s coming in order to adjust.”

This general state of not knowing what to think extends to economists and economic-development leaders as well, meaning that uncertainty is perhaps the prevailing sentiment heading into a year that promises to be an intriguing one in many ways and on many levels, including a presidential race that will likely consume the nation and its business community.

Bob Nakosteen

“I think growth will slow down in 2024, and there’s less than a 50-50 chance of going into a mild recession, with the emphasis on mild.”

But despite this uncertainty, there is strong sentiment that many of the positive forces seen in a better-than-expected 2023 — from job growth to still-robust consumer spending to falling inflation — will continue into next year.

“I think growth will slow down in 2024, and there’s less than a 50-50 chance of going into a mild recession, with the emphasis on mild,” said Bob Nakosteen, a semi-retired professor of Economics at UMass Amherst. “I don’t expect anything seriously negative to happen; I personally think the economy will be relatively healthy all through 2024.”

Beyond the presidential race, there will be many other things to watch in the year ahead, eveything from interest rates and inflation (and the broad impact of both) to the ongoing workforce crisis and efforts to stem that tide; from global turmoil and the impact it may have on various sectors of the economy to initiatives to address an ongoing housing shortage in this region and beyond; from continual changes in where and how people (and the impact of all this on commercial real estate and individual cities and towns) to those two letters that convey both enormous promise and great concern: AI.

For its 2024 Economic Outlook, BusinessWest talked with several business and economic leaders about these and other topics. Their comments add exclamation points to what we generally knew already — that 2024 will be an important year, one of both challenge and opportunity.

The Indicators Are Indicating…

Historically, Nakosteen told BusinessWest, the Fed tries — that’s tries — to keep a low profile in presidential-election years, and especially after the primaries are over. Elaborating, he said the Fed generally tries to keep from influencing a race with monetary policy, including sharp increases or decreases in interest rates.

And he expects that pattern to continue in 2024 while acknowledging that “anything could happen.”

And while that broad sentiment applies to the general economy as well, the prevailing opinion, if there is such a thing, is that the mostly tepid growth in GDP — roughly 2% in quarters 1 and 2, but then nearly 6% in Q3 — will continue into 2024, with only a modest chance of the country slipping into a recession, especially if interest rates start coming down, as the Fed has hinted. Sort of.

Tom Senecal

“All indications are that inflation is coming under control, which has caused the Federal Reserve to pause on interest-rate increases.”

Overall, 2023 was, in many ways, better than some economists projected, with the country able to skirt a recession despite aggressive efforts to tame inflation through interest-rate hikes. Nakosteen said the overriding reason for this was that, with the notable exception of housing, consumers were still willing to spend, and with supply chains righting themselves, there was plenty for them to spend on.

“In effect, supply created demand and kept things moving,” he said, adding that there are plenty of other positive notes in 2023. Indeed, Wall Street recorded a solid year, with the S&P 500 up a robust 23% over the past year, heading into the final week. Meanwhile, the country continues to add jobs — roughly 240,000 per month, on average, over the past year — and unemployment remains low at 3.8%.

On the downside, the housing market cratered, and banks started to suffer from a combination of a depressed housing market, a slower commercial-lending environment, and having to pay more than 5% interest on deposits when they had been paying close to zero. However, housing starts surged nearly 15% in November, providing still more evidence that the Fed is engineering a soft landing, with another 2% growth projected for the fourth quarter.

The $64,000 question, obviously, is whether the momentum seen on these various fronts can continue into 2024.

Rick Sullivan

“Overall, I’m optimistic that the pieces are coming together, and that we’ll see more progress in 2024.”

Nakosteen, as always, said he is not equipped with a crystal ball, and forecasting is difficult given the many unknowns. But he offered this:

“It takes interest rates many, many months, if not years, to work their way through the channels to affect the economy. And some of that is still happening, and that’s causing a slowdown,” he said, noting the decline from Q3 to what is projected for Q4. “But there is nothing approaching recession; the job market is still very healthy, and that’s the key signal that will tell us if we’re heading into a recession.”

Points of Interest

As he looks ahead to 2024, Tom Senecal, president and CEO of Holyoke-based PeoplesBank, said he believes the momentum generated on inflation and interest rates — meaning the pause orchestrated by the Federal Reserve as inflation started to ease throughout the year — will likely continue into 2024, although there are no certainties.

“All indications are that inflation is coming under control, which has caused the Federal Reserve to pause on interest-rate increases,” he said. “At worst, we are hoping for no further increases, which should help the housing and commercial real-estate markets. At best, some predict lower rates, and, quite frankly, many consider equity markets to be overreacting to this potentially good news. We’re not out of the woods yet, but hopefully we are in for a soft landing as recessionary fears seem to be easing.”

Elaborating, Senecal said that much hinges on inflation and the needle continuing to move in the right direction.

Brooke Thomson

“It’s imperative that policymakers send the right signals through their actions that we’re going to continue on this course of enhancing our competitiveness and promoting economic stability.”

“Everything points to price stability, and as long as price stability continues, we should see a stabilization of interest rates,” he explained. “As long as interest rates stay high on mortgages, the housing market will continue to have a ripple effect throughout our economy. Not only are housing sales down, but all economic activity related to homebuying and construction has been severely impacted.

“Several national economists and the Federal Reserve are expressing caution and a non-commitment about the direction of interest rates,” he went on. “Equity markets seemed to react extremely quickly to the interest-rate pause as good news. I am not so sure that we will see any change in interest rates. I think rates will remain stable throughout the year because the Federal Reserve is extremely cautious in any move, up or down, until they have clear signs that the economy, inflation, and employment are back to pre-pandemic levels.”

Overall, Senecal sees improvement on the residential real-estate market, but some lingering challenges, many of them pandemic-related.

“With the recent Federal Reserve pause, and the market’s reaction to that, it has started to impact long-term interest rates on mortgages coming down almost three-quarters of a percentage point,” he noted. “I would expect and hope the impact on the residential real-estate market come spring will have a positive effect on inventory and therefore increase residential RE purchases and inventory.”

Meanwhile, he added, “commercial office-space markets will continue to see a continuing decline as the effects of the pandemic on lease maturities will continue to impact commercial real-estate values. Because Western Mass is heavily concentrated in the medical and educational markets, neither of which are severely impacted by these interest-rate economic changes, I fully expect Western Mass. to remain economically stable throughout 2024.”

Progress Report

It’s called the CHIPS and Science Act. This is a federal statute signed into law by President Biden in August 2022 that authorizes roughly $280 billion in new funding to boost domestic research and manufacturing of semiconductors in the U.S., and also includes $39 billion in subsidies for chip manufacturing on U.S. soil, along with 25% investment-tax credits for costs of manufacturing equipment and $13 billion for semiconductor research and workforce training.

Rick Sullivan, president and CEO of the Western Massachusetts Economic Development Council, said provisions of the CHIPS Act require that companies in the supply chain be U.S.-based. And this has translated into some intriguing early-stage talks between the EDC and some international companies.

Sam Hanmer

“Insurance isn’t sexy. It isn’t high-tech, it isn’t Wall Street, it’s just … not sexy, so young people aren’t interested in it, and the ones who are interested are aging out.”

“Not only is there onshoring being discussed, but there’s also some foreign investment from different companies, European mostly, that are looking to get a foothold; they’re at least looking,” he said, adding that, between developable land on which to build and precision manufacturers that could be acquired, there is plenty within the 413 to show them. “It’s an opportunity I haven’t seen in the past seven or eight years.”

And this fairly recent development is one reason why Sullivan is rather optimistic about 2024 and what it holds for the region.

Other reasons include everything from progress on the workforce front (see related item below), with area colleges and universities seeing a boost in enrollment as well as new programs and initiatives to put workers in the pipeline for various sectors, to headway in the preparation of a new growth strategy for the region, to some new businesses in different, and promising, sectors.

Businesses like CleanCrop Technologies in Holyoke, which boasts technology that “redefines food and agriculture efficiency.”

“This is a company that came out of UMass, it’s growing significantly, and it’s getting the attention of some multi-national companies in terms of potential investment,” said Sullivan, adding that there are other companies in what he called the “clean-tech realm” that are emerging and offering great promise for that sector. “Overall, I’m optimistic that the pieces are coming together, and that we’ll see more progress in 2024.”

The State We’re In

Thomson told BusinessWest that the tax cut orchestrated by the Healey administration in 2023 was a welcome signal that the state might actually get it when it comes to the high cost of living and doing business in the Commonwealth and the need to take steps to make it more competitive.

She hopes there will be more of these to come in 2024 because the state still has a long way to go when it comes to being competitive with North Carolina’s Research Triangle and other regions like it.

“It’s imperative that policymakers send the right signals through their actions that we’re going to continue on this course of enhancing our competitiveness and promoting economic stability,” she said. “We’re really at an inflection point.”

George Timmons

“It’s about how you respond to the populations that you have on your campus and ensuring that they have the resources and the support they need to be successful.”

There continues to be an outmigration from Massachusetts, said Thomson, noting that the so-called ‘millionaire’s tax’ certainly has something to do with this. But the larger issue is simple affordability, she went on, adding that many young professionals feel priced out by the Bay State, and especially the broad area east of Worcester.

Housing is a huge issue, she said, adding that the state needs to prioritize efforts to create housing on many different levels, from affordable to what would be considered starter homes for young professionals. But it’s not the only issue, she noted, adding that overall affordability also includes transportation and childcare, which are also very high in this state.

“The outmigration numbers worry me because they indicate that the biggest population group that we’re losing are these 25- to 36-year-olds,” she said. “These are the people who maybe came here for college and then concluded that it’s too expensive to stay here.”

Finding ways to keep them here, Thomson added, will go a long way toward easing the workforce issues that are impacting every business sector and in some ways stunting their growth.

‘Workforce, Workforce, Workforce’

As he talked with BusinessWest about his sector and efforts to attract and retain talent, Sam Hanmer hit upon an uncomfortable truth.

“Insurance isn’t sexy,” said Hanmer, president of the Chicopee-based Rush Insurance Group, with Rush being his mother’s maiden name. “It isn’t high-tech, it isn’t Wall Street, it’s just … not sexy, so young people aren’t interested in it, and the ones who are interested are aging out. Let’s be honest, insurance has been an ugly word forever — you have to have thick skin to be in this game because no one wants to talk to you.”

With that, he summed up the ongoing challenge of attracting and maintaining a workforce today, hitting on two of the key points: Baby Boomers are retiring, and it’s becoming increasingly difficult to hire their successors, especially in insurance.

“If you have that skillset, you’re in an environment where you can change jobs and get a pretty significant pay increase,” he said, referring to seasoned insurance professionals. “In order to get that skillset — and the number of people who possess it is diminishing — employers have to pay up for it, and that squeezes everyone.”

But even those business sectors that would be considered sexy continue to struggle on this front, with many of those we spoke with summing up 2023, and the overriding issue for 2024, with three simple words: “workforce, workforce, workforce.”

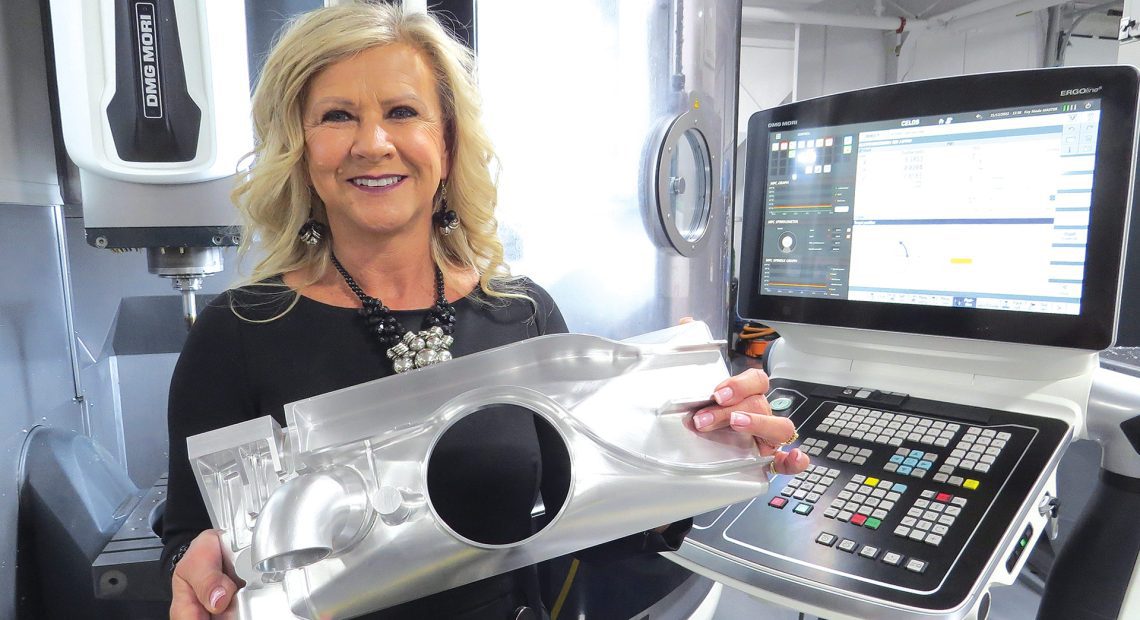

Susan Kasa

“Commercial aerospace had come to a virtual standstill for many suppliers, and they had to reinvent the wheel for themselves. But we’re starting to see a comeback to pre-pandemic levels.”

Hanmer was one of them, noting that, in his sector and many others, ‘virtual assistants,’ technology, and especially AI hold the promise of removing the human element, meaning hired help, from some backroom functions, the broad realm of customer service, and “helping customers understand what they’re buying.”

In the meantime, though, Hanmer and those in many other sectors are focusing their efforts on educating young people about what could be promising careers, including those in that non-sexy realm known as insurance, and grooming them for this work.

“We’re going to start looking at young, inexperienced people who have a desire to potentially have a good-paying job in insurance, because these are good-paying jobs, and you just can’t get people to fill them,” he explained. “So we’re going to have to start growing them from a younger age, and, hopefully, they’ll stick around.”

With that, again, he spoke for business owners across virtually every sector.

School of Thought

It will be called the Adult Learner Success Center.

This is a new initiative at Holyoke Community College (HCC), that, as the name suggests, has been created to help adult learners — non-traditional students generally in the their mid-20s and older — achieve success, however they choose to define it.

“It will help address the specific needs of the adult leader, and we’re really excited about it,” said George Timmons, who took the helm as HCC’s president this past summer. “It’s about how you respond to the populations that you have on your campus and ensuring that they have the resources and the support they need to be successful.”

And the program says a lot about the state of higher education as the caldendar turns to 2024.

Indeed, with the passage of the MassReconnect program, which provides free community college to eligible individuals 25 and older, these institutions have seen a much-needed boost in enrollment (4% at HCC, for example) that is also changing the demographic on their campuses.

While enrollment has edged higher at community-colleges and other institutions in 2023, overall enrollment and financial challenges persist, said Timmons, citing the announced closing of the College of St. Rose in Albany, N.Y., after more than a century of operation, providing more evidence — not that any was needed — that these are difficult and somewhat perilous times in higher education.

“It’s still real when you think about the challenges facing colleges and universities, especially in the Northeast, where the birth rates are signficantly less than they were years ago, putting fewer students in the pipeline,” he said, noting that, on a different spectrum, there are an estimated 700,000 people in the Bay State who have attended college but not finished what they started.

This represents a tremendous opportunity for community colleges, he said, adding that this focus on the adult learner and helping them achieve success will be among the many key issues to watch in 2024.

Making Things Happen

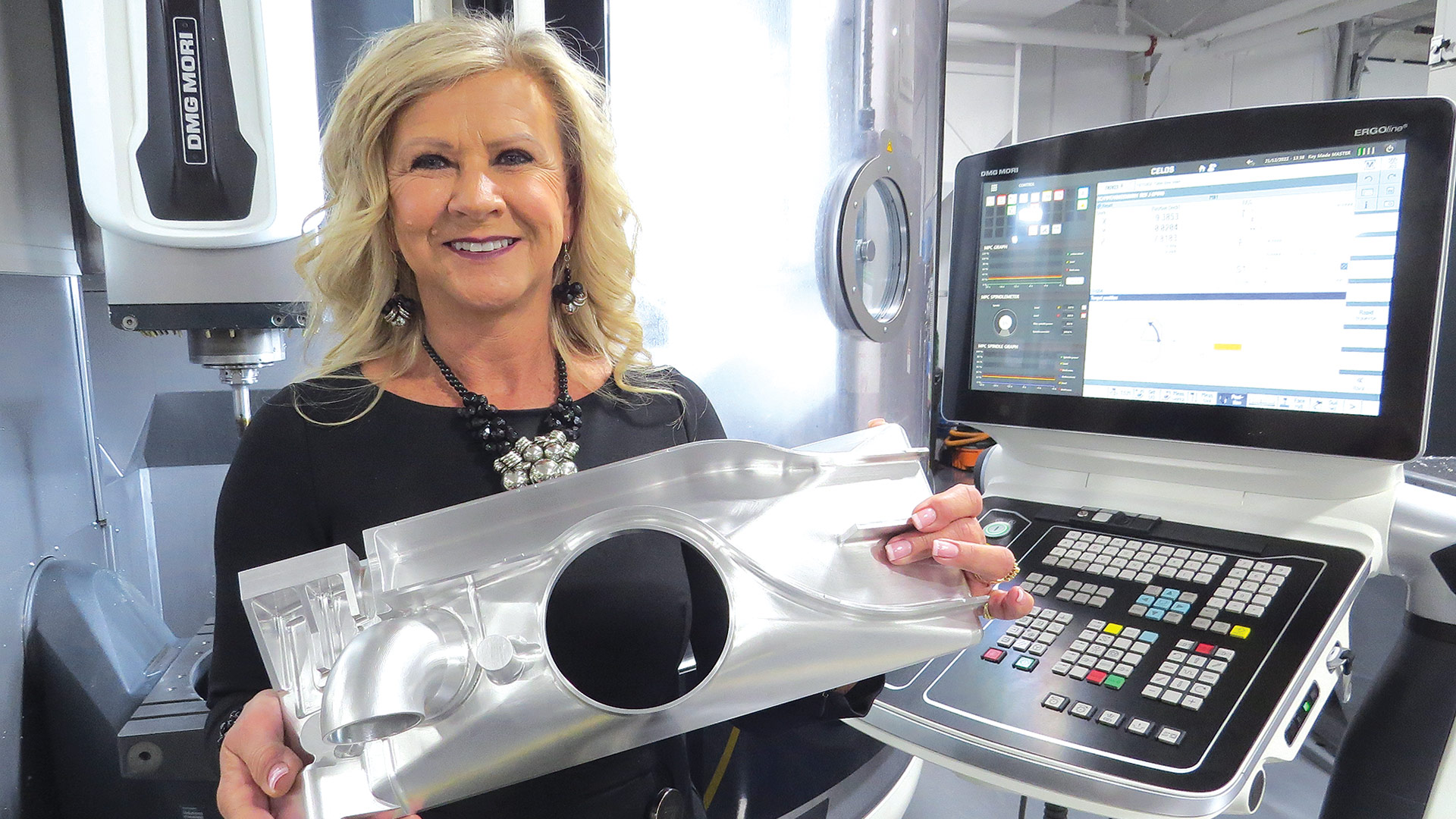

Susan Kasa, president of Boulevard Machine & Gear in Westfield, said that, a year ago, her shop was able to shut down the week between Christmas and New Year’s Day, a non-traditional break that was enjoyed by employees and managers alike.

So much so that the plan was to do it again, she said, adding that it just wasn’t possible to do so this year.

“Right now, we have so much demand that we will be open that week and plugging along,” she said in an interview prior to the holidays, adding that this demand comes in the form of a high volume of orders, a number of them in the expedited category, that cover most all of the customer groups served by this precision manufacturer.

That includes what Kasa calls ‘outer space,’ meaning everything from satellites to the rockets taking billionaires and their clients to the edge of space; from defense to aerospace.

This surge in orders reflects many of the issues that will define 2024, from turmoil in the Middle East, Ukraine, and other hotspots to a resurgence in airline travel — all of which is positively impacting precision manufacturers, and there are many of them in the 413, who serve original equipment manufacturers in those markets.

Indeed, on the space and defense sides of the ledger, Boulevard is currently handing orders for parts for everything from the satellites that track incoming missiles to the Apache helicopter, and all indications are that the pace of activity will only increase in 2024 and probably beyond.

“We’ve been delivering parts in this last quarter of the year, and the numbers are very strong right through 2032,” she said, ading that L3Harris, the Florida-based defense contractor that specializes in microwave weaponry, surveillance solutions, and electronic warfare, has become one of Boulevard’s larger customers for outer space, satellite, and aerospace work.

This upward trajectory in orders, which led to the hiring of three new machinists in 2023, also includes aerospace, she said, adding that a pronounced lull in that sector, resulting from the grounding of the Boeing 737 Max, a sharp decrease in air travel during the pandemic, and other factors, is now to be discussed with the past tense.

“Commercial aerospace had come to a virtual standstill for many suppliers, and they had to reinvent the wheel for themselves,” Kasa said. “But we’re starting to see a comeback to pre-pandemic levels. We’re finally getting back to normal; orders are resuming, and they’re taking all this inventory that may have been sitting for a while. With both Boeing and Airbus, they’re seeing orders come in, and they’re large orders.”

“Supply chain is also a big problem because, if businesses can’t get the product, they can’t sell it. And if they want the product bad enough, they pay increased shipping costs to try to make product available; all this is leading to diminished bottom lines.”

“Supply chain is also a big problem because, if businesses can’t get the product, they can’t sell it. And if they want the product bad enough, they pay increased shipping costs to try to make product available; all this is leading to diminished bottom lines.”

Entering a new year, there are always question marks about the economy and speculation about the factors that will determine just what kind of year it will be. For 2021, there are far more questions — and fewer definitive answers — and the speculation comes in layers. A great many of them. Much of this speculation involves the pandemic and, with vaccines becoming available to ever-greater numbers of people, whether we are truly seeing light at the end of the tunnel, the beginning of the end (of the pandemic), or any of those other phrases now being used so frequently. But there are other things to speculate about as well, including what the landscape will look like when and if things to return to normal, or a ‘new normal,’ another phrase one hears a lot these days. Will the jobs that have been lost come back? Will people pick up old habits regarding going to restaurants, the movies, the doctor’s office, or sporting events? Will businesses return to their offices? And will their offices be the same size and in the same community? Another phrase you’re hearing — and will read in the stories that follow — is ‘pent-up demand.’ Many businesses, from eateries to colleges and universities to medical practices, are counting on it, but will it actually materialize? These are all good questions, and for some answers, we turned to a panel of experts for a roundtable discussion, without the roundtable. Collectively, they address the question on everyone’s minds: what is the outlook for 2021?

Entering a new year, there are always question marks about the economy and speculation about the factors that will determine just what kind of year it will be. For 2021, there are far more questions — and fewer definitive answers — and the speculation comes in layers. A great many of them. Much of this speculation involves the pandemic and, with vaccines becoming available to ever-greater numbers of people, whether we are truly seeing light at the end of the tunnel, the beginning of the end (of the pandemic), or any of those other phrases now being used so frequently. But there are other things to speculate about as well, including what the landscape will look like when and if things to return to normal, or a ‘new normal,’ another phrase one hears a lot these days. Will the jobs that have been lost come back? Will people pick up old habits regarding going to restaurants, the movies, the doctor’s office, or sporting events? Will businesses return to their offices? And will their offices be the same size and in the same community? Another phrase you’re hearing — and will read in the stories that follow — is ‘pent-up demand.’ Many businesses, from eateries to colleges and universities to medical practices, are counting on it, but will it actually materialize? These are all good questions, and for some answers, we turned to a panel of experts for a roundtable discussion, without the roundtable. Collectively, they address the question on everyone’s minds: what is the outlook for 2021?

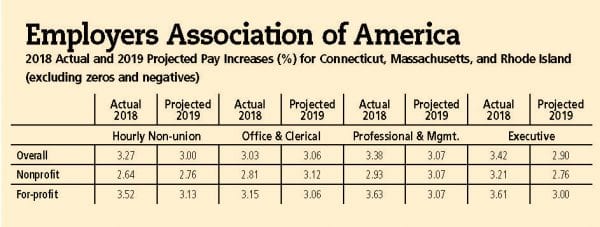

More of the same. That’s what the experts are predicting for this region, and the country as a whole, when it comes to the economy. And by more of the same, they mean growth that is steady if unspectacular — even with tax reform — and few if any signs of what could amount to real trouble. “Another boring year,” was how one economist put it. But for many businesses, boring is more than acceptable.

More of the same. That’s what the experts are predicting for this region, and the country as a whole, when it comes to the economy. And by more of the same, they mean growth that is steady if unspectacular — even with tax reform — and few if any signs of what could amount to real trouble. “Another boring year,” was how one economist put it. But for many businesses, boring is more than acceptable.

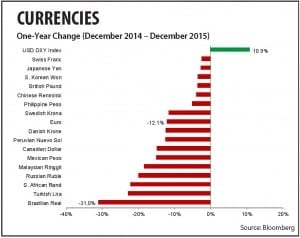

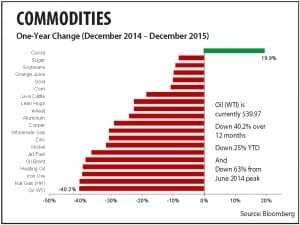

After six years of largely uninterrupted economic growth in both Massachusetts and the U.S. as a whole, questions have arisen as to how long the expansion can last, especially coming on the heels of an unusual election season and amid sluggish economic trends internationally. The consensus seems to be that the present course should hold in 2017, but also that recessions are a regular occurrence in the American economy, and it wouldn’t take much to spark a slowdown. For now, though, cautious optimism reigns.

After six years of largely uninterrupted economic growth in both Massachusetts and the U.S. as a whole, questions have arisen as to how long the expansion can last, especially coming on the heels of an unusual election season and amid sluggish economic trends internationally. The consensus seems to be that the present course should hold in 2017, but also that recessions are a regular occurrence in the American economy, and it wouldn’t take much to spark a slowdown. For now, though, cautious optimism reigns.