Start the Conversation

From the AARP FOUNDATION

The reality is that some conversations are just plain difficult — even with the people to whom you feel the closest. When preparing to discuss a difficult topic like senior care needs, it helps to follow the ground rules below to ensure that everyone’s feelings are respected and viewpoints are heard. To help make the conversation as productive and positive as possible:

1. Try not to approach the conversation with preconceived ideas about what your loved ones might say or how they might react. “Dad, I just wanted to have a talk about what you want. Let’s just start with what is important to you.”

2. Approach the conversation with an attitude of listening, not telling. “Dad, have you thought about what you want to do if you needed more help?” — as opposed to “we really need to talk about a plan if you get sick.”

3. Make references to yourself and your own thoughts about what you want for the future. Let them know they are not alone, that everyone will have to make these decisions. “Look, I know this isn’t fun to think about or talk about, but I really want to know what’s important to you. I’m going to do the same thing for myself.”

4. Be very straightforward with the facts. Do not hide negative information, but also be sure to acknowledge and build on family strengths. “As time goes on, it might be difficult to stay in this house because of all the stairs, but you have other options. Let’s talk about what those might be.”

5. Phrase your concerns as questions, letting your loved ones draw conclusions and make the choices. “Mom, do you think you might want a hand with some of the housekeeping or shopping?”

6. Give your loved ones room to get angry or upset, but address these feelings calmly. “I understand all this is really hard to talk about. It is upsetting for me, too. But it’s important for all of us to discuss.”

7. Leave the conversation open. It’s okay to continue the conversation at another time. “Dad, it’s OK if we talk about this more later. I just wanted you to start thinking about how you would handle some of these things.”

8. Make sure everyone is heard — especially those family members who might be afraid to tell you what they think. “Susan, I know this is really hard for you. What do you think about what we are suggesting?”

9. End the conversation on a positive note. “This is a hard conversation for both of us, but I really appreciate you having it.”

10. Plan something relaxing or fun after the conversation to remind everyone why you enjoy being a family. Go out to dinner, attend services together, or watch a favorite TV program.

These are just a few suggestions of things you, your loved ones, and other family members can do to unwind after a difficult conversation.

Understand the Difference, and Seek Help If It’s Needed

By Beth Cardillo

As Baby Boomers are getting older and representing the largest age group, the questions concerning dementia, as opposed to normal aging, continue to crop up in medical offices.

In the Greater Springfield area, 16.9% of residents over age 65 are living with a diagnosis of Alzheimer’s disease or other related dementia. The national average is 13.6%.

Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.

Given these numbers, it’s understandable when loved ones become concerned when they notice a family member having memory issues. It’s also understandable when people start to wonder themselves if they a problem. So how does one know if it’s dementia or simply normal aging?

“Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.”

Let’s discuss normal aging first, so you can have a sigh of relief. We all have occasional word-finding difficulties, but you can come up with the word given a bit of time. Not remembering someone’s name if you don’t see them often, or see them out of context, is normal. That is something we all do. Misplacing an item, but having the ability to retrace your steps and locate the item, is also normal. How many times do we all walk into a room and not remember why, then walk out and immediately remember, ‘oh yeah, I was getting the book I left on the couch’?

Rest assured, these are all normal signs of aging. Have any of you purchased ‘the tile’ so you can keep track of your keys, work keys, iPad, and whatever else you need? It can even help you find where you parked your car, which is extremely helpful in New York City, where there’s alternate parking every day.

What isn’t normal is having new problems finding words when speaking or writing (more than being on the tip of your tongue) and you just can’t bring them up. Or forgetting things more often, such as appointments, events, and your way around familiar places. Perhaps you can’t remember or keep up with conversations, books, movies, or newspapers. Are you stopping in the middle of the conversation because you can’t remember what was just said, or the thread of the conversation?

Also, are decisions harder to make? Is your judgment a bit skewed? Are friends and families asking if you are OK? Are you showing up to people’s homes or appointments on the wrong date? Is your mood and behavior a bit unstable or unpredictable? Are you withdrawing from social activities because you don’t want people to notice that you are having difficulty, but instead they notice you aren’t showing up?

These are symptoms of mild cognitive impairment, a precursor to a full dementia diagnosis.

There are more than 100 types of dementia. People are very reluctant to use the ‘A’ word. They quickly point out it’s not Alzheimer’s or they have just “a little bit of dementia.” The reality is that Alzheimer’s disease accounts for approximately 75% of all dementias. It could be vascular dementia, frontotemporal lobe dementia, Parkinson’s disease, or the 97 other types, and often they are concurrent. If you feel like this could be you, contact a neurologist, or a neuropsychologist, or the Alzheimer’s Assoc. at (413) 787-1113.

Today, there is no cure, but there are medications that can slow down the progression of the disease. Diet, exercise, genetics, and co-morbidities all play a part in the diagnosis, and it is said that those physiological changes could be forming in the brain 10 to 20 years before the actual symptoms start to show. There is no shame in asking for help if you feel you may have increased symptoms or you suspect them in a loved one.

On a side note, worth mentioning is that COVID-19 has wreaked havoc with the senior population, and the virus could be a new type of dementia. It has many side effects consistent with dementia if the virus has traveled to the brain. People are experiencing physiological and neurological changes within the brain, causing confusion, seizures, emotional dysregulation, and strokes that are having long-term effects.

Beth Cardillo, M.Ed., LSW, CDP is a licensed social worker, certified dementia practitioner, and executive director of Armbrook Village, and has worked in the dementia field for more than 20 years. Previous to working with dementia, she opened the nation’s first state-funded traumatic brain injury program in Westfield. She was named Western New England Social Worker of the Year in 2016, and was the 2019 Friends of the Alzheimer’s Assoc. Honoree of the Year; [email protected]; www.armbrookvillage.com

How Will You Know If Your Older Parents Need Help?

By Brenda Labbe

Many experience aging as a joyful time in their life, filled with retirement, travel, and spending more time with family. But for some, aging represents a series of losses — loss of employment, health and energy, friends, mobility, and independence.

As such, it is not uncommon for older adults to resist reaching out for help. To help start the conversation, we have listed some common signs that might indicate your loved one may need some extra support.

“Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.”

1. Neglecting household responsibilities. Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking. Lack of interest in eating or preparing nutritious food and/or lack of food in the home can be a sign that they may need help with grocery shopping or meal prep.

2. Frequent falls. If your loved one experiences frequent falls or you have observed new bruises on their face or body, chances are they should be evaluated by their physician for illness, dehydration, or infections, or X-rayed for fractures. Other items that can increase the risk for falls include the lack of proper medication management and the lack of proper safety equipment in the home. You may want to consider having a safety evaluation of the home to look for any other factors that may be contributing to their falls.

3. Unsafe driving. As our bodies slow down in the aging process, so too will our reflexes, which can make driving even more difficult. Observe your loved one’s car for new scrapes, scratches, dings, or missing mirrors. Avoiding driving or not being able to tolerate any changes in directions may indicate some cognitive changes which signal that now might be the time to consider transportation assistance.

4. Listen for clues in conversation. Many seniors will state they do not want to burden their busy adult children with requests for help. They describe feeling foolish for not being able to keep up with cleaning, medications, or repairs. However, if you listen closely, you may hear repeated areas of concern. Your loved one’s close friends or neighbors may also have input to offer, if asked in confidence.

Finally, consider the old adage “it is all in how you wrap the gift.” In this case, the gift is the offer of help and support. Try asking the question in a manner that is non-threatening and neutral. For example: “gosh, I would be so overwhelmed if I got all this mail — how about I help you go through it?”

Unfortunately, many people will experience a traumatic event before realizing that they need assistance. One way to help better prepare for any emergencies is to monitor your loved one’s physical and mental abilities and start researching care options before you need them. Greater Springfield Senior Services is your local resource to find help, support, and care for your loved one.

Call our office Monday through Friday, 8 a.m. to 5 p.m., and ask to speak with one of our highly trained information and referral specialists to find out more. Knowledge is power, and we are here to help.

Brenda Labbe is the caregiver specialist at Greater Springfield Senior Services and specializes in assisting caregivers in accessing respite and support services for their loved ones.

It’s Important to Understand Your Alternatives

By Eric Aasheim

Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.

The move is usually permanent; is unfortunately often made in crisis mode or under duress, and involves a host of emotional and psychological implications around declining physical capabilities, perceived loss of independence, and financial worry.

“Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

Knowing the answers to these commonly asked questions will help seniors and their adult children plan ahead and ultimately put themselves in a position to make thoughtful and informed decisions about the most appropriate living and care options for their needs.

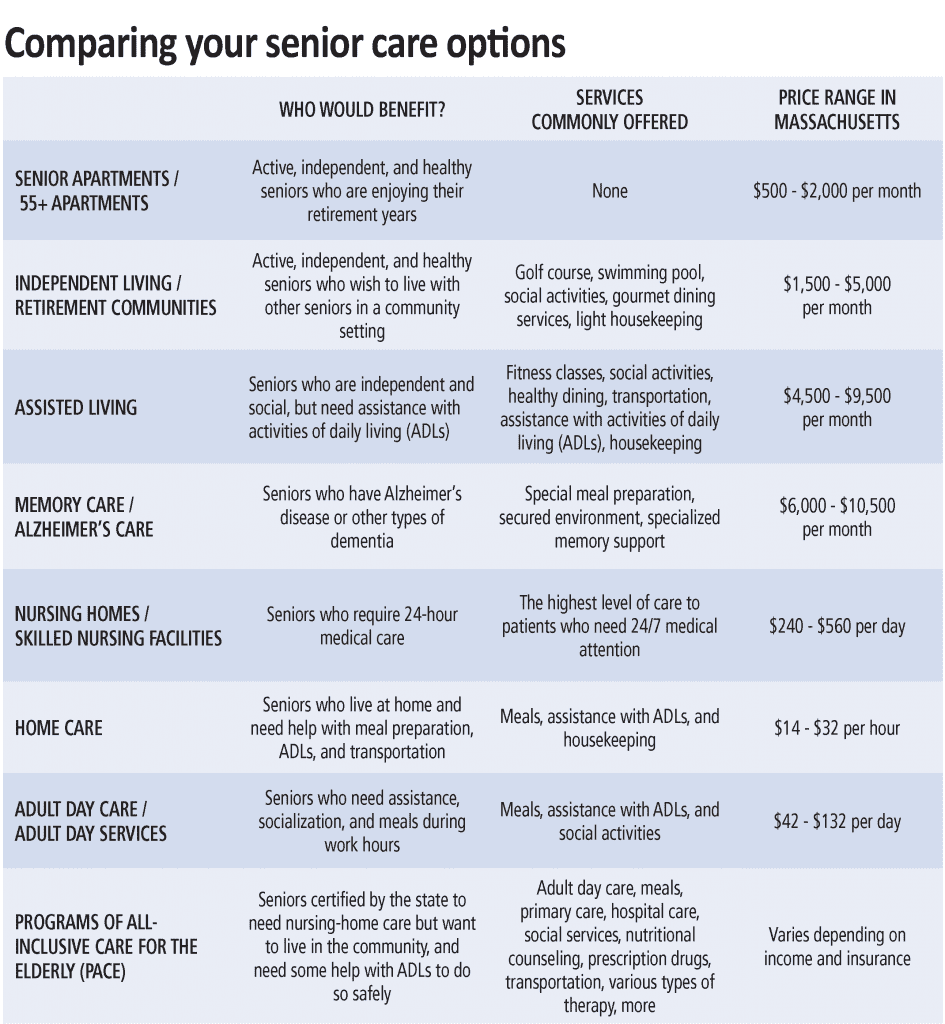

What is the difference between independent living, assisted living, memory care, and skilled nursing?

Independent living (IL) is intended for seniors who do not need assistance or supervision with independent activities of daily living (IADLs) like showering, dressing, toileting, eating, or transferring (mobility, bed to standing, sitting to standing, etc.).

Most IL communities provide apartments with full kitchens, and the monthly fee includes one main meal per day in the dining room. Independent living in Western Mass. ranges from $2,000 to $5,000 per month.

Assisted living (AL) communities are appropriate for seniors who require some level of assistance with two or more IADLs and help with medication management; apartments are typically equipped with a kitchenette only because the monthly fee includes three restaurant-style meals per day. Assisted living in Western Mass. ranges from $4,000 to $9,000 per month.

Memory care (MC) is intended for individuals who have dementia, Alzheimer’s, or other neurogenerative diseases and require an intensive or specialized program of care and supervision. Memory-care communities are secure settings with passcode entrances and enclosed outdoor spaces to keep residents on site, and can be stand-alone facilities or a separate wing or ‘neighborhood’ within a traditional assisted-living community. Memory-care communities most often provide private studio or shared companion suites for their residents. Memory care in Western Mass. ranges from $3,500 (companion suites) to $11,000 per month.

Skilled-nursing facilities (SNFs) are licensed healthcare residences for individuals who require a higher level of medical care than can be provided in an AL setting. Skilled-nursing staffs consisting of RNs, LPNs and CNAs (certified nursing assistants) provide 24-hour medical attention for their long-term and short-term rehabilitation residents. While private rooms are available in many SNFs, shared living arrangements with two or three residents to a hospital-style room are much more common. Skilled-nursing facilities in Western Mass. range from $250 to more than $500 per day.

Can I receive care at home rather than moving to a senior-living community?

Absolutely. There are any number of quality home-care companies that can provide a wide range of custodial and healthcare services in the comfort of your own home. Home care is often referred to as non-skilled care (grooming, dressing, bathing, cleaning, and other everyday tasks) and home health care as skilled care (skilled nursing and therapy).

Seniors who are largely independent but can benefit from limited home care or home-healthcare services may choose to continue living in their homes as long as these services help them do so safely. Unless you hire a full-time live-in, skilled and non-skilled care are typically provided for only a few hours per day a few days per week, meaning family members often are called upon to supplement the home-care schedule on their own.

Seniors who are at risk for (or have experienced) frequent falls or who require consistent overnight supervision or assistance may find that moving to an assisted-living community provides them with a more secure living environment.

The choice between home care and senior living is highly personal and almost always comes down to a question of safety, location, the desire and need for socialization, and finances.

What is a continuing-care retirement community (CCRC), and what are the benefits compared to other senior-living communities?

Continuing-care retirement communities (CCRCs) are senior-living communities that offer a complete continuum of care (IL, AL, MC, and SNF), usually on a single campus. The primary benefit of a CCRC is that you can stay in the same community and never have to move, even as your care requirements change as you age. CCRCs (also referred to as life-plan communities) do typically require a substantial up-front community fee that can range from $10,000 to $300,000 or more depending on the community, the structure of the life-care plan, and the size and type of apartment.

Many CCRCs offer declining, refundable options that can return 70% to 90% of the up-front community fee to the resident when he or she moves, or to her estate when the resident passes away. CCRCs do still charge monthly fees, but they are often lower and increase less from one level of care to the next than traditional senior-living communities. CCRCs also offer a potential tax-deduction benefit that many non-CCRCs do not provide.

Will my health insurance cover the cost of assisted living or memory care? What if I am eligible for Medicaid?

Medicare and private insurance plans do not cover the cost of assisted living or memory care. Medicare will cover short-term and intermittent home care or rehabilitation stays in a SNF following hospitalization, but will not pay for either long-term. Seniors generally must pay for assisted living, memory care, and home care privately unless they have long-term-care insurance with benefits specifically designed to cover these services.

Qualifying veterans and their spouses may be eligible for the aid and attendance benefit from the VA to help pay for the cost of assisted living, memory care, home care, and skilled-nursing facilities.

Some, but not most, assisted-living and memory-care communities do participate in programs administered by Medicare and Medicaid that are designed for low-income seniors who could otherwise not afford senior-living communities.

Medicaid does cover the cost of long-term care in Medicaid-certified skilled-nursing facilities and home healthcare services for recipients who would qualify for nursing-home care.

What other senior-living and care options are there?

• Residential care facilities (also called rest homes) provide meals, housing, supervision, and care for seniors who need assistance with activities of daily living but don’t yet require skilled nursing care.

• Congregate housing is a shared-living environment that combines housing, meals, and other services for seniors but does not provide 24-hour care or supervision. Public congregate housing is administered by municipal housing authorities and is partially subsidized by the state and federal government.

• Adult foster care is an alternative to residential care and matches seniors who can no longer live on their own with individuals or families who provide room, board, and personal care in their homes.

• Respite care is short-term care and supervision provided for seniors at home or in assisted-living or skilled-nursing facilities to provide family members who need some time off from their caregiver duties.

• Adult day health programs (also called adult day care) provide a wide array of community-based services for seniors during the day (skilled nursing, supervision, direct care, nutrition and dietary services, and therapeutic, social, and recreational activities) so that family members can work or attend to other responsibilities.

• Hospice care is available for individuals with life-threatening illnesses or a life expectancy of six months or less and can be provided in the home, in assisted-living or skilled-nursing facilities, in the hospital, or in specialized hospice facilities. When curative treatment is no longer an option, hospice professionals work to make a patient’s life as dignified and comfortable as possible and provide critical emotional and spiritual support services to the patient and family members.

How have senior-living and care options been impacted by COVID-19?

In short, the impact has been profound, and the ‘new normal’ is taking shape as we speak. Most home-care providers and senior-living communities have resumed services to current and new clients at some level. However, the provision of these services is governed by strict protocols to protect the health and safety of residents, staff, and family members.

For instance, many assisted-living communities are not currently offering in-person tours and assessments and instead facilitating these interactions virtually. Since most senior-living communities are observing social-distancing guidelines, new residents must quarantine for 14 days after move-in, and residents are dining in their apartments rather than in the community dining room. Social activities and outings have largely been modified or canceled, and visits from family members have been curtailed for the time being.

Eric Aasheim is a certified senior advisor and owner of Oasis Senior Living of Western Massachusetts. He assists seniors and family members through the entire process of transitioning from home to senior-living communities in Hampden, Hampshire, and Berkshire counties and surrounding areas.

Some Questions and Answers About Home-care Services

By Tania Spear

What is home care?

Home-care services are delivered to clients wherever they call home. There is a wide variety of assistance available, including everything from occasional help with housekeeping, meal preparation, companionship, and errands to skilled services such as nursing, physical therapy, occupational therapy, speech therapy, and hospice care. The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.

Who provides home care?

Home-care services can be provided by an agency or an individual. Support can be provided from one hour to up to 24 hours a day, 365 days per year. There are many reputable agencies in the area. Your physician, area Council on Aging, hospital-discharge planner, or geriatric-care manager will be able to refer you to a home-care provider most appropriate to assist you.

“The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.”

How do I pay for home-care services?

Government and private insurance may pay for services under specific circumstances such as after a recent hospitalization when skilled nursing or therapy services are needed. Ongoing assistance with activities of daily living (bathing, dressing, feeding, etc.) and housekeeping are generally not covered by insurance and are often private pay. It would be best to contact your provider for more information.

Are there benefits to using an agency?

While you may pay more using an agency caregiver, there are some advantages. An agency will offer pre-screening of workers, liability protection, workers’ compensation, and backup care in the event a particular caregiver isn’t available. An agency handles scheduling, payroll, and taxes, resulting in less paperwork.

How do I evaluate a home-care agency?

You will want to know if the agency works with you to develop a written plan of care and/or service contract and, if so, how often it is updated. How does the agency screen and evaluate employees? Are caregivers and supervisors available 24/7/365? How does the agency resolve concerns or complaints? Can the agency provide a list of local references?

What about COVID-19?

While accepting help at home from an agency may cause some fear during the pandemic, there are some things to consider that may help make you feel more confident in your decision to refuse or accept care as well as minimize risks. First, you want to assess the need for care. For many, care is essential, and refusing assistance in not an option. If you’ve determined help is necessary, check with the agency to determine what infection-control protocols are in place and if the agency has enough personal protective equipment (PPE) available. In addition to following CDC guidelines, you may want significant details related to how the agency is protecting staff and clients.

Are there any other things I should consider before receiving home care?

If a client or family hasn’t ever had help at home in the past, it can create some distress. The loss of independence and privacy can be factors. Oftentimes, if a competent caregiver with the right skills is placed, even the most seemingly resistant client may begin to look forward to the caregiver visits. Establishing expectations based on an appropriate plan of care and a goal for each visit is important for both the client and caregiver. With the right blend of care and compassion, a bit of support can make a world of difference in allowing someone who wishes to remain home to stay safe and healthy.

Tania Spear, MSN, MBA, RN is the owner and administrator of Silver Linings Home Care, LLC. She is a registered nurse and an Elms College graduate with a master of science degree in nursing and health services management and an MBA in healthcare leadership; (413) 363-2575; [email protected]

Many Options Are Available for Seniors and Their Families

From the NATIONAL INSTITUTE ON AGING

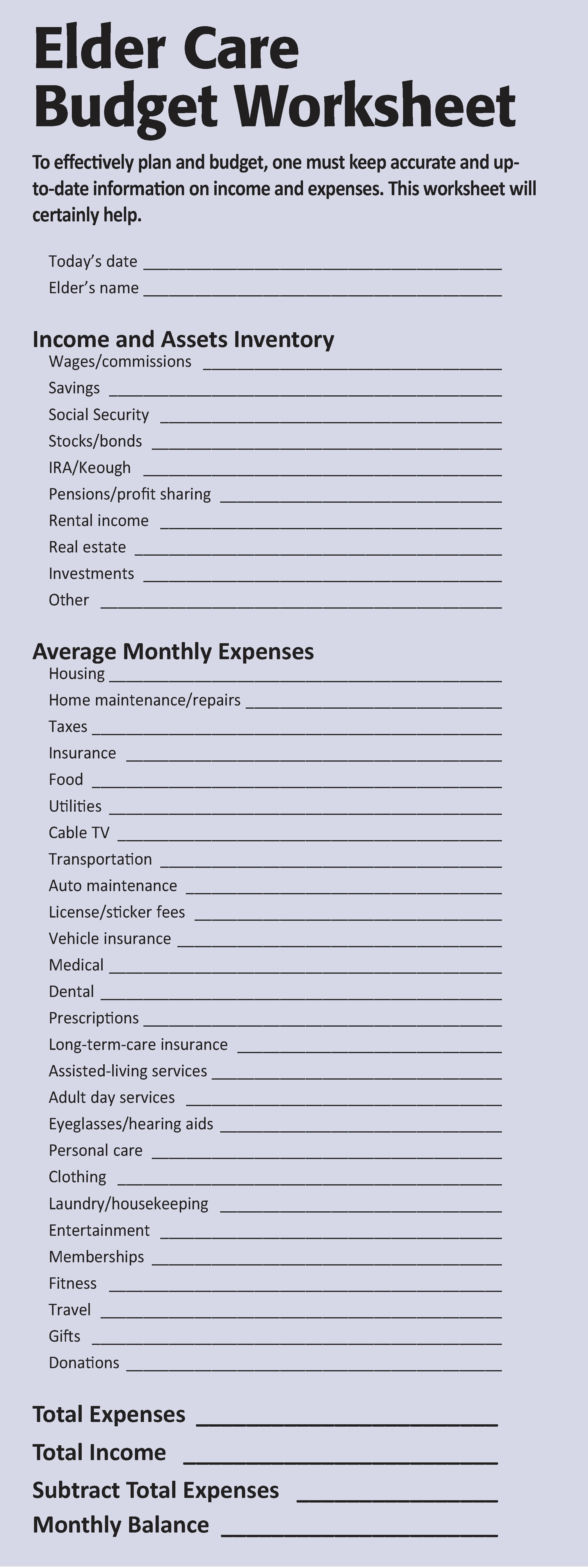

Many older adults and caregivers worry about the cost of medical care. These expenses can use up a significant part of monthly income, even for families who thought they had saved enough.

How people pay for long-term care — whether delivered at home or in a hospital, assisted-living facility, or skilled-nursing facility — depends on their financial situation and the kinds of services they use. Often, they rely on a variety of payment sources, including personal funds, government programs, and private financing options.

Out of Pocket

At first, many older adults pay for care in part with their own money. They may use personal savings, a pension or other retirement fund, income from stocks and bonds, or proceeds from the sale of a home.

“How people pay for long-term care — whether delivered at home or in a hospital, assisted-living facility, or skilled-nursing facility — depends on their financial situation and the kinds of services they use.”

Professional care given in assisted-living facilities and continuing-care retirement communities is almost always paid for out of pocket, though Medicaid may pay some costs for people who meet financial and health requirements.

Medicare

Medicare is a federal government health-insurance program that pays some medical costs for people age 65 and older, and for all people with late-stage kidney failure. It also pays some medical costs for those who have gotten Social Security Disability Income (discussed later) for 24 months. It does not cover ongoing personal care at home, assisted living, or long-term care.

Medicaid

Some people may qualify for Medicaid, a combined federal and state program for low-income people and families. This program covers the costs of medical care and some types of long-term care for people who have limited income and meet other eligibility requirements.

Program of All-Inclusive Care for the Elderly (PACE)

PACE is a Medicare program that provides care and services to people who otherwise would need care in a nursing home. PACE covers medical, social-service, and long-term-care costs for frail people. It may pay for some or all of the long-term-care needs of a person with Alzheimer’s disease. PACE permits most people who qualify to continue living at home instead of moving to a long-term care facility. There may be a monthly charge.

State Health Insurance Assistance Program (SHIP)

SHIP, the State Health Insurance Assistance Program, is a national program offered in each state that provides counseling and assistance to people and their families on Medicare, Medicaid, and Medicare supplemental insurance (Medigap) matters.

Department of Veterans Affairs

The U.S. Department of Veterans Affairs (VA) may provide long-term care or at-home care for some veterans. If your family member or relative is eligible for veterans’ benefits, check with the VA or get in touch with the VA medical center nearest you. There could be a waiting list for VA nursing homes.

Social Security Disability Income (SSDI)

This type of Social Security is for people younger than age 65 who are disabled according to the Social Security Administration’s definition. For a person to qualify for Social Security Disability Income, he or she must be able to show that the person is unable to work, the condition will last at least a year, and the condition is expected to result in death. Social Security has ‘compassionate allowances’ to help people with Alzheimer’s disease, other dementias, and certain other serious medical conditions get disability benefits more quickly.

Private Financing Options for Long-term Care

In addition to personal and government funds, there are several private payment options, including long-term-care insurance (see story on this page), reverse mortgages, certain life-insurance policies, annuities, and trusts. Which option is best for a person depends on many factors, including the person’s age, health status, personal finances, and risk of needing care.

Reverse Mortgages for Seniors

A reverse mortgage is a special type of home loan that lets a homeowner convert part of the ownership value in his or her home into cash. Unlike a traditional home loan, no repayment is required until the borrower sells the home, no longer uses it as a main residence, or dies.

There are no income or medical requirements to get a reverse mortgage, but you must be age 62 or older. The loan amount is tax-free and can be used for any expense, including long-term care. However, if you have an existing mortgage or other debt against your home, you must use the funds to pay off those debts first.

Trusts

A trust is a legal entity that allows a person to transfer assets to another person, called the trustee. Once the trust is established, the trustee manages and controls the assets for the person or another beneficiary. You may choose to use a trust to provide flexible control of assets for an older adult or a person with a disability, which could include yourself or your spouse. Two types of trusts can help pay for long-term-care services: charitable remainder trusts and Medicaid disability trusts.

Life-Insurance Policies for Long-term Care

Some life insurance policies can help pay for long-term care. Some policies offer a combination product of both life insurance and long-term-care insurance.

Policies with an ‘accelerated death benefit’ provide tax-free cash advances while you are still alive. The advance is subtracted from the amount your beneficiaries will receive when you die.

You can get an accelerated death benefit if you live permanently in a nursing home, need long-term care for an extended time, are terminally ill, or have a life-threatening diagnosis such as AIDS. Check your life-insurance policy to see exactly what it covers.

You may be able to raise cash by selling your life-insurance policy for its current value. This option, known as a ‘life settlement,’ is usually available only to people age 70 and older. The proceeds are taxable and can be used for any reason, including paying for long-term care.

A similar arrangement, called a ‘viatical settlement,’ allows a terminally ill person to sell his or her life-insurance policy to an insurance company for a percentage of the death benefit on the policy. This option is typically used by people who are expected to live two years or less. A viatical settlement provides immediate cash, but it can be hard to get.

Using Annuities to Pay for Long-term Care

You may choose to enter into an annuity contract with an insurance company to help pay for long-term-care services. In exchange for a single payment or a series of payments, the insurance company will send you an annuity, which is a series of regular payments over a specified period of time. There are two types of annuities: immediate annuities and deferred long-term-care annuities.

Five Things to Know About Long-term-care Insurance

By ELLEN STARK for the AARP BULLETIN

By the time you reach 65, chances are about 50/50 that you’ll require paid long-term care (LTC) someday. If you pay out of pocket, you’ll spend $140,000 on average. Yet you probably haven’t planned for that financial risk. Only 7.2 million or so Americans have LTC insurance, which covers many of the costs of a nursing home, assisted living, or in-home care — expenses that aren’t covered by Medicare.

“Long-term care is the unsolved problem for so many people,” said Christine Benz, director of Personal Finance at Morningstar, an investment research firm in Chicago. Here’s what you need to know about long-term-care insurance today.

1. Traditional policies have fewer fans. For years, long-term-care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day-to-day activities such as bathing, dressing, and eating meals. Typical terms today include a daily benefit for nursing-home coverage, a waiting period of about three months before insurance kicks in, and a maximum of three years’ worth of coverage.

“This is a classic story of market failure. No one wants to buy insurance, and no one wants to sell it.”

But these stand-alone LTC policies have had a troubled history of premium spikes and insurer losses, thanks in part to faulty forecasts by insurers of the amount of care they’d be on the hook for. Sales have fallen sharply. While more than 100 insurers sold policies in the 1990s, now fewer than 15 do. “This is a classic story of market failure,” said Howard Gleckman, a senior fellow at the Urban Institute, a nonpartisan think tank in Washington, and the author of Caring for Our Parents. “No one wants to buy insurance, and no one wants to sell it.”

2. You might not need insurance … but you need a plan. Premiums for LTC policies average $2,700 a year, according to the industry research firm LifePlans. That puts the coverage out of reach for many Americans. (One bright spot for spouses: discounts for couples are common — typically 30% off the price of policies bought separately.)

If your assets are few, you may eventually be able to cover LTC costs via Medicaid, available only if you’re impoverished; if you have lots of money saved, you likely can pay for future care out of pocket. But weigh factors other than cash: do you have home equity you could tap? Nearby children who can be counted on to pitch in? Or do you have a family history of dementia that puts you at higher risk of needing care?

3. There’s a new insurance in town. As traditional LTC insurance sputters, another policy is taking off: whole life insurance that you can draw from for long-term care. Unlike the older variety of LTC insurance, these ‘hybrid’ policies will return money to your heirs even if you don’t end up needing long-term care. You don’t run traditional policies’ risk of a rate hike because you lock in your premium up front. If you’re older or have health problems, you may be more likely to qualify.

4. But old-school policies are cheaper. If all you want is cost-effective coverage — even if that means nothing back if you never need help — traditional LTC insurance has the edge. “Hybrid policies are usually two to three times more expensive than traditional insurance for the same long-term care benefits,” said Scott Olson, an insurance agent and co-owner of LTCShop.com in Camano Island, Wash. With hybrids, you’re paying extra just for the guarantee of getting money back.

A hybrid policy may make the most sense if your alternative is to use your savings, or if you have another whole-life policy with a large cash value.

5. Speed and smart shopping pay off. If you want insurance, start looking in your 50s or early 60s, before premiums rise sharply or worsening health rules out robust coverage. “Every year you delay, it will be more expensive,” Olson said. Initial premiums at age 65, for example, are 8% to 10% higher than those for new customers who are 64.

As for where to shop, seek out an independent agent who sells policies from multiple companies rather than a single insurer. For extra expertise and a wider choice of policies, Olson suggests looking for agents able to sell what are known as long-term-care partnership policies — part of a national program that has continuing-education requirements for insurance professionals.

Ellen Stark, a former deputy editor of Money, has written about personal finance for more than 20 years.

Consider These Important Estate-planning Documents

By KEN COUGHLIN

Making sure you have the right estate-planning documents is one of the simplest ways to have a positive impact on your family’s future. Proper planning ensures that your wishes will be followed and that your family will have less to worry about after you are gone.

Estate planning does not need to be difficult; a few documents can make a big difference. Here are the five legal documents, in order of priority, that everyone should have in place:

1. Durable Power of Attorney. This appoints one or more people to act for you on financial and legal matters in the event of your incapacity. Without it, if you become disabled or even unable to manage your affairs for a period of time, your finances could become disordered and your bills not paid, and this would create a greater burden on your family. They might have to go to court to seek the appointment of a conservator, which takes time and money, all of which can be avoided through a simple document.

“Estate planning does not need to be difficult; a few documents can make a big difference.”

2. Healthcare Proxy and Medical Directive. Similar to a durable power of attorney, a healthcare proxy appoints an agent to make healthcare decisions for you when you can’t do so for yourself, whether permanently or temporarily. Again, without this document in place, your family members might be forced to go to court to be appointed guardian. Include a medical directive to guide your agent in making decisions that best match your wishes.

3. HIPAA Release. While the healthcare proxy authorizes your agent to act for you on health care matters, you may appoint only one person at a time. It may be important for all of your family members to be able to communicate with healthcare providers. A broad HIPAA release — named for the Health Insurance Portability and Accountability Act of 1996 — will permit medical personnel to share information with anyone and everyone you name, not limiting this function to your healthcare agent.

4. Will. Your will says who will get your property after your death. However, it’s increasingly irrelevant for this purpose, as most property passes outside of probate through joint ownership, beneficiary designations, and trusts. Yet, your will is still important for two other reasons. First, if you have minor children, it permits you to name their guardians in the event you are not there to continue your parental role. Second, it allows you to pick your personal representative (also called an executor or executrix) to take care of everything having to do with your estate, including distributing your possessions, paying your final bills, filing your final tax return, and closing out your accounts. It’s best that you choose who serves in this role.

5. Revocable Trust. A revocable trust is icing on the cake and becomes more important the older you get. It permits the person or people you name to manage your financial affairs for you as well as avoid probate. You can name one or more people to serve as co-trustee with you so that you can work together on your finances. This allows them to seamlessly take over in the event of your incapacity. Revocable trusts are not as simple as the prior four documents because there are many options for how they can be structured and what happens with your property after your death. Drafting a trust is more complicated, but also more nuanced, giving you more say about what happens to your assets.

Unless your situation is complicated, these documents are straightforward, and the process to create them is not difficult. By drafting an estate plan, you can save your family a great deal of strife, difficulty, and cost at an already-tough time.

Ken Coughlin is editorial director of ElderLawAnswers.

These regional and statewide nonprofits can help families make decisions and access resources related to elder-care planning.

AARP Massachusetts

1 Beacon St., #2301, Boston, MA 02108

(866) 448-3621

states.aarp.org/region/massachusetts

Administrator: Mike Festa

Services: AARP is a nonprofit, nonpartisan, social-welfare organization with a membership of nearly 38 million that advocates for the issues that matter to families, such as healthcare, employment and income security, and protection from financial abuse

The Conversation Project and the Institute for Healthcare Improvement

53 State St., 19th Floor

Boston, MA 02109

(617) 301-4800

www.theconversationproject.org

Administrator: Kate DeBartolo

Services: The Conversation Project is dedicated to helping people talk about their wishes for end-of-life care; its team includes five seasoned law, journalism, and media professionals who are working pro bono alongside professional staff from the Instititute for Healthcare Improvement

Elder Services of Berkshire County Inc.

877 South St., Suite 4E, Pittsfield, MA 01201

(413) 499-0524

www.esbci.org

Administrator: Christopher McLaughlin

Services: Identifies and addresses priority needs of Berkshire County seniors; services include information and referral, care management, respite care, homemaker and home health assistance, healthy-aging programs, and MassHealth nursing home pre-screening; agency also offers housing options, adult family care, group adult foster care, long-term-care ombudsman, and money management, and oversees the Senior Community Service Aide Employment Program

Greater Springfield Senior Services Inc.

66 Industry Ave., Suite 9

Springfield, MA 01104

(413) 781-8800

www.gsssi.org

Administrator: Jill Keough

Services: Private, nonprofit organization dedicated to maintaining quality of life for older adults, caregivers, and people with disabilities, through programs and services that foster independence, dignity, safety, and peace of mind; services include case management, home care, home-delivered meals, senior community dining, money management, congregate housing, and adult day care

Highland Valley Elder Services

320 Riverside Dr., Florence, MA 01062

(413) 586-2000

www.highlandvalley.org

Administrator: Allan Ouimet

Services: Services include care management, information/referral services, family caregiver program, personal emergency-response service, protective services, home-health services, chore services, nursing-home ombudsman services, adult day programs, elder-care advice, bill-payer services, options counseling, respite services, representative payee services, local dining centers, personal-care and homemaker services, and home-delivered meals

LifePath

101 Munson St., Suite 201

Greenfield, MA 01301

(413) 773-5555

www.lifepathma.org

Administrator: Barbara Bodzin

Services: LifePath, formerly Franklin County Home Care Corp., an area agency on aging, is a private, nonprofit corporation that develops, provides, and coordinates a range of services to support the independent living of elders and people with disabilities with a goal of independence; it also supports caregivers, including grandparents raising grandchildren

Massachusetts Assoc. of Older Americans

19 Temple Place, Boston, MA 02111

(617) 426-0804

www.maoamass.org

Administrator: Chet Jakubiak

Services: Aims to improve the economic security of older Massachusetts residents through research and advocacy on policies that may reduce risk and hardship; fights against the dual stigma of being old and mentally ill, to preserve Medicare and Social Security, to ensure access to community-based long-term care, and to obtain mental healthcare for elders suffering from depression and other brain disorders; organizes regular conferences on important issues throughout the state and collaborates with councils on aging to hold training sessions for senior advocates

Massachusetts Executive Office of Elder Affairs

1 Ashburton Place, Unit 517

Boston, MA 02108

(617) 727-7750

www.mass.gov/elders

Administrator: Elizabeth Chen

Services: Connects seniors and families with a range of services, including senior centers, councils on aging, nutrition programs such as Meals on Wheels, exercise, health coaching, and more; supports older adults who may be somewhat frail through programs in nursing homes, such as the ombudsman program, volunteers who visit residents, and quality-improvement initiatives in nursing homes and assisted-living facilities; caregiver programs offer support to people with mild Alzheimer’s disease or those caring for someone with more advanced Alzheimer’s

Massachusetts Senior Legal Helpline

99 Chauncy St., Unit 400, Boston, MA 02111

(800) 342-5297

www.vlpnet.org

Administrator: Joanna Allison

Services: The Helpline is a project of the Volunteer Lawyers Project of Boston that provides free legal information and referral services to Massachusetts residents age 60 and older; the Helpline is open Monday through Friday, 9 a.m. to noon

MassOptions

(844) 422-6277

www.massoptions.org

Administrator: Marylou Sudders

Services: A service of the Massachusetts Executive Office of Health and Human Services, MassOptions connects elders, individuals with disabilities, and their caregivers with agencies and organizations that can best meet their needs; staff can also assist with determining eligibility for and applying to MassHealth

VA Central and Western Massachusetts Healthcare System

421 North Main St., Leeds, MA 01053

(413) 584-4040

www.centralwesternmass.va.gov.

Administrator: Andrew McMahon (interim)

Services: Provides primary, specialty, and mental-health care, including psychiatric, substance-abuse, and PTSD services, to a veteran population in Central and Western Massachusetts of more than 120,000 men and women

WestMass ElderCare Inc.

4 Valley Mill Road, Holyoke, MA 01040

(413) 538-9020

www.wmeldercare.org

Administrator: Roseann Martoccia

Services: Provides an array of in-home and community services to support independent living; interdisciplinary team approach to person-centered care; information, referrals, and options counseling as well as volunteer opportunities available; primary service area includes Holyoke, Chicopee, Granby, South Hadley, Belchertown, Ludlow, and Ware, as well as other surrounding communities

Five Steps to Take When Your Parents Need Assisted Living

By MERRITT WHITLEY

Many families look to assisted-living facilities to provide essential care and peace of mind when it comes to their aging parents. Finding the best senior-living community means matching your parents’ needs, lifestyle, and budget with communities in their desired area. The process is easiest and most successful when you ask the right questions, prepare, and have open conversations with your family.

If you’ve noticed signs your parents need help, it may be time to look for assisted-living options. Follow these six steps to find the right senior-living facility for your parents.

Determine Cost and Payment Options

Decide what your family can afford on a monthly basis, and look for assisted-living communities that fit your budget. Some people have savings or long-term-care insurance to help fund senior living, while tthers need to be creative. You may consider options such as Social Security, VA benefits, cashing out a life-insurance policy, selling a home, or reverse mortgage to help pay for care.

Have a Conversation with Your Aging Parents

You can do much of the legwork for your parents, but have regular discussions with them about their desires and preferences. When you have a list of options ready, talk to them about communities you think are a good fit and why you like them. The more your parents know and are involved, the smoother their transition to senior living will be.

Visit or Virtually Tour a Community

No amount of time spent viewing brochures, floor plans, photos, or reviews can substitute for an in-person visit to or virtual tour of an assisted-living community. Visit at least three communities for comparison. Schedule visits for you and your parent, and try to tour during mealtimes. This allows you to interact with staff and residents, and sample the food. Overall, you’ll get a good feel for the environment and culture of the community.

Consult a Variety of Sources

You can always bounce ideas off of a senior-living advisor during the decision-making process. When making a decision, talk to those in the know to learn as much as you can. Read reviews of senior communities on senioradvisor.com to help you make an informed and confident decision. Check the background of an assisted-living community you’re considering with the state licensing agency tasked with monitoring facilities.

Prepare for the Transition

Do not delay the move — it’s risky to procrastinate, especially when a parent needs care. Delays can lead to avoidable accidents and medical problems. When preparing for a move, it’s important to:

• Consolidate possessions. Is your loved one downsizing? Can you help them sell or donate any items?

• Plan and coordinate the move. Are you hiring a company or helping on your own? Set up a schedule and plan to ensure the move goes smoothly to alleviate stress.

• Gather and manage legal documents. Locate medical documents, tax returns, or any important information your parents may need. Make sure they’re in a safe place so they don’t get lost or misplaced during the move.

Bottom Line

Whether your parents are choosing the community themselves, or you’re helping decide for a parent, the above steps should help ensure everyone in your family feels good about the assisted-living facility selection. When possible, have conversations with your parents, discuss the pros and cons of each option, and try to come to a consensus together.

Merritt Whitely is an editor at A Place for Mom.

It’s Not About Giving Up, but About Quality of Life

From the AMERICAN ACADEMY OF HOSPICE AND PALLIATIVE MEDICINE

There may come a time when efforts to cure or slow an illness are not working and may be more harmful than helpful. If that time comes, you should know there’s a type of palliative care — called hospice — that can help ensure your final months of life are as good and fulfilling as they can be for you and your loved ones.

Hospice is not about giving up. It’s about giving you comfort, control, dignity, and quality of life.

Insurers, Medicare, and Medicaid will generally provide coverage for hospice care if your doctors determine you likely have six months (a year in some cases) or less to live if your illness follows its normal course.

“Requesting hospice care is a personal decision, but it’s important to understand that, at a certain point, doing ‘everything possible’ may no longer be helping you. Sometimes the burdens of a treatment outweigh the benefits.”

So, how do you know when it’s time for hospice care? Requesting hospice care is a personal decision, but it’s important to understand that, at a certain point, doing ‘everything possible’ may no longer be helping you. Sometimes the burdens of a treatment outweigh the benefits. For instance, treatment might give you another month of life but make you feel too ill to enjoy that time. Palliative doctors can help you assess the advantages and disadvantages of specific treatments.

Unfortunately, most people don’t receive hospice care until the final weeks or even days of life, possibly missing out on months of quality time. This may be out of fear that choosing hospice means losing out on a chance for a cure. Sometimes doctors fear their patients will feel abandoned if they suggest hospice.

Hospice care can help you continue treatments that are maintaining or improving your quality of life. If your illness improves, you can leave hospice care at any time and return if and when you choose to.

The following are some signs that you may experience better quality of life with hospice care:

• You’ve made several trips to the emergency room, and your condition has been stabilized, but your illness continues to progress.

• You’ve been admitted to the hospital several times within the last year with the same symptoms.

• You wish to remain at home, rather than spend time in the hospital.

• You are no longer receiving treatments to cure your disease.

Hospice care can free you up to ensure a time of personal growth and that you get the most you can out of your time left, allowing you to reflect on your life; heal emotional wounds and reconnect with a loved one with whom you have been estranged; visit favorite places or those with special meaning, such as a school, house, or location with a beautiful view you’ve always loved; put your financial affairs in order; create a legacy, such as a journal, artwork, or a videotaped message; or simply be with the people you love and who love you.

There are other benefits of hospice care, too:

• Hospice care allows you to remain and receive medical care in your own home, if desired and possible.

• It prevents or reduces trips to the emergency room for aggressive care that you might not want. Although you still might go to the hospital for tests or treatments, hospice allows you and your loved ones to remain in control of your care.

• Members of the hospice team can clean, cook, or do other chores, giving your loved ones a chance to run errands, go out to dinner, take a walk, or nap.

• Hospice programs offer bereavement counseling for your loved ones, often for up to a year.

Hospice care may not be appropriate if you are seeking treatments intended to cure your illness. Whether receiving hospice or palliative care, you should make a plan to live well so that your wishes for care and living are known.