Casting Call

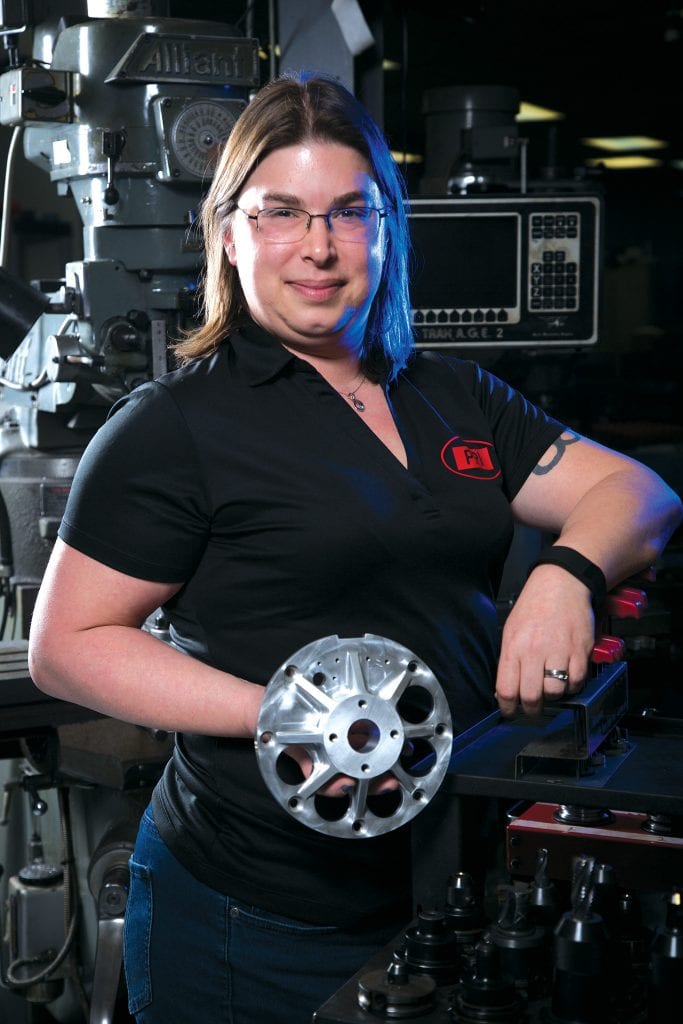

Laura Teicher and Adam Rodrigues, seen here at FORGE’s satellite office in the Springfield Technology Park, say the agency is more than living up to its new name.

The agency formerly known as Greentown Learn has been rebranded as FORGE, a name that more effectively speaks to its mission of making connections between entrepreneurs and manufacturers that can create prototypes of their products or actually produce them. Since its inception, FORGE has facilitated such connections for nearly 200 companies, helping improve the survival rate of such ventures while also bringing more work to a number of area manufacturers.

Neil Scanlon equated it to a sales force — a different kind of sales force, to be sure.

He was referring to the agency now known as FORGE and formerly known as Greentown Learn — a rebranding was deemed necessary, and we’ll get into that in some detail later — the nonprofit arm of Greentown Labs in Somerville, which loudly proclaims itself the “largest clean-technology incubator in the United States” and “the best place in the world to build a clean-tech hardware company.”

FORGE was created to help those entrepreneurs developing this hardware to create prototypes and find manufacturers that could build the products they’ve developed and specific components for them — more specifically, manufacturers in Massachusetts and especially Western Mass.

Indeed, one of the primary goals behind FORGE was to build what’s being called an east-west connection — products developed in the eastern part of the state and prototyped and produced in the western region. It’s still a work in progress, but there have been a number of matches made, including several with Scanlon’s company, Worthington Assembly in South Deerfield.

“It’s like a sales force in a way — not a traditional sales force in most respects. It’s giving recognition to a manufacturer that might be able to help a startup — a connection that might not have happened otherwise.”

He’s not sure exactly how many of these matches have been made because many of the orders are placed through a sophisticated online system. But he’s quite sure that a good number of boxes heading out the door are bound for Somerville.

“Worthington ships to Greentown quite often, and I don’t always know how that connection was made,” he said, adding that he does know that his firm, which specializes in circuit-board assembly and has customers in many different sectors, has gained some new customers through FORGE.

“It’s like a sales force in a way — not a traditional sales force in most respects,” he went on. “It’s giving recognition to a manufacturer that might be able to help a startup — a connection that might not have happened otherwise.”

This is exactly what those at Greentown Labs had in mind when they created its sister organization, now known as FORGE, said Laura Teicher, the agency’s executive director.

As she talked with BusinessWest in FORGE’s satellite office in the Springfield Technology Park in Armory Square, she said the nonprofit is succeeding with its basic mission of helping to see that products blueprinted in Massachusetts are prototyped and manufactured here, when possible.

“Through its Western Mass. office, FORGE is able to engage a critical cluster of precision manufacturers in producing prototypes, early runs, and production at scale, deepening the east-west link between Eastern Mass. startups and Pioneer Valley manufacturers that was started with the support of leadership in the House of Representatives,” she said.

Startups like RISE Robotics, which is working to replace energy-intensive hydraulic systems with clean and efficient electronic models, and has engaged area manufacturers such as Peerless Precision and MTG Inc., both in Westfield, to create prototypes.

And like Clean Crop Technologies (CCT), a Haydenville-based startup working to solve the crisis of aflatoxin infection in grain and nut crops, which reportedly causes more than 100,000 deaths and $1.7 billion in lost revenues each year, especially in developing countries.

And like Clean Crop Technologies (CCT), a Haydenville-based startup working to solve the crisis of aflatoxin infection in grain and nut crops, which reportedly causes more than 100,000 deaths and $1.7 billion in lost revenues each year, especially in developing countries.

Led by co-founder and President Dan White, the company has, through FORGE, connected with Newbury, Mass.-based Product Resources to create a prototype of a post-harvest assembly-line-like fumigation process that removes up to 90% of aflatoxin from crops in less than 20 minutes.

But White noted that some components for this system, which he equated to the sandwich-making line at Quiznos, may be produced by manufacturers in the 413.

For area manufacturers, meanwhile, FORGE acts as that sales force that Scanlon mentioned by introducing entrepreneurs to area shops and acquainting them with their capabilities. And most need some help in this critical step in bringing a product to the marketplace, because they don’t know what skills are needed or how to find a firm that possesses those capabilities.

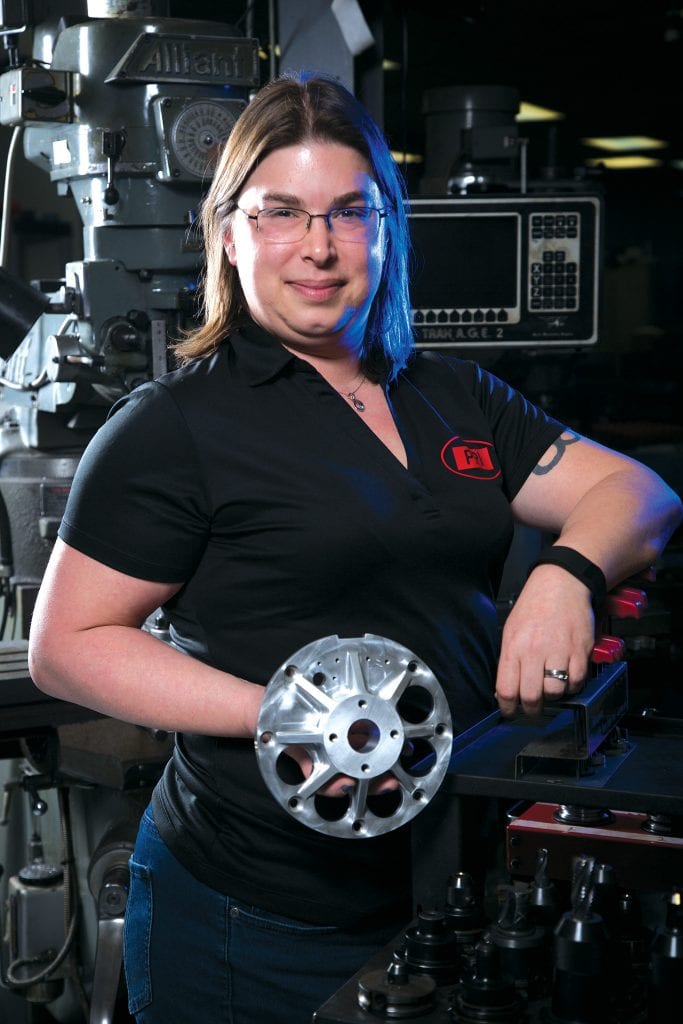

“Greentown Labs is inventing products in Massachusetts, and FORGE’s mission is to make sure they’re made in Massachusetts,” said Kristin Carlson, president of Peerless Precision, adding that she conducts ‘lunch and learns’ in Somerville and takes other steps to educate entrepreneurs not only about the firms in the area and what they can do, but also how to approach manufacturers, what those shops need to submit a quote, and about the higher quality they’ll get if they choose a Baystate firm instead of one overseas.

Scanlon agreed. “It’s not easy to figure out who might be a good match just by doing Google searches,” he said. “Especially when it comes to small, Western Mass. shops that are not strong in marketing themselves — that’s where FORGE comes in.”

For this issue, BusinessWest talked with manufacturers and entrepreneurs alike to find out how FORGE is living up to its mission — and its name.

Testing Their Metal

Teicher told BusinessWest that, even as she was being interviewed for the job of executive director of Greentown Learn more than a year ago, she was thinking the agency’s name didn’t effectively convey what it was all about, and that it needed to be changed.

And when she won the job, she made it one of her first priorities to orchestrate a rebranding.

This was a months-long process, she noted, adding that the agency wanted a name that reflected its mission, a task made more difficult by the fact that most words associated with manufacturing, making, metalworking, and so on were not usable because they’d been copyrighted or trademarked, or incorporated into a URL.

“It might be six months or 12 months later that you hear from the entrepreneur who has a set of fabrication files, and they need something quoted.”

“Any cool name that you can come up with that signals hardware has been taken,” she said, adding that some that weren’t already taken came with other problems, or baggage.

Like ‘KINECT,’ a brand option that was one of several finalists, if you will. It’s a play on words, and an effective one, blending ‘connect’ with ‘kinetic energy.’ Problem was, said Teicher, that research revealed this same name was attached to a failed Super Nintendo app.

“We were very close; we were attached to it for a while,” she said. “It was great because we’re forging connections, we’re working with physical products, and it’s pretty simple. But we didn’t want to be mixed up with a failed product at all. And there’s something a little childish about it because of the K’Nex toys — so we didn’t want that association, either.”

Kristin Carlson says FORGE helps educate entrepreneurs on the capabilities of Bay State shops and also the advantages to getting work done in the Bay State instead of overseas.

Eventually, those involved with the process settled on FORGE, which is not an acronym for anything (the capital letters are used for emphasis), but a name that drives home that ‘forging relationships’ is a critical part of the equation.

Which is important because, while the companies at Greentown Labs are pushing the envelope when it comes to clean-tech hardware, they often struggle to find partners to take their concepts off the drawing board — or the computer image, as the case may be.

And they are likely unaware of the large and in many ways historic precision-manufacturing sector in the Pioneer Valley, a sector born, in many respects, essentially where that satellite office is located, within what was the Springfield Armory complex.

FORGE makes introductions to companies in a number of ways. It organizes tours — manufacturers we spoke with said they have hosted a number of visits as a result of the initiative — and also helps companies draft requests for proposals for specific projects. And it organizes events such as the first annual Supplier and Innovation Showcase at Greentown Labs.

The gathering was designed to support connection-building efforts between inventors and makers, and it drew more than 200 attendees from the innovation and manufacturing ecosystems, said Teicher, who noted that, since its inception in 2015, FORGE has helped more than 190 startups source their supply chain with what she called “right-fit and ready local connections to manufacturers,” thus helping them over some critical humps that often derail such ventures.

“These startups have an 85% survival rate to date, far exceeding national standards, proving that FORGE has identified and provides a critical intervention for these startups,” she told BusinessWest, adding that programming has led to more than 130 contracts to manufacture innovative physical products and components in the region, infusing a known economic value of roughly $11 million — and counting.

The Western Mass. satellite office plays a key role in these efforts, said Adam Rodrigues, director of Regional Initiatives, adding that it serves as a clearinghouse for connecting startups with area manufacturers, often through those aforementioned tours, which are often eye-opening.

Companies may or may not be ready to seek manufacturing help when they take the tour, he added, but they’ve made a connection and generally go home with a business card. And when they are ready, they use it.

Scanlon agreed.

“Oftentimes, the connection may happen much later — it’s not right after the tour,” he explained. “It might be six months or 12 months later that you hear from the entrepreneur who has a set of fabrication files, and they need something quoted.”

Getting a Lift

The case of RISE Robotics, which has recently ‘graduated’ from Greentown Labs and is now operating in Somerville, exemplifies just how FORGE makes those connections.

Arron Acosta, co-founder and CEO, told BusinessWest that the company is making strides in its efforts to create a ‘green’ alternative to energy-intensive hydraulic systems used in everything from fork trucks to bulldozers to tractor trailers. Through FORGE, the company was connected with three manufacturers with the requisite capabilities, including Peerless and MTG, to produce prototypes of the RISE cylinder, which, according to the company’s website, “delivers hydraulic-like performance in a simple, maintenance-free and fluid-free package.”

The prototypes developed by the firms in this region have not moved to the production stage for various reasons, he said, but the experience of working with those firms has been very beneficial on the company’s long climb to find the optimal market fit.

CCT is another solid example of how FORGE works, said Teicher, noting that the nonprofit not only connected the company with relevant manufacturers, but also helped it find R&D lab space in Haydenville and at the Institute of Applied Life Sciences at UMass Amherst that allowed it to remain in Western Mass.

White said the ag-tech startup combines air with electricity to degrade contaminants in food and is focusing much of its energies on combating alfatoxins on peanuts.

“But as a technology and as a venture, we’re looking much bigger and broader than that over the long term,” he told BusinessWest. “By sterilizing the surface of foods with these ionized gases, we can get up to two to three times shelf-life extension for perishable foods; for example, we’ve been treating blackberries, and we’ve been able to get an additional five days of shelf life in the refrigerator because we’re knocking off that surface mold while otherwise not affecting the quality of the food.”

White said the company, looking to scale up, was drawn to the Bay State and, more specifically, Western Mass. — instead of Virginia, where his partner in the venture was living — because of the extensive innovation ecosystem in the Commonwealth.

And FORGE is a big part of this ecosystem.

“Fairly early on, in April or May, I can’t remember how, but I found out about Greenfield Learn,” he explained. “And they were extremely helpful in connecting me very quickly to a range of product-prototyping and manufacturing partners that I had no idea existed here in Massachusetts.”

Those thoughts sum up why FORGE was created — to give entrepreneurs an idea of the shops that exist and their capabilities, but also some education in why firms in the Bay State are often their best option, said Carlson, who, like Scanlon, sits on the board of advisors for the nonprofit agency.

She told BusinessWest that, oftentimes, entrepreneurs are looking for “cheap and fast” to get a prototype out the door.

“One of the goals at FORGE, and also within the firms in Western Mass., is to educate these entrepreneurs that, in Massachusetts, you get what you pay for,” Carlson went on. “You’re not going to get something you didn’t order.”

Jack Adam, vice president and co-owner of MTG, agreed. He said his firm, which provides a wide range of services, including high-volume laser cutting, welding, machining, precision forming, and more, works with clients — and RISE Robotics is one of them — to look at products and “make them more manufacturable,” as he put it.

“We support the OEMs and new-company startups to some degree, to come up with a product that’s manufacturable — we try to tell them that, ‘if you do it this way, instead of that way, you can eliminate a lot of welding, save some money, be more cost-effective, and be more competitive out there,’” he said, adding that this is the kind of support it provided to RISE Robotics as it helped the company produce close to 20 prototypes of its products.

And while helping startups by providing such services, these manufacturers are also helping themselves become more nimble and more competitive, said Scanlon, adding that it also helps them think more globally.

“It gets them thinking that there’s more out there than defense work, there’s more out there than United Technologies work,” he noted. “Meanwhile, these projects will be a little more challenging, they’ll be a little more cost-sensitive. It’s kind of like working out; it gets you more fit — it gets your business more fit.”

Parts of the Whole

As he talked with BusinessWest about RISE Robotics and the team behind it, Adam said, “they’re trying; they’re young folks, and they’re pretty talented. They’re going to hit some home runs someday, and they’re getting pretty close.”

With that, he described most of the startups at Greentown Labs and those who have graduated as well. Many are getting close, and a good number are potential home-run hitters.

To clear the bases, though, most need help taking a product from the concept stage to the prototype stage to the production line. And the aptly named FORGE is helping companies find that help.

As Scanlon noted, it’s become a different kind of sales force, and a very effective one.

George O’Brien can be reached at [email protected]

And like Clean Crop Technologies (CCT), a Haydenville-based startup working to solve the crisis of aflatoxin infection in grain and nut crops, which reportedly causes more than 100,000 deaths and $1.7 billion in lost revenues each year, especially in developing countries.

And like Clean Crop Technologies (CCT), a Haydenville-based startup working to solve the crisis of aflatoxin infection in grain and nut crops, which reportedly causes more than 100,000 deaths and $1.7 billion in lost revenues each year, especially in developing countries.

President Trump has made no secret of his hope that a series of tariffs on goods from China and other countries will eventually force a more favorable balance of trade for the U.S. But in the meantime, the escalating trade war has posed very real, often negative impacts for manufacturers, particularly in the form of higher costs and a general sense of uncertainty that makes it difficult to pursue growth. And no one seems to have any idea when the situation will ease up.

President Trump has made no secret of his hope that a series of tariffs on goods from China and other countries will eventually force a more favorable balance of trade for the U.S. But in the meantime, the escalating trade war has posed very real, often negative impacts for manufacturers, particularly in the form of higher costs and a general sense of uncertainty that makes it difficult to pursue growth. And no one seems to have any idea when the situation will ease up.