Many Ways to Celebrate

Lynn Kennedy says the Log Cabin, Delaney House, and Log Rolling catering services have something for every business during the holiday season, no matter their size.

Companies have long celebrated the hard work they’ve done over the course of the year with a holiday party. Whether hosting a small gathering or a large corporate bash, plenty of restaurants, banquet facilities, and caterers in the Western Mass. area are willing to get the job done each year. Although these parties have been popular for decades, owners and managers say trends are always changing in how people want to celebrate the year and ring in a new one.

Lynn Kennedy says one of the most common things she hears from employers booking holiday parties is that they want to do something special for the people that work for them.

“This is something people don’t want to do halfway,” said Kennedy, director of Sales and Marketing at the Log Cabin. “They want to go all in because they realize it’s the best way for them to show their employees the appreciation they deserve for a lot of hard work that they put out there.”

While end-of-the-year holiday parties have long been a tradition for companies of all sizes, employers are finding new ways to show employees their appreciation this season.

Aside from the traditional but enjoyable small group parties and restaurant reservations, companies are going above and beyond to make sure all employees are able to join in the celebration, no matter how big the organization may be.

The Log Cabin offers a wide array of options for holiday parties, including small-group holiday parties that are always a hit. Indeed, the facility is hosting a total of six this year, as opposed to the usual four or five, because of how popular they are.

“This is something people don’t want to do halfway. They want to go all in because they realize it’s the best way for them to show their employees the appreciation they deserve for a lot of hard work that they put out there.”

The Starting Gate at GreatHorse is another popular venue for small-group holiday parties, including a Breakfast with Santa, a Holiday Dinner Dance with the Clark Eno Orchestra, and the annual Holiday Luncheon with Dan Kane & Friends.

Cathy Stephens, director of Catering Sales, says these events are affordable options for small to mid-sized companies looking to enjoy a festive night.

“It is cost-effective for the smaller and even the mid-size companies to host their holiday celebration at venues that are providing live entertainment and a festive menu that satisfies just about everyone,” she said. “It also provides the opportunity to network with other local businesses.”

In addition to Center Square Grill, Bill Collins recently opened another restaurant, HighBrow, in Northampton.

There is no shortage of businesses in the Western Mass. area, and all have their own preferences as to what kind of gathering will appeal to their employees. This encourages restaurants like Center Square Grill to expand their options and accommodate unique requests.

Owner Bill Collins says he does his best to work with any request, no matter how big or small, and often does so himself to make sure everything goes smoothly.

“What makes this restaurant stand out is that the owner is on deck,” he said, adding that General Manager Kim Hulslander is also frequently involved with booking parties. “If you want to call and work with me, you’re going to get me on the phone. You’re in ownership’s hands when you’re booking an event with us, and we see it through to the end.”

The holiday season poses a strong business opportunity for restaurants and banquet facilities, but it is also a great time for caterers.

“We have people who book at the end of the prior year. Once their holiday party finishes, most people, within a week or two, are booking already for the next year.”

Nosh Restaurant and Café in Springfield may be fairly small on the inside, but its catering business is booming, and uses creative food and elegant edible centerpieces to stand out from the competition.

“I think our food is super creative, and we present it beautifully,” said owner Teri Skinner. “It’s important to be creative in how you present the food, the taste, and the flavors. It’s really what a catering company is built on.”

These caterers are seeing a lot more business around the holidays over the past few years for a number of reasons. For this year’s holiday party planning issue, BusinessWest spoke with local restaurants and caterers about these changing traditions and how they strive to stand out among local competition.

Teri Skinner, owner of Nosh, says it’s important to be creative when it comes to food presentation.

Keep Them Coming Back

When Missy Baker at Arland Tool e-mailed Skinner to set up the company’s annual party, she sent just five short words: “all set for the 24th?” Skinner responded, “yes, we’re all set.”

That’s because this is the seventh or eighth time Skinner has hosted Arland’s annual party, and she knows exactly what they like and need.

“It’s great for the customer because they know I’m going to be there, they know the quality of food, and it’s great for me because I know how much they eat and how long it takes,” Skinner said. “It’s a very precise job that we can control very well.”

These kinds of relationships are not uncommon for restaurants and caterers, and it’s often the unique experiences customers have that keeps them coming back year after year.

Collins noted that a loyal clientele books parties at Center Square Grill every year.

“For us not being a big corporate chain, I just try to go above and beyond for the customer,” he said. “It’s worth it for me to do that to try to build in the business year after year.”

Some sites, like the Log Cabin, are so popular that regulars will book their next annual event just weeks after they enjoy their party this year.

“There are a lot of companies where their business is heaviest during this season, and it doesn’t make sense for them to actually have the celebration before Christmas, so they do it as a type of new-year celebration.”

“We have people who book at the end of the prior year,” Kennedy said. “Once their holiday party finishes, most people, within a week or two, are booking already for the next year.”

This mainly includes the larger parties that rent out big rooms at the Log Cabin for 300 to 400 people, like Tighe & Bond, Florence Bank, and PeoplesBank.

Because of the desire for a smaller, more intimate setting, Kennedy says the company’s Delaney House, where several rooms can fit 15 to 50 people, is also jam-packed during the holidays. Whatever the booking party’s size, she has seen an increase in catering over the last few years, which she credits partly to a changing workforce schedule.

“A major component of that is work schedules because you have first and second and third shifts of people,” she said. “Heads of businesses are really trying to figure out a way to incorporate their entire workforce in a holiday celebration and not just limit it to a particular time.”

These multi-shift businesses include news crews, manufacturers, and even hospitals, where it is nearly impossible to get everyone in the same room at the same time. This is where Log Rolling, the catering service for Log Cabin and the Delaney House, comes in handy.

“They’ll come in and ask us, ‘can you set up a breakfast for our morning crew? Can you set up a lunch for our afternoon crew? Can you set up a dinner for our evening crew?’ so everyone is kind of being hit at a different time and everyone gets to enjoy that holiday experience,” Kennedy said.

Making Spirits Bright

Caterers aren’t the only ones bringing unique styles to holiday celebrations. At Center Square Grill, Collins says customized packages are available for parties of any size, including both food and décor.

The restaurant offers packages for private dining that start at $20 and typically go up to $45 per person, although that isn’t the limit. Lower packages might offer unlimited alcoholic beverages with an entrée choice and a salad. With the $45 packages, everyone is greeted with a glass of champagne and gets an appetizer, salad, entrée, and dessert.

Collins also said he can arrange rooms in a variety of ways, with everything from decorated tables for a sit-down dinner to cocktail tables for a more casual night out.

“What’s unique about us is that you can come here casually, or you can come here dressed up, and you’re not going to feel bad in either direction,” he said. “We want you to be comfortable coming in for a burger and a beer or filet, oysters, and a bottle of champagne.”

Perhaps one of the most important parts about a holiday party is the quality and presentation of food, Skinner said. From everything from the plate the food goes on to the way the food itself is presented itself, Nosh puts together each “edible centerpiece” with with care.

“We call them edible centerpieces because they’re so beautiful when they go out,” she elaborated. “That’s how we build things here. We want them to look gorgeous and taste great, so that’s our goal at the end of the day.”

Cathy Stephens says events at Great Horse, including the holiday dinner dance and holiday luncheon, are perfect for businesses with a smaller budget.

More recently, Nosh catered a Halloween party for Northwest Mutual and provided edible centerpieces, appetizers, and a bartender dressed up for the spooky season.

Skinner agrees that catering has become more popular over the years and thinks a lot of people just want to feel comfortable and laid-back. “I think having it at home or at an office is relaxing,” she said.

Perhaps one of the most relaxing options all these restaurants have seen is the decision to hold off on a holiday party until the beginning of the following year to avoid the craziness of booking during peak season.

Kennedy says people normally book parties at the Log Cabin through the first few weeks of January, but some even book all the way into February.

“There are a lot of companies where their business is heaviest during this season, and it doesn’t make sense for them to actually have the celebration before Christmas, so they do it as a type of new-year celebration,” she said.

This happens frequently at restaurants in the area as well, and it’s the reason why Center Square keeps decorations up well into the new year so customers can still feel the holiday spirit even after the holidays are over.

In short, whether businesses are going with a new tradition or sticking with an old one, there is no shortage of options for holiday parties in Western Mass. — and banquet halls and restaurants say they’re happy to oblige.

Kayla Ebner can be reached at [email protected]

When BusinessWest and the Healthcare News first started publishing an annual Senior Planning Guide, the idea wasn’t to create a roadmap to the end of life, though it could, in some sense, be described as such.

When BusinessWest and the Healthcare News first started publishing an annual Senior Planning Guide, the idea wasn’t to create a roadmap to the end of life, though it could, in some sense, be described as such.

“Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.”

“Someone develops Alzheimer’s disease every 68 seconds, with 5 million Americans affected, and the number expected to increase to 20 million by 2050.” “Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.”

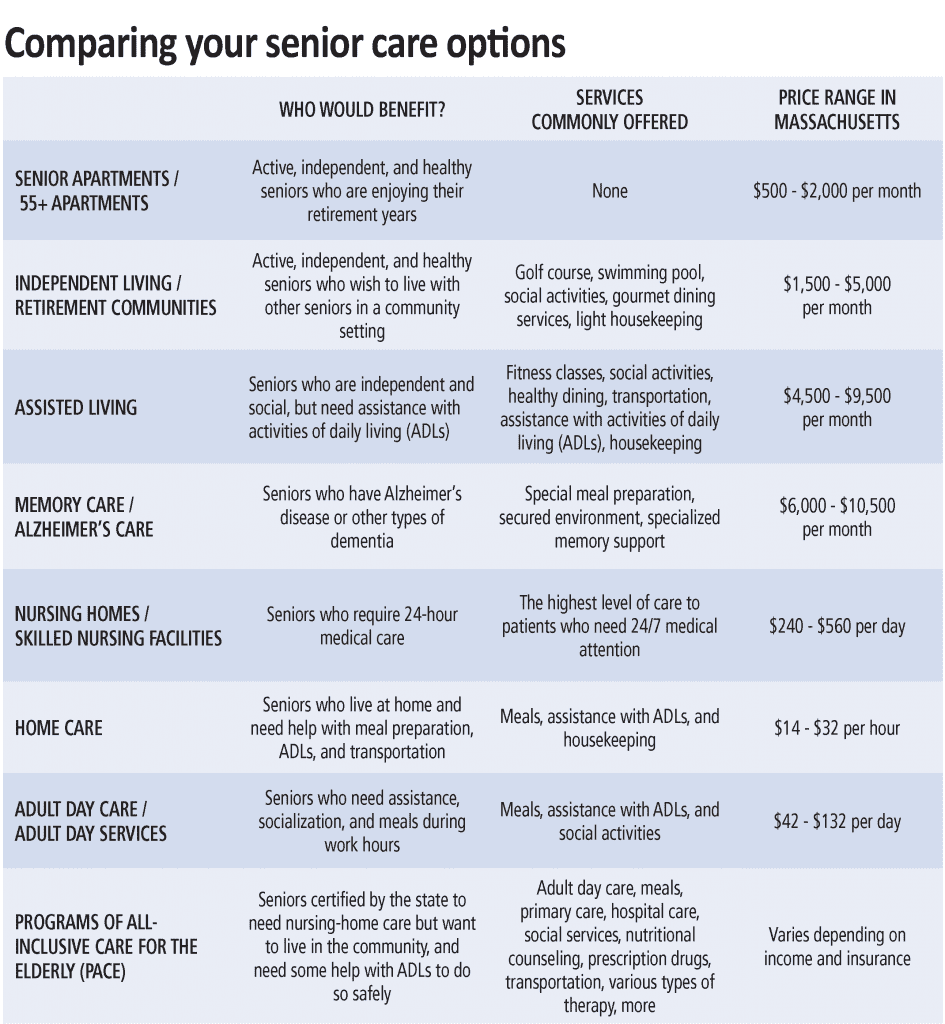

“Stacks of unopened mail, late-payment notices, unfilled prescriptions, and the lack of general upkeep of the house can all be signs that your loved one may need someone to assist with bill paying or homemaking.” “Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

“Moving from home to a senior-living community is one of the most consequential decisions elder loved ones may be faced with in their lifetimes.”

It’s called the Setting Every Community Up for Retirement Enhancement Act, and it was signed into law just a few weeks ago and took effect on Jan. 1. It is making an impact on taxpayers already, and individuals should know and understand its many provisions.

It’s called the Setting Every Community Up for Retirement Enhancement Act, and it was signed into law just a few weeks ago and took effect on Jan. 1. It is making an impact on taxpayers already, and individuals should know and understand its many provisions.

JD, LLM, CLU, ChFC, AIF, CDFA

JD, LLM, CLU, ChFC, AIF, CDFA

Most working Americans have only one source of steady income before they retire: Their jobs. But when you retire, your income will likely come from a number of sources, such as retirement accounts, Social Security benefits, pensions, and part-time work.

Most working Americans have only one source of steady income before they retire: Their jobs. But when you retire, your income will likely come from a number of sources, such as retirement accounts, Social Security benefits, pensions, and part-time work.

There are many changes that businesses and individuals should be aware of under The Tax Cuts and Jobs Act (TCJA), the most significant tax legislation in the U.S. in more than 30 years. Here are the 10 changes that will have the most significant impact this tax season.

There are many changes that businesses and individuals should be aware of under The Tax Cuts and Jobs Act (TCJA), the most significant tax legislation in the U.S. in more than 30 years. Here are the 10 changes that will have the most significant impact this tax season.