The Surge Continues

By Elizabeth Sears

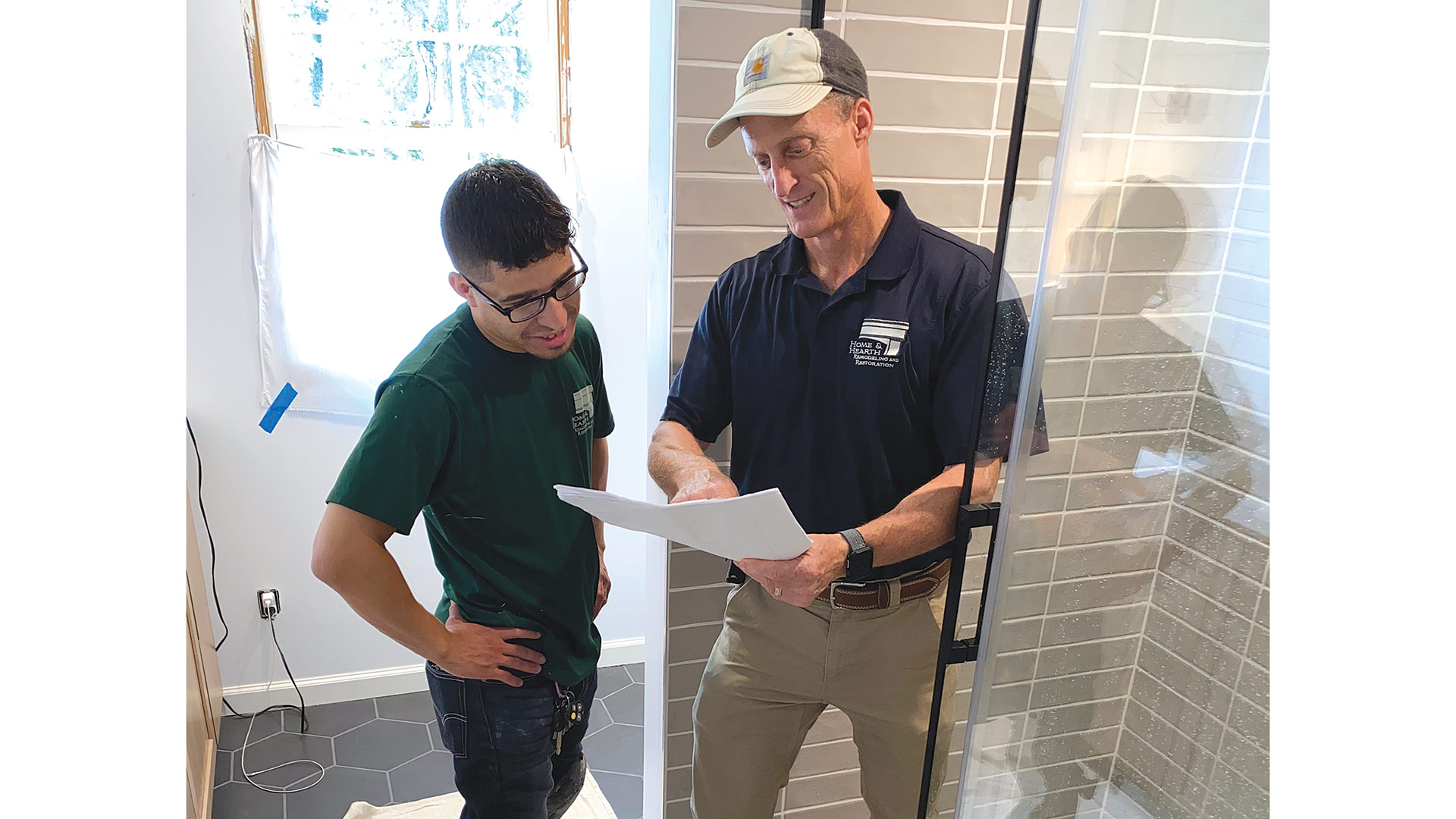

Dave Coyne (right) says the Home & Garden Show has been beneficial to his business.

A ‘COVID bump.’

That’s what some in the home-improvement industry call that surge in business that accompanied the pandemic nearly three years ago now.

“It’s been kind of amazing; I think the industry had a sort of bump when, sadly, people stayed home and conserved their money and their time outside of their home,” said Deb Kelly, staff designer at Modern Kitchens in Agawam, which specializes in start-to-finish kitchen and bathroom renovations.

“Then, maybe they looked around and thought their home was a little shabby, and they could pick some things up,” she went on. “Since they weren’t taking cruises or going out to dinner as much, they said, ‘let’s do these projects that we’d really love to accomplish.’ We’re still feeling the effects of that; we’re going into a strong 2023.”

Yes, the COVID bump, or whatever one chooses to call it, still has some legs to it, and this bodes well for area businesses across the very broad spectrum of home improvement, many of which are gearing up for the 68th Western Mass. Home & Garden Show on March 23-26 — and expecting to come away from that event with more prospective customers.

Tony Witman, owner of property-management company Witman Properties in Holyoke, said he recognizes that, despite these beneficial trends in this sector, services are not necessarily going to sell themselves — which is where the Home Show comes in.

“Since they weren’t taking cruises or going out to dinner as much, they said, ‘let’s do these projects that we’d really love to accomplish.’ We’re still feeling the effects of that; we’re going into a strong 2023.”

“Many of the services we provide are same-day or next-day, whether it’s plumbing, electrical, HVAC … and I don’t think homeowners get that level of service by just flipping through the internet calling people,” he said, noting that the event offers an immediate response to their inquiries from a professional contractor. “I think there’s value.”

Indeed, it seems the value of the Home Show goes beyond in-person contact. There is a unique human aspect to local clients brainstorming renovations with local home-improvement businesses. That’s where Home & Hearth Remodeling in West Springfield got its motto, “a craftsman who cares.”

“When I interview people, I just look at them and think, ‘is this person a craftsman, and do they care about their work? Do they care about doing a good job? Do they care about getting better in learning? Do they care about the customer who’s home? Do they care about the people they’re working with?’ Those are all important,” owner Dave Coyne explained. “We have a very low turnover, and we generally have pretty experienced people working for us — and they stick around.”

Coyne joined the Home Builders & Remodelers Assoc. of Western Mass. (HBRAWM) — which stages the annual Home Show — when he moved to the area, and said it has been a great resource. He began at the show as a solo practitioner, but as his company has grown, he’s added more staff, and now has “a proper business,” as he called it, and his company has increased its presence at the show, with its booth becoming “a little bit fancier” year after year.

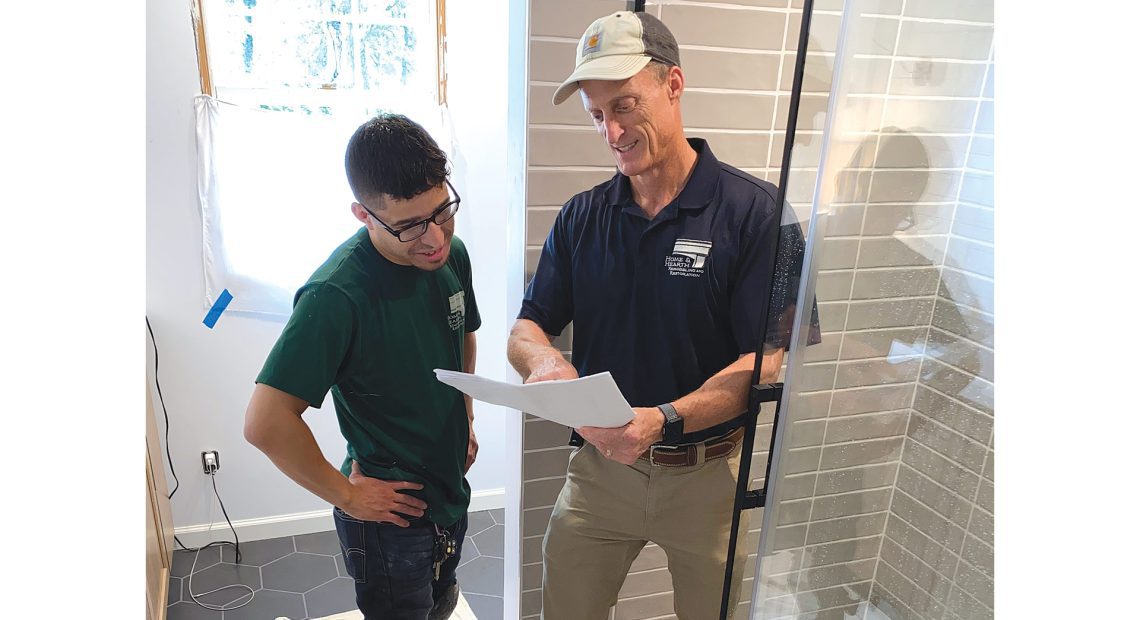

Tom Cerrato says the pandemic-fueled surge in home improvement is still going on.

“We still have just a single booth this year, which we are in the process of refurbishing,” he explained. “Next year, we’re contemplating actually getting two side by side to focus part of the home show on decks and outdoor work, and then the other part on the interior remodeling and additions.”

Captive Audience

It’s a plan that reflects the event’s flexibility and opportunities to showcase one’s offerings to an enthusiastic audience, many of them actively shopping for services.

And many vendors are still seeing that COVID (or, perhaps, post-COVID) bump.

“People are still thinking about staycations, right? That buzzword is still out there,” said Andy Crane, executive director of HBRAWM. “Even though COVID is in the rearview mirror, it made people rethink how they’re going to live. A lot of these companies did pretty well during the pandemic, during the height of it, because people were investing in their homes because they weren’t going away.”

And they’re still investing, said Tom Cerrato, branch manager at Kelly-Fradet Lumber in East Longmeadow. “When the pandemic started, we went back and forth on whether we’d even stay in business, but fortunately for us, it turned out to be a boom because there were so many people who stayed home, stopped traveling, and had those extra funds to spend, and fortunately spent it on an industry that benefited us — home improvement and building. It’s been very good for us the last few years.”

In the years Kelly-Fradet has participated in the Home Show, Cerrato said the event has created strong brand awareness among a receptive crowd.

“It’s a good-sized booth, and our presence gives us good branding locally. We get to be top of mind with customers in our market, and a lot of them are making large purchases for their home, decks, windows, kitchens, doors, a lot of stuff. So we like to be in front of them as they start their projects.”

“We get to be top of mind with customers in our market, and a lot of them are making large purchases for their home, decks, windows, kitchens, doors, a lot of stuff. So we like to be in front of them as they start their projects.”

First-time Home Show vendor Witman Properties, is exhibiting this year due to the visibility and tangibility of meeting potential clients, and making that personal connection that others described as being vital to good business.

“There’s so much online marketing, and I think people in general might be getting a little burned out from just looking at their screens and their phones all the time,” Witman said. “We figure it’s a really good chance to get in front of people. A lot of people see our trucks driving around, and they see our signs … but they don’t know who we really are. So it’s a good way to get out there and meet the local people in the communities we service.”

Crane can relate. “I have never bought anything off the internet. I will drive three hours on a Saturday morning to go see a safe in Rhode Island before I buy it off the internet.”

That’s one of the show’s main draws for a company like Eastern Security Safe in West Springfield, Crane explained. “What is the value? If I was Eastern Security Safe, I would say the value is people can touch and feel my safe. They feel the quality. They want to see my face; they want to talk to me and negotiate face to face. You can’t negotiate to a computer too well, and when nothing shows up or something is dented or scratched, you don’t even know who to talk to.”

That’s not to say technology is a hindrance to local businesses gaining customers; sometimes, it is a great help. With the availability of home-improvement inspiration online, clients often come to the Home Show prepared with ideas and visions of what improvements they would like to achieve.

“I think one unique aspect we have is this — a lot of times people have images in their head of what they would like their kitchen or bathroom to look like,” Kelly said. “Many will walk in with their phone starting to scroll and show me things they’ve researched, that they’d like to try to accomplish in their own home.

“That’s where we sit down with them and pull together all those puzzle pieces, and actually physically lay them out on the tabletop — ‘here’s your door, here’s your countertop, here’s the paint color, here’s your tile that we’re going to use,’” she went on. “It really allows them to pull the whole project together and turn it into more of a reality instead of just a pretty picture they found on their phone.”

She went on to note the large volume of contacts Modern Kitchens has made as a result of being a vendor at the Home Show over the years. The company has followed up with all of them, converting many into customers.

“We’ve met some really nice people who were at the Home Show with some project in mind,” Kelly said. “It’s like talking to qualified leads, really.”

Get Out There

Crane said the Home & Garden Show is a personal experience in another way: many attendees turn it into a social gathering with family or friends.

Before he was actually in charge of it, “we would go all the time to the Home Show, spend two or three hours, then go to some local restaurant. People consider it a social event.”

The vitality of the Home Show — booth sales are way up (see sidebar on page 33) — accurately reflects the booming prosperity of the industries represented at the show. However, substantial business often means substantial wait times, one downside to this ongoing surge. Clients may find themselves disappointed with long wait times before they see their renovation plans come to fruition — but so far, that hasn’t seemed to deter their willingness to book projects far in advance.

Over the past few years, Kelly said, “people were willing to wait; I think the industry was busy, so people could accept a timeline that was a little further out. When you want to do a project, you’re a little antsy, you make the decision — ‘yes, let’s move forward with this, we have the money, let’s do it’ — and many people who normally would want to have a start date within a couple of weeks have been willing to wait because the industry is busy.”

As a result, Modern Kitchens has been able to schedule a full year’s worth of business from the Home Show. Coyne echoed this experience, having also received large amounts of business from previous shows.

“I get enough business from the Home Show to carry me through the year. We always get plenty of good leads,” he said. “After this last Home Show … I’m not joking, we were probably still following up with leads four months or more afterwards. We have jobs that we are starting in April — we actually have a job that we just started today — that I think came from the Home Show last year.”

The 68th presentation of the Western Mass. Home & Garden Show will take place in the Better Living Center building at the Eastern States Exposition, with displays in the outdoor area. This year’s show hours are Thursday and Friday, March 23-24, noon to 8 p.m.; Saturday, March 25, 10 a.m. to 8 p.m.; and Sunday, March 26, 10 a.m. to 5 p.m.

General show admission is $10 for adults, and children under 12 are admitted free. A coupon reducing admission to $7 can be found on the show’s website. Active military and veterans will receive free admission on Thursday, March 23. Parking on the Eastern States Exposition grounds costs $5 per vehicle.

Home Show Has Evolved in Many Ways

As Andy Crane perused a list — a very long list — of vendors at the 68th annual Western Mass. Home & Garden Show, he made a point of picking out a bunch that may surprise some attendees.

A chiropractor. A healing and spiritual-development center. Gourmet food producers. Makers of jewelry and accessories.

“That’s a cool theme this year,” said Crane, executive director of the Home Builders & Remodelers Assoc. of Western Mass., which stages the annual show at the Eastern States Exhibition, slated this year for March 23-26. “It’s not just roofing and siding and patios. It’s home life.”

The annual event sees all types of attendees who visit for a variety of reasons, he noted. Attendees typically fall into one of several categories:

• People planning to buy or build a new home, who may visit with builders, real-estate agents, financial institutions, and sellers of component products, such as hardwood flooring, tile, and appliances;

• People planning to remodel or renovate, who may want to check in with all of the above, plus vendors of replacement components such as windows and doors, as well as appliances, wall treatments, and home furnishings;

• Yard and garden enthusiasts, who tend to be interested in lawn and landscaping services; wall, walk, and edging components and materials; and trees, shrubs, flowers, and seeds;

• Committed renters, who have no plans to own a house, but may be interested in space-conservation and space-utilization products, as well as home furnishings;

• Impulse buyers, who flock to vendors of home décor, arts and crafts, cooking and baking products, jewelry, and personal goods; and

• Lifestyle-conscious individuals, who like to check out trendy, high-tech, or time-saving products, as well as home furnishings and products focused on self-improvement, fitness, and health.

It’s those last two categories that many people don’t often think of when they consider who wants to set up shop at the show.

“The Home & Garden Show is really about taking care of you and your family in your home. Quality of life is a good way to put it.”

“B-Well and Thrive is one company that’s going to be very interesting,” Crane said of the Hampden-based wellness practice, which will feature bioenergetic testing, therapeutic crystal mats, and the expertise of holistic practitioner Colleen Mancuso at its booth, among other offerings.

Then there’s Adult & Teen Challenge Greater Boston, which will be on hand to talk about resources to treat addiction, a scourge that affects far too many families in Massachusetts.

“I feel terrible for any family that has to go through that. They often don’t know where to turn,” Crane said. “But here’s at least one company — and there are many more than one — that is addressing it publicly so that people will have someone to turn to.”

Or, on a lighter note, Own Your Own Arcade Game, a national company that … well, the name pretty much describes it: they sell full-size, stand-up arcade games for the home. “They realized they found a niche that works, and they’re buying a booth,” Crane said.

In all these cases and more, from personal health and wellness to just plain fun, vendors aren’t selling building supplies and home-improvement services, Crane added. “The Home & Garden Show is really about taking care of you and your family in your home. Quality of life is a good way to put it.”

Andy Crane says the Home Show isn’t just about home improvement, but lifestyle improvement as well.

Fran Beaulieu, vice president of Phil Beaulieu & Sons Home Improvement Inc. in Chicopee — and president of this year’s Home & Garden Show — can appreciate the ways in which the event has evolved, as his company has been participating as a vendor for almost seven decades.

“The value has changed over the years,” he told BusinessWest. “Everyone has a smartphone, so they don’t necessarily need a home show, but we’ve noticed something over the past several years: in the early days, it was about generating leads because it was really hard to get in front of everybody. Nowadays, with such a huge customer base, we’re rekindling old relationships.”

He can cite many instances of meeting a former customer for, say, a roofing project, they get to talking, and by the end of the conversation, she’s ordering patio doors.

In fact, about 70% of Phil Beaulieu & Sons’ projects last year were repeat customers, and “we think the Home Show is huge for that because we get a lot of the same people coming back every year and buying something new — not to mention, we do a lot of work for people who have booths. Not everyone is in the roofing, siding, and windows business, so we do work for garage-door guys, and we cultivate those relationships.”

Fran Beaulieu’s company has been involved with the Home Show for almost seven decades.

Another category of show attendees are those who attend purely for fun, who may arrive without an agenda but often develop ideas for future purchases and home products. Not only might they make a connection on a traditional improvement project, but they might find something unique, in realms like home entertainment, security, and energy efficiency.

“A high point of this year’s show will be energy,” Crane said. “Everyone knows their energy bills have gone up, specifically electricity. Energy is a big buzzword; everyone’s talking about it, and the building industry has to react to it.”

Of course, many vendors are producing not high-tech innovations, but quality craftsmanship in time-honored fields, like American Rustic Woodworks of Spencer. “People are asking for that, too,” Crane said. “It’s beautiful stuff — and where do you go to get it?”

That, in the end, may be the one unchanging draw of the Home & Garden Show — bringing together, in one space, old and new disciplines in every possible aspect of home improvement and, yes, quality of life at home.

“Sometimes it’s hard to get all that on a computer,” Crane said. “Here, you can certainly talk to the salesperson, owner, what have you, and feel like you’re leaving with an answer.”

While on active duty at Fort Campbell, a military base in Kentucky, Christopher Martin was a private assigned to a barracks with a roommate he didn’t know. More than a decade later, that roommate is now Martin’s business partner. Not only that, but he was the one who convinced Martin they needed to get out of the barracks.

While on active duty at Fort Campbell, a military base in Kentucky, Christopher Martin was a private assigned to a barracks with a roommate he didn’t know. More than a decade later, that roommate is now Martin’s business partner. Not only that, but he was the one who convinced Martin they needed to get out of the barracks.

It’s called the Setting Every Community Up for Retirement Enhancement Act, and it was signed into law just a few weeks ago and took effect on Jan. 1. It is making an impact on taxpayers already, and individuals should know and understand its many provisions.

It’s called the Setting Every Community Up for Retirement Enhancement Act, and it was signed into law just a few weeks ago and took effect on Jan. 1. It is making an impact on taxpayers already, and individuals should know and understand its many provisions.

This past year was one that saw a number of landscape-changing developments in the broad realm of employment law. From paid family leave to cannabis to overtime-threshold changes, there were a number of changes to existing laws, new measures to keep track of, and new challenges for employers.

This past year was one that saw a number of landscape-changing developments in the broad realm of employment law. From paid family leave to cannabis to overtime-threshold changes, there were a number of changes to existing laws, new measures to keep track of, and new challenges for employers.

Year-end tax planning in 2019 remains as complicated as ever. Notably, we are still coping with the massive changes included in the biggest tax law in decades — the Tax Cuts and Jobs Act (TCJA) of 2017 — and pinpointing the optimal strategies. This monumental tax legislation includes myriad provisions affecting a wide range of individual and business taxpayers.

Year-end tax planning in 2019 remains as complicated as ever. Notably, we are still coping with the massive changes included in the biggest tax law in decades — the Tax Cuts and Jobs Act (TCJA) of 2017 — and pinpointing the optimal strategies. This monumental tax legislation includes myriad provisions affecting a wide range of individual and business taxpayers.

On Nov. 3, 2019, news broke that the McDonald’s board of directors voted to terminate CEO Steve Easterbrook for having a consensual relationship with an employee.

On Nov. 3, 2019, news broke that the McDonald’s board of directors voted to terminate CEO Steve Easterbrook for having a consensual relationship with an employee.

The #MeToo movement has brought about change and challenge — from a liability standpoint — in workplaces of all kinds. And this includes the broad spectrum of education. Indeed, recent cases indicate that courts may soon hold schools, colleges, and universities strictly liable for any sexual misconduct by their staff toward their students.

The #MeToo movement has brought about change and challenge — from a liability standpoint — in workplaces of all kinds. And this includes the broad spectrum of education. Indeed, recent cases indicate that courts may soon hold schools, colleges, and universities strictly liable for any sexual misconduct by their staff toward their students.

The cannabis industry is off to a fast and quite intriguing start in the Bay State, and two new categories of license have particular potential to move this sector in new directions: one for home delivery of cannabis products, and another for social-consumption establishments, or cannabis cafés.

The cannabis industry is off to a fast and quite intriguing start in the Bay State, and two new categories of license have particular potential to move this sector in new directions: one for home delivery of cannabis products, and another for social-consumption establishments, or cannabis cafés.

Section 199A of the Tax Cuts and Jobs Act was created to level the playing field when it comes to lowering the corporate tax rate for those businesses not acting as C corporations. For most profit-seeking ventures, qualifying for the deduction is not difficult, but for rental real estate, it becomes more difficult.

Section 199A of the Tax Cuts and Jobs Act was created to level the playing field when it comes to lowering the corporate tax rate for those businesses not acting as C corporations. For most profit-seeking ventures, qualifying for the deduction is not difficult, but for rental real estate, it becomes more difficult.

Consider this — tomorrow, you take a terrible fall.

Consider this — tomorrow, you take a terrible fall.

JD, LLM, CLU, ChFC, AIF, CDFA

JD, LLM, CLU, ChFC, AIF, CDFA