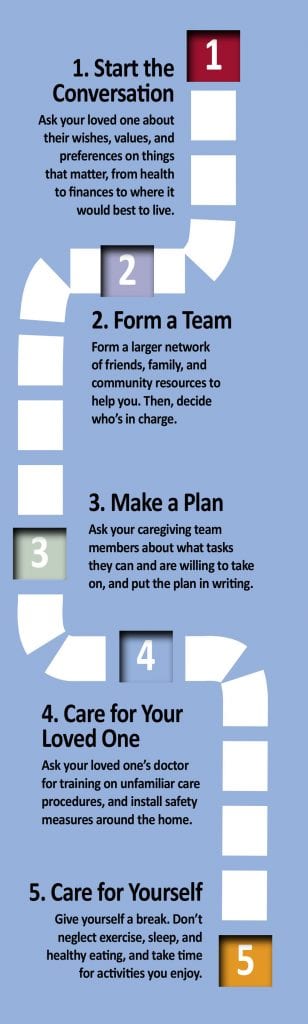

Follow These Five Steps When It’s Time to Talk About Care

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time.

Whether your loved one needs full-time care or you’re just beginning to anticipate a need, here’s a series of steps you’ll need to take, with some thoughts on each from leading voices in the field. Just take it one step at a time.

1. Start the Conversation

“Talking with your parents about their future will not be a one‐time conversation, but an ongoing process,” says Catherine Hodder, author of Estate Planning for the Sandwich Generation: How to Help Your Parents and Protect Your Kids. “You must be patient and willing to wait until your parents feel comfortable. They will need to be ready to talk with you or to make certain decisions about their future. The hardest part will be for them to admit they need help and that you will be taking on more responsibility for them. Understand they still see you as their child who they should be helping, not the other way around. Try to feel out the right times to talk about healthcare concerns and when to talk about finances. Depending on your parents’ personalities, one may be an easier conversation than the other.”

2. Consider How Much You Can Take On

“For many, our responsibilities extend beyond the needs of our aging parents and carry over to our own families,” says Amy Osmond Cook, author of Things to Discuss with Aging Parents Before Becoming Their Caregiver. “Those obligations don’t end when a parent needs extra care. By discussing a schedule with your loved one, you can establish a balance between his needs and the needs of your family. For example, you may have a nurse stay in the home on certain days with an understanding you will take your aging parent to all of the doctor’s appointments. A routine can provide comfort to your loved one because he will know when to expect you or other helpers when care is needed.”

3. Build a Team and Make a Plan

“Family meetings are a way for siblings, parents, and other concerned relatives or friends to try to clarify the situation, work out conflicts, and set up a care plan that, ideally, all can agree upon,” says Bonnie Lawrence, author of A Sibling’s Guide to Caring for Aging Parents. “If the meeting is likely to be contentious, or if you want an experienced, objective voice to guide it, involve a facilitator such as a social worker, counselor, geriatric care manager, or trusted outside party who will ensure that all participants have a chance to be heard. You may need more than one meeting.”

4. Discuss How You Will Pay for Care

“What is the truth about your parent’s situation — finances, health, and what they want for care?” asks Catherine Flax, author of Aging Parents and Money: Difficult Conversations That Need to Be Had. “The reality is that, when it comes to finances, most people (parents and their children) are largely in the dark. What are the rules around Social Security? How much do they currently spend on healthcare, and how do Medicare and insurance supplements work? What is the optimal, tax-efficient draw-down schedule for their retirement assets — and how far will these assets take them? Do they have other assets that they could manage to their advantage (like a home that could be downsized) to give them a higher quality of life, and would they want that?”

5. Make the Transition — and Follow Up

“Once your mother selects a place and settles in, visit frequently — by whatever means possible,” says Kerry Patterson, author of Preparing for a Crucial Conversation with an Aging Parent. “Check to see what is working and what isn’t. Where possible, make further changes to match her needs to the facility. Finally, live up to the promise you made to yourself. You meant it when you decided that you wanted what’s best for your mom/dad or loved one. Whether this turns out to be true depends a great deal on how often you make contact with him/her once she’s/he’s found a new place to live.”

Some Questions and Answers About Home-care Services

By Tania Spear

What is home care?

Home-care services are delivered to clients wherever they call home. There is a wide variety of assistance available, including everything from occasional help with housekeeping, meal preparation, companionship, and errands to skilled services such as nursing, physical therapy, occupational therapy, speech therapy, and hospice care. The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.

Who provides home care?

Home-care services can be provided by an agency or an individual. Support can be provided from one hour to up to 24 hours a day, 365 days per year. There are many reputable agencies in the area. Your physician, area Council on Aging, hospital-discharge planner, or geriatric-care manager will be able to refer you to a home-care provider most appropriate to assist you.

“The goal is to support clients who prefer to remain at home, but need care that cannot easily or effectively be provided by family or friends.”

How do I pay for home-care services?

Government and private insurance may pay for services under specific circumstances such as after a recent hospitalization when skilled nursing or therapy services are needed. Ongoing assistance with activities of daily living (bathing, dressing, feeding, etc.) and housekeeping are generally not covered by insurance and are often private pay. It would be best to contact your provider for more information.

Are there benefits to using an agency?

While you may pay more using an agency caregiver, there are some advantages. An agency will offer pre-screening of workers, liability protection, workers’ compensation, and backup care in the event a particular caregiver isn’t available. An agency handles scheduling, payroll, and taxes, resulting in less paperwork.

How do I evaluate a home-care agency?

You will want to know if the agency works with you to develop a written plan of care and/or service contract and, if so, how often it is updated. How does the agency screen and evaluate employees? Are caregivers and supervisors available 24/7/365? How does the agency resolve concerns or complaints? Can the agency provide a list of local references?

What about COVID-19?

While accepting help at home from an agency may cause some fear during the pandemic, there are some things to consider that may help make you feel more confident in your decision to refuse or accept care as well as minimize risks. First, you want to assess the need for care. For many, care is essential, and refusing assistance in not an option. If you’ve determined help is necessary, check with the agency to determine what infection-control protocols are in place and if the agency has enough personal protective equipment (PPE) available. In addition to following CDC guidelines, you may want significant details related to how the agency is protecting staff and clients.

Are there any other things I should consider before receiving home care?

If a client or family hasn’t ever had help at home in the past, it can create some distress. The loss of independence and privacy can be factors. Oftentimes, if a competent caregiver with the right skills is placed, even the most seemingly resistant client may begin to look forward to the caregiver visits. Establishing expectations based on an appropriate plan of care and a goal for each visit is important for both the client and caregiver. With the right blend of care and compassion, a bit of support can make a world of difference in allowing someone who wishes to remain home to stay safe and healthy.

Tania Spear, MSN, MBA, RN is the owner and administrator of Silver Linings Home Care, LLC. She is a registered nurse and an Elms College graduate with a master of science degree in nursing and health services management and an MBA in healthcare leadership; (413) 363-2575; [email protected]

Eight Tips for Medication Management for Seniors

By Kara James

In general, as we age, our need for a variety of medications increases. This includes everything from prescriptions to over-the-counter medications, as well as vitamins and supplements.

Unfortunately, as the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses. Here are eight tips to help properly manage medications.

1. Check for interactions. Talk to your pharmacist and let them know about all the medications you are taking, including natural remedies and over-the-counter products. Your pharmacist can let you know in advance about any potential for interactions that could have serious health consequences.

“As the number of remedies we take increases, so too does the difficulty in managing them, which can lead to problems such as potential interactions and missed doses.”

2. Make a written schedule. It’s important to take medications as prescribed so they work effectively. Write down which medications you need to take, and at what time of day (morning, noon, evening, or bedtime). Be sure to include any important reminders, such as if you are supposed to take a medication with food or on an empty stomach. Keep this schedule in a visible place. Use an alarm to set reminders, if necessary, to stay on schedule.

3. Pre-sort medications weekly. A pill organizer makes it easy for you to see what medications you need to take and when, and also lets you easily see if you already took a dose so you don’t accidentally take it twice. Our MediBubble medication-management system does this for you with monthly pill-pack organizers.

4. Create a comprehensive list. Make a list of all your medications and supplements and keep it on your phone or in your wallet for easy reference. Include the medication name, dosage, frequency, and purpose.

5. Store medications appropriately. Many people store their medications in the bathroom; heat and humidity can cause medications to degrade. They should be kept in a cool, dark place, out of the reach of children.

6. Ensure accessibility. Some seniors struggle with opening child-proof bottles, so make sure you can actually access the medications you need to take. If you must put them in another container, make sure the container is labeled with the medication name, dosage, and other instructions.

7. Understand side effects. Make sure you understand the potential side effects of medications you take, and be sure to let your provider know if you experience any that are serious. They can often provide advice or change the medication or dosage to minimize issues. You can also talk to your pharmacist with questions and concerns about side effects.

8. Plan ahead for refills. Make sure you order refills well in advance to avoid missed doses. Some pharmacies now offer medication-management programs allowing for routine refilling of your prescriptions, and will notify you when your refill is ready. n

Kara James, Ph.D. is pharmacy manager and co-owner of Louis & Clark Pharmacy in Springfield.

Many Options Are Available for Seniors and Their Families

From the NATIONAL INSTITUTE ON AGING

Many older adults and caregivers worry about the cost of medical care. These expenses can use up a significant part of monthly income, even for families who thought they had saved enough.

How people pay for long-term care — whether delivered at home or in a hospital, assisted-living facility, or skilled-nursing facility — depends on their financial situation and the kinds of services they use. Often, they rely on a variety of payment sources, including personal funds, government programs, and private financing options.

Out of Pocket

At first, many older adults pay for care in part with their own money. They may use personal savings, a pension or other retirement fund, income from stocks and bonds, or proceeds from the sale of a home.

“How people pay for long-term care — whether delivered at home or in a hospital, assisted-living facility, or skilled-nursing facility — depends on their financial situation and the kinds of services they use.”

Professional care given in assisted-living facilities and continuing-care retirement communities is almost always paid for out of pocket, though Medicaid may pay some costs for people who meet financial and health requirements.

Medicare

Medicare is a federal government health-insurance program that pays some medical costs for people age 65 and older, and for all people with late-stage kidney failure. It also pays some medical costs for those who have gotten Social Security Disability Income (discussed later) for 24 months. It does not cover ongoing personal care at home, assisted living, or long-term care.

Medicaid

Some people may qualify for Medicaid, a combined federal and state program for low-income people and families. This program covers the costs of medical care and some types of long-term care for people who have limited income and meet other eligibility requirements.

Program of All-Inclusive Care for the Elderly (PACE)

PACE is a Medicare program that provides care and services to people who otherwise would need care in a nursing home. PACE covers medical, social-service, and long-term-care costs for frail people. It may pay for some or all of the long-term-care needs of a person with Alzheimer’s disease. PACE permits most people who qualify to continue living at home instead of moving to a long-term care facility. There may be a monthly charge.

State Health Insurance Assistance Program (SHIP)

SHIP, the State Health Insurance Assistance Program, is a national program offered in each state that provides counseling and assistance to people and their families on Medicare, Medicaid, and Medicare supplemental insurance (Medigap) matters.

Department of Veterans Affairs

The U.S. Department of Veterans Affairs (VA) may provide long-term care or at-home care for some veterans. If your family member or relative is eligible for veterans’ benefits, check with the VA or get in touch with the VA medical center nearest you. There could be a waiting list for VA nursing homes.

Social Security Disability Income (SSDI)

This type of Social Security is for people younger than age 65 who are disabled according to the Social Security Administration’s definition. For a person to qualify for Social Security Disability Income, he or she must be able to show that the person is unable to work, the condition will last at least a year, and the condition is expected to result in death. Social Security has ‘compassionate allowances’ to help people with Alzheimer’s disease, other dementias, and certain other serious medical conditions get disability benefits more quickly.

Private Financing Options for Long-term Care

In addition to personal and government funds, there are several private payment options, including long-term-care insurance (see story on this page), reverse mortgages, certain life-insurance policies, annuities, and trusts. Which option is best for a person depends on many factors, including the person’s age, health status, personal finances, and risk of needing care.

Reverse Mortgages for Seniors

A reverse mortgage is a special type of home loan that lets a homeowner convert part of the ownership value in his or her home into cash. Unlike a traditional home loan, no repayment is required until the borrower sells the home, no longer uses it as a main residence, or dies.

There are no income or medical requirements to get a reverse mortgage, but you must be age 62 or older. The loan amount is tax-free and can be used for any expense, including long-term care. However, if you have an existing mortgage or other debt against your home, you must use the funds to pay off those debts first.

Trusts

A trust is a legal entity that allows a person to transfer assets to another person, called the trustee. Once the trust is established, the trustee manages and controls the assets for the person or another beneficiary. You may choose to use a trust to provide flexible control of assets for an older adult or a person with a disability, which could include yourself or your spouse. Two types of trusts can help pay for long-term-care services: charitable remainder trusts and Medicaid disability trusts.

Life-Insurance Policies for Long-term Care

Some life insurance policies can help pay for long-term care. Some policies offer a combination product of both life insurance and long-term-care insurance.

Policies with an ‘accelerated death benefit’ provide tax-free cash advances while you are still alive. The advance is subtracted from the amount your beneficiaries will receive when you die.

You can get an accelerated death benefit if you live permanently in a nursing home, need long-term care for an extended time, are terminally ill, or have a life-threatening diagnosis such as AIDS. Check your life-insurance policy to see exactly what it covers.

You may be able to raise cash by selling your life-insurance policy for its current value. This option, known as a ‘life settlement,’ is usually available only to people age 70 and older. The proceeds are taxable and can be used for any reason, including paying for long-term care.

A similar arrangement, called a ‘viatical settlement,’ allows a terminally ill person to sell his or her life-insurance policy to an insurance company for a percentage of the death benefit on the policy. This option is typically used by people who are expected to live two years or less. A viatical settlement provides immediate cash, but it can be hard to get.

Using Annuities to Pay for Long-term Care

You may choose to enter into an annuity contract with an insurance company to help pay for long-term-care services. In exchange for a single payment or a series of payments, the insurance company will send you an annuity, which is a series of regular payments over a specified period of time. There are two types of annuities: immediate annuities and deferred long-term-care annuities.

Five Things to Know About Long-term-care Insurance

By ELLEN STARK for the AARP BULLETIN

By the time you reach 65, chances are about 50/50 that you’ll require paid long-term care (LTC) someday. If you pay out of pocket, you’ll spend $140,000 on average. Yet you probably haven’t planned for that financial risk. Only 7.2 million or so Americans have LTC insurance, which covers many of the costs of a nursing home, assisted living, or in-home care — expenses that aren’t covered by Medicare.

“Long-term care is the unsolved problem for so many people,” said Christine Benz, director of Personal Finance at Morningstar, an investment research firm in Chicago. Here’s what you need to know about long-term-care insurance today.

1. Traditional policies have fewer fans. For years, long-term-care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day-to-day activities such as bathing, dressing, and eating meals. Typical terms today include a daily benefit for nursing-home coverage, a waiting period of about three months before insurance kicks in, and a maximum of three years’ worth of coverage.

“This is a classic story of market failure. No one wants to buy insurance, and no one wants to sell it.”

But these stand-alone LTC policies have had a troubled history of premium spikes and insurer losses, thanks in part to faulty forecasts by insurers of the amount of care they’d be on the hook for. Sales have fallen sharply. While more than 100 insurers sold policies in the 1990s, now fewer than 15 do. “This is a classic story of market failure,” said Howard Gleckman, a senior fellow at the Urban Institute, a nonpartisan think tank in Washington, and the author of Caring for Our Parents. “No one wants to buy insurance, and no one wants to sell it.”

2. You might not need insurance … but you need a plan. Premiums for LTC policies average $2,700 a year, according to the industry research firm LifePlans. That puts the coverage out of reach for many Americans. (One bright spot for spouses: discounts for couples are common — typically 30% off the price of policies bought separately.)

If your assets are few, you may eventually be able to cover LTC costs via Medicaid, available only if you’re impoverished; if you have lots of money saved, you likely can pay for future care out of pocket. But weigh factors other than cash: do you have home equity you could tap? Nearby children who can be counted on to pitch in? Or do you have a family history of dementia that puts you at higher risk of needing care?

3. There’s a new insurance in town. As traditional LTC insurance sputters, another policy is taking off: whole life insurance that you can draw from for long-term care. Unlike the older variety of LTC insurance, these ‘hybrid’ policies will return money to your heirs even if you don’t end up needing long-term care. You don’t run traditional policies’ risk of a rate hike because you lock in your premium up front. If you’re older or have health problems, you may be more likely to qualify.

4. But old-school policies are cheaper. If all you want is cost-effective coverage — even if that means nothing back if you never need help — traditional LTC insurance has the edge. “Hybrid policies are usually two to three times more expensive than traditional insurance for the same long-term care benefits,” said Scott Olson, an insurance agent and co-owner of LTCShop.com in Camano Island, Wash. With hybrids, you’re paying extra just for the guarantee of getting money back.

A hybrid policy may make the most sense if your alternative is to use your savings, or if you have another whole-life policy with a large cash value.

5. Speed and smart shopping pay off. If you want insurance, start looking in your 50s or early 60s, before premiums rise sharply or worsening health rules out robust coverage. “Every year you delay, it will be more expensive,” Olson said. Initial premiums at age 65, for example, are 8% to 10% higher than those for new customers who are 64.

As for where to shop, seek out an independent agent who sells policies from multiple companies rather than a single insurer. For extra expertise and a wider choice of policies, Olson suggests looking for agents able to sell what are known as long-term-care partnership policies — part of a national program that has continuing-education requirements for insurance professionals.

Ellen Stark, a former deputy editor of Money, has written about personal finance for more than 20 years.

Consider These Important Estate-planning Documents

By KEN COUGHLIN

Making sure you have the right estate-planning documents is one of the simplest ways to have a positive impact on your family’s future. Proper planning ensures that your wishes will be followed and that your family will have less to worry about after you are gone.

Estate planning does not need to be difficult; a few documents can make a big difference. Here are the five legal documents, in order of priority, that everyone should have in place:

1. Durable Power of Attorney. This appoints one or more people to act for you on financial and legal matters in the event of your incapacity. Without it, if you become disabled or even unable to manage your affairs for a period of time, your finances could become disordered and your bills not paid, and this would create a greater burden on your family. They might have to go to court to seek the appointment of a conservator, which takes time and money, all of which can be avoided through a simple document.

“Estate planning does not need to be difficult; a few documents can make a big difference.”

2. Healthcare Proxy and Medical Directive. Similar to a durable power of attorney, a healthcare proxy appoints an agent to make healthcare decisions for you when you can’t do so for yourself, whether permanently or temporarily. Again, without this document in place, your family members might be forced to go to court to be appointed guardian. Include a medical directive to guide your agent in making decisions that best match your wishes.

3. HIPAA Release. While the healthcare proxy authorizes your agent to act for you on health care matters, you may appoint only one person at a time. It may be important for all of your family members to be able to communicate with healthcare providers. A broad HIPAA release — named for the Health Insurance Portability and Accountability Act of 1996 — will permit medical personnel to share information with anyone and everyone you name, not limiting this function to your healthcare agent.

4. Will. Your will says who will get your property after your death. However, it’s increasingly irrelevant for this purpose, as most property passes outside of probate through joint ownership, beneficiary designations, and trusts. Yet, your will is still important for two other reasons. First, if you have minor children, it permits you to name their guardians in the event you are not there to continue your parental role. Second, it allows you to pick your personal representative (also called an executor or executrix) to take care of everything having to do with your estate, including distributing your possessions, paying your final bills, filing your final tax return, and closing out your accounts. It’s best that you choose who serves in this role.

5. Revocable Trust. A revocable trust is icing on the cake and becomes more important the older you get. It permits the person or people you name to manage your financial affairs for you as well as avoid probate. You can name one or more people to serve as co-trustee with you so that you can work together on your finances. This allows them to seamlessly take over in the event of your incapacity. Revocable trusts are not as simple as the prior four documents because there are many options for how they can be structured and what happens with your property after your death. Drafting a trust is more complicated, but also more nuanced, giving you more say about what happens to your assets.

Unless your situation is complicated, these documents are straightforward, and the process to create them is not difficult. By drafting an estate plan, you can save your family a great deal of strife, difficulty, and cost at an already-tough time.

Ken Coughlin is editorial director of ElderLawAnswers.

These regional and statewide nonprofits can help families make decisions and access resources related to elder-care planning.

AARP Massachusetts

1 Beacon St., #2301, Boston, MA 02108

(866) 448-3621

states.aarp.org/region/massachusetts

Administrator: Mike Festa

Services: AARP is a nonprofit, nonpartisan, social-welfare organization with a membership of nearly 38 million that advocates for the issues that matter to families, such as healthcare, employment and income security, and protection from financial abuse

The Conversation Project and the Institute for Healthcare Improvement

53 State St., 19th Floor

Boston, MA 02109

(617) 301-4800

www.theconversationproject.org

Administrator: Kate DeBartolo

Services: The Conversation Project is dedicated to helping people talk about their wishes for end-of-life care; its team includes five seasoned law, journalism, and media professionals who are working pro bono alongside professional staff from the Instititute for Healthcare Improvement

Elder Services of Berkshire County Inc.

877 South St., Suite 4E, Pittsfield, MA 01201

(413) 499-0524

www.esbci.org

Administrator: Christopher McLaughlin

Services: Identifies and addresses priority needs of Berkshire County seniors; services include information and referral, care management, respite care, homemaker and home health assistance, healthy-aging programs, and MassHealth nursing home pre-screening; agency also offers housing options, adult family care, group adult foster care, long-term-care ombudsman, and money management, and oversees the Senior Community Service Aide Employment Program

Greater Springfield Senior Services Inc.

66 Industry Ave., Suite 9

Springfield, MA 01104

(413) 781-8800

www.gsssi.org

Administrator: Jill Keough

Services: Private, nonprofit organization dedicated to maintaining quality of life for older adults, caregivers, and people with disabilities, through programs and services that foster independence, dignity, safety, and peace of mind; services include case management, home care, home-delivered meals, senior community dining, money management, congregate housing, and adult day care

Highland Valley Elder Services

320 Riverside Dr., Florence, MA 01062

(413) 586-2000

www.highlandvalley.org

Administrator: Allan Ouimet

Services: Services include care management, information/referral services, family caregiver program, personal emergency-response service, protective services, home-health services, chore services, nursing-home ombudsman services, adult day programs, elder-care advice, bill-payer services, options counseling, respite services, representative payee services, local dining centers, personal-care and homemaker services, and home-delivered meals

LifePath

101 Munson St., Suite 201

Greenfield, MA 01301

(413) 773-5555

www.lifepathma.org

Administrator: Barbara Bodzin

Services: LifePath, formerly Franklin County Home Care Corp., an area agency on aging, is a private, nonprofit corporation that develops, provides, and coordinates a range of services to support the independent living of elders and people with disabilities with a goal of independence; it also supports caregivers, including grandparents raising grandchildren

Massachusetts Assoc. of Older Americans

19 Temple Place, Boston, MA 02111

(617) 426-0804

www.maoamass.org

Administrator: Chet Jakubiak

Services: Aims to improve the economic security of older Massachusetts residents through research and advocacy on policies that may reduce risk and hardship; fights against the dual stigma of being old and mentally ill, to preserve Medicare and Social Security, to ensure access to community-based long-term care, and to obtain mental healthcare for elders suffering from depression and other brain disorders; organizes regular conferences on important issues throughout the state and collaborates with councils on aging to hold training sessions for senior advocates

Massachusetts Executive Office of Elder Affairs

1 Ashburton Place, Unit 517

Boston, MA 02108

(617) 727-7750

www.mass.gov/elders

Administrator: Elizabeth Chen

Services: Connects seniors and families with a range of services, including senior centers, councils on aging, nutrition programs such as Meals on Wheels, exercise, health coaching, and more; supports older adults who may be somewhat frail through programs in nursing homes, such as the ombudsman program, volunteers who visit residents, and quality-improvement initiatives in nursing homes and assisted-living facilities; caregiver programs offer support to people with mild Alzheimer’s disease or those caring for someone with more advanced Alzheimer’s

Massachusetts Senior Legal Helpline

99 Chauncy St., Unit 400, Boston, MA 02111

(800) 342-5297

www.vlpnet.org

Administrator: Joanna Allison

Services: The Helpline is a project of the Volunteer Lawyers Project of Boston that provides free legal information and referral services to Massachusetts residents age 60 and older; the Helpline is open Monday through Friday, 9 a.m. to noon

MassOptions

(844) 422-6277

www.massoptions.org

Administrator: Marylou Sudders

Services: A service of the Massachusetts Executive Office of Health and Human Services, MassOptions connects elders, individuals with disabilities, and their caregivers with agencies and organizations that can best meet their needs; staff can also assist with determining eligibility for and applying to MassHealth

VA Central and Western Massachusetts Healthcare System

421 North Main St., Leeds, MA 01053

(413) 584-4040

www.centralwesternmass.va.gov.

Administrator: Andrew McMahon (interim)

Services: Provides primary, specialty, and mental-health care, including psychiatric, substance-abuse, and PTSD services, to a veteran population in Central and Western Massachusetts of more than 120,000 men and women

WestMass ElderCare Inc.

4 Valley Mill Road, Holyoke, MA 01040

(413) 538-9020

www.wmeldercare.org

Administrator: Roseann Martoccia

Services: Provides an array of in-home and community services to support independent living; interdisciplinary team approach to person-centered care; information, referrals, and options counseling as well as volunteer opportunities available; primary service area includes Holyoke, Chicopee, Granby, South Hadley, Belchertown, Ludlow, and Ware, as well as other surrounding communities

Five Steps to Take When Your Parents Need Assisted Living

By MERRITT WHITLEY

Many families look to assisted-living facilities to provide essential care and peace of mind when it comes to their aging parents. Finding the best senior-living community means matching your parents’ needs, lifestyle, and budget with communities in their desired area. The process is easiest and most successful when you ask the right questions, prepare, and have open conversations with your family.

If you’ve noticed signs your parents need help, it may be time to look for assisted-living options. Follow these six steps to find the right senior-living facility for your parents.

Determine Cost and Payment Options

Decide what your family can afford on a monthly basis, and look for assisted-living communities that fit your budget. Some people have savings or long-term-care insurance to help fund senior living, while tthers need to be creative. You may consider options such as Social Security, VA benefits, cashing out a life-insurance policy, selling a home, or reverse mortgage to help pay for care.

Have a Conversation with Your Aging Parents

You can do much of the legwork for your parents, but have regular discussions with them about their desires and preferences. When you have a list of options ready, talk to them about communities you think are a good fit and why you like them. The more your parents know and are involved, the smoother their transition to senior living will be.

Visit or Virtually Tour a Community

No amount of time spent viewing brochures, floor plans, photos, or reviews can substitute for an in-person visit to or virtual tour of an assisted-living community. Visit at least three communities for comparison. Schedule visits for you and your parent, and try to tour during mealtimes. This allows you to interact with staff and residents, and sample the food. Overall, you’ll get a good feel for the environment and culture of the community.

Consult a Variety of Sources

You can always bounce ideas off of a senior-living advisor during the decision-making process. When making a decision, talk to those in the know to learn as much as you can. Read reviews of senior communities on senioradvisor.com to help you make an informed and confident decision. Check the background of an assisted-living community you’re considering with the state licensing agency tasked with monitoring facilities.

Prepare for the Transition

Do not delay the move — it’s risky to procrastinate, especially when a parent needs care. Delays can lead to avoidable accidents and medical problems. When preparing for a move, it’s important to:

• Consolidate possessions. Is your loved one downsizing? Can you help them sell or donate any items?

• Plan and coordinate the move. Are you hiring a company or helping on your own? Set up a schedule and plan to ensure the move goes smoothly to alleviate stress.

• Gather and manage legal documents. Locate medical documents, tax returns, or any important information your parents may need. Make sure they’re in a safe place so they don’t get lost or misplaced during the move.

Bottom Line

Whether your parents are choosing the community themselves, or you’re helping decide for a parent, the above steps should help ensure everyone in your family feels good about the assisted-living facility selection. When possible, have conversations with your parents, discuss the pros and cons of each option, and try to come to a consensus together.

Merritt Whitely is an editor at A Place for Mom.

It’s Not About Giving Up, but About Quality of Life

From the AMERICAN ACADEMY OF HOSPICE AND PALLIATIVE MEDICINE

There may come a time when efforts to cure or slow an illness are not working and may be more harmful than helpful. If that time comes, you should know there’s a type of palliative care — called hospice — that can help ensure your final months of life are as good and fulfilling as they can be for you and your loved ones.

Hospice is not about giving up. It’s about giving you comfort, control, dignity, and quality of life.

Insurers, Medicare, and Medicaid will generally provide coverage for hospice care if your doctors determine you likely have six months (a year in some cases) or less to live if your illness follows its normal course.

“Requesting hospice care is a personal decision, but it’s important to understand that, at a certain point, doing ‘everything possible’ may no longer be helping you. Sometimes the burdens of a treatment outweigh the benefits.”

So, how do you know when it’s time for hospice care? Requesting hospice care is a personal decision, but it’s important to understand that, at a certain point, doing ‘everything possible’ may no longer be helping you. Sometimes the burdens of a treatment outweigh the benefits. For instance, treatment might give you another month of life but make you feel too ill to enjoy that time. Palliative doctors can help you assess the advantages and disadvantages of specific treatments.

Unfortunately, most people don’t receive hospice care until the final weeks or even days of life, possibly missing out on months of quality time. This may be out of fear that choosing hospice means losing out on a chance for a cure. Sometimes doctors fear their patients will feel abandoned if they suggest hospice.

Hospice care can help you continue treatments that are maintaining or improving your quality of life. If your illness improves, you can leave hospice care at any time and return if and when you choose to.

The following are some signs that you may experience better quality of life with hospice care:

• You’ve made several trips to the emergency room, and your condition has been stabilized, but your illness continues to progress.

• You’ve been admitted to the hospital several times within the last year with the same symptoms.

• You wish to remain at home, rather than spend time in the hospital.

• You are no longer receiving treatments to cure your disease.

Hospice care can free you up to ensure a time of personal growth and that you get the most you can out of your time left, allowing you to reflect on your life; heal emotional wounds and reconnect with a loved one with whom you have been estranged; visit favorite places or those with special meaning, such as a school, house, or location with a beautiful view you’ve always loved; put your financial affairs in order; create a legacy, such as a journal, artwork, or a videotaped message; or simply be with the people you love and who love you.

There are other benefits of hospice care, too:

• Hospice care allows you to remain and receive medical care in your own home, if desired and possible.

• It prevents or reduces trips to the emergency room for aggressive care that you might not want. Although you still might go to the hospital for tests or treatments, hospice allows you and your loved ones to remain in control of your care.

• Members of the hospice team can clean, cook, or do other chores, giving your loved ones a chance to run errands, go out to dinner, take a walk, or nap.

• Hospice programs offer bereavement counseling for your loved ones, often for up to a year.

Hospice care may not be appropriate if you are seeking treatments intended to cure your illness. Whether receiving hospice or palliative care, you should make a plan to live well so that your wishes for care and living are known.

It’s Important to Act Based on Facts, Not What You Think You Know

By Gina M. Barry

In the realm of estate planning, the following myths are rampant. You may have heard them, or even believe them, yourself.

As it is not possible to make proper decisions with incorrect information, it is important to dispel these myths.

Myth 1: “If I need to go into a nursing home, Medicare will pay for my care.”

This myth may very well be perpetuated by the fact that ‘Medicare’ sounds very much like ‘Medicaid,’ which does pay benefits for nursing-home care for qualified applicants. Medicare Part A will pay for medically necessary inpatient care in a skilled-nursing facility, but only following a three-day hospital admission.

Gina M. Barry

“The best estate-planning legal advice comes from a qualified estate-planning attorney, who will explain the options that best suit your unique situation and help you choose the best option for you based on correct information.”

In this case, Medicare will pay for up to 100 days of skilled-nursing care or rehabilitation services. The actual length of benefits could be much shorter than 100 days if those services are no longer required.

When Medicare benefits are available due to a qualifying hospital admission, Medicare pays 100% of the cost for the first 20 days, but only 80% of the cost for the next 80 days. Most Medicare recipients also have Medigap insurance, which will pay the balance not covered by Medicare. When Medicare benefits are exhausted, an alternative payment source is needed to pay for ongoing nursing-home care.

This alternative source could be long-term-care insurance benefits, private payment from income and assets, and/or Medicaid. For qualifying individuals, benefits from the Veterans Administration may also be available.

Myth 2: “I can give away assets and then obtain Medicaid benefits to pay for my nursing-home care.”

When faced with a nursing-home bill of approximately $13,000 per month, many people seek Medicaid benefits to pay for this care. In order to obtain Medicaid benefits, an asset limit must be met; therefore, assets valued above this amount must be reduced to the asset limit before benefits will be paid.

To reach this asset limit, most hope to give away excess assets, usually to their children. The Medicaid program imposes a penalty when any assets are given away within five years of the application for benefits, except in very specific circumstances. This penalty results in the applicant being unable to obtain Medicaid benefits for at least five years after such a gift is made.

There are planning options available at the time of a nursing-home admission, but in most cases, gifting will not be one of those options. Gifting options can exist if undertaken five years prior to nursing-home admission or earlier.

Myth 3: “I can give away $10,000 to as many people as I want each year, but if I give more, then I have to pay gift tax.”

This myth emanates from the federal gift-tax system. There is currently no gift tax in Massachusetts. In 2020, you may give up to $15,000 to as many people as you want without having to file a federal gift-tax return. The amount that can be gifted is stated incorrectly in the myth, as most people remain unaware of the ongoing increases in the allowable gift amount, which is known as the annual gift-tax exclusion. Also, in 2020, even if a gift-tax return must be filed because more than $15,000 is given to one person in one year, the giver of the gift will not pay any gift tax until they have gifted more than $11.58 million during their lifetime.

All gifts made that exceed the annual gift-tax exclusion will reduce the estate-tax exclusion available at the death of the giver of the gift. Thus, if you have $115,000, and you give all of it away in one year to one person, then you will need to file a federal gift-tax return. You will not owe any gift tax because the gift itself does not exceed the lifetime threshold, but when you die, the amount of assets you would have been allowed to pass without paying estate tax will be reduced by $100,000 (the amount of the gift that exceeded the annual exclusion amount).

Myth 4: “When I die, if I have a valid will, my estate does not have to go through probate.”

The assets in your probate estate are those that, when you pass away, are held in your name alone and do not have a designated beneficiary. Whether probate is needed is not based upon whether you have a will; rather, it is based upon how your assets are owned when you die. If you leave probate assets, then in order for your will to ‘speak,’ a probate estate must be opened. To avoid probate, you would need to have all assets held jointly or in a trust or with a designated beneficiary.

Although the above myths remain popular, they are not accurate. The best estate-planning legal advice comes from a qualified estate-planning attorney, who will explain the options that best suit your unique situation and help you choose the best option for you based on correct information.

Gina M. Barry is a partner with the regional law firm Bacon Wilson, P.C. She is a member of the National Assoc. of Elder Law Attorneys, the Estate Planning Council, and the Western Massachusetts Elder Care Professionals Assoc. She concentrates her practice in the areas of estate and asset protection planning, probate administration and litigation, guardianships, conservatorships, and residential real estate; (413) 781-0560; [email protected]

It’s Helpful … Like Driving with Google Maps

By Liz Sillin

It is a product of the COVID-19 era, but we have found that many people are thinking about wills and other estate-planning issues this year. The truth is that people of all ages should be thinking about a will, and not just during a pandemic.

What is a will, and why would you want one?

A ‘last will and testament’ is a document that spells out who it is that you would like to receive certain assets of yours — your ‘probate assets’ — at your death. In it, you name a ‘personal representative’ (formerly known as an executor/executrix) who oversees the directives in your will.

If you have minor children, you name a guardian and conservator for them. A will is a formal document, signed in front of two disinterested witnesses and a notary who attest to your apparent soundness of mind and that you appear to be over the age of 18 and signing willingly.

It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there. You can say who you want to receive specific assets, be it your mother’s wedding ring or your house, and you can direct assets to family, friends, and charities in whatever proportions you wish.

“It’s a little like having Google Maps for those you leave behind — it lays out where you want your assets to go and how to get there.”

If you die without a will, state law takes over. The state has tried to determine what most people would want in the absence of a will, but it is not nuanced. For example, if you are married and all your children are from that marriage, state law presumes that you want all your probate assets to go to your spouse — no direct gifts to your children, no charitable gifts, no gifts to friends. By contrast, if you are married and have children from a prior marriage, then state law presumes that the first $100,000 of your probate assets should go to your surviving spouse, and the rest of the probate assets are split 50/50 between the spouse and the children of the prior marriage.

State law cannot know that you have a disabled child who needs a special-needs trust or a house that you really want your surviving spouse to have. State law also sets forth who has priority to serve as your personal representative if you don’t have a will.

We should pause to talk about ‘probate assets.’ These are assets that you own in your own name — not jointly with someone else and not owned in a trust — and assets as to which you have not made a beneficiary designation or a pay-on-death payee. You own a house in your own name — it’s a probate asset. You own a house jointly with your spouse — it transfers to the spouse by operation of law at your death and is not a probate asset. If you have a retirement asset, such as a 401(k) or an IRA, or a life-insurance policy on which you have filled out a form designating a beneficiary, the asset passes to that beneficiary at your death and is not a probate asset.

If you make a will and in it you say your life insurance proceeds go to Joe, but your life-insurance beneficiary designation form says they go to Jane, the proceeds go to Jane. It is important to understand that the will only deals with your probate assets.

Why is a will helpful?

• It is easier to sell real estate from your probate estate if you have a will.

• You may not want your assets to go the way that state law directs. In Google Maps talk, state law provides directions to Boston, and you are thinking more about Alaska, with stops in Ohio and California along the way…

• You may not want the person state law prescribes as your ‘driver’ (the personal representative); perhaps you love your spouse dearly, but your sister is much more organized and would be much better at following directions.

• You want to name your neighbors to serve as guardians for your children if your spouse is unable to do so, because it is important that they stay in the neighborhood and stay in their current schools through high school.

• It provides certainty among those you leave behind that the map you have drawn is going to direct your heirs to where you want your assets to go, with the driver you have selected. It provides you, as well as your family, with certainty. And certainty, in this COVID-19 era, is a very nice thing.

Liz Sillin is an estate-planning specialist with the law firm Bulkley Richardson; (413) 272-6200.

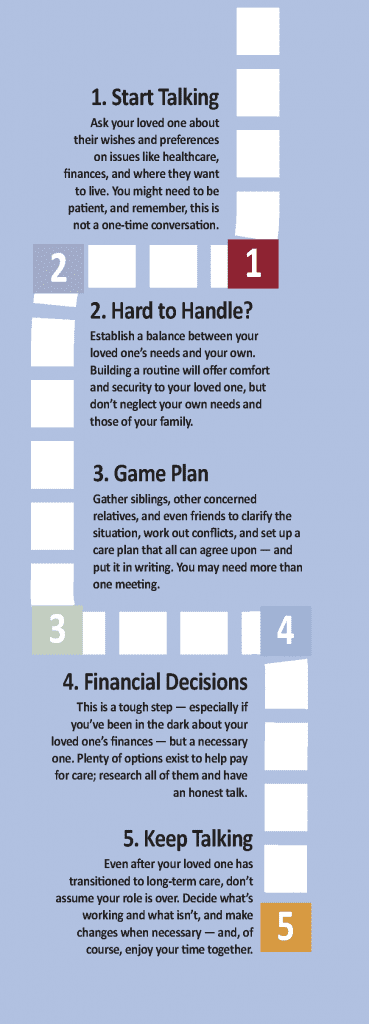

Don’t Neglect Any of These Five Important Steps

Whether you’re taking care of a family member full-time or just beginning to anticipate a need, the American Association of Retired Persons recommends a series of five steps to make the process easier for both you and your loved one. Just take it one step at a time.

Whether you’re taking care of a family member full-time or just beginning to anticipate a need, the American Association of Retired Persons recommends a series of five steps to make the process easier for both you and your loved one. Just take it one step at a time.

1. Start the Conversation

Ask your loved one about their wishes, values, and preferences on things that matter, from health to finances. If you wait until a fall, accident, or serious diagnosis, your choices may be more limited, more difficult to evaluate, and made hastily under stress.

Look for an opening. Rather than bringing up a tough topic out of the blue, it can help to point to a newspaper story or a relevant comment as a conversation starter. (Example: “You mentioned your eyes are bothering you. Is this causing problems with reading or driving?”)

It can be hard for some people to admit they need help. If your first conversation doesn’t go well, gently try again. Listen to and respect your loved one’s desires. If you are repeatedly shut out, consider asking another trusted family member, friend, or doctor to approach them about your concerns.

2. Form a Team

Don’t go it alone. Trying to handle the responsibilities of caregiving yourself can lead to burnout and stress-related health problems. It’s important to form a larger network of friends, family, and community resources to help you. Remember to consider your loved one part of the team.

Then, decide who’s in charge. It’s important to have a point person to keep the process moving and make sure everyone on the team understands the plan and priorities. In most families, one person assumes the primary role because he or she lives nearby, has a close relationship, or simply is a take-charge person. That may be you.

Also, consider a mediator. It can be useful to engage an unrelated facilitator, such as a social worker or minister, to help keep everyone focused, manage potential disagreements, and communicate difficult subjects when meeting with your team.

3. Make a Plan

Now it’s time to work with your team to develop a plan. You can’t anticipate every detail or scenario, but being forward-thinking now will help you respond more quickly and effectively in an emergency. It also helps assure that everyone keeps the focus on what’s best for your loved one.

You’ll need to determine roles. Ask your caregiving team members about what tasks they can and are willing to take on. Who is free to travel to medical appointments? Who can prepare meals a few times a week? Who can be responsible for bill paying?

Finally, summarize the plan in writing. A written record will assure everyone is on the same page and help avoid misunderstandings (while remembering, of course, that the plan will likely change as time passes).

4. Care for Your Loved One

This step encompasses the others, of course, and every caregiver’s situation is different. But there are a wide range resources and tools that can make your job easier, whether you’re caring for a parent from another state, a spouse with a long-term illness, or a family member with dementia.

Advocate for yourself. Let the doctor know if you are the primary caregiver and need to be informed about your loved one’s condition and the treatments prescribed. Ask for training on procedures you’ve never done at home, such as injecting medication or changing bandages.

If the person you’re caring for has more difficulty getting around or their vision or hearing fades, implement some simple changes to make their home less hazardous. Consider installing things like handrails, grab bars, nightlights, and adjustable shower seats.

5. Care for Yourself

It’s easy to forget about your own needs, which is why caregivers are more likely to report high stress levels and suffer from depression and other health problems. Don’t neglect exercise, sleep, and healthy eating, and take time for activities you enjoy. You’ll need to keep up your energy and stay well to care for others.

Understand that your personal finances can take a hit from family caregiving — which might require time off of work, cutting back on hours, or passing up promotions, as well as paying for things like groceries and prescriptions for your loved one from your own pocket. Also, find out if your workplace will accommodate your working from home part-time or making certain adjustments to your schedule.

Finally, give yourself a break. Sometimes caregivers feel guilty about taking time to have fun. Find ways to reduce your stress and enjoy yourself.

A Challenging First Step

By Joe Gilmore, Landmark Senior Living

By Joe Gilmore, Landmark Senior Living

Talking about long-term care needs with an elderly parent or other loved one can be a difficult thing. You may not know exactly how to approach it without coming off as rude or disingenuous. However, when it comes to a loved one’s health, it is important to cast aside how you feel to ensure that they can live safely and happily later in life. It is especially important to have this conversation before a problem occurs, not after.

An American Assoc. of Retired Persons survey found that two-thirds of adult children have never had this conversation. This is most likely due to the fact that a lot of adult children don’t know how to engage in this type of talk, or how to begin it. To begin, you have to decide who is going to be there during the talk and what the discussion is going to center around.

Keeping your loved one or parent safe later in their life is a priority, and talking to them about living situations, such as assisted living or even enlisting the help of a caregiver, is the first step. This is especially true if your parent or loved one has experienced a traumatic event in the recent past, such as a fall or the loss of a spouse.

Tips for the Talk

• Decide how you are going to do it and who’s going to be there. Sometimes a one-on-one talk is best; however, if you need someone to back up your points or provide another point of view, it may be a good idea to get other family members involved.

• Go over which talking points you will speak on before approaching your loved one, and set up a time and place to talk.

• Express each idea as an opinion of yours rather than a need for them. For example, choosing phrases like “I think” or “I need” rather than “you should” or “you need” are good ways to avoid conflict.

• Remind your loved one that everyone is there because they care and want to help keep them safe.

• Stay calm. Don’t raise your voice, speak over your loved one, or encourage any hostility during this discussion, as it will only make the situation worse.

• If your loved one immediately dismisses the idea of leaving their home, it may be best to drop the issue for the moment and bring it back up at another time.

The first step in beginning the talk is setting up how you are going to do it and who’s going to be there. Sometimes it is best for the talk to be a one-on-one; however, if you need someone to back up your points or provide another point of view, it may be a good idea to get other family members or loved ones involved. Every family is different, and it may be a good idea to disregard some family members when deciding who is invited to speak.

It is best to go over which talking points that you will speak on before approaching your parent or loved one. Meeting beforehand to talk about these things is recommended. Create a plan on how you wish to talk about this.

Understanding Your Loves Ones’ Goals for the Future

Your conversation about the future doesn’t have to focus only on a caregiving plan. You may also consider talking generally with your loved ones about what is important to them as they grow older. This checklist can be used as a starting point to better understand their priorities. Start by asking then to check all those that apply and then spend some time talking about each one in a little more detail:

__ To remain as independent as possible for as long as possible

__ To remain healthy and active

__ To remain in my home as long as possible

__ To focus on a hobby

__ To work for as long as possible

__ To become involved in the community

__ To remain as financially independent as possible

__ To take classes

__ To create a safety net in the event of an emergency or crisis situation

__ To start my own business

__ To buy a second home

__ To move closer to my family

__ To relocate to a smaller home

__ To retire in a different place

__ To travel

__ To be able to help my children and grandchildren

After going over the points you will make, the first thing you’ll want to do is set up a time and place to talk with your parent or loved one. This may require the use of some type of web communications like Skype or just over the phone if someone can’t be there or lives in a different area.

Depending on how you are hoping to help your parent, there are a few ways to go about this. For example, if you are just hoping to enlist the help of a caregiver, or become the caregiver yourself, it will take less convincing than, say, getting them to agree to be admitted to an assisted-living or residential care facility.

When speaking with a parent or a loved one about what you feel they should do, it is best to phrase it in a way that expresses that it is an opinion of yours rather than a need for them. For example, choosing phrases like “I think” or “I need” rather than “you should” or “you need” are good ways to avoid conflict.

Be sure to remind your parent or loved one that everyone is there because they care and want to help keep them safe. It may even be beneficial to bring up times when your parent may have had their health put at risk — maybe a fall or another incident.

This is also true for other major events like the loss of a spouse. There is evidence that the social isolation that stems from living alone and independently can lead to problems like loneliness and depression.

It is also important not to raise your voice or encourage any hostility during this discussion, as it will only make the situation worse. You should also be aware of when your parent is trying to talk. Do not try to speak over them, as it will likely lead to an argument. Keep your cool and remain calm during the discussion, even if others don’t.

Some parents will dismiss the idea of moving to an assisted-living facility immediately or adamantly. If this is the case, it may be best to drop the issue for the moment and bring it back up at another time down the road.

At the end of the meeting, make sure everyone has a clear understanding of the issues, concerns, and considerations presented.

Choosing the Right Level of Care Begins with Understanding All of Them

By the Massachusetts Senior Care Assoc.

By the Massachusetts Senior Care Assoc.

Massachusetts has a broad array of care options and a national reputation for quality. Understanding the different types of healthcare services offered by providers is the first step to determining which care option best fits your needs.

Skilled Nursing and Rehabilitation

Nursing facilities provide both short- and long-term care services for older adults and people with disabilities or chronic illnesses.

Of the more than 120,000 people Massachusetts Senior Care Assoc. members care for annually, close to two-thirds return to their community within one month after a brief, post-hospital, rehabilitative stay. With ever-shortening hospital stays, skilled-nursing facilities have become the preferred choice for discharged hospital patients who need short-term transitional care before they can return safely to their homes. Those who cannot live safely and comfortably at home receive precisely the care and community they need as long term residents of Massachusetts’ nursing and rehabilitative facilities.

Short-term care is available for individuals who have been hospitalized and need a period of medical monitoring and/or rehabilitation before returning home. Often referred to as subacute or transitional care, this kind of care can be provided in a free-standing nursing facility or a hospital-based skilled-nursing unit. Most stays are for fewer than 30 days, after which the patient usually returns home. This kind of care can be beneficial after a surgery or a prolonged hospitalization, or for rehabilitation following a stroke or other serious medical event.

Long-term care is available for people who are unable to live safely and comfortably at home, require 24-hour nursing care and support, and need help with many of the activities of daily living, such as eating, dressing, toileting and bathing. When considering long-term nursing facility care, it is important to discuss the issue thoroughly with the person involved and his or her personal physician before the situation becomes an emergency. Finding the right facility can take time, and since some facilities have waiting lists, it helps to plan ahead so space will be available when it is needed.

Among the services provided are 24-hour nursing care; rehabilitative care such as physical, occupational, speech, and respiratory therapy; and help with personal care such as eating, dressing, toileting, and bathing. In addition, a growing number of nursing facilities provide post-operative rehabilitative care, inpatient and outpatient rehabilitation, Alzheimer’s/dementia specialty care, respite care, restorative and residential care for people with multiple sclerosis and other neurological disorders, pediatric specialty care, and acquired brain-injury specialty care.

Assisted Living

Assisted-living residences are for older people who no longer feel comfortable or safe living alone, but do not need 24-hour nursing and medical care. While assisted-living residences monitor the well-being of their residents and help coordinate health services by licensed outside agencies or providers, they do not provide these services directly and are not designed for people with serious medical needs. State law prohibits assisted-living residences from admitting or retaining individuals who need skilled nursing care for more than 90 days in a 12-month period.

Assisted living residences combine apartment-like living with a variety of support services, including meals, assistance with activities of daily living such as bathing and dressing, on-site staff to respond to emergencies and help with medications, housekeeping and laundry services, social and recreational programs, and 24-hour security.

Assisted-living residences have one- or two-bedroom units with private bathrooms and entry doors that lock. Some units may also have a living or sitting room. In addition to a group dining area, assisted-living residences typically provide either a private kitchenette or access to a communal cooking area. Units are usually furnished with a resident’s personal belongings and furniture.

Continuing-care Retirement Community

Continuing-care retirement communities (CCRCs) combine independent retirement housing, assisted-living services, and nursing facility care, usually on the same campus, to allow elders to have their current and future care needs met at one location. As a senior’s needs change, he or she can choose from among the services and care settings available.

CCRCs are another option for older people who no longer want the responsibility of caring for a house and want the peace of mind of knowing that they have planned for their future long-term-care needs. Most CCRCs require incoming residents to be fully capable of independent living upon entering, or may impose conditions based on certain pre-existing conditions. However, some CCRCs allow residents to enter their assisted-living units directly from the community.

CCRCs also provide assisted-living services (either in separate assisted-living units or to individuals residing in the independent living units) and 24-hour nursing-facility care.

Most independent-living units in a CCRC consist of one or two bedrooms, a living room, a kitchen, and a full bathroom. CCRCs typically have a number of common areas, including one or more resident dining rooms, and many also have libraries, hair salons, convenience stores, exercise and game rooms, and banking facilities.

Other Care Options

• Adult day health programs, also known as adult day care centers, provide supervision, recreation, health, and personal-care services during the day to older people so that family caregivers can work or attend to other responsibilities. All adult day health programs must meet minimum standards set by the Massachusetts Medicaid program, also known as MassHealth. Adult day health programs are provided either on a private pay basis or through Medicaid.

• Adult foster-care programs match elders who are no longer able to live alone with families willing to provide room and board and personal care. Families are paid a stipend by MassHealth for elders who are Medicaid-eligible. Some adult foster-care funding is also available to pay for assisted-living services for people who are clinically and financially eligible through the state’s Group Adult Foster Care Program.

• Congregate housing facilities provide a living arrangement in which elders have a private bedroom and share common space with others. Support services are usually available to help elders maintain their independence. Most congregate housing sites are sponsored by local municipal housing authorities or nonprofit organizations. Public congregate housing is partially subsidized by the state or federal government.

• Home-based services help individuals live independently at home and are provided by home health agencies, visiting nurse associations, and state-funded home-care corporations (called aging services access points, or ASAPs). They include homemaker services to maintain household functioning, including help with home management, shopping, meal preparation, and light housekeeping; and personal care, including bathing, dressing, grooming, and toileting. They may also provide health services; home health aides provide basic healthcare services such as personal care, recording temperatures and checking pulses, changing simple bandages, and assisting with self-administered medications, while licensed nurses and therapists provide skilled nursing care and therapeutic services.

• Hospice care serves patients with a life-threatening illness and a life expectancy of six months or less. Hospice care may be provided in the home, nursing facility, or hospital, and the hospice team works cooperatively with the patient, family, physician, and other caregivers to provide specialized care that is focused on comfort, not cure. The hospice team includes the patient’s physician, hospice medical director, registered nurses, home health aides, licensed social worker, bereavement counselor, pastoral counselor, rehabilitation therapists, and volunteers.

• Resident Care Facilities (RCFs), also known as rest homes, provide housing, meals, 24-hour supervision, administration of medications, and personal care to individuals who do not routinely require nursing or medical care.

• Respite care is short-term care provided at home, in a nursing facility, or in an assisted-living residence to give families caring for elders at home some time off from their caregiving responsibilities.

• Finally, independent-living senior communities are an option if you want to live on your own, but don’t want to have all the chores that go along with having a home. It’s also a great option for people who want to live in a community with other seniors. Depending on the community you choose, you can rent an apartment either at the market rate or, if your income level applies, a lower rate. They are often specially designed with things like railings in bathrooms or power outlets higher up on the wall. They may also offer a 24-hour emergency call service if residents need help right away. Some facilities may also offer services like meals, transportation, social activities, and other programs.

What Options Are Available?

Many seniors are not aware of the options available for affordable housing and care as they age. In Massachusetts, there are a few financial-assistance programs that can assist low- to moderate-income seniors pay for both housing and care options. Residential care homes in Massachusetts offer seniors and disabled adults affordable housing options that include services such as homemade meals, snacks, scheduled activities, housekeeping, laundry, and clinical oversight with medication management.

Many seniors are not aware of the options available for affordable housing and care as they age. In Massachusetts, there are a few financial-assistance programs that can assist low- to moderate-income seniors pay for both housing and care options. Residential care homes in Massachusetts offer seniors and disabled adults affordable housing options that include services such as homemade meals, snacks, scheduled activities, housekeeping, laundry, and clinical oversight with medication management.

“Many homes, like the Lathrop Home, offer private rooms, with shared common areas and daily activities to enrich the lives of the residents we serve,” said Crystal Cote-Stosz, executive director of the Northampton facility. “For many individuals, the offerings of a residential care home can bridge the care gap by providing assistance that is customized and affordable. Finances are a major consideration with life’s transitions, and for those of us needing support services such as meals, medication management, and assistance with personal care, making these choices can be difficult. Luckily for Massachusetts residents, subsidized care options are available in many residential care homes and assisted-living facilities.”

Paying for care is a significant stressor for families, especially for those who have not planned ahead or saved enough. According to a TD Bank study, one in five Millennials helps to financially support their aging parents, to the tune of $18,250 per year on average, and nearly three-quarters of the financial aid goes towards general living expenses like food and housing.

Both the state and federal government offer subsidy programs for residential care facilities, like the Lathrop Home, Cote-Stosz noted. The federal subsidy that assists individuals pay for residential care is through the Supplemental Security Income (SSI) program combined with the state Supplemental Security Program. Both programs work together to supplement an individual’s income to pay for the care provided by a residential care home.

The state program that assists residents in Massachusetts pay for residential care is called EAEDC (Emergency Aid to Elderly and Disabled Children). Residential care facilities like the Lathrop Home can have residents with monthly incomes up to $3,450 qualify for assistance paying for care. Many Massachusetts residential care facilities offer nursing on staff to triage residents’ clinical care needs, which allows individuals to remain independent from long-term care.

Residential care facilities provide application assistance for the financial-assistance programs available to those residents that spend down or require a subsidy application from point of admission. Individuals interested in residential care should visit the Massachusetts Assoc. of Residential Care Homes website at maresidentialcarehomes.org.

These regional and statewide nonprofits can help families make decisions and access resources related to elder-care planning.

AARP MASSACHUSETTS

1 Beacon St., #2301, Boston, MA 02108

(866) 448-3621; states.aarp.org/region/massachusetts

Administrator: Mike Festa

Services: A nonprofit, nonpartisan, social-welfare organization with a membership of nearly 38 million that advocates for the issues that matter to families, such as healthcare, employment and income security, and protection from financial abuse.

THE CONVERSATION PROJECT

20 University Road, 7th Floor, Cambridge, MA 02138

(617) 301-4868; www.theconversationproject.org

Administrator: Kate DeBartolo

Services: Helps people talk about their wishes for end-of-life care; its team includes five seasoned law, journalism, and media professionals working pro bono alongside professional staff from the Institute for Healthcare Improvement.

ELDER SERVICES OF BERKSHIRE COUNTY INC.

877 South St., Suite 4E, Pittsfield, MA 01201

(413) 499-0524; www.esbci.org

Administrator: Christopher McLaughlin

Services: Information and referral, care management, respite care, homemaker and home health assistance, healthy-aging programs, and MassHealth nursing home pre-screening; also offers housing options, adult family care, group adult foster care, long-term-care ombudsman, and money management, and oversees Senior Community Service Aide Employment Program.

GREATER SPRINGFIELD SENIOR SERVICES INC.

66 Industry Ave., Suite 9, Springfield, MA 01104

(413) 781-8800; www.gsssi.org

Administrator: Jill Keough

Services: Dedicated to maintaining quality of life for older adults, caregivers, and people with disabilities, through programs and services that foster independence, dignity, safety, and peace of mind; services include case management, home care, home-delivered meals, senior community dining, money management, congregate housing, and adult day care.

HIGHLAND VALLEY ELDER SERVICES

320 Riverside Dr., Florence, MA 01062

(413) 586-2000; www.highlandvalley.org

Administrator: Allan Ouimet

Services: Care management, information/referral services, family caregiver program, personal emergency-response service, protective services, home-health services, chore services, nursing-home ombudsman services, adult day programs, elder-care advice, bill-payer services, options counseling, respite services, representative payee services, local dining centers, personal-care and homemaker services, and home-delivered meals.

LIFEPATH

101 Munson St., Suite 201, Greenfield, MA 01301

(413) 773-5555; www.lifepathma.org

Administrator: Barbara Bodzin

Services: Private, nonprofit corporation that develops, provides, and coordinates a range of services to support the independent living of elders and people with disabilities; also supports caregivers, including grandparents raising grandchildren.

MASSACHUSETTS ASSOC. OF OLDER AMERICANS

19 Temple Place, Boston, MA 02111

(617) 426-0804; www.maoamass.org

Administrator: Chet Jakubiak

Services: Aims to improve the economic security of older Massachusetts residents through research and advocacy on policies that may reduce risk and hardship; fights against the dual stigma of being old and mentally ill, to preserve Medicare and Social Security, to ensure access to community-based long-term care, and to obtain mental healthcare for elders suffering from depression and other brain disorders.

MASSACHUSETTS EXECUTIVE OFFICE OF ELDER AFFAIRS

1 Ashburton Place, Unit 517, Boston, MA 02108

(617) 727-7750; www.mass.gov/elders

Administrator: Elizabeth Chen

Services: Connects seniors and families with services like senior centers, councils on aging, nutrition programs such as Meals on Wheels, exercise, health coaching, and more; supports frail adults through programs and quality-improvement initiatives in nursing homes and assisted-living facilities; caregiver support programs.

MASSACHUSETTS SENIOR LEGAL HELPLINE

99 Chauncy St., Unit 400, Boston, MA 02111