Branching Out

Lull in New-home Construction Leads Builders to Diversify

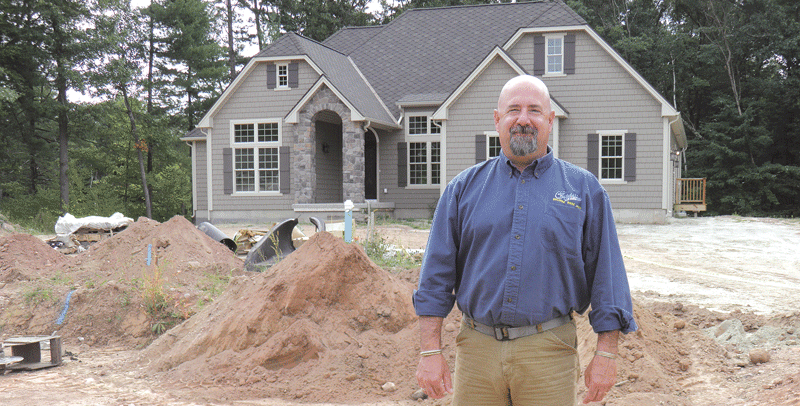

Several months ago, Jos. Chapdelaine & Sons broke ground on the first new subdivision the company has built since 1998. The site has 10 lots, but, in keeping with a changing trend, the homes that will be built on Pondview Drive in East Longmeadow are expected to be much smaller than the McMansion-style structures people clamored for a decade ago.

Several months ago, Jos. Chapdelaine & Sons broke ground on the first new subdivision the company has built since 1998. The site has 10 lots, but, in keeping with a changing trend, the homes that will be built on Pondview Drive in East Longmeadow are expected to be much smaller than the McMansion-style structures people clamored for a decade ago.

“Initially, we were apprehensive about the project, as we were not sure what the economy was doing,” R.J. Chapdelaine, the company’s president. “But we have already sold two houses and have a list of seven additional people who are interested. In the last two years, we have definitely seen an increase in business, which is refreshing.”

Todd Cellura agrees. “Things are definitely getting better. Every year, it seems like there is more activity, and there is a lot more interest in new homes than there was in the past,” said the president of Sovereign Builders in Westhampton.

Still, most local companies have put up only one or two houses in the last two years, so although the market is showing signs of improvement, the majority of local builders no longer depend on new-home sales as their primary source of income.

More specifically, when the economy crashed in 2008 and the housing market collapsed, they were forced to diversify into different aspects of their business. Since that time, many have come to rely on additions, renovations, and commercial and institutional work as their primary source of income. And although work has been steady for the past few years, margins are tighter, and bidding is more competitive than ever.

R.J. Chapdelaine stands outside the entrance of a new subdivision his company is building in East Longmeadow.

Jerry Bolduc’s business also underwent significant change. Prior to the economic downturn, he built several custom homes in the $700,000 to $1 million range each year, along with a few spec houses, which are homes built prior to finding a buyer.

“The years between 1995 and 2005 were really great,” said the owner and president of Bolduc Construction in Ludlow. “But when the bubble started twisting, I began doing a lot more remodeling and additions and more commercial work. A lot of other homebuilders did the same thing, although some specialized in one market.”

Today, one of Bolduc’s specialties is power washing and removing black algae from homes, which is something he never dreamed of doing when the economy was flush. In 2010, he started a second business called Pro Aqua Clean, which has snowballed into a significant source of income (more about that later), although he is still in the construction industry. “I went from building million-dollar custom homes to cleaning them. But I am also saving them,” he said, as he spoke about homes where algae had eaten through the roof and gotten into the attic.

Tomlinson Builders in Greenfield, a third-generation family business, also switched its focus from the custom and spec homes that had been its signature offering to additions and renovations. In fact, when the banking crisis hit, Tomlinson had to call a complete halt to a project. The company had purchased a parcel of land in 2007 in Hadley and planned to develop it, but by 2008, it became clear that it was too risky to build. So the build was tabled, and although Tomlinson held onto the lots, it finally put them up for sale last year.

“We have really had to change. Prior to the crash, we did some large-scale renovations and built 2,800- to 6,500-square-foot homes, and now we are doing 700-square-foot additions. But it has been a little easier for us to weather the storm, as we are a small company,” said owner Tyler Tomlinson, adding he has done a lot of work for local banks, along with a variety of commercial jobs throughout the state. But the majority of the company’s income is dependent on home remodeling.

Although Chapdelaine is putting up a new subdivision, its work has been split between home building and home renovations since the ’60s, when the company was forced to diversify due to an economic downturn.

However, builders agree that past recessions were short-lived occurrences. “But this has been a very long and involved process, and as times became more lean, we had to work smarter and get more in tune with the economy and what people want,” Chapdelaine said. “But the outlook seems to have gotten more positive in the past few years, and we are hoping the calls and influx of work we are getting is something that has some legs, some momentum, and will keep things moving along.”

Paradigm Shift

Mark Ludwell, executive vice president of Wright Builders in Northampton, said the company hasn’t seen a dramatic change in its volume of work, but it has more of a backlog than it enjoyed over the past four or five years.

“People are planning ahead in terms of projects and life decisions, and there has been an upswing in the last year or two,” Ludwell said. “But everyone took a big hit when the economy soured, and we were no exception, even though our business has been based on multiple disciplines for 20 years.

Jerry Bolduc says many people are remodeling their kitchens and baths or putting on additions, which has helped builders stay busy.

Local construction companies say they have continued building new homes, although most have averaged only one or two a year since the recession began.

However, the majority are smaller than they were in the past, and energy efficiency has become a top priority in every arena. “People don’t want to maintain large homes and are learning to live with less space. But they want their homes be much more energy-efficient,” Cellura said, adding that he recently built a new house in Williamsburg that costs only $1,000 a year to heat.

Tomlinson agreed. “The cost of heating and cooling a home is driving the trend toward smaller homes. People are thinking more long-term than they did before and feel their money is better spent on insulation and air sealing as opposed to crown molding and fancy refrigerators,” he said, adding that his company built one new home last year, which was under 2,000 square feet.

Baby Boomers have had a role in the downsizing trend, as approximately 35% of new homes built today are purchased by empty nesters. “They are building ‘forever homes’ that are their final destination,” Cellura said. “The last two I have built and a new home I am about to start are for empty nesters, and each one was a downsize.”

Chapdelaine said he expects the majority of homes in the new subdivision to be about 2,300 square feet, but the company will build 1,800-square-foot structures if people want them. “Baby Boomers seem to want to downsize, and we are seeing clients move from homes that ranged between 3,500 to 4,000 square feet to homes in the 2,000- to 2,200-square-foot range. They want first-floor master bedrooms with an overall reduction in size.”

The company has also heard from people who have purchased small houses, but want to upgrade them with new windows, front entryways, kitchens, and baths, which Chapdelaine says can be cost-effective if they are on streets with larger, more updated homes. “We are starting to get a lot of phone calls for remodeling that range from the whole house to kitchens and bathrooms. The economy slowed the process, but the trend has been fairly steady for the last two years.”

Bolduc expects the demand for renovations to continue. “Business has been steady for the last four or five years, even during the winter, due to remodeling and additions,” he said. “And as long as interest rates stay low, people will continue to refinance their homes and spend money on them.”

Builders agree that the economy will continue to play a significant role in the amount and type of business they do, but they say return on investment impacts homeowners’ decisions. “Clients are staying away from trends, as they don’t want to date their house,” Chapdelaine said. “During the boom, homeowners did whatever they wanted. But today, budgets are tighter than they used to be. People want to increase the resale value of their homes, but also want to enjoy what the remodeling or addition will add to their lives.”

Different Tacks

Wright Builders was one of the few companies that continued to build homes when the market dried up. However, the majority were at Village Hill in Northampton, which is an ongoing project. “It made quite a difference, but it hasn’t been an easy road,” Ludwell said, adding that the property is controlled by the state, so the parcels were subject to publication of requests for proposals from builders. “While we have always been competitive, things got even more competitive.”

Bolduc’s new venture began after tornadoes struck Western Mass. in June 2011, and he started getting requests to power-wash people’s homes and remove windswept debris. The jobs were a far cry from the custom home building that had been his mainstay since 1980, and he was less than enthusiastic about the work, but he soon discovered a type of black stain on the northern side of homes that was difficult to remove.

Although many people thought the stains were from trees, Bolduc discovered it was a type of black algae that arrives as spores or clumps of cells. If they land on the north side of a roof, where there isn’t much sun and moisture is plentiful, the algae begins to multiply. It also feeds on the powdered limestone filler often added to the liquid asphalt in shingles during the production process.

After experimenting, Bolduc found an environmentally friendly chemical that would remove the algae, which he applied before power-washing and allowed him to remove stains that people had never been able to get rid of.

As word spread about his service, he got so many referrals, he put a truck on the road and opened a business called Pro Aqua Wash.

The enterprise has surpassed anything he could have imagined, and this summer business was so brisk that he employed five people. However, Bolduc has not lost his love for building and told BusinessWest that he still does his share of home renovations. “We often get requests to expand kitchens as well as create open floor plans in homes, which can mean knocking down walls and even additions. And I also do some light commercial work.”

Cellura performs all types of work, but takes real pride in doing modern European design renovations, a minimalist trend becoming popular in metropolitan areas. “It’s almost stark in design, but it’s stunning how striking it is,” he said.

Overall, local builders are glad to see the economy improving. But diversification has become the new norm, and there are no signs of that changing.

Although Chapdelaine is building a new subdivision, other builders don’t feel the time is right. “There are some towns where building lots still sell, but it’s a much greater gamble today,” Cellura said. “So we will remain conservative until there is more activity.”

Tomlinson has similar feelings. The company had a profitable year and is building an estate with a two-bedroom guesthouse, which will be done in phases. “But the housing market hasn’t completely turned around, and buying land and developing it has become very costly, due to changes in regulations and the fact that towns and cities are trying to preserve it, so we are a lot more conservative than we used to be when it comes to doing anything of size, like a subdivision,” he said. “We don’t feel things will ever go back to the way they were before the housing crash.”

But business is steady for those nimble enough to find it, and builders have learned to compensate and sniff out new ways to make money, even though profit margins are tighter.

“When the economy soured, we learned to work harder and smarter, and we made adjustments,” Ludwell said. “We keep reaching out, moving forward, and refocusing. And it’s worked out.”