Supplements

Willie Ross Continues to Set the Tone in Education for the Deaf

Willie Ross School for the Deaf Executive Director Louis Abbate says people from school districts around the world have visited the campus to find out how it has been able to establish and maintain a ‘school within a school’ partnership with the East Longmeadow school system.

“The school was founded in 1967 by a group of parents who were pioneers in the field of education,” said Executive Director Louis Abbate, adding that an epidemic of rubella in the early ’60s caused many children to be born deaf. “They were led by Willie’s parents, Barbara and Gene Ross, at a time when all deaf children went to residential schools. It was a very bold step, because a day program for deaf children was something that was unheard of. But these parents wanted their children home so they could be part of the family.”

Since that time, Willie Ross has continued to forge ahead in the field of education for the deaf with a number of innovative programs that have served as a model for other schools of its kind. They include an integrated approach to communication, frequent examination of its instructional approach, and the acknowledgement and understanding that students with hearing loss from different backgrounds and cultures have different needs best met by a multitude of options to ensure that they get the best education possible and become productive members of society.

For this edition, BusinessWest takes an indepth look at what Willie Ross has done to stay at the forefront and inspire other schools for the deaf and hard of hearing, not only in this country, but across the world.

First Steps

In the beginning, the school’s founders rented self-contained space within public-school classrooms.

“The parents of these deaf children wanted them in a hearing setting,” said Abbate. “This was a bold first step because no one in the history of special education thought it was a good idea or even possible. But they wanted to integrate their children.”

The founders faced many challenges, as they had to develop a curriculum and were on uncharted ground. But they were able to pool their resources and, in 1967, purchased the old Norway School in Longmeadow for $27,000. “The school had been built in 1917 and was quite dilapidated. But the lot included three acres and another building,” Abbate said.

These parents were active advocates for their children in the early ’70s, and their program had made such progress that local public schools began sending students with hearing deficiencies to Willie Ross. The state paid their tuition because the school was a nonprofit. In 1974, a shift came due to the adoption of Chapter 776, which shifted the responsibility of educating students with special needs from the state to the local community.

“There was a big push toward mainstreaming in 1974, which really began to give children with disabilities the right to a quality education,” Abbate explained. “And at that point, the school began to roll forward.”

However, since Willie Ross had always rented classroom space in public schools, it had enough experience to recognize that, “although it was our legacy to find opportunities for mainstreaming, it was not what some students needed. So we also offered a center-based model,” Abbate said. They also had rented classroom space for elementary students in East Longmeadow schools, for middle-school students in Longmeadow, and for high-school students in Longmeadow, and at the old William Dean Technical High School in Holyoke.

Abbate was hired in 1985, and he developed a partnership with officials in the East Longmeadow school system that he says was unique in the U.S. at that time.

“It took time, but it is amazing,” he said, noting that all students in public schools were moved to East Longmeadow, giving them the opportunity to make friendships that could continue throughout their schooling.

“It’s very interesting that, over the past 20 years, an entire generation has grown up with deaf students. They have developed wonderful friendships in an extremely welcoming and supportive environment,” Abbate said, adding that many students and East Longmeadow staff members have taken sign-language courses offered by Willie Ross.

The system developed by the partnership offers immersion and inclusion as a service for deaf and hard-of-hearing students when it is appropriate. East Longmeadow agreed that the students could be mainstreamed, with the caveat that Willie Ross would provide interpeters and staff to teach the classes. Willie Ross also does consultations for East Longmeadow students who have hearing loss.

In fact, the system of shared resources works so well that, although Willie Ross has students from 19 school districts, it has never had one from East Longmeadow.

“We were able to keep our corporate soverigenty even though we were in the public schools, as both systems worked cooperatively; everything was worked out legally to make it an optimal experience for all students,” Abbate explanined. “Because we can offer our students two campuses, we can provide them with a wide range of opportunities. It is all about changing our business plan to respond to the changing needs of students, which is what we have always tried to do.”

The system has been so successful that it has become a model that others strive to emulate.

“Within the last three years, we have had visitors from South Africa, China, India, Taiwan, and Trinidad who came to see how it is possible to link public-school opportunties with a private school. People can’t imagine how a program like ours can work,” Abbate said, adding that one obstacle is that private schools are concerned about their institutional identity, while the notion of having a school inside a school seems like an insurmountable challenge to many public schools.

“But I think this is the model of the future and is a very good use of physical resources,” Abbate said, adding that he recently met with officials from the Washington D.C. public school system as part of ongoing efforts at Willie Ross to help other schools across the nation establish satellite programs.

A trustee committee oversees the partnership. “They are committed to children, and the fact that this school was founded by parents gives us a different view,” Abbate said. “The fact that a group of parents were so committed to their children that they built a school for them is a legacy that needs to be rejuvenated and change as kids change. It’s part of the reason why we are one of the only schools in the country for the deaf which has a campus inside a public school. We look at ourselves as heirs of the legacy of our founders, as our philosophy is to educate one child at a time.”

Five years ago, the school revisted its mission and instituted an outreach and early-intervention team. Not only did they realize it was important to serve students as early as possible, children’s needs were changing due to advanced technology, which includes cochlear implants, surgically implanted electronic devices that can provide a sense of sound to people who are profoundly deaf or severely hard of hearing.

In addition, an increasing number of students came from homes where English isn’t the primary language. So administrators assembled a team of three leading educators of the deaf and worked with them to develop a new mission, which reflects the contemporary needs of their students.

“We came to the conclusion that one size doesn’t fit all, which meant more recognition of the value of different approaches,” Abbate said, adding that this is highly ununsual for a school that serves the deaf and hard of hearing. “We started out as an oral school, saw its limitations, introduced sign language in addition to voice, and continue to use both modalities,” he said.

Meeting operational costs is a challenge, however, even though the school’s teachers work at well below the public-school rate. “Our revenue is dependent on tuition from students, and the state has frozen the rate. This year it only went up 0.75%. Plus, we are not eligible for any stimulus money which poured into the state for public schools,” Abbate said.

But administrators continue to forge ahead with programs and modes of learning to best serve their students.

“We have been able to do a lot, but it is primarily due to the generosity of the community. They are very supportive of us, and we rely on their help more and more,” Abbate said. “We have three goals for our students — competitive employment, sheltered employment, or college. Most schools of our size only concentrate on one of these goals, so it is a lot for us to do. But having our East Longmeadow partnership is an enormous opportunity for our students.”

New Opportunities

The school recently completed a campus-enhancement project, which involved purchasing an overgrown acre of land adjacent to the property and developing it to enhance programs for students.

The new West Campus will be used for recreational, instructional, and athletic programs, as well as for school activities. It boasts an outdoor classroom, a walking/fitness track, a nature trail, an honor garden with plaques that celebrate deaf people who have made significant contributions to improve the lives of their peers, a basketball court, and playing fields.

The $500,000 project, funded by a capital campaign, also features a new multi-purpose room which will help the school provide more sophisticated services to students with cochlear implants and expand transition services for students graduating from high school.

Abbate said the school plans to have an after-school and summer program, and he’s happy that the board and staff members had the vision to look at the land “which was completely overgrown and littered with trash” and see its potential for their population of students, who range in age from 3 to 22. They went ahead with their vision when the land became available, and staff and students participated in decisions, such as choosing the deaf individuals who are commemorated on plaques in their Deaf Honor Garden.

“We are a nonprofit school, and it has always been a challenge to operate with limited resources, so I am grateful for the support and proud of what we will be able to offer students,” Abbate said. “The outdoor classroom puts us in the forefront of research-based education, and the property combines instructional and recreational opportunities that weren’t available before. It is a wonderful feeling to know that generations of students will be able to enjoy it.”

Elms College to Introduce M.B.A. with Three Concentrations

David Kimball and Kerry Calnan say the new M.B.A. program at Elms College, slated to start in the fall, provides a solid growth opportunity for the school.

Kerry Calnan acknowledged there was already a crowded field when it came to M.B.A. programs being offered in this region — before Elms College decided to enter the mix with three offerings slated to make their debuts this fall.

To stand out in this field, programs have to be somewhat unique, provide intrinsic value to students, provide the skills needed in the modern workforce, and address the many changes that are taking place in the broad realm of graduate programs in business administration, said Calnan, director of the program, who believes that Elms has all that covered, convincingly.

“M.B.A students are younger, less likely to come from disciplines other than traditional business disciplines, and expect course-delivery methods that go beyond the traditional classroom model,” said Calnan, an accounting professor at the college. “Elms College’s M.B.A. will provide the flexibility and accelerated delivery expected by today’s students.”

Elaborating, Calnan said the new M.B.A. program will offer concentrations in accounting, health care leadership, and management, and will be delivered in an accelerated hybrid format, with 11-week terms that allow students to combine online and on-campus classes, or take the entire program online. The program also features a community-service component to engage students in solving business problems within their own community.

Looking at the sum of these parts, meaning the concentrations, community work, and other components, Walter Breau, vice president of Academic Affairs at Elms, said the 82-year-old college is “taking its foundational strengths and building on them.

“I’m always looking for strategic initiatives to move forward,” he continued. “We have very high-quality programs and a great reputation in the health care field, in nursing, autism, and other areas, and I see the business area as another center of high quality where we can leverage what we have into future programming.”

Noting that a high percentage of Elms students stay in this region upon graduation, Breau said the M.B.A. is considered another opportunity to “educate young people and keep them in the Pioneer Valley.”

Administrators are projecting, conservatively, that each concentration will attract at least 10 students for the fall semester, and they wouldn’t be surprised if that number is easily exceeded.

“The feedback we’ve been getting is tremendous,” said David Kimball, chair of the college’s Business and Law Division. “The Facebook inquiries have been off the charts, with alumni being very interested; some were in accounting, others want health care leadership … all three tracks are drawing interest.”

For this issue, BusinessWest takes an in-depth look at Elms’ new offerings, how school leaders believe they will advance the college’s mission, and why they believe these offerings will stand out in that increasingly crowded field.

Course of Action

Kimball told BusinessWest that M.B.A. programs have been talked about at the Elms for some time now. And often the discussions involved the school’s business and accounting students who were enjoying, and appreciating, their undergraduate experience at the Elms and asking if they could continue on there.

“As they would approach graduation, our students would ask about graduate programs they could do on campus,” he said, adding that these queries provided not only inspiration, but evidence of a solid core of potential students. “So there will be some retention of those students who want to stay and enjoy their experience here.”

For a number of reasons that he would articulate, Breau said school administrators and the board of directors decided that the time was simply right to forge ahead with a multi-faceted M.B.A. program.

Several factors played into this decision that the timing was right, said Breau, listing everything from the school’s strong track record in placing students in graduate programs, to changes in the accounting field (individuals are not being hired by most firms unless they have completed 150 credits of work, or a fifth year of education), to an expansion of the region’s health care sector and the subsequent need for more individuals with advanced degrees.

“Health care needs are only increasing here in Western Mass., and we have some tremendous health care facilities in this area,” he explained. “I see our program helping any of the health care enterprises in this region moving forward, because leadership is becoming an increasingly important component, and these institutions are looking for ways to not only keep their people but help them move up the ladder.”

As they moved forward with its M.B.A initiative, Elms administrators sought feedback from local business leaders in order to ensure that the offerings would provide the educational background and help develop the skills needed to succeed in today’s changing workplace, said Calnan.

“There’s an increasing need for advanced education in order to be more effective in the workplace, and our program fits the needs of the market,” she explained, adding that Elms administrators were influenced, and motivated, by acknowledged changes in graduate business administration degrees, as outlined in the popular book on that subject, Rethinking the M.B.A.

“Today’s M.B.A.s are very different from those in the past,” she noted. “We need to develop programs that will meet this new need, rather than continue on with the old philosophy of what an M.B.A. should look like.

“Today, you don’t see people from other disciplines, like engineering, getting into M.B.A. programs, at least as much as you once did,” she continued. “Now, it’s generally a business student, and they’re doing it when they’re much younger and with much less experience than they had in the past. So this program tries to blend both pieces, meaning the older, traditional approach and the new approach, along with a hybrid delivery.”

Calnan said one of the distinctions of the program, and a facet that will add value and thus drive enrollment, will be its faculty, most of whom are practitioners and experts from area businesses and nonprofits.

“We have a strong commitment to excellence, and we’ve worked very hard going after top executives in all fields to be a part of this program, and in two different ways,” she explained. “First, in an advisory capacity, and then as instructors, or partners with current instructors.

“For example, there’s a course in global political economy and its impact on social and ethical responsibility,” she continued, “and it will be taught primarily by a corporate mergers and acquisitions person from MassMutual, and it will be partnered with our own Theology department, where one of our professors will co-facilitate all of the discussions during the 11 weeks. So by partnering with corporate business and community members to be involved in delivering the program, as well as advising us as a college on curriculum and important trends going on in the world of business, those two pieces should help drive our enrollment in each of those tracks.”

To build awareness of the new programs and gauge interest, Elms administrators are using a broad range of marketing and communication strategies. These include the traditional — everything from billboards on I-91 to direct mail, to an open house and information session slated for Jan. 11 at the Alumni Library — to the new and non-traditional, including social media and especially Facebook.

“We’re getting a lot of very good response already — there are a number of current students who have expressed interest in staying on and getting an M.B.A. here,” said Kimball. “There’s been a good deal of excitement generated; we’re creating a buzz.”

School of Thought

Summing up what the new M.B.A. program means for the college, Calnan said that, in the simplest of terms, it is a tremendous growth opportunity and a chance to expand the mission.

“This will impact the school in a profound way,” she explained. “Graduate programs are a way for a college to sustain and grow — that’s where the growth potential lies.”

Time will tell if the school can indeed make its program stand out amid a strong field of competitors, but administrators believe they have offerings that will resonate within the marketplace and provide a degree of progress, literally and figuratively, for this Catholic institution.

George O’Brien can be reached at [email protected]

Do You Need Full-replacement Insurance on Your Building?

The owners of a new company found a building on the market for an affordable price, so they bought it. Built in the 1940s to manufacture aircraft for the war effort, the metal structure had a large open space. The company occupying this space was in the software-development business, and the building was much larger than it needed, but the price made it seem like a sensible move. However, the owners got a surprise from their insurance agent about property coverage.Insurance companies base limits of insurance on the cost of replacing a building exactly as it was before the loss. The cost of reconstructing this old building was much higher than both its purchase price and that of other suitable properties. The company did not need that much insurance, and paying the higher premium for it would have been wasteful, so the owners asked the agent for alternatives. What if, they asked, we don’t rebuild our building as it was?

After a fire or some other catastrophe destroys a building, its owners may decide not to rebuild or replace with a similar structure for a number of reasons:

• As was the case with the software company, the current building’s design may be impractical. The company bought the building because of a good price, not because of its large open space. A software developer ordinarily does not need that much space; if it were to rebuild, it would almost certainly choose a smaller building with a different layout. Also, very old buildings often include materials that builders do not commonly use today, such as plaster and lathe. Reconstruction with these materials is expensive and often unnecessary for the continued operation of the business.

• The company may decide to consolidate the operations of two locations into one. The second location may have the capacity to absorb the first one’s operations, and management may feel that it will gain efficiencies by consolidating.

• Depending on the building’s age, it may not meet current building codes. The local government may require any new buildings to meet expensive new codes.

The standard business property-insurance policy states that the insurance company will pay ‘actual cash value’ — the cost of replacing the property minus an amount for depreciation. However, it offers the option of valuing a loss at replacement cost without deduction for depreciation. A business that chooses this option will need to purchase the amount of insurance equal to the cost of replacing the building “as is.”

The company will pay the difference between the actual cash value and the replacement cost only if the property owner actually rebuilds or replaces the property, and then only if he does so as soon as reasonably possible after the loss. The policy also provides a small amount of additional insurance (typically the lesser of 5% of the insurance on the building or $10,000) to cover the increased cost of construction resulting from changes in building codes.

Businesses like the software company, which do not need an exact replacement of their current buildings, should ask their agent about adding a ‘functional building valuation’ endorsement to their policies. It establishes a limit of insurance somewhere between actual cash value and full replacement cost, and allows the property owner to replace the building with one that fulfills the same function as the old one did, but at a lesser cost.

The discussion with the agent should also include increased ‘ordinance or law’ coverage to provide additional insurance for increased costs from new building codes. With the right attention to detail, a business can get the property insurance it needs without having to waste money on unnecessary coverage.

John E. Dowd Jr. is a fourth-generation principal of the Dowd Agencies, and one of three partners at the oldest insurance agency in Massachusetts with operations and management under continuous family ownership. The Dowd Agencies is a full-service agency providing commercial, personal, and employee benefits. It has four offices in Western Mass.; (413) 538-7444.

More Big-bank Customers Switch to Community Banks and Credit Unions

Jim Kelly has long touted the benefits of banking with a local institution.

“It’s important to do business with people you trust,” said Kelly, president of Polish National Credit Union. “When you run into a difficult situation, you can come into our credit union and talk to someone face to face. I think that’s important. It’s all about helping people.”

These days, that’s a message that resonates more than ever, as large, national banks have begun to see a trickle — perhaps a stream — of customers closing their accounts and moving them to smaller institutions.

“All our business is coming from other banks,” said Trent Taylor, chief operation officer and chief credit officer of NUVO Bank, which opened its doors for business just three years ago. “Everyone who comes in here has come from another bank. And the tellers out front are constantly seeing people come in because they’re tired of the fees, and they’re aggravated by their old bank.”

That aggravation is widespread. According to a Zogby survey earlier this year, almost 15% of respondents moved from a national bank to a community bank or credit union in the previous year alone. Reasons — and many people named more than one — ranged from lower service charges (36%) to better rate of return (32%) to convenience (20%). A full 60% added that they wanted to make a statement of protest against one or more policies of the large bank.

Some people feel that way but are hesitant to change, Taylor continued, but many feel the hassle of switching is worth it. “We can offer all the frills of the other banks, but none of the charges.”

Jeff Sattler says the largest institutions don’t care whether they lose a $1,000 checking account, but community banks value those customers.

“Every time a bank is acquired, change is inevitable, and as they get bigger, Western Mass. becomes a smaller percentage of the size of the bank,” he told BusinessWest. “The big banks are not the bad guys, but this is just not the market they’re interested in anymore. A $100 billion bank doesn’t have the same appetite for a $1,000 checking account; it’s just simple math. And they’re going to charge the fees and say ‘take it or leave it.’

“Bank of America is a trillion-dollar bank,” he continued. “They want that business to leave. But that’s our bread and butter. Our roots are here; we have no one else to answer to.”

Jumping Ship

John Heaps says national banks have been losing mortgage, commercial-loan, and retail business to smaller institutions.

“On the mortgage side, it’s clear that consumers and Realtors both like going to local banks because they can look people in the eye and know they’re getting the right product for their financial situation,” he said. “And they know that we, as well as other local banks, also service the loans. That’s huge; we don’t sell the servicing. If you have a question about your mortgage, you can come in and talk to us, and we’ll do what we need to do.”

That local presence is important to both borrowers and their agents, he continued. “If they have a need to modify the loan, like going interest-only, we can make a decision right here in this area. If they have an issue and need to talk to somebody, we’re right here. Realtors are also concerned with getting a relatively short turnaround time for a purchase.”

On the small-business side, Heaps continued, “you just can’t find people in this market area from the larger banks who are looking to make small-business loans. They don’t have the resources; all the people have been transferred to Hartford or Boston, and as a result, the local community banks have really picked up the pace.”

Heaps said he has heard chatter about whether banks are prepared to lend, but that it hasn’t been an issue for institutions based in Western Mass.

“Every single community banker I’ve talked to in this marketplace is willing to lend,” he noted, adding that most of the reluctance to pursue loans is on the borrowers’ side, partly due to uncertainty over the status of the extension of Bush-era tax cuts.

“There’s a reluctance among business people to invest, particularly until they know what the tax situation is,” Heaps said. “A significant number of borrowers have come to us with great ideas, but said, ‘as a small-business person, I don’t know what’s going to happen with my taxes.’ Keeping the tax rates in place for at least next year will have a more significant impact than people realize.”

Finally, on the retail side, Heaps said, many depositors in large banks have become weary of constant changes to the fee schedule designed to hit them with charges for everything from debit transactions to fraud alerts.

In fact, constantly changing fee schedules (rarely in customers’ favor) have chased many depositors away from national banks and toward community banks with much more stable charges (see story, page 28).

“That’s what we’re all about,” Polish National’s Kelly said. “We have some of the lowest fees in the area. We don’t need the money; we make a lot of bottom-line income, so we don’t have to charge a lot of fees. A lot of these large banks brag about how many households they have, but to customers, I don’t think ‘too big to fail’ is seen as a positive thing anymore.”

He said the public recognizes the role of megabanks — specifically questionable lending practices — that contributed mightily to the economic collapse of 2008, and the fact that this region’s community banks and credit unions never operated like that should be a selling point.

“Some of these large banks are going to try to regain their respectability in the industry, and we don’t have to do that,” Kelly explained. “We’ve always done the right thing. If you’re applying for a mortgage, you want to know more than whether you’re getting the best rate and not paying a lot of fees; you also want to be with a financial institution you can trust. These things didn’t come into play a few years ago; then, you were shopping for a rate, and that’s it.”

It’s no surprise, he said, that customers increasingly want to bank at institutions that embrace responsible practices no matter what the economic conditions.

“We’re not going to be able to predict the next recession, but we will have one at some point,” Kelly continued. “At the start of the Great Recession, when the market melted down, we not only maintained strong capital, but remained profitable, and didn’t see any impact on asset quality.”

Should I Stay or Should I Go?

With seemingly so many reasons to leave megabanks, Megan McArdle, business and economics editor at the Atlantic, recently explored the question of why some people choose not to leave. And she started with herself.

“I bank in two places: Navy Federal Credit Union and Citibank,” writes the Washington, D.C. resident. “NFCU is better in all ways except one: they don’t have a branch in D.C. That means that every time I want to make a deposit, I have to drive out to Virginia. So I tend to go there once every few months and put a bunch of cash in the bank for our regular or big expenses: car loan, wedding stuff, rent and utilities. But it is not a convenient place to do my everyday banking.”

She admitted that she stays with Citibank because it has a presence all over the country, and she’s moved her residence often over the past decade — not to mention business travel.

“America does have high rates of labor mobility, and a lot of people travel for work,” she concludes. “That’s going to favor national banks, which, in turn, lets them offer less-favorable terms to their customers. I’m paying for convenience. But frankly, it’s worth it.”

Still, an increasing number of customers insist that it’s not, and that they’d rather bank at the institutions that didn’t contribute to the financial meltdown, yet will have to pay in some ways for the mistakes of the megabanks. Heaps noted that, while about 30 new rules emerged from federal regulators in the wake of the Enron scandal, the Dodd-Frank financial-reform bill passed earlier this year includes about 300.

“That’s what we’ve been living with; we’ve paid the price,” he said. “But now we’re starting to see consumer confidence picking up.” And that means more opportunities for big-bank customers who are starting to reconsider the value of the local touch.

Joseph Bednar can be reached at

[email protected]

A chart of business and economic-development resources

Please click here

Business & Economic Development Resources

For Many Locally, There Is Room for Cautious Optimism

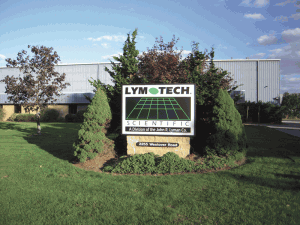

Lym Tech Scientific will soon be moving into this building on Westover Road in Chicopee, an acquisition that is one of many positive signs for the local economy.

He told BusinessWest that the evidence comes in the form of remarks and unspoken thoughts that come with conversations he has with prospective clients, specifically couples looking at major home-renovation projects or new-home-building initiatives.

“You sit with a couple, and whether it’s a remodeling job — a kitchen, family room, bedroom, whatever — or a new house, she’s saying, ‘we need to get this done,’ and he’s saying, ‘I’m not sure this is the right time to do it,’” said Pecoy, owner of Kent Pecoy & Sons Construction. “And she starts kicking him under the table, saying, ‘we can’t put this off any longer — the kids will be out of the house by the time we get this done.’”

While acknowledging that there is some stereotyping going on with this anecdote, Pecoy said it serves to make his point — that, during recessions, and especially this past one, couples will put off things as long as they can. The fact that the under-the-table kicking is prompting more husbands to say ‘yes’ to such projects means that many people really can’t wait any longer, but they also have the confidence to move ahead.

This is especially true with remodeling, he continued, adding that this segment of his business now accounts for far more than 50% of revenues, not the breakdown he’d like — he’d much prefer to build new, high-end homes — but he’s happy that at least one aspect of his operation is seeing an uptick, and that he’s getting more of his time-honored evidence that times are getting better.

Others involved in business and economic development say they don’t have such a tell-tale sign that a recession is winding down. For them, things are somewhat murkier. Indeed, there is still considerable uncertainty about if, when, and to what extent things will improve. There is, however, general agreement that 2010 was a real struggle, and the year ahead should yield some improvement, but this will be, by and large, a mostly jobless recovery.

“We predicted 2010 to be this kind of year; we were hoping it wouldn’t be, but we predicted it would be, in terms of land sales in our development corporations and general absorption of real estate,” said Allan Blair, president and CEO of the Economic Development Council of Western Mass. “We thought there would be a slowdown in layoffs in 2010 and there was, but we also thought the job growth would be slow, and it was. So as disappointing as all this was, it wasn’t a surprise to us.

“It looks as though the layoff situation has bottomed out, so that jobs appear to be stable, but there are a lot of unemployed people out there who are going to be struggling to find employment equal to what they left,” he continued. “They’re going to have a hard time — it’s going to be a real struggle for a lot of people, which is going to create a lot of problems for our communities and our citizens. The government is spending what it can to retrain and reposition people, but the business environment isn’t responding fast enough to absorb them.”

Russell Denver, president of the Affiliated Chambers of Commerce of Greater Springfield, said some sectors have performed better than others in 2010, and that uneven performance will likely continue in the year ahead as players in different industries respond — or don’t — to the conditions.

“It’s been a mixed bag … there is not general economic growth spread evenly among the business community. It entirely depends on what sector you’re in,” said Denver. “I’ve heard that temporary employment agencies are having a good year, and some advertising agencies are having a good year, and some architectural firms are enjoying better times.”

“Companies are becoming much more efficient, much more productive, and, interestingly, the companies that are hiring are having a difficult time finding the right person,” he continued. “People attribute this to the fact that, even a few years ago, people were willing to leave one company to go to another; now, many of the people are hunkering down, afraid to leave for another position, because the grass is not always greener on the other side, and if there’s a layoff, they may not get employed again very quickly.”

Hire Ground

Looking back on 2010, Blair said that, while it came off as predicted — rather unremarkable in terms of real growth — there were some positive developments.

At the top of that list would be the groundbreaking for the high-performance computing center, a project that has many question marks in terms of overall impact, especially with jobs, but enormous potential to spark other economic development.

“The Holyoke high-performance computing center is something that we’re looking forward to understanding, as far as the economic impact is concerned,” said Blair. “But the fact that this is happening, and with those particular players, is encouraging to say the least, and we’re optimistic that we have something to rally around in terms of that digital technology cluster, and can see what we have here.”

Movement with regard to identifying clusters and facilitating their growth was another of the bright spots in 2010, Blair continued, noting the hiring of the EDC’s first ‘manager of cluster development,’ Michael Wright (see related story, page 6).

Still another was some signs of movement on absorption of some of the vast amounts of commercial and industrial inventory now on the market, a situation that is no doubt contributing to the lack of new building in the EDC industrial parks and similar facilities across the region.

Bill Wright, president of Lym Tech Scientific, a manufacturer of cleanroom wipes, is responsible for some of that absorption. His company, which has been based in several smaller buildings at the Cabotville Industrial Park complex in Chicopee, recently acquired the 78,000-square-foot building at 2245 Westover Road that was most recently home to Engineered Polymers, and is slated to move in next month.

Wright said the move was necessitated by the need for more space and also better space — the multiple floors at Cabotville are not conducive to efficient operations — but also by confidence that the company would continue its recent growth pattern.

“I hope the economy stays on track,” said Wright. “It appears to be a jobless recovery, but we seem to have found some pockets of business that work OK for us. It’s tough to make predictions about the local economy and employment, though.”

Indeed, it is, said Jim Barrett, manager partner for the Holyoke-based accounting firm Meyers Brothers Kalicka, who hears from clients every day about the economy and how it is impacting business.

‘Cautious optimism’ was a phrase Barrett used repeatedly as he talked about 2011 and his clients’ prospects for stability, growth, and additional hiring.

“Some people are up this year, but most all business owners are thinking hard about whether they should bring back people,” he told BusinessWest. “They’re paying people overtime, things are looking up, but credit is still tight, and there are outside factors impacting specific industries, like health care reform and medical practices; there are a lot of question marks.

“With certain sectors, like manufacturers and retailers, things are looking better, but they’re not yet ready to commit a lot of capital to expansion, because they’re just not sure,” he continued, hitting on one of the variables that will certainly define progress in the year ahead: business confidence. “Some of them are, but most people are still very cautious about spending, and that includes hiring.”

Elaborating, he said many of the staffing agencies the firm represents are reporting growth in 2010, which is a good sign for the overall economy. This uptick means that, while companies might be reluctant to bring people on full-time, they are adding temporary help or paying overtime, which are big steps in the right direction (see related story, page 22).

“Some employers have people working overtime, which is always a good sign,” he said. “They’re paying OT and using temps, which is one step before actually hiring someone. Instead of hiring the staff in anticipation of the work coming, people are waiting for the work to come in, and then they’re hiring staff and they’re augmenting with temporary help or overtime.”

Watch Words

Denver said he’s also observed some improvement in various sectors. Like Barrett, he’s buoyed by the improved health of staffing agencies, but also sees rays of optimism in the growth of some marketing agencies and even architectural firms.

The former indicates that companies that have cut back on their marketing — one of the first areas to be trimmed when times are tough — are putting some dollars back in that area. As for the latter, it provides some glimmers of hope for the construction sector, one of the hardest-hit industries in the region.

Overall, Denver said 2010 was not a year of big, positive headlines in the business community, but of many important success stories. He listed the high-performance computing center, construction of Baystate Medical Center’s $251 million Hospital of the Future, more progress on the State Street corridor in Springfield and also in the South End and downtown, and the start of construction of the new data center in the old Technical High School on Elliot Street.

Many of the positive developments in 2010 were funded, or assisted, with federal stimulus money, said Denver, adding that as this pipeline dries up, which it is expected to do in the months ahead, there may be a negative impact on recovery and the rate of same.

“Government propping up the economy was the story of 2010,” he said. “And now those funds are running out. What happens without federal stimulus, or far less stimulus money, may well be the most significant story of 2011.”

Evan Plotkin knows what he would like the biggest story of the year ahead to be — more visible evidence of progress in Springfield’s central business district, a goal that has become somewhat of a passion for the president of NAI Plotkin.

While noting that the commercial real-estate market remains sluggish amid some signs of improvement, Plotkin said 2010 was a year in which downtown revitalization efforts took steps forward, through everything from the retenanting of the old federal building to the popular Art & Soles program that brought dozens of colorful, five-foot-high sneakers — and some additional vibrancy — to the downtown.

And 2011 may yield more positive developments with projects ranging from revitalization of long-dormant Union Station to ongoing efforts to bring more market-rate housing in locations such as Court Square, the Bowles Building, and others.

“I’m excited that developments like Union Station are getting to a point where people are developing those properties,” said Plotkin. “There’s been a lot of talk, and it’s been very frustrating for many years, but we’re at the end of the discussion phase, and I think we’re at the point where we’re ready to pull the trigger and get started on some of these projects.

“If we convert some of the buildings downtown into market-rate housing, and if we start to do some of these other cultural things that people have been talking about for some time,” he continued, “we’re going to start to see a whole new Springfield emerge.”

The Finish Line

If Pecoy is right, and the recession is not just technically over but really behind us, then more wives will be kicking their husbands under the table in the months ahead, urging them to move ahead with major renovation plans.

Area business owners and economic-development leaders will be looking for these and other signs — real and metaphorical — over the course of a year that seems destined to be defined by more uncertainty.

But it will be one that should, by most accounts, anyway, bring some much- anticipated improvement for a region that is still, in many ways, digging out from the Great Recession.

George O’Brien can be reached at

[email protected]

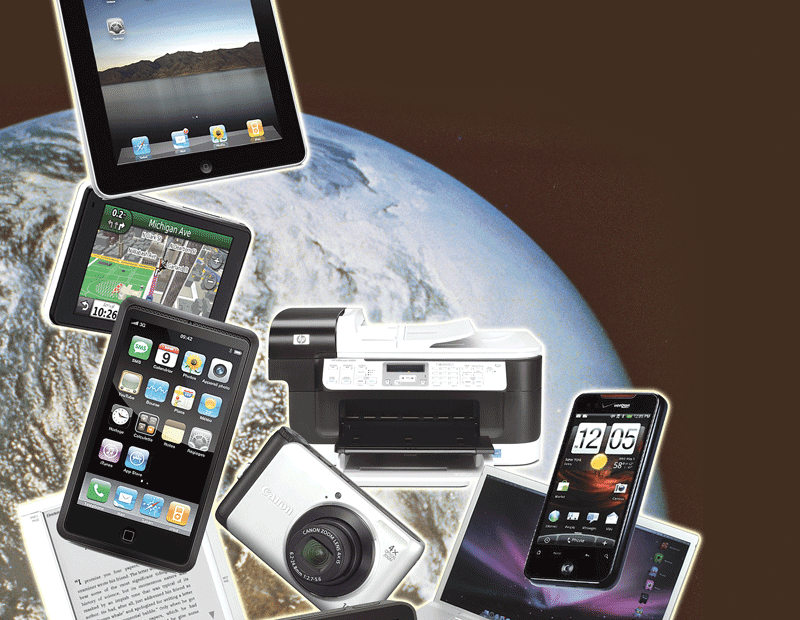

Why Blocking Employee Access to Social Media Won’t Work

Many employers are fearful of opening up Pandora’s box and allowing employees access to social sites that may cause a distraction and reduce productivity. Well, if your employees carry cell phones, most of them already have access right in their pockets or purses, so your effort to block access is defeated before you even implement it.Employers should try to understand that, first and foremost, social-media sites such as Twitter, Facebook, LinkedIn, YouTube, and blogs are communication tools. They offer your company a channel to listen, monitor, and engage with customers like never before. They open new sales outlets by introducing your product or service to an expanded group of prospects, and they help to build relationships by creating a human voice and face for your company by empowering employees to listen, care, and resolve issues.

There is a potential dark side, though. Companies risk employees conducting themselves unprofessionally, antagonizing irritable customers, and distributing incorrect information, which may damage your brand. In addition, you may fear that you’re actually providing your employees with toys to play with all day long instead of doing ‘real work.’

So how can an employer cash in on the tremendous potential benefits of social media while mitigating risk? Here are a few suggestions:

Monitor Brand Chatter

The conversations about your product or service are happening on social media whether or not you’re listening, so isn’t it better to know what people are saying about you? This gives you the opportunity to thank loyal customers for their praise, as well as solve problems that often turn unhappy customers into publicly satisfied ones. Ignoring social-media channels is essentially overlooking customer feedback.

Engage in the Conversation

Can you really afford to block access to any place where people are talking about your company? When employees use these communications tools, they ultimately bump into these conversations, whether deliberately or accidentally. This opens up an expanded, albeit perhaps informal brand-monitoring and customer-service channel.

Don’t Worry About Lost Productivity

Do your employees work exclusively 9 to 5, or do they regularly stay late, take work home, and read e-mail off-site? If your employees have the dedication to work outside the traditional box, your concerns about allowing them to check their Facebook page or watch a YouTube video at the office seem a little misdirected.

Remember that social media is a communication channel, and people typically utilize the path of least resistance when reaching out to a company, so social media makes it easy to get to the right person within an organization very quickly. Also, people are migrating to social media to share resources and problem solve, so if you block access, you’re preventing your employees from accessing people who can offer solutions and keeping them at the mercy of time-consuming, paid phone tech support.

Provide Guidelines and Trust Your Employees

Guide your employees in the appropriate use of social media. Remind them that they are representing your company and to refrain from negativity, profanity, and augmentative or confrontational conduct. Encourage them to listen to the chatter and not to be afraid to disclose their identities. Social media is about building relationships, and people don’t build relationships with companies, they build them with people.

You have to trust your employees, and the best way to guide social media efforts is to provide suggestions about how they can help you. Encourage them to report any negativity they bump into, or encourage them to jump in and offer to connect the customer with someone within your organization who can help. This can effectively turn your entire organization into a customer-service team.

The Viral Epidemic

The beauty of social media is that information often spreads virally. Consider the instant celebrity of Susan Boyle from Britain’s Got Talent. Her audition earned her a soft spot across the globe almost overnight because the YouTube video was shared repeatedly across social-media channels. What did that do to viewership? Although few products or services can expect to gain that level of overnight notoriety, people’s choices are affected daily by recommendations made via social-media channels.

People like to share ideas and make recommendations. That’s how things go viral online, and social media provides an ideal vehicle because it’s so easy to share information. If your company is there, you can participate and respond.

Business is done, referrals are made, problems are solved, and chatter about brands happens every day on social media. If you block access, you’re missing out on amazing opportunities to develop relationships with potential customers, those who need help with your products, and people who are your best advocates. Worst of all, you’re handing potential business to your competition if they’re making it easier for customers to communicate than you are. Can you afford that? n

Christine Pilch is a partner with Grow My Company and a social-media marketing strategist. She trains clients to utilize LinkedIn, Twitter, Facebook, blogging, and other social-media tools to grow their businesses, and she collaborates with professional service firms to get results through innovative positioning and branding strategies; (413) 537-2474; linkedin.com/in/christinepilch; facebook.com/

growmycompany; twitter.com/christinepilch;

youtube/user/christinepilch; growmyco.com

Listings for December 20, 2010

Please click here

Commercial Real Estate BW12.10b

How to Ask an Employer for a Raise in a Difficult Economy

Regardless of economic conditions, rewarding good employees is an investment companies have to maintain. Recession or not, employers need to consider the consequences if their best employees leave. And, let’s be honest, if you’ve made it this far, you’re probably on the list of good employees.Although the job market is often tough to crack when you’re unemployed, those who do have jobs may find themselves in an interesting position. That’s because some businesses prefer to look only at people who are already employed. Although that sounds strange, let’s think about it. In a tough economy, most companies make their first cuts in areas that aren’t vital to their operations. The employees who survive are likely to have skills that are essential to the business.

So you still have a job, and you think you have a desirable skill set. How do you ask for a raise when the economy is struggling? The first thing to do is spend some time evaluating your current employer’s position. Some organizations have found it difficult to provide raises. They’re fortunate to be meeting their current payroll, and are just hoping to survive until things turn around. If this is your company’s situation, you’ll have to wait for your organization’s fortunes to improve, but, while you wait, work on broadening or developing the skills you have. You want to make your boss’s decision an easy one when the time comes.

You may learn that your company’s position is not all that bad. Some businesses have been building their financial reserves. As we emerge from the downturn, these companies are looking to expand their operations by adding key personnel. What better way to strengthen your company’s position than by luring vital employees away from your competitors? This atmosphere can create a unique bargaining opportunity for employees who are aware of the value they represent.

Before you ask for a raise, you also have to determine if your salary warrants an increase. You can get some perspective on your current pay by visiting Salary.com or any of the government’s compensation Web sites. If you’re already paid above your market pay rate, negotiating a raise can be difficult, though not impossible. There are a number of intangibles that you may bring to the table, often based on your years of experience. It is also important to remember that a successful negotiation is always based on your merit and not on why you need additional money. While your employer may care about you, providing additional salary to fund your chosen lifestyle is not their responsibility.

If your research indicates that you are undervalued, you then need to justify why you deserve a raise. One of the best ways to identify your value is to track your accomplishments. Keep a notebook, or a computer file, which summarizes your accomplishments, the date you achieved them, and a summary of the work completed, plus what you’ve learned. In our knowledge-based economy, you want to draw attention to the additional skills you’ve acquired since you were first hired. This would include any certifications, continuing education, industry or community awards, or any other activities that show you’ve grown as an employee. You’ll also want to document any cost savings you’ve achieved, how you’ve helped improve productivity, any important projects you’ve worked on, and other ways in which you’ve contributed more than your job required.

There is probably no best time to ask for a raise when the economy isn’t doing well. However, if you’re confident you have a case to make, there are a few things you should consider before approaching your employer. First, be cognizant of their time. If your boss’ schedule is hectic on a particular time of day, be sure to schedule an appointment outside of that time frame. Furthermore, you want to plan to ask for a raise before the annual budget is complete. After the budget is set, it may be difficult for your employer to allocate any additional funding for increased compensation. Finally, be mindful of the overall work environment. If things are particularly crazy, and people are juggling multiple tasks or racing to meet deadlines, wait until things die down.

You should also give some thought to what you’ll do if your employer declines your request, or agrees to a raise that isn’t exactly what you had in mind. Discuss your employer’s reasons, and ask what you can do over the next few months to improve your chances for increased compensation in the future. Don’t back them into a corner. Your attitude should clearly be, “how do I become a more valuable employee?” That should make their decision easier next time around.

Thomas J. Fox is the community outreach director at Cambridge Credit Counseling in Agawam. He is an AFCPE-accredited credit counselor, a CFC-certified educator in personal finance, and an NCHEC-certified housing counselor. He also hosts Your Money 2.0 (YouTube) and Money America (91.9 WAIC); (413) 241-2362; [email protected]

StenTel Keeps the Information Flowing

Ray Catuogno didn’t graduate high school with plans to become a court reporter. But when opportunity knocked, he ran with it, and eventually founded a company that employs about 700 people nationwide, providing transcription services for the medical, legal, law-enforcement, and insurance fields. His story is a case study in how embracing new technology, and being willing to change with the times, have continually opened doors for growth.In the front lobby of StenTel in Springfield, several shelves are lined with decades-old typewriters, adding machines, and other outmoded devices.

One is a Dictaphone that used wax cylinders to make recordings; to erase a message and start over, the wax was simply heated and melted. Against another wall sits a Graphotype, a century-old machine that punched words onto paper from metal plates. One of the typewriters dates from the 19th century.

Among these devices, which Raymond Catuogno has collected over a lifetime in the transcription industry, is the first dictation machine he used to record court proceedings some 40 years ago. He would keypunch words onto reel-to-reel tapes, which a secretary would type onto paper. “How far we’ve come,” he said.

Indeed, Catuogno — who launched Catuogno Court Reporting in 1978 and later expanded the business to medical dictation and other fields under the name StenTel — is now president of a nationwide network of transcription services that employs the Internet and state-of-the-art communication tools to provide clients with same-day or next-day turnaround.

“We’ve grown to approximately 700 people working for the firm, across the United States,” he said. “Most of them work out of their homes, using the Internet, doing transcription for us.”

It’s a classic story of a business model that rode a wave of technological advances to grow market share. In this issue, BusinessWest examines how StenTel has continually staked out new ground on the cutting edge, and why this family business is well-positioned for the next wave of changes, particularly in health care.

Courting a Career

Catuogno’s life may have been completely different had he not taken a typing course as a teenager.

“After high school, I wanted to build skyscrapers and bridges around the world. But my father said, ‘geez, Ray, I don’t have the money to send you to college; what about joining the Navy on the GI Bill?’ I said, ‘sure, Pop, no problem, I can do that,’ and I joined the Navy.”

He ended up stationed in Key West, Fla., and because he had taken that high-school typing class, he was assigned an administrative role there. Later, his boss sent him to Newport, R.I., where he went through the Naval War College, learning about military law. After that, he returned to Florida, where he served as a court reporter for Navy court martials in Key West and similar Air Force proceedings at Homestead Joint Air Reserve Base in Miami.

“Back and forth along the Florida Keys for three and a half years … that was a really good duty,” he recalled with a smile.

After his military service, Catuogno brought his skills back home to Springfield, where he took a job as a court reporter at Hampden Superior Court, and also started picking up freelance work in courts across the region. In 1978, sensing a growing opportunity, he launched Catuogno Court Reporting, and eventually grew it to five offices, in Springfield, Boston, Worcester, Chelmsford, and Providence, R.I.

But that was only the beginning.

“Over the course of time, we ended up helping a gentleman out with medical transcription, and medical transcription was becoming a national type of business, so we started doing that, too,” Catuogno said. Transcription for insurance companies and police departments soon followed.

But medical transcription was a slower process back then, and required employees who were local.

“The way it used to be done was on tapes — cassette tapes, or even reel-to-reel tapes when we first began — and it’s changed along the way,” he said. “We went from tapes to phone dictation with 800 numbers, and then, of course, to the Internet.”

Catuogno’s son George joined the company in the mid-’80s and eventually took the reins of the medical-transcription side of the business.

“When we entered into medical transcription, we were transcribing cassette tapes for the first customers we picked up,” the younger Catuogno told BusinessWest. But even after the Internet, “we saw an opportunity to further develop that part of the business and do it well. We wanted to get the technology that would allow us to pick up and support customers anywhere in the United States, and wouldn’t be limited to the local region.

“When we went down that road,” he continued, “we saw what technology was available, and we saw an opportunity to develop our own technology.”

The breakthrough was the company’s development and patent of a system of combining audio and text in the same database, allowing doctors, police officers, or other clients to dictate information into the system and print out the transcript from the same location the next day. That technology allowed Sten-Tel to grow rapidly nationwide.

StenTel has since adopted speech-recognition technology and developed a product called Natural Language Processing, that codifies items such as problems, findings, allergies, procedures, lab tests, etc. That capability will streamline the construction of electronic medical records, which will soon be required of all medical practices in the U.S.

That federal mandate, George Catuogno said, will only make cutting-edge medical-transcription services more important, as doctors, by and large, are not going to want to keypunch their own records.

“That’s just not going to happen. In smaller markets, the low-volume guys may be willing to do that, or have their staff do some of that work,” he said, but he predicts most offices will rely on transcription professionals who can create those documents with speed, completeness, and efficiency. “In the end, time is money for these guys.”

New Opportunities

StenTel has built its client roster to more than 7,000, including some of the largest hospitals in the region, including Baystate Medical Center, Mercy Medical Center, Holyoke Medical Center, Wing Memorial Hospital, and UMass Medical Center, as well as Mass General and Brigham and Women’s Hospital in Boston.

“Police, lawyers, doctors — they use handheld recording devices, and they download those through the Internet, and thousands of reports come here daily,” Ray Catuogno said. “Transcriptionists located across the country access those reports, transcribe them in their homes, and then send them back to our mainframes.”

From his start in a one-room office on State Street, Catuogno’s Springfield operation now occupies the entire sixth floor of Monarch Place downtown. And with additional space has come new avenues for business.

“Our five New England offices are set up for attorneys to use,” he said, gesturing around the large conference room where he spoke to BusinessWest. “Lawyers come in and do arbitrations or depositions here just about every day. It gives attorneys a neutral place to go, which works well for the legal profession.”

The offices are also equipped with videoconferencing equipment, so individuals, groups, or companies can connect to some 10,000 sites around the world. “We can connect to China, Russia, Japan, South America, Europe … almost anywhere in the world.”

Like the use of StenTel offices by attorneys, this was a service that grew organically, and made sense. “It’s expensive to fly, and time-consuming,” Catuogno said. “Here, talking to someone on the TV screen, within five minutes, it’s like they’re here in the room. It’s amazing how it works.”

When asked what he enjoys most about this work, Catuogno immediately cited the relationships he has built over 45 years in the profession — with attorneys and court personnel, insurance companies and medical practices, and the public, but especially with the people his growing business employs.

“One of the things I enjoy is seeing young people come into this business and start their lives — lots of them don’t even have an apartment or an automobile — and then begin to grow,” he said. “As their lives evolve, down the road, you see them get their car, get their apartment, eventually become engaged, get married, have children, and really launch their lives.

“I call them all my family, my working family,” Catuogno continued. “I feel close to all the people here, and I love to see their successes. That’s probably my favorite part of doing this work today.”

But it’s a family business in the literal sense, too, as three of Ray’s children work in the Springfield office full-time, and another daughter, a teacher, helps out during the summer.

“That’s the exciting part,” he said. “The family being here means the business will continue for years to come and, I’m sure, become a much larger and more exciting business with all the new technologies coming on line.”

Whether it’s giving credit to the people who helped grow StenTel into a major player in transcription or proudly displaying those typewriters and dictation machines from the last century or two, Catuogno hasn’t forgotten the past as he looks to what promises to be a bright future. n

Joseph Bednar can be reached

at [email protected]

New Law Offers Tax Savings to Real-estate Industry

After several months of negotiations and overhauls within the House and Senate, President Obama recently signed into law the Small Business Jobs Act of 2010. This bill contains two key provisions for the real-estate industry: enhanced Section 17 depreciation and the return of ‘bonus’ depreciation.Both provisions are designed as incentives targeted to small-business owners, but owners of many large businesses will benefit, too.

Boost to Section 179 Depreciation

Rather than depreciating business property over several years, Section 179 now allows a taxpayer to expense the entire cost of certain property in the year of purchase. The new law allows a Section 179 deduction for up to $500,000 in 2010 and 2011 for qualified property. If the total purchase of all acquired property exceeds $2 million, there is a dollar-for-dollar decrease in the allowable deduction.

Generally, qualified property includes tangible personal property (such as equipment and furniture) and software that must be used more than 50% in a trade or business. Prior to this new act, real property (buildings and structural components, air and heating units) did not qualify for this special treatment. Now the definition of qualifying property expands to include ‘qualified real property,’ and limits the Section 179 deduction on this type of property to $250,000. Qualified real property includes the following:

• Qualified leasehold improvements. These are improvements to interior parts of non-residential real property placed in service more than three years after the date the building was first placed in service. This does not include improvements to the exterior, elevators or escalators, common areas, or internal structural framework.

• Qualified restaurant property, a building or improvement to a building if more than 50% of the building’s square footage is devoted to preparation of and seating for on-premises consumption of prepared meals.

• Qualified retail improvement property, improvements to non-residential real property if such space is open to the general public and used in the retail business of selling to the general public that meets the other definition of qualified leasehold improvements.

The Section 179 deduction is allowed to the extent of taxable income, with the remainder carried forward to the next year. Be careful, however, because Section 179 carry-forwards on qualified real property are not allowed beyond 2011.

Extension of ‘Bonus’ Depreciation

The bill also extends through 2010 the 50% first-year bonus depreciation that had expired. The allowance is 50% of the depreciable basis of qualified property for assets purchased and placed in service for 2010. To qualify, the property must be a new (not used) asset that has a depreciable tax life of 20 years or less, software, water-utility property, or qualified leasehold-improvement property.

Land improvements also qualify as eligible property and include items such as sidewalks, roads, fences, bridges, and landscaping. There are no purchase or income limitations as described in the Section 179 deduction, and many large businesses can benefit from taking this extended provision to offset taxable income.

New Reporting Requirements

The law provides for $12 billion of tax relief and builds in some revenue raisers to help foot that bill. One revenue booster requires informational reporting (typically 1099-MISC) on rental-property expense payments of $600 or more for individuals who receive rental income. There are exceptions to reporting requirements, such as for individuals who can show that the requirements create a hardship, individuals who receive rental income of a minimal amount, for members of the military who rent their principal residences temporarily. Further guidance on these exceptions should come out by the end of the year.

What This Means for Your Business

For many, 2010 may be a year when cash flow does not match taxable income, and businesses are striving to maintain their capital in the business instead of paying taxes. If qualified-asset purchases are less than $2 million, a Section 179 deduction can be taken to reduce taxable income.

In addition, if there are new land improvements or qualified asset purchases over $2 million, taxable income can be offset by taking the bonus 50% depreciation. Businesses can also elect to exclude real property from qualified Section 179 property if the regular $2 million cap is close to being reached. Whichever method is used, there are several strategies that may be implemented to defer taxation. In deferring taxation, property owners have additional cash available to grow their business.

The act has given plenty to discuss over the coming months. With proper planning and analysis of capital purchases, businesses can achieve favorable tax treatment. Consult your tax professional as to the most effective approach as well as proper qualification and timing of purchases.

Jeffrey Cheney, CPA/CFE, is a manager in the Tax Department at Kostin, Ruffkess & Co., LLC, a certified public-accounting and business-advisory firm with offices in Springfield as well as Farmington and New London, Conn. Beyond traditional accounting, auditing, and tax consulting, the firm also specializes in employee-benefit-plan audits, litigation support, business valuation, succession planning, business consulting, forensic accounting, wealth management, estate planning, fraud prevention, and information-technology assurance; (413) 233-2300; www.kostin.com

10 Reasons Why You May Need One — and Why You May Not

Perhaps you have heard a neighbor or a friend comment that they have put their house in a trust or that they have a trust that avoids probate or saves taxes. These are good reasons to have a trust, but all trusts are not alike, and there are just as many reasons not to set up such an arrangement.

Trusts can be revocable or irrevocable, for the benefit of the individual who set them up or for family members, friends, or charities. Trusts are set up by one person and managed by an individual or institutional trustee for beneficiaries.

So, you may need a trust:

To avoid probate. If your assets are held in a revocable trust rather than in your name alone, your property passes to your heirs directly without going through the expense, delay, and publicity of probate. But you don’t need a revocable trust if all of your property is held jointly with a right of survivorship with another person, and your life insurance, retirement benefits, bank accounts, and investment accounts all have beneficiaries.

To minimize estate taxes. In Massachusetts, if an estate exceeds $1 million, the estate will pay taxes on the entire amount, not just the excess. If a married couple has $2 million and leaves everything to the survivor, the tax on the survivor’s estate will be in excess of $100,000. However, if the property had been left through a revocable trust to a marital trust for the survivor, there is no tax on either estate. But if you are married with assets under $1 million or single with any amount of assets, you do not need a revocable trust for estate-tax purposes. Note: the federal estate tax returns in 2011, and revocable trusts work just as well to reduce federal taxes. For larger estates, specialized trusts such as qualified personal residence trusts or grantor-retained income trusts can also help to reduce taxes.

To protect assets for children of your prior marriage. A revocable trust can pass assets to a marital trust for a current spouse, with the property remaining at the spouse’s death going to the children. But mutual wills leaving all assets to the children also work as long as your spouse does not change his or her will after your death.

To protect a family member whose medical expenses may exceed their resources. A special-needs trust (SNT) can hold assets for the beneficiary without adversely affecting eligibility for Medicaid, MassHealth, etc. But a SNT cannot be for your own or your spouse’s benefit.

To delay distribution to your beneficiaries. A revocable trust pours over into a family trust which holds property until trust beneficiaries reach specified ages or a sufficient level of maturity. But in these days of merging financial institutions, be sure the beneficiaries can remove and replace an institutional trustee.

To provide centralized management. A trust can hold and administer property for the benefit of multiple trust beneficiaries and succeeding generations. But a limited-liability company may be more appropriate for business-property management.

To provide liquidity at death to pay estate taxes. An irrevocable life insurance trust can hold life insurance proceeds outside of your taxable estate. But if your estate is not taxable, life insurance (and the creation of a trust) may not be the best investment.

To provide financial-management services while you are living. A trustee named by you in a revocable trust can do this. But you could individually hire a trustee to do the same thing.

To make gifts to charity. A charitable-remainder trust allows you to receive annual payments from trust property, often well in excess of customary investment returns. The charity receives what is left at your death, and you receive a charitable deduction against income. But charitable gift annuities frequently work better for smaller gifts and are much less expensive to create.

To preserve some of your assets for your heirs in the event of a long-term illness. An income-only trust can own your home, and you can continue to live there or in a replacement home purchased by the trust. But do not use such a trust if you anticipate the need for nursing-home care for you or your spouse in the next five years, because the transfer disqualifies you (and your spouse, if applicable) for MassHealth nursing home benefits for five years.

So, a trust is a great tool, but only if you need it!

Ann I. Weber is a partner with the Springfield-based law firm Shatz, Schwartz & Fentin. She specializes in estate planning, elder law, and probate; (413) 737-1131.

NLRB: Employees May Complain About Their Employers on Facebook

It’s not surprising, but it’s official. The National Labor Relations Board has taken the position that criticizing one’s employer on Facebook or other social-networking sites constitutes protected concerted activity under the National Labor Relations Act.Over the past several years, as Facebook and other social-networking sites have increased in popularity, employers have become concerned about the potential implications of their employees’ use of such Web sites. Social-networking sites tend to foster a very casual atmosphere, and such an atmosphere often leads to interactions that employers feel are inappropriate. Facebook status updates like “my job sucks” or “I hate my boss” (or worse) are not uncommon. Understandably, employers want to discourage employees from broadcasting negative comments about them to the Web, and many employers have adopted social-networking policies for employees to follow in their use of these sites.

One such employer is American Medical Response of Connecticut. AMR created a policy prohibiting employees from representing AMR “in any way” on social-networking sites. It also prohibited employees from making disparaging comments about the company or the employees’ superiors or coworkers.

Accordingly, when an employee posted comments on Facebook complaining about her supervisor, AMR fired the employee. The employee had posted the complaint about her supervisor on her Facebook wall, and other co-workers saw the message and posted follow-up comments, creating a situation where employees were having a discussion about the supervisor. The National Labor Relations Board filed a complaint against AMR, alleging that its termination of the employee violated the employee’s right to engage in protected concerted activity.

Section 8 of the National Labor Relations Act provides, among other things, that it is an unfair labor practice for employers to “interfere with, restrain, or coerce employees in the exercise of the rights guaranteed in Section 7.” Among the rights guaranteed in Section 7 is the right for all employees, whether unionized or non-unionized, to engage in concerted activity for the purpose of “collective bargaining or other mutual aid or protection.” This means that employers may not prohibit their employees from discussing with co-workers their wages or other terms and conditions of employment, such as benefits, work hours, or assignments.

The NLRB traditionally has interpreted employees’ Section 7 rights very broadly. For example, under the National Labor Relations Act, employers may not enact confidentiality policies that require employees to keep secret their wages or benefits, and the NLRB has held that even a general confidentiality provision that makes no reference to wages or working conditions constitutes a violation of the National Labor Relations Act if an employee reasonably could interpret the confidentiality provision to include information concerning wages or other working conditions.

Given the NLRB’s broad interpretation of employees’ rights to engage in protected concerted activity, the NLRB’s position regarding employees’ social-networking activity is not surprising. The NLRB has taken the position that AMR’s termination of an employee for complaining about her supervisor on Facebook was a clear case where an employer took action against an employee for discussing the terms and conditions of her employment. According to Lafe Solomon, the NLRB’s acting general counsel, “this is a fairly straightforward case under the National Labor Relations Act — whether it takes place on Facebook or at the water cooler, it was employees talking jointly about working conditions, in this case about their supervisor, and they have a right to do that.”

The NLRB also has suggested that merely having a general policy prohibiting employees from making disparaging comments about the company violates the National Labor Relations Act, because it interferes with the right of employees to discuss their working conditions with each other.