Deposits Are Soaring, but Banks Struggle to Put Them to Work

Developments of Interest

By Mark Morris

John Howland calls the recent flood of deposits an “unprecedented” situation.

John Howland admits that the word ‘unprecedented’ is overused these days. But for him and others in the banking business, it seems like the right word to describe all that’s going on.

Howland, president and CEO of Greenfield Savings Bank, was talking specifically about the record amounts of deposits flooding into banks — and what’s happening with those deposits, or not happening, as the case may be.

In the early months of the pandemic, from January to June of 2020, banks in the U.S. saw a surge of nearly $2 trillion in deposits. At that time, most people were staying close to home and had reduced their spending to necessities.

As a local example, PeoplesBank reported deposit increases of 33% since last April, or nearly $700 million in additional deposits.

More deposits arrived as businesses applied for Paycheck Protection Program (PPP) loans and consumers received stimulus checks from the government. During normal times, money gets deposited but does not stay in an account for long. These days, however, deposits are staying and growing to an extent Howland and his counterparts in Western Mass. have never seen before.

And while record deposits would seem like a good thing, all that cash is sitting still, for the most part, and the key to any bank generating revenue and earning profits is loaning its deposits out to borrowers.

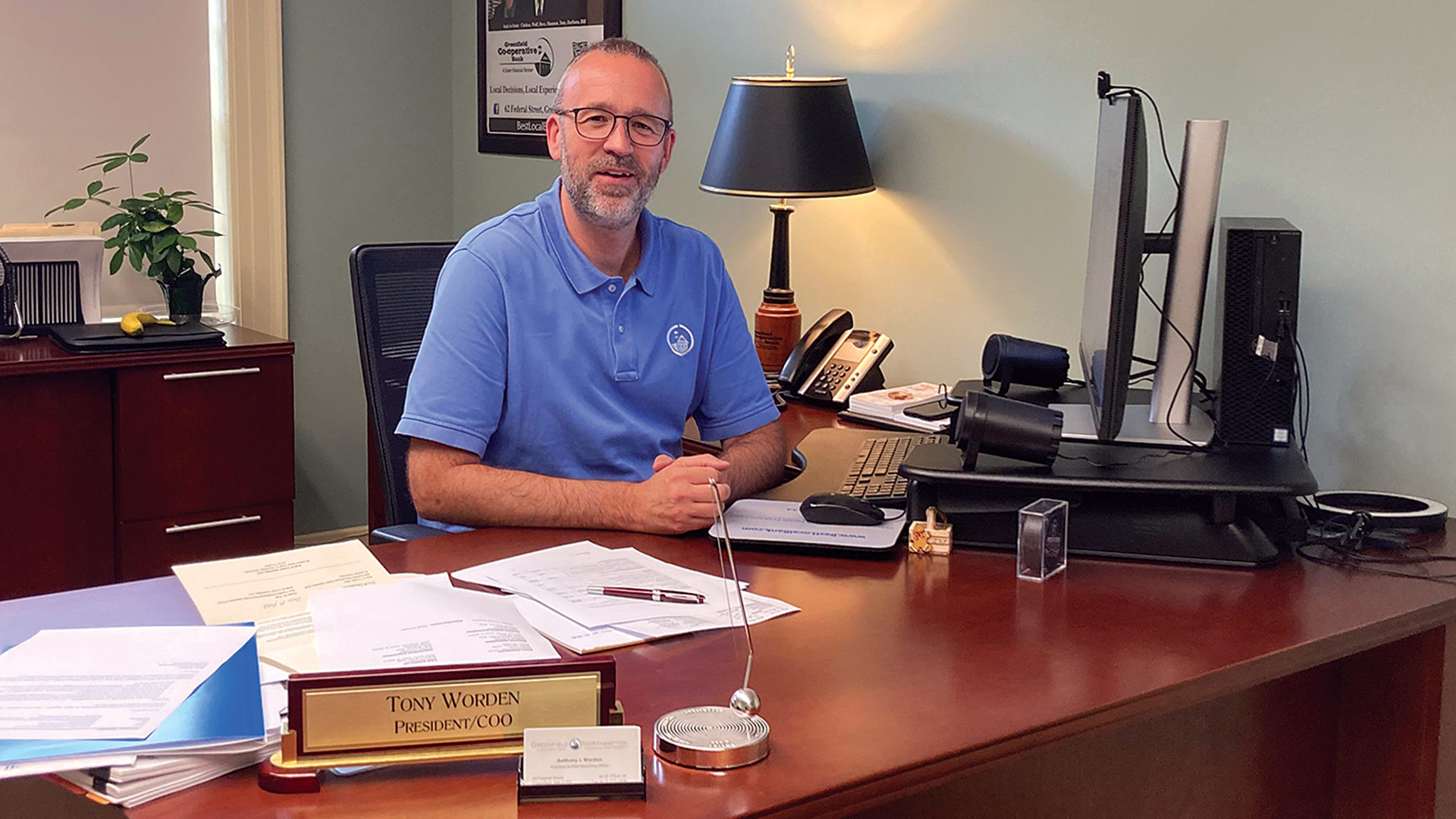

“I never thought I would say there are too many deposits and not enough people to lend the money to,” said Tony Worden, president and chief operating officer of Greenfield Cooperative Bank. “The point of our business is to get deposits … so this goes against everything we were taught.”

In normal times, banks take in deposits and lend that money out to businesses and individuals. Balancing the number of loans to deposits helps determine what interest rates will be paid to savers and charged to borrowers. Banks profit on the difference between the two.

“I never thought I would say there are too many deposits and not enough people to lend the money to. The point of our business is to get deposits … so this goes against everything we were taught.”

But these are certainly not normal times. These days, banks have record deposits and diminished loan demand — for several reasons, which we’ll get into later — which translates to lower interest rates for savers and borrowers, as well as lower profits for banks.

Howland pointed out that the lower interest rates are great news for people looking for a business loan or a mortgage.

“The residential and commercial rates are down to levels that were inconceivable 10 years ago,” he said, adding that, moving forward, banks will be competing much harder to entice people to borrow money than deposit it.

By All Accounts

There are many theories as to why deposits have soared at area banks — and why those deposits are going largely untouched.

Dan Moriarty, president and CEO of Monson Savings Bank, suggested that once people tightened their spending during the pandemic, they may have changed their overall spending patterns, which is in many ways good for consumers, but not for the overall economy.

“It’s good for consumers to increase their savings and their capacity to have money, but it also slows down the economy,” Moriarty told BusinessWest. “We believe there is still some pent-up rebound spending by both consumers and businesses that we will be seeing.”

Howland agreed, noting that there are a number of reasons contributing to the surge in deposits, with one of them bring what he called a “flight to quality.”

“With all the uncertainty in the world, people understand that putting their money into a bank where their deposits are insured by the FDIC is one of the safest moves you can make,” he said, adding that, despite the consistently upward movement of the stock markets, many consumers are seeking a safe harbor in which to park their money.

Tony Worden says he never expected there to be too many deposits and not enough people to lend to.

As for the business of converting those deposits into loans — and revenue — many of those same factors are holding some consumers back from borrowing, said those we spoke with, although many have pressed ahead with purchases of new cars, new homes, and vacation homes.

Meanwhile, a number of businesses, still struggling to fully recover from the pandemic, are being cautious about moving ahead with expansions or new ventures. And for those that have the confidence to move forward, the current workforce crisis is keeping them from doing so.

Indeed, Worden said the current labor market is affecting activity in commercial lending. “We have businesses that can’t take on all the jobs they want because they don’t have enough staff to get them done.”

Moriarty agreed, but spoke optimistically about the prospects for improvement when people return to the workforce in large numbers. “Once our businesses can hire the staff they need and expand their products and services, they may look to the banks to borrow and grow.”

The surge in deposits and frustrating inability to put much of them to work has been one of many stories to unfold during what has been a challenging — and very different — year for area banks.

They all played a key role in helping businesses apply for PPP loans when they became available last spring. During two rounds of PPP loan offerings, Moriarty said, Monson Savings processed 565 loans totaling nearly $50 million.

In the early days of the pandemic, qualifications for PPP loans included every small business that was affected by COVID-19. Tom Senecal, president and CEO of PeoplesBank, said many applied because they didn’t know if they were going to be impacted.

“It’s good for consumers to increase their savings and their capacity to have money, but it also slows down the economy. We believe there is still some pent-up rebound spending by both consumers and businesses that we will be seeing.”

“There were many businesses that thought they were going to be hit hard but really weren’t,” he noted, giving an example of construction companies that were closed early in the pandemic but were then designated as essential and allowed to reopen.

Worden added that many companies that received PPP loans in the first round didn’t touch the money until it became clear their loan would be forgiven by the government. Once they figured out how to get loan forgiveness, they didn’t sit on the next round.

“We’ve had around 96% of our first- and second-round PPP loans forgiven with no denials,” he said. “The only ones who haven’t been forgiven have all started the process.”

All the bankers who spoke with BusinessWest said they were grateful to process PPP loans for area businesses. Worden said the urgency to get the first-round applications done required an “all hands on deck” approach that brought in many outside the loan department. His story reflects similar efforts from the other banks.

Dan Moriarty says the pandemic changed people’s spending patterns, which may not be good for the overall economy.

Another dominant story during the pandemic was the real-estate boom, driven in part by record-low interest rates. Moriarty said activity on the buying and selling side has been brisk for some time. “We’ve seen a lot of activity where people are moving into a new house or buying a second home, whether it’s for vacation or an investment.”

The low interest rates have also brought a significant increase in people looking to refinance their mortgage.

“While it’s smart for people to refinance their current debt to get a lower rate, it doesn’t necessarily create new funds for the bank,” Worden said.

In early 2020, Monson Savings opened a new branch in East Longmeadow to increase its access to more companies and consumers. Moriarty admitted he had some anxiety about the timing.

“We made the decision back when no one predicted the pandemic would last so long,” he said, noting that, after a soft opening in August 2020, the branch has performed far above its forecasted numbers. “We’ve seen deposits increase 40% to 50% from when we opened.”

Bottom Line

All the bankers we talked with agreed the next three to six months will give everyone a better idea of where the economy, COVID, and the prospects for area banks are headed.

“I think we need to focus on getting through these next few months, and let’s get through the Delta variant,” Worden said. “We all have short-range goals, but we’re also keeping our eye on the long range.”

And that long-range forecast will hopefully call for taking that surge in deposits and putting it to work in ways that will bolster the local economy.