Liberty Bank Continues Expansion into Western Mass.

Moving North

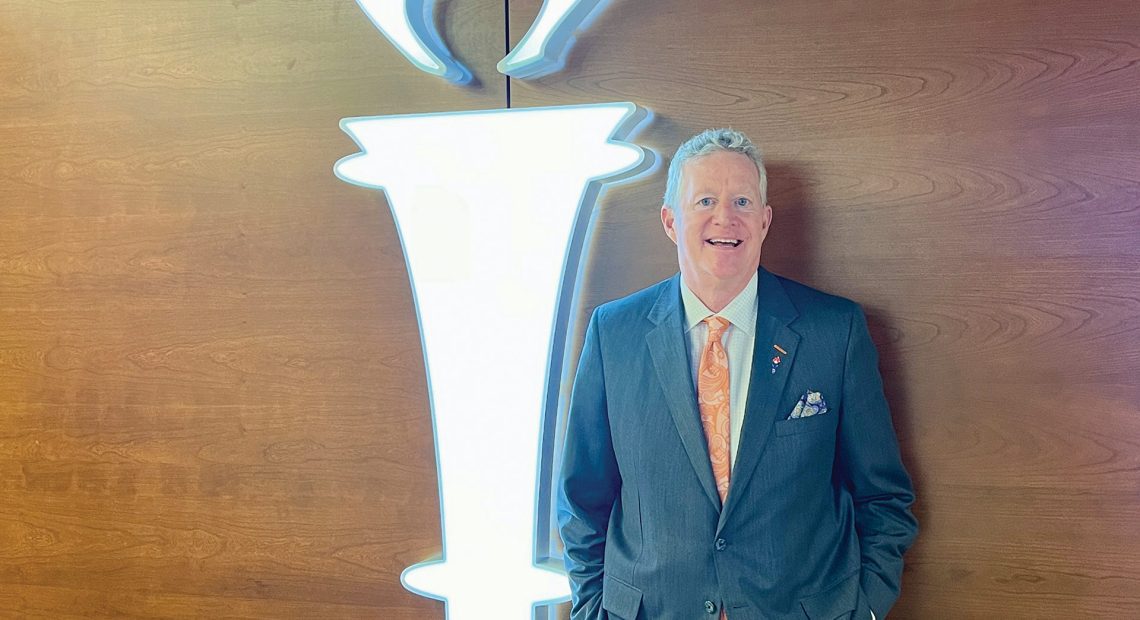

President Dave Glidden

Dave Glidden has long referred to it as the “I-91 corridor strategy.”

This is the growth plan for Middletown, Conn.-based Liberty Bank, one that, as the name suggests, focuses on the I-91 corridor, which stretches from New Haven into Southern Vermont.

The bank has followed that strategy, increasing its presence in Southern Conn., and now Western Mass. as well, taking another important step in what could be called its northward advance with the opening last month of its first branch in this region — on Shaker Road in East Longmeadow, just a few miles from the state line.

The facility, a former United Cooperative and then PeoplesUnited branch, was home to a commercial loan-production office that Liberty opened in 2021 and eventually moved to the 23rd floor of Monarch Place in downtown Springfield — after that LPO gave Liberty a foothold of sorts and convinced Glidden, the bank’s president, and other members of his leadership team that it was time to open a full-service branch in the 413.

“We generated a lot of volume and a lot of new customers out of there, and some good deposits,” he said. “When it got to that point, I said, ‘OK … we’ve proven that there’s space and a place for us in this market,’ and that’s when I decided to move the commercial-lending team and their support staff to Monarch Place and tear down the sheetrock and outfit a nice branch on Shaker Road.”

“We are selectively and cautiously considering where to go next. We don’t have to be in a rush, but I can see a total of maybe three to six branches over the next few years — if the right opportunities present themselves.”

With that move, the logical questions — and Glidden was ready for them — is where will the bank go next within the 413, and when?

“We are selectively and cautiously considering where to go next,” he told BusinessWest. “We don’t have to be in a rush, but I can see a total of maybe three to six branches over the next few years — if the right opportunities present themselves.

“I wouldn’t force the issue,” he went on, saying there is no firm timetable and no specific number of locations as a firm goal. “Maybe three to six branches, strategically located, with drive-thrus, with the focus on catering to small to medium-sized business owners. That’s our future plan.”

How this plan shakes out remains to be seen, obviously, and we’ll delve more into where the Liberty name and logo might appear next. For now, the bank wants to continue solidifying its beachhead and take the I-91 corridor strategy to different corners of the 413.

For this issue and its focus on banking and financial services, BusinessWest talked with Glidden about the next possible steps with this strategy and how the drive north will unfold.

Points of Interest

Glidden laughed when he noted that, when people tell him they see the bank’s TV commercials — “the ones with the emu and that guy with the mustache” — he no longer makes the effort to correct them and inform them that those are for the insurance giant Liberty Mutual.

“Why bother — what am I fighting it for?” he asked rhetorically, adding quickly that the last four words of each of those frequently, as in frequently, aired spots — ‘Liberty, Liberty, Liberty … Liberty’ — constitute solid name recognition that he doesn’t have to pay for. “Every time I see that commercial, I’m cheering; people come up to me and say, ‘I saw your commercial.’ I just say, ‘thank you; let me open a checking account for you.’”

Bank employees and elected officials cut the ceremonial ribbon last month on Liberty Bank’s East Longmeadow branch.

This form of free advertising, if you will, is just one of many things that have gone well for Liberty over the past several years. In fact, Glidden said 2023 may be the bank’s third straight year of record profits, though the final numbers are not yet in.

But even if it’s not a record, the bank is maintaining a strong upward trajectory, which it owes to several factors, but especially its aggressive I-91 corridor strategy and the qualities needed to carry it out and gain market share across that wide area.

Elaborating, Glidden said the bank has several advantages, from a name that resonates and crosses state lines easily to a broad portfolio of products on both the commercial and consumer sides of the ledger; from a commitment to the latest digital technology to an attractive size.

Indeed, with more than $7 billion in assets and 56 locations in Connecticut and two in the Bay State, Liberty, the oldest mutual bank in the country, can “out-local the national banks and out-national the local banks,” said Glidden, a native of Holyoke who is well-known in this region and has long considered Western Mass. the next logical area of expansion for the bank.

“We can deliver a balance sheet that’s going to be large enough for 99.9% of the companies up there to grow to whatever they want to be,” he said, adding that this size, coupled with lenders who know and hail from Western Mass., has enabled Liberty to make solid inroads in the local market and presents opportunities to gain market share in this region.

And many changes to the banking landscape, but especially the advent and continued evolution of digital platforms and mobile apps, make it easier to cross state lines, he went on.

“The habits of consumers and small businesses, what they’re looking for from a bank, are not the same as they were 15 years ago.”

“The habits of consumers and small businesses, what they’re looking for from a bank, are not the same as they were 15 years ago,” Glidden explained. “Do they want to know that their bank has a branch so that, if there’s an issue, they can go in and sit with someone and get advice? Yes. But, across the board, transactions and visitations to branches continue to decline, and that decline is not projected to slow down any time soon.

“And that kind of changes the playing field in the sense of being able to go over the line with maybe a toe in the market,” he continued. “If this was 10 to 15 years ago, and I made the decision that I wanted Liberty to go into Western Massachusetts and compete, I probably would have looked to do it through an acquisition strategy. That doesn’t mean that acquisition strategies are off the table, but you don’t have to do that now with digital and mobile apps.”

By All Accounts

As for the growth strategy in the 413, Glidden said that, as with the initial thrust into the region in East Longmeadow, the focus — the ‘macro strategy for this market,” as he called it — is an emphasis on small business and commercial lending, realms that build customers, relationships, deposits, and more, and cement the need for additional branches.

This was the strategy followed in New Haven, where the bank established an LPO, and again in Hartford. And it is the same strategy being deployed north of the border in Greater Springfield.

As he scans the Western Mass. landscape — and, again, he knows it well from his years as regional president at TD Bank — Glidden acknowledged that Western Mass., is, by and large, a no-growth area. And most of its communities — and East Longmeadow is squarely in this category — are considered overbanked.

But there are opportunities, he noted, adding that his team is looking at maps and crunching numbers as they consider where to go next.

There are what would be considered obvious landing spots, he said, mentioning larger population and commercial centers such as West Springfield, Holyoke, Chicopee, and Westfield, and these may well be the next push pins on the wall map.

“The analytics you use on this stuff gets so complicated … sometimes you need to just take a step back and say, ‘where are all the people, and where are all the businesses?’” he said. “And just put them there.”

‘There’ probably doesn’t mean Hampshire County, at least not at this time, he went on, adding quickly that he certainly wouldn’t rule out putting a branch in a community like South Hadley, which borders Holyoke, Chicopee, and Amherst, and is another of those ‘overbanked’ communities in Western Mass.

“Right now, we’ve had success on the commercial and small-business side; let’s look at Greater Springfield and the surrounding communities,” he told BusinessWest. “If Springfield is the hub, then look at the spokes around there and find the right places to sprinkle a few more branches to service our growing customer base there.”

As he looks ahead, Glidden isn’t expecting another record year when it comes to profitability for Liberty Bank.

Indeed, while 2023 was a very strong year, the pace of growth started to slow during the third and fourth quarters, and this trend will, in all likelihood, continue in the year ahead.

But what will also continue is implementation of the bank’s I-91 corridor strategy, one that has seen Liberty makes its first moves in the Western Mass. market and establish a foothold.

The goal for 2024 and the years to follow will be to strengthen that hold and take the brand to different communities across the region. Just where, when, and how the next steps will take place remain to be seen, but one thing is clear: Liberty’s march north is just getting started.