Paul Silva Has Not Just One New Startup, but Two of Them

Venturing Forth

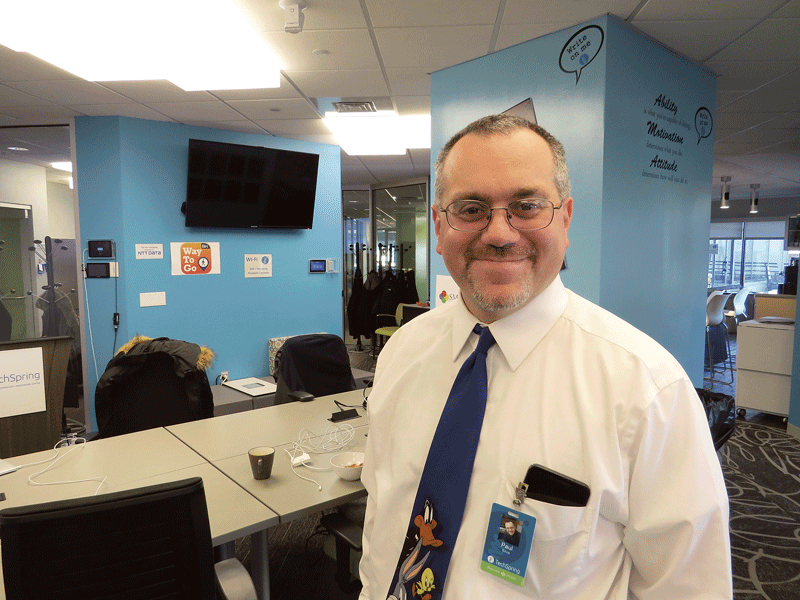

Paul Silva says Launch413 one of two new startups he has launched himself, will fill a recognized gap in the region’s entrepreneurial ecosystem.

Paul Silva uses the word ‘retired’ when he references his departure (at least as a full-time employee) from Valley Venture Mentors (VVM), the groundbreaking nonprofit he co-founded to assist startups and next-stage companies.

And he acknowledged that he gets some strange looks when he does, not simply because he’s only 40 — and people that age usually aren’t retired from anything other than professional sports — but also because they can’t fathom why he would leave the organization he has helped lead to great success.

As for that word ‘retire,’ he said it sounds better than most all of the alternatives he could use, like ‘moved on,’ or ‘left,’ or even ‘transitioned from,’ all of which, or at least the first two, have largely negative connotations, at least in his opinion.

“Unfortunately, we really don’t have a good word for when you hand your startup off to the next group of people,” he explained. “Maybe someone will come with one; I’m open to suggestions.”

Meanwhile, as to why he retired, that will take a lot longer to explain. There is a short answer — that he considers doing so beneficial for him (ultimately), VVM, and the region as a whole — but one couldn’t possibly leave it at that. One would need to explain why that’s the case, and we’ll do most of that in a bit.

First, though, we’ll get to that ‘better for the region’ part.

In short, Silva said he can now focus his efforts — or a good portion of them, anyway, because his time will now be split in a number of ways — on filling what he called the next “gap” in the region’s entrepreneurial ecosystem.

That would be the one between organizations like VVM and the services they provide, and investing groups like the one Silva leads, River Valley Investors (RVI).

“For the past three years, VVM has been kicking ass at graduating startups, and good ones,” he explained. “And they come to my angel group and…”

His voice tailed off a bit as he noted that some come to angel investors ready, willing, and able to get to the next stage, and thus have relatively little trouble gaining all-important financial backing. Many others are willing, but not exactly ready or able. And this is where Launch413 comes in.

“Most early-stage investors don’t want to pay for the entrepreneur’s education in the many aspects of running a business, like selling and financials,” he explained. “So they don’t know how to operationalize and execute their business model. They graduate from VVM with a great business model, with evidence that it’s the right business, but they’re often missing great chunks of skills on how to get there; Launch413 parachutes in and fills the gap.”

But such skydiving will only fill part of Silva’s calendar. Indeed, as noted earlier, he is splitting his time between a number of different endeavors, including not one, but two new startups.

You have to know what your strengths and weaknesses are professionally. I know what I love to do; I love to teach and work with the entrepreneurs, and I’m really good at that. To be the CEO of an organization that’s scaling up is a very different set of skills.”

“I’m a glutton for punishment,” he said, adding that the second is called the Lean Innovation Institute (LII).

In simple terms, this initiative is an adaptation, and expansion, of VVM’s manufacturing accelerator, initiated last year, but orphaned by that agency (Silva’s word) because it didn’t exactly meld with its mission.

Sensing an opportunity, he essentially took ownership of that initiative with the intention of selling it to a host of sectors. And he’s already making headway with one he didn’t exactly expect — nonprofits, as we’ll see later.

The new adventures of Paul Silva — yes, he’s the one who wears the ties patterned with the likenesses of cartoon characters — are all spelled out on the back of his new business card — if you should happen to get one and have the time to read everything on it.

On the front, it declares he’s a startup advisor, angel-group leader, and innovation accelerator. For this issue and its focus on entrepreneurship, BusinessWest talked with Silva about those various talents and how he’s developed them into his own intriguing startups.

In Good Company

Getting back to why he was phased out of VVM at his request — that’s another way he phrased what’s happened — Silva said it’s beneficial for VVM because the agency is growing, expanding, and moving in new directions, and he is not exactly suited to lead an agency at that stage. By retiring, others more suited to that work can step in, he said, mentioning Liz Roberts, VVM’s CEO, by name.

As to why it’s better for him … well, if he stayed in a role he wasn’t really suited for, he said he wouldn’t enjoy it much, if at all.

“You have to know what your strengths and weaknesses are professionally,” he told BusinessWest. “I know what I love to do; I love to teach and work with the entrepreneurs, and I’m really good at that. To be the CEO of an organization that’s scaling up is a very different set of skills.

“I knew I had reached my limit,” he went on. “And if I wanted VVM to keep growing, either it was going to grow slower while I learned, or it could grow faster with Liz, who had already been there, done that, and been successful. And even if I could learn, I don’t think I would like it.”

So, after some due diligence and explaining to people that he was soon to be a ‘free agent,’ as he put it, Silva moved on to some things he does like.

Such as the broad mission of Launch413.

That name pretty much says it all — it’s focused on helping companies in Western Mass. get well off the ground — but its method of operation needs some explaining.

Working with several venture partners, Silva will parachute in, as he put it, and act as a venture fund in many ways, but the investment is in time and expertise, not dollars. In exchange for those investments, Launch413 gets a piece of the company’s future revenue.

This concept is called royalty financing, and while not exactly new, it has been gaining traction in recent years. That’s because entrepreneurs don’t want to give up a piece of their business, as in equity financing, but are more willing to part with a percentage of future revenues.

But royalty financing has benefits for both sides in this equation, especially in a smaller market like Western Mass., Silva explained.

“If I take equity in a company, the only way I get paid is if the company sells,” he said, adding quickly that there are other ways investors can reap dividends in such cases, but the company in question would have to be doing very well. “With a royalty deal, my incentive is in line with helping the company succeed; if they make money, I’ll get paid faster.”

Launch413 is currently working with one company, and Silva expects to soon be working on a batch of up to four. He will limit the number and start small, he said, to learn about what works and what doesn’t.

“We’ll figure out how much larger we can make the batches over time,” he said, adding that, given the great amount of entrepreneurial energy in the region, he expects Launch413 to flourish.

As for LII, as noted earlier, it is solidly based on VVM’s manufacturing accelerator, which was different from a traditional accelerator in that it focused on established companies rather than those just getting off the ground, which is why it became a business opportunity for Silva.

“VVM wants to focus on startups, which makes sense, because one of the great dangers with nonprofits is mission creep and losing focus,” he explained.

But the manufacturing accelerator was very similar to the traditional model in the way it prompted participants to identify who their customers were, what they wanted and needed, and how this should drive change moving forward.

And the LII (so named because it will hopefully involve companies in all sectors) will do all of the above with established entities, including a constituency Silva wasn’t exactly expecting when he launched: nonprofits.

He’s working with one at present — Pathlight, formerly the Assoc. for Community Living — and running pretty much the same curriculum put to use with the manufacturers at VVM.

Elaborating, Silva said Pathlight, which helps intellectually disabled individuals lead full and productive lives, developed a curriculum to help it meet that mission, one that could be adopted by other nonprofits doing similar work.

“They see this as an opportunity to create revenue from something they built that would help further their mission,” he explained, adding that the accelerator he’s running is focused on developing and maximizing this opportunity — one that amounts to a startup business.

“It looks like we have something that might make a difference here,” he went on, adding that he believes there is potential to add many more nonprofits to the portfolio moving forward because of changing dynamics within that sector, which has a huge presence in this region.

“The competitive pressure to raise grant dollars is intense,” he explained, “especially because Western Mass. has more nonprofits than just about anywhere else. So they need to find new ways of generating revenue; they need to think differently and in more innovative ways. It’s shocking how many of them don’t actually think about their customers and what they really need because they believe they know already.”

Meanwhile, he’s had discussions with Ira Bryck, director of the Family Business Center of Western Mass., about possibly running similar accelerators for groups of that agency’s members.

Overall, he said his business plan, like LII’s website, is very much a work in progress because, at the moment, he’s busy practicing what he preaches — meaning he’s figuring out who his potential customers are and what they want.

“If you asked me a year ago if nonprofits would be excited by this curriculum, I would have said ‘no,’” he explained. “But it turns out, among the sectors I’ve talked to, nonprofits are the most excited about this.”

Transition Game

Summing up the many changes in his life, career-wise at least, over the past several months, Silva acknowledged that he has taken a fairly sizable risk when it comes to leaving the steady employment provided by VVM.

But with the blessing of his wife — “she said, ‘this is the right thing for VVM; I’m proud of you’” — he gladly accepted that risk and moved on to something different and, in his opinion, at least equally rewarding, only in different ways.

This is what entrepreneurs do, and anyone who knows Silva is quick to grasp that he not only mentors and motivates such individuals; he is one himself.

George O’Brien can be reached at [email protected]