Striking Results

Jasmine Kerrissey acknowledged that, when it comes to labor and business management, it’s difficult, but not impossible, to chart who’s winning and losing the various types of skirmishes between the two sides and post standings, as they do in sports.

But if they did … labor would be enjoying a sizable lead in the standings as this year comes to a close.

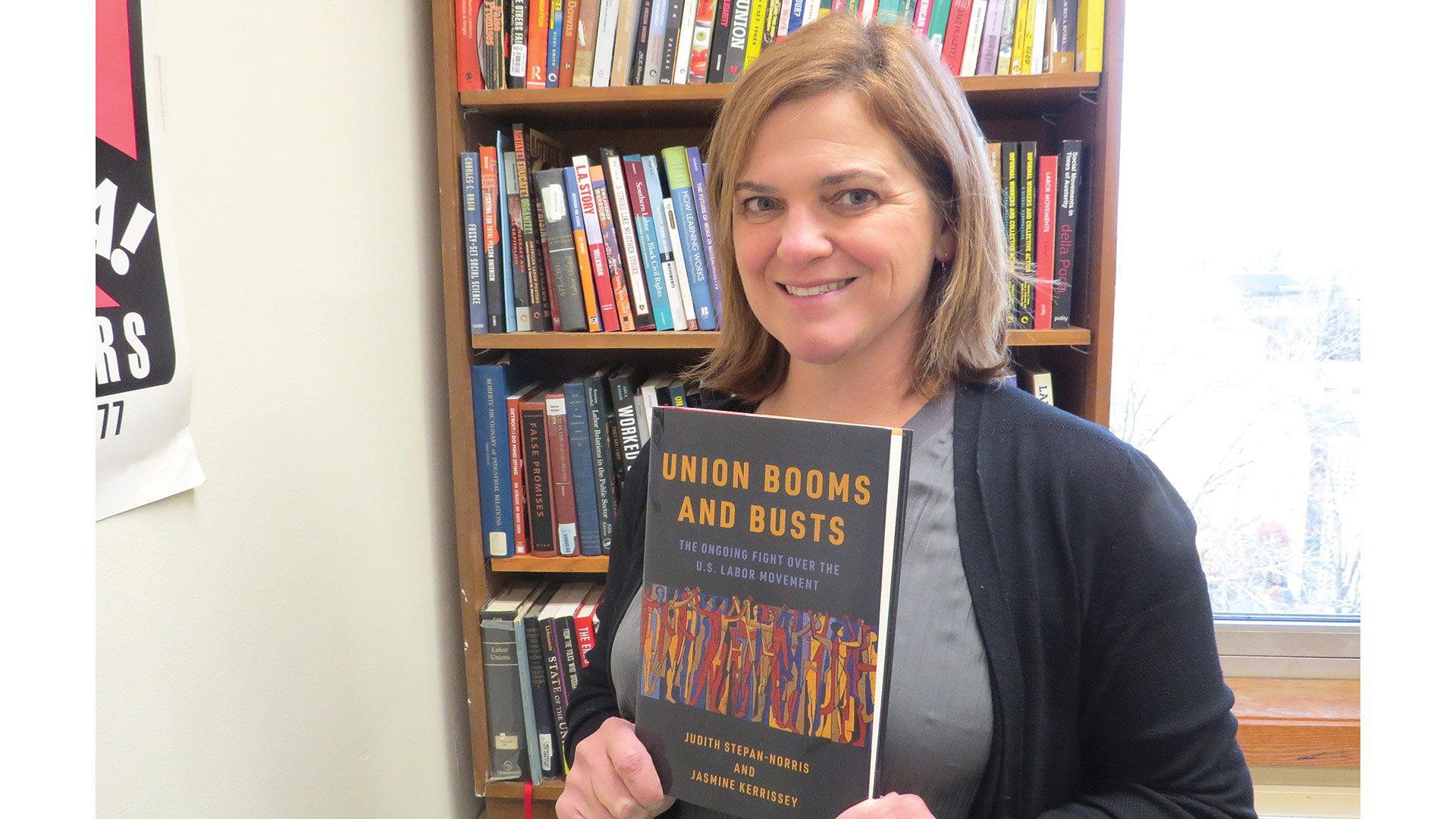

Indeed, there have been some recent — and significant — wins for the labor movement in this country, said Kerrissey, associate professor of Sociology and director of the UMass Labor Center, and co-author of the recently released book Union Booms and Busts: The Ongoing Fight Over the U.S. Labor Movement. She cited recent strikes involving United Auto Workers (UAW), who won 25% wage gains from Ford, General Motors, and Stellantis; employees at UPS; and TV and film actors and writers, among others, as well as union campaigns at large employers such as Amazon, Starbucks, REI, and Trader Joe’s.

In a word, labor is enjoying a large dose of momentum and one of the most pronounced ‘booms’ in recent times, she said.

“The number of strikes, and the number of new types of elections and new union organizing, is much higher than it’s been in the last several decades,” Kerrissey noted. “And many of those elections and strikes are being won by workers.

“Momentum is really important,” she went on. “And we should never underestimate momentum; when other workers see other workers winning, it’s really powerful, and it inspires others to think that they might be able to do the same.”

“Momentum is really important. And we should never underestimate momentum; when other workers see other workers winning, it’s really powerful, and it inspires others to think that they might be able to do the same.”

This momentum was perhaps best exemplified in early September when President Biden joined the UAW picket line at a General Motors plant in Michigan — the first time in U.S. history that a sitting president had done so. (Presidents have traditionally worked to broker deals, not take sides in labor disputes.)

Wearing a UAW cap and toting a bullhorn, Biden said of automakers’ profits after receiving federal assistance, “now they’re doing incredibly well. And guess what — you should be doing incredibly well, too.”

Such sentiments, the notion that workers should be doing as well as the CEOs running these large corporations, are at the heart of labor’s recent surge, said Tanzania Cannon-Eckerle, a labor attorney at the Springfield-based Royal Law Firm, who represents businesses in such matters.

Jasmine Kerrissey says labor is enjoying some real momentum in 2023, especially though victories in several recent, high-profile strikes.

Elaborating, she said that, while the 25% wage hikes won by the auto workers during their month-long strike are certainly an aberration, such a figure emboldens workers in other industries and instills what she called “overexaggerated fear” among employers, including those in the 413.

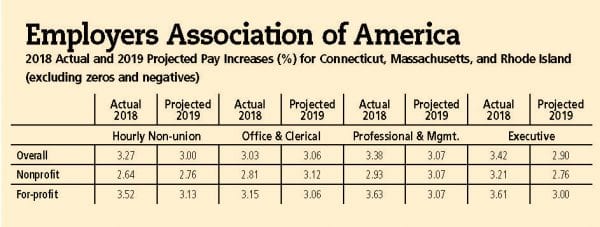

“Those numbers are extraordinary,” she said. “Usually, when you see these union pay increases, we’re talking 3% to 8%, with 8% being the max. These 25% increases … I honestly don’t think we have that to fear locally, but … there is that public sentiment.”

Indeed, workers are further emboldened by seemingly endless headlines concerning the salaries of CEOs — and by the ongoing workforce crunch that is impacting virtually every sector of the economy, putting a premium on retention of talent.

“With the tight labor market, people can’t find workers — people don’t want to do the traditional jobs anymore,” Cannon-Eckerle said. “Employers need employees, so they do have that leverage, that bargaining power. And with this crunch being in the public, workers know it, and they feel it.”

Meanwhile, the National Labor Relations Board (NLRB) recently announced new union election rules and issued six significant union- and employee-favorable decisions that, among other things, make it easier for unions to gain the right to represent employees, redefine the standard for what constitutes concerted activity subject to protection under the NLRB, and substantially heighten employers’ collective-bargaining obligations.

“The NLRB has also shortened the period from election time to when to when it actually happens, so it can come hard, and it can come fast. You have one upset employee that you’re tiptoeing around, and before you know it, you have someone who’s asked for there to be a union election, and within 14 days, it’s happening. That’s scary for employers, and it should be.”

“The NLRB has also shortened the period from election time to when to when it actually happens, so it can come hard, and it can come fast,” Cannon-Eckerle added. “You have one upset employee that you’re tiptoeing around, and before you know it, you have someone who’s asked for there to be a union election, and within 14 days, it’s happening. That’s scary for employers, and it should be.”

For this issue and its focus on workforce and education, BusinessWest looks at the momentum that labor is enjoying at present, what it means, and what might come next.

Labor Gains

What labor is enjoying now would certainly qualify as a boom, said Kerrissey, who told BusinessWest there have been a number of upsurges and periods of retraction since 1900, the period studied for her book, co-written with Judith Stephan-Norris, professor emerita in the Department of Sociology at the University of California Irvine.

That book was essentially finished before the pandemic, she said, adding that the scene has changed dramatically since it was sent it to the printer.

“When we were writing this book, it was hard to imagine that we would be in a boom period like this, but here we are,” she said. “It has been great timing for this book, and it’s been really exciting to apply some of the historical lessons to the present day.”

Tanzania Cannon-Eckerle says that, in the current labor climate, the best quality employers can display is transparency.

Kerrissey said booms are defined by momentum on several different fronts. Successful strikes — with success meaning that workers were able to win all or most of what they were asking for when they went to the picket lines — are easily the most visible.

And there have been many of those over this past year and in many different industries, said Kerrissey, citing the UAW strike, the averted UPS strike — a settlement that was reached gave more than 300,000 workers represented by the Teamsters significant wage hikes and new minimums — and the new contracts won by actors and screenwriters. But there have also been “successful” strikes in healthcare — In October, Kaiser Permanente struck a deal with a coalition of unions granting them 21% wage increases over the next four years — and many teacher strikes, including several in Massachusetts, that have garnered higher wages, especially for paraprofessionals.

But momentum is visible in other fronts as well, Kerrissey said, including what she called a “wave” of new union organizing over the past few years, elections that go through the National Labor Relations Board.

“These have stood out, both because it’s more workers doing these elections, but it’s also in industries that have typically not had a lot of union presence,” she said, listing the action at Starbucks as both the most visible and impactful example of such movement, with more than 300 locations across the country now unionized and the total of represented workers approaching 10,000.

But there have been others as well, including Trader Joe’s, Amazon, Chipotle, and REI, the camping and outdoor sports equipment retailer.

“That’s a real shift to have those types of elections in industries that have long been non-union,” Kerrissey told BusinessWest, adding quickly that workers in those industries, while now unionized, have mostly had a difficult time bringing companies to the table to negotiate.

“The bottom line is … if workers are happy, they’re not going to strike. If your employees are happy, they don’t feel like they need to organize. Usually, it’s one or two people that are upset about something and start to gather their forces, and they start nodding their heads and say, ‘yeah, you’re right, we do deserve more.’”

And while some numbers are trending upward, she went on, overall union representation is relatively flat, if not actually declining.

Indeed, according to the NLRB, union petitions increased 3% in fiscal 2023 compared to 2022, with 2022 seeing a 53% increase in union election petitions from the previous year. However, U.S. union membership declined to 10.1% in 2022 from 10.3% in 2021, the lowest on record, according to the Bureau of Labor Statistics. Although the number of workers belonging to unions increased by 273,000 workers to 14.3 million in 2022, the total number of workers in the U.S. workforce grew by 5.3 million, resulting in the drop in union density.

Those numbers show that, while labor is enjoying momentum, there is still room for more improvement, Kerrissey said.

“The next big hurdle is making the playing field more even for working people, and that comes down to labor policy,” she said. “The labor policy we have in this country is antiquated, and it’s been hard to change; the basic structure is still from the 1930s. But work has changed a lot since then.”

“It’s been quite difficult to make an updated, 21st-century labor policy,” she went on. “And I think some of the strikes are in reaction to that — there are few alternatives.”

Meanwhile, it’s difficult to project what will happen short- and long-term.

“It’s hard to make predictions,” she said. “Historically, when workers are striking and winning, union membership also surges — those two things are correlated. But it’s really hard to look too far into the future.”

Labor Pains

While long-term projections may be cloudy, Cannon-Eckerle said it’s rather easy to look short-term and see a time (it’s already here, actually) when it is much easier for unions to gain the right to represent employees, and for an election to come much more quickly.

Indeed, as she recapped the changes made by the NLRB in September, she said they have the potential to be as impactful as any of the recent strikes and could cause some real anxiety among employers.

The NLRB decisions, which came down in one hectic week in late August, bring significant changes to the landscape and essentially enable unions to get faster elections, make it easier to show that individual employee comments or actions constitute concerted activity, and limit past practice as a justification for unilateral changes, she explained, adding that these are all clear wins for employees and unions.

Summing them all up, Cannon-Eckerle said, “my clients are afraid — and they should be. They don’t know what they’re allowed to say or not allowed to say; there’s a gray line about whether you can actually say something to somebody, even if they’re being disruptive to the workplace.

“The fear is, ‘am I not going to be able to police the conduct of my employees, because they’re essentially allowed to say and do whatever they want?’” she went on. “And it just takes that one really upset or really vocal employee to create that pre-storm, if you will.”

That pre-storm is the series of events that can lead to a union election, she said, adding that the NLRB decisions can bring one about faster and more easily than perhaps ever before. In essence, the new rule resurrects what was known as the ‘ambush election’ process, which inhibits employers’ ability to educate their workforces about union representation and adequately prepare for union elections — hence the term.

In such a climate, businesses large and small should be focused on transparency, she said, adding quickly that this doesn’t necessarily mean wide-open books but does mean being open and honest about the financial big picture and a detailed explanation of revenues and expenses.

“If you explain to your workforce, ‘here’s what our budget is, and here’s the cost of each employee,’” she began, noting that this means the full cost of each employee, meaning salary, benefits, training, and more. “Most employees don’t know that; they understand budgets, and they understand what it costs to run their households, most likely, but they don’t fully understand everything that goes into charging $7 for a cup of coffee.”

Overall, Cannon-Eckerle said, business owners and managers should do what they can to impress upon workers that they are valued and heard when it comes to the issues that impact them, meaning everything from wages to working conditions to flexibility around where people work.

“The bottom line is … if workers are happy, they’re not going to strike,” she noted. “If your employees are happy, they don’t feel like they need to organize. Usually, it’s one or two people that are upset about something and start to gather their forces, and they start nodding their heads and say, ‘yeah, you’re right, we do deserve more.’

“The way to control that, first of all, is to right your ship; you have to make sure that your house is in order at your company,” she went on. “If it’s not, maybe there’s justification for the union cozying up to the workforce.”

While salary is still the most important aspect of a job for most, a new survey from the

While salary is still the most important aspect of a job for most, a new survey from the

That’s because the elaborate board was crafted by students at

That’s because the elaborate board was crafted by students at

It took almost two years, but Massachusetts regulators have finally started to issue licenses to businesses looking to grow, manufacture, distribute, and sell recreational marijuana products in the Commonwealth.

It took almost two years, but Massachusetts regulators have finally started to issue licenses to businesses looking to grow, manufacture, distribute, and sell recreational marijuana products in the Commonwealth.