Hazen Paper Co.

This Family Business Has Been Innovating for Nearly a Century

President and CEO John Hazen

John Hazen figured there was some risk in purchasing his first holographic printer back in 2005. But, as the third-generation co-owner of Hazen Paper Co. in Holyoke, he also saw the potential.

“I always say I was like Jack and the beanstalk,” he told BusinessWest. “Dad sent me out with a bag of beans — ‘grow the business, son!’ — and I bought this crazy thing called a holoprinter.”

But he was determined to build Hazen’s footprint in the world of holographic printing, and plenty of other technology at the company sprung from that first investment.

These days, Hazen regularly wins awards from the Assoc. of International Metallizers, Coaters and Laminators for everything from beverage packaging to annual programs for the Basketball Hall of Fame induction ceremonies and the Super Bowl. The 200-employee company has also been recognized for workforce-development efforts like an internship program with Western New England University that helps engineering students gain experience.

Clearly, Hazen Paper has come a long way from its origins in 1925, when Hazen’s grandfather, also named John, launched the enterprise as a decorative paper converter and embosser. His younger brother, Ted, joined Hazen in 1928 to help manage the growing company, which grew rapidly in the 1930s and expanded into printing and foil laminating by the 1940s.

Ted’s son, Bob, joined the company in 1957, and John’s son, Tom, signed on in 1960, and the second generation dramatically expanded the company, which became known worldwide for specializing in foil and film lamination, gravure printing, specialty coating, and rotary embossing. Hazen products became widely used in luxury packaging, lottery and other security tickets, tags and labels, cards and cover stocks, as well as photo and fine-art mounting.

The third-generation owners, John and Robert Hazen, joined the company at the start of the 1990s, and have continued to grow and expand, with a special emphasis on coating, metallizing, and — of course — holographic technology.

“It really was a startup, a technology startup in an older company. And ultimately, we really reinvented Hazen Paper,” John told BusinessWest. “The holographic technology ended up feeding the old business. So it’s like we installed a new heart in an old body.”

—Joseph Bednar

Crave

Nicole Ortiz Has Turned a Love of Food into a Growing Enterprise

Owner Nicole Ortiz

Nicole Ortiz was born in Springfield, but became intrigued by food during her four years in Cleveland.

There, she worked her first job in a kitchen, prepping and washing dishes in a small Puerto Rican restaurant, and the city’s West Side Market — filled with fresh foods from all over the world — became her favorite place, where she became captivated with food culture, local ingredients, and … food trucks.

After moving back to New England in 2016, she put her business degree and an itch for entrepreneurship to work, enrolling in the HCC MGM Culinary Arts Center, then winning a pitch contest and setting up a successful pop-up restaurant experience at HCC. She bought a food trailer, graduated from both HCC and EforAll Holyoke, and launched a food-truck business called Crave, specializing in modern Puerto Rican cuisine, all in 2020.

“My father is from Puerto Rico, and my mom’s family is from Italy and Finland,” she said. “I think the food we offer is different and unique, and draws inspiration from the many walks of life that I have had the opportunity to experience.”

Despite opening into the teeth of the pandemic, Crave Food Truck was a big-enough hit that Ortiz started sharing storefront space on High Street with Holyoke Hummus early in 2021, where she could prep meals and sell takeout orders. In June, she solely took over the lease, and Crave had a full-service restaurant, which now offers sit-down and takeout service, in addition to the food-truck operation and catering gigs.

Now managing a staff of eight, Ortiz is proud to be part of an ongoing entrepreneurial renaissance on High Street (see related story on page 36).

“We want to build on that and let people know what’s going on down here. Before, this street had a bad image, and a lot of people didn’t want to come down here. We created a High Street Business Association to look at all the businesses here on High Street and get all of us on the same page, working for a common goal — you know, bringing more people down here. That’s really exciting.”

—Joseph Bednar

Nick’s Nest

Area Residents Relish Visits to This Holyoke Landmark

Co-owner Jenn Chateauneuf

If you’re looking for perhaps the most iconic hot dog this side of Fenway, look no further than Nick’s Nest — a Holyoke landmark since 1921.

What originally started as a simple popcorn cart evolved into the well-known hot dog stand it is today, more than a century later. It started when founder Nick Malfas was told by his wife that the original location looked like a little bird’s nest — and the name ‘Nick’s Nest’ stuck.

The current owners of 18 years are Jenn and Kevin Chateauneuf.

“We always worked in the restaurant business; my husband was a bartender, and I was a waitress,” Jenn said. “We always wanted to venture out and own our own place. I’m from Holyoke, he’s from South Hadley, so obviously we knew of Nick’s Nest. When it came up for sale, we just jumped at the opportunity.”

Nick’s Nest has been at its current location on Northampton Street since 1948, but Jenn and Kevin have since expanded the menu from its original offerings. “Our specialty is hot dogs; when we bought the place, it was hot dogs, baked beans, and popcorn,” she explained. “We’ve added french fries, onion rings, homemade soups … we have homemade potato salad, homemade macaroni salad.”

Nick’s Nest continues to be the area’s go-to destination for hot dogs. In fact, the venerable eatery has won ‘best hot dog’ honors in the Valley Advocate’s reader poll every one of the 18 years the Chateauneufs have owned the restaurant.

In addition to its food offerings, Nick’s Nest has an assortment of branded merchandise including T-shirts and hats that display the name of the establishment along with its slogan — “A Holyoke Tradition” — for patrons to proudly show their love of good food and community.

Though Nick’s Nest has achieved much success over the years, Chateauneuf noted that it hasn’t been without its fair share of trials.

“We try to do a lot for the community because, obviously, they support us,” she said. “They were tremendous through COVID. We’re happy that we’re still standing after those couple of years because a lot of small businesses can’t say that.”

—Elizabeth Sears

Star Dancers Unity

This Business Helps Young People Take Positive Steps

Alex Saldaña has made important moves to improve his community — dance moves, that is.

He’s been the owner and operator of Star Dancers Unity on High Street in Holyoke for the past 10 years. He originally became an enrichment dance instructor for Holyoke Public Schools, which is what inspired him to open his own business.

“I pretty much didn’t know what I was getting myself into,” he said. “But it’s just finding the opportunity — to be able to open a center in our community for youth that can benefit from dance services.”

Saldaña knew he wanted to use his background in dancing for good within the community, and he envisioned a space where area young people could go, noting high rates of teen pregnancy at the time of the studio’s opening.

“My inspiration was to be able to help some of those kids get some different activities besides being on the streets or doing things other than being productive in the community,” he said.

Star Dancers Unity currently has 65 students enrolled, said Saldaña, adding that Holyoke has been a great place to run his growing dance studio.

“The community has been supportive of my business, and also the aspect of understanding that I serve not just the youth but families in povery,” he explained. “I try to keep my tuition in a reasonable price range where it could be affordable to all families.”

As an extension of this work, Saldaña has taught salsa and hip hop for Holyoke Public Schools, and has been a visiting teacher in local afterschool and summer programs throughout the region. Currently, he works as a family coordinator for Holyoke Public Schools.

Star Dancers Unity not only participates in dance competitions, but is involved in many community events as well, from Celebrate Holyoke to performances at Holyoke High School for Hispanic Heritage Month.

“We partner up with different art pageants and do things for the schools,” Saldaña said. “When they have cultural diversity times, we also do presentations there.”

Clearly, by creating a safe, inclusive space, Star Dancers Unity is offering young people much more than dance lessons.

—Elizabeth Sears

Black Rose Trucking

These Two Women Are Hauling a Load of Ambition

Co-owners Yolanda Rodriguez (left) and Ashley Ayala

All Yolanda Rodriguez and Ashley Ayala needed to start a hauling company was … well, a truck. Soon, they will have two. And they’re not stopping there.

That second truck is the result of a successful crowdfunding campaign on Patronicity, bringing in $21,448 from 35 backers, more than their goal of $19,950. It’s an example of growing by thinking outside the box.

“Our long-term goal is to have more equipment and do more transport, which means more employees and growing our company,” said Ayala, the daughter in the mother-daughter ownership team that launched Black Rose Trucking three years ago. “We definitely have big dreams of having a lot of trucks, and being able, in the future, to offer different services than what we do now.”

Rodriguez has been in the commercial trucking industry for a long time, and Ayala eventually caught the bug. “She had a dream of owning her own business,” Ayala said. “She’s passionate about what she’s doing, and that kind of rubbed off on me. So a few years ago, I ended up getting my commercial driver’s license as well. And we decided to make a business out of it. Her dream kind of became my dream.”

COVID-19 delayed the process, and Black Rose didn’t start taking jobs in earnest until early 2021. “We just kept going until everything kind of opened up,” Ayala said.

They haul asphalt and other materials to and from construction sites, as well as doing paving and milling work for contractors and on highway projects, all the while taking pride in their position as women of color in a male-dominated field — and pride in their city as well.

“I was raised in Holyoke, so I see how Holyoke has progressed. And I’ve seen all these small businesses also come about and grow,” Ayala said. “We see these restaurants and other businesses come about that are owned by women of color. You can see every day how they’re progressing, and they’re still around. It’s definitely a nice feeling to be a part of that.”

—Joseph Bednar

Holyoke Sporting Goods

This Venerable Institution Helps Foster Team Spirit

Owner Betsy Frey

Nothing says ‘team spirit’ quite like matching uniforms, and whether you’re on a sports team, a sales team, or even team Gas & Electric, there’s a place in Holyoke to find your team spirit — Holyoke Sporting Goods.

Originally founded in 1928 in downtown Holyoke by James Clary, the company moved to its current location on Dwight Street under current owner and operator Betsy Frey in 2005.

“It’s in a much easier section of town to get to, we’re right off of the highway, which is convenient,” Frey said. “We have our own dedicated parking lot, which is nice, too; you don’t have to park on the street.”

Holyoke Sporting Goods caters not only to sports teams, but to many area businesses. “We do a lot of schools; we sell their sports equipment and their uniforms,” Frey said. “Then we do leagues like Little Leagues — we’ll supply them with all their baseballs, their equipment, their uniforms. I also do a lot of municipal stuff for the city of Holyoke or the city of Springfield, like Holyoke Gas & Electric, Water Works, Housing Authority, all the uniforms that they wear — they’ll wear shirts and stuff with a company logo on them. So we do all that.”

And with St. Patrick’s Day — along with Holyoke’s famous St. Patrick’s Day Parade — right around the corner, look no further than Holyoke Sporting Goods for related merchandise.

“Right now, we’re doing a lot of stuff for St. Patrick’s Day,” Frey said, “so I have a lot of Holyoke stuff with shamrocks and things like that.”

Frey said she enjoys running a business in Holyoke, adding that she gets a real team-spirit feeling from the city.

“Oh, it’s great,” she said. “Holyoke’s a great place to be in business. The people here are extremely supportive; they like to support their local businesses. I sell a lot of stuff in the store that has ‘Holyoke’ on it or is related to Holyoke. The people in Holyoke are wonderful; they support the business. This is a good community to have a business in.”

—Elizabeth Sears

Hadley Printing

For 125 Years, This Holyoke Staple Has Been on a Roll

Owners and brothers Greg (left) and Chris Desrosiers

Hadley Printing has been a family-owned business for 125 years. Currently in its third generation under the direction of brothers Chris and Greg Desrosiers, the commercial printer offers digital printing, offset printing, and mail services to a wide variety of customers in New England.

The business originated in South Hadley, but in 1976, it moved to its current location on Canal Street in Holyoke. When asked about operating a business in the 33,000-square-foot building alongside one of the city’s historic canals, Vice President Greg Desrosiers had a lot to say.

“We’re in an old mill building … it used to be a silk company years and years ago; that’s when it was originated, so we’re kind of in an old silk mill,” he said. “The building itself serves us well — these mill buildings were made really well back in the day; so long as you take care of them, they serve you back really well. Obviously, it has tons of windows with natural light. In a manufacturing setting, that’s really, really welcomed and beneficial.”

Desrosiers noted that many manufacturing settings don’t have any windows to allow natural light to come in, so having the abundant natural light of one of the Holyoke mill buildings is much preferred to the usual dreary setting of four solid walls. The water view of the canal is not only another added bonus for day-to-day working pleasure, but it actually helps with the printing itself — Desrosiers can say with certainty that at least 50% of the company’s power is hydroelectric, but noted the actual percentage is probably much higher than that.

Hadley Printing, with 30 employees working across two shifts, has found another advantage to being located in Holyoke aside from operating out of the former silk mill. The company services customers in Connecticut, Vermont, New Hampshire, the Boston area, and Albany, in addition to local customers, making Holyoke a sweet spot.

“It’s really the crossroads of New England, with 91 and the Mass Pike intersecting right through Holyoke,” he explained. “It’s the center of our customer base. We’re in the middle of who we service.”

—Elizabeth Sears

International Volleyball Hall of Fame

For a Half-century, It Has Lifted Up Its Sport and Its City

Executive Director George Mulry

Honor. Preserve. Promote.

Those three simple words reflect a robust, multi-pronged effort to celebrate the sport of volleyball and secure its future, and George Mulry detailed just a few of those prongs. Or spikes, if you will.

“On the honor side, we certainly recognize the inductees and those worthy of enshrinement in the Hall of Fame,” said Mulry, the Hall’s executive director. “But with some of our awards, we’re recognizing local individuals and organizations that are doing great things, not just for the sport of volleyball, but to help move the Volleyball Hall of Fame forward, which in turn helps move the city of Holyoke forward.

“The preserve side is really where we’re focusing a lot of our time now,” he added. “We have our Archival Preservation and Community Access Project, where we’re going through our entire archive, cataloguing it, and trying to digitize it and make it available as a resource library for the area. That will help bring some scholars in, which will give us an opportunity to improve the exhibits that we have and improve some online exhibits as well.

“And on the promote side, we’re not only trying to promote the growth of volleyball, but we want to promote volleyball itself within our region,” Mulry said, listing events like a summer volleyball festival, the collegiate Morgan Classic tournament at Springfield College, and no-cost youth clinics. “We’re just promoting the sport as a whole, while at the same time promoting the Hall of Fame as that vehicle for telling the story.”

From the Hall’s inception in 1971 to the opening of its current facility on Dwight Street in 1984 through today, with conversations taking place about what a future Hall of Fame might look like, Mulry said Holyoke has always been top of mind.

“For over 50 years, the city has really embraced being the birthplace of volleyball and used that as an economic driver for tourism and economic spinoff,” he explained. “There are a lot of really exciting things going on. But it’s the support that we’ve received from the city of Holyoke that really makes the whole thing go.”

—Joseph Bednar

Valley Blue Sox

This Team Has Become a Summer Tradition in Holyoke

If you visit Holyoke during the summertime, you might catch the Valley Blue Sox in action at Mackenzie Stadium.

The Blue Sox, originally known as the Concord Quarry Dogs, began in New Hampshire but have since rebranded and have called Holyoke their home for more than a decade now. The team is part of the New England College Baseball League, with players coming from all over the U.S. each summer.

“Having a team in Holyoke is great for us; you have a really loyal fan base, the same fans that usually come to a lot of games, so we get to know the same people throughout the summer in the city,” said Tyler Descheneaux, the new general manager. “The community really rallies around it.”

He went on to explain the team’s national impact as well as local significance.

“The purpose of this league is to try and have players that are trying to make it to that next level, to the major leagues, play summer ball,” he explained. “Our league is ranked as one of the top leagues in the entire country for summer leagues — last year, we were number two in the entire country. It’s a highly coveted league, so a lot of MLB scouts or even college scouts will come to our games to see how these players are.”

The team is going to bat with plenty of new promotions this season, including a partnership with Michael’s Bus Lines on a raffle, with one lucky fan winning a free bus ride for 25 people. Additionally, opening weekend will feature a giveaway of shirts to the first 250 fans who come to the game, and these aren’t just any shirts — the team is debuting a new logo this season, and this will be the first chance for fans to sport the team’s new look.

The Blue Sox are actively involved in the community — on and off the field.

“One thing that we do every summer is we always hold different youth baseball clinics, which usually last a week. We always hold one in Holyoke, and that’s coming up,” Descheneaux said.

With so much in store for the team and the community, this summer seems to be shaping up to be a home run.

—Elizabeth Sears

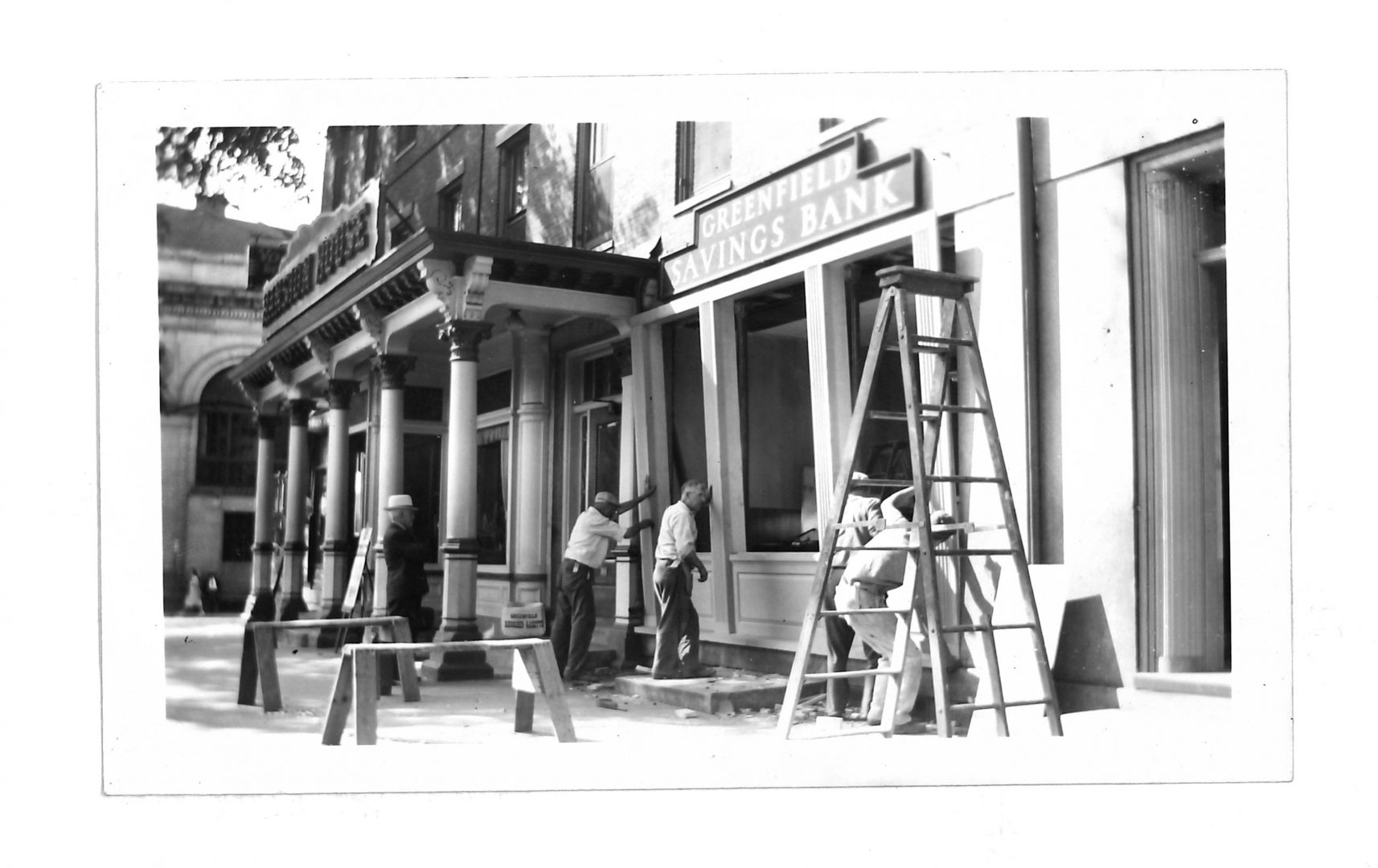

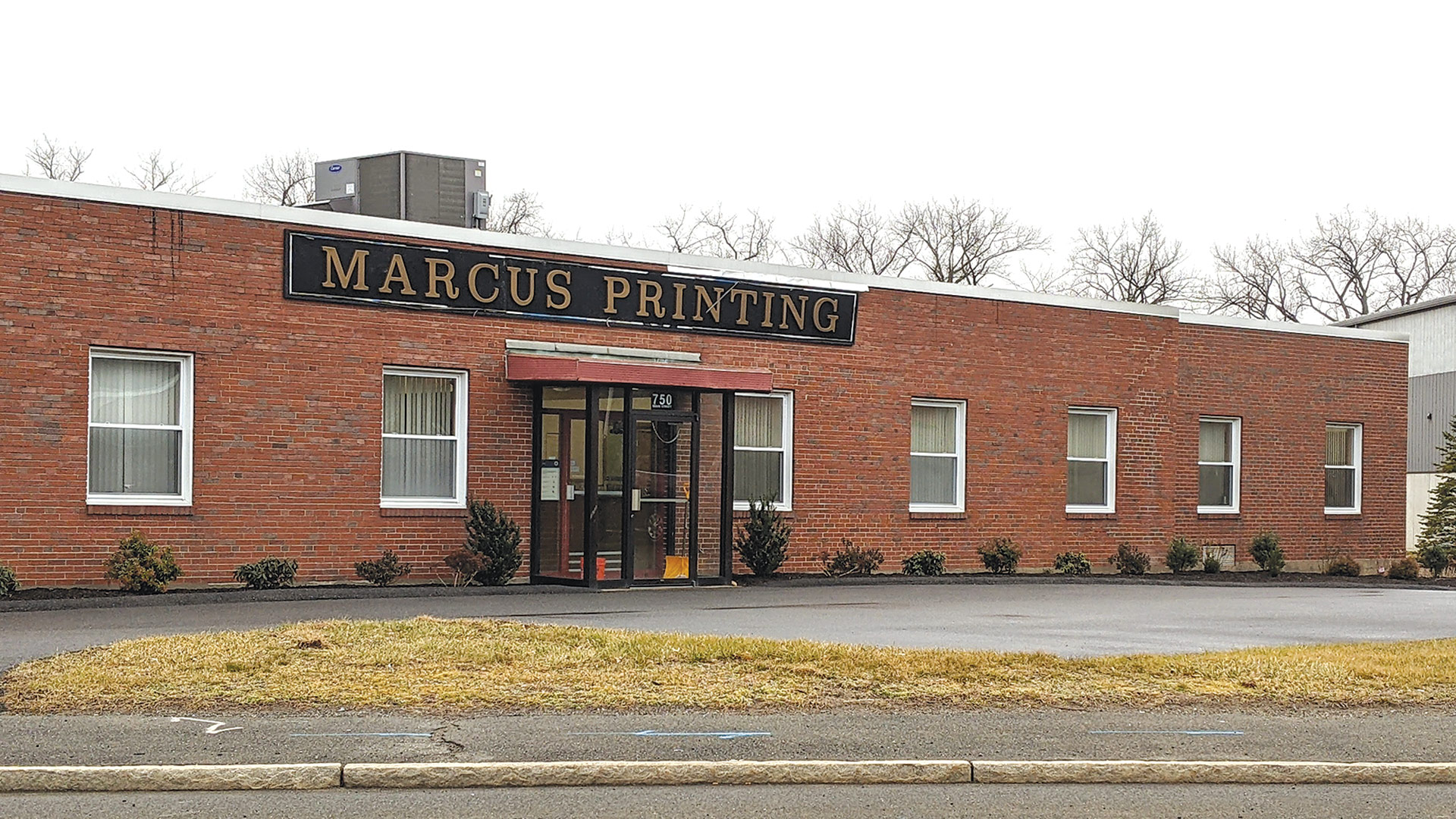

Marcus Printing

For Almost a Century, This Press Has Found Success

The printing industry has seen plenty of changes over the past century, but they’ve only accelerated in the new century, said Susan Goldsmith, president of Marcus Printing.

“Technology in printing has changed more rapidly in the past 20 years than the 100 years before that,” she noted. “We have basically kept up with technology, starting with eliminating film from the printing process and going direct to plate, and then getting into the digital world and most recently expanding into mailing as well as wide-format; we’ve become a little bit of everything to everybody.”

It’s a model that works for Marcus, she added. “We couldn’t be just a standalone digital shop, or a standalone offset shop. We’re a mid-sized print shop. That’s where we’re most comfortable — not printing a million pieces, but we can print 50,000, or we can print two for you. That’s been the niche we always wanted to serve.”

The third-generation family business was established in 1930 by Phil and Sarah Marcus at 32 Main St. in Holyoke, who moved to 109 Main St. in 1942. Back then, it was strictly a fine letterpress printing company, installing its first offset press in 1945.

In 1961, Marcus moved to a 7,000-square-foot space in the former Skinner Mill on Appleton Street. During the next 25 years, it expanded its offset production, purchased the building, and expanded to use all of its 21,000 square feet on three floors. The current location, at 750 Main St., is a 33,000 square-foot facility, all on one floor.

The company’s 30-plus employees pride themselves on customer service, Goldsmith said. “We don’t make promises we can’t keep, and we do everything in our power to get it to you when you need it. And we try to employ as many Holyoke people as we can.”

She’s also proud of her company’s place in the Paper City.

“Holyoke has a great business community, and printing and paper have been at its foundation. We just had a conversation with John Hazen about work our parents did together, and I’m guessing maybe our grandparents. It’s nice to have that long-term connection with the history of what the city is built on.”

—Joseph Bednar

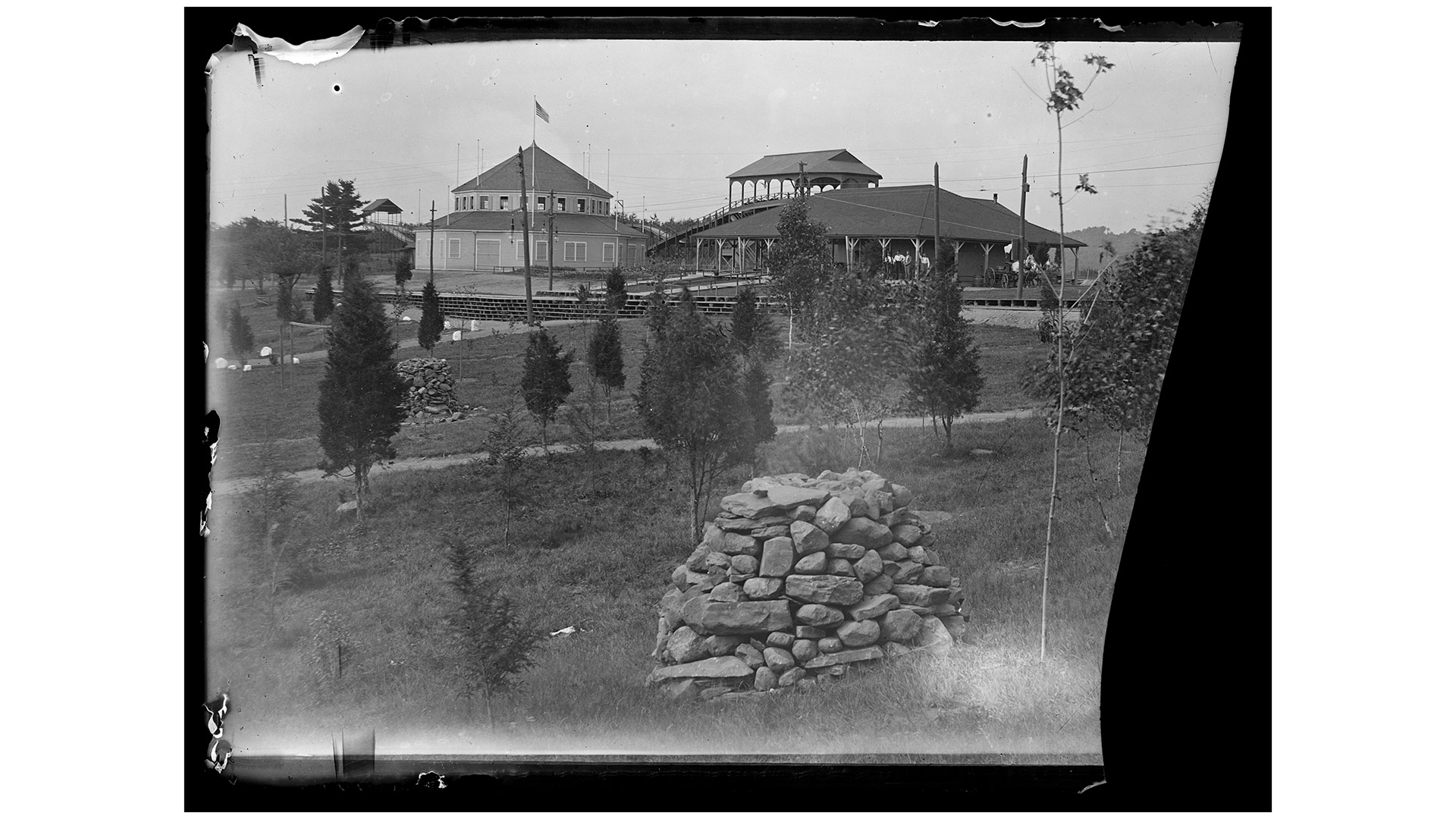

Whatever the date is, the building certainly looks different on the outside than it does today — there have been several expansions. On the inside, though, most areas — from the lobby to most of the manufacturing spaces — probably look very much the same as they did back then.

Whatever the date is, the building certainly looks different on the outside than it does today — there have been several expansions. On the inside, though, most areas — from the lobby to most of the manufacturing spaces — probably look very much the same as they did back then.