Host of Forces Create Momentum

Analysts Say the Economy Could Be Headed

With Talent Scarce, Many Employers Are

MGM One of Many Factors Spurring

Forward Progress

Rick Sullivan says the region has considerable momentum carrying over in 2019, and it comes from most all sectors of the economy.

Momentum.

Webster defines that word in several ways, including this one: ‘strength or force gained by motion or through development of events.’

Over the past few years, and especially in 2018, there was a good deal of motion and quite a few singular and ongoing events that have made this region stronger and created quite a bit of momentum, said Rick Sullivan, president and CEO of the Economic Development Council of Western Mass. (EDC).

And this movement has been across a number of sectors and most all area communities, not just Springfield, although that’s where it is easily most visible and palpable.

“We’re seeing a great deal of momentum across the region,” he said. “And it’s across the board — manufacturing, healthcare, higher ed, tourism.”

Elaborating, he cited just a few examples of this momentum, starting with the most obvious:

• MGM Springfield opened its doors on Aug. 24, but it began to impact the regional economy long before that, through the filling of more than 2,000 jobs, proving a boost for area hotels (see related story, page 27), inspiring movement toward additional market-rate housing projects in and around the downtown, and even awarding life-changing vendor contracts with several area businesses, from a bus company in Chicopee to a dry cleaner in the Forest Park section of Springfield.

• Eds and meds. The region’s two main economic drivers, education and healthcare, are thriving and becoming ever-larger contributors to economic development in the region, he said, noting, on the education side, that the region’s community colleges continue to find ways to step up and help meet workforce needs and provide specific skills needed in the workplace.

• The cannabis industry. This intriguing new era in Massachusetts history is impacting everything from the commercial real-estate market to traffic in downtown Northampton, where a dispensary became just one of two sites in Massachusetts selling marijuana for recreational use.

• A host of other forces are at play in downtown Springfield, ranging from new tenants on Bridge Street to the revitalization of Stearns Square; from a new Starbucks (actually, two of them; there’s also one at MGM) to soaring interest in new housing projects; from new train service coming into Union Station to the opening (soon) of the Innovation Center.

“When I’m out downtown, I generally have to wait in line to get lunch — and I’m happy to do it. That’s a good thing; it means the economy is doing well.”

• Progress continues with developing new sources of jobs in fields such as cybersecurity (Bay Path University and UMass Amherst are becoming regional and even national leaders in that field) and water technology — a $3.9 million demonstration center is set to open at UMass Amherst within the next two years.

• The construction industry, usually a bellwether for the economy, remains sound, with many companies reporting they have ample jobs on the books for the coming. “The phones have been ringing — and that’s always a good sign,” said Tim Pelletier, president of Ludlow-based Houle Construction.

Sullivan has another, far more personal measure of progress and momentum. “When I’m out downtown, I generally have to wait in line to get lunch — and I’m happy to do it. That’s a good thing; it means the economy is doing well,” he told BusinessWest, noting that there is considerably more foot traffic in the central business district, and many businesses are benefiting from this.

Yes, there are some challenges to contend with, and even a few possible storm clouds on the horizon; workforce issues are impacting most all sectors, and they could stifle the growth of some companies (see related story, page 22), and most economic analysts are predicting a slowdown (but not a recession) in 2019.

But for the most part, there is momentum and continued cause for optimism, even as question marks grow in number.

‘Stable’ is the word Tom Senecal uses when he talks about the local economy, and in most ways, ‘stable’ is good.

“Several sectors are doing very well — education, construction, multi-family housing, green energy, and others,” said Tom Senecal, president and CEO of Holyoke-based PeoplesBank, who spoke from the perspective of his own bank, which saw roughly 8% growth this calendar year, and what he’s seen and heard anecdotally.

Senecal said he’s seen a noticeable slowing of residential real-estate business over the past month to six weeks, after a strong start to the year — a development probably linked to rising interest rates — but overall, as he said, the local economy is chugging along nicely.

Keith Nesbitt, vice president and Commercial Banking Team leader at Community Bank’s Springfield location, agreed.

“I would describe what’s happening in Western Mass. as transition against a backdrop of real stability,” he said, using ‘transition’ to mean many things, from the beginning of the casino era to the passing of many businesses from one generation to the next. “There’s a lot of certainty around those well-established, mature businesses that we have in this region. And those businesses that haven’t been around as long but are growing … they’re pretty solid, and they’re pretty confident.”

Banking on It

Both Senecal and Nesbitt put that word ‘stable’ to use early and quite often as they talked about the local economy and what they’re witnessing.

And in most all respects, ‘stable’ — and ‘steady’ and ‘predictable,’ words that were also used — is good, Senecal noted, adding, as many others have over the years while analyzing the local market, that while this region hasn’t soared like some others, including Boston, where the commercial and residential markets are white hot, that means it isn’t susceptible to the dramatic falls that those cities and regions also see.

“Fortunately, and sometimes unfortunately, we don’t see the highs and lows economically; we’re sheltered a little bit,” he explained. “We have a very stable economy when it comes to healthcare, education, and our nonprofit sector — those are three stable industries that keep Western Mass. insulated from the highs and lows.

“I would equate ‘stable’ to ‘predictable,’” he went on. “And for a small business, predictability is a huge part of job growth and just economic growth in general for small business.”

His own business moved forward with several initiatives in 2018, including the acquisition of First National Bank of Suffield and the start of work to convert the former Yankee Pedlar restaurant into a new and intriguing branch. And he said many businesses had the requisite confidence to move ahead with their own growth initiatives, be it through workforce expansion, new facilities, or new business lines.

And he expects this stability to continue into 2019, although possible, if not probable, additional interest-rate hikes (the Fed was set to vote on one as this issue went to press) could bring uncertainty, and therefore greater cautiousness, to the fore.

“Anything that stays stable and is predictable is good for economic development, and anything that is unpredictable is a slowdown in economic development,” he said, adding that there is uncertainty regarding everything from interest rates to the trade war.

“I would equate ‘stable’ to ‘predictable.’ And for a small business, predictability is a huge part of job growth and just economic growth in general for small business.”

Like Sullivan, though, Senecal said MGM has provided a boost to the local economy in several ways — through the jobs it has created and its contribution to greater vibrancy downtown. And it is just one of the many factors contributing to the improved picture locally.

Others include the steady performance of education and healthcare and movement toward creating new sources of jobs.

Sullivan cited the work being done at Bay Path and UMass Amherst in cybersecurity — Bay Path recently entered into a partnership with Google, for example — and creation of the water-technology demonstration center as developments to watch.

“Those are jobs of the future, and there’s real excitement about what can develop,” he noted. “There are now some partnerships with large companies, like Google, and tremendous promise.”

Elaborating, he said that, across the region, colleges and universities are playing key roles in providing individuals with the hard and soft skills to thrive in today’s technology-driven economy, and thus, they’re playing a major role in economic development.

Examples abound, from Holyoke Community College’s new culinary-arts facility, which is helping to meet the needs of individual employers like MGM and a growing field in general, to Greenfield Community College and its efforts to train workers for the manufacturing sector, to Holyoke Community College and Springfield Technical Community College working together with MGM to create the Casino Career Training Institute.

“What it comes down to is that economic development for this region, and across the country, for that matter, is all about workforce — developing, finding, and retaining talent,” he said. “And the good news for us is that we have a very robust higher-ed presence — four-year public and private, and the community colleges as well — and the future is bright.”

Returning to the subject of downtown Springfield, he said that, in addition to that waiting in line for lunch, he’s seen other signs of vibrancy and, most importantly, interest on the part of developers in investing in that area.

“We’ve had a number of investors express interest in possible hotels and potential housing, both market-rate and workforce-housing projects,” he noted. “And those are discussions that may not have beem happening in … pick a time period — five years ago, 10 years ago, 20 years ago. It’s been a while since we’ve seen this.”

Keith Nesbitt describes what’s happening in this region economically as “transition against the backdrop of stability.”

Nesbitt concurred, and noted that, while the multi-family housing segment of the commercial real-estate market is heating up — it has been for some time — there is movement across the spectrum, much of it fueled not only by MGM, but by a promising outlook for the future.

“Long-time property owners are realizing that now is the time to realize value, so they’re putting those properties on the market,” he said of multi-family units but also other holdings. “And those that are speculating on the future are generally thinking that now is the time to get into the market based on some of those other transitions that are going on. So the commercial real-estate market has been very consistent.”

Steady As She Goes

“Consistent.’ ‘Stable.’ ‘Predictable.’ ‘Steady.’

Those are the words you hear most often in discussion of the local economy today and what is likely to happen in 2019.

There is a good amount of uncertainty in the air regarding everything from trade balances (or imbalances, as the case may be) to interest rates to the political scene in Washington.

But locally, stability and momentum seem to be the prevailing forces.

And they should enable the region to build on that momentum in the year ahead.

George O’Brien can be reached at [email protected]

Running out of Gas?

What’s that old saying about death and taxes? It notes that they are the only real certainties in this world.

Actually, there’s another one: when it comes to the economy and making plans for the future, business owners and consumers certainly don’t like uncertainty.

Unfortunately, there is no shortage of that commodity at the moment, and the volume may only be growing. Indeed, there is political uncertainty — lots and lots of that — and uncertainty about the housing market. And the trade war with China. And with the workforce — the nation as a whole is at or near full employment, and business owners and managers across all sectors are asking out loud where the workers are going to come from (see related story, page 22). There’s uncertainty about the stock market, except that there’s considerable amounts of turbulence (we’re certain about that). And about interest rates and what will happen with them. And about whether the tax cuts introduced a year ago will continue to be a source of economic fuel (although the consensus seems to be that they won’t be).

Add it all up, and, as we said, there is a lot of uncertainty out there.

Certainly enough to likely cause a slowdown in the economy, but not a recession in the technical sense of that word, said Bob Nakosteen, a professor of Economics at the Isenberg School of Management at UMass Amherst and a frequent voice in BusinessWest’s annual Economic Outlook.

“When there’s uncertainty, businesses tend to pull in their horns, and consumers, by and large, do the same; they wait until there’s more certainty about what they can expect,” said Nakosteen, adding that, instead of a growth rate between 3.5% and 4%, which is what the country and this region saw in 2018, both are probably looking at 2% to 2.5% for next year.

Again, that’s not a recession, but it is a slowdown.

Like Nakosteen, Karl Petrick, an associate professor of Economics in the College of Arts and Sciences at Western New England University, is predicting that this is what the nation, this state, and this region will see.

Note the future tense.

“When there’s uncertainty, businesses tend to pull in their horns, and consumers, by and large, do the same; they wait until there’s more certainty about what they can expect.”

“I really don’t think the slowdown has started yet. But I think it’s coming,” he said, adding quickly that there are signs things are cooling off somewhat.

He pointed to robust sales in the days and weeks following Thanksgiving as solid evidence that many Americans still have the confidence to spend. But a few months of severe turbulence on Wall Street, large amounts of political uncertainty, and a host of other factors will eventually erode some of that confidence, he added.

Karl Petrick says various forces, from turbulence on Wall Street to political uncertainty, will soon start to generate more cautiousness on the part of consumers and business owners.

“We’re starting to see people become more cautious,” he noted. “They start to see what’s going on, they start to look at their 401(k) statements — even if they’re fairly young, they start to look at such things — and we’re going to start to see people be more cautious. And if and when that happens, companies start to become more cautious, too, because they start to see their markets dry up a bit.

“The momentum will carry into 2019, but unless we see some more certainty, that momentum will peter out into 2020,” he told BusinessWest. “The earliest a recession could happen is 2020, but there’s a lot of time between now and then to avoid that.”

For this issue and its Economic Outlook focus, BusinessWest talked with Nakosteen and Petrick about the proverbial big picture.

On-the-money Analysis

As he talked about the state of the economy and what is likely to happen in 2019, Nakosteen acknowledged that some economists are, in fact, using the dreaded ‘R’ word as they look into their crystal balls.

He’s not ready to join them — yet. But he said there are more than enough signs that a slowdown is coming — if it hasn’t arrived already.

Starting with the housing market.

“The housing market is clearly slowing down, and it is so important to so many segments of the economy and so many parts of the country,” he told BusinessWest. “It’s not well-recognized, but we’ve had a period since 2012 of one of the most sustained increases in housing prices in our history; in fact, it comes close to matching what happened during the price bubble [of 2007-08]. The difference is that there isn’t this froth around it, and there isn’t this huge toxic-credit buildup.

“I don’t see this as a danger to the economy in terms of it exploding and dragging us into a recession,” he went on. “But I do see a slowdown affecting the overall economy and the economy of this state.”

Beyond the housing market, there are other signs, or indicators, of whitewater, including the trade war, if it can be called that, with China, Canada, and other countries.

Nakosteen said this region doesn’t produce many, if any, of the products directly affected by rising tariffs, but this area is affected indirectly because its precision manufacturers provide links in the supply chains that are impacted by the tariffs.

Petrick agreed. “We need to find some stability when it comes to our trade relationships,” he said. “Trade wars are not good for anybody.”

There’s also diminishing impact from the tax cuts implemented a year ago — “those cuts gave the economy a sugar high, but almost everyone thinks that effect will dissipate in 2019,” said Nakosteen — as well as all that turmoil on Wall Street.

Indeed, as of this writing, the S&P was in negative country after being up more than 8% for the year a few months ago — and there wasn’t much time left in 2018 to get onto the plus side.

Then there’s the workforce issue. While things are bad in this region in terms of employers finding good help (see related story, page 22), they’re much worse in other markets, including Boston, said Nakosteen.

“One of the things going on in this state is that we’re running out of workers, especially in the eastern part of the state,” he noted. “For the past 18 months, we’ve hired a lot of people, and no one’s quite sure where they’ve come from. And at some point, the labor-force constraint is going to be binding to our economy, and that’s going to slow things down; it’s going to be like squeezing a rock.”

But the biggest issue heading into 2019 is the one that’s fueling some of the problems listed above — growing uncertainty about the economy, the markets, jobs (GM announced plant closings and significant layoffs, for example), trade, and more.

This uncertainty generally leads to greater cautiousness, which manifests itself in several ways, said those we spoke with, starting with the obvious, such as slowdowns in home sales and other significant purchases.

Some signs are perhaps less obvious, such as the roller-coaster ride on Wall Street, said Petrick, adding that, when there is uncertainty, or no clear trends, the market becomes far more “news-driven,” as he called it, which manifests itself in wild swings, sometimes over the course of just a few hours, as news breaks.

“These big swings happen with the smallest provocation because people want to react to something,” he explained. “And whatever comes up on the news wire is what they’re reacting to.”

Reading the Tea Leaves

Looking at the proverbial big picture, Petrick said political uncertainty and economic uncertainty pretty much go hand-in-hand.

“That’s how we’re wired,” he said, adding that about the only thing that appears certain for 2019 is ongoing uncertainty.

Nakosteen agreed.

“Business decisions, as well as household decisions, regarding big-expense items such as cars, appliances, and houses, depend in large part — not totally, but in large part — on expectations of the future: ‘am I going to lose my job?’ ‘Am I going to get a raise?’ ‘Is my product going to keep selling?’ ‘Are my suppliers going to be disrupted?’”

Like he said, in many cases, they will hold off on such purchases until there is more uncertainty.

And as things are looking now, it might be a pretty long wait.

George O’Brien can be reached at [email protected]

The Employment Picture

As the job market tightens, Meredith Wise says, it becomes an employees’ market, with business owners increasingly having to pay for talent.

Meredith Wise says it’s probably not a recent addition to the business lexicon. But it was certainly new to her when she heard it the first time.

‘Ghosting’ is the phrase in question, and it refers to a situation where an individual applies for a job, is given an offer, accepts the offer, passes a drug test, is given a starting date, accepts the starting date, and when it comes … he or she just doesn’t show up for work.

“That individual doesn’t feel the need or have the courtesy to call the company and say, ‘I’m not going to take the job; I have another opportunity that’s going to be better for me’; they just don’t show up,” said Wise, executive director of the Employers Assoc. of the NorthEast (EANE), adding that, when she first heard the term from one of her members, she thought it was an aberration and certainly not a common occurrence.

Suffice it to say that she has been corrected on that viewpoint at several of EANE’s monthly member roundtables over the past year or so.

“When I first brought it up I said, ‘oh, this can’t really be happening — this isn’t something people would do,’” she recalled, flashing back several months. “I expected pushback and people saying, ‘no, that doesn’t happen to me.’ Instead, there was agreement around the table that it is happening — a lot.”

Wise said this pattern of ghosting, which is happening in many sectors and at all rungs of the ladder — from entry-level service jobs to senior engineering positions — might be a form of role reversal when it comes to the employment process, and a very clear sign that this is an employees’ market.

“When employers get applicants, there are many times when they don’t communicate back to people; they don’t say, ‘thanks for applying, but we don’t have anything at this time,’” she explained. “As a candidate, you feel your résumé or your application has gone into a black hole. And it almost feels to me like the candidates are turning the tables on employers and saying, ‘I’m not going to get back in touch with you, and I’m just going to do what’s best for me.’”

Bryan Picard, president of Springfield-based Summit Careers Inc., agrees with Wise’s take and can certainly verify the overall tightness of the market, at least through most of this year — and the ghosting phenomenon.

To capture it, he cited the example of a company in Northampton trying to fill a basic warehouse position, with the emphasis on trying.

“We had to fill that same position six or seven times,” he explained, “because the first five people just didn’t show up for the job, and this is a position paying $5 an hour more than the average. There were so many opportunities for strong candidates to go somewhere else, they just didn’t show up.”

Finally, Summit decided to send several people to this client at the same time with instructions to pick the one it liked most — on the theory that at least one of them would show. And a few did, actually.

Meanwhile, the firm has strongly advised its clients to condense the overall hiring process — especially the period between when one is offered a job and when one starts — to hopefully keep would-be employees from becoming ghosts.

“The reality is that minimum wage went to $12 an hour four months ago. There are still companies paying $11 an hour, but the vast majority of them are paying more than what the minimum wage is because they know it’s required.”

All this is part of life in the current employment market, one that is expected to continue into 2019, in most ways and in most sectors — although Picard is seeing some signs of a slowdown in manufacturing (more on that later), and economists, in general, are projecting that the pace of expansion will slow in the year ahead.

“Overall unemployment numbers should stay steady into the first quarter of 2019, said Larry Martin, director of Business Services and Market Research for the MassHire Hampden County Workforce Board, noting that unemployment was quite low — 4% to 5% — across the region this year. “We see things being steady in the first quarter without any major shifts or changes — we should remain fairly flat.”

Wise agreed, and said flat means more challenging times for employers. Indeed, for now and the foreseeable future, the laws of supply and demand clearly favor employees, she said, with business owners adjusting, out of necessity, with slightly higher wages and better benefits.

“Employers are now sometimes having to buy talent,” she explained. “The applicant pool just isn’t what it was, and to lure people away from their current employer, they may need to be paying a few dollars per hour more to get people to come.”

For this issue and its Economic Outlook 2019, BusinessWest takes an in-depth look at the employment market and what employers can expect in 2019. For the most part, it is more of the same.

Work in Progress

Picard told BusinessWest that, although the minimum-wage hike to $12 an hour — the first in a series of incremental increases contained in the so-called ‘grand bargain’ legislation — doesn’t become law until Jan. 1, practically speaking, it went into effect long ago.

“The reality is that minimum wage went to $12 an hour four months ago,” he said. “There are still companies paying $11 an hour, but the vast majority of them are paying more than what the minimum wage is because they know it’s required.”

Bryan Picard says he’s seeing a slight slowdown in manufacturing, but overall, the job market remains tight.

And this upward movement on wages, at least on the lower end, is yet another sign of how tight the labor situation is and how this is an employees’ market. And while there is speculation on just how long it will stay that way, employers for the moment face a number of challenges, and are responding accordingly, said Wise, who said it starts with the applicant pool, or what passes for one, in many cases.

“Employers are finding real problems with the applicants — they’re just not getting the volume of applicants they used to get, and the people they are getting just don’t have, in many cases, the qualifications and the skills that they’re looking for.”

But the problems certainly don’t end there, Wise said, adding that a huge issue for employers is finding applicants that can pass a drug test. The percentage of applicants that can’t would surprise some, but certainly not anyone working in human resources today, she told BusinessWest.

And if they do have the skills and they can pass a drug test … that generally means that they have many opportunities to choose from and are a solid candidate to become a ghost.

“When we would get candidates of a higher caliber that we would send on a temp-to-perm type of position, the challenge we saw was that they didn’t just have one job offer, they had five job offers,” said Picard. “And the companies that were really struggling starting bringing up their pay scales.”

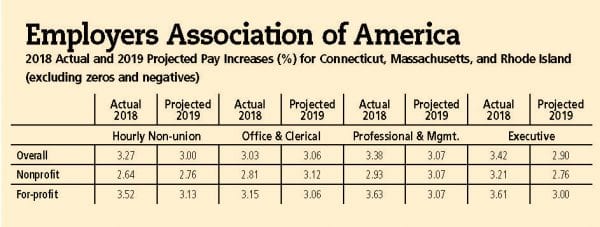

Indeed, in response to all this, wages are increasing, but the pace of increase is still sluggish, as the chart on page 24 shows.

“I think wages are slightly higher, but wage growth is, overall, very slow,” said Wise, adding that there are several reasons for this, including the fact that retiring Baby Boomers are being replaced by less-experienced, lower-paid employees. Also, pay increases at the top end of wage earners are smaller increases for lower-wage earners, resulting in a lower overall average increase.

Beyond ‘paying for talent,’ to whatever extent they are doing so, employers are also responding to the tight market by altering their hiring policies and practices in some ways to keep good talent from going elsewhere and thus becoming ghosts.

“These trends are forcing employers to go back to what might be considered best practices,” Wise explained, noting, as one example, that after having an applicant accept an offer, the company in question is working harder to stay in touch with that applicant until they arrive for work, asking if they have any questions or just staying in communication with them.

Meanwhile, others are sending soon-to-be employees what she called “swag bags” or “swag items” such as a jacket with the company’s logo on it or a mousepad or other items as a gesture designed to show that the individual is valued.

Meanwhile, and as noted earlier, companies are being advised to condense the hiring process, especially the period between when one is hired and when that individual is slated to start work.

“If there is someone good that you want to put in a position, you put them in right away,” said Picard, adding that he went to far as to encourage clients to skip or accelerate the interview the process, hire promising candidates, and essentially interview them after they were hired.

Hire Power

If all this seems a world apart from what was happening only a few years ago, it is, said Picard, adding that conversations he had with colleagues in this field from across the country revealed that this past year, and especially this past summer, was among the most difficult times anyone could remember when it came to securing qualified help for clients.

“They said it was the worst summer they’d seen in … forever, or at least 50 or 60 years, and that’s understandable with unemployment being at an all-time low,” he said, adding that, while things were not that bad in this market, employers in many markets struggled to find and keep talent.

That’s certainly been the case with precision manufacturing, one of the specific sectors that Summit specializes in.

“Every single company out there right now is looking for CNC machinists,” he told BusinessWest. “Many have more work than they can get out the doors, or more sales orders than they have people to fill them.”

“Employers are finding real problems with the applicants — they’re just not getting the volume of applicants they used to get, and the people they are getting just don’t have, in many cases, the qualifications and the skills that they’re looking for.”

The $64,000 question heading into the new year concerns how long things will stay this way.

As noted earlier, Picard said he has witnessed a slowdown when it comes to some segments of the manufacturing sector, and somewhat easier going when it comes to finding employees for those clients.

“I think things are changing; a lot of times, manufacturing is a leading indicator for what’s going to happen with the economy,” he explained. “The summer was very tight, but now, probably over the past month and a half, things were not as tight. We’re seeing very qualified, strong candidates that are coming through that four months ago … well, we would be begging for someone with half the talent that we’re seeing right now.”

Elaborating, he said he projects that 2019 will be “an interesting year” for his company and a less-busy one for some of his clients, especially those in manufacturing, and he comes to that conclusion mostly by comparing numbers from the fourth quarter this year compared to last year.

“In the fall of 2017, we were very busy, and I brought on someone to help in November,” he recalled. “I said, ‘this is our slowest time of the year, it’s a great time to come on, we’ll be able to do some coaching, things will be nice and easy.’ About January, she said, ‘when is it going to slow down again?’ because it never did.”

This year, it has, and Picard says it may be a sign of what’s to come in the year ahead.

Martin, meanwhile, is projecting essentially the status quo when it comes to the employment market — in manufacturing and most other sectors.

“For manufacturers, it’s going to be steady going, and they are going to need skilled help because of the individuals who are retiring,” he explained. “That’s not going to slow down whatsoever.”

He noted that the region essentially absorbed the arrival of MGM Springfield and its hiring of more than 2,000 people without major disruption to most sectors of the economy, even the broad culinary field, primarily because of proactive steps in anticipation of that seismic event.

“There was a lot of foresight and forecasting done in advance of MGM,” he explained. “There were a lot of new partnerships established, especially with the community colleges to help meet specific needs, such as those in culinary.

“Several sectors were impacted — culinary, retail, financial services, and others — but enough forecasting was done ahead of time to prepare for MGM’s arrival,” he went on. “And a lot of companies planned ahead and internally provided financial encouragement or other types of encouragement for existing staff.”

The challenge moving forward will be with the inevitable churn that the casino complex will experience, he went on, adding that while MGM, working with those partners he mentioned, had enough employees to get the doors open, it must now deal with ongoing turnover and the task of keeping workers in the pipeline.

Learning on the Job

As he talked about the job market and what may come in 2019, Picard concurred with Wise when she talked about many workers not exactly being courteous when it comes to taking better offers and instead becoming ghosts.

Likewise, he said all this amounts to a kind of payback, if you will, for how employers act when the laws of supply and demand are tilted in their favor.

He warned, however, that too much moving around and a great many lines on a résumé may come back to … well, haunt those ghosts when things change and the market is not so tight.

For now, though, it’s an employees’ market and will be for the foreseeable future, and employers looking to land good talent quickly and easily likely have a ghost of a chance of doing so.

George O’Brien can be reached at [email protected]

Right Place, Right Time

John Doleva shows off the Basketball Hall of Fame’s renovated theater, one of many improvements at the hall.

They call it the ‘need period.’

There are probably other names for it, but that’s how those at the Greater Springfield Convention & Visitors Bureau (GSCVB) refer to the post-holiday winter stretch in this region.

And that phrase pretty much sums it up. Area tourist attractions and hospitality-related businesses are indeed needy at that time — far more than at any other season in this region. Traditionally, it’s a time to hold on and, if you’re a ski-related business, hope for snow or enough cold weather to make some.

But as the calendar prepares to change over to 2019 — and, yes, the needy season for many tourism-related businesses in the 413 — there is hope and optimism, at least much more than is the norm.

This needy season, MGM Springfield will be open, and five months into its work to refine and continuously improve its mix of products and services. And there will also be the American Hockey League (AHL) All-Star Game, coming to Springfield for the first time in a long time on Jan. 28 (actually, there is a whole weekend’s worth of activities). There will be a revamped Basketball Hall of Fame, a few new hotels, and some targeted marketing on the part of the GSCVB to let everyone know about everything going on in this area.

“The last half of 2018 has been great, and we’re very optimistic — our outlook for tourism is really positive for 2019. Certainly, MGM is a factor — it’s a huge factor, it’s a game changer — but it’s just part of the story.”

So maybe the need period won’t be quite as needy as it has been.

And if the outlook for the traditionally slow winter months is brighter, the same — and more — can be said for the year ahead, said Mary Kay Wydra, president of the Greater Springfield Convention & Visitors Bureau, noting that expectations, based in large part on the last few quarters of 2018 and especially the results after MGM opened on Aug. 24, are quite high for the year ahead.

“The last half of 2018 has been great, and we’re very optimistic — our outlook for tourism is really positive for 2019,” she told BusinessWest. “Certainly, MGM is a factor — it’s a huge factor, it’s a game changer — but it’s just part of the story.”

Elaborating, she said MGM is helping to spur new development in this sector — one new hotel, a Holiday Inn Express, opened in downtown Springfield in 2018, and another, a Courtyard by Marriott, is set to open on Riverdale Street in West Springfield — while also filling more existing rooms and driving rates higher.

Indeed, occupancy rates in area hotels rose to 68.5% in October (the latest data available), up nearly 2% from that same month in 2017, and in August, they were up 5% (to 72.6%) over the year prior.

Meanwhile, room revenue was up 4.6% in October, from $113 a night on average in this region to $119 a night, and in August, it went up 7.2%.

And, as noted, MGM is just one of the reasons for optimism and a bright outlook in this sector, Wydra said. Others include the renovated hoop hall, yearly new additions at Six Flags, and the awesome drawing power of the Dr. Seuss museum on the Quadrangle.

An architect’s rendering of the renovated third-floor mezzanine at the Basketball Hall of Fame, which includes the tributes to the inductees.

For 2019, the outlook is for the needle to keep moving in the right direction, she said, noting that some new meetings and conventions have been booked (more on that later); Eastec, the massive manufacturing trade show, will be making its biennial pilgrimage to this region (specifically the Big E); the Babe Ruth World Series will again return to Westfield; and the AHL All-Star weekend will get things off to a solid start.

John Doleva, president of the Basketball Hall of Fame and a member of the executive board of the GSCVB, agreed.

“With MGM now in the marketplace and being active, there does appear to be a lift, much more of an excited spirit by those that are in the business,” he noted. “Everybody is saying that, at some level, their business is up, their interest in visitation is up — there is a general feeling of optimism.”

Getting a Bounce

Doleva told BusinessWest that MGM opened its doors toward the tail end of peak season for the hoop hall — the summer vacation months. Therefore, it’s too early to quantify the impact of the casino on attendance there.

But the expectations for the next peak season are quite high, he went on, adding that many MGM customers return several times, and the hope — and expectation — is that, on one or several of those return trips, guests will extend their visit far beyond the casino’s grounds.

“Once people return a few times, they’re going to be looking for other things to do,” he said. “I definitely feel a sense of excitement and anticipation, and I’m definitely looking forward to next summer when it’s the high-travel season, and really get a gauge for what the potential MGM crossover customer is.

“Conversely, there are probably individuals that would probably have the Hall of Fame on their list of things to do,” he went on, “and now that there’s more of a critical mass, with MGM right across the street, I think we rise up on their to-do list.”

But MGM’s arrival is only one reason for soaring expectations at the hall, said Doleva, adding that the facility is in the middle of an ambitious renovation project that is already yielding dividends.

Indeed, phase one of the project included an extensive makeover of the lobby area and the hall’s theater, and those steps have helped inspire a significant increase in bookings for meetings and events.

“Our renovations have led to a great number of facility rentals for events that are happening in our theater, our new lobby, and Center Court,” he said, adding that the hall was averaging 175 rentals a year, and will log close to 240 for 2018. “Before, the theater wasn’t a hidden gem, it was just hidden; it was like a junior-high-school auditorium — it was dark, it was gray, it had no life. Now, it’s a great place to have a meeting or presentation like a product launch.”

Phase 2 of the project, which includes a renovation of the third-floor mezzanine, where the Hall of Fame plaques are, and considerable work on the roof of the sphere, will commence “any minute now,” said Doleva, adding that the work should improve visitation numbers, but, even more importantly, revenue and profitability.

The improved numbers for the hall — and the optimism there concerning the year ahead — are a microcosm of the broader tourism sector, said Wydra, adding that a number of collaborating factors point toward what could be a special year — and a solid long-term outlook.

It starts with the All-Star Game. The game itself is on a Monday night, but there is a whole weekend’s worth of activities planned, including the ‘classic skills competition’ the night before.

“Even with the average daily rate going up and occupancy growing, we still have that need period — which is true for all of Massachusetts,” she noted. “When you have an event like the All-Star Game in January, that really helps the hotels and restaurants.”

Additional momentum is expected in May with the arrival of EASTEC, considered to be New England’s premier manufacturing exposition. The three-day event drew more than 13,000 attendees last year, many of whom patronized area restaurants and clubs, said Wydra, adding that MGM Springfield only adds to the list of entertainment and hospitality options for attendees.

The Babe Ruth World Series is another solid addition to the year’s lineup, she noted, adding that the teams coming into the area, and their parents, frequent a number of area attractions catering to families.

Analysts say MGM Springfield has a far-reaching impact on the region’s tourism sector, including higher occupancy rates at area hotels and higher room rates.

Meanwhile, the region continues to attract a diverse portfolio of meetings and conventions, said Alicia Szenda, director of sales for the GSCVB, adding that MGM Springfield provides another attractive selling point for the 413, which can already boast a host of amenities, accessibility, and affordable hotel rates.

In June, the National Assoc. of Watch and Clock Collectors will stage its 75th annual national convention at the Big E, she said, an event that is expected to bring 2,000 people to the region. And later in the summer, the Professional Fire Fighters of Massachusetts will bring more than 900 people to downtown Springfield.

Those attending these conventions and the many others slated during the year now have a growing list of things to do in this region, said Wydra, who mentioned MGM, obviously, but also the revamped Hall of Fame; Six Flags, which continues to add new attractions yearly (a Cyborg ride is on tap for 2019); and the Dr. Seuss museum, which is drawing people from across the country and around the world.

“The Seuss factor is huge,” said Wydra. “It’s a big reason why visitation is up in this region. Seuss is a recognizable brand, and the museum delivers on the brand, and they keep reinventing that product.”

Staying Power

This ‘Seuss factor’ is just one of a number of powerful forces coming together to bring the outlook for tourism in this region to perhaps the highest plane it’s seen.

Pieces of the puzzle continue to fall into place, and together, they point to Western Mass. becoming a true destination.

As noted, even the ‘need period’ is looking less needy. The rest of the year? The sky’s the limit.

George O’Brien can be reached at [email protected]