Economic Outlook 2016

Questions About Sustainability Cloud the Picture for 2016

By most accounts, the state’s economy — and area businesses — had a solid 2015. Performance didn’t match pre-recession levels, but it was an improvement over the previous three or four years. The question looming over 2016 is whether that performance can be sustained, and there are enough doubts, or reservations — created by everything from a stronger dollar to still-falling oil prices to uncertainty about who will win the White House next November — to keep confidence in check.

Dan Flynn calls it “soft confidence.”

That simple, two-word phrase goes a long way toward explaining the current state of the local and national economy and the general attitude concerning it among business owners.

Elaborating, Flynn, executive vice president and chief operating officer of Wholesale Banking for West Springfield-based United Bank, said many of the institution’s commercial clients are doing well — not as well as before the so-called Great Recession that started in 2008, but performance has been solid. Some even recorded their proverbial ‘best year ever’ in 2015, he noted, adding that most saw at least improvement over 2014.

Dan Flynn says many area businesses had a solid 2015, but the question moving forward is whether that performance can be sustained.

But — and this is an important ‘but’ — these business owners are not at all sure that such performance is sustainable given a host of factors that are almost all well beyond their control. These range from global and domestic violence to still-spiraling healthcare insurance costs to extreme uncertainty about who will prevail in the 2016 presidential election — and what he or she might do after getting elected.

Thus, existing confidence is, well, soft.

“For most business owners, their inventory backlog or their job backlog is building, but they don’t have the confidence that this will sustain itself in 2016 or 2017,” Flynn explained. “They think it will, but it’s not like that flat-out ‘we’re confident, we’re going to hire a couple of extra people, we’re going to add a second shift.’ They’re not that confident.”

John Patrick agreed. The CEO of Farmington Bank, which recently made a foray into the Western Mass. market with locations in West Springfield and then East Longmeadow, said there is some optimism about the year ahead, but there are also serious doubts, enough to keep confidence from becoming deep or profound.

“The economy, especially the local economy, is all about confidence,” he noted. “And I wouldn’t say there is strong confidence in the marketplace relative to everything that’s happening around them.”

And by ‘everything,’ he meant factors ranging from terrorism in Paris and California to the ever-rising cost of health insurance.

Bob Nakosteen concurred, summoning another word to describe the current picture and outlook for 2016: ‘fuzzy.’

He would go into much greater detail, obviously, but Nakosteen, professor of Economics at the Isenberg School of Management at UMass Amherst and co-editor of MassBenchmarks, the quarterly publication devoted to analysis of the Bay State economy, said that one word pretty much does the job.

Indeed, the outlook is fuzzy, as in not sharp, not clear, and, for the most part, not predictable.

“The picture is fuzzy, and through the fuzziness, we see a lot of positives, but we also see some risk,” he explained. “There’s a lot of internal strength in the U.S. economy, and it is going to overcome various weaknesses, and that means this state is going to do well. It’s a mixed picture, but the overall trend is positive. But do I have 100% confidence in what I just said? Absolutely not.”

That’s soft confidence personified.

“We’re in the middle of a slowdown … it’s not anywhere near a recession, but we’re definitely seeing some slowing,” Nakosteen went on. “The economy has been growing at 2% or a little less, and that’s not vibrant.”

John Patrick says a number of area manufacturers have seen exports impacted by the weakening of many foreign currencies.

Moving beyond ‘fuzzy,’ Nakosteen, like Flynn and others we spoke with, said there are a number of factors impacting the state and national economy — everything from a weak Canadian dollar, which is hurting exports to that country, to the fact that most Americans are not putting the money they’re saving at the gas pump back into the economy, to impressive job growth in the Commonwealth (if not Greater Springfield). Together, they make predicting what will come next an even more difficult assignment than it generally is.

Most observers are expecting growth to remain right around that 2% level, but it could go higher or lower depending on how matters evolve, especially that critical confidence level among business owners.

Money Matters

As he talked with BusinessWest about 2015 and what will likely happen in the year ahead, Nakosteen said there are certainly plenty of reasons to look at the glass and declare it at least half-full.

“Within the lack of clarity that we’re seeing, there lies a solid core of economic strength,” he explained, adding that the Bay State continues to match or outperform the nation overall, but it is very much dependent on the relative health of this country, as well as international markets, for its success.

As evidence, he cited some recent data showing that Massachusetts is experiencing an economic expansion in many ways reminiscent of the late ’90s, though without the impetus of the tech bubble that drove that cycle, meaning that this one is more well-rounded.

Gross state product is growing robustly, he went on — 7.1% for the second quarter compared to national GDP growth of 3.7% — and employment growth is steady, although limited geographically. The unemployment rate remains low by historical standards, and has been below the national rate since — and even before — the Great Recession.

“The current expansion appears to be on firm footing — the economy in the state has slowed down recently, but it’s still been a really good year,” he said while offering the global view.

“We’re expecting strong growth over the year or so,” he went on, using ‘we’ to mean the editors at MassBenchmarks. “It might be as strong as what we had up to the second quarter of this year, but pretty solid growth. How much of it makes its way out to the western part of the state remains to be seen.”

Flynn agreed.

“Overall, clients performed better over the past 12 months than the previous three to four years,” he said while generalizing the comments of business owners within the bank’s portfolio. “As a whole, they’re not seeing the same rate of return as before the recession, but they’re doing better than they were a year ago.

“And it’s across the board,” he went on. “You can take retail, manufacturing, wholesalers … generally, companies are performing better than they had.”

Given all that, though, the question looming over 2016 is whether that performance — by individual companies and the economy as a whole — can be sustained. And strong doubts about whether it can have led to heavy use of phrases such as ‘soft confidence,’ ‘fuzzy picture,’ ‘mixed signals,’ and the always-popular ‘cautiously optimistic,’ which Flynn said he’s heard repeatedly.

That’s because most all of the factors that will decide the fate of 2016 come complete with ‘ifs,’ ‘buts,’ question marks, and both points and counterpoints.

Take the jobs picture, for example. The nation’s economy added another 211,000 jobs in November after a gain of nearly 300,000 in October, a solid boost by most accounts that exceeded almost all expectations and propelled the stock market to a more than 2% gain the day the figures were released.

Click HERE to download a PDF chart listing the region’s largest employers

But do those numbers and the stated 5% national unemployment rate reflect real progress in what’s happening locally? The short answer is ‘no’ or ‘probably not.’

“I was in New York recently, and I heard a nationally respected economist who said that, if you really take a look at the numbers, unemployment on a normalized basis is closer to 9% when you take into consideration all the people who are unemployed and those working part-time who would prefer to be working full time,” said Patrick.

Like others, he noted that, overall, many employers have not yet reached — and likely won’t reach for some time — that threshold of confidence needed to add back some of those employees trimmed during extensive efforts during and after the recession to become more efficient and rightsize.

“Businesses are a little apprehensive about continuing to make significant investments in people, technology, and franchise, because they’re just unsure about what’s going to happen,” Patrick told BusinessWest. “And there many businesses that, because of the cost of healthcare, don’t want to go over that 50-employee number, and they’re trying to manage their business accordingly.”

Meanwhile, Nakosteen said, despite the start of work on the Springfield casino and a host of other construction projects across Western Mass., the employment needle has “barely budged” in the city of Springfield, meaning the jobless rate is still hovering around 9%, in sharp contrast to what’s happening elsewhere in the Commonwealth.

Bob Nakosteen says the Bay State added jobs at an impressive clip in 2015, but by and large, those gains did not extend to Western Mass.

“Employment in the state has really grown at an amazingly fast clip over the past year to 18 months, but it’s not the same in Western Mass., as is usually the case,” he explained, adding that the Bay State has added 50,000 to 60,000 jobs over the past year, most of them in technology-related sectors, although healthcare and education remain solid contributors to such growth.

“A different picture emerges out here,” he went on, talking from his office on the UMass Amherst campus. “Springfield has added a few jobs but not many — at least it hasn’t gone down. The picture is better in the larger metropolitan area, but all the construction is in Springfield, so that’s where it should be recorded, but so far we’re not seeing it.”

Dollars and Sense

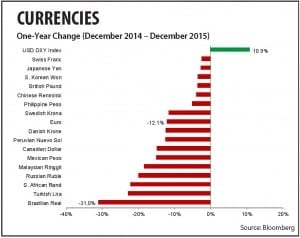

Another factor that is contributing to uncertainty is the stronger U.S. dollar. It certainly benefits those traveling overseas and has provided a huge boost for airlines and cruise lines, but overall, a strong dollar hurts exporters, including the many precision manufacturers that call the Knowledge Corridor home.

“I think many of the manufacturers in this region got off to a good start in 2015 and had good backlogs,” said Patrick, referring to companies on both sides of the border. “But companies within that corridor are usually producing a product that has export potential, and because of the strong dollar internationally, they’ve seen a lot of the orders slow down and some of them put on hold, with the buyer saying, ‘what we’ll do is wait for the dollar to drive down in value a bit.’”

There was some movement in that direction in early December, he noted, but overall, the dollar remains quite strong against all other currencies, and until a pattern of weakness occurs, exports will continue to suffer.

Nakosteen agreed, and said one country often overlooked when it comes to currency rates is Canada. It is a big trading partner, and at the moment that country’s dollar, also known as the ‘loonie,’ is in a hard spiral fueled by a host of factors, including falling energy prices and questionable monetary policy.

“Canada is our most important trade partner; a year ago, it was about one U.S. dollar to one Canadian dollar; now, a Canadian dollar is worth about 70 cents,” he explained. “What that means is for Candians, U.S. products are much more expensive, and you can see it in the export numbers — they’ve really dropped over the past year.”

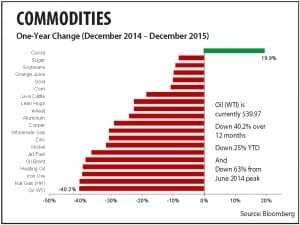

As for falling oil prices, which analysts say will remain low for the foreseeable future, they are not producing a surge in consumer spending, as some had predicted, and in the meantime, they are taking a hard toll on the energy industry, which is having a ripple effect, in this country and elsewhere.

“We have not seen the surplus from lower gas prices turn into consumer spending — it’s going into savings or to reduce debt,” Nakosteen said. “It has not created the bump that was expected by everyone, including me.

“From everything I’m reading in the energy industry, low gas prices are here for a while,” he went on. “So it will be interesting to see if, over time, consumers start behaving a little differently and take this surplus and spend it.”

Still another factor is interest rates, which, after that strong November jobs report, are almost certain to rise after roughly seven years of stagnancy. The projected 0.25% increase, though minor, will finally bring some measure of relief to investors who have focused on low-risk options, such as bonds, which have yielded marginal returns. But the hike will also make borrowing more expensive, and this may slow the economy somewhat.

Cliff Noreen, president of Springfield-based Babson Capital, told Bloomberg News Radio recently that he welcomed the U.S. interest rate hike — “I think it’s about time; it’s been seven years, and we’ve been living with manipulated rates for that long, and we should go back to a more normal rate environment.”

“I think the biggest victims today are retirees — they retired with the assumption five or 10 years ago that they would earn a risk-free rate of 4%, 5%, or 6%; now, the risk-free rate is zero,” he told Bloomberg. “So they have to take more risk to make their return to live on, and they’ve been forced to invest in higher-risk assets like high-yield bonds and stocks, and they’ve had to adjust their asset allocation to make up for the zero-percent rate environment we’re in globally.”

Overall, Noreen said there were several surprises in 2015 — from falling commodities prices to spiraling foreign currencies (see charts) to gasoline prices that could have fallen further than they did — and all signs point to these conditions (and the negative impact and uncertainty they bring) continuing into 2016.

Overall, Noreen said there were several surprises in 2015 — from falling commodities prices to spiraling foreign currencies (see charts) to gasoline prices that could have fallen further than they did — and all signs point to these conditions (and the negative impact and uncertainty they bring) continuing into 2016.

“We expect lower-than-normal investment returns for all asset classes,” he noted, “and slow economic growth globally, although things have been stabilizing, and continued very, very low interest rates that are in the process of rising.”

And there are still other factors to consider looking ahead, said Noreen, listing everything from a slowing of the growth rate in China to slowing corporate-profit growth in this country, and historically low yields on bonds, with many European countries, including Germany, France, Belgium, and the Netherlands, gaining status in what Noreen called the “negative-rate club.”

As for the upcoming presidential election, Nakosteen noted that, while elections themselves typically don’t have an impact on the economy and individual presidents don’t often dictate fiscal policy, elections do generate anxiety, which has its own trickle-down effect.

Bottom Line

Speaking from experience, Patrick agreed, noting that the one commodity business owners dislike the most is uncertainty.

And because there is no lack of it at the moment — not just because of the election but all those other issues mentioned above — there is a corresponding shortage of perhaps the most important element for at least the short-term health of the regional and national economy: confidence.

There is confidence that the progress measured in 2015 can be sustained, but, as Flynn noted, it is soft confidence.

And as long as that condition remains, the picture for 2016 will remain fuzzy.

George O’Brien can be reached at [email protected]