Granite State Development Corp. Helps Businesses — and the Economy — Expand

Growth Engine

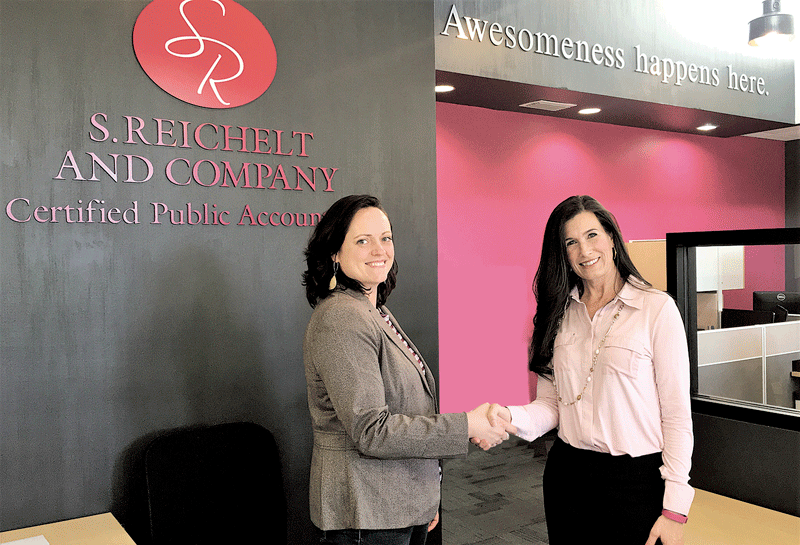

Tracey Gaylord of Granite State Development Corp. (right) with Shannon Reichelt, who used Granite State’s services to finance a new property for her company, S. Reichelt & Co.

Certified development companies, or CDCs, are entities that partner with banks to help small businesses secure financing to grow their operations. But in doing so, they’re also growing the economy by promoting economic development, which is, in fact, a key element of their mission. Since its inception in New Hampshire in 1982 — and its subsequent, ever-expanding work across Massachusetts — Granite State Development Corp. has been executing that mission.

Shannon Reichelt recently purchased a building in Holyoke to consolidate her CPA organization, S. Reichelt & Co.

Meanwhile, Ben LaRoche and Jared Martin purchased a property in Lanesboro to house their technology-integration business, Amenitek; Gordon and Patricia Hubbard bought Hidden Valley Campground in Lanesboro and renamed it Mt. Greylock Campsite Park; and Pat Ononibaku purchased the adult day-care operation known as ThayerCare and renamed it Bakucare.

Then there are Anthony Chojnowski, who is building a new structure for his clothing store, Casablanca, in Lenox, and Frank Muytjens and Scott Cole, who are developing the Inn at Kenmore Hall in Richmond, near the New York line.

While those are six very different businesses, the common thread is how they financed their property purchases: through the certified development company (CDC) called Granite State Development Corp. (GSDC).

“We work with businesses looking to either acquire an existing business that has tangible assets, or take a loan on real estate or piece of equipment,” said Tracey Gaylord, Granite State’s vice president and business development officer.

Specifically, Granite State is a nonprofit lender authorized to process and service Small Business Administration (SBA) loans utilizing the 504 lending program (more on that later). It’s the second active certified development company (CDC) in New England and provide financing in the states of Maine, Massachusetts, New Hampshire and Vermont.

“The main goal is to promote economic development and job growth,” Gaylord said. “We help banks do loans they might not be able to do otherwise.”

Those loans are spread among a broad range of sectors, she added. “We do anything from manufacturing companies to wineries to restaurants to healthcare facilities to assisted living to campgrounds. And equipment financing for manufacturing — big machines they might buy every 10 or 15 years — we do a lot with those types of projects as well.”

For this issue’s focus on banking and financial services, Gaylord explained why companies find the 504 loan program — and Granite State’s services — an attractive option when financing a purchase or investing in future growth.

Impressive Growth

GSDC President Alan Abraham created the company in 1982 in Portsmouth, N.H., with a geographic territory initially limited to three counties in that state. In 1986, its territory expanded to include the entire state of New Hampshire, and it has since grown to provide statewide coverage for the four northernmost New England states, including Massachusetts.

Granite State Development is one of the largest CDCs nationwide, ranking fifth in both loan volume and dollars, and has been the most active 504 lender in New England for almost a decade. Since 1990, in cooperation with its bank lending partners, the nonprofit has participated in more than 4,000 transactions worth more than $1.5 billion, helping create more than 20,000 jobs in New England in the process, based on borrower growth stemming from the loans.

Meanwhile, 2017 was a banner year for GSDC in Western Mass., where it has poured increasing resources in recent years, as most of its Bay State projects have historically been farther east.

Those projects fall under the SBA’s 504 loan program, which provides approved small businesses with long-term, fixed-rate financing to acquire assets for expansion or modernization. These 504 loans are made available through CDCs like Granite State. CDCs — there are more than 260 nationwide — are certified and regulated by the SBA, and work with SBA and participating lenders, typically banks, to provide financing to small businesses.

A typical 504 loan is structured in three parts: 50% is a lien from the bank, 40% is a second lien through the CDC, and 10% is a required down payment from the borrower.

This is an important element in the program, Gaylord noted, as many banks require 20%, 25%, even 30% down for certain loans, simply as a matter of policy, “and this actually allows them to do projects people may need.”

At the same time, it’s a win for the borrower, she added, because a bigger down payment may cut into funds they need to get through a lean time. “Maybe it’s a seasonal business, and they need money to get through the winter, to fill that gap.”

The bank sets its own interest rate and term for its 50% share of the loan, she went on. “If they want to do a fixed five-year rate, they can do that. They do not have to match what we do. That’s the benefit for the bank.”

As for GSDC’s portion, it determines terms based on the type of project, she explained. A real-estate project might come with a 20-year term, while 10 years might be more appropriate when purchasing a piece of equipment with a useful life of 10 to 15 years.

“Whatever the type of project, the bank chooses what to do with the other 50%,” Gaylord said. “People say, ‘why would I use this program?’ My quick response is, ‘it’s a low capital investment and a low fixed rate.’”

There are limits to what 504 loans may be used to purchase, however. They are specifically intended for fixed assets and certain soft costs, including the purchase of existing buildings; the purchase of land and land improvements, including grading, street improvements, utilities, parking lots, and landscaping; the construction of new facilities or modernizing, renovating, or converting existing facilities; the purchase of long-term machinery; or the refinancing of debt in connection with an expansion of the business through new or renovated facilities or equipment.

The 504 program cannot be used for working capital or inventory, consolidating or repaying debt, or refinancing, except for projects with an expansion component.

Bigger Picture

At its heart, the 504 lending program and CDCs like Granite State exist not only to help small businesses, but to boost economic development over an entire region. In short, applicants must demonstrate that their purchase or investment will create jobs.

“That’s one of the primary purposes of this,” Gaylord said. “We have to track the number of jobs the business has at the current time and how many jobs they’re predicting they’ll have in the first year and the next 24 months.”

That calculation incorporates job retention as well, she noted. “If they have only two employees but doing the project means they’ll be able to retain those two, that’s fantastic. If they can create more jobs, that’s even better.”

According to the SBA, community-development goals of the 504 loan program include improving, diversifying, or stabilizing the local economy; stimulating other business development; bringing new income into the community; and assisting manufacturing firms and production facilities located in the U.S.

Public-policy goals include revitalizing a business district of a community with a written revitalization or redevelopment plan; expanding exports; expanding small businesses owned and controlled by women, veterans, and minorities; aiding rural development; increasing productivity and competitiveness; modernizing or upgrading facilities to meet health, safety, and environmental requirements; and assisting businesses in, or moving to, areas affected by federal budget reductions, including base closings; reduction of energy consumption by at least 10%.

There are a few environmental goals as well, including increased use of sustainable design, building design that reduces the use of non-renewable resources and minimizes environmental impact; reduction in the use of greenhouse-gas-producing fossil fuels; and production of alternative and renewable forms of energy.

These are worthy goals, obviously, but businesses that qualify for 504 loans are typically more concerned with how the program affects their bottom line.

“We see ebbs and flows, just like conventional banks do, but we’re obviously in a good market right now,” Gaylord said. “This is a good opportunity for people to lock in those loan rates before they start to rise. Now is a really good time.”

There have been many of those good times since Granite State Development Corp. took root in New England 35 years ago, with a mission to help small businesses expand and grow, thereby helping the New England economy.

“It’s a very easy process,” Gaylord told BusinessWest. “I think that the bankers are comfortable with it, and look to us for guidance. We’re bankers and want to work with them.

“People ask, ‘are you competing with banks?’” she went on. “No, we don’t compete with banks, we work with them. We look at banks as our partners. And I get excited when I see the jobs and economic growth. That’s the best part.”

Joseph Bednar can be reached at [email protected]