Millennials Are a Growing Force in Auto Sales

Supply and Demand

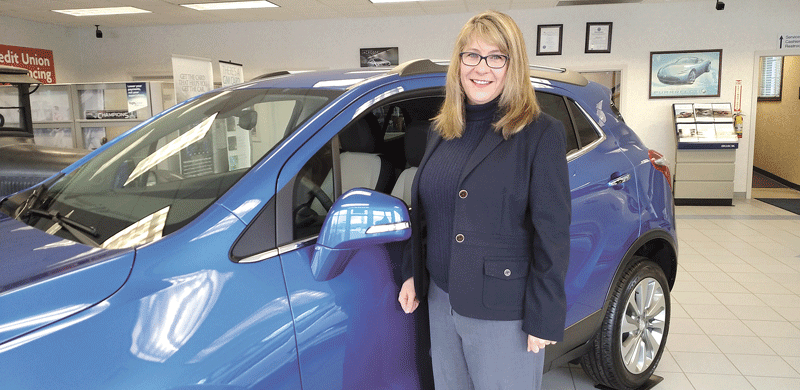

Jennifer Cernak says technology and connectivity features often appeal to younger buyers.

With the Millennial generation quickly becoming a more powerful force in the economy — totaling around 85 million, they’re now in their 20s and 30s, and their spending clout is only growing — auto dealers have definitely taken notice.

“They’re becoming more influential in the purchase of durable goods, including vehicles,” said Bill Peffer, president and chief operating officer of Balise Motor Sales. “They’re buying for themselves as they get older, but many are still living with their parents, so they’re also influencing their parents’ decisions. That’s quite a reversal from the Baby Boomers, who wanted to break free of the Greatest Generation and develop their own tastes.”

One way Millennials are changing the car-buying process is in their reliance on technology, specifically the online experience of car shopping.

According to Automotive News, more than 90% of car shoppers begin the journey online, visiting an average of 18 sites, including Google, online shopping networks, and social media, before showing up at a dealership, usually unannounced. However, Millennials take this process further, visiting an average of 25 sites before buying a vehicle.

“They definitely use technology to find what they need before they come into the store,” Peffer said. “Not too many years ago, the average consumer visited four or five stores. Now, with the explosion of technology and social media and the Internet, they’re making visits to far fewer stores before they actually make their purchase.”

Most Millennials don’t like to negotiate. They have information; they know what the cost is. They do their negotiating online.”

The average, actually, is fewer than two, he said. “They go to one store, and if the experience isn’t pleasant, if it’s not to their satisfaction, they go to the next one. Particularly with Millennials, they know what they want; the question is, are you able to meet their needs? You have to arrive at a mutually acceptable price and respect the convenience of when they want to make the purchase.”

J.D. Power reports that Millennials — usually defined as the generation born between 1980 and 1998 — bought 4 million cars and trucks in 2015, their share of the new-car market jumping to 28% — a number expected to rise steadily each year, with some estimates having them accounting for 75% of all purchases by 2025. So dealers need to understand their habits and preferences.

“I think it forces everyone to be on their game. It forces dealers to adopt — and not only adopt, but utilize — technology to fulfill the dealer’s end of the process,” Peffer said. “This is how shopping has evolved, not just for vehicles, but for everything. You can shop from your house for a suit at 10 o’clock at night.”

As for car shopping, he continued, “the deal has to be completed in the store, but we can make it convenient as well. We can deliver the car to the house for a test drive. We help the consumers make the decision where and when they want to.”

It’s all about meeting demand — for a generation of car buyers that can be well, demanding.

What’s New?

Jennifer Cernak, co-owner of Cernak Buick in Easthampton, understands the demands placed on a dealership by a prepared shopper.

“Most customers have already spotted the car they want; they’ve seen it online, and they know what they’re looking for,” she said.

Young people tend to appreciate technology, she said, from smartphone apps that connect a smartphone’s navigation feature to the vehicle, and infotainment apps like Pandora, Apple CarPlay, and Android Auto.

“There’s definitely some cutting-edge technology,” she said. “People don’t always think of that when they think of Buick; they don’t realize we have some of the latest and greatest technology and features out there.”

Bill Peffer says young, Internet-savvy shoppers, armed with data before they arrive at the dealership, are changing the car-buying game.

While Millennials certainly appreciate infotainment and connectivity packages — features that make the car a sort of platform for all one’s personal tech — that’s only one part of what they’re looking for in a car, Peffer said.

The second big draw is safety features — everything from lane-departure sensors and active braking systems to multiple airbags and safety shields: in other words, components that both help avoid crashes and protect riders in the case of one.

The third attraction is, quite simply, value, a concept that goes beyond the bottom-line price, encompassing everything from how well a vehicle holds its resale value to how it will serve their lifestyle and needs. That explains the popularity of compact SUVs, or crossovers, because they tend to support the activities of families and outdoor enthusiasts at a more reasonable price than larger SUVs.

Cernak noted that the Buick Encore compact SUV has broad, cross-generational appeal, and that includes Millennials, who appreciate features like all-wheel drive, Bluetooth connectivity, in-car wi-fi, backup cameras, and being able to start the car from their phone — a mix of traditional and thoroughly modern amenities. “The younger generation seems to like these things — not that the older generation doesn’t like them too. But older buyers are looking for a more traditional luxury experience.”

She also said young buyers are increasingly leasing, but that’s true across the generations. “More and more people are leasing. If someone likes to get in a brand-new car every few years, it can be more affordable. Some people just want to keep up with the latest and greatest.”

Peffer likewise doesn’t see much difference in the popularity of leasing between the generations, but noted that, as a whole, the New England region leads the country, along with the West Coast, in the percentage of car shoppers who choose that option. “I don’t see that waning. No matter what the generation, it’s a great option.”

Jeff Sarat, president of Sarat Ford Lincoln in Agawam, said he sees plenty of crossover in what vehicles and elements of the car-buying experience appeal to the different generations, though he noted that some of the company’s outreach, particularly search-engine marketing, is created with younger, more tech-savvy consumers in mind.

One big difference, however, is the loyalty factor. Baby Boomers were far more likely to develop brand and even dealer loyalty and return for new product every few years for decades. Millennials, Sarat said, are less likely to forge those bonds, and are much more willing to switch models, brands, and dealerships if they see more value elsewhere.

“Millennials are apt to jump around a little bit, meaning they might go with a Volkswagen this time and then next time try a Ford,” Sarat said. “Maybe their friend recommended a car they thought was phenomenal, so they try that. They’re more likely to switch around, and they don’t have set buying habits, so you really have to work to make them a customer for life. We try to do that with everyone, of course, but with Millennials, if you don’t stay in contact with them, they’re more likely to move around.”

Unfounded Fears

According to Business Insider, there was some concern in the auto-sales industry about how enthusiastic the growing Millennial generation would be; among the questions were whether they’d reject SUVs and whether they would gravitate toward mass transit. But those fears proved unfounded, as young professionals and families were a key factor in the industry’s surge to its current sales pace, which has topped 17 million for two straight years, with the same expected in 2017.

Yes, Millennials are demanding, and their penchant for Internet research doesn’t make things easier on auto dealers, but it’s not a negative, Peffer said; it just means dealers have to know as much as buyers do, and be ready to clearly explain subtle differences in pricing and features, skills they should already have.

“Most Millennials don’t like to negotiate. They have information; they know what the cost is. They do their negotiating online. They come in knowing exactly what they want to pay,” he told BusinessWest. “This is how shopping has evolved in the overall economy. The question is, are you able to meet their needs?”

Joseph Bednar can be reached at [email protected]