Firm Resolve

Sean Buxton was talking about why he chose to join the Springfield-based law firm Bulkley Richardson, and what he’s found since he came on board not quite a year ago.

“It’s been an amazing experience,” said Buxton, who handles general commercial litigation and is currently doing a lot of work in the firm’s new office in Greenfield, referring specifically to being around — and being mentored by — seasoned attorneys with decades of experience.

“Just in the Litigation department alone, we have Sandy Dibble — I can’t even tell you how long he’s been practicing — and Mike Burke, too; they’re such valuable asssets,” he said. “In the legal field, you get this feeling sometimes that the problem you’re coming on is something you’re seeing for the first time and that no one’s ever dealt with this before. To have someone to go to and have them say, ‘that same exact circumstance hasn’t happened to me, but here’s what my instincts say’ and ‘here’s what I’ve experienced,’ that is so valuable.

“You can bounce ideas off so many people here and make sure that your decisions are informed not only by you and what you’ve learned, but by the instincts and experience of everyone around you,” Buxton went on. “And they’re just fascinating people; we have Judge [John] Greaney here, who sat on the Appeals Court and the Supreme Judicial Court, and Sandy as well; the stories they tell and the experiences they can relate … they’re great mentors.”

While the names of the older lawyers and mentors may have changed, and the exact words used to describe their impact may have changed as well, generations of lawyers who have worked at the firm have been saying pretty much the same things as Buxton.

“You can bounce ideas off so many people here and make sure that your decisions are informed not only by you and what you’ve learned, but by the instincts and experience of everyone around you.”

And that’s just one of many things the firm is celebrating as it marks its centennial this year in what could be described as quiet, poignant fashion (we’ll get back to that in a bit).

It’s taking place at a time of change in the business landscape, such as the rise of the cannabis industry, and at a time when many firms are smaller or have been merged into larger entities. Meanwhile, the firm’s ongoing commitment to the community has become a focal point of the centennial, said Managing Partner Dan Finnegan, who came on board in 1992.

“We wanted to celebrate all of the amazing work that has gone into supporting, celebrating, and engaging in the communities in which we live, work, and play through initiatives such as helping to feed the hungry and addressing food insecurity, supporting arts and culture, contributing funds to lifesaving healthcare and research organizations, and providing pro bono legal services to those in need, among many, many others,” he explained. “Members of the firm have contributed time, resources, and finances to help so many worthy causes over the past century, and we plan to continue that legacy.”

Dan Finnegan says the firm’s commitment to the community has become a focal point of its centennial celebration.

Elaborating, he said the firm has launched a new campaign called ‘Be the Change.’ It will connect lawyers and staff with opportunities to engage with organizations in Western Mass. and beyond so they can act together to bring positive change.

The campaign was launched last fall, with a team of 50 from the firm taking part in the annual Rays of Hope breast-cancer walk. Other specific initiatives include a YMCA clean-up day on May 3, when attorneys and staff rolled up their sleeves and helped prepare Stony Brook Acres, a YMCA camp in Wilbraham, for a June opening; partnering with Greater Springfield YMCA to assist area boys and girls attend summer camp (the firm will send 16 youth campers to a YMCA-run camp this summer for one week); and a $10,000 donation to Baystate Health to purchase infusion chairs.

“Giving back to the community is one of the core values that differentiates us,” said Peter Barry, who joined the firm in 1982 and preceded Finnegan as managing partner, adding that this is one of many qualities and traditions that essentially go back to 1924.

For this issue and its focus on law, BusinessWest takes a look at 100 years of tradition, expansion, innovation, entrepreneurship, and giving back — and at how these traits will continue to define the firm moving forward.

Making Their Case

When asked how Bulkley Richardson intends to celebrate its centennial — beyond ‘Be the Change’ — Finnegan suggested that the annual holiday party “might be a little more robust this year.”

In most respects, though, it will be business as usual.

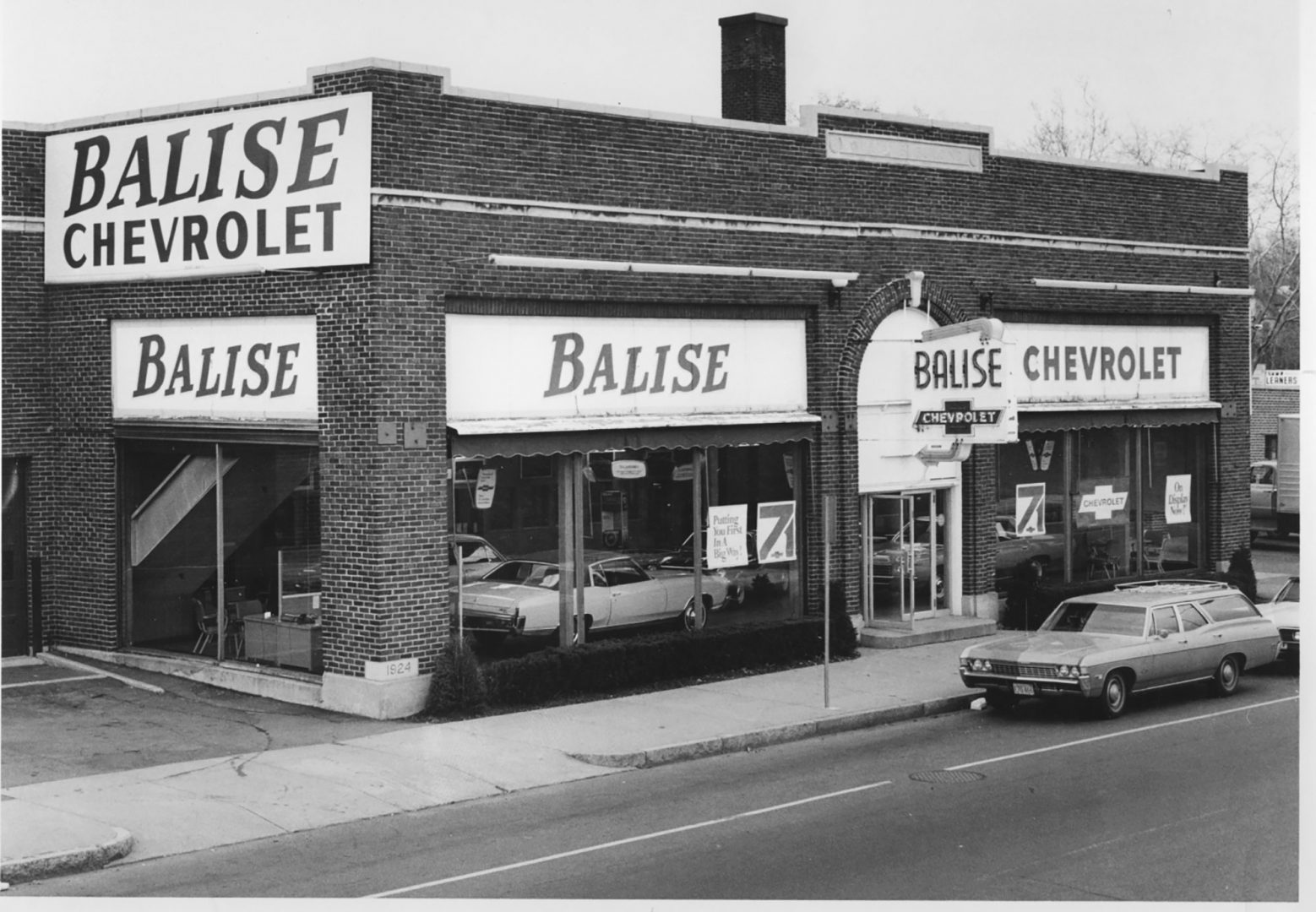

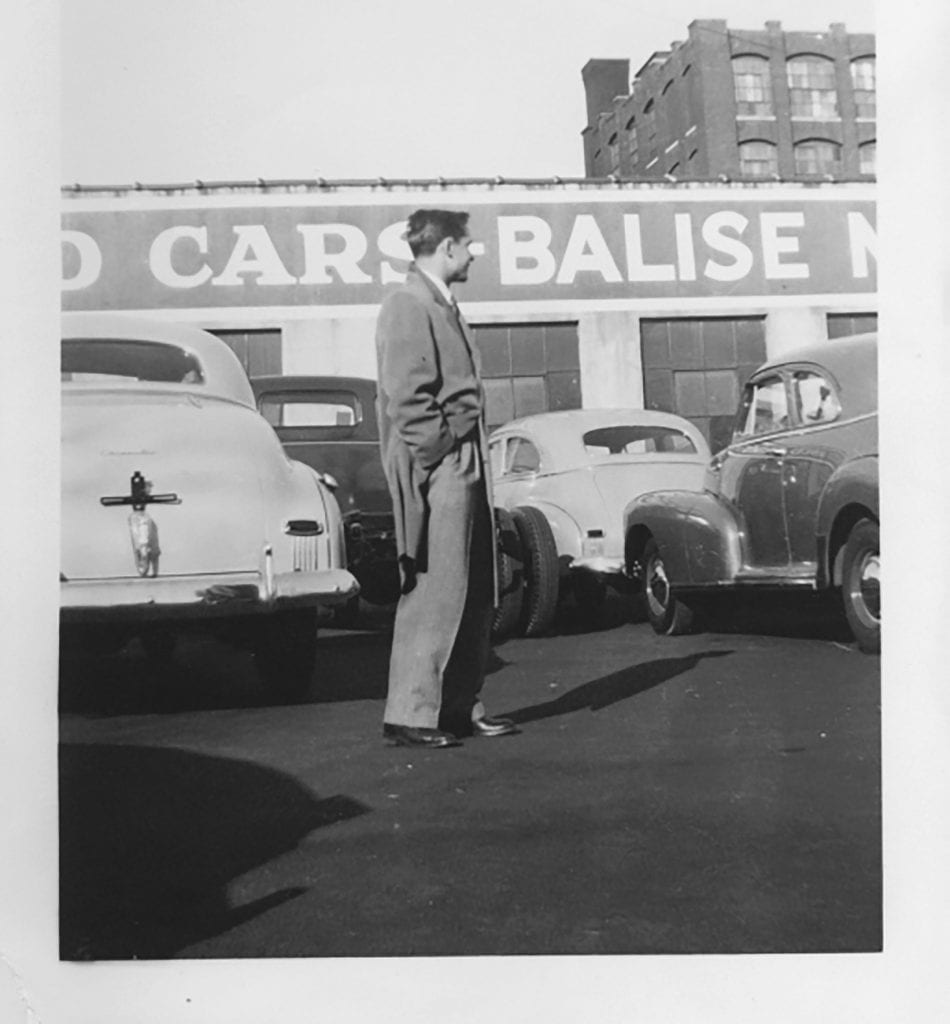

And it has been this way since 1924, when R. DeWitt Mallary became associated with the law firm of Frederick Wooden and Harold Small, located in an office at 387 Main St. in Springfield, several blocks south of where the firm is headquartered now, in Tower Square. Eventually, the firm would become Wooden, Small & Mallary.

Peter Barry says the firm has had a noticeable impact on Springfield and surrounding communities over the years.

Mallary would later partner with Morgan Gilbert to form Mallary & Gilbert, and in 1934, J. Bushnell Richardson, a graduate of Springfield’s Central High School, Amherst College, and Harvard Law School, would join them, and in 1947, the firm became Mallary, Gilbert & Richardson.

In 1950, the firm was reorganized, with the law practice conducted in collaboration by two separate partnerships — Mallary & Gilbert, and Richardson Dibble & Atkinson, adding Norris Dibble and Robert Atkinson as partners. The firms practiced together in shared office space.

Fast-forwarding through the middle of the 20th century, Richardson Dibble & Atkinson merged with the firm of Gordon, Bulkley, Godfrey and Burbank in 1956, and the firm was renamed Bulkley, Richardson, Godfrey and Burbank. A year later, Robert Gelinas joined the firm, and in 1964, Godfrey left to form a partnership with Edwin Lyman. Matthew Ryan Jr., elected as district attorney, a part-time office in those days, joined Bulkley, Richardson, Godfrey & Burbank soon thereafter. And with Burbank’s departure in 1972, the firm was renamed Bulkley, Richardson, Ryan, and Gelinas.

In 1978, the district attorney’s role became full-time, and Ryan left the firm, whch was renamed Bulkley, Richardson, and Gelinas. By 1983, the firm consisted of 27 attorneys and was occupying a suite of offices at Baystate West, which later became Tower Square.

It is still there and recently renewed its lease, said Finnegan, so it will be there for a long while to come. Meanwhile, the firm recently opened a Greenfield location (it also has one in Hadley), and now consists of 40 attorneys and more than 30 staff.

“We work hard, and we provide quality service, but we’re pretty good at work-life balance and understanding that folks have to have lives outside of the office.”

That brings us to today, when the firm is marking what have remained constants through all those changes to the letterhead over the past 100 years — especially quality service to a wide array of clients across dozens of different specialities, and an environment where generations of lawyers have, as Buxton noted, worked together and mentored those new to the profession.

It is also marking change, including the contunuing expansion of its practice areas — there are now 32 of them, Finnegan noted.

“We’ve always been a full-service law firm, one of the biggest, if not the biggest, in the area,” he said. “And we’ve always been able to provide a wide array of services to clients.”

Within those 32 practice areas there have long been specific strengths, such as health law, said Barry, noting that the firm has long represented many of the region’s larger providers, as well as education, representing several colleges and universities.

Bulkley Richardson’s leaders say the firm was built on excellence and has maintained it through the decades.

But there have been important additions to the portfolio over the years as well, he went on, citing the broad realm of cyber law and service to the growing, changing cannabis industry as just two examples.

Continuing a Legacy

Barry, who has been with the firm for 42 of its 100 years, joined it just before it relocated from State Street to Tower Square, a big move and a rather large risk for the partners at the time, he said, adding that downtown Springfield was a much different place at the time.

And the firm has been involved in many of the changes that have taken place since, representing entities ranging from the Basketball Hall of Fame, which built its new home just over 20 years ago, to the Springfield Redevelopment Authority, which presided over the renovations that brought Union Station back to productive life after nearly 40 years of dormancy, to the Massachusetts Convention Center Authority, which operates the MassMutual Center.

“It’s nice to be able to drive around and say, ‘we were involved with that,’” Barry said, adding that the firm has also represented the Westover Metropolitan Development Corp. in its many endeavors in Chicopee and Ludlow and countless other clients as well.

Like Finnegan, Barry said many changes have come to the field of law and the firm over the past few decades, let alone the past century — everything from the demise of law libraries, with all that material now online, to the advent of depositons and other legal functions via Zoom.

What’s probably more important is what hasn’t changed — and won’t change, they said, especially the firm’s commitment to excellence as well as the environment that Buxton described earlier, one where lawyers and staff with wide ranges of experience and knowhow work together to generate positive results for clients while learning from each other.

In fact, both Barry and Finnegan used similar words and phrases to describe those who mentored them when they arrived four and three decades ago, respectively.

“I’ve had a lot of great mentors here,” said Barry, noting that he and others now serve as mentors to the younger atttorneys.

Finnegan said the firm has created a strong culture, one that has promoted many lawyers (he’s one of them), and staff members as well, who then spend their entire careers at Bulkley Richardson.

“That’s a testament to the culture of the firm,” he said. “We work hard, and we provide quality service, but we’re pretty good at work-life balance and understanding that folks have to have lives outside of the office.”

Looking ahead, Barry and Finnegan said the business plan is rather simple. It calls for continued growth and building upon the solid foundation laid in 1924.

“We’ve made a commitment to growth. Within the past few years, we’ve hired quite a few young lateral attorneys, as well as several attorneys right out of law school,” said Finnegan, adding that the firm has what he calls a rather robust summer associate program (he was one himself) that has served to help keep talent flowing through the pipeline. “We have a lot of young lawyers that we’ve hired over the past few years.”

“Overall, the firm has long managed to maintain an important mix of older attorneys, those in the middle of their careers, and those just joining the profession,” said Barry, adding that such a mix is critical to the ongoing success of any law firm.

Finnegan agreed, noting that this quality is one of many that have defined the firm since Warren Harding was in the White House, and will continue to do so moving forward.

“When I got here, the word I always heard was ‘excellence’ — this firm was built on excellence,” he said. “The firm has always been a collection of exceptional lawyers providing top-quality legal services to our clients. I don’t think that’s ever changed over the 100 years the firm has been in existence, nor is it going to change moving forward.”

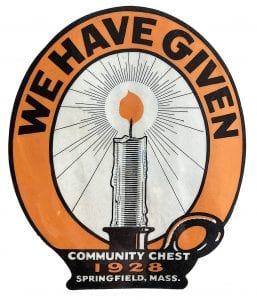

Over the years, Paul Mina says, the name over the door and on the stationery has changed many times — previous incarnations include Community Chest, Red Feather, and United Fund — but the basic mission of the

Over the years, Paul Mina says, the name over the door and on the stationery has changed many times — previous incarnations include Community Chest, Red Feather, and United Fund — but the basic mission of the

That’s just one example, he said, noting that the agency has stepped up during other periods of turbulence, change, and need, providing help with everything from administering the polio vaccine in the 1950s to supplying food to the many who needed it during the Great Depression.

That’s just one example, he said, noting that the agency has stepped up during other periods of turbulence, change, and need, providing help with everything from administering the polio vaccine in the 1950s to supplying food to the many who needed it during the Great Depression.